Jupiter: The new king of Lego Dex

introduction

Jupiter was founded in 2021. Its project is positioned as a decentralized trading liquidity aggregator on the Solana blockchain. After three years of development, Jupiter has now aggregated more than half of the trading volume on the Solana chain. It can be said that it has developed to the ceiling level of the Solana chain transaction aggregator. There is not much room for development in its main project transaction aggregator, so it began to develop projects in the direction of horizontal development of its business, and launched the Launchpad platform Jupiter Start and the incubator Jupiter Labs, respectively, to achieve Jupiter's goal of horizontal development in various parallel fields by incubating other high-quality projects.

Basic information of the project

basic information

Website: https://jup.ag/zh-SG

Twitter: https://twitter.com/JupiterExchange, 420,000 followers

Reddit.: https://www.reddit.com/r/jupiterexchange/

Discord: https://discord.com/invite/jup

Whitepaper: https://station.jup.ag/docs

Launch time: The token will be launched in 2024

project team

core team

Meow: Co-founder. He also built Meteora and RACCOOONS. He is also the co-founder of wBTC, the largest Wrapped token, and one of the founding contributors to the Handshake project.

Ben Chow: Co-founder. With many years of experience in interactive design and product, he was one of the founding team members of the social gaming company Hive 7, which received Series A funding from True Ventures. In 2010, Hive 7 was acquired by Disney/Playdom. In late 2007, he helped design and launch Hive 7's popular social game Knighthood.

Advisory Team

Shun Fan Zhou: One of the authors of the Phala Network white paper, he is a Ph.D. in System Software and Security Laboratory of Fuzhou University. He has published research on attack transactions and defense methods in the Dafang ecosystem at the top international security conference USENIX Security, and has collaborated in publishing papers at many top international security conferences.

Sandro Gorduladze: Angel Investor and Partner at HASH CIB. Sandro set up the research department at HASH, which has become famous for its in-depth reports. Prior to joining HASH, Sandro worked at PwC Russia, providing tax consulting to companies in the TMT industry.

Konstantin Shamruk: PhD in Economics from the University of Toulouse, France. He led the theoretical analysis of Phala Network’s economic design.

Jonas Gehrlein: Research Scientist at Web3 Foundation. He is responsible for researching economic issues in the Polkadot ecosystem at Web3 Foundation. Prior to joining W3F, Jonas received his PhD in Behavioral and Experimental Economics from the University of Bern, where he studied human behavior in markets and organizations. Prior to that, he received his Master's degree in Quantitative Economics from the University of Konstanz.

Zo Meckbach: Senior Polkadot Ambassador, researcher and advocate for Web3 and network security. She is currently the COO of MH-IT& Service GmbH and worked in application analytics at Google before joining MH-IT.

Financing

The Jupiter team has not disclosed any funding information.

Development Strength

Jupiter was launched in 2021 by co-founders Meow and Ben Chow. The key events in the development of the project are shown in the table:

Judging from Jupiter’s project development roadmap, although the Jupiter team has achieved great success after the launch of the project, it can still continuously provide innovative functions to the project, continuously optimize the user experience, and can quickly discover and change its thinking to expand other parallel businesses after its main business transaction aggregator reaches the extreme on the Solana chain. It can be seen that Jupiter’s project team has keen business insight and enterprising spirit, and can also complete development tasks in a timely manner in terms of technical development.

main products

Transaction Aggregator

Trading aggregators are Jupiter's core products and the basis of Jupiter's success. Trading aggregators are a type of Defi project that originated in the last bull market. Because the last bull market was ignited by the Defi summer, many traders gathered on the chain to use various DEXs for token transactions. However, DEX has an obvious flaw, that is, each DEX has its own liquidity pool, and the liquidity pools of various DEXs are not interoperable. Therefore, when investors trade, they often need to find the best trading pool to obtain the best trading price. This is not only time-consuming and laborious, but also difficult to ensure the optimality of the transaction due to the dispersion of liquidity.

However, this situation has changed after the emergence of trading aggregators. Trading aggregators can aggregate the liquidity pools of different DEXs on the same chain. When using trading aggregators, users can clearly see the depth, slippage, etc. of all pools of the tokens they want to trade in the market. Traders can choose the DEX that suits them according to their needs.

Jupiter aggregates many liquidity pools in the Solana ecosystem, automatically finds and aggregates the best liquidity resources through algorithms, and provides users with a one-stop optimal trading path. Jupiter's operating interface is very user-friendly, similar to Uniswap's trading interface, allowing most users to adapt and be familiar with its use. Before operating Jupiter, users can set various transaction parameters according to their needs, such as transaction fees, transaction slippage, or transaction path, so that users can choose the transaction price and slippage that best suits them. Jupiter mainly monitors and analyzes in real time through its own smart contract algorithm. Through real-time monitoring and analysis of these market data, Jupiter will intelligently help users choose the best transaction path in the market to improve the success rate of user transactions and the efficiency of capital use.

In order to ensure the safety of traders and the quality of transactions, Jupiter requires that the pool of trading pairs connected to Jupiter must have a minimum liquidity of US$500,000, and must undergo a relatively strict audit. For the above reasons, Jupiter aggregates most of the transaction volume on Solana, and now accounts for more than 50% of the transaction volume on the entire Solana chain, occupying an absolute dominant position on the Solana chain.

Limit Order

Solana has placed its main development orientation on the trading chain, and because the Solana chain's unique consensus mechanism and SVM parallel capabilities make it very trader-friendly, many traders choose to trade on the Solana chain. Because Jupiter itself serves traders, it provides traders with the function of limit orders, helping traders effectively avoid the cost increase and slippage caused by price influence during transactions, while avoiding the MEV problem.

Jupiter's user-friendliness is also reflected in its interface operation. Jupiter cooperates with Birdeye and TradingView. Birdeye provides Jupiter with on-chain price data of tokens, and Jupiter uses TradingView's technology to display chart data. This makes Jupiter's operating interface very similar to the traditional CEX interface, making users more adaptable to Jupiter's operating interface and providing users with a better experience.

When used, the limit order is set to be partially executed and obtain tokens for the executed portion. When proposing a transaction, users can choose the order validity period, exchange price and exchange quantity to execute their own trading strategies more accurately. This allows users to more conveniently avoid the cost increase and slippage caused by price influence during trading, while avoiding the MEV problem.

DCA Fixed Investment

Dollar-Cost Averaging (DCA) is an investment strategy that is widely used in reality. Users can reduce their purchase costs to their expected price range by setting regular and fixed investments in the future. This method can help investors reduce the risk of investing at a single price point in a volatile market environment. Jupiter provides DCA fixed investment products. Users only need to set their purchase frequency, purchase price range, total time period, and the currency they want to purchase. After the fixed investment takes effect, the tokens purchased by the user will be transferred to the user's own account in Jupiter, and the transaction will be automatically executed according to the preset price range and transaction frequency. After the fixed investment is completed, the tokens will be automatically transferred back to the user's wallet.

Jupiter's DCA has the advantages of controllable cost price, low fees and fully managed trading process. Since the bear market, DCA is very friendly to traders. Due to the large price fluctuations and high uncertainty, DCA allows investors to buy assets evenly at a lower cost price over a period of time, thereby reducing the risk of a single investment. In addition, DCA can also help investors avoid the emotional impact of market fluctuations and maintain a rational and stable investment strategy. However, in a bull market, the advantages of DCA no longer exist. Since the market is in an upward trend, a single investment can often obtain higher returns, so the use of DCA fixed investment may not fully seize the opportunity of a rapid market rise.

Therefore, as a long-term investment strategy, DCA has certain advantages in a specific market environment. However, due to its certain requirements for market trends and cycles, the overall demand for this function is relatively small at present. When choosing whether to adopt DCA fixed investment, investors need to make comprehensive considerations based on their own risk preferences, market environment, and long-term investment plans.

Jupiter Labs

Jupiter Labs is an independently operated project investment laboratory independent of Jupiter. Its operation is based on its own and community promotion and is not affected by the Jupiter project. However, it is strongly supported by Jupiter in terms of technology and funds, so Jupiter users and community members enjoy certain priorities, including priority use rights and token incentives.

Jupiter Labs is a sign that Jupiter has begun to develop its business horizontally. It achieves horizontal expansion of its share and influence in the entire Solana ecosystem through investment support in various horizontal fields. At this stage, Jupiter Labs is committed to the development of two project areas: perpetual contracts and LST stablecoins. We can also know that perpetual contracts and LSD stablecoins are the two most profitable and influential areas in an ecosystem.

Perpetual Contract

Jupiter Perpetual is Jupiter's first step towards perpetual contracts. Its operating model is similar to GMX. The participants in Jupiter Perpetual are: liquidity providers and traders. Liquidity providers provide funds to the pool, which are converted into a basket of tokens, mainly including BTC, ETH, SOL, USDC and USDT, among which SOL and USDC have a higher weight and become the main trading objects. When traders conduct leveraged transactions, they use the tokens in the liquidity pool to establish leveraged positions. Traders need to pay transaction fees and borrowing fees. Liquidity providers receive 70% of transaction fees and all borrowing fees. Similar to GMX, liquidity providers are the opposite of traders in transactions. Traders conduct contract transactions, which means they are acting as counterparties to liquidity providers. Therefore, this model will have a lot of liquidity providers in a bear market, but it is not very friendly to liquidity providers in a bull market.

Jupiter Perpetua allows traders to trade perpetual contracts with up to 100x leverage, while LPs can provide funds to earn fees. In perpetual contracts, traders are able to take on larger positions with less capital allocation (leverage) in order to take advantage of future price fluctuations. In Jupiter Perpetua, traders can open long or short positions on SOL, ETH, and wBTC using almost any supported Solana token as collateral. Long positions require the corresponding underlying asset, while short positions require stablecoins as collateral. Traders can take on leverage by borrowing assets from liquidity pools.

LST Stablecoin

XYZ is a LST stablecoin project supported by Jupiter Labs. In XYZ, users can mint interest-free stablecoin SUSD by pledging SOL. The user's collateral is locked in the smart contract until the user repays the corresponding SUSD. This lending model allows users to obtain stablecoins without incurring borrowing interest. And the income obtained by XYZ through LST staking will be distributed to SUSD holders and governance token holders to encourage more users to actively participate in the protocol. In addition, the XYZ protocol also adopts a leveraged arbitrage strategy to maximize returns. When the LST yield is higher than the SOL borrowing rate, users can adopt a leveraged arbitrage strategy to obtain higher returns. XYZ also uses a redemption mechanism similar to Lybra to maintain the price stability of SUSD. In order to reduce the impact on the borrower's position, XYZ adopts the method of using governance tokens to redeem SUSD in a small price range. When the price of SUSD is between 0.95-1 US dollars, XYZ uses SUSD to redeem governance tokens to reduce the frequency of borrowers being redeemed.

Jupiter LFG Launchpad

LFG Launchpad adopts an innovative approach to support new projects, emphasizing a model centered on community-driven and transparency. Traditional project launch platforms often have complexity, while LFG Launchpad abandons this complexity and adopts an open market and community participation approach. At the same time, the platform also abandons complex incentive structures and isolated price discovery mechanisms, highlighting its uniqueness. The core advantages of LFG Launchpad lie in its huge community support, customizable Launchpad to prevent robot operations, user-friendly design tools for liquidity management, and comprehensive trading functions. These features ensure that users can discover fair prices and instant liquidity, while providing good support for technical aspects. First, LFG Launchpad relies on huge community support to promote the development of new projects. The community-driven model enables projects to receive wider attention and support, providing new projects with a broader space for development. Secondly, LFG Launchpad adopts a customizable Launchpad to prevent robot operations, effectively ensuring the fairness and transparency of transactions. This feature makes transactions safer and more reliable, effectively avoids malicious manipulation and improper intervention, and provides users with a more stable and reliable trading environment. In addition, LFG Launchpad also provides user-friendly design tools for liquidity management, allowing users to manage their assets and liquidity more conveniently. This feature is conducive to improving user experience and providing users with a more convenient and efficient way of operation. Finally, LFG Launchpad has comprehensive trading functions, providing users with richer and more diverse trading options. Regardless of the type of transaction or the type of transaction, users can find a trading method that meets their needs on LFG Launchpad, which is conducive to improving trading efficiency and meeting users' personalized needs.

In addition, Jupiter's co-founder Meow clearly affirmed the enhancement of Jupiter's brand influence by LFG Launchpad in the H2 plan mentioned in a recent media interview, and it is expected that Jupiter will continue to explore and develop in depth around the rules and development of LFG Launchpad in the third quarter.

Compared with projects on the same track

As the most successful decentralized trading liquidity aggregator in the Solana ecosystem, Jupiter has accounted for half of the trading volume in Solana, so its main competitor is 1inch, the decentralized trading liquidity aggregator giant in the Ethereum ecosystem.

Underlying operating logic

Jupiter is a decentralized trading liquidity aggregator running on the Solana chain. It enjoys the high performance advantages of the Solana chain, which is mainly reflected in the use of SVM. SVM supports smart contract codes written in Rust, C, and C++. After being connected to SVM, they will be automatically converted to BPF bytecode, which is particularly friendly to project developers. However, the biggest advantage for Jupiter is SVM's ability to support parallel processing. The Sealevel engine is a key component for implementing parallel processing on Solana, and with the integration of state access lists in Solana transactions, non-conflicting transactions can run simultaneously, thereby achieving faster overall performance. SVM supports multi-threading and can process more transactions in a shorter time. Each thread contains a queue of transactions waiting to be executed, and transactions are randomly assigned to the queue. This gives Jupiter a very powerful transaction processing capability, which can support a huge number of transaction operations at the same time and is very friendly to trading users.

1inch is a decentralized trading liquidity aggregator running on the Ethereum chain. Its underlying logic is built on EVM, which is a single-threaded operating environment, meaning it can only process one contract at a time, which makes it incomparable to Jupiter in terms of transaction processing capabilities. Although Ethereum has improved its performance after the Cancun upgrade in 2023, coupled with the introduction of various L2 solutions, it is still not comparable to Solana. As a result, Jupiter has a natural advantage in performance over 1inch.

Gas Fees

Decentralized trading liquidity aggregators are a high-frequency on-chain transaction behavior, which makes users very sensitive to gas fees. The Solana chain uses a historical proof consensus method to improve the efficiency and reliability of the system, and uses SVM to give Solana extremely high processing speed and low latency, which allows transactions to be confirmed quickly, thereby reducing the gas fees that need to be paid. Based on this, Jupiter's trading users only need to pay a cost of US$0.00015 per transaction, which is enough to support users to use high-frequency operations to complete their trading strategies, which plays a vital role in Jupiter's limit orders, DCA fixed investments, and perpetual contract transactions.

Although the gas fee on Ethereum has dropped after the Cancun upgrade, the average transaction fee on Ethereum has reached $0.3 per transaction, which is much higher than the gas fee on Solana. Then 1inch, a decentralized trading liquidity aggregator, is essentially a high-frequency on-chain transaction behavior. The gas fee paid by the trading user will increase exponentially with the frequency of the transaction behavior, which is very unfriendly to the trading user during the bull market. The essence of the aggregator is to provide users with better prices by obtaining liquidity from multiple sources, rather than just from one specific DEX. Then the high gas fee on Ethereum will make it very expensive to use a trading aggregator to obtain liquidity from multiple different pools, which will worsen the problem that was originally intended to be solved. It may actually be more beneficial to trade on liquidity obtained from only one place.

Product Diversity

Jupiter provides a variety of products for trading users, such as limit orders, DCA fixed investment, derivatives trading and other services, so as to meet the different needs of users. In this regard, Jupiter can be said to be doing its best to help customers solve various problems encountered in trading. It is not only from the perspective of a single product of liquidity aggregator, but also provides users with a full range of financial services from the perspective of financial development. It can not only meet the various financial needs of users, but also provide the most suitable financial services for trading users in various market stages.

1inch's products are somewhat single-minded. 1inch only focuses on the product positioning of DEX aggregator, and only provides better prices to trading users by obtaining liquidity from multiple sources, and does not provide other financial service products.

Future direction

Jupiter now occupies an absolute leading position in the decentralized trading liquidity aggregator track in the Solana ecosystem. There is not much room for development in the original track, so it has shifted its attention to other parallel tracks, and launched Jupiter Labs and LFG Launchpad to increase its influence by supporting and investing in projects in different tracks in other Solana ecosystems. Therefore, from the perspective of future development direction, in addition to constantly updating and adding various functions to its own liquidity aggregator, Jupiter's development focus is on vigorously promoting Jupiter Labs and LFG Launchpad. Its co-founders made it clear in their work plan in H2 that Jupiter will continue to explore and develop in depth around the rules and development of LFG Launchpad.

Although 1inch occupies a major position in the decentralized trading liquidity aggregator track in the Ethereum ecosystem, it does not have the absolute dominance that Jupiter occupies in the Solana ecosystem, because Uniswap is a very successful DEX in the Ethereum ecosystem, and Uniswap also gathers a considerable number of users. Therefore, 1inch's subsequent development path is different from Jupiter. 1inch mainly focuses on the decentralized trading liquidity aggregator track business, and optimizes the transaction speed and gas fee by deploying itself to different L2s.

Project Model

Business Model

Jupiter is a decentralized trading liquidity aggregator and also provides derivative contract services and project incubation, so the Jupiter economic model consists of three roles: trading users, liquidity providers, and new incubation projects.

Trading users: Trading users are the foundation of the success and development of the Jupiter project. Trading users enjoy a variety of financial services on the Jupiter platform, such as liquidity aggregation, limit orders, DCA fixed investment, and contract services. For this, trading users need to pay a certain percentage of transaction and service fees to Jupiter, which is also the main source of income for the Jupiter project.

Liquidity providers: Because Jupiter not only limits its own business to liquidity aggregators, but also extends to perpetual contracts, its operating model is similar to GMX, so it must have users who specialize in providing liquidity to ensure the normal operation of perpetual contracts. Liquidity providers obtain 70% of transaction fees and all lending fees, and the remaining 30% is the source of income for the Jupiter project.

New incubation projects: After Jupiter launched LFG Launchpad, it adopted an innovative way to support new projects, in which Jupiter not only provides technical support but also certain financial support. In return, the newly incubated projects will give part of their tokens to Jupiter, which is also a source of income for the Jupiter project.

From the above analysis, we can see that Jupiter's income is:

The fee for using Jupiter's liquidity aggregator is less than 2%, and the fee depends on different liquidity pools.

To use Jupiter’s limit order feature, users will be charged a 0.3% fee.

To use Jupiter’s DCA fixed investment feature, users need to pay a fee of 0.1%.

With Jupiter’s perpetual contract product, you will need to pay 0.1% to open/close a position, a swap fee of up to 2% (varies based on pool weight), a borrowing rate of 0.01%/hour*token utilization%, and 30% transaction fees and all borrowing fees.

Projects incubated or operated by Jupiter Launchpad will allocate part of their tokens to Jupiter.

Token Model

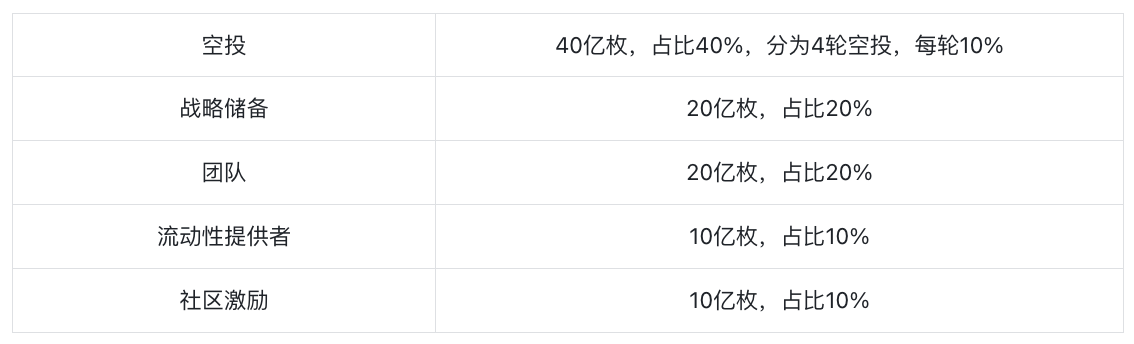

According to the white paper: the total amount of JUP is 10 billion, and the current circulation is 1.35 billion, with a circulation rate of 13.5%. The initial circulation is 1.35 billion, of which 1 billion are used for airdrops, 250 million for Launchpool, and another 50 million for CEX market making and on-chain LP needs. The overall token distribution is as follows:

The agreement promises to distribute 50% of the tokens to the community, and allocates a cold wallet to the team and the community respectively. The initial circulating tokens are expected to be 5% for adding liquidity and 10% for airdrop tokens (there may be an additional 2% or so of tokens unlocked).

Token Empowerment

According to the white paper, the uses of JUP in Jupiter are as follows:

Governance Warrants: JUP token holders can participate in the DAO (decentralized autonomous organization) governance of the Jupiter platform, express their opinions through voting, and influence the operation and development direction of the protocol.

Liquidity Mining: Users can earn JUP token rewards by providing liquidity to the Jupiter liquidity pool, incentivizing users to increase platform liquidity, reduce transaction slippage, and improve transaction efficiency.

Fee discounts: Users holding JUP can enjoy a certain degree of fee reduction when using Jupiter for transactions, further enhancing the practical value of the token.

Expanded functionality: As the Jupiter platform continues to evolve, the functionality of the JUP token is also expanding. For example, users may be able to use JUP to participate in perpetual contract transactions launched by the platform or obtain priority access to new products and services.

JUP Value Judgment

According to the white paper, in the Jupiter project, there is no scenario in which JUP is destroyed in a centralized or regular manner, or in which fees are charged for staking.

Less empowerment of JUP is a significant shortcoming of the Jupiter project. There is no staking mechanism in its design, which reduces the key point of locking JUP tokens to increase the value of the project. In addition, the current circulation rate of JUP tokens is 13.5%. In the future, with the unlocking of each airdrop, 1 billion JUP will be released to the market, which will create huge market selling pressure. Therefore, more value increase of JUP tokens comes from the value of the Jupiter project itself, which is somewhat similar to the situation of UNI and Uniswap. In addition, JUP does not have a staking mechanism to participate in the sharing of project income, which leads to less empowerment of the project. The rise of JUP can only depend on the development trend of Jupiter and users' optimism about the future of Jupiter.

Token Price Performance

According to Coingecko statistics, since the issuance of JUP on January 31, 2024, the price has risen more than 2.8 times (lowest point 0.46 US dollars, highest point 1.75 US dollars), and the main trading venues are Binance, OKX, HTX, bybit and other first-tier exchanges.

JUP price trend (data source: https://www.coingecko.com/en/coins/jupiter)

According to Coingecko statistics, since the issuance of JUP on January 31, 2024, the price has risen more than 2.8 times (lowest point 0.46 US dollars, highest point 1.75 US dollars), and the main trading venues are Binance, OKX, HTX, bybit and other first-tier exchanges.

Market value: The current price of JUP is $0.973, the current circulation is 1.35 billion, and the market value is: $1.33057 billion.

FDV: The current price of JUP is $0.973, the total circulation is 10 billion, and the market value is $9.73 billion.

Average daily trading volume

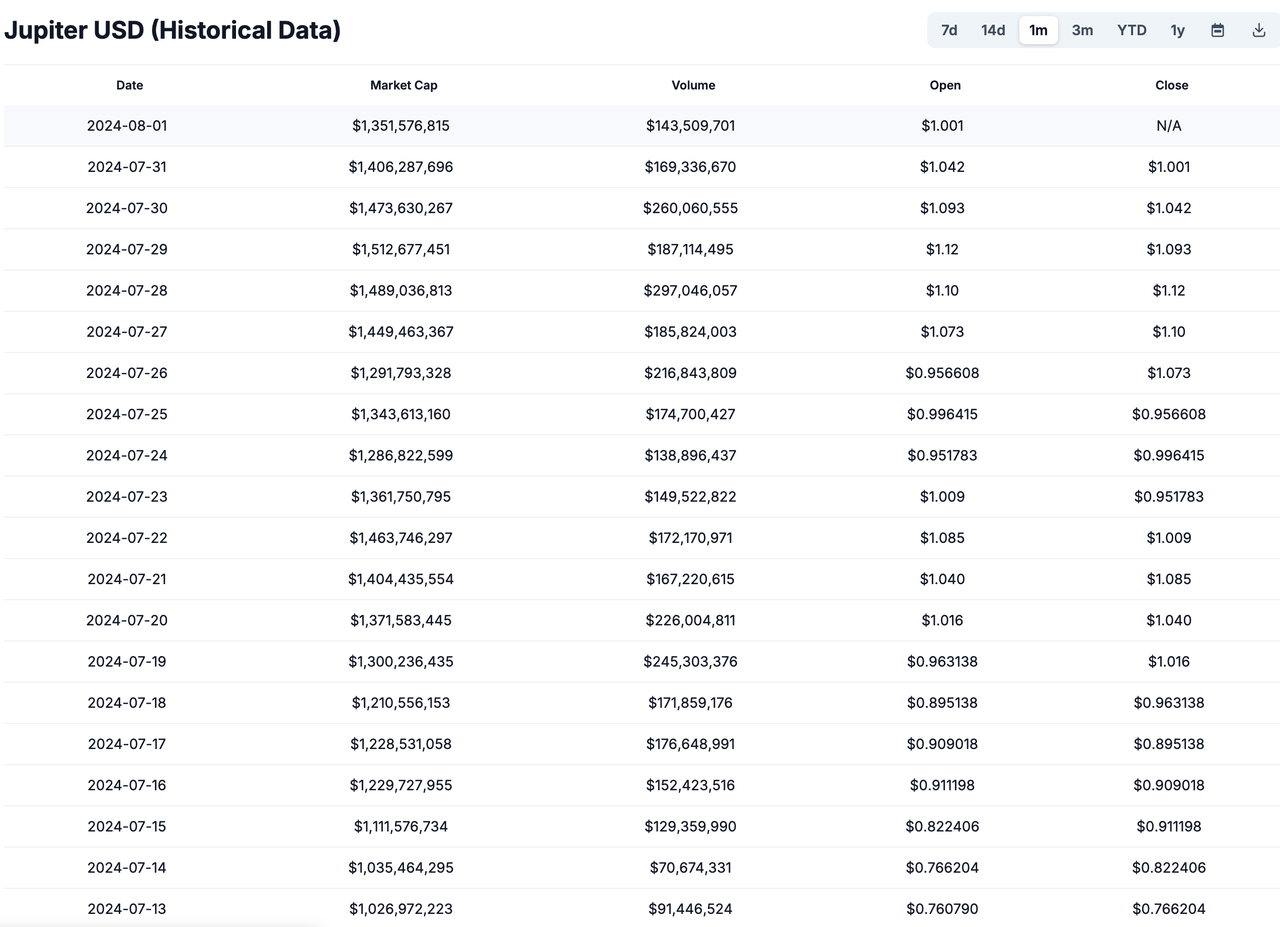

JUP daily trading volume (data source: https://www.coingecko.com/en/coins/jupiter/historical_data)

JUP's daily trading volume is $154 million, its market capitalization is approximately $1,330.57 million, and its turnover rate is 11.57%, which is at a medium level.

Top 10 Token Holding Addresses

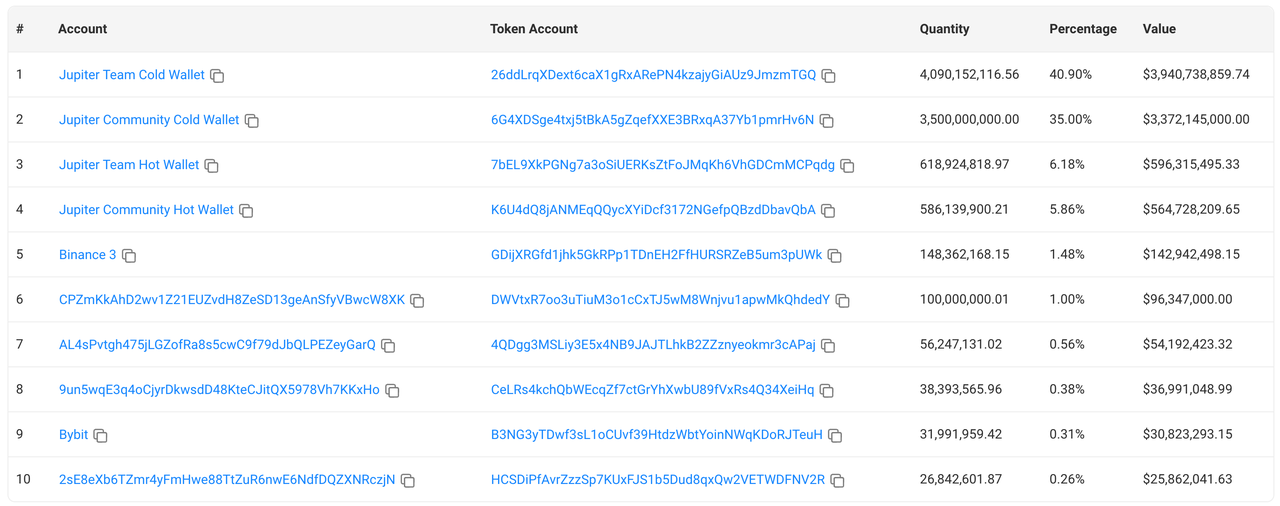

Top 10 JUP holders (data source: https://solscan.io/token/JUPyiwrYJFskUPiHa7hkeR8VUtAeFoSYbKedZNsDvCN#holders)

As can be seen from the figure, the top ten PHA holding addresses account for a total of 91.93%.

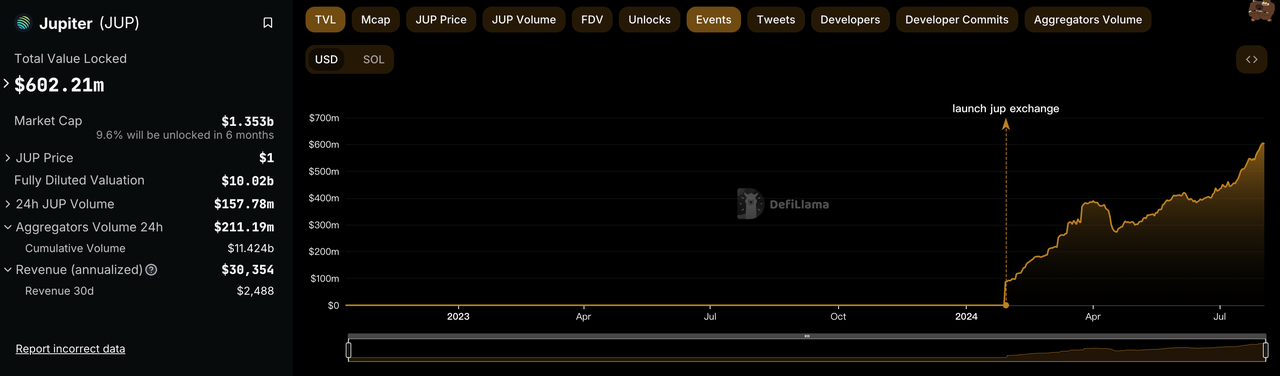

TVL

Jupiter’s TVL (data source: https://defillama.com/protocol/jupiter#information)

It can be seen that Jupiter's TVL has been growing in the past six months and has now reached US$602 million.

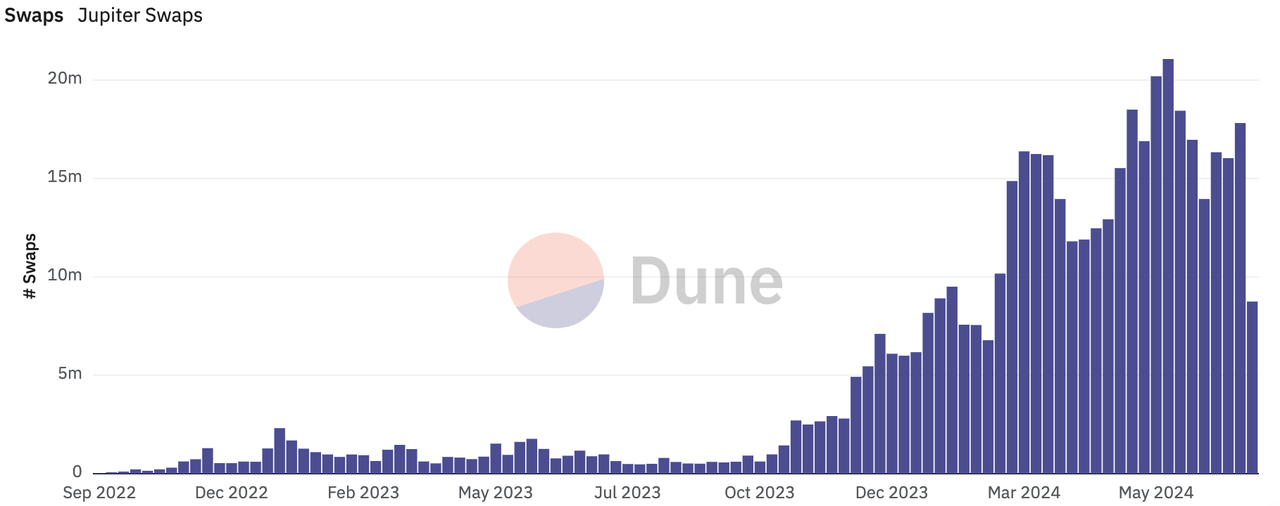

Daily Trading Volume

It can be seen that Jupiter’s daily trading volume has been increasing continuously over the past year.

It can be seen that Jupiter’s daily trading volume has been increasing continuously over the past year.

Project Risks

In addition to being Jupiter's governance token, JUP tokens are rewards for liquidity providers and can provide some discounts on transaction fees when holding JUP. However, JUP tokens lack the Ve token mechanism like Cruve, and there is no centralized destruction or regular destruction, or staking to share transaction fees. As a result, JUP is like UNI, which is just a token of the Uniswap project, but it has basically no other functions and only serves as a project mascot. Therefore, there is no design for staking JUP tokens in Jupiter's token economics, which is not conducive to the increase of token prices.

Summarize

Jupiter is a trading aggregation platform whose business is close to the ceiling, so it has adopted a strategy of developing into other parallel tracks. In addition to innovations in its main business, Jupiter has also launched the Launchpad platform and the incubation platform, making full use of its own resource advantages. The projects it has launched are worth paying attention to and have great development potential with the support of Jupiter. With the continuous development and growth of investments in other parallel tracks, I believe Jupiter will achieve greater success in other fields.

However, Jupiter’s token economics is too simple, and there is no good staking mechanism, which leads to high liquidity of tokens, which indirectly has an adverse impact on the rise of token prices. Although Jupiter has also empowered JUP with governance and fee reduction, it has never involved staking, centralized destruction or regular destruction, and staking fee sharing scenarios. This is not conducive to the rise of JUP token prices.

In summary, Jupiter has consolidated its position in the decentralized liquidity aggregator track with the launch of innovative products such as limit orders, DCA fixed investment, and user contracts. It has also taken a long-term view and started to actively lay out the entire Solana ecosystem. If the projects it supports and launches are successful, it will not only greatly increase its influence in the Solana ecosystem, but will also gradually grow into a unicorn project in the Solana ecosystem. So we are very optimistic about Jupiter's future development.

References

Aggregating over 50% of DEX trading volume, is Jupiter the future of Solana DeFi ecosystem?

First Class Warehouse Research Report: Jupiter, the Aggregator on Solana