Original author: 2 Lambro

Original translation: Bai Ze Research Institute

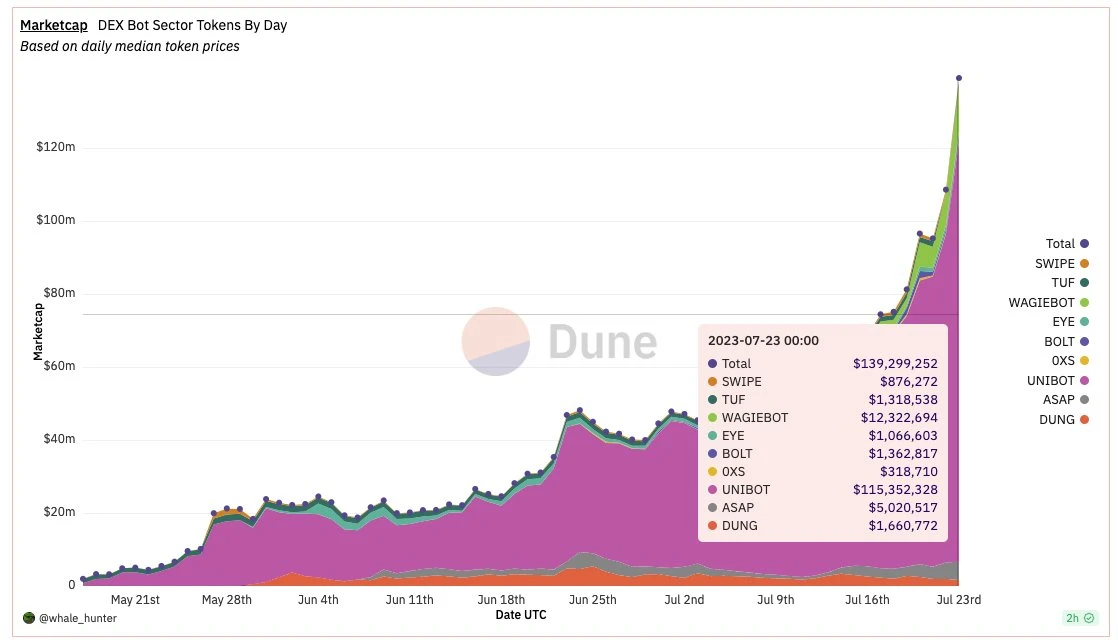

The Telegram Bot track has recently exploded. The Unibot token has skyrocketed from $2.46 two months ago to $143, and its maximum supply market value has increased from $30 million to $140 million in the past 30 days.

Is the bot just a meme?

Can Unibot prove that its market value of $140 million is more valuable than DeFi applications Trader Joe ($JOE) and Kyber ($KNC) with smaller market values?

Did I miss the opportunity to buy $unibot early on? Can I still buy now?

What is Telegram Bot?

In short, Telegram Bot is a bot on Telegram that provides various DeFi trading tools. After entering your wallet mnemonic, it can execute certain commands for you, such as token exchange, copy trading, analysis, automatic airdrop trading, cross-chain assets, and so on.

$Unibot has become the leader in the Telegram Bot track with a market value of $140 million, while all other projects except $WAGIEBOT have market values below $5 million.

Most of these projects provide various functions through Telegram or Discord and share revenue with token holders, so they can also be called "real yield" projects.

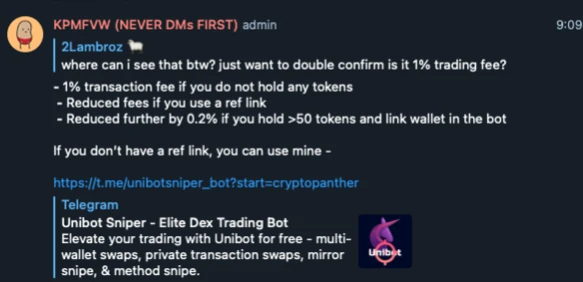

Unibot's revenue (similar to Safemoon's model):

• 1% transaction fee

• 5% sales tax when selling tokens

Here, the translator has simply organized the existing projects in this track:

DeFi Category

Unibot (Trading), WagieBot (Trading and Tracking), Boltbot (Trading), 0 x Sniper (Trading), NitroBot (Trading), Xbot (Custom Trading), ASAP (Discord Exclusive), SwipeBot ($ETH, $ARB, $BSC AI Trading), Bridge Bot (Cross-Chain), AI DEV (AI Trading, Token Issuance), All In (AI Trading)

Data Analysis

Cipher Protocol (Analysis), NeoBot (Analysis and Tracking), Meowl (Analysis and Tool Suite), TokenBot (Social Trading), Trace AI (AI Analysis), Scarab Tools (Analysis), BlackSmith (AI Analysis), TrackerPepeBot (AI Analysis and Contract Security Testing), DAGMI (Tracking), First Sirius (Analysis), The DIG (Token and NFT Analysis), WallyBot (Wallet Analysis),

Airdrop Ambush Trading

Farmer Friends, LootBot, alfa.society (with Airdrop Alerts)

Others

EnigmaAI (Customizable AI Trading on CEX), NexAI (A bunch of AI tools), 0 x 1 (Multifunctional), MagiBot (Privacy)

Why has Telegram Bot Narration become popular?

• Most crypto users are heavy users of Telegram

• Products that can be easily used by non-crypto users

• Unibot ranks in the top 10 for revenue, earning around $890,000 per week

• Even Coingecko co-founder Bobby ONG praises them

• Coingecko and Coinmarket Cap start working with these Bots

As Bobby ONG said:

One of the biggest pain points of bringing retail into cryptocurrencies is that using wallets and interacting with DeFi protocols is too difficult.

A few weeks ago, after experiencing Unibot, I think I now know how the next wave of billions of new users will interact with cryptocurrencies. The idea behind Unibot is simple - build a fast and easy-to-use wallet on Telegram, and integrate closely with DEXs to reduce the risk of buying junk coins and copy trading.

For me, trading DeFi on mobile is now too easy.

Opportunities and Risks

I remain neutral on this, but here are some opportunities to seize:

• MaestroBots earns $1.1 million in weekly revenue and launches tokens (the second most commonly used Telegram Bot)

• Unibot's new trading terminal, Unibot X, integrates with GeckoTerminal

• CEX listing frenzy for Bot tokens

• Twitter bots are becoming mainstream

At the same time, risks should be taken into account:

• Low decentralization - importing mnemonics into these "centralized applications" could result in a total loss due to a single hack

• Do these Bots have self-regulation? Should we be worried if Unibot's total market value exceeds $300 million?

• Current costs mainly come from taxes

Thoughts and Conclusion

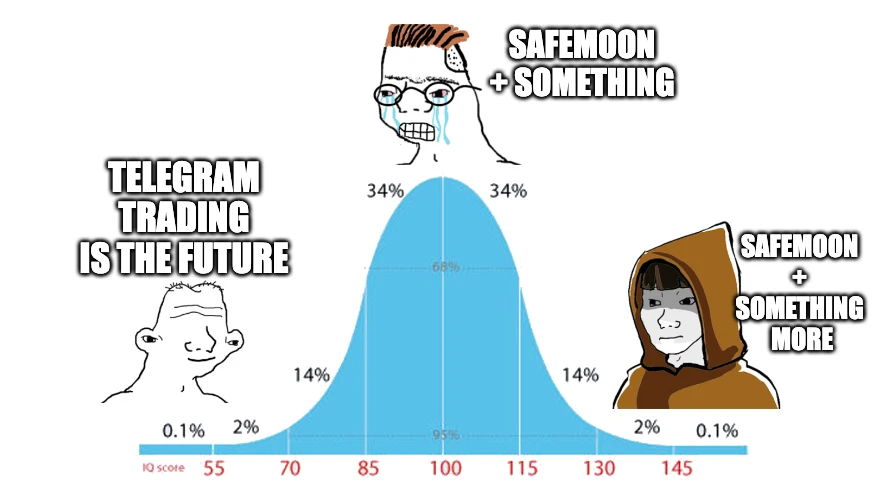

Personally, although it is still in the early stage, I don't believe Telegram Bots will be a long-lasting narrative because:

• It is still not user-friendly for users outside the circle

• It lacks sufficient decentralization, and even crypto users cannot adopt it on a large scale

• Unibot's total market value is currently too high

• It seems to be just a Bot version of Safemoon (collecting transaction fees as revenue and distributing them to token holders)

• Following the trades is indeed good, but do you still remember all those NFT tools? The Alpha opportunity is only the best when it can make money.

• Not sure about the token distribution or how Unibot was initially launched.

But I do think the popularity of Telegram Bot storytelling will continue to rise because:

• The "worship" of Unibot has been established.

• Taxation (income distribution for token holders).

• The CEX listing frenzy has not started yet.

• Since the launch of Unibot, the team has continuously released new products while outlining future products.

To be honest, I really like Unibot and regret not discovering it earlier.

I am a cautious person, and in my opinion, its token is now too expensive, and it may reach its peak at most with another 2-fold increase. I don't think its market value will be larger than that of GMX.

At the same time, I am very interested in how Unibot will continue to develop or deliver new products in the future.

In addition, I will pay close attention to the following questions:

Can these bots enhance users' trust in them by protecting mnemonic phrases?

Will these bots launch their own DEX?

Taxation is indeed a good start for these bots, but how far can they go if they don't change this model and enter the public's vision more?

Risk Warning:

According to the notice issued by the central bank and other departments on "Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation," the content of this article is only for information sharing and does not promote or endorse any business or investment activities. Readers should strictly comply with local laws and regulations and not participate in any illegal financial activities.