1. Project Introduction

Linea is an innovative blockchain solution that combines powerful zero-knowledge proof functionality with full Ethereum Virtual Machine (EVM) compatibility. It allows developers to build scalable decentralized applications (dapps) or migrate existing dapps without changing the code or rewriting smart contracts, greatly simplifying the development process. Linea is built by ConsenSys and is one of the Type 2 variants of zkEVM, leveraging zkEVM's scalability properties to provide faster transaction times and higher throughput. zkEVM is a Zero-Knowledge Proof (ZKP) version of the Ethereum Virtual Machine (EVM) that ensures validated transactions and smart contract executions without leaking any sensitive information. This not only enhances security but also achieves a more scalable and efficient platform.

In the fourth quarter of 2022, ConsenSys launched an internal test version of Linea, providing early access to a limited number of users, handling over 350,000 transactions, and deploying various decentralized applications. The testnet allows Solidity developers to build, test, and launch dapps, while also conducting large-scale testing of zkEVM.

On March 28, 2023, Linea launched its public testnet and released zkEVM rollup to stress test Layer 2 scaling technology. During the public testnet phase, approximately 5.5 million unique wallets executed over 46 million transactions.

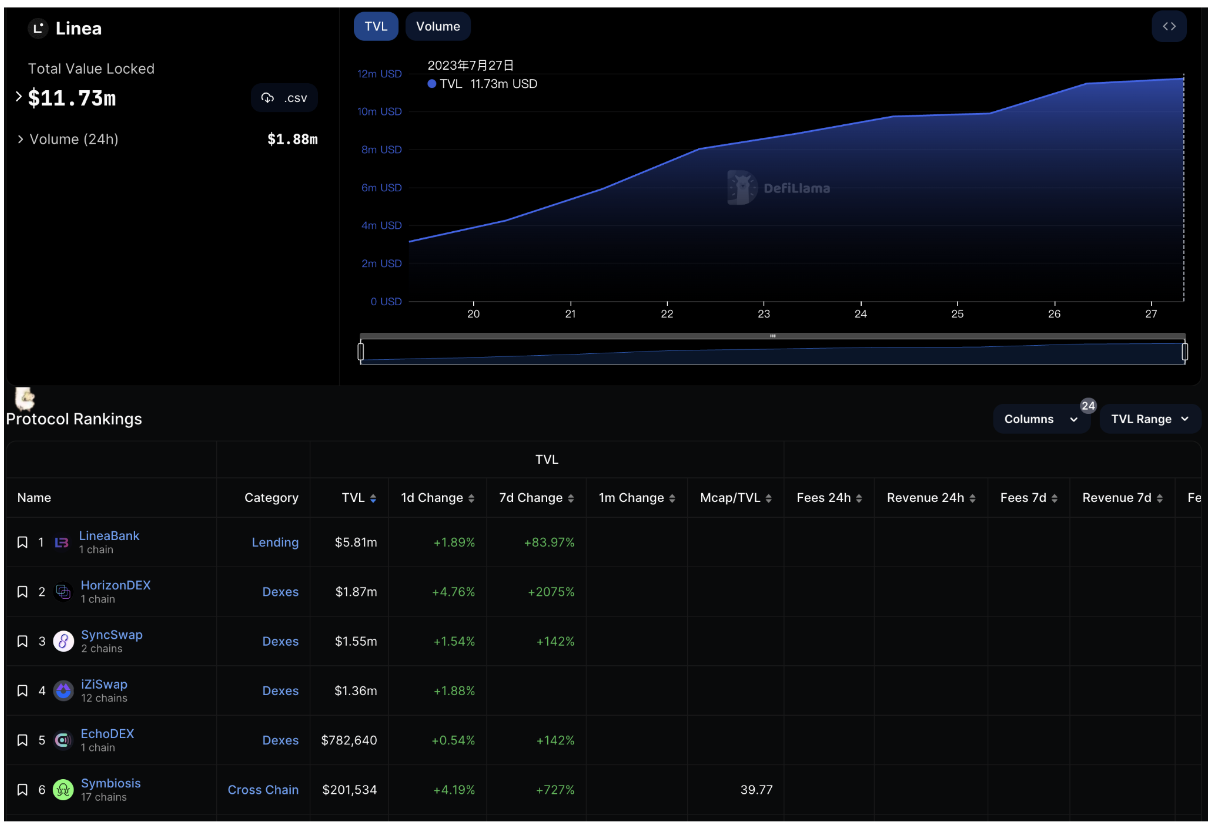

On July 18, Linea launched the Alpha version of its mainnet. As of July 24, Linea mainnet has over 100 ecosystem projects, holding 10,921 ETH, with 64,604 transactions and 58,344 interacting addresses.

According to the Global Business Lead of Linea, @hotpot_dao, after the mainnet launch, Linea plans to focus on the development of Layer 3 and Appchain to meet the throughput and peer-to-peer transaction needs of gaming projects, while further advancing the collaboration on Multi Prover.

2. Background Team

Linea is developed, designed, and operated by ConsenSys, a leading Ethereum software company founded in 2014. ConsenSys operates globally and employs top entrepreneurs, computer scientists, protocol engineers, software developers, and enterprise delivery experts. As one of the largest and foundational entities in the blockchain technology field, ConsenSys' global personnel, projects, and company network are building development tools, decentralized applications, and solutions for enterprises and governments determined to harness the power of Ethereum blockchain. In 2018, the organization was referred to as "the most famous and widespread decentralized application developers and promoters in the Ethereum community" by The New Yorker. The current product suite consists of Infura, Quorum, Truffle, Codefi, MetaMask, and Diligence.

Joseph Lubin is a co-founder of Ethereum and the founder of ConsenSys. Lubin was born and raised in Toronto, Canada, and graduated from Princeton University with degrees in Electrical Engineering and Computer Science. He developed autonomous music composition tools at Tomandandy Music's Princeton Robot Orchestra Lab and autonomous mobile robots at private research company Vision Applications Inc. Lubin specializes in the intersection of cryptography, engineering, and finance.

III. Analysis of ZK EVM Types

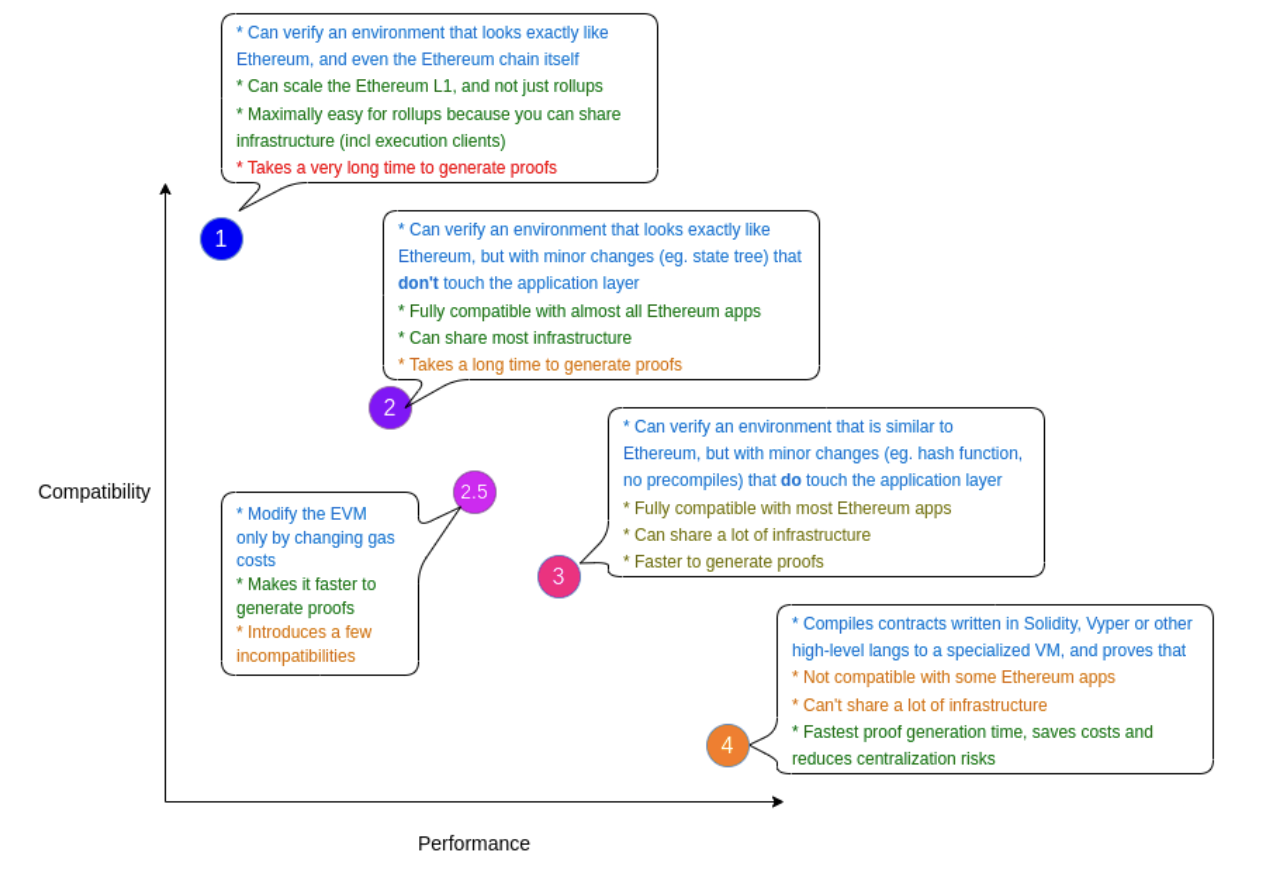

As mentioned earlier, Linea belongs to the Type 2 among the four types of zkEVM. So, what are these four types? What are their respective characteristics? Vitalik provides an overview of zkEVM types based on Ethereum compatibility in his blog post.

Before diving into the details, it is important to note that **the closer zkEVM is to Ethereum functionality, the slower the generation of zk proofs and the higher the cost**. On the other hand, if a blockchain or Rollup adheres more closely to Ethereum specifications and standards, developers can more easily build applications and integrate them into the Ethereum ecosystem. Therefore, Ethereum-compatible blockchains may have a competitive advantage.

Type 1: Zk rollups that are identical to Ethereum in all aspects (including hash, state tree, transaction tree, precompile, or any other consensus logic). Currently, there are no zkEVMs that can achieve equivalence with Ethereum in practice, but Taiko's ultimate goal is to achieve Ethereum equivalence, so theoretically Taiko can be classified as this type. Type 2: Zk rollups that are identical to EVM and strive for EVM equivalence, but not identical to Ethereum. They are fully compatible with existing applications, but have made minor modifications to Ethereum to make development easier and proof generation faster. Linea currently falls into this category. Type 3: Nearly identical to EVM, sacrificing more elements and equivalence in order to generate proofs faster. Polygon zkEVM and Scroll currently fall into this category. This category is usually a stepping stone to enter Type 2. Type 4: High-level language equivalence, which means they accept smart contracts written in Solidity and then convert them to another custom language suitable for Zk. zkSync and StarkNet belong to this category, although zkSync may add compatibility with EVM bytecode over time and eventually transition to a higher Type 3/Type 2. It should be noted that these different types are not superior or inferior to each other. They are mainly developed and chosen based on different technical choices and proof generation speed, and they can also be transformed into each other. As a Type 2 solution, Linea is fully equivalent to EVM. Unlike Type 3 and Type 4 projects, if a project has a Dapp on the mainnet, it can be directly migrated to Linea without any code changes, just by performing a one-click conversion to use Linea's Layer 2 protocol. However, if you want to migrate to Type 4 StarkNet, you will need a compiler and add an extra step, which may introduce security issues and additional development costs. In terms of current technology, Type 2 is relatively easier to implement compared to Type 1. Linea has already launched on the mainnet, while the Type 1 solution, Taiko, has not yet announced the launch date on the mainnet. This suggests that Type 2 may be more practical while Type 1 is relatively more idealistic, and its project is relatively early-stage.

IV. Linea vs other zkEVMs

1. Financial Aspect:

In terms of financing, Linea did not undergo separate project financing, but its parent company ConsenSys has raised $726 million, so it is well funded. At the same time, ConsenSys' subsidiary project MetaMask is a well-deserved leader in the wallet field, providing strong support for Linea while generating substantial profits for ConsenSys.

In addition, other zkEVM projects have also received substantial financing: zkSync has received $458 million, StarkNet has received $273 million, Polygon zkEVM has received $450 million, Scroll has received $83 million, Taiko has received $22 million. Compared to others, Linea is well-funded and has strong background support, making it one of the leaders in the zkEVM field.

2. Technical Aspect:

In terms of technology, Linea has the advantage of Type 2 (which is currently not fully compatible and is in the transition phase from Type 2 to Type 3. The seventh part will provide detailed progress of the project) and has EVM equivalence. It can fully match the Ethereum Virtual Machine (EVM), allowing developers to build scalable decentralized applications or directly migrate existing ones without modifying code or rewriting smart contracts.

In addition, Linea utilizes unique verifiers (the fifth part will provide detailed information), which, under the premise of ensuring compatibility, can maximize transaction speed and reduce gas fees.

However, due to the inherent difficulty of zk-rollup in being EVM-compatible, Linea's transaction speed is relatively slower and its gas fees are slightly higher compared to Type 4 and Type 3 zkEVM projects (such as zkSync, StarkNet, and Polygon zkEVM) while maintaining high compatibility.

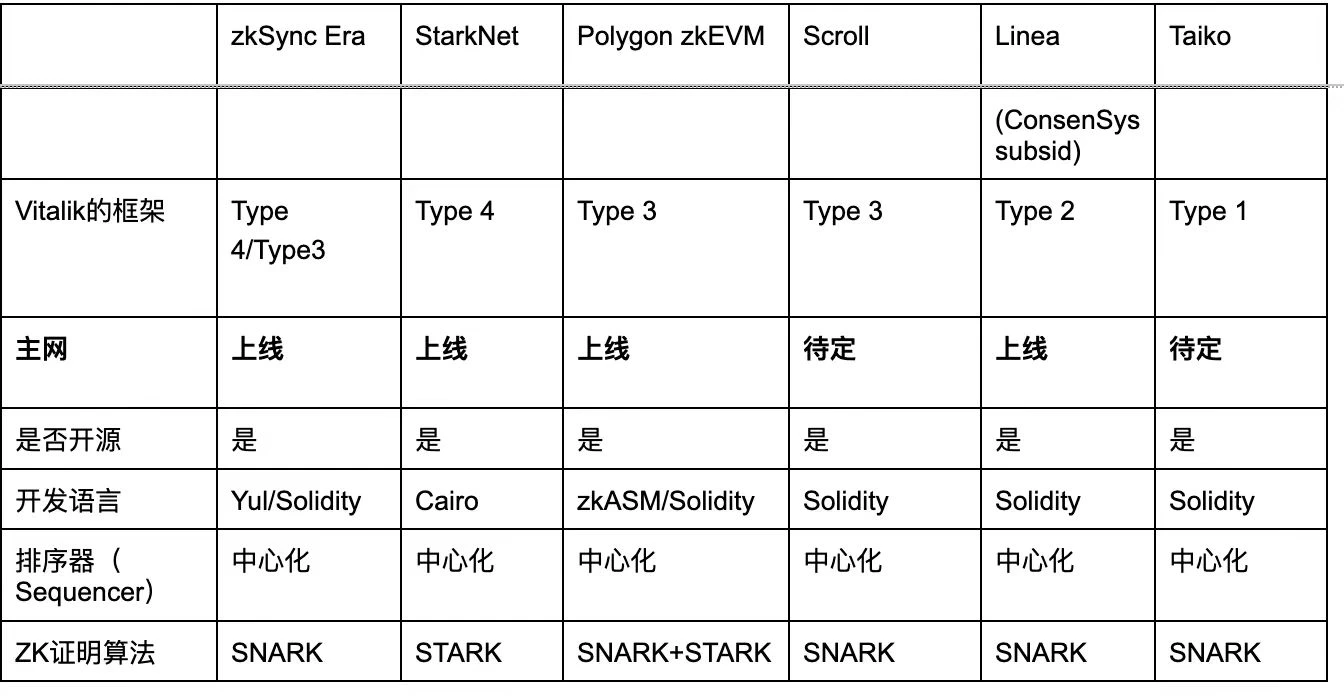

Other technologies are illustrated in the following figure:

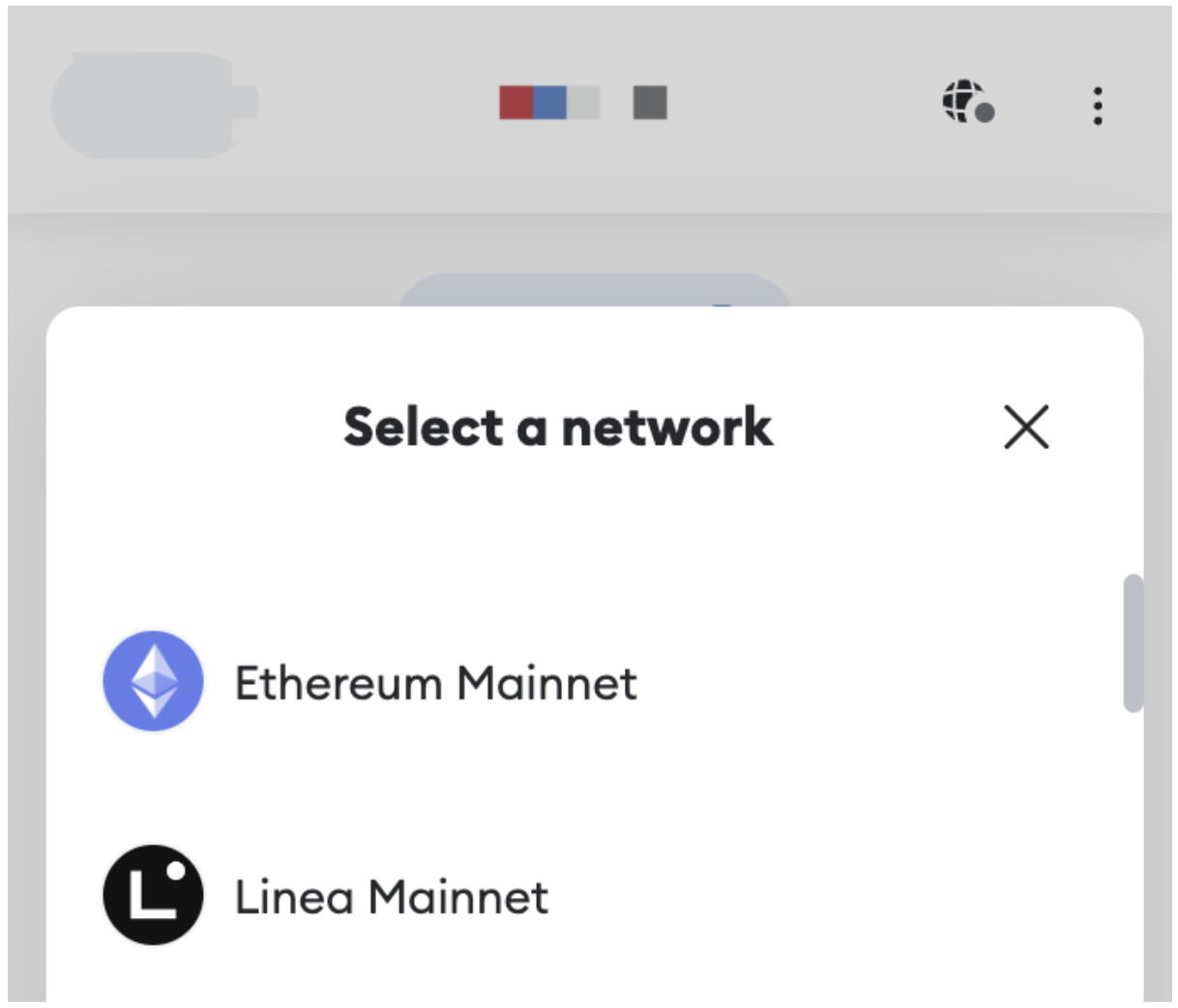

3. Data Aspect:

Note: Due to Scroll and Taiko not being launched on the mainnet, they are replaced by Arbitrum and OP Mainnet.

Data source:

[ 1 ]https://dune.com/gopimanchurian/arbitrum

[3]https://dune.com/optimismfnd/Optimism-Overview

[4]https://dune.com/KARTOD/zk-evm-mega-dashboard

[5]https://dune.com/tk-research/linea

The above chart shows the related data of various zkEVM projects. It should be noted that Linea's mainnet has just gone live, so its data currently has limited significance and is for reference only.

As the chart shows, zkSync is in a clear leading position in terms of data. However, it should be pointed out that Web 3 data has a significant degree of unreliability, with many data contributions from airdrop hunters. Nevertheless, this also reflects more people's optimism about the project.

Another notable reason for zkSync's significant lead in data is that shortly before its mainnet went live, another Layer 2 solution in the same track, Optimistic Rollup project Arbitrum, issued tokens and airdropped them to many users, allowing many airdrop hunters to generate substantial profits. This situation fueled the enthusiasm of Web 3 users and prompted zkSync's mainnet to attract nearly 100,000 independent wallets within just three days. Meanwhile, the market is undoubtedly in a bear market phase, with a low trading volume and a cold market atmosphere, causing many users to choose to wait and see. Therefore, Linea, which has just launched its mainnet, did not experience the same level of popularity as zkSync's mainnet launch, attracting less than 25,000 independent wallets in the first three days.

In addition, currently only Polygon zkEVM has its own token, which may be one of the reasons why its data is relatively inferior to zkSync Era and StarkNet. After all, this means that Polygon zkEVM does not have the expectation of an airdrop and cannot attract community contributors to provide data.

Finally, the charts show that among the various zkEVM projects in the entire Layer 2 track market share, zkSync Era has an absolute leading position with 4.27%, followed by StarkNet, while Linea accounts for only 0.24%, nearly 20 times lower compared to zkSync Era. It can be seen that if Linea wants to stand out among the many zkEVM projects, it will undoubtedly need to make more efforts.

5. What are the highlights of Linea?

1. Linea can seamlessly integrate with ConsenSys products such as Infura, MetaMask, and Truffle:

Builders can easily attract users using the web 3 wallet MetaMask. For example, in the network selection of the MetaMask wallet plugin, the Linea testnet is available by default, eliminating the user experience barrier of manually adding a network, which also reduces the entry threshold to a certain extent.

In addition, developers can publish and scale dapps faster with the easy-to-use API provided by Infura. Developers can use Truffle or popular developer environments like Hardhat, Foundry, and Brownie to build, test, debug, and deploy their Solidity smart contracts. Compatible with Ganache and Diligence for local code testing and auditing respectively.

In addition, ConsenSys' native, trustless bridge and MetaMask-friendly bridge allow developers to securely move tokens in and out of the network.

2. Unique proof-of-internality system and compression method

Linea Proof Process

The technology of Linea differs from other zkEVMs in terms of arithmetic schemes and internal proof systems. To prove the occurrence of a transaction, Linea follows a series of steps. It starts with arithmetization, converting computer programs into mathematical expressions that can be understood by zk proofs. This process transforms transactions into traces and a set of constraints that verify their accuracy.

Next, Linea employs internal proof systems Vortex and Arcane, which recursively decrease the size of proofs and enhance their efficiency and compactness through optimized calculations and specific algorithms. Eventually, after multiple iterations and internal optimizations, the proofs are further compressed into the final external proof system, Plonk.

This design enables Linea to efficiently generate and verify zk proofs, ensuring the privacy and security of transactions. By utilizing recursive optimizations in the internal proof systems and the final compression step, Linea reduces the size of proofs and improves overall performance, providing users with fast and efficient transaction experiences. This innovative technical approach sets Linea apart in the zkEVM race and offers robust technical support for building scalable decentralized applications.

Internal Proof Systems: Vortex and Arcane

Lattice-based design:

Vortex is a lattice-based SNARK scheme that can run on domains with reasonable binary precision and efficiently handle various types of queries. Lattice-based hashes have multiple advantages compared to traditional encryption methods. It performs faster than popular elliptic curve cryptography and is post-quantum, meaning it can resist quantum computing attacks. The lattice design is optimized for recursion, enabling effective hardware acceleration and compatibility with SIMD parallelism. Additionally, lattice-based functions avoid the trade-off between speed and utility in SNARKs, making them more versatile.

In comparison to STARK, SNARK schemes also have several advantages. SNARK adoption is actually much faster than STARK, with SNARK being discovered several years earlier, giving it a significant head start in adoption. SNARKs have a larger developer community, more published code, projects, and developers actively working on the technology. Furthermore, the gas usage of SNARKs is estimated to be only 24% of STARK, making transactions much cheaper for end-users. Finally, SNARK proofs are much smaller in size than STARK, requiring less on-chain storage.

2.Transparent Settings:

The setting process of Vortex is transparent, and no trust in the setting participants is required, which makes Vortex more secure and reliable.

3.Linear Commitment Scheme:

Vortex uses an innovative linear commitment scheme that can efficiently handle multiple scalar products' commitment and prove smaller size compared to other schemes.

4.Self-Recursive Technique:

Vortex uses a self-recursive technique that allows for the reuse of different Ring-SIS instances and different error correction codes, thereby allowing flexible trade-offs between proof size and runtime when choosing Ring-SIS parameters and error correction codes.

5.Interactive Oracle Proof (IOP) Model:

Arcane compiles arithmetic into the Interactive Oracle Proof (IOP) model, which allows verifiers to query an oracle, a trusted third party that probabilistically provides necessary information. Linea adopts the Wizard-IOP framework, providing more complex queries than the standard IOP model, and Arcane transforms constraint sets into polynomial evaluations, enhancing the mathematical form of the proof. To eliminate the reliance on third parties, Linea employs cryptographic assumptions and iterative transformations, replacing oracles with polynomial commitment schemes.

Final Compression Step: Plonk

To enable direct verification on Ethereum's L 1, Linea uses the PlonK proof for the final compression step. PlonK is a zkSNARK construction, similar to Groth 16 (originally used by Linea), that leverages advanced cryptographic techniques. PlonK's SNARK-friendly properties and lattice-based hash ensure fast verification and generate compact proofs suitable for efficient validation on L 1.

Plonk vs Groth 16: The transition from Groth 16 to PlonK is driven by a trusted setup process. Whenever the circuit changes, Groth 16 requires repeating the setup, while PlonK performs a one-time setup independent of the circuit. Linea's iterative circuit design necessitates frequent reruns of the trusted setup with Groth 16, which raises concerns over trust. By adopting PlonK, Linea maintains the integrity of the protocol while providing the community with confidence in fair competition.

After this transformation, a proof will be created for validation by Linea's verifier contract on Ethereum L 1. Upon successful verification of the proof, state commitments, and invocation data, the new aggregated state will be finalized on the L 1 smart contract.

What benefits do these technologies bring to Linea?

In short, the technology described above enables Linea to improve transaction speed and reduce user gas fees while ensuring high compatibility with EVM. As zk-rollup itself is difficult to be compatible with EVM, there is a negative relationship between zk-rollup's compatibility and speed. As a highly compatible Type 2 zkEVM that is completely equivalent to EVM, Linea faces even greater challenges in improving speed. Therefore, the Vortex SNARK scheme based on "lattice" is an outstanding and rare technological breakthrough in this regard.

3. Promotion of Multi-Prover

Multi Prover treats Linea as a client of Ethereum, and there are already many different clients, such as zkSync, Polygon zkEVM, and other Layer 2 projects. Only by having multiple clients can the security of Ethereum be ensured, because even if one client fails, there are other alternative clients available.

Declan Fox, the senior product manager of Linea, stated that to mitigate potential risks, Linea will promote the use of multi-provers (Multi Prover) approach. This means that multiple provers (which can be understood as multiple different Layer 2 products) jointly use various implementations of zkEVM to verify transactions. Therefore, if one prover has errors or becomes unavailable, as long as the other available provers reach the required number, the system will continue to operate reliably.

Hotpot_dao, Global Business Lead at ConsenSys, explains: "Multi Prover is a product that allows three different Layer 2 solutions to provide proofs. As long as all three pass, the product can be verified and return to the mainnet, greatly enhancing the security of Ethereum. This is also what we believe Linea can achieve when building Layer 2 protocols. As ConsenSys, we are mainly committed to promoting Multi Prover. This also aligns with the direction of the entire Ethereum or our future vision for the Ethereum network, and it is also a significant technical challenge."

Multi Prover is crucial for the entire Layer 2 space. As the initiator, promoter, and even leader of Multi Prover, if Multi Prover is successfully implemented, Linea will gain more recognition and trust in the market and obtain more opportunities and advantages in its future development.

6. Ecological Development

So far, Linea has attracted more than 100 ecosystem partners to join. The mainnet of Linea will be launched together with this massive ecosystem of partners, providing opportunities for users, builders, and developers to build the next generation of scalable Ethereum Dapps.

Based on our long-term observation of Linea, Linea has been focusing on building cross-chain bridges, wallets, and other infrastructure in the early stage of the ecosystem development. Its layout includes the Defi tracks such as DEX, lending, as well as deep cultivation in Social and Gamefi, constantly attracting users and developers, and achieving the large-scale implementation of web 3. As ConsenSys Global Head of Business said, "Like social networks, network computation is needed, but there is a cold start problem, which is difficult to achieve on layer 2 protocols. So we first do Defi well, and then do some smaller Gamefi projects, and then Linea hopes that users can experience our platform and network first, lay a solid foundation, and then hope that good social software can come over for development."

With the launch of the mainnet, we have selected some of the currently popular and active projects from the Linea mainnet ecosystem for analysis. For more detailed and comprehensive information, please refer to the official website.

DEFI

LineaBank

LineaBank is a lending protocol built on Linea, focusing on privacy protection and scalability. The protocol empowers users with full control of their assets and eliminates intermediaries through a decentralized marketplace, providing users with competitive interest rates. As the project name suggests, LineaBank is a native project on the Linea blockchain. Additionally, according to the chart above, LineaBank currently has the highest Total Value Locked (TVL) on Linea, reaching $5.81 million as of today (7/27).

In addition, it is worth mentioning that after Linea went live on the mainnet, LineaBank held a "pre-mining" activity, during which users could earn 100% of the protocol's revenue.

iZUMi Finance

iZUMi Finance is a liquidity optimization protocol built on the Ethereum network, and it is a Uniswap V 3 ecosystem project that provides "programmable liquidity as a service" for blockchain projects.

iZUMi's LiquidBox program assists projects in attracting liquidity by planning effective incentive liquidity supply plans. It also provides a shared liquidity box that maps the liquidity of a token across multiple chains, allowing LPs to mine on multiple chains using liquidity from the original chain.

iZUMi Finance has also launched iZiswap on BNB Chain and zkSync, an upgraded version of the Uniswap V 3 concentrated liquidity model. iZUMi is also developing iUSD, a stablecoin pegged to the US dollar and backed by USDC. iUSD is used for the iZUMi bond mining program.

iZUMi's other user-centric decentralized financial products include impermanent loss insurance, which provides liquidity providers with refunds for impermanent losses caused by their LP tokens. It also offers fixed income opportunities with annual interest rates as high as 10% for a 30-day period.

iZUMi Finance has raised a total of $57.6 million so far, with investors such as Mirana Ventures, Everest Ventures Group, and IOSG, which have strong funding and resources.

As shown in the above figure, on July 11, iZUMi announced a partnership with Linea. As of today, iZUMi Finance ranks fourth on Linea's TVL leaderboard, and as of today (7.27), TVL has reached $1.36 million. This means that iZUMi Finance has been recognized and actively involved in the Linea ecosystem. Through cooperation with Linea, iZUMi will further expand its influence and contribute to the development of the Linea ecosystem.

Mendi Finance

Mendi Finance is an EVM-compatible lending protocol that will launch on the Linea network.

Mendi Finance provides peer-to-peer lending in a fully decentralized, transparent, and non-custodial manner. As a native project on Linea, its goal is to become the leading lending platform on Linea by providing competitive incentives and deep liquidity to the money market.

After launch, users can borrow any supported asset on Mendi Finance and use their funds as collateral to borrow these supported assets, including ETH, BTC, USDC, USDT, and DAI. The collateral factors for these assets range from 0-90%, representing the maximum limit for borrowing against specific assets. If the borrowing balance of an account exceeds the limit set by the collateral factor, the account will be liquidated.

HorizonDEX

HorizonDEX is a centralized liquidity decentralized exchange that allows users to allocate liquidity within a customized price range, enabling traders to maximize efficiency and minimize slippage. As a native project on the Linea blockchain, HorizonDEX ranks second on Linea's Total Value Locked (TVL) leaderboard, and as of today (7.27), its TVL has reached $1.87 million.

In addition, as shown in the above picture, after the launch of the Linea mainnet, HorizonDEX held an event where users could earn airdropped tokens $HZN by trading and providing liquidity. During the event period (7.19 ~ 8.2), for every $1 traded or $1 liquidity provided for 24 hours, users will be able to receive 1 yHZN token. After the event ends, the airdrop will be distributed proportionally based on the amount of yHZN held, meaning the more yHZN you hold, the more airdropped tokens you will receive.

EchoDEX

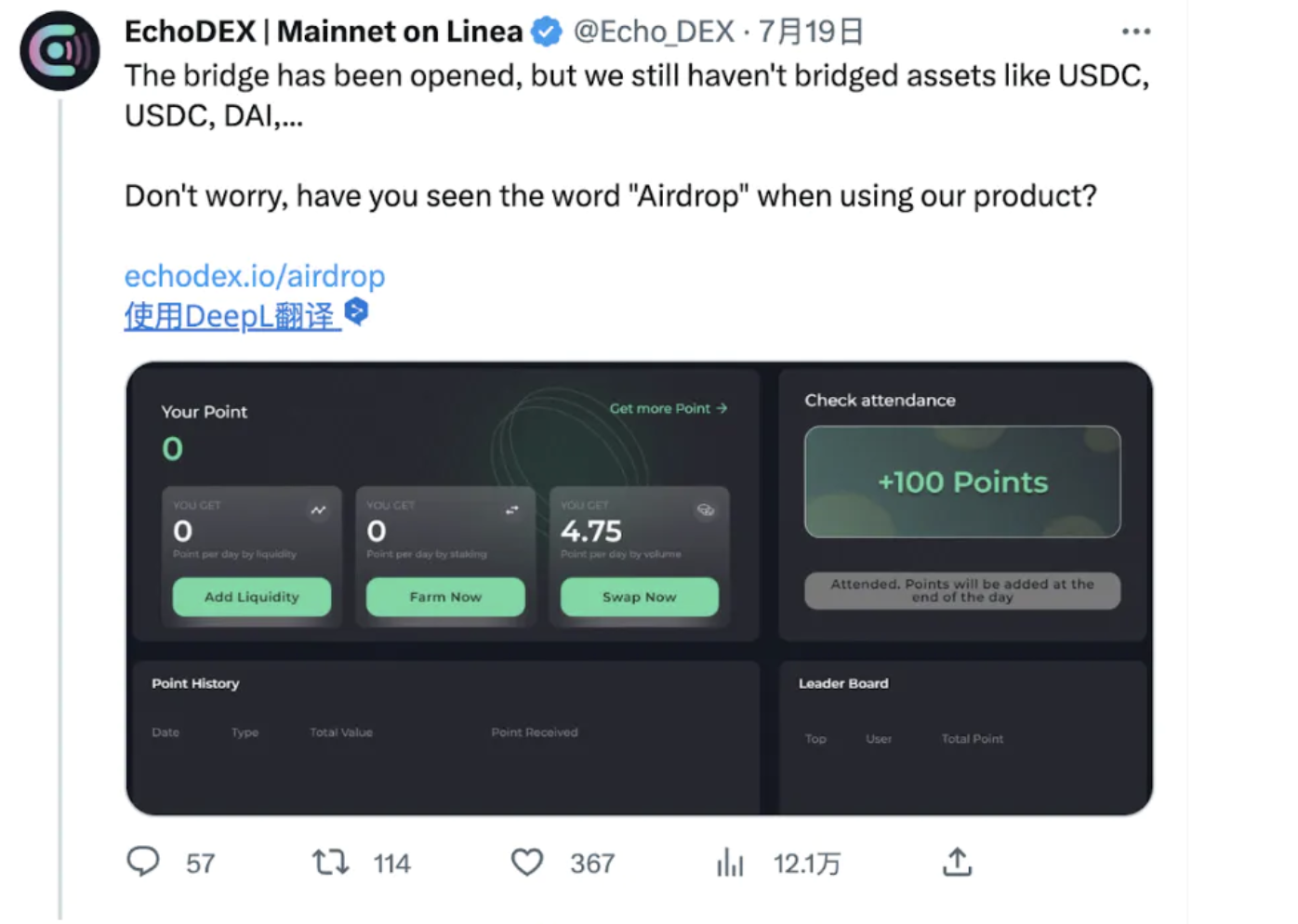

EchoDEX is a decentralized exchange built on the Linea Consensys network and is also a native project on the Linea blockchain. It is the first decentralized exchange (DEX) to go live on Linea and currently ranks fifth in the Total Value Locked (TVL) leaderboard with a TVL of over $780,000 as of today (7.27).

It is worth mentioning that its token ECP currently has a market cap of $37.4M and has garnered a lot of attention from the community since its initial launch.

And EchoDEX, like the two projects mentioned earlier, also has its own airdrop expectations. On July 19th, they announced that users can earn points by swapping, adding liquidity, mining, or even daily check-ins, and have the opportunity to get airdrops.

Owlto Finance

Owlto Finance is a decentralized cross-rollup bridge that provides a low-cost, secure, and fast asset transfer solution. The smart contracts are audited by the security company Beosin. It is worth mentioning that after the Linea mainnet is launched, Owlto Finance has opened a 7-day zero fee cross-chain activity for Linea.

It is worth mentioning that in the official documentation, Owlto Finance states that this Cross-Rollup bridge is different from other Cross-Rollup bridges based on secure Rollup technology. The asset transfer is between the EOA addresses of the "sender" and "liquidity provider" on the "source" and "target" networks, and the "sender" does not interact with the smart contract address. This design reduces risks because smart contract addresses may be more vulnerable to attacks, while EOA addresses are usually more secure.

NFT

NFTs 2 ME

To simplify the process of creation, deployment, and management of NFTs on the Linea network, NFTs 2 ME claims to provide a utility program that allows users to create and manage NFTs without writing any code. Additionally, NFTs 2 Me claims that this facility is open to anyone and free to use.

The platform's toolkit includes a design panel that allows creators to define the attributes of their NFTs. It features AI-driven art and image generation tools, enabling users to generate artwork on the platform, define its metadata, and set minting prices. It supports multiple NFT smart contract standards and allows collectors to pay minting fees in any (crypto) denomination.

NFT creators can use the platform's tools in various ways to manage the generated artwork. NFTs 2 Me's user dashboard comes with analytical tools to help users track the performance of their NFTs. Users can also schedule and execute airdrops, take snapshots, design NFT gating mechanisms, and prepare whitelists for their NFT minting activities through NFTs 2 Me profiles.

NFTs 2 Me is multi-chain and can be used on Ethereum, Polygon, Taraxa Chain, and Layer 2 networks such as Arbitrum, Optimism, and zkSync Era, as well as the current Linea network.

ghostNFT

ghostNFT is one of the official testnet projects on the Linea network and is expected to be available on the mainnet with the launch of alpha version.

ghostNFT claims to utilize the ERC-721 Envious standard (an improved version of the ERC-721 standard) to provide additional monetization features for NFTs through NFT collateralization. It claims to empower NFT creators and collectors in various ways by merging NFTs and decentralized finance through its NFT 2.0 project, allowing creators to define collateralization plans, collect collateral, and crowdfund their NFT releases. Users can also perform this operation on individual NFTs or entire collections using the "Fractionalize" feature.

ghostNFT is multi-chain and is already available for users on Ethereum, Binance Smart Chain, Avalanche, and several other networks.

Infra

thirdweb

thirdweb is a UK Web 3 software developer that offers free Web 3 development tools for building, launching, and managing web 3 projects without any coding. Developers can easily add features including NFTs, social tokens and currencies, token marketplaces, and NFT trading with just a few clicks.

On August 25, 2022, thirdweb completed a strategic funding round of $24 million with a valuation of $160 million. The round was led by Haun Ventures and involved participation from Coinbase Ventures, Shopify, Protocol Labs, Polygon, Shrug VC, and other investors. Additionally, individual investors include Joseph Lacob, a partner at top Silicon Valley venture capital firm Kleiner Perkins and a major shareholder of the NBA's Golden State Warriors. In a previous seed funding round of $5 million, Thirdweb also received investments from Mark Cuban, owner of the NBA's Dallas Mavericks, and renowned American entrepreneur Gary Vaynerchuk, bringing the total funding to $29 million, demonstrating a strong financial backing.

In addition, Linea has also released a tutorial on "How to quickly build using thirdweb" which provides a detailed introduction on how to deploy smart contracts using the Solidity SDK of thirdweb, manage them through a dashboard, and build an application to interact with the SDK.

SocialFi

QuestN

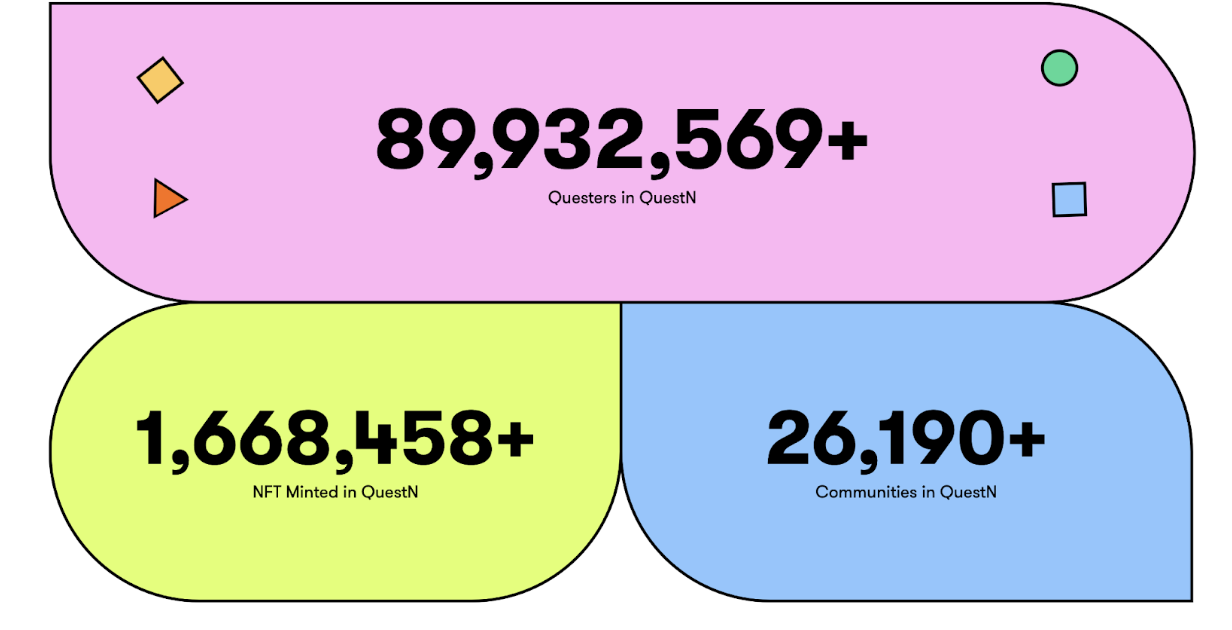

QuestN is a Web 3 task and activity platform incubated by Hogwarts Labs. Users can earn tokens and NFT badges by participating in tasks and activities.

QuestN is dedicated to providing a variety of permissionless on-chain and off-chain tasks for GameFi, DAO, and other projects, bringing ongoing benefits to users and the Web 3 ecosystem along with its native value.

As shown in the above picture, up to now, QuestN has completed nearly 90 million tasks, issued over 1.6 million NFTs, and has the support of over 26,000 communities.

In addition, on June 1st this year, QuestN's parent company Hogwarts Labs completed Pre-A round financing and raised $8 million.

Conclusion:

Based on the previous discussion, it is evident that Linea's ecosystem is still in the very early stages of development. Currently, the majority of projects with high TVL rankings are primarily attracting a large number of airdrop hunters through expected airdrops, resulting in an increase in TVL and trading volume.

However, Linea has the backing of the powerful blockchain company Consensys, which provides strong resources and financial support, laying a solid foundation for the development of its ecosystem. Over time, Linea's ecosystem may gradually improve and expand, and the strong background support can also attract more developers and projects to bring users more useful and innovative applications.

7. Project Progress and Future Plans

Project Progress:

The recent "Linea Voyage" event organized by Linea has achieved tremendous success, with over 30 million transactions and 5.2 million unique wallets participating in just nine weeks. Additionally, during the Linea testnet phase, there were over 46 million transactions submitted by 5.5 million unique wallets, making Linea one of the largest and fastest-growing projects on the Goerli network.

Now, Linea has entered a new phase. Last week, Linea released the alpha version of its mainnet. In the alpha phase, Linea will start evaluating partners and users, monitoring the system, and providing support for those building new features with Linea. This version will serve as the "training round" for Linea on the mainnet, allowing users to learn and adapt to Linea's usage in a real-time environment.

Future Plans:

At the same time, the Linea team is actively pursuing the gradual decentralization and trust minimization of the system. This process is divided into five phases, namely phases 0 ~ 4:

Phase 0

EVM equivalence: Linea's zkEVM provides the same functionality as the EVM specified by the Ethereum Foundation to ensure default portability. Based on Linea, developers can choose to transfer their dapps to other EVM-supported chains, such as Ethereum, without rewriting smart contracts, reinstalling tools, or paying new fees.

Initiating the Security Council: In addition, the Linea official will hold the first Linea Security Council meeting to monitor the network, protect users, and mitigate risks associated with the new system.

In addition, the client software used to run native nodes on the Linea network will be made public, allowing any participant to choose to independently verify the status of Linea and minimize trust in Linea operators.

Phase 1

Open source stack: The Linea team plans to license the Linea software stack under AGPL-3.0, a free software license that ensures users can freely view, fork, and modify the code.

100% EVM coverage: Linea will generate computational proofs for all EVM opcodes and precompiles, unlocking trustless execution of all use cases. In addition, arithmetic specifications will be published, audited, and receive bug bounties to improve the security and reliability of the system.

Phase 2

Diversification of the Security Council: The Security Council established during the launch of the Linea Mainnet Alpha plays a critical role in the supervision and control of the network. To prevent centralization of power and potential biases, the Linea team plans to expand participation in the council while retaining the 6 out of 8 multi-signature threshold or stricter immediate upgrade threshold, ensuring balanced representation and promoting more robust collective decision-making, adding an additional check layer to the system.

Resistance to censorship exits: This architecture will be improved to prevent Rollup operators from preventing user withdrawals. In this phase, Linea will ensure that users can initiate exits independently, ensuring continuous access and control of their assets on Linea.

Phase 3

Decentralized Operator: The Linea team plans to significantly enhance the trust of network participants and the overall integrity of the system by decentralizing the roles of Provers and Sequencers. Currently, Provers and Sequencers are responsible for generating zero-knowledge proofs and managing second-layer transactions, which are crucial roles in the Linea ecosystem. Furthermore, the Linea team acknowledges that this may bring some technical complexities, such as potential latency, increased transaction costs, and potential Maximum Extractable Value (MEV) issues. However, the team states that they are committed to addressing these challenges and building a trusted and efficient platform for the community.

Decentralized Governance: The official team emphasizes that the democratization of Linea governance is essential for ongoing development. This approach fosters a fair and transparent system where all stakeholders can participate, and the future of Linea is guided by its user community. This shared governance not only mitigates the risks of unilateral decision-making and single points of failure, but also enhances the resiliency of the network. In turn, it promotes collective ownership and trust among network participants, thereby strengthening the sustainability of the ecosystem.

Stage 4

The last stage of the official roadmap aims to further ensure the robustness of the ecosystem, and mitigate trust-related risks by implementing multi-proofers and limiting governance power.

Multi-Prover rollup: The EVM will continue to evolve as described in the Ethereum roadmap and will be driven by a larger Ethereum community and the Ethereum Foundation. Therefore, in order to make changes to the Linea network at a reasonable pace and guard against implementation risks, the official plan is to integrate multiple different implementations of zkEVM provers, called Multi-Prover rollup.

And because every transaction on Linea is validated by multiple heterogeneous implementations of zkEVM, it can ensure uninterrupted operation of the system even if one prover encounters an error or becomes unavailable (considering the complexity, this is not impossible). This approach not only enhances confidence in platform reliability during the continuous development of EVM specifications, but also encourages exploration of innovative advancements while maintaining exceptional system uptime.

Limiting governance power: Finally, the Linea officials plan to limit governance power and keep governance within necessary boundaries. Upgrades to the rollup logic will be immutable, only allowing upgrades to verifiers in cases where the EVM specification changes. Users will receive reasonable notice to exit the rollup. These measures aim to maintain system stability and security, and foster community participation and trust.

VIII. Summary

Linea's emergence has not yet brought significant changes to the Web 3 industry and has relatively weak influence on the Layer 2 track. However, in the zkEVM track, Linea can be considered a breakthrough. As the first equivalent EVM zkEVM project to go live on the mainnet, Linea itself is an important advancement for the zkEVM track. This means that the progress of zkEVM has reached a level of full equivalence with the EVM, enabling seamless migration from the mainnet to zk-Rollup.

In addition, compared to other zkEVM projects, Linea has strong background support, with users, resources, and financial support that surpass other projects, making it a formidable competitor. This increases the sense of urgency for other zkEVM projects and further accelerates the development process of the entire zkEVM track.

However, according to the data analysis in the previous text, we can see that Linea still has a significant gap compared to the leading zk-rollup project, zkSync. At the same time, in terms of ecosystem development, Linea still lags behind several other zkEVM projects that have already gone live on the mainnet. Therefore, Linea needs continuous improvement and refinement in order to surpass other zkEVM projects and become the leader in the zkEVM track.

The dragon head of this requires continuous efforts from the Linea team and actively attracts more developers and users to participate, promoting the prosperity and development of the entire ecosystem.

References:

[1] A Quick Look at Linea: Blockchain Technology Innovation Led by Web3 Giant ConsenSys

[2] Biteye Interviews ConsenSys: Linea's Strategy and Roadmap

[3] ConsenSys' zkEVM Linea Mainnet Goes Live, Overview of Its Ecological Development Status