Exclusive interview with Linea: "Web3 giant" with a core competitiveness worth $7 billion

Interview: Jack, BlockBeats

Translation: DaiTJ, Jaleel, BlockBeats

Editor: Jack, BlockBeats

After nearly 5 years of research and development, the Linea team announced the launch of the mainnet Alpha during the ETHCC conference in Paris in July, which has attracted widespread attention from the community. As of August 4th, according to data from Dune, the mainnet has seen over 100 ecosystem projects join within a week, with over 20,000 ETH staked, over 170,000 transactions, and over 127,000 interacting addresses, making Linea one of the projects with the highest trading volume and fastest growth on Goerli.

Meanwhile, the ZK track has entered a stage of arms race this year, with the competition heating up in recent months. zkSync and Starknet closely follow the OP camp, releasing their own L3 plans. Similarly, Linea emerged at the beginning of this year and entered the already crowded ZK track, gradually attracting more and more users and attention as a dark horse.

ConsenSys, the parent company of MetaMask, launched a public testnet renamed as Linea in March. This test network, scheduled to go live in Q4 2022, has already processed over 350,000 on-chain transactions in three months. In an official blog post, the team wrote, "Linea represents the next stage of evolution for ConsenSys zkEVM, providing power for the next generation of dApps on Ethereum."

As a blockchain scalability solution built by the parent company of MetaMask, Linea aims to combine powerful zero-knowledge proofs with the vibrant EVM ecosystem, helping developers build or migrate existing dApps in the simplest way possible. As an EVM-equivalent Type 2 zkEVM, Linea offers new possibilities for solving compatibility issues between ZK Rollup and EVM. In addition, ConsenSys also hopes to leverage its ecological advantages by integrating Linea natively with the MetaMask wallet and the developer toolkit Truffle.

Declan joined the ConsenSys team as the Linea Product Lead in 2021, with the core responsibility of thinking about the features the Linea core development team should drive and understanding the importance behind these features and the challenges that customers and partners may face when using our network. However, Declan mentioned in the interview that from a broader perspective, his long-term goal is to gradually make his role "redundant".

"It may sound arrogant, but I believe the true success for Linea is the increased attention to our Web3 infrastructure and team. When people focus on the application itself rather than the underlying infrastructure, we know we're heading in the right direction. This mindset is not unfamiliar in the Web2 world. For example, people usually don't care about which cloud server Facebook runs on, they care about the Facebook application itself. So that's what we need to do in terms of infrastructure."

Recently, BlockBeats interviewed Declan Fox, delving deep into topics such as Linea's Alpha mainnet, ConsenSys ecosystem, zkEVM track's status and future, account abstraction, and multi-provers.

About the Alpha Mainnet

At the ETHCC conference in July, Linea released its own Alpha mainnet. With the anticipation of airdrops and a series of task activities, the Total Value Locked (TVL) on the Linea network surpassed $30 million in less than a month, and the ecosystem quickly saw the emergence of over 100 DeFi-focused projects. However, there have been feedback regarding "cross-chain difficulties" and "slow interactions" during the process. What explanation can the Linea team provide for this?

According to L2 BEATS data, Linea's mainnet TVL grew to over $30 million within about two weeks and is currently stable at around $28 million.

BlockBeats: First of all, congratulations on surpassing $30 million TVL on the Linea mainnet in such a short period of time. In your opinion, what is the main reason for this?

Declan Fox: I believe there are two main reasons for our success. First, as you mentioned, we gained significant momentum from the testnet. The Linea testnet launched a 9-week "Journey with Linea" where users could experience different themed dApps each week, such as DeFi Week, NFT Week, Cross-chain Week, etc. This activity was very successful, and we saw around 50 million transactions and attracted many interesting protocols to join, such as the Account Abstraction protocol, which had over 1 million user interactions on the testnet.

We quickly launched the mainnet after the testnet event and carried the momentum forward. Additionally, during the mainnet launch, we conducted a massive NFT airdrop, which was one of the largest on-chain NFT airdrops. We airdropped 352,000 NFTs to participants of the testnet event as a reward for helping test the network and facilitate the mainnet launch. We also opened up a public, free NFT minting event to reach a wider audience.

I believe the second reason is that people see the potential of Linea and have high expectations for its future. As a zkEVM public chain, Linea allows developers to seamlessly migrate existing dApps or develop new ones. Additionally, Linea integrates with other ConsenSys products and will be automatically integrated with MetaMask upon mainnet launch.

This not only makes it easier to attract users but also means that developers' users can easily access dApps on the Linea mainnet. I think people see the value in this integration and have joined the Linea ecosystem despite it being in its early stages. We have intentionally labeled it as an Alpha version, signifying a significant milestone. Linea already has over 30 million TBR (Total Blocked Resources), and this doesn't even include the upcoming Token Bridge, which will enable cross-chain transactions of stablecoins and other ERC20 tokens.

Linea has many exciting features on the horizon, and many dApps are eagerly awaiting these features to go live. Overall, Linea has made an excellent start.

BlockBeats: You mentioned several DeFi and NFT applications based on Linea. With the launch of the mainnet Alpha, what kind of applications do you most hope to see on Linea?

Declan Fox: DeFi is definitely a focal point for Linea. In the crypto and Web3 space, DeFi has already established itself as a crucial element, and Linea brings new possibilities to DeFi.

Firstly, Linea is not just a general-purpose smart contract platform; it supports the composition of different DeFi protocols on top of it. It also offers lower gas fees and higher throughput, which Ethereum lacks. This provides a better user experience for DeFi users.

Furthermore, as a ZK rollup, Linea inherits the security of Ethereum without making dangerous trade-offs like sidechains. As a ZK rollup, Linea can achieve determinism for L2 transactions in minutes, which is crucial for DeFi. It can provide determinism guarantees for high-value transactions within minutes, instead of taking weeks as before.

Additionally, considering cross-chain bridging with Ethereum and other systems, Linea's fast determinism significantly improves the efficiency of cross-chain capital utilization. This is similar to countries that have lifted capital controls, attracting external funds in a more fluid manner.

In conclusion, as a zkEVM rollup, Linea brings unique advantages to DeFi, ensuring security while providing efficient and low-cost user experience. This will be crucial for the thriving development of DeFi on Linea.

Blockbeats: Next, I would like to ask about the delay in withdrawal time. Previously, Linea announced that, for security reasons, there would be a minimum 8-hour withdrawal delay. Could you explain the reason behind this decision?

Declan Fox: The 8-hour withdrawal delay can be seen as a temporary security measure or a "training round." As mentioned, Linea's mainnet is currently in the Alpha stage, and we have just deployed the system, needing to ensure the protection of users' assets during the early stages of the system.

The purpose of setting an 8-hour withdrawal delay is to have enough time to pause operations or intervene if any issues occur with the rollup or if we need to investigate to protect user assets. In our risk disclosure document, we mentioned that we can initiate a security committee if necessary to take action and intervene. We don't want to do this, but it is a security measure.

Currently, the withdrawal delay is 8 hours. As we gain a deeper understanding of the system, run the mainnet for a longer time, and everything goes smoothly, we will gradually remove this restriction. I believe zkSync currently has a withdrawal delay of 21 hours or even longer. But all these systems have their "training rounds" at the beginning, and I believe these restrictions will decrease over time.

BlockBeats: However, there have been complaints about network latency in interaction with the Linea network. What is the cause of this?

Declan Fox: There are two types of latency. The determinism on Layer 2 is softer, while Layer 1 is the final determinism confirmed by Ethereum itself. Currently, the latency on Layer 1 is mainly caused by the 8-hour withdrawal delay we set, but it will gradually decrease over time.

Currently, Linea itself has a block time delay of 12 seconds with a gas limit of 30 million. In the next few months, we will gradually reduce the block time and lower the latency. Technically, there is no bottleneck; we just want to release the system in stages. The next phase will reduce the block time by around 60%, making it 4 seconds per block with a gas limit of 15 million, and we will further reduce the block time and increase the gas limit.

Reducing latency and increasing throughput is indeed not easy, but we are in a favorable position because we have the Basu team providing technical support. The Basu team is currently executing blocks on the Ethereum Layer 1 and will also become the sorting nodes for Linea in the future.

This is an experienced team, and the client software they have developed has been tested in practice and can be seamlessly applied on Linea. This will be the key differentiating factor that ensures we can achieve both fast transaction confirmation and handle a large volume of transactions. In summary, this is not limited by technological bottlenecks but rather the result of a phased and progressive system rollout.

About Linea and ConsenSys

It is undeniable that many people are interested in Linea because of its powerful backing from "Web3 giant" ConsenSys. Founded in 2014, ConsenSys, an OG cryptocurrency company, now has a presence throughout the entire crypto industry. As one of the largest and fundamental entities in the blockchain technology field, ConsenSys boasts top computer scientists, protocol engineers, software developers, and enterprise delivery experts. In 2018, ConsenSys was hailed by The New Yorker as "the most famous and ubiquitous developer and promoter of decentralized applications in the Ethereum community."

Among the numerous products created by ConsenSys, MetaMask undoubtedly holds the most influence. Now, with its large user base, this Web3 wallet will naturally bring Linea an advantage in terms of user count. To date, Linea has raised $726 million in multiple rounds of funding and is valued at approximately $7 billion. As a strong performer under ConsenSys, Linea will undoubtedly carve out its own niche in the race for market expansion. Of course, this also raises concerns and contemplation regarding the decentralized spirit of Web3 and the centralization of development within large teams.

ConsenSys Founder and CEO Joe Lubin speaking at the 2019 Ethereum New York Conference, with the background title "The Era of Collective Capitalism"

BlockBeats: In your opinion, what role does Linea play in the ConsenSys ecosystem?

Declan Fox: ConsenSys has a whole suite of products. ConsenSys has been present since the early days of Ethereum, and its founder, Joseph Lubin, is also a co-founder of Ethereum, so it can be said that Ethereum is the lifeblood of ConsenSys. Throughout Ethereum's development journey, ConsenSys has consistently provided support and has launched Infura, which manages over half of the Web3 traffic, as well as incubated MetaMask, a leading Web3 wallet.

ConsenSys has also incubated many public products, such as Baesu (one of the leading Ethereum execution clients), Teku (one of the important execution clients for Ethereum 2.0 merger under ConsenSys), and Web3 Signer (a tool for securely signing private keys or transactions). Linea serves as a critical infrastructure to expand Ethereum's transaction capabilities. We recognized this need several years ago and also needed to maintain the network effects of the EVM during the expansion process.

Therefore, Linea can be said to perfect ConsenSys' technology stack in order to impact and support the entire process of user-initiated transactions through MetaMask to the RPC layer and actual execution of transactions on a scalable, general-purpose platform, which is the EVM-compatible Linea. Linea seamlessly integrates with the solution suite provided by ConsenSys, driving the development of the entire ecosystem.

BlockBeats: But this has also raised concerns among some people, who believe that ConsenSys is becoming a centralizing force in the Web3 and crypto world. Most people use MetaMask as their wallet, along with the RPC provided by ConsenSys, and soon there will be more people using the Linea network. How does the Linea team view this perspective?

Declan Fox: I believe we should see that all these products are planned to evolve towards decentralization and permissionless innovation.

Taking them one by one, first of all, Linea has already released a roadmap for decentralization and trust minimization when it launched on the mainnet, clearly stating that Linea's operations and governance will gradually become more decentralized, reducing reliance on ConsenSys. MetaMask users can also choose different RPC nodes and use non-Linea networks. The team is developing MetaMask Snaps, which allows any developer to extend MetaMask without permission.

Linea also supports the use of any wallet. It can be seen that ConsenSys has propelled the development of the entire Web3 ecosystem by providing these critical infrastructure products. However, the core principles of these products remain decentralized and user-choice freedom. Users can choose to opt out anytime based on their own needs.

BlockBeats: Let's talk about account abstraction on Linea. As an L2 network that natively integrates with MetaMask, can Linea better assist in the innovation of account abstraction?

Declan Fox: Yes, our philosophy is innovation without permission. So even for today's Linea, there are other wallets that support Linea. Likewise, MetaMask will continue to support all other networks apart from Linea. We are working hard to find ways to improve the user experience together, but at the same time, we need to maintain a delicate balance between maintaining permissionless innovation and creating an environment that can address user issues and drive the space forward.

It is not practical to achieve account abstraction at the protocol layer in the short term. While it is on Ethereum's roadmap, we won't see the implementation of EIP-4337 tomorrow. We have currently implemented EIP-4337 and smart contract accounts at the application layer, but it is still costly and more suitable for Layer 2 application. Linea, as a Layer 2 zkEVM public chain, is fully compatible with the Ethereum mainnet.

Therefore, various standards promoted by the Ethereum community, such as 4337, can be easily implemented on Linea. This allows us to leverage the rapidly growing community around account abstraction and support this feature from day one in the Linea ecosystem. Additionally, we will seek support for new endpoints to simplify management and protect the RPC and serialization layers from denial-of-service attacks. These are all based on the larger Ethereum community consensus. As Linea is a fully compatible zkEVM, we are fortunate to be able to easily join and continue the network effects of Ethereum.

About zkEVM and RaaS

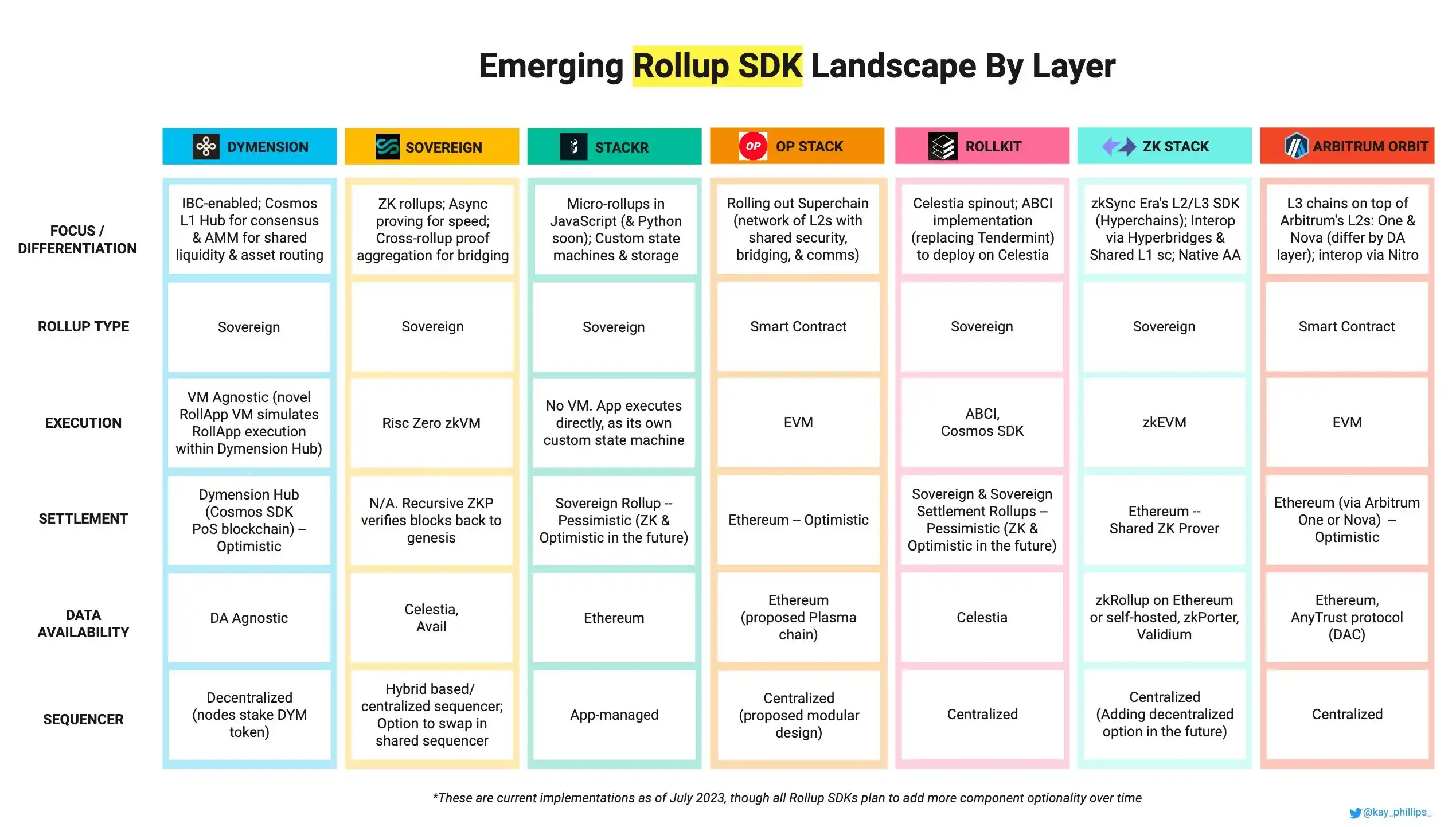

When it comes to Linea, the discussion about zkEVM is inevitable. As the "hottest" track in the cryptocurrency industry, zkEVM brings together the most capable and intelligent developers in the industry. Apart from the different technical implementations of ZK L2, "RaaS" has recently become a "disaster area" for these geniuses. Following the release of OP Stack and Orbit by the OP camp, zkSync and Starknet also subsequently launched ZK Stack and Appchain. As one of the strong representatives of zkEVM, will Linea make similar moves in this field?

Rollup SDK Map compiled by Kayla Phillips from Truffle Ventures

BlockBeats: Next, I would like to talk about the general topic of zkEVM. Why did Linea choose to be a Type 2 zkEVM? What is Linea's biggest advantage compared to Polygon zkEVM and Scroll?

Declan Fox: The decision to build Type 2 zkEVM can be traced back to four years ago, in January 2019. At that time, our research and development team, Consensus R&D (which also helped implement the merge and engine API), was studying scalability solutions. The discussions were predominantly focused on optimistic rollups, while zero-knowledge technology was still in its early stages and it was not feasible to directly simulate EVM as a circuit.

As a result, many people were hesitant to pursue the zero-knowledge proof route and instead built their own zkEVMs. These virtual machines had their own programming languages, while EVM had the largest developer, tool, and dApps ecosystem in Web3. Considering the size of the EVM ecosystem, we did not want to start from scratch but rather maintain the network effects of EVM. Therefore, we believed that zero-knowledge proofs were the most optimal scalability solution for the future while also preserving the network effects of EVM. We set out to achieve this goal and after four years, we finally built a zkEVM that is both high-performance and compatible with EVM.

Being Type 2 means that we are largely equivalent to EVM. We use the same Solidity compiler as Ethereum and our RPC interface is compatible with Ethereum JSON-RPC. This is very developer-friendly as they do not need to learn new languages or tools, and existing dApps can seamlessly integrate. It also benefits decentralization as users can choose to exit at any time without the risk of vendor lock-in. We adhere to Ethereum's standards and remain consistent with any project implementing EVM, which is also beneficial for decentralization.

There are other projects building similar Type 2 zkEVMs, and I believe Linea stands out in two main aspects: technical implementation and ecosystem integration.

In terms of technology, we can deliver higher performance. Specifically, the speed of the Prover and the verification cost in zero-knowledge proofs are crucial for user experience and transaction fees. Since January 2019, we have been building our own Prover, and after four years of investment in research and development, it can be said to be the best in the industry. We directly operationalize EVM computations instead of adding intermediate translation steps. This allows us to optimize at a lower level, which other systems cannot achieve.

In terms of ecosystem integration, Linea has deep integration with other products under ConsenSys. For example, native integration with MetaMask, which is just the beginning but has already demonstrated the potential for a complete user experience from wallet to RPC to execution. Additionally, Infura provides infrastructure support to enhance Linea's stability and security. Finally, the Basu team provides execution clients and ordering nodes. This collaboration can create a more comprehensive and coherent user experience, which is unmatched by other platforms.

BlockBeats: In addition to different types of ZK Rollups, another popular concept recently is "RaaS" (Rollup as a Service). As a strong competitor in the zkEVM field, does Linea have any plans in this direction?

Declan Fox: This is indeed an interesting topic. In general, we are discussing the proliferation of Appchains or chains tailored to specific use cases, which is not a new concept. I believe that with the emergence of rollups, starting a new chain is now much simpler and more meaningful compared to the previously monolithic Appchains.

The reason why some people want to do this is sometimes because they need a more flexible execution environment, or they may want to have their own isolated block space and full control over the throughput and requirements of their applications. I don't think it's likely that there will be only one shared execution environment to handle all transactions in the future, similar to the evolution of computing from initially running multiple applications on a single server to the trend of one application per server.

Of course, shared execution environments still have their value, and we can continue to advance their development to see what use cases can be built. Shared execution environments can achieve synchronous composition, which is difficult to replicate in the fragmented multi-chain world. Linea has already committed to open-source its code, so Linea's technology stack can be instantiated. If the trend of fragmentation continues to intensify, there will be a greater demand for different instantiations of the Linea virtual machine for state verification with other chains, ensuring a smooth user experience.

Linea happens to have a very fast Prover, so if this trend persists, Linea's technology stack and virtual machine will be very attractive to teams that want to build their own execution environments and eventually aggregate to the Ethereum mainnet. Many teams have already realized this in preliminary discussions, but we have not received any formal news yet.

About Multi Prover and the Future

In the Linea team, there is also a focus of attention on the concept of Multi Prover. What does this concept refer to? What can Multi Provers bring to the zkEVM and cryptocurrency industry? Why does the team consider it so important?

BlockBeats: Linea has been promoting the concept of "Multi Prover". What are the team's current thoughts on this proof generation model?

Declan Fox: Yes, this is the content mentioned in our decentralized and trust-minimized roadmap released during the Alpha launch of the mainnet. The basic idea is that Layer 2 transactions or batch transactions can be proven simultaneously by multiple zero-knowledge proofs. As long as the majority of them are validated on Layer 1, security can be ensured. This is more reliable than a rollup with a single proof provider, as there is no risk of a single point of failure. As Ethereum continues to evolve, the specifications need to be re-audited and updated, and a multi-proof provider model can help overcome various limitations.

As a zkEVM that closely replicates the EVM specification, Linea is in an excellent position to unlock the multi-proof provider mode. I believe that once this is achieved, it will attract new risk-averse enterprises, liquidity, and users to Layer 2. This gives them better assurance that even if one proof provider has a vulnerability, the system can still remain secure. This is similar to having multiple execution clients on the Ethereum mainnet, providing diversity. We hope to replicate the same level of security on Layer 2.

BlockBeats: Does the team currently have a mature design plan?

Declan Fox: The specific design plan for multi-proof providers is still an open topic, and we don't want to prematurely converge on a fixed solution. But in basic terms, there will be three different implementations of zkEVM generating proofs for a batch of transactions simultaneously. As long as the required number of validations on Layer 1's verification contract is reached, for example, two out of three implementations are valid, security can be ensured even if one implementation has an issue.

Multi-proof providers also allow us to innovate more in the Prover aspect, as there is fallback protection. Overall, multi-proof providers bring many interesting possibilities, which are also long-term goals in our roadmap. As for the specific technical solutions, we will maintain an open attitude and not fixate prematurely. Our goal is to achieve similar security diversity on Layer 2 as on the Ethereum mainnet. Multi-proof providers not only enhance stability but also provide greater innovation space in proof generation, which is very exciting. Implementing multi-proof providers will still take time, but it is definitely our long-term goal and vision.

BlockBeats: Has the team discussed any interesting things that can be done with the multi-proof provider model?

Declan Fox: From the user's perspective, the multi-proof provider model is roughly similar to its current form. However, it can give developers and users higher confidence in the maturity of the system by increasing diversity and resilience to errors. This is similar to Ethereum having various execution clients and consensus clients on the mainnet. If one client has an error, as long as there is enough diversity in the overall implementation, Ethereum can still ensure security. We are applying these design principles of Ethereum to Linea and Layer 2.

BlockBeats: In general, what do you think is the most important work for the team next?

Declan Fox: What we are most concerned about is the growth in user adoption, and for this we plan to approach it from several aspects.

Firstly, we will continue to reduce transaction costs. Linea's fees are already much lower than Ethereum's, but there is still room for further reduction in the short term. We can achieve this by using aggregated proof, where we use either zero-knowledge proofs or validity proofs to complete second-layer transactions on Ethereum. In fact, we can aggregate many proofs together and recursively prove them in order to spread the fixed proof verification cost over a larger set of transactions and reduce gas fees.

Data compression can also help reduce the cost of invoking data from Linea to Ethereum. We also hope to implement EIP-4844, which will reduce the cost of invoking data to Ethereum. This Ethereum protocol change will be applied later this year, and at that time we will pass on the cost savings to users.

The second aspect is improving the onboarding experience for new users. We aim to attract a new wave of users by simplifying the process of wallet opening and initial use of DApps through account abstraction and other methods. We have already implemented the application of EIP-4337 for account abstraction on Linea, and on the Linea mainnet, we are also exploring the possibility of opening wallets without the need for passwords in collaboration with partners such as Pimnico.

In addition, we need to strengthen security. We will encourage ecosystem partners and security-focused protocols to provide insights and information to users about malicious smart contracts in an unauthorized manner to help them avoid scams. There are currently many fraudulent activities on various chains, which hinders mass user adoption. We will strive to improve security in a decentralized manner while maintaining openness.