Original author: Flamie

Original editor: Lisa

Abstract

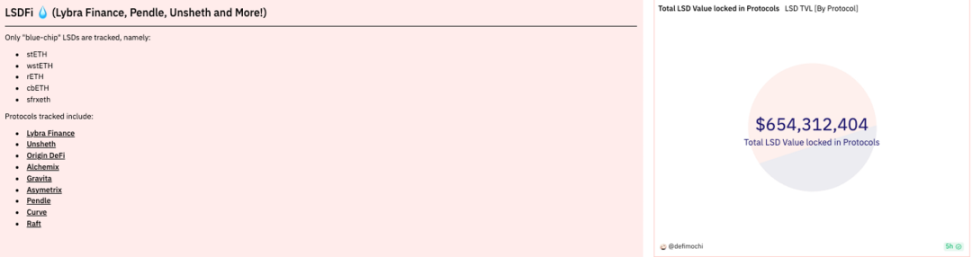

After the upgrade of Ethereum in Shanghai, LSDfi and ETH derivatives have undoubtedly become hot topics and narratives, as well as tracks that attract funding. Unlike RWA, ETH staking solves the profitability issue of crypto users in a more native way, becoming an important part of the future narrative of DeFi.

According to incomplete statistics, the current scale of ETH staking is $22.7 million ETH, approximately $41.4 billion, while the funds locked in the LSDfi protocol are less than $1 billion.

https://dune.com/defimochi/lsdfi-summer / https://ethereum.org/en/staking/

How to create "risk-free" returns and utilize the massive ETH liquidity pool to generate a flywheel effect with ETH derivatives has become a major focus of future DeFi. In addition to protocols like Lybra and UnshETH that use newly issued protocol tokens to borrow ETH and LSD TVL, there are also Defi projects that have gone through a cycle of bull and bear markets silently competing for TVL.

This article will inventory how the already launched projects lay out the ETH staking / derivative track.

1. Redacted Cartel

Redacted Cartel officially announced in April the launch of Dinero, a stablecoin protocol supported by Ethereum block space. Dinero is a derivative protocol that utilizes high-quality block space market by creating a public and permissionless RPC and combines it with ETH staking.

https://commonwealth.im/redacted-cartel/discussion/11005-launch-dinero-protocol

The stablecoin DINERO is minted by collateralizing ETH in CDP. Users' ETH collateral is used to launch the Redacted Relayer RPC and block builder, protecting users from MEV. Redacted Cartel will also use its governance power of CVX and CRV to provide liquidity for DINERO and pxETH.

Similar to the first version of DAI, DINERO will introduce a PSM anchoring stabilizing module, using USDC as collateral to alleviate price pressure. Additionally, when users mint DINERO using ETH/pxETH, the generated staking rewards will be paid in DINERO, with the interest rate managed by DAO. Dinero will also adopt an oracle design inspired by Liquity, using two oracles.

Meanwhile, the Redacted Relayer is the final piece of the Dinero protocol, allowing users to perform meta-transactions, i.e., completing 0-gas-fee transactions by paying arbitrary tokens as fees to the Redacted Relayer. By absorbing sufficient ETH TVL, Redacted Cartel's ability to process transactions and build blocks will significantly increase, potentially enabling privacy transactions through a memory pool, such as payments for order flow.

Currently, the Dinero product is not yet launched.

2. ManiFold Finance

In the same year, ManiFold Finance also launched the mevETH, an ETH staking derivative, and initiated a flow staking solution that implements full-chain functionality through LayerZero. Previously, ManiFold Finance has been committed to building a MEV stack: block builder, SecureRPC Relayer, and validator.

mevETH is an ETH staking derivative supported by LayerZero. By using ETH to mint mevETH, users can earn additional income from multiple MEV strategies supported by the stack. Initially, the protocol will generate profits through arbitrage between ETH and mevETH. Additionally, users will be able to create custom blocks and ensure their inclusion in the chain as they will be running their own validators.

To kickstart the protocol, Manifold has acquired the validator set of Cream Finance. This means that users who stake ETH in Cream Finance will now be staking it in Manifold's liquid staking protocol. When the protocol launches, this will give Manifold control over more than 20,000 ETH. In the future, Manifold aims to add re-staking functionality to mevETH, allowing ETH stakers to protect multiple chains or protocols and take on more risks while earning more income.

As of now, all ETH users staked within Cream Finance have started new ETH validation nodes, and over 50,000 ETH has been staked to kickstart mevETH.

https://etherscan.io/address/0x617c8de5bde54ffbb8d92716cc947858ca38f582#internaltx

3. Yearn Finance

Earnings aggregator Yearn is launching a new yield product called yETH. It aims to replace a basket of LSD assets with yETH to diversify risk and utilize the protocol's CRV voting power to guide liquidity and increase returns.

Users can deposit supported LSD assets into the protocol to mint yETH and stake it as st-yETH to earn compound interest. The basket of LSD assets within yETH will be added through a whitelist. Each protocol seeking whitelist inclusion will pay an application fee to yETH holders in the form of yETH prior to the voting period or make adjustments to relative weights, with the application fees being allocated to the POL contract.

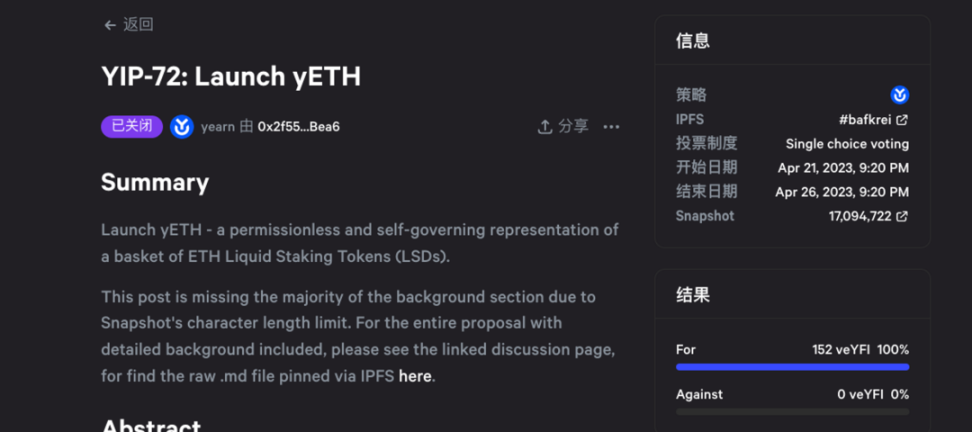

Yearn team initiated a proposal in April and received unanimous approval. Currently, the yETH product has not been officially launched.

https://snapshot.org/#/veyfi.eth/proposal/0x8969cde98d5d8a7be745e442a3288ce0cf3b35bf99ab72265f66c96d117a0f78

4. Index Coop

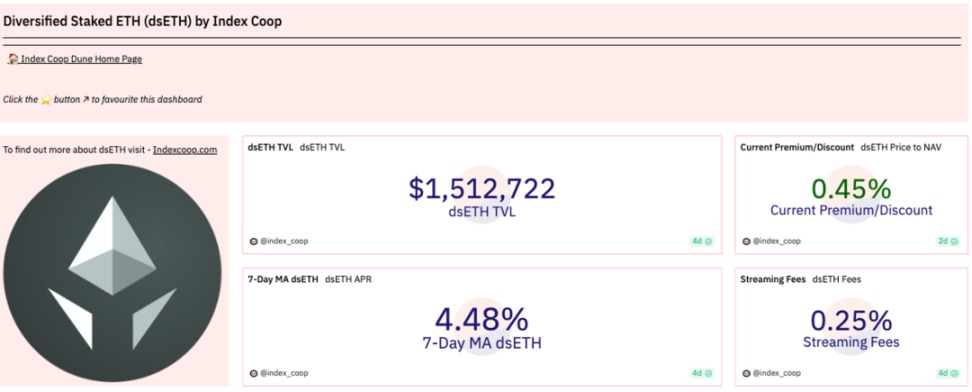

The cryptocurrency index protocol Index Coop has released a diversified ETH collateralized index token called dsETH. dsETH currently consists of stETH, rETH, wseth, and sETH 2.

Similar to Yearn's yETH, the goal of dsETH is to provide holders with diversified exposure to LSD risk. dsETH charges a 0.25% streaming fee to the protocol without any minting or redemption fees. Currently, dsETH has a TVL of 1.5 million USD.

https://dune.com/index_coop/dseth

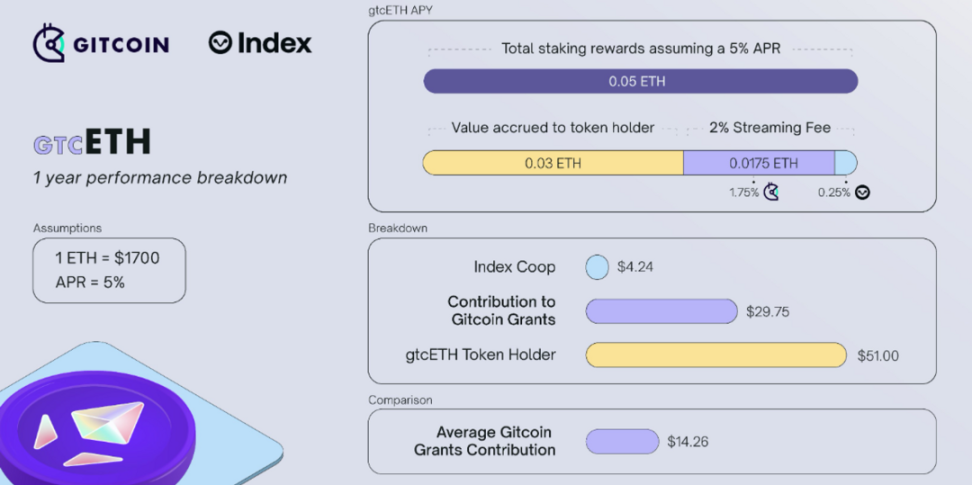

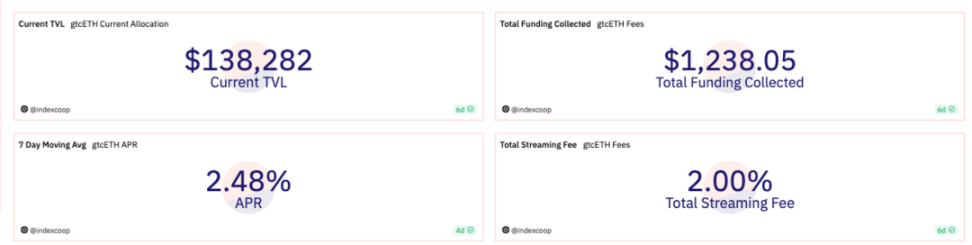

In addition, Index Coop has partnered with Gitcoin to launch gtcETH, which allows users to provide funding for Gitcoin grants through ETH staking rewards, while charging a 2% streaming fee, with 1.75% going to Gitcoin grants and 0.25% to Index Coop. Additionally, Index Coop also has icETH, a leverage liquidity staking strategy product based on Set Protocol, which can provide higher ETH returns. Currently, gtcETH's TVL is $138,282.

https://dune.com/indexcoop/gitcoin-staked-eth-index

5. Aura Finance

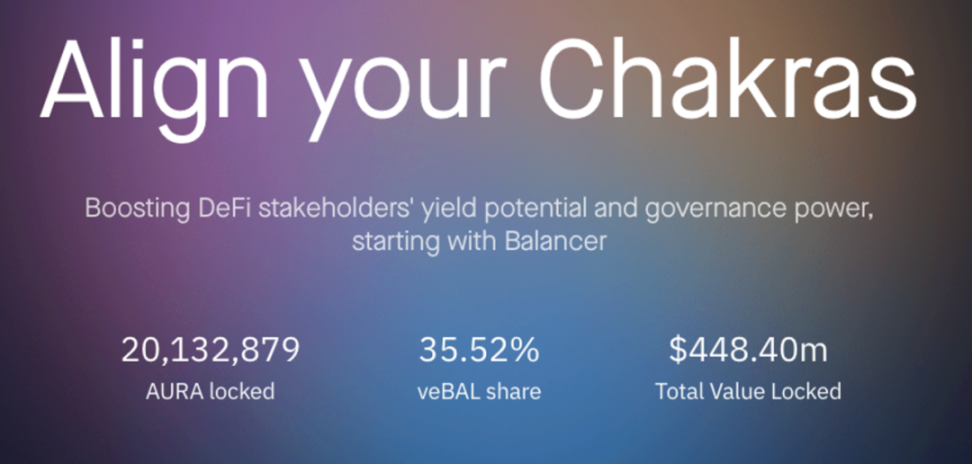

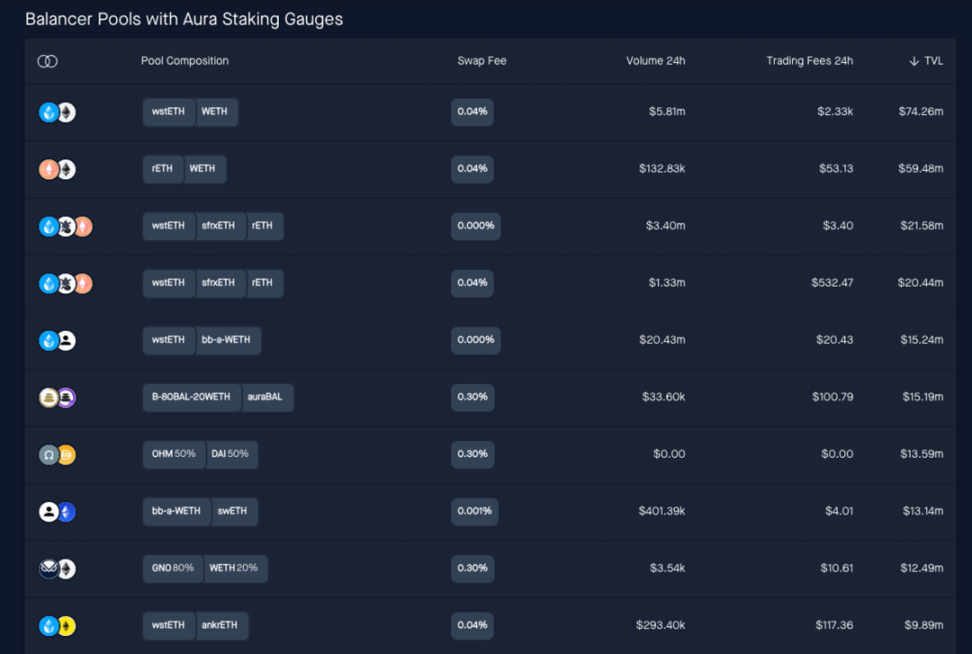

Aura, an eco-profit governance platform built on Balancer, is also incentivizing different LSD and LSDfi protocols to build pools with its own over 35% BAL voting power.

Founder 0x Maki has established close partnerships with top ETH staking protocols through active collaboration. RocketPool is the first underlying staking protocol to closely collaborate with Aura, and since the partnership, TVL has increased by 10 times.

The current Total Value Locked (TVL) of wstETH incentivized by Aura Finance exceeds $30 million, LSDfi Raft Finance has liquidity guided by Aura Finance exceeding $30 million, and the liquidity of BadgerDAO's native token with rETH is approximately $15 million. The total absorbed funds in LSD-related liquidity pools exceeds $200 million.

https://aura.defilytica.com/#/pools

6. BadgerDAO

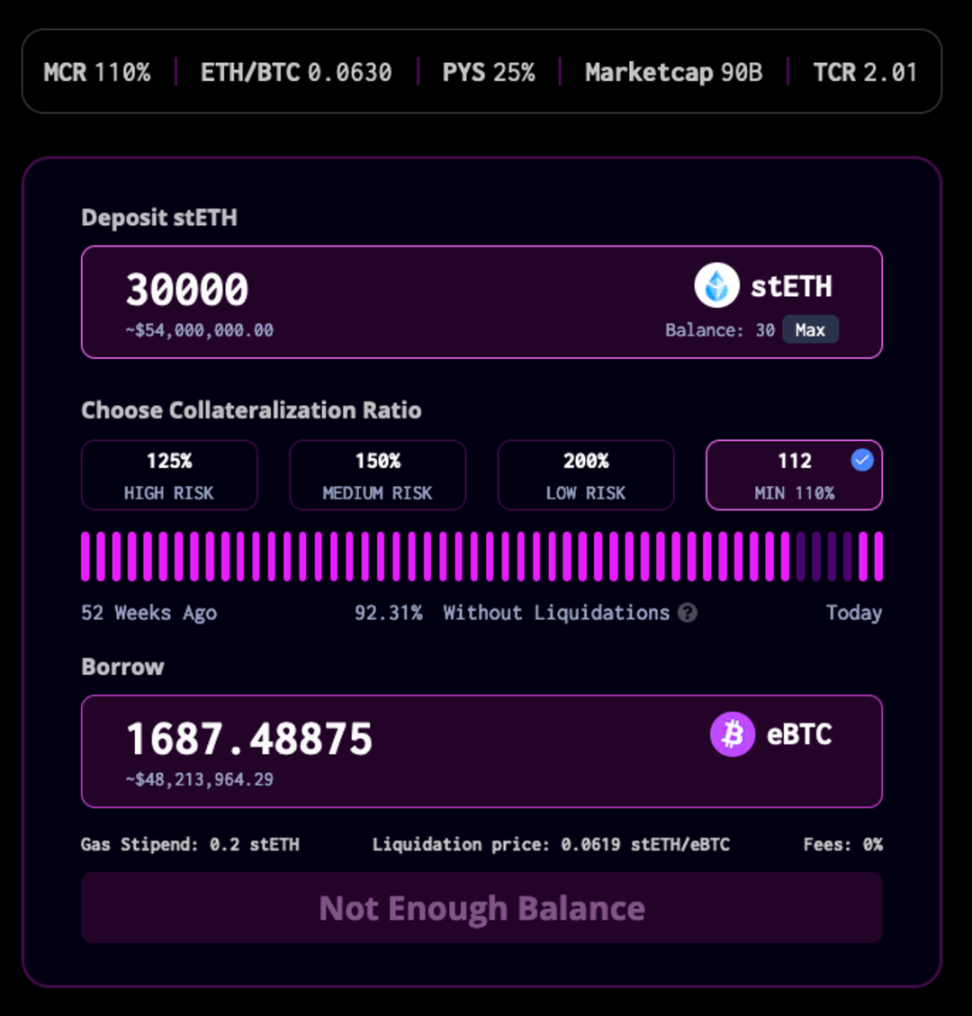

The once popular yield protocol, BadgerDAO, also announced the launch of synthetic asset eBTC collateralized by ETH and LSD, aiming to bring BTC into ETH Defi.

eBTC adopts a CDP-based design, allowing anyone to borrow eBTC using stETH with 0% fee, aiming to become the most capital-efficient way to utilize stETH on the mainnet. eBTC allows a minimum collateral ratio of 110% and provides users with leverage of over 10 times, enabling them to maximize their capital exposure. At the same time, the protocol allows users to adopt various market strategies, including longing ETH to earn interest and shorting BTC with 10x leverage. Due to the correlation between ETH/BTC, users can also mitigate liquidation risks by utilizing their ETH staking rewards.

Currently, eBTC is still in internal testing.

https://github.com/Badger-Finance/ebtc-purple-paper/blob/main/eBTC_Protocol_-_Purple_Paper.pdf

7. Pendle

Pendle is undoubtedly one of the biggest winners of the LSDfi narrative in 2023. By timely incorporating different LSD assets, the protocol has successfully borrowed the momentum of the LSD narrative and has a relatively stable source of assets, telling the story of its own interest rates to the fullest, which is not elaborated further in this article.

After the V2 update, the upgrade of vePendle not only reduces gas fees but also supports the payment of ETH to stakers, and it has also given rise to the ecosystem projects Equilibria and Penpie based on its own veToken. As of now, Pendle AMM has absorbed over $50 million in ETH staked TVL.

https://defillama.com/protocol/pendle

8. Tokemak

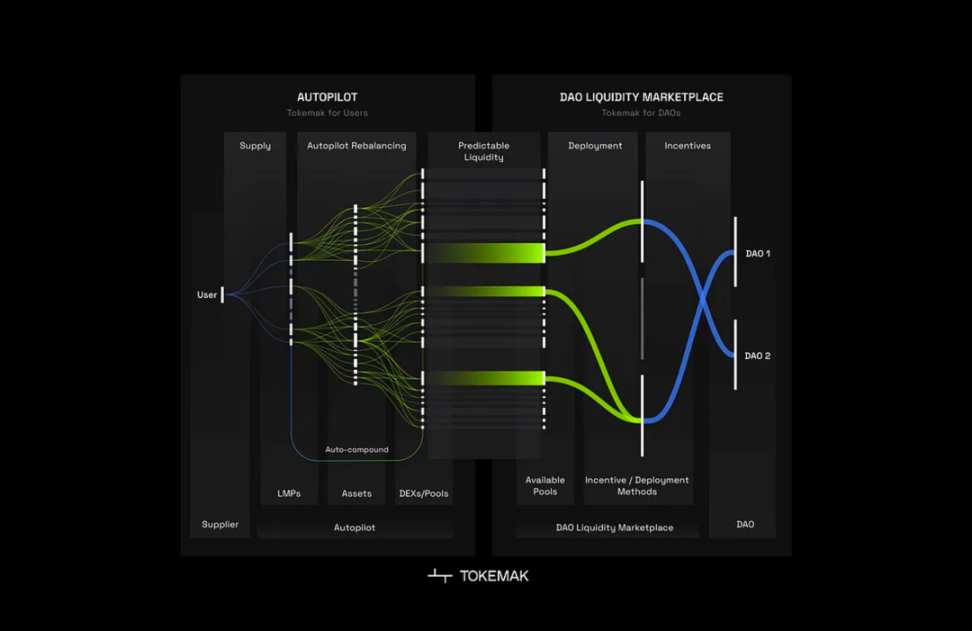

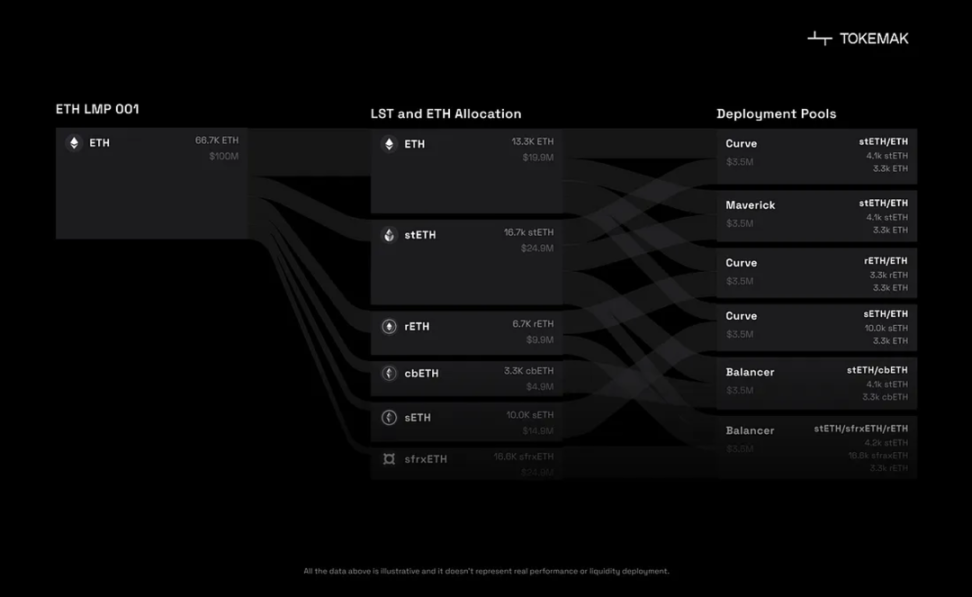

Liquidity protocol Tokemak, after a significant loss of TVL that has been stagnant for a while, announces the upcoming launch of Tokemak V2, which will introduce a Dynamic Liquidity Management Pool (LMP) primarily for serving LSD assets.

The new system consists of two separate products. The first one is Autopilot, a dynamic pool allocator that optimizes the yield of LP for different pools and DEX. The second one is the Liquidity Order Book, which enables DAO to rent liquidity based on transparent market rates. Tokemak V2 will be launched in sequence, with Autopilot as the first product, followed by the DAO Liquidity Marketplace.

Tokemak V2 provides liquidity management pools for DAO and LP. The initial focus is on ETH liquidity staking tokens, providing dynamic exposure to ETH for LP, and offering new liquidity management tools for the LSD protocol. Afterwards, Tokemak V2 will expand its product range to stablecoins, other stable pools, and volatile asset pairs.

https://medium.com/tokemak/tokemak-v2-introducing-lmps-autopilot-and-the-dao-liquidity-marketplace-86 b 8 ec 0656 a

Overall, the current protocols related to LSD and LSDfi are still growing rapidly, with the emergence of many new protocols such as Prisma, a stablecoin protocol based on the Curve ecosystem, and Ethena, an ETH Delta Neutral stablecoin protocol developed by Arthur Hayes. Currently, it is just the first shot fired in the battle for a significant ETH TVL.

References

https://commonwealth.im/redacted-cartel/discussion/11005-launch-dinero-protocol

https://dune.com/indexcoop/gitcoin-staked-eth-index

https://aura.defilytica.com/#/pools

https://github.com/Badger-Finance/ebtc-purple-paper/blob/main/eBTC_Protocol_-_Purple_Paper.pdf