Author: Alex Xu, Mint Ventures

In 2023, the Cancun upgrade is undoubtedly one of the most critical industry events after the Shanghai upgrade, and the L2 projects that benefit from it are also the track we will focus on tracking this year.

According to current news, the Cancun upgrade included in EIP 4844 is expected to be carried out between 2023.10-2024.1, and the token prices of the two main L2 projects Arbitrum (hereinafter referred to as ARB) and Optimism (hereinafter referred to as OP) have successively increased. After hitting a new high in half a year, it has experienced a deep correction, and it may still be a better time for layout.

Of course, from the perspective of market value, OP’s circulating market value has been hitting new highs since 2023, while ARB has been consolidating at a low level. The author tries to sort out the following content through this article:

Source of value and business model of L2

OP and ARB Competitiveness and Business Data Comparison

How the Cancun upgrade drastically improved L2s fundamentals

Potential risks for OP

The content of the following article is the authors staged opinion as of the time of publication. It is more evaluated and explained from a commercial perspective, and the technical details of L2 are less inked. There may be errors and prejudices in facts and opinions in this article, which are only for discussion, and we also look forward to corrections from other investment and research peers.

1. The source of value and business model of L2

1.1 The source of value and moat of L2

The products provided by L2 are similar to L1, namely: stable, censorship-resistant and open block space. We can also regard it as a specialized on-chain cloud service. The main advantage of L2 blockspace over L1 is that it is cheaper. Taking OP as an example, its average Gas cost is only 1.56% of Ethereum.

Precisely because block space is a specialized cloud service, it also means that the needs it meets are not universal. Most Internet services do not need to run based on L1 or L2. In the traditional world, financial services with heavy constraints and insufficient transparency have the most abundant application practice on the blockchain.

The demand of service builders and users for L2 block space determines the upper limit of L2 value.

Like L1, L2 can build a moat based on network effects.

On L2, the larger the user scale and the richer the types, the easier it will be for people to cooperate on L2, and the easier it will be for new service models to sprout here to further satisfy and introduce users to this network. Every new User entry and residency on the L2 network both increase the potential value of this L2 network to other users.

In the Web3 world, the network effect intensity of L1L2 is second only to stablecoins represented by USDT. The more leading L1L2, the higher their barriers, so they often enjoy higher valuation premiums.

1.2 L2’s profit model

The profit model of L2 is clear and simple. On the one hand, it purchases storage space from the trusted DA (Data Availability, data availability) layer, and backs up its own L2 data (so that when there is a problem with L2 operation, it can be restored through the backup data) On the other hand, it provides users with cheaper block space services and charges accordingly. Its profit comes from: L2 charges (basic fee + MEV income) - the cost paid to DA service providers.

Taking OP and ARB as an example, the DA layer they chose is Ethereum, the most decentralized and most credible L1. By paying Gas to Ethereum, their compressed L2 data is processed on Ethereum. store. The fees they charge are the Gas and MEV income paid by users (including ordinary users and developers) when using their L2. The latter minus the former is their gross profit.

The reason why it is called gross profit is because this part of the profit has not yet deducted other expenses of the project, such as labor costs, rewards for the ecosystem, marketing expenses, etc.

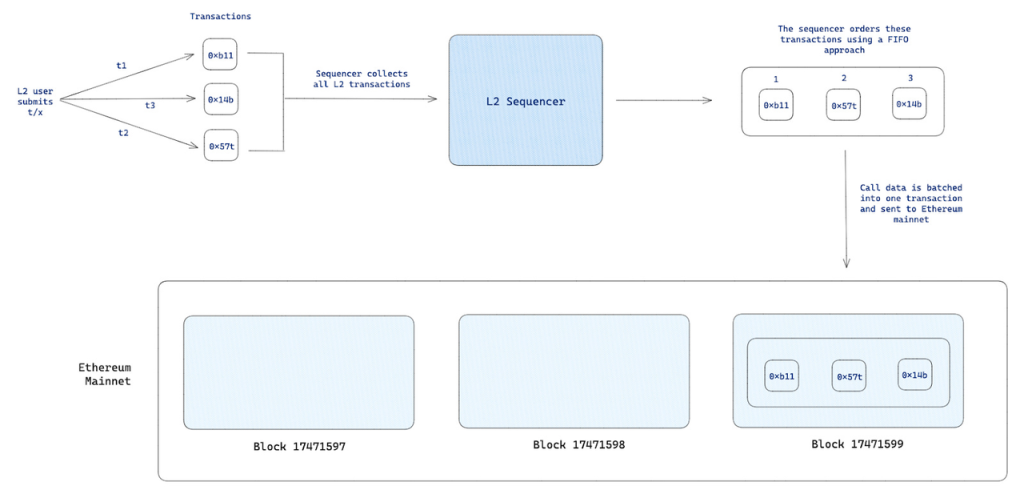

The role of the sequencer in the L2 business process

L2s fee collection and L1s cost payment are both executed by the L2 sequencer, and the profits also belong to the sequencer. At present, the OP and ARBs sequencers are both run by the official, and the profits also belong to the official treasury. Of course, a centralized sorter means extremely high single-point risks, and OP and ARB have a long-term commitment to decentralizing the sorter.

The mechanism of decentralized sorters is likely to operate on a POS mechanism, that is, decentralized sorters need to pledge L2’s native tokens such as ARB or OP as a credit deposit. When they fail to perform their duties, the deposit will be slashed. . Ordinary users can pledge themselves as a sorter, or they can use a pledge service similar to that provided by Lido. Users provide mortgage tokens, and professional and decentralized sorter operators perform sorting and uploading services, and pledge users can get most of it. Sorters get L2 fees and MEV rewards (90% under Lidos mechanism).

At that time, ARB and OP tokens will receive economic value empowerment in addition to pure governance.

1.3 ARB VS OP

OP’s competitive advantage

Since its launch, ARB has been significantly better than OP in various business data of L2. According to the L2 network effect mentioned above, ARB, as the leading L2, has stronger competitiveness than OP and should enjoy a higher valuation premium. .

But this began to change gradually after OP proposed the Superchain strategy in February this year and began to promote the OP stack.

Op stack is an open source L2 technology stack, which means that other projects that want to run L2 can use it for free to quickly deploy their own L2, greatly reducing the cost of development and testing. Superchain is the future blueprint drawn by OP. L2s using OP stack can achieve safe, efficient, atomic-level communication and interaction of information and assets due to the consistency of their technical architecture, similar to the interconnection of Cosmos. Interchain, which is called Superchain.

After the launch of OP stack and Superchain, it was first adopted by Coinbase. Its L2 Base built using OP stack and Superchain strategy were officially announced in February and officially launched on August 10. With the demonstration effect of Coinbase, Op stack has been adopted by more and more projects, such as Binances opBNB, the NFT project ZORA invested by Paradigm, the Loot ecological project Adventure Gold DAO, and the public goods service project Public Goods Network supported by Gitcoin ( PGN), the leading option project Lyra, the well-known on-chain data dashboard Debank, and even Celo, which was originally L1, have chosen OP stack as their L2 solution.

In the past, the service targets of L2 projects were users who used their own block space. Superchain and OP stack expanded the definition of users to L2 operators, from 2C (here L2 developers are also defined as C) The business has become a 2 B2C business, which has built a new source of value and moat for the OP:

Multi-chain network effects. Expand the definition of network in network effects from single chain to multi-chain network. Multi-chains carry out cross-chain links of funds and information through OP stacks with consistent standards, and L2 operators are responsible for the introduction and operation of users. , to expand the total user population of the multi-chain network. The increase in the total population of the multi-chain network also increases the value of the network to every user and every L2 in the network.

scale effect. Fixed technical infrastructure costs (such as OP stack upgrades and maintenance) are borne by the OP, but feedback and improvements provided by other OP stack users further improve the quality of the OP stack, which reduces the technical maintenance and upgrade of a single chain. The cost of sorters and index incentives increases the appeal to potential adopters of L2 solutions.

Community of interests. Introducing more Web3 industry giants into the OP ecosystem will make it easier to obtain their support in technology, users, developers, investment and other aspects due to the consistency of interests.

From the single-chain ecosystem to the interconnected chain ecosystem, OP not only benefits from the expected growth in the number of users and developers across the chain, but the main business data of its OP main chain also continues to approach or even surpass ARB, which was once far ahead of it, such as:

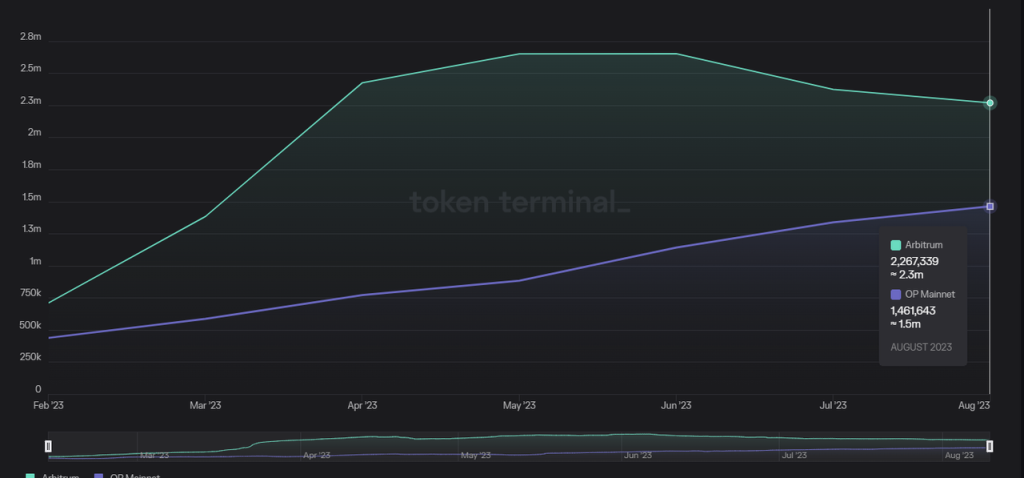

a. Number of monthly active addresses: OP/ARB’s weekly active addresses have increased from a low of 32.1% to 73.6% today.

Data source: tokenterminal

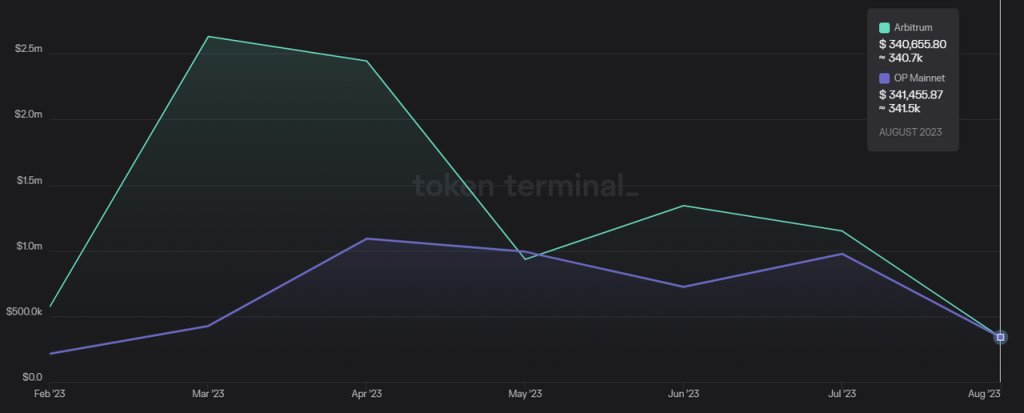

b. Monthly L2 profit: OP/ARB’s L2 profit has increased from a low of 16.4% to 100.2% today (overtaking)

Data source: tokenterminal

c. Number of monthly interactions: The number of monthly interactions of OP/ARB has increased from a low of 22.4% to 106.5% today (overtaking)

Data source: tokenterminal

d. Amount of funds on the chain: OP/ARB’s on-chain TVL has increased from 1/3 of the low to 1/2 of the current level.

TVL, the capital on the OP chain, was around 2 billion in March and is currently around 3 billion.

TVL of funds on the ARB chain was around 6 billion in March (up to 7 billion), and is still around 6 billion currently.

Data source: https://l2 beat.com/

Valuation comparison of OP and ARB

Corresponding to the rapidly rising business data of OP, the valuation of the OP main chain relative to ARB is becoming more and more attractive.

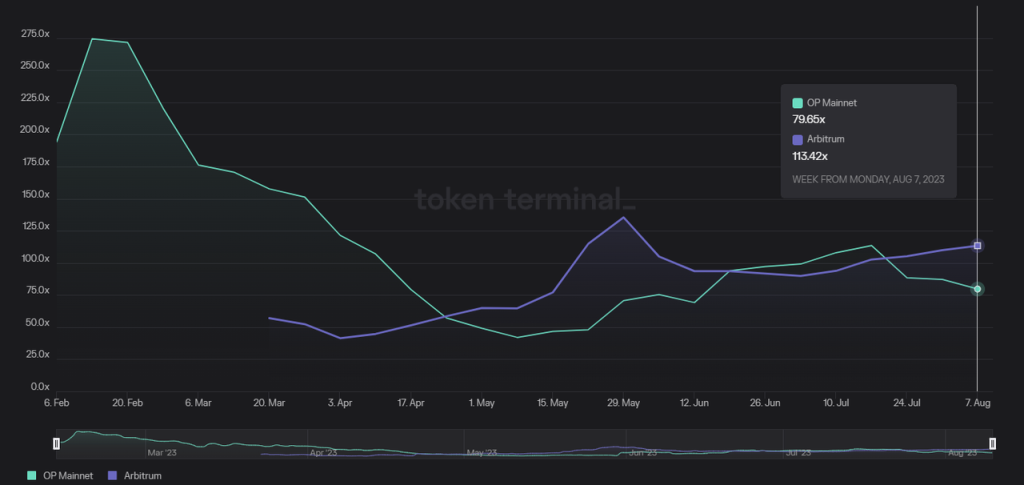

P/E (annualized profit of circulating market value/L2): Taking the last weeks Revenue as the calculation base, OPs PE has fallen below 80, and ARB is 113. This is despite the significant strength of OPs price in recent months. This is achieved as the amount is continuously unlocked and increased.

Data source: tokenterminal

The new force of OP ecology is developing rapidly

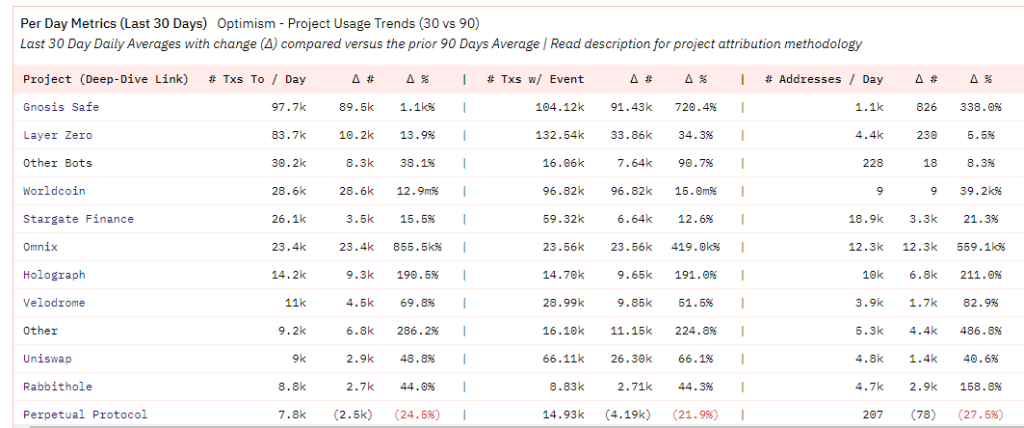

Compared with ARBs continuous catching up, OPs main chain business data has the impact of its own ecological recovery, but new business partners who have joined the OP camp have made greater contributions. For example, the OP main chain has contributed the largest number of transactions in the past 30 days, among which Gnosis Safe contract operations ranked first and Worldcoin ranked fourth.

Data source: https://dune.com/optimismfnd/Optimism

In fact, a large number of Gnosis Safe transactions were also contributed by the Worldcoin team. As early as the end of June this year, World App had deployed more than 300,000 Gnosis Safe accounts. This was caused by the migration of World App accounts to the Optimism mainnet.

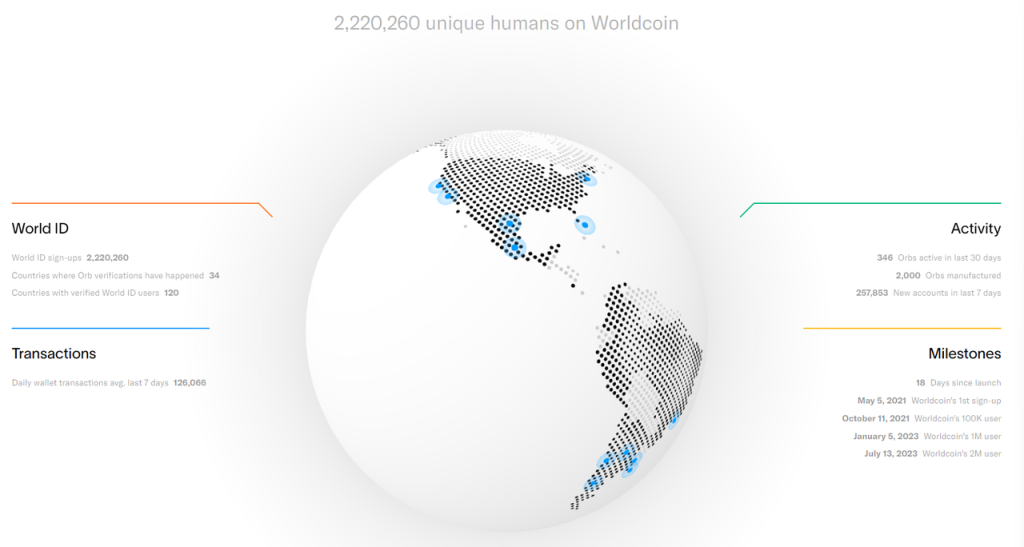

According to Worldcoin’s official website data on August 11, its registered users have exceeded 2.2 million, and 257,000 new accounts have been created in the past 7 days. The average daily transfer number of World app is as high as 126,000, which is equivalent to the current number of OP and ARB masters. Approximately 21% of daily online transfers.

Data source: https://worldcoin.org/

Currently, Worldcoin has only migrated its ID system and tokens to the main network. It will also develop an application chain based on OP stack in the future, which is expected to bring more active users and developers.

In addition to Worldcoins contribution to OPs main network, Coinbases Base L2, the first and largest supporter of OP stack L2, has also seen very strong data growth since its launch. Its number of active addresses reached 136,000 on August 10, which is far from L2 TOP 1 ARB of 147,000 is just a stones throw away.

Data source: https://dune.com/tk-research/base

Among all smart contracts L1L2, this data ranks only behind Tron (1.5 M), BNBchain (1.04 M), Polygon (0.37 M) and Arbitrum (0.14 M). In addition, the first popular application after Base was officially launched on August 10 was not the traditional DeFi or Meme, but the application friend.tech with social attributes, which was even more surprising.

ARBs Dilemma

ARBs dilemma is that, in addition to Arbitrum one, an L2 main chain with strong business data, and the higher-performance Arbitrum nova, it has also launched the Orbiter L3 stack that competes with the OP stack, but it is still in the ascendant in L2. At this stage, there are not many large projects that are willing to define themselves as L3 and use Arbitrum one as their DA layer. Those projects with better industrial resources (users, developers, IP content) are often more inclined to build L2. This It means a higher valuation ceiling and broader user orientation.

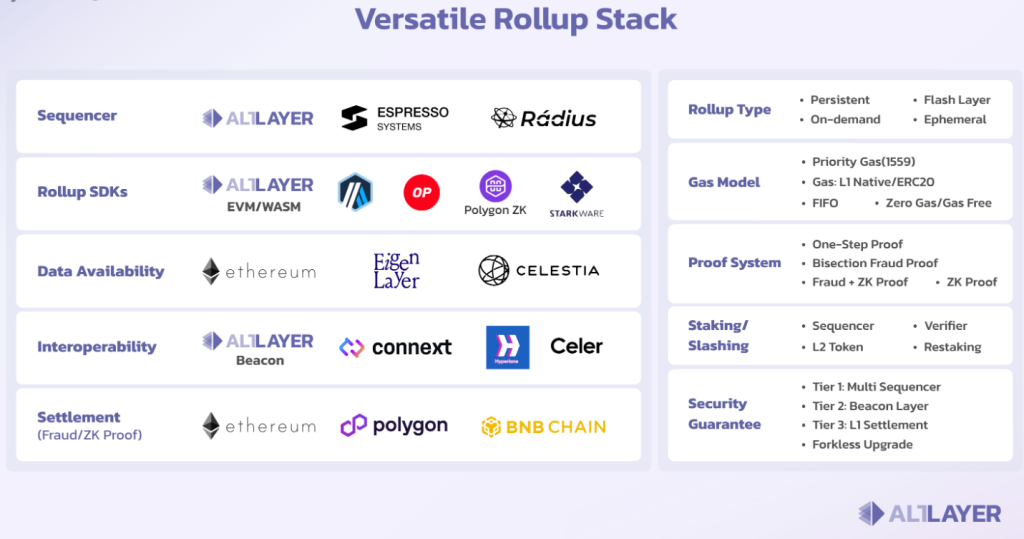

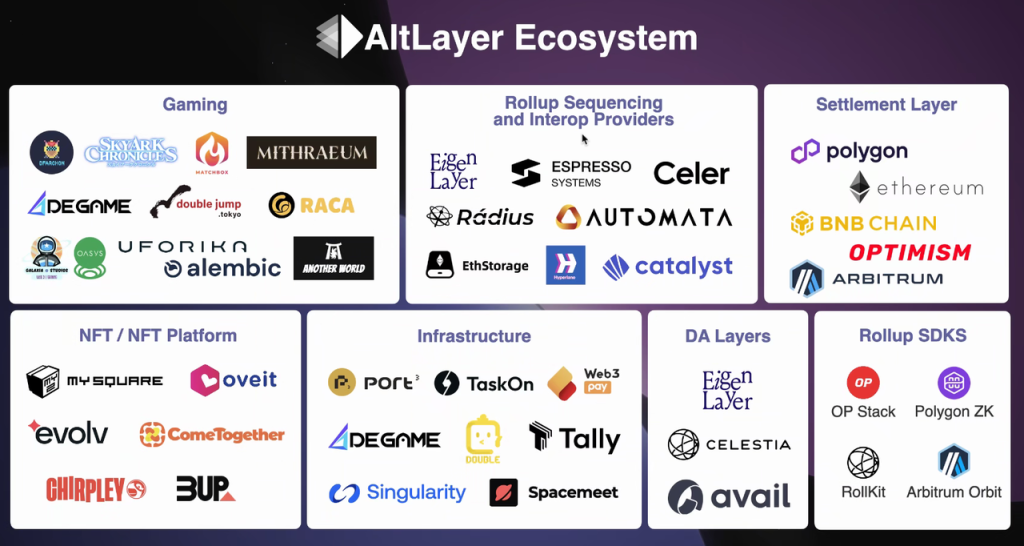

In the smaller Rollup project market, Arbitrums Orbiter faces competition from RaaS (Rollup as a service) projects represented by ALTLayer. ALTLayer provides low-threshold, low-code rollup construction and operation solutions. They help users integrate multiple solutions for various rollup modules on the market, allowing users to mix and match them like Lego.

RaaS modular solution provided by ALTLayer

In the Rollup menu provided by the RaaS project, the Orbiter provided by Arbitrum is only one of the optional solutions. Small users may also choose an economical and cheap L2 solution after comparing the solutions instead of defining themselves as L3.

Under this situation, although Arbitrum one, as an L2 single chain, still maintains a slight lead in business data compared to other L2s, its user share in the entire L2 market is actually declining rapidly, because a large number of new and old users have It flows to OP system and hybrid system L2.

In general, OP uses the open source L2 suite to introduce the network effect of partner users in a B 2 B 2C model. In the long run, it has obvious commercial advantages over Arbirtum’s strong single-chain approach. If ARB does not adjust its strategy in the future, its status as the L2 single-chain king will also be in jeopardy.

2. How Cancun Upgrade Improves L2 Project Fundamentals

2.1 ARB and OP’s current project valuation calculations

We use the revenue data and current prices of ARB and OP in the past three months or so to calculate their valuation levels.

If we assume that the P/E indicator remains unchanged, the L1 cost of ARB and OP will drop by 90% after the Cancun upgrade is completed (EIP 4844 is expected to reduce the L1 cost of L2 by 90-99%, here we take a conservative value, see reference materials for details ), and the charging standard of L2 remains unchanged, the prices of ARB and OP are calculated as follows:

The direct impact of the reduction in L1 costs brought about by the Cancun upgrade is an increase in profits, corresponding to an increase in valuation.

2.2 The impact of Cancun upgrade on L2 valuation

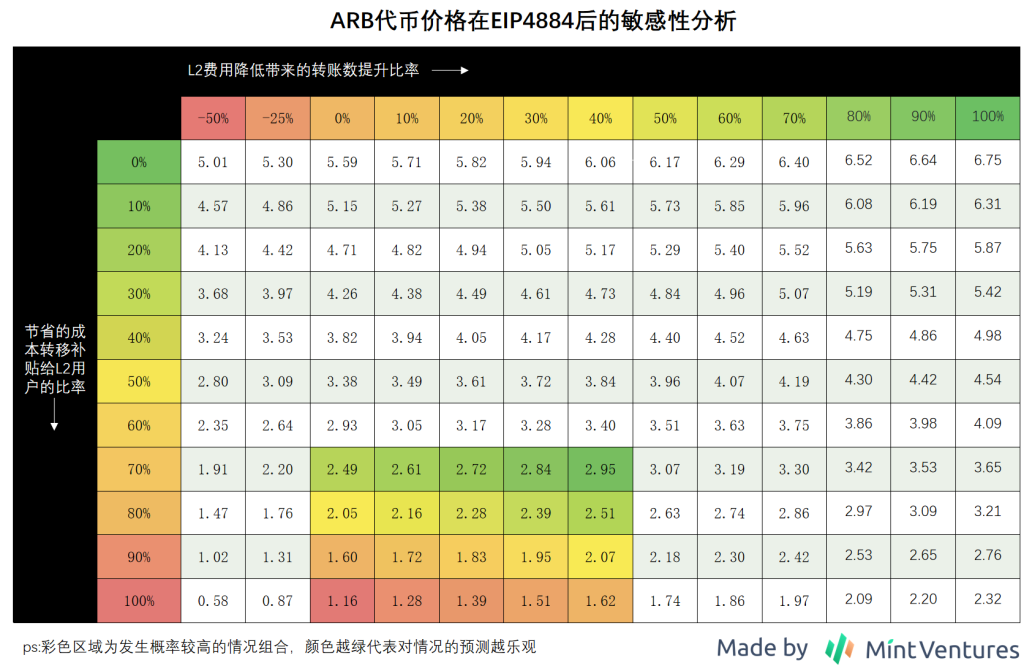

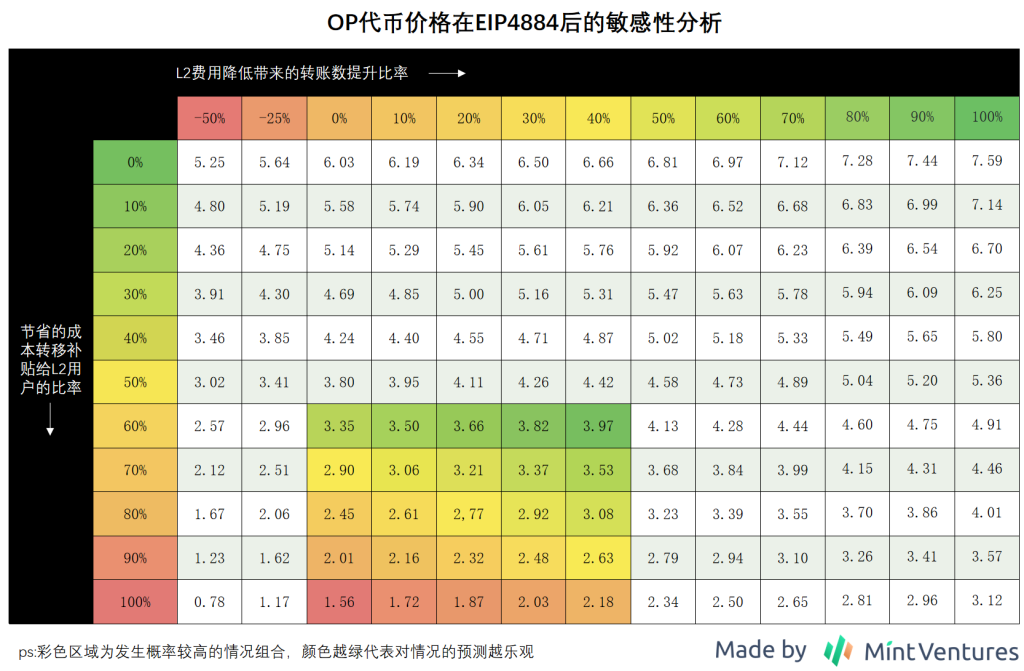

Of course, with the reduction in L1 costs after the Cancun upgrade, it is impossible for both ARB and OP not to reduce the corresponding L2 charges. Therefore, we also need to take two variables into consideration in the valuation:

1. How much will ARB and OP reduce costs and benefit users in the form of lower L2 costs?

2. As L2 fees decrease, what percentage of L2 transaction activity will increase?

Also based on the premise that the P/E multiple remains unchanged, the author based on the changes in the two values of the ratio of cost reductions converted into fee reductions and the increase in the number of transactions brought about by fee reductions, analyzed Cancuns upgraded ARB and Deduction of OP token price:

The core logic of the above two token price estimation tables is:

After the Cancun upgrade, the lower the rate at which L2 will benefit from the significantly reduced costs to L2 users, the higher its L2 operating profits will be.

The higher the transfer activity increase rate brought by L2s reduction of second-tier fees, the higher its L2 operating profit will be.

In addition, because OPs current gas cost is about 30-50% lower than ARB, so with the reduction of L1 cost, OP has more room for self-reservation of the cost savings. Therefore, the author believes that OP has 60-100% room for transferring cost savings to users, while ARB has 70-100%.

Judging only from the impact of the Cancun upgrade on OP and ARB single chains, the current price of OP and ARB have relatively similar upside potential.

Of course, the above price sensitivity analysis of ARB and OP after their upgrade in Cancun is relatively mechanical. Factors not taken into account in this calculation include at least:

The above calculation is based on the current project PE, and the current PE already includes expectations for the Cancun upgrade.

When the Cancun upgrade comes, OP will emit more tokens than currently. It is estimated that the token price should be lower if the circulating market value remains unchanged.

But the unchanging logic is that the higher the operating profit of L2, the higher the intrinsic value of its tokens, and the easier it is to obtain a higher market valuation. The Cancun upgrade can bring obvious marginal improvements to L2 projects in terms of cost savings and increased activity on the chain.

3. Potential risks of OP

As mentioned above, OP relies on the narrative of Superchain and the widespread adoption of OP stack to upgrade from a single chain L2 to an L2 interconnected chain ecosystem. It relies on OP stack partners in a B 2 B 2C manner to introduce more ecological populations, and in the long run Looking at allies with stronger network effects, scale effects and common interests is a better business form than ARB. In addition, the main business data of the OP main network has continued to catch up with or even surpassed ARB in recent months. Other OP stack L2 such as BASE have also developed rapidly, further squeezing ARBs market share.

Considering that OP and ARBs L2 main chain have similar expected space for token price appreciation due to the Cancun upgrade, OP has the blessing of the Superchain narrative and may be a better allocation target at present.

However, the competition on the L2 track is still fierce. The author believes that we need to pay attention to the following risks of OP:

3.1 ARB chooses to open its own L2 license and compete for the total network population of L2 in the same way as OP

Currently, Arbitrum still uses a commercial code license (BSL). Other partners who want to use the Arbitrum stack to build the Rollup ecosystem either need to obtain formal authorization from Arbitrum DAO or Offchain Labs (Arbitrums development company), or develop L3 based on Arbitrum one. . But with the rapid expansion of the OP stack and the surge in the network population in the past few months, the Arbitrum community began to feel a little restless. On August 8, ARB team member stonecoldpat posted a discussion on the governance forum, hoping that the community could participate in the discussion on the conditions and timing of Arbitrum issuing code use licenses to partners. The specific discussion content includes:

Understand the communitys attitude towards licensing Arbitrums code to other partners

Discuss whether additional conditions should be placed on code licenses

How to establish an evaluation mechanism to decide whether to grant a license to the other party

Short and medium term roadmap for the above

In the short term, determine which partners that meet the standards can be issued licenses

In the medium term, standards must be clarified. As long as the standards are met, any partner can obtain a license.

The discussion thread also summarizes the feedback the official has received so far on this topic, which states:

“The fact that the Arbitrum Foundation or Offchain Labs have not yet licensed the Arbitrum software stack to large strategic partners appears to be a strategic misstep. This indecision may actually harm the Arbitrum ecosystem.”

“We have not received any feedback that the Arbitrum Foundation should not license the Arbitrum technology stack to strategic partners. Much of the focus is on the criteria for licensing and what conditions should be attached and allow the DAO to have control over the process Make preliminary comments.”

Based on the above situation, the OPization of Arbitrums future strategy is already a definite trend, and it will soon join the competition in the L2 interconnection chain market. This will inevitably cause a sniper attack on the current OP stack, which is in full bloom.

On August 9, Andre Cronje, co-founder and architect of Fantom Foundation, said in an interview with The Block that they are considering the Optimism L2 solution, including both Op stack and Arbitrum stack. In the authors opinion, Fantom, as a former first-line L1, is impossible to consider operating as Arbitrums L3. The Arbitrum stack mentioned by AC should be an L2 solution.

But the question is, how long will it take for the Arbitrum community and partners to reach an agreement before licenses are issued? How many core customers will there be in the market by then? The longer this time is delayed, the more collaborators will join the OP stack ecosystem, which will be more detrimental to ARB.

3.2 The overall competition in the L2 service market is intensifying

In addition to ARB and OP, ZK series L2 is also developing rapidly or waiting to be launched. ZKsync has outstanding business data (although there is a big bubble due to airdrop hunters), backed by Consensys (its Metamask has 30 million monthly active users) users, infura has more than 400,000 developers), Linea, the highly anticipated Scroll, and more. In addition, the Rollup as a Service platform, represented by Altlayer, provides Rollup developers and operators with extremely low-threshold modular assembly and operation services through service aggregators. It directly enters the upstream of the OP stack and also has a positive impact on the OPs Ecological bargaining power creates squeeze.

Altlayer’s product and customer ecosystem

3.3 The development of Superchains overall ecology, whether the value can be transmitted to the OP Foundation and OP tokens

There is still no direct value capture method for OP tokens, and among the many adopters of OP stack, except for BASE, which will clearly donate 10% of its L2 profits to the OP Foundation, other cooperation projects have not provided similar information for the time being. promise. The verification of OP token value capture may have to wait until its decentralized sorter protocol is officially launched and observe its acceptance by major OP stacks. If everyone can support and adopt the decentralized sorter system with OP as collateral, it will inevitably generate direct demand for OP and complete value transmission. However, if each L2 still implements its own sorter standards, or is run by its own node system, it will not only prevent OP from capturing value, but will also weaken the synergy between L2s within the OP ecosystem.

3.4 Valuation risk

As mentioned in the OP valuation section above, the authors calculation of the OP price increase brought about by the Cancun upgrade is based on the premise that the PE of OP L2 after the upgrade remains consistent with the current one. Considering that the Cancun upgrade is one of the most concerning events in the market this year, the current OP PE valuation has more or less priced in this expectation. For those who are pessimistic, they may even think that the current PE is just The benefits of Cancun have been overdrawn.

Reference content

ASXN:EIP-4844 Research Report

The Block:Fantom is exploring adding optimistic rollups to connect to Ethereum

Supporting EIP-4844: Reducing Fees for Ethereum Layer 2 Rollups