Original author: duoduo, LD Capital

The GMX V2 version will be officially launched on August 4, 2023. This article reviews the development and existing problems of GMX V1, compares the modification of V2, and analyzes the possible impact.

1. GMX V1: An Effective Model for Derivatives DEX Protocol

The GMX V1 version was launched at the end of 2021. The GLP model adopted provides a simple and effective trading model, creates the narrative concept of real returns, and plays an important role in the derivatives DEX protocol. Many projects have forked the GMX V1 model.

The GMX V1 protocol captures a significant amount of fees. Since 2023, the revenue of GMX V1 agreement is 98.1 million US dollars, ranking eighth among all projects, and ranking first in the derivative DEX track.

source:token terminal

However, GMX V1 also has limitations, mainly including:

1. The imbalance of open interest (OI) causes LP providers to face greater risks

The fees of GMX V1 are opening/closing fees and borrowing fees, and there is no funding rate. Borrowing fees make holding positions costly, so as to avoid liquidity being occupied indefinitely. In addition, the dominant party needs to pay more fees, but since both long and short parties are charged fees, there is no room for arbitrage, and open positions cannot restore balance quickly through arbitrage.

And if this balance is not handled, in extreme cases, the GLP pool will face huge losses, and LP providers will suffer losses, leading to the collapse of the protocol.

2. Fewer assets that can be traded

There are only 5 tradable varieties in GMX V1, BTC/ETH/UNI/LINK and AVAX. And DYDX and Synthetix can provide dozens of trading varieties. Gains provides foreign exchange trading varieties. The new platform HMX provides commodities and US stocks.

3. Higher fees for small and medium-sized traders

The opening fee and closing fee of GMX V1 are both 0.1%, which is a relatively high fee. In the case of the inversion of the derivatives DEX track, the fees of many agreements are below 0.05%.

2. GMX V2: Guarantee the security and balance of the protocol

1. Core

The core of GMX V2 is to ensure the security and balance of the protocol, and maintain the balance of long and short positions by modifying the fee mechanism to reduce the probability of GMX experiencing systemic risks when facing severe market fluctuations. Through the setting of the isolation pool, high-risk trading assets can be increased while controlling the overall risk. By cooperating with chainlink, we can provide more timely and effective oracle services and reduce the probability of price attacks. The project team also considered the relationship between traders, liquidity providers, GMX holders and the continued development of the project, and ultimately adjusted and balanced the protocol revenue distribution.

2. Fee model adjustment: increase funding rate and price impact fee

The charging model of GMX V2 has undergone substantial adjustments, focusing on how to balance long and short positions and improve capital utilization efficiency. The charging model is as follows:

l Reduce position opening/closing fees.

It has been reduced from the previous 0.1% to 0.05% or 0.07%. The fee is charged based on whether the opening of the position is beneficial to the balance of long and short. If it is beneficial, a lower fee is charged.

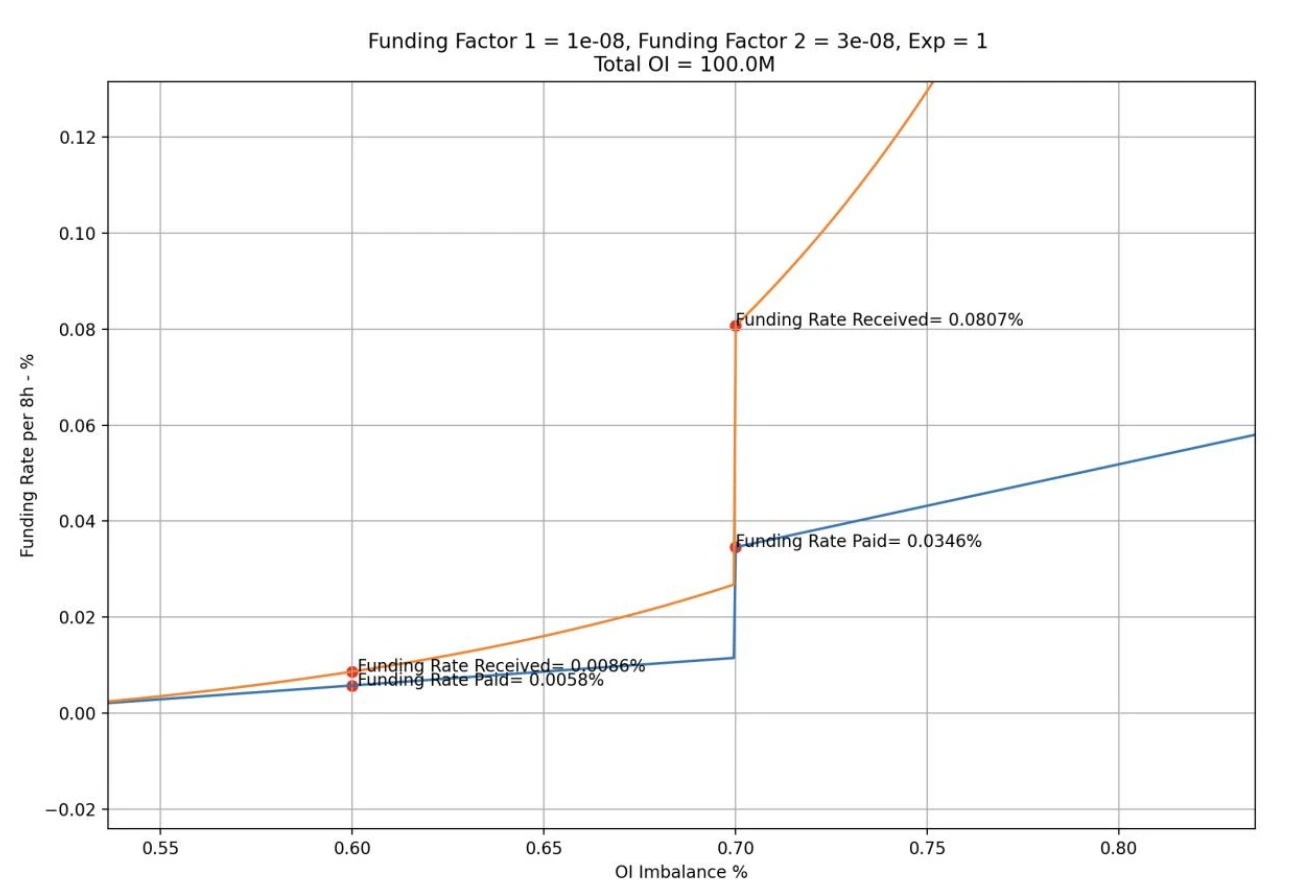

l Increase the funding rate, and the strong party will pay the funding rate to the weak party.

The funding rate will be adjusted in stages. When the strong partys position/full position is between 0.5 and 0.7, the funding rate will be at a lower level; when it reaches 0.7, it will be raised to a higher level, increasing the arbitrage space and promoting arbitrage. Funds enter, thereby restoring the long-short balance.

source:chaos labs

Retain borrowing fees to avoid unlimited liquidity occupation.

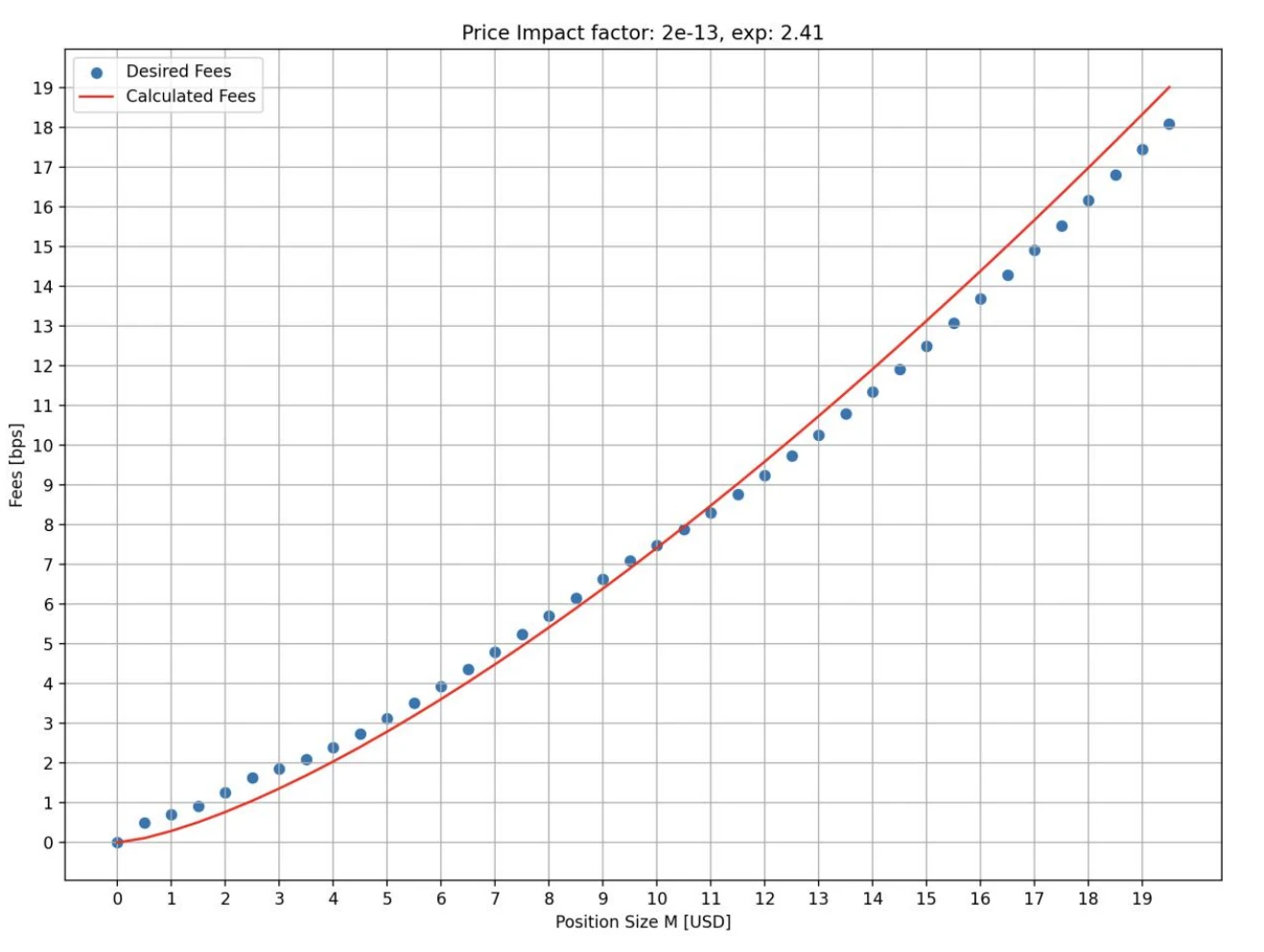

Increase the price impact fee, the larger the position, the more unfavorable it is to the long-short balance, the more fees will be charged.

The price impact fee simulates the dynamic process of price changes in the order book trading market, that is, the larger the position, the greater the impact on the price. This design can increase the cost of price manipulation, reduce price manipulation attacks, prevent price crashes or surges, and maintain balanced long and short positions to maintain good liquidity.

The figure below shows the price impact rate faced by different opening sizes in the simulation state. It can be seen that the larger the position, the higher the rate. The horizontal axis is the opening size (millions of dollars), and the vertical axis is the rate (bps).

source:chaos labs

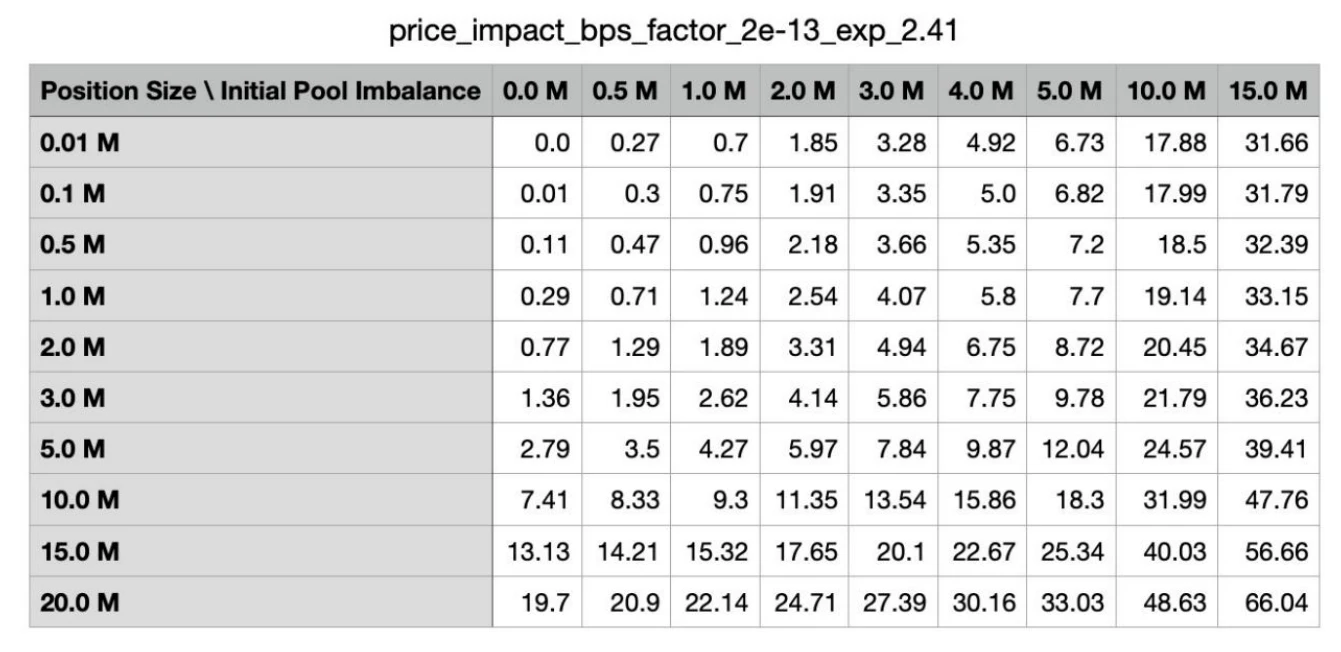

In addition, if opening a position is more unfavorable to the long-short balance, the fee will be higher. The table below shows the fees charged under different long and short balance states in the simulation state. The first column is the size of the opening position, and the first row is the size of the initial pools unbalanced position.

source:chaos labs

A brief comparison of the fees of several major derivatives DEX protocols:

DYDX: Maker 0.02%, taker 0.05%, the greater the transaction volume, the greater the discount;

Kwenta:maker 0.02% ,taker 0.06% -0.1% ;

Gains Network: 0.08% opening/closing fee + 0.04% spread + price impact fee.

It can be seen that the fees of GMX V2 are still high, but from the previous high level to the medium level, the opening/closing fees have dropped by nearly 50%. For small and medium-sized traders, V2’s fees are more friendly.

3. Liquidity provision: increase isolation pool mode, increase synthetic assets

The liquidity pool of GMX V2 is called the GM pool, and each pool is independent of each other. You can see the fund amount, fund rate and fund utilization rate of each pool on the official website.

source:GMX

The advantage of the isolation pool is that different token markets can have different underlying support and different parameter settings to achieve their own risk control, with a high degree of flexibility, thereby expanding trading assets while keeping risks under control. For liquidity providers, they can also select exposures based on risk appetite/return expectations. The problem with isolation pools is the fragmentation of liquidity. Some pools may not be able to attract sufficient liquidity.

Currently, GMX V2 is divided into 3 different types of markets:

l Blue chip: BTC and ETH. These two tokens are less likely to be price manipulated, so the price impact fee can set a lower rate and be more competitive than CEX. All are supported by native tokens.

l Mid-market capitalization assets: The market capitalization is between US$1 billion and US$10 billion. They have large liquidity and trading volume on CEX. However, they are susceptible to severe price fluctuations caused by external factors. For example, regulatory news causes a sharp drop in currency prices. For such assets, the price impact fee will be set at a higher ratio, and the liquidity will not be higher than other external markets, which will increase the cost of attack. LINK/UNI/AVAX/ARB/SOL belong to this type. Use native token support.

l Medium market capitalization synthetic assets: Do not use native tokens, but use ETH as the underlying liquidity support. DOGE and LTC fall into this category.

The problem with this type of asset is that if the underlying token rises significantly in the short term, the ETH in the pool may not be able to cover all of the gains.

If there are 1,000 ETH and 1 million USDC in the pool, the maximum long DOGE position limit is 300 ETH, but the price of DOGE has increased 10 times, while the price of ETH has only increased 2 times, in this case the profit will exceed that in the pool The value of ETH.

To avoid this, the ADL (Automatic Deleveraging) feature was introduced. When the pending profit exceeds the threshold of market allocation, the profitable position may be partially or completely closed. This helps ensure that the market remains solvent and that all profits are paid in full at the close. But for traders, automatic reduction of positions may lead to the loss of advantageous positions, thus missing out on subsequent profits.

According to a report issued by chaos labs, it is recommended that during the initial operation of V2, the upper limit of BTC and ETH open positions will be US$256 million respectively, the upper limit of AVAX/LINK will be US$4 million respectively, and the remaining tokens will be US$1 million. Subsequent adjustments can be made according to actual operating conditions. However, the current total TVL of the GM pool is about 20 million US dollars, which is still far from the upper limit.

4. Improve user experience: increase currency-based contracts, faster execution speed and lower slippage

In GMX V1, traders can only open U-margin contracts. No matter what asset a trader uses to open a position, the position value is calculated based on the price at the time of opening the position converted into USD. The profit is equal to the USD value at the time of closing the position minus the USD value at the time of opening the position.

In GMX V2, currency-based contracts were added. Traders can deposit relevant trading assets as collateral, which will no longer be converted into USD. This will meet more needs of traders and provide a richer investment portfolio.

In addition, GMX V2s oracle system will price each block, and orders will be executed at the latest price as much as possible, with faster execution and lower slippage.

5. Distribution mode

In order to maintain the long-term development of the project, the protocol income of GMX V2 has also been adjusted. 8.2% will be allocated to the agreement treasury, which can be used for project operations and other matters.

GMX V1: 30% allocated to GMX stakers, 70% allocated to GLP providers.

GMX V2: 27% allocated to GMX stakers, 63% allocated to GLP providers, 8.2% allocated to protocol treasury, 1.2% allocated to chainlink. This allocation has been approved by community vote.

3. GMX V2 operation status

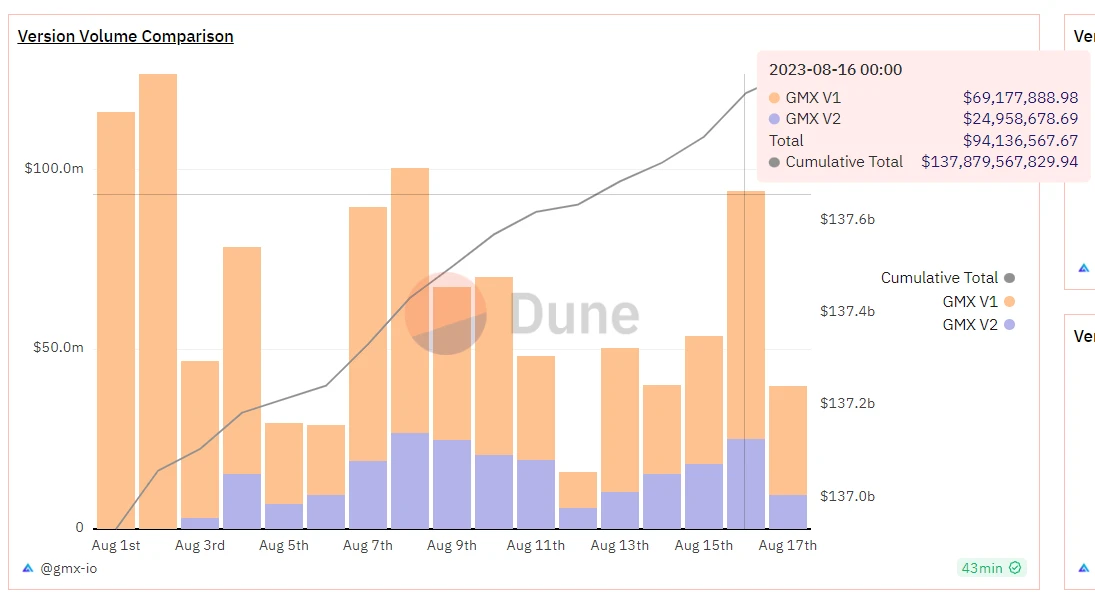

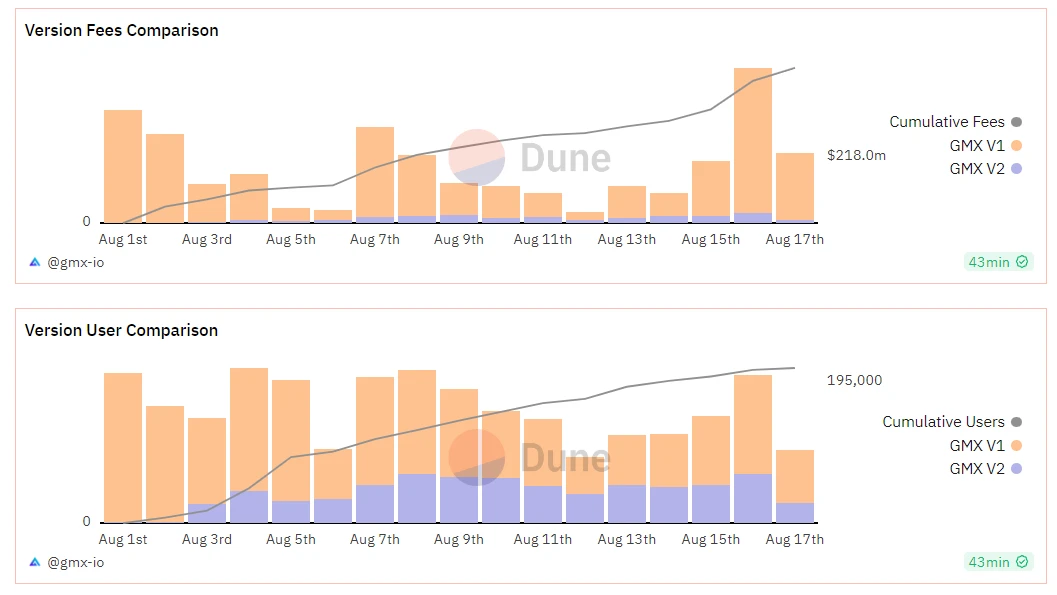

GMX V2 has been in operation for about 2 weeks, the TVL is about 20 million US dollars, the average daily trading volume is 23 million US dollars, the average daily agreement income is 15,000 US dollars, the open interest is 10.38 million US dollars, and the daily active users are about 300-500 people. As a starting point, the performance is acceptable without using transaction incentives.

Some V1 users have been migrated to V2. The trading volume and daily active users of V2 are roughly equivalent to 40%-50% of the trading volume of V1. The comparison of transaction volume, protocol revenue and users between V1 and v2 is shown in the figure below:

source:dune

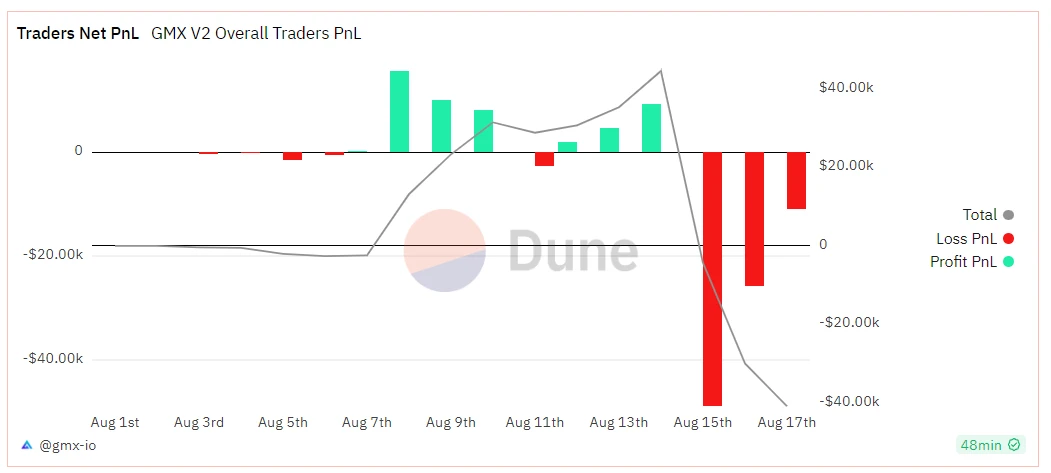

GMX V2 traders are currently in a state of net loss, with a cumulative net loss of $40,000.

source:dune

From the perspective of yield, the recent yield of GMX V1 has continued to be sluggish. This week, the GMX staking yield was 1.44%, GLP (arbitrum) was 3.18%, and GLP (Avalanche) was 8.09%. In comparison, GMX V2 has a higher yield, as listed below:

source:GMX

After GMX V2 was launched, the market enthusiasm was not high and the financial response was average. The main reason is that the recent market volatility has dropped to historically low levels, the overall transaction volume has shrunk, and the track has been involved, resulting in sluggish growth in protocol revenue.

4. Conclusion

GMX V1 is a successful model in the derivative DEX circuit and has many followers. The delivery of GMX V2 is also basically in line with market expectations, showing that the GMX team has strong protocol design capabilities. From a mechanism perspective, V2 increases the balance of the liquidity pool, expands the types of trading assets, and provides a variety of collateral positions. For liquidity providers and traders, there are more investment options, better risk balance, and lower fees.

However, from the initial stage, due to the adoption of independent pools, there is a problem of liquidity fragmentation, and some assets may have insufficient liquidity. In addition, the GMX project party has basically not adopted marketing actions and transaction incentives, and has not had a significant impact on the new users and new transaction volume of the agreement in the short term.

In essence, GMX V2 focuses more on protocol infrastructure, protocol security and balance. In the current bear market environment, focusing on the construction of the underlying structure, ensuring the security of the protocol, and using the accumulated data to design better risk parameters may be of greater help to the future development of the project in the bull market. At that time, it will be able to provide a higher capacity of open contracts, a richer trading market, and launch more marketing measures in line with the market heat to acquire more new users.