Original author: Crypto Ann

Original compilation: Baize Research Institute

While things are grim for major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins, deep inside the on-chain world, things aren’t quite as bloody. Instead, you can often see price charts like the one below.

The summer of “on-chain speculation” is still underway.

But will they be solid and durable and extend into a bull market?

Today I want to delve into 6 coins that are currently outperforming. After a side-by-side comparison, analyze the commonalities, patterns, and traits that make them perform so well (or seem so).

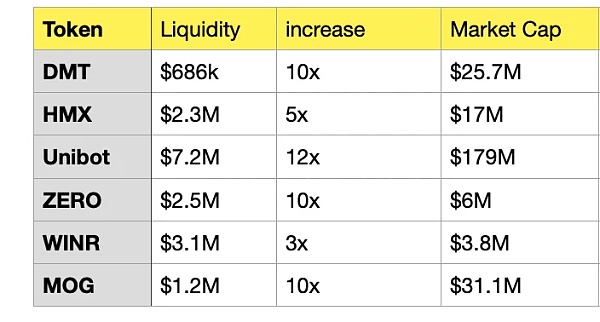

The candidates analyzed are as follows, and since there is only hype surrounding them, I will call them Sh*tcoin (sh*tcoin):

• Perpetual DEX HMX ($HMX)

• Crypto Game Sanko Game ($DMT)

• Telegram bot Unibot ($UNIBOT)

• On-chain gambling game WINR ($WINR)

• No liquidation, LSD-backed lending protocol ZeroLiquid ($ZERO)

• Memecoin $MOG

Target: Market Cap

Market cap is the easiest metric for token holders to follow, it represents achievements, milestones.

Youll often see on Crypto Twitter: Lets get our market cap to X million dollars!! along with the rocket emoji.

Of the six projects studied in this article, Unibot leads the way with a market capitalization of nearly $200 million, and other projects are also hoping to achieve this goal.

However, market capitalization is a misleading indicator. Just like support and resistance in technical analysis. You can take profits at resistance levels or buy when price breaks through resistance levels. This doesnt really make any sense. Some projects have market caps of up to $50 million, while others will never exceed $10 million. Its even easy to get to $5 million for some projects, and then it becomes difficult to climb up.

Liquidity is more important

Liquidity is really the only comparison you need.

The most capital efficient are $DMT and $MOG, both of which achieved 10x price appreciation with minimal liquidity.

$HMX and $WINR still have a lot of room to rise, provided they maintain liquidity at current levels.

$ZERO is more susceptible to selling because the ratio between market cap and liquidity is quite close. The situation for Unibot is exactly the opposite, because with a market capitalization of $179 million, it is difficult to sell/liquidate with $7.2 million in liquidity.

The bigger the gap between market capitalization and liquidity, the more people are forced to continue holding. Suppose the buyer of Unibot succeeds in making a $5 million profit, but this gain is only on paper because he is unable to maintain price stability when selling Unibot for ETH. (If the liquidity pool consists of $3.5 million worth of ETH and $3.5 million worth of Unibot, then he simply cant sell because there arent enough Unibots in the pool.)

The only strategy to win in this speculative game of “chasing shitcoins” is to be an early buyer (or a token deployer itself) while maintaining a position well below the liquidity pool. Buying early is best because if the coin fails and hits a sell-off, you can still save your initial capital (cost) and even make a small profit. Insiders usually also gradually sell when the price rises to keep the liquidity in the pool relatively stable, thus maintaining the upward momentum.

Why should you sell gradually?

I used to think that the age of a project or token didnt matter, but then I realized I was wrong. Although this article only studies 6 projects and the sample size is small, a common pattern can be identified. The best performing items were neither too young nor too old, with the optimal age being a few months old.

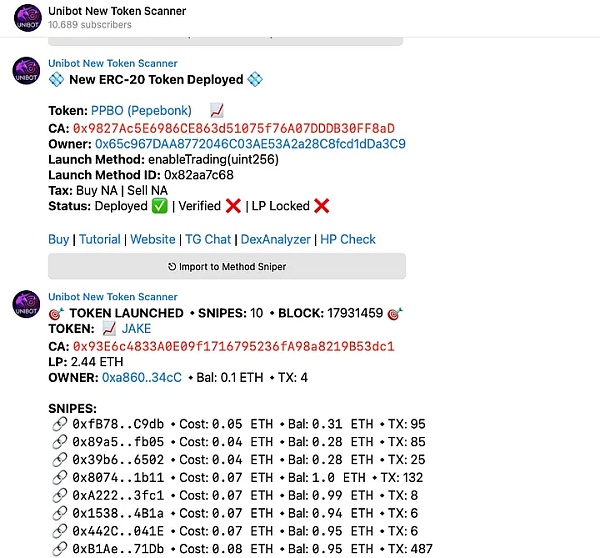

Recently, more and more project parties know that it is better to keep the token rising for a period of time than to sell it quickly. They know to keep the price low long enough to convince people that the project is going away, but not so long that attention wavers and people slowly lose interest.

Im sure keeping liquidity low is one of the strategies. If you are buying garbage coins similar to the above projects on the chain, the first thing to pay attention to is whether the liquidity has increased.

One would consider more liquidity to be bullish, as happened to the $BALD token a few weeks ago. Liquidity increased to $31 million, attracting more and more buyers, and shortly after, the token crashed completely.

Conversely, if you have a large position, you can take increased liquidity as a sell signal and sell gradually.

Unibot, the hub of memecoin

I also dont think the type of item matters for negotiability. Generally speaking, how junkcoins work is that, in general, if a coins use case or narrative is unique, the hype surrounding it will last longer than other coins.

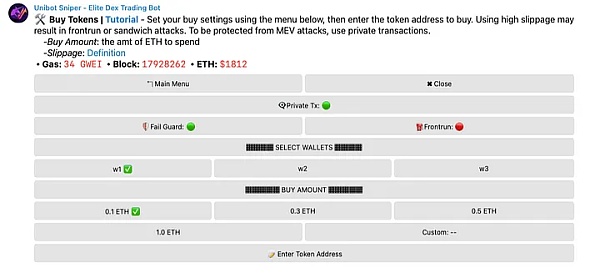

Here, I am referring to Unibot. For that, we need to talk about what exactly is a Unibot?

Proponents argue how Unibot could revolutionize the user experience. I just want to say that those are crap.

Instead, the real appeal of Unibot is the memecoin trading feature. With it, you can get alerts for new token launches and be able to buy tokens as soon as they become available. For on-chain traders, this is of course a good user experience, and it is also the reason why cracking the dog (gambling in disguise) is fascinating.

In short, Unibot is not just a memecoin itself, it is the center of the memecoin universe.

Unibot managed to sustain the hype for longer as it went from unique to race track leader. It will be difficult for other projects to replicate its successful fate.

When the hype around Unibots will end will depend on what happens with on-chain speculation and the crypto market as a whole. (Unibot keeps liquidity pools low to avoid cascading price drops.)

These junkcoins are vulnerable to capital rotation

Once traders take notice of changes in liquidity in the broader crypto market, they walk away from the “shitcoin” hype.

Cycles will come again where Bitcoin and Ethereum control most of the liquidity, which usually happens in the early to mid stages of a bull market.

Back in 2021, DeFi blue-chip tokens like $UNI and $SUSHI were already stagnating while newcomers (Layer 1 - “Ethereum Killers”) pushed the bull market to its peak. The situation is no different for the 6 “junkcoins” mentioned in this article.

However, the real bull market thousand-fold project is still lurking somewhere. Their token isnt going to go up 10x in 2 months, and its certainly not another perpetual DEX in the endless stream. Currently, there is a large gap between the price of these tokens and the innovation/quality of the projects themselves. At least in the on-chain speculation craze of 2019-2020, DeFi blue-chip projects like UniSwap and Curve were indeed novel and pioneering, and the current junk coins simply do not have these.

risk warning:

According to the Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.