Original source:TokenInsight

In June 2023, a new round of Bitcoin spot ETF applications led by BlackRock caused the price of Bitcoin to rise by 20% in a week, soaring from US$25,000 to US$30,000. Yesterdays news that Grayscale won the lawsuit caused the recently depressed Bitcoin price to rebound by 5% within 24 hours, rising from 26,000 to a maximum of 28,000 US dollars. The market’s confidence in the successful approval of the Bitcoin spot ETF has once again been ignited.

Next, let us take a closer look at the current application status of Bitcoin spot ETFs and the important time points when they may be approved.

1. Bitcoin Spot ETF 2023 Application Status

In June 2023, asset management giant BlackRock submitted an application for iShares Bitcoin Trust, kicking off a new round of Bitcoin spot ETF application competition. Spurred by BlackRock, many investment/asset management institutions joined the competition. As of August 2023, including BlackRock,Eight institutions have applied to the SEC for Bitcoin spot ETFs.

2023 Bitcoin Spot ETF Information Summary

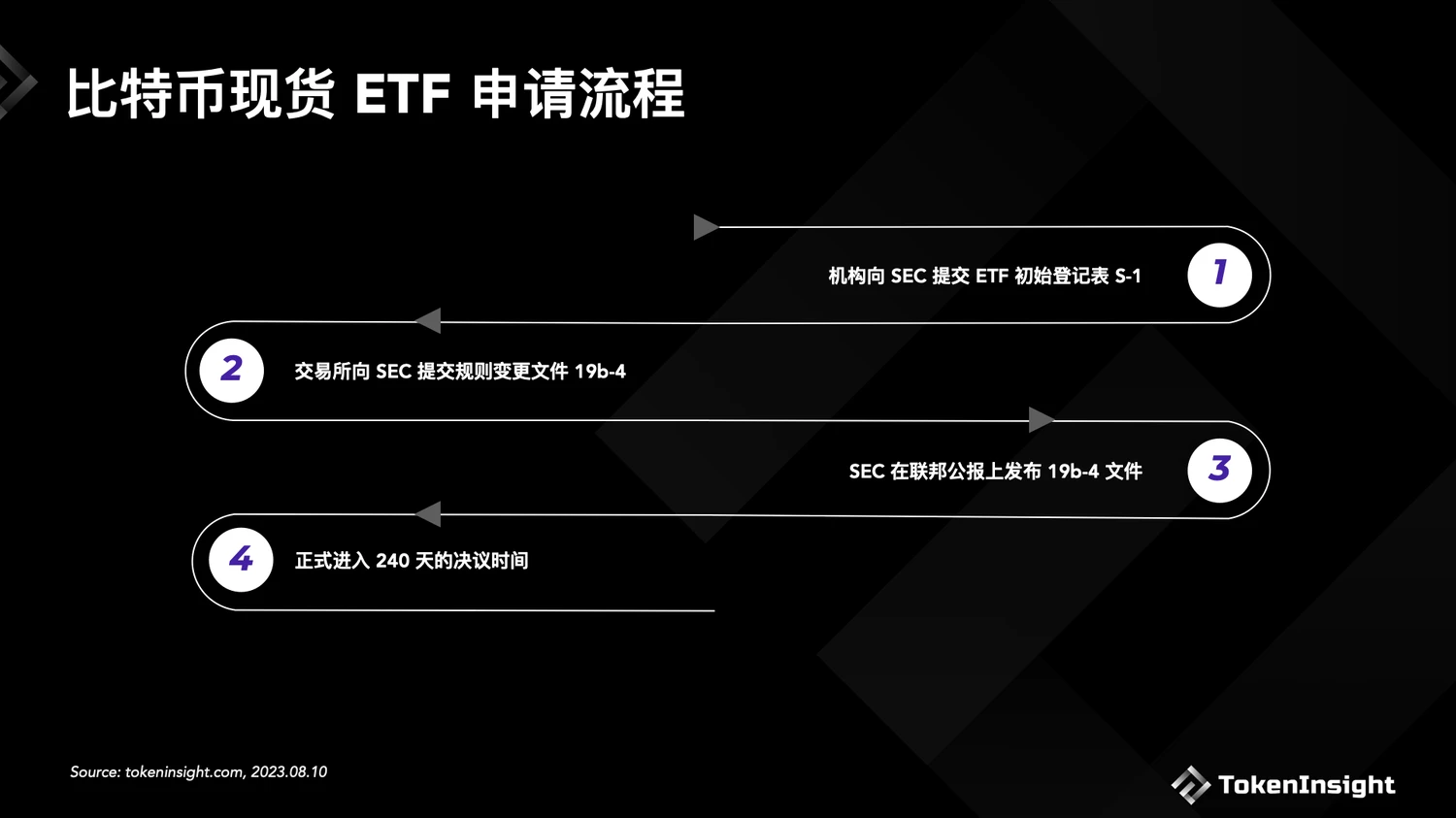

According to the Bitcoin spot ETF application process announced by the SEC, the ETFs resolution time will begin to be calculated after the SEC publishes 19 b-4 in the Federal Register.

The total SEC decision time for Bitcoin spot ETF applications is 240 days. There will be 3 public replies in between. The intervals of reply dates are 45 days, 45 days, 90 days, and 60 days respectively.In other words, the SEC can have three opportunities to postpone the ETF application results before the SEC issues a final decision (approval or rejection). At the same time, the SEC has the power to approve or reject the application at any time during the resolution process.

The specific application process for Bitcoin spot ETF is as follows:

Taking BlackRock as an example, the SEC published the 19 b-4 rule change document for iShares Bitcoin Trust in the Federal Register on July 19. Therefore, pushing back 45 days from July 19 is the first reply deadline for iShares Bitcoin Trust, which is September 2. If the SEC decides to postpone the resolution before this deadline, the next response will be postponed to 45 days later. And 240 days later, March 15, 2024, will be the final reply date from iShares Bitcoin Trust.

Below, we list the specific application information of these 8 institutions, including the application project name, listing exchange, sponsor, trustee, custodian, application-related time, and historical application status.

BlackRock

Application project: iShares Bitcoin Trust

Exchange: Nasdaq

Sponsor: BlackRock Fund Advisors

Trustee: Delaware statutory trust

Bitcoin Custodian: Coinbase Custody Trust Company, LLC

Cash Custodian: Bank of New York Mellon

Among them, Bitcoin custodians and cash custodians are collectively referred to as custodians.

Application related time:

Nasdaq filed a filing with the SEC on June 29, 2023, regarding the proposed rule changes.

Notice published in Federal Register July 19

Date of first reply: September 2

Application history: None

Fidelity

Application project: Wise Origin Bitcoin Trust

Exchange: Cboe BZX

Sponsor: FD Funds Management LLC

Trustee: Delaware Trust Company

Manager: Fidelity Service Company, Inc. (FSC)

Transfer Assistant: Third-party organization (no clear information yet)

Marketing Agent: Fidelity Distributors Corporation

Bitcoin Custodian: Fidelity Digital Assets Services, LLC (FDAS)

Application related time:

Cboe BZX filed a filing with the SEC on June 30, 2023, regarding the proposed rule changes.

Notice published in Federal Register July 19

Date of first reply: September 2

Application history:

Fidelity submitted a spot ETF application in May 2021 and was rejected in February 2022.

Ark Invest

Application project: ARK 21 Shares Bitcoin ETF

Exchange: Cboe BZX

Sponsor: 21 Shares US LLC

Trustee: Delaware Trust Company

Cash Custodian (Transfer Agent): Bank of New York Mellon

Manager: Bank of New York Mellon

Marketing Agent: Foreside Global Services, LLC

Custodian: Coinbase Custody Trust Company, LLC

Marketing Assistant: ARK Investment Management LLC

Application related time:

Cboe BZX filed a filing with the SEC on April 25, 2023, regarding the proposed rule changes.

Notice published in the Federal Register on May 15

First reply date: June 29 (SEC decided to postpone the resolution)

Reason for rejection: The committee believed that more time was needed to consider the issues involved in the rule change and therefore decided to postpone the resolution.

The exchange submitted Amendment No. 2 on June 30; Amendment No. 3 was submitted on July 11

Second reply date: August 13 (SEC decided to postpone the resolution)

On August 11, the SEC issued a document soliciting opinions on Amendment 3, and the resolution time was postponed again.

Application history:

Ark Invest had previously submitted two spot ETF applications, in 2021 and 2022, both of which were rejected.

Invesco

Application project: Invesco Galaxy Bitcoin ETF

The Galaxy in the name comes from the fact that the ETF tracks the Bloomberg Galaxy Bitcoin Index

Exchange: Cboe BZX

Sponsor: Invesco Capital Management LLC

Trustee: Delaware Trust Company

Custodian: American third-party trust company and qualified custodian (no clear information yet)

Manager: Mature global fund manager (no clear information yet)

Transfer agent: third-party institution (no clear information yet)

Application related time:

Cboe BZX filed a filing with the SEC on June 30, 2023, regarding the proposed rule changes.

Notice published in Federal Register July 19

Date of first reply: September 2

Application history:

Invesco jointly submitted a spot ETF application with Galaxy in September 2021, and withdrew the application in the same year.

WisdomTree

Application project: WisdomTree Bitcoin Trust

Exchange: Cboe BZX

Sponsor: WisdomTree Digital Commodity Services, LLC

Trustee: Delaware Trust Company

Administrator/Transfer Agent: US Bank Global Fund Services

Custodian: US Bank, National Association

Application related time:

Cboe BZX filed a filing with the SEC on June 30, 2023, regarding the proposed rule changes.

Notice published in Federal Register July 19

Date of first reply: September 2

Application history:

WisdomTree had previously submitted two spot ETF applications, in March 2021 and January 2022, both of which were rejected.

VanEck

Application project: VanEck Bitcoin Trust

Exchange: Cboe BZX

Sponsor: VanEck Digital Assets, LLC

Trustee: Delaware Trust Company

Administrator/Transfer Agent: The State Street Bank and Trust Company

Marketing Assistant: Van Eck Securities Corporation

Bitcoin custodian: third-party qualified custodian (no clear information yet)

Application related time:

Cboe BZX filed a filing with the SEC on June 30, 2023, regarding the proposed rule changes.

Notice published in Federal Register July 19

Date of first reply: September 2

Application history:

VanEck first submitted an application for a Bitcoin spot ETF in June 2018 and withdrew its application in September 2019. VanEck then submitted applications for spot ETFs in March 2021 and June 2022, but both were rejected.

Bitwise

Application project: Bitwise Bitcoin ETP Trust

Exchange: NYSE Arca

Sponsor: Bitwise Investment Advisers, LLC

Trustee: Delaware Trust Company

Cash custodian (transfer agent): third-party service provider (no clear information yet)

Bitcoin custodian: third-party custodian (no clear information yet)

Application related time:

NYSE Arca filed a filing with the SEC on June 28, 2023, regarding the proposed rule changes.

Notice published in Federal Register July 18

Date of first reply: September 1

Application history:

Bitwise submitted a spot ETF application in October 2021 and was rejected in June 2022.

Valkyrie

Application project: Valkyrie Bitcoin Fund

Exchange: Nasdaq

Sponsor: Valkyrie Digital Assets, LLC

Trustee: Delaware Trust Company

Bitcoin custodian: third-party qualified custodian (no clear information yet)

Administrator/Transfer Agent: US Bank Global Fund Services

Application related time:

Nasdaq filed a filing with the SEC on July 3, 2023, regarding the proposed rule changes.

The notice is published in the Federal Register on July 21

Date of first reply: September 4

Application history:

Valkyrie submitted a spot ETF application in April 2021 and was rejected in December 2021.

All the above information comes from the SEC Federal Register.

Summarize

Ark Invests ARK 21 Shares Bitcoin ETF is the earliest Bitcoin spot ETF to submit an application in this round. It has already received two responses and both suffered delays.The first response dates for the remaining ETFs are all in early September.

Except for BlackRock, all other companies have experience in applying for Bitcoin spot ETFs. Of these, VanEck has the most experience. It has applied for Bitcoin spot ETF three times since 2018.

The application documents of 8 ETFs all added the reason for rejection that was mentioned repeatedly in earlier 2021 applications, the Surveillance Sharing Agreement (SSA).

The eight ETF applications all propose trading on one of three exchanges: Nasdaq, Cboe BZX and NYSE Arca. Among them, the exchange with the largest proportion of applications is Cboe BZX, accounting for 5/8. This may be related to the positive attitude towards crypto assets and their derivatives that Cboe BZX has expressed.

The eight ETFs have slightly different levels of detail in their application documents. Take Valkyrie and VanEck as examples. Neither of them has published detailed custodian information.

2. Can Bitcoin spot ETF be successfully approved?

This round of Bitcoin spot ETF applications have a high probability of being successfully approved. The main reasons are the extremely high success rate of BlackRock ETF applications and the addition of the Monitoring Sharing Agreement SSA.

BlackRock ETF application success rate

BlackRock is best known for its index-tracking fund products. Its flagship fund product (iShares) accounts for nearly 50% of the US ETF market. BlackRock has extensive experience in obtaining ETF approvals. According to the statistics,The success rate of the ETFs it applied for was nearly 100%, with the number of approvals being 575/576.The only failure was an actively managed ETF jointly submitted by BlackRock and Precidian Investments. The reason given by the SEC for rejection was a lack of transparency in earnings.

Monitoring Sharing Agreement SSA

This time, the ETF application documents of 8 institutions have added the Monitoring Sharing Agreement (SSA) mentioned in the reasons why the Bitcoin spot ETF was rejected many times earlier.

SSA, full name Surveillance-Sharing Agreement, is an agreement between cryptocurrency exchanges and market regulators. The agreement allows both parties to share transaction data and information to monitor transactions.If suspicious trading data or information appears, this information will be pushed to regulators, ETF issuers and exchanges at the same time.SSA is often used in situations involving financial products such as ETFs. It can increase the effectiveness of financial market surveillance and help regulators detect market manipulation, fraud and other inappropriate trading practices.

The inclusion of SSA in this round of application documents will have a high probability of making the SEC less relaxed in preventing fraud and manipulation of transactions.At least, this time the SEC cannot give the same reasons for rejection as in 2021.

Which ETFs can be successfully approved?

Judging from the application date,Except for Ark Invest, these eight institutions all chose to apply to the SEC at almost the same time. It’s hard not to wonder whether they have gotten some news that the SEC may agree to the issuance of a Bitcoin spot ETF this year.Of course, we cannot verify whether such news actually exists. But the attitude conveyed is undoubtedly positive.

At the same time, because the dates of responses are all very close, it is likely that multiple ETFs will be approved or delayed at the same time. The contents of these ETF proposed rule change documents are quite similar, and they also include the Surveillance Sharing Agreement SSA. So there is no reason why the SEC would reject one and approve the other. That is to say,If BlackRocks Bitcoin spot ETF is approved, there is a high probability that ETF applications submitted by other institutions will be approved as well.

3. Prediction of approval time

Judging from the previous approval status of Bitcoin spot ETFs, the probability of this ETF being successfully approved within the first and second response time is very slim. When applying for a Bitcoin spot ETF, the SEC will basically wait for 240 days before making a decision to reject it. This time, although the SEC cannot use the same reason to reject the application for spot ETF,However, due to its consistent attitude towards the encryption market, it is likely to search for other reasons to delay the application response.Finally put off making a decision until closer to the final reply date.

On the other hand, the selection of Bitcoin custodians in ETFs may also be a key point affecting the SEC’s resolution. For Bitcoin spot ETFs, the Bitcoin custodian not only needs to have sufficient influence and experience in the encryption field, but also needs to be recognized by the SEC (can become a transaction supervisor to supervise transactions). for example,BlackRock made it clear in its ETF application documents that it would use Coinbase as a Bitcoin custodian. Coinbase’s previous litigation with the SEC may affect the final decision of the application to a certain extent.While the lawsuit has nothing to do with Bitcoin per se, it could delay the filing.

Therefore, we predict that the most likely time for successful approval of this round of Bitcoin spot ETFs will occur 240 days after the publication of the Federal Register 19 b-4 announcement, which is the final response date.

According to the publication time of each ETF application’s rule change document in the Federal Register, the possible approval times for the 8 institutional ETFs are as follows: