Foreword

As a rising L2 public chain, Mantle faces competition from established L2 networks. The "Four Heavenly Kings" in the established space include Optimism and Arbitrum, which use fraud proofs, as well as Zksync and Starknet, which use ZK proofs. The new players also have strong backgrounds, such as Base built by Coinbase using the OP Stack, Linea, an EVM-compatible chain launched by Consensys, and ZK-EVM launched by Polygon. How can Mantle stand out among the numerous L2 public chains?

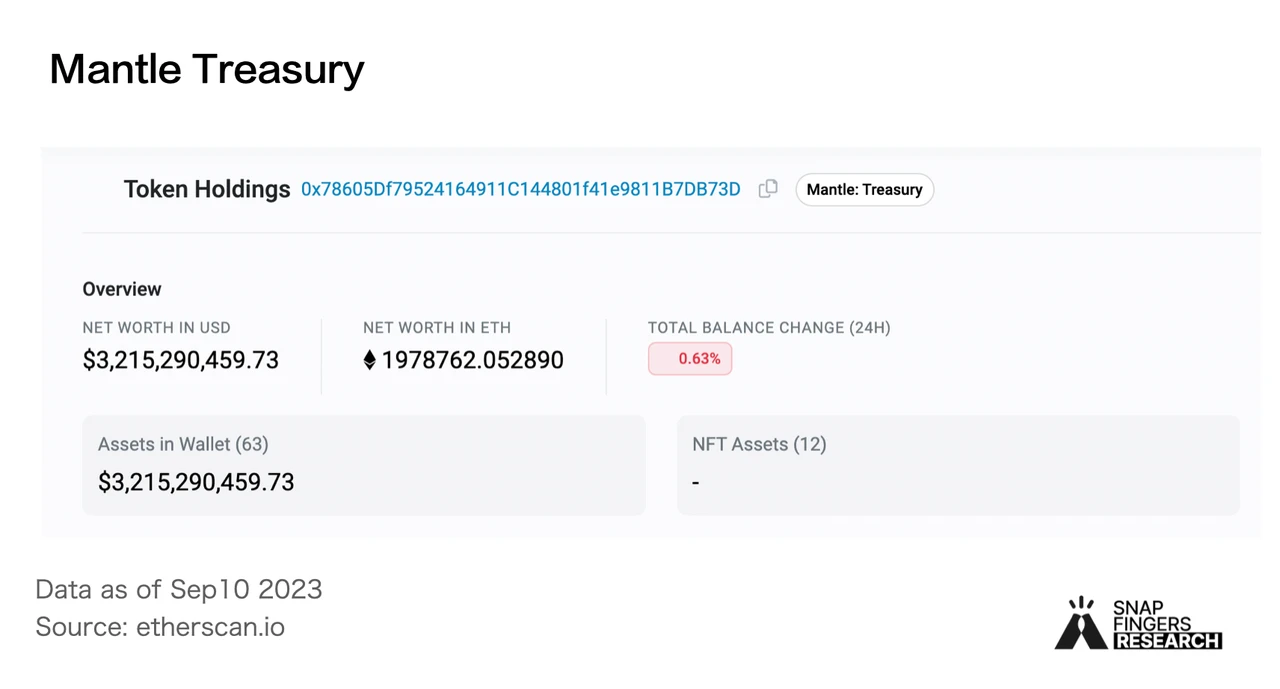

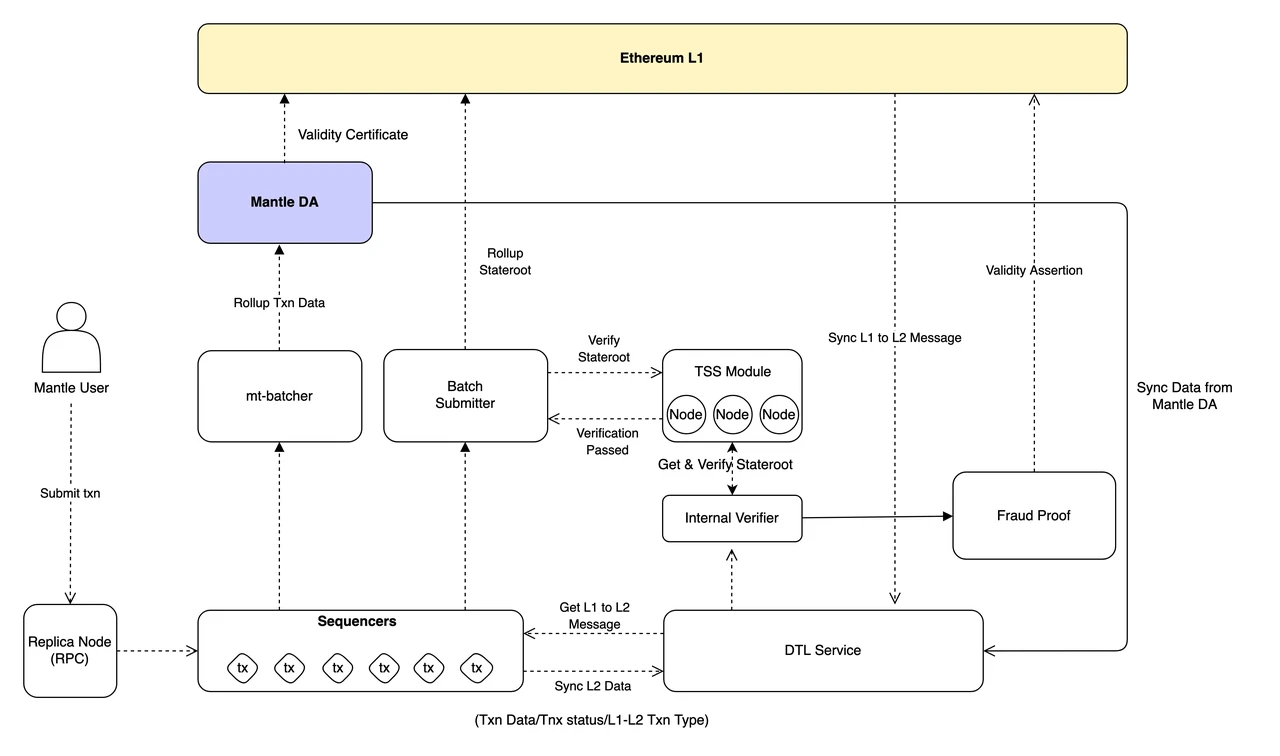

Mantle's core is built on Optimistic rollup and combined with the modular DA layer of EigerLayer. It introduces the TSS threshold signature scheme for network node management to improve TPS and reduce costs. In addition to technological innovation, Mantle has ample financial support, with a treasury of over $3 billion providing strong guarantees for the project's sustainable development. These funds will be used to attract developers to build applications and expand the user base, forming a virtuous cycle. How will Mantle provide better performance through technological innovation and better leverage its financial advantages to build an ecosystem? This article will explore Mantle's historical background, technical features, operational status, and plans.

01 Background of Mantle's Birth

1.1 Development History of Mantle

Mantle was initially an L2 network project incubated and managed by BitDAO. In May of this year, Mantle officially became an independent brand and completed a brand merger with the original incubator. Mantle Treasury manages assets worth about $3.2 billion, mainly consisting of BIT, MNT, ETH, USDC, and USDT. The initial supporters include cryptocurrency exchange Bybit, venture capitalists Peter Thiel, Dragonfly, Pantera Capital, and Polygon. From the historical background, it can be seen that Mantle has the backing of a DAO treasury with a large capital scale and carries the vision of supporting DeFi and decentralized tokenized economies, with strong motivation and resources.

1.2 Major Platforms Enter the L2 Track

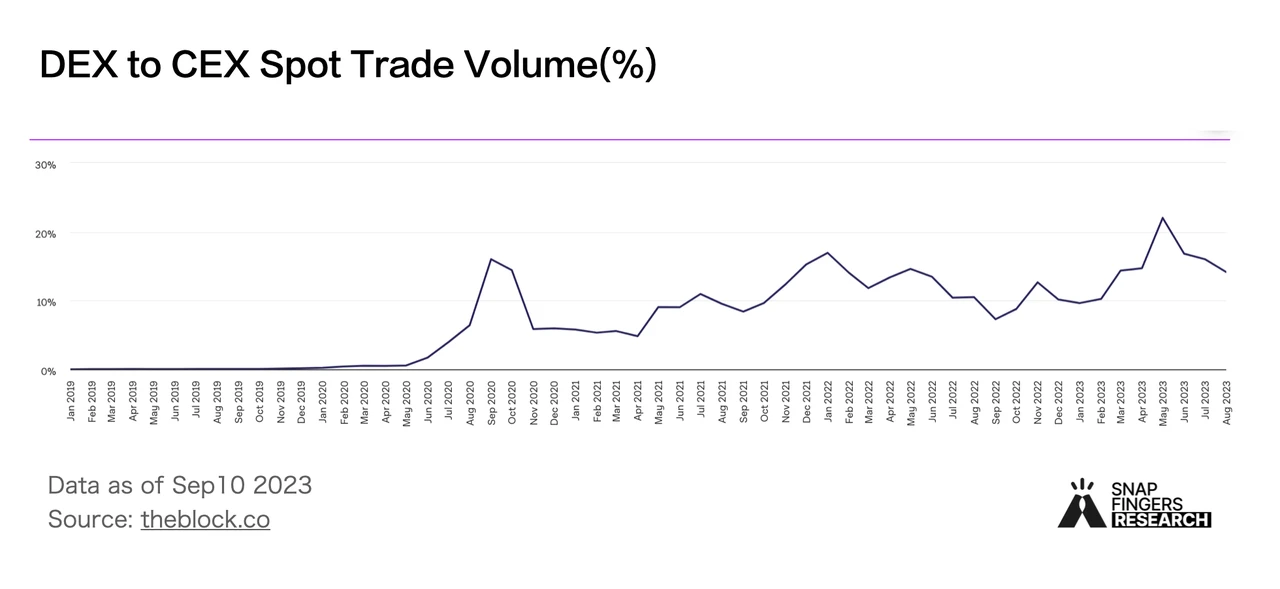

With the continuous rise of DEX, there is a clear trend of cryptocurrency trading volume shifting from CEX to DEX. This is evident in Coinbase's Q2 financial report, where its non-trading revenue exceeded trading revenue for the first time, and both YoY and MoM trading revenue began to decline.

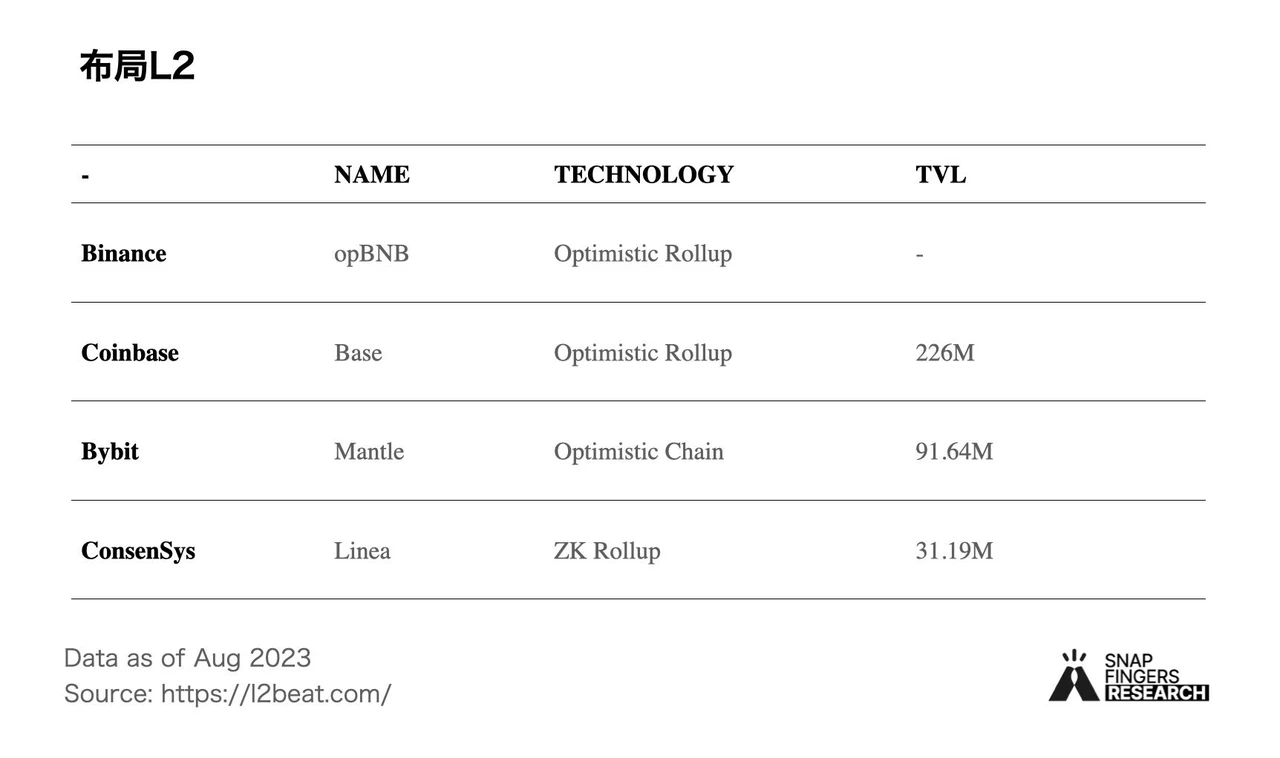

Platforms with a large number of users have laid out in L2 this year: opBNB from Binance, Base from Coinbase, Mantle supported by Bybit, and Linea from Metamask. Base, as L2 launched by Coinbase, is a manifestation of expanding the lifetime value of its users. Binance's L2 layout is more strategic. In order to keep the L2 network active, there needs to be enough users to use and contribute liquidity. Binance has the largest user base among global exchange platforms, followed by high user activity on BNBchain. It can leverage its large user base to force or incentivize them to use their own Layer 2, thereby helping the network grow rapidly and become stronger.

Mantle's development plan and progress conform to the current L2 trend. L2 is rapidly developing and iterating. The Ethereum Cancun upgrade scheduled for November will significantly reduce the storage cost of L2. Lower transaction fees and faster user experience will inevitably give birth to more diverse application scenarios. On the other hand, compliance is also an important issue in the current crypto world. The SEC has repeatedly debated whether cryptocurrencies are securities, which may be the reason why both the Base and Linea teams have stated that they have no plans to issue tokens. In fact, even without issuing tokens, L2 can obtain gas and MEV income through sequencers. The two largest L2 solutions (Arbitrum and OP) currently use sequencers that operate in a centralized manner. In addition, with the support of modular infrastructure like the OP Stack, L2 can be rapidly deployed under compliance conditions. It can be said that L2 is almost a deterministic future.

The concept of Mantle L2 was proposed in June 2022. In November, the Mantle network opened for internal testing. In March of this year, the Mantle testnet went live. In July, the mainnet entered the Alpha phase, which has already implemented Mantle DA data layer and a threshold signature scheme (TSS) with node slashing mechanism. According to the roadmap, in September, Mantle will launch the mainnet Beta version, providing a more stable and reliable network service, and supporting more DApps and protocols. The ecological development of Mantle is also progressing synchronously. During the testnet phase, there were 83 projects running on its network. After the mainnet launch, a $200 million ecological fund called the Mantle EcoFund was established from the national treasury to support the construction of the Mantle ecosystem, promote the adoption of Mantle Network by developers and DApps, and incentivize strategic partners to support and invest in the Mantle ecosystem.

02 The Dilemma of L2 and the Mantle Technical Architecture

The two major technical solutions for Rollup, OP Fraud Proof and ZK Zero-Knowledge Proof, each have their own advantages and challenges. OP has higher storage costs for CallData, while ZK has higher computation costs. In addition, the current mainstream solutions use a centralized sequencer, which has a certain risk of single point of failure. Mantle is a protocol based on Optimistic Rollup, and what sets it apart from other Rollups is its modular architecture, which can improve performance in computing, execution, and other aspects separately. The transaction execution, data availability, and transaction confirmation on the Mantle network are handled by independent modules, which can effectively improve data availability without compromising network security, optimize the journey of the Mantle network, and allow developers to deploy contracts in a relatively low-cost and more efficient ecosystem environment.

2.1 Introducing Modular Data Availability Layer to Significantly Reduce Transaction Fees

In the current blockchain architecture, Optimistic Rollup needs to submit a large amount of transaction data to the data availability layer of Ethereum at a high cost of Calldata. As the transaction volume grows, this part of the cost can reach 80-95% of the total cost, severely restricting the cost efficiency of Rollup.

As an emerging L2 solution, Mantle successfully reduces operational costs by introducing a modular EigenLayer as an independent data availability layer. EigenLayer is a low-cost and efficient off-chain data availability network, which allows Mantle to only submit necessary state roots to the Ethereum mainnet, while storing a large amount of transaction data in EigenLayer.

EigenLayer, as the first data availability module, combines organically with Ethereum, enabling Mantle to ensure both security and ultra-low transaction fees. This breakthrough addresses the technical challenge of "high security and low scalability" in current L2 solutions. EigenLayer also outputs the security of Ethereum's collateral assets to external protocols through the mechanism of "repeatedly staking ETH," providing Mantle with security guarantees in the billions of dollars. This significantly reduces the threshold and cost of launching the security model for L2 networks like Mantle. Overall, EigenLayer's modular data availability layer can separate the high costs of L2 network storage and data submission from the Ethereum mainnet while ensuring security. Under the premise of security, the transaction fees of Mantle are expected to decrease by several orders of magnitude, and the throughput will increase by hundreds of times.

In addition, EigenLayer supports dual staking. This allows $MNT and $ETH to operate as staking tokens together. Through dual staking, $MNT can be used by validators as collateral to provide security and data availability to the network, while also serving as Gas.

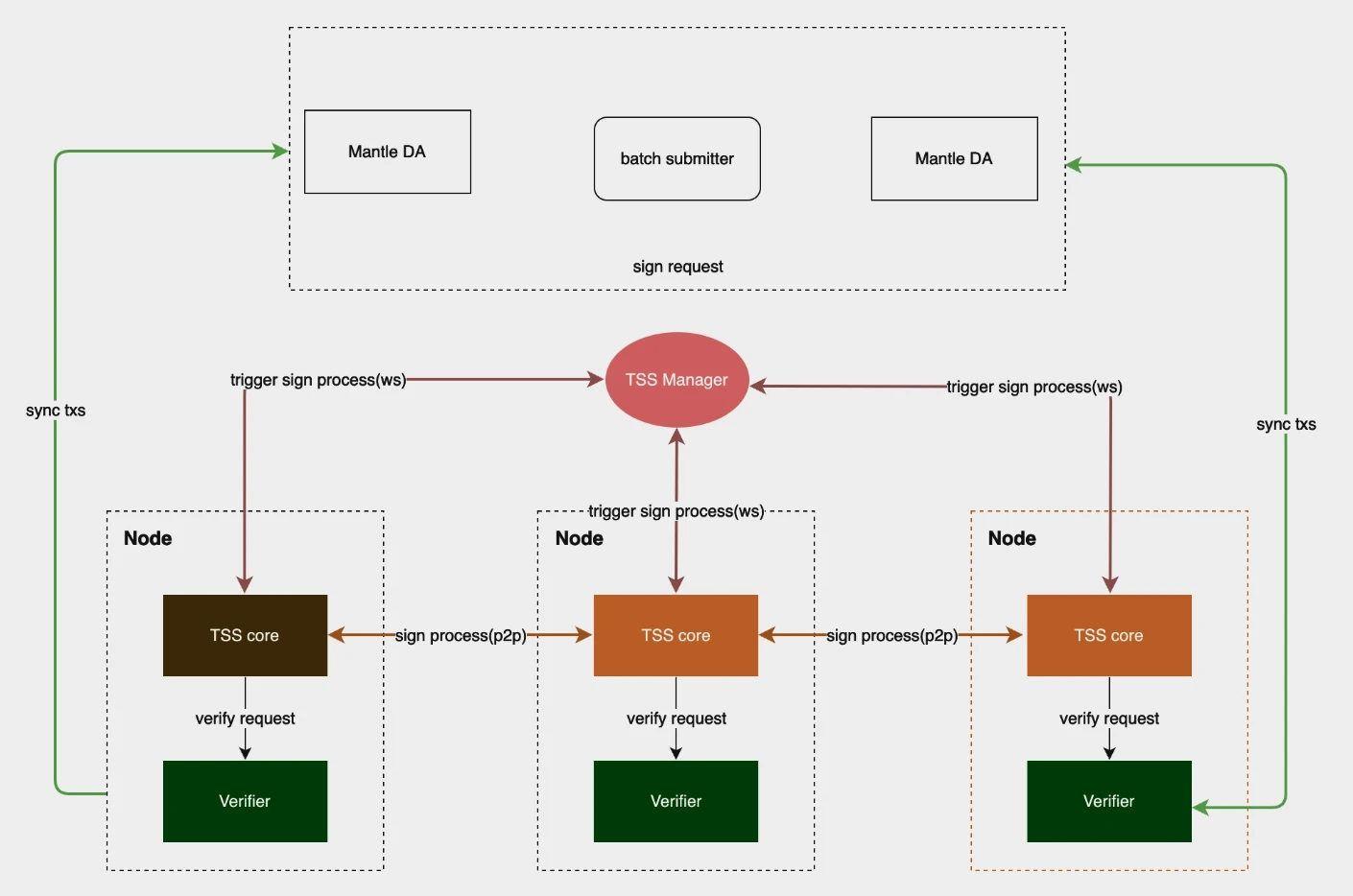

2.2 Mantle improves fraud proof security and shortens the challenge period through TSS nodes

Fraud proofs optimistically assume that the Rollup transactions submitted by the sequencer are valid. To ensure security, the challenge period is long, taking 7 days to withdraw from L2 to the mainnet. If node verification security can be improved, the challenge period can be effectively shortened.

Mantle's validation nodes adopt the threshold signature scheme (TSS), which minimizes the trust risk of executing results. TSS can generate public keys through distributed key generation, and each node holds a portion of the private key to generate valid signatures. Multiple TSS nodes verify and sign the block data sent by the sequencer to ensure its correctness.

Mantle TSS node operators need to stake a fixed amount of MNT on Ethereum. If malicious behavior or failures are detected, the stake will be slashed to ensure network security. The Slashing module defines two types of malicious behavior for nodes:

If a node is absent from validation or engages in malicious signing, the TSS administrator will record it. When the absence of node validation increases, the TSS administrator will submit a proposal to slash a portion of the staked amount from that node, with the agreement of the majority of other nodes (based on staking ratio).

If a TSS node submits fraudulent data to the network, it will be recorded by other nodes and reported to the TSS administrator. The TSS administrator will then submit a punishment proposal to slash a portion of the staked amount from that node, with the agreement of the majority of other nodes (based on staking ratio).

Note: The initial solution for Mantle's validation node was a multi-party computation (MPC) technology, which has been changed to a TSS solution in the Mainnet Alpha phase.

03 The Ecological Potential of Mantle

3.1 Ecological Incentives of Mantle

Mantle possesses a powerful ecological asset, including over 3.2 billion US dollars, including the treasury, and a large user base, which lays a solid foundation for the development of the Mantle ecosystem.

To better incentivize ecological development, Mantle has launched a series of ecological incentive programs, which primarily support ecological projects in two aspects:

Firstly, there is financial support. Mantle has established a $200 million ecological fund, with four main objectives: attracting developers to enter the Mantle ecosystem, promoting venture capital, supporting the flourishing development of the ecosystem, and achieving investment returns. Sufficient ecological funds can attract a large number of high-quality projects to choose Mantle for deployment, enriching its L2 ecosystem.

Secondly, there is a collaboration with the exchange Bybit. High-quality projects in the Mantle ecosystem have the opportunity to be listed on Bybit, thereby gaining a wider user base and liquidity, which provides strong impetus for the long-term development of the projects.

3.2 Mantle LSD Plan may significantly increase the user base and asset scale

Mantle's treasury has a reserve of over 270,000 ETH, providing strong financial strength in the LSD field. Based on such a strong financial backing, Mantle will conduct strategic collaborations with multiple top LSD protocols, forming a powerful ecological synergy to jointly promote the research and application of LSD solutions based on the Mantle network, greatly increasing the user base and asset scale of the Mantle network. This ecological synergy can not only generate network effects but also optimize capital utilization efficiency. This will significantly enhance the adoption rate and influence of the Mantle network.

First, the Mantle project plans to release a liquidity ETH deposit protocol called Mantle LSD, which will be a liquidity staking protocol based on the Ethereum mainnet. Users can deposit ETH into the protocol to obtain mntETH tokens with equivalent profits. These tokens still retain the price and liquidity of ETH while earning staking rewards. Mantle LSD can leverage the unique advantages of the Mantle ecosystem. Firstly, the Mantle treasury currently holds about 270,000 ETH, providing Mantle LSD with a large initial deposit scale and liquidity advantage. It is expected that the total market value of mntETH after issuance could reach billions of dollars, making it a top three protocol in the decentralized LSD field. This will not only bring scale effects to Mantle LSD itself but also provide positive incentives for the usage and circulation of mntETH on the second-level network, Mantle.

Secondly, mntETH can be directly used within the Mantle network, and can even serve as another version of ETH on that network. This will greatly enhance the use cases of mntETH and strengthen its stickiness within the Mantle ecosystem. This is a unique advantage compared to other LSD projects, as it increases user adherence to the Mantle network. Furthermore, Mantle LSD can maximize the reuse of resources such as the established community, governance structure, and brand influence of Mantle, thereby significantly reducing operational costs and risks, while optimizing capital efficiency. At the same time, Mantle LSD will operate within the overall governance framework of Mantle, ensuring its long-term competitiveness and sustainability. Finally, from a technical perspective, Mantle LSD adopts a simple system architecture, reducing complexity risks and making it easy to be integrated and compatible with other applications and ecosystems, laying the foundation for cross-chain interoperability and ecosystem expansion.

In addition to issuing mntETH, Mantle will also engage in strategic partnerships with top DeFi protocols, such as the collaboration with Lido Finance to establish the stETH ecosystem on Mantle Layer 2. Mantle is also considering collaboration with protocols like Pendle and StakeWise. Additionally, Mantle is exploring revenue schemes such as direct collateralization and proposing the establishment of an Economic Committee as a sub-DAO to enhance asset management efficiency.

Through issuing mntETH, strategic partnerships with high-quality ecosystem resources, and leveraging its own funds and governance advantages, Mantle has formulated a comprehensive LSD strategic plan. This not only enriches its DeFi ecosystem but also brings more unique user stickiness to the Mantle network. Compared to other L2 solutions, Mantle has significant advantages in this regard, which will strongly drive the rapid growth and cross-chain interoperability of the Mantle network.

Currently, Mantle has reached a TVL (Total Value Locked) of $40 million. With the expansion of ecosystem incentives and LSD strategic partnerships, Mantle's ecosystem projects and TVL are expected to experience rapid growth.

In recent times, Mantle has also launched community incentives. Users can participate in activities on the mainnet or testnet to share a reward pool of 20 M MNT in the first season. There are also rewards for participants in the Citizen of Mantle NFT whitelist who initially mint SBT. The first 5000 participants can receive a reward of 500 k MNT.

For more details, please refer to the following links:

Mantle Journey: Create Your Profile to Access the Season Alpha 20 M $MNT Reward Pool

500, 000 $MNT Mantle Journey Season Alpha Explorer Event

A Guide to Mantle Journey Miles

04 Token Economics of Mantle

4.1 Token Overview

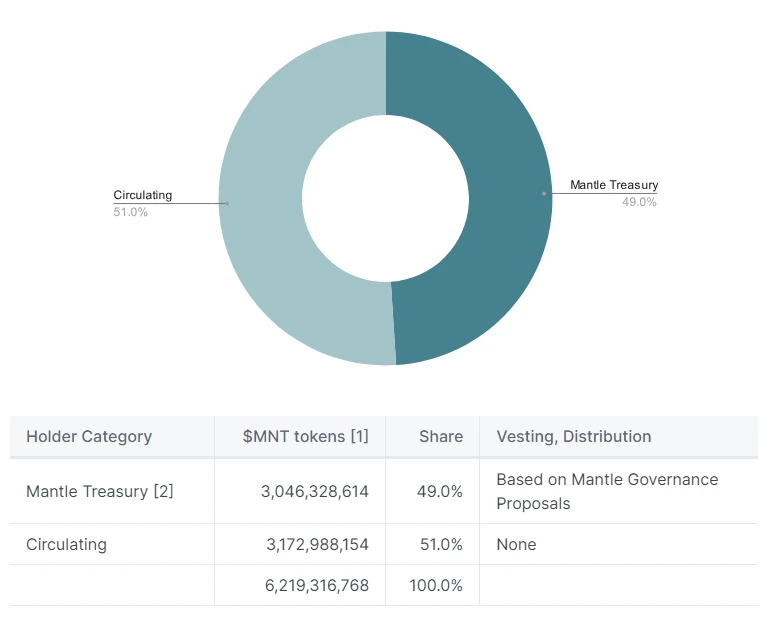

$MNT token plays a dual role in the Mantle ecosystem: both as a governance token and a utility token. $MNT holders can participate in ecosystem governance by holding the token, as well as use the token for various interactions within the ecosystem. With the adoption of proposal BIP-21 (branded as Mantle) and MIP-22 (Mantle token design), $MNT became the new governance token. Subsequently, proposal MIP-23 was passed, further clarifying the total circulating supply of Mantle tokens as 7 billion. Referring to the initial allocation snapshot of $MNT provided by the official on 2023-07-07, the distribution of $MNT is as follows:

From the distribution chart, it can be seen that the Mantle Treasury holds nearly half of the $MNT tokens. The official documentation also states that the $MNT held in the Mantle Treasury can be considered as "not circulating". The allocation of $MNT tokens in the Mantle Treasury must follow the Mantle governance process, and the budget, fundraising, and allocation processes adhere to strict procedures.

After the initial distribution, the sources of $MNT in the Mantle Treasury include:

Periodic donations from Bybit

Mainnet gas fees from Mantle

According to the official documentation, the $MNT in the Mantle Treasury is expected to be primarily used for the following purposes:

1. User incentives

Drive the adoption of Mantle products by implementing various strategies such as multi-season achievements, tasks, and other incentive programs. The target metrics for user adoption include daily active users, total transactions and protocol fees, total locked value (TVL), and other relevant product adoption metrics. These incentive measures aim to attract and engage users within the Mantle ecosystem.

2. Incentives for technical partners

Key incentives for dApps, infrastructure service providers, and core protocol technology partners who contribute to the growth and development of the Mantle ecosystem. By providing incentives to these partners, Mantle aims to foster collaboration and partnerships to enhance the entire ecosystem and expand its capabilities.

3. Core contributors and advisors

Follow the same budget proposal process to ensure transparency and accountability in the allocation of resources to teams and advisors who have made positive contributions to the project's success.

4. Others

When situations such as acquisitions, token swaps, inventory sales, and other transactions arise, they will be evaluated based on specific circumstances, taking into consideration their potential benefits to the Mantle ecosystem and alignment with project goals.

4.2 Token Functions

Currently, $MNT is expected to serve two functions:

Governance token. As a governance token, each $MNT token is given equal voting weight, allowing users to participate in the project's governance decision-making process simply by holding the token. The influence of personal opinions on proposal decisions is determined by the amount of tokens held. The community hopes to actively involve token holders in community governance through this approach to ensure decentralization and drive the future of the Mantle ecosystem through community-driven means.

Utility token. As a utility token, $MNT will become the gas token on the Mantle network, meaning that all gas fees incurred by users' interactions on the Mantle network will need to be paid with $MNT.

In addition, the $MNT token can be used as collateral for Mantle network nodes, further incentivizing participation and contributing to the security and stability of the network. In the long run, when the Mantle ecosystem expands into the LSD track and Restaking businesses, $MNT can also be used as collateral either alone or in combination with LP tokens.

4.3 Valuation Analysis

Due to the fact that the Mantle mainnet is still in the Alpha phase and both the infrastructure and application ecosystem are still developing, there is insufficient data for valuation analysis. Therefore, qualitative valuation analysis will be conducted based on token circulation.

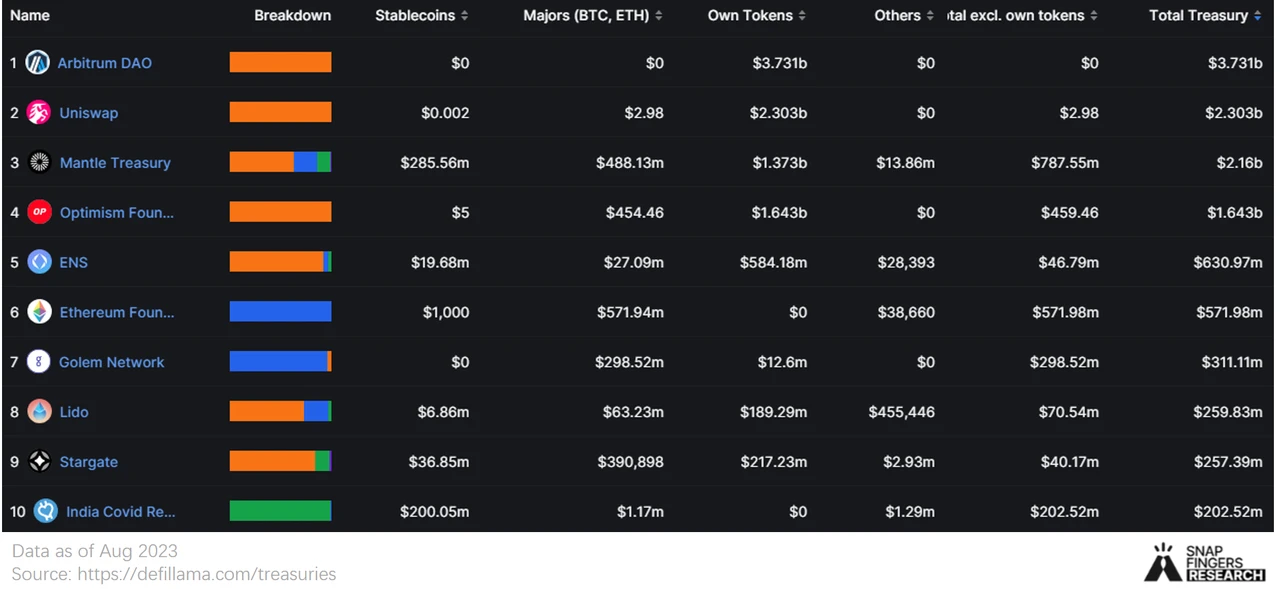

1. Mainstream high-quality assets in the Mantle DAO treasury can provide strong market-making support

From the following graph (Top 10 DAO organizations in terms of funds held), it can be observed that although the treasury funds of Mantle rank third among all DAOs, compared to the top two DAOs (Arbitrum DAO and Uniswap), Mantle has a clear advantage. Arbitrum and Optimism treasuries are almost 100% composed of their own governance tokens, whereas ETH, USDC, and USDT collectively account for 22.1% of the Mantle treasury. This indicates that the Mantle DAO will have stronger market-making capabilities compared to other DAOs and will have more high-quality assets to support ecosystem development. These factors provide a solid foundation for the valuation of the MNT token.

2. Mantle network operations involve multiple token staking scenarios, which will effectively reduce token circulation

Unlike other L2 solutions that use ETH as the gas token, the MNT token serves as the gas token for the Mantle chain. As long as the ecosystem develops stably and there is active on-chain interaction, MNT will be stably consumed without the need for other artificial adjustments.

There are multiple scenarios in Mantle network operations that can help reduce MNT circulation:

Staking MNT tokens to become Mantle DA nodes

Staking MNT tokens to become sequencer nodes

Staking MNT tokens to become TSS node validators

Additionally, the planned LSD platform will also make MNT the primary token for LP token staking.

3. The Mantle DAO has long-term plans for the stability and appreciation mechanism of the MNT token

In April of this year, BitDAO passed the BIP-20 proposal to modify the donation method for Bybit. Instead of donating a floating amount of BIT based on the exchange rate, the donation will now be a fixed amount of BIT per month. This plan will last for 48 months, with a total donation of 2.7 B. The donated BIT will be held in the DAO treasury and may be destroyed if necessary. In May, the BIP-21 proposal was passed, completing the total intended donation mentioned in the BIP-20 proposal (2.7 B). This proposal is undoubtedly beneficial for holders, as it makes the circulation of BIT more predictable and further reduces the concentration of BIT holdings, mitigating the market's tendency to view BIT as a token of Bybit exchange.

Furthermore, from the BIP-22 proposal, it can be seen that Mantle DAO has been considering mechanisms to stabilize and appreciate the MNT token. Some control measures include:

Potential destruction of MNT tokens in the treasury to control possible inflation.

Referencing the ARB token model, controlling the annual minting of new MNT tokens to not exceed 2% of the total supply.

05 Risk Warnings

5.1 Centralization Risk

From the distribution of token holders, there is currently a high level of concentration, which is also a common concern in the market. The proposals show that Mantle DAO is actively addressing market concerns, and the donation plan in the BIP-20 proposal demonstrates the project's actions to gradually reduce the centralization of token holdings. In terms of the number of holders, the MNT token has reached 70,000 addresses (including L1 and L2). In terms of liquidity, MNT is listed on multiple DEXs such as Uniswap and has millions of dollars in liquidity, providing sufficient liquidity options for MNT holders.

5.2 Community Governance Risk

Currently, the Mantle treasury holds approximately 49% of total $MNT tokens. In the official documentation, it is stated that these tokens should be considered "non-circulating" and will be used to support the development of the ecosystem and applications. With the latest MIP-24 and 25 proposals, the DAO has established a dedicated Economic Committee and LSD strategy proposals, demonstrating its efforts to optimize community governance.

According to information obtained from the official sources by FingerSnap Research, the Mantle treasury is managed by Mantle Governance and, at the current stage, serves as a part of DAO's asset management with usage decisions made by the DAO through proposals. Currently, the Mantle treasury does not participate in Mantle governance voting.

5.3 Technical Security Risk

Mantle is an L2 protocol based on Optimistic Verification, and the current Mainnet Alpha version of Optimistic Verification is still under development.

The Data Availability layer Mantle DA is a core technical component of the Mantle Network, and Mantle DA is rewritten based on Fork EigenDA. Currently, Mantle DA is the version of Mantle before integration into EigenDA Mainnet. After the EigenDA Mainnet is launched, the team will reassess whether to migrate to EigenDA based on actual circumstances.

References

https://snapshot.org/#/bitdao.eth

https://treasurymonitor.bitdao.io/mantle-treasury

https://www.bitdao.io/analytics

https://treasurymonitor.bitdao.io/

https://www.gate.io/zh/learn/articles/what-is-mantle/454

BIT Network: An Iterative Modular Chain Approach,https://discourse.bitdao.io/t/archived-bit-network-an-iterative-modular-chain-approach/2988

https://www.panewslab.com/zh/articledetails/8903p3w6.html

https://cryptowesearch.com/blog/all/mantle-network-mainnet-launch-modular-layer2-blockchain

https://www.theblockbeats.info/news/43897

https://www.theblockbeats.info/news/42349

https://www.mantle.xyz/blog/announcements/mantle-a-new-approach-to-scaling-ethereum

https://www.theblockbeats.info/news/36518

https://twitter.com/0x Mantle/status/1613236965562015745

https://web3 caff.com/zh/archives/63434

https://w3hitchhiker.mirror.xyz/GDSJApI2AyhfQSQVkdcAzlEeMqGxTiiypu1rVJX1JZw

https://twitter.com/Moomsxxx/status/1671904364393295873

https://followin.io/zh-Hans/feed/5645145

https://discourse.bitdao.io/t/discussion-mantle-ecofund/4692

https://twitter.com/Moomsxxx/status/1671569578743169039

https://forum.mantle.xyz/t/discussion-mantle-lsd/7085

About Snapfingers Research

Snapfingers Research is a research platform under Snapfingers, focusing on infrastructure, DeFi, and TradeFi research on various public chains.

Twitter @SnapFingersLabs

Mirror.xyz/snapfingersresearch.eth