On September 18, 2023, KOL Lin Zuo was arrested by the Hong Kong police on suspicion of participating in a conspiracy to commit fraud on the cryptocurrency trading platform JPEX. At the same time, KOL Chen Yi was also controlled by the police for the same reason. In addition to these two people, six others were arrested. According to official reports, four men and four women were involved in the arrests, a total of eight people.

It is reported that the case has involved more than 1,400 victims and the amount involved is as high as 1 billion yuan. Suddenly, this sky-high cryptocurrency exchange fraud shocked the entire Hong Kong.

And it all started with the CSRC roll call on September 13th.

SFC warning statement

On September 13, 2023, the Hong Kong Securities and Futures Commission (SFC) issued a warning statement titled Regarding Unregulated Virtual Asset Trading Platforms. The SFC stated that it has noticed a virtual asset trading platform called JPEX. None of the companies under this platform group have been licensed by the SFC, and they have not applied to the SFC for a license to operate a virtual asset trading platform in Hong Kong. .

Regarding the issues involved in JPEX, the Hong Kong Securities Regulatory Commission pointed out six major doubts:

JPEX states on its website that it is “a licensed and recognized digital asset and virtual currency platform.” It claimed on its website and in local editorial advertisements that it had obtained licenses from certain overseas regulators to operate virtual asset trading platforms, which was actually untrue.

JPEX offers extremely high returns on some of its products.

The Securities and Futures Commission received complaints from retail investors and noted media reports that some retail investors were unable to withdraw virtual assets from accounts opened at JPEX or found that their account balances were reduced and changed.

Some of the products offered by JPEX appear to be arrangements involving virtual assets, such as virtual asset “deposits,” “savings,” or “income” that are not permitted under the Securities and Futures Commission’s virtual asset trading platform regulatory regime.

JPEX advertised on its website and local editorial advertisements that it had entered into a business cooperation with and received investment from a Hong Kong listed company, when in fact the cooperation had been terminated and the listed company had not actually made any investment.

Internet celebrities and over-the-counter exchange shops made false or misleading statements on social media, stating that JPEX had independently or jointly with a Hong Kong listed company applied for a virtual asset trading platform license in Hong Kong. In fact, JPEX Group None of its entities has submitted any application for a virtual asset trading platform license to the Securities and Futures Commission.

Doubts about withdrawing money

In fact, apart from the naming of the Hong Kong Securities and Futures Commission, the issues involved in JPEX have long been full of doubts. Among them, the most widely circulated is the rumor that JPEX cannot withdraw funds.

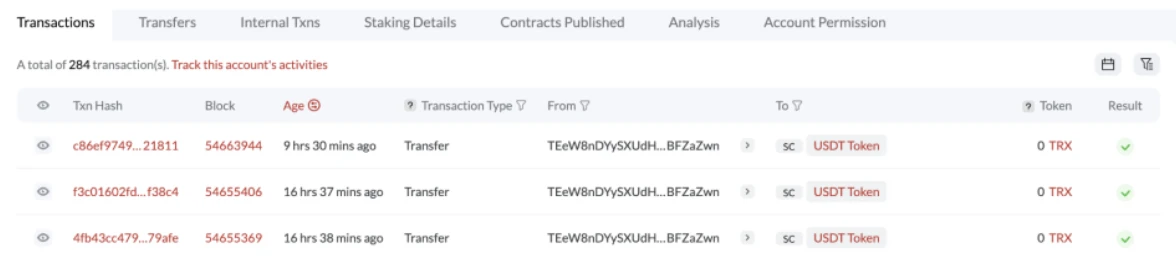

According to data on the chain, for a period of time, several withdrawal addresses related to JPEX did not have any fund transfer records for more than 7-8 hours. According to screenshots taken by JPEX official Discord community members, the withdrawal limit of the JPEX exchange is suspected to be limited to 1,000 USDT, but the withdrawal fee is as high as 999 USDT, which means that users actually withdraw only 1 US dollar.

The records on the chain also show multiple records of 1 U withdrawals, which are suspected to be records of users trying to withdraw cash.

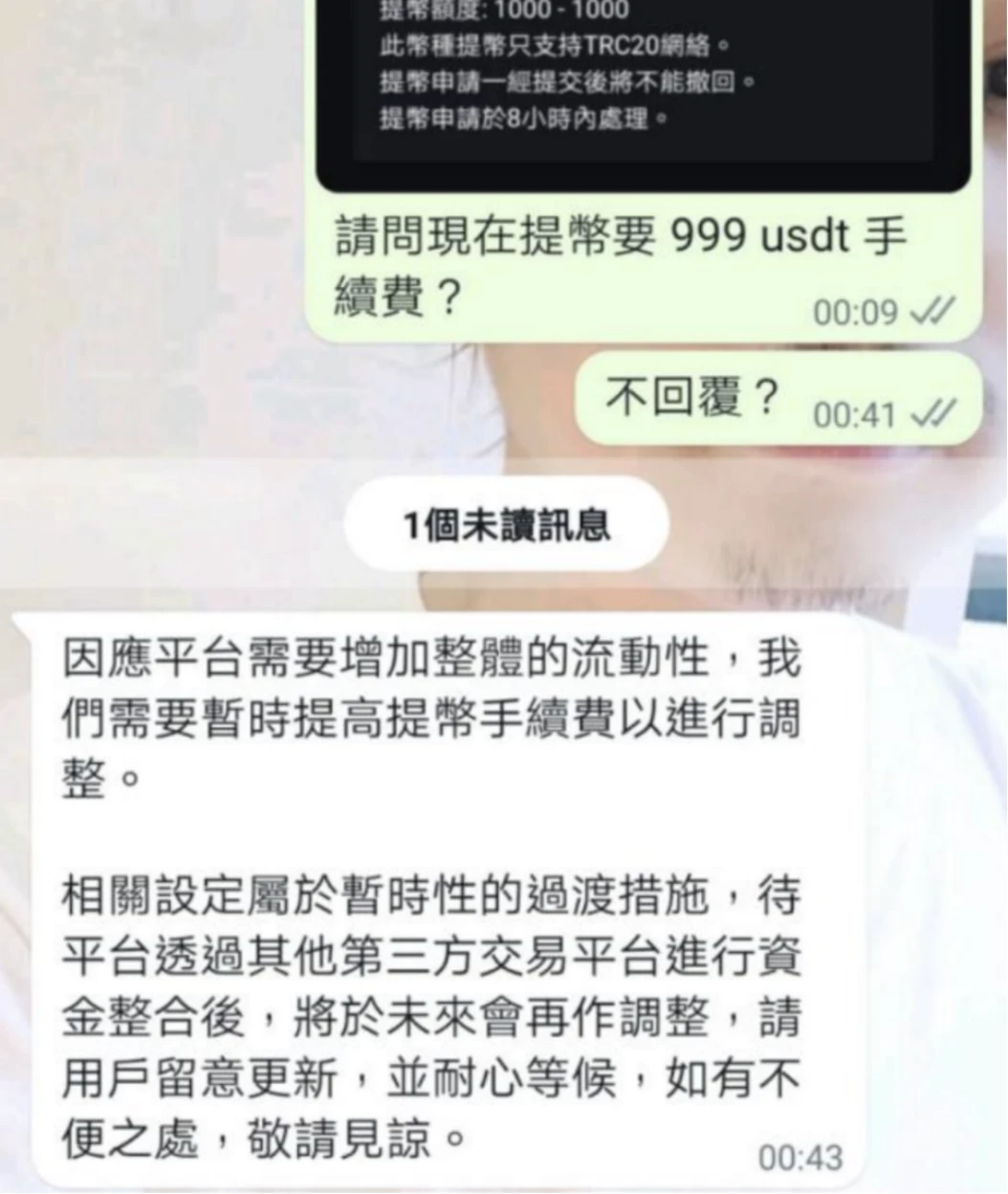

Regarding this situation, community members also began to provide official feedback. In response to this, the official reply is:

“In response to the increase in overall liquidity on the platform, we need to increase the handling fee to make adjustments.”

As soon as the news broke, it instantly caused panic among users. Affected by this incident, the JPEX platform currency JPC also plummeted, falling by more than 20% within 24 hours.

fake license plate

Previously, JPEX had advertised having licenses from multiple countries. However, after investigation, it was found that the directors of JPEX’s companies in the United States, Canada, Australia, Lithuania and other countries are all different people. At the same time, since the platform was registered in 2020 and started operating in 2021, the actual person in charge and office location have never been made public.

Dating back to the initial stage, JPEX claimed to be JP-EX Crypto Asset Platform Pty Ltd, a registered company in Australia. According to the Australian Securities and Investments Commission (The Australian Securities and Investments Commission) search records, the company was listed in September 2020. Established in March, the current director and secretary are named Jiayi CHEN. In addition, JPEX also registered another company in Australia called JPEX Technical Support Co. Pty Ltd, but the company had its registration revoked in 2022, and the company with the same name was also named by the Hong Kong Securities Regulatory Commission.

In addition, in the early stages, JPEX has been trying to package itself as a Japanese cryptocurrency exchange and promoted it through artists and Internet celebrities. However, the Japan Financial Services Agency stated that the name JPEX is not included in the list of crypto asset exchanges.

In the Americas, JPEX has registered companies in the United States and Canada, which are: JP-EX Crypto Asset Bank and JP-EX Exchange Limited. But what is suspicious is that JPEX USA was registered in Denver, Colorado, but did not register a director. It only registered an acting secretary company, Zhongteng Accounting Co., LTD, and its contact person was Weihan WANG. Although the Canadian company has registered a director, the director has the same name as the contact person of JPEX US company, and the registered address is different.

Currently, specific information about Weihan WANG remains unconfirmed. However, during the investigation, we discovered that although JPEX claimed to have obtained licenses from Australia, the United States, Canada and other countries, in fact, these licenses were not exchange operating licenses, but registrations required to engage in foreign exchange and finance.

The focus is on Europe. JPEX said in June 2022 that it had obtained a Lithuanian cryptocurrency license, and its local company registration name was JP-EX Crypto Asset Platform UAB. However, after investigation, it was found that the company was just an ordinary limited liability company and had been deregistered in July this year, and there was no trace of the Lithuanian licensing press release on JPEXs official website.

Finally, back to Hong Kong. JPEX established a company called JPEX Technical Support Co. Pty Ltd in July 2021. The company was renamed Web3.0 Technical Support Limited in April 2022, and the directors name is Guo Haolin. It is reported that in addition to JPEX, Guo Haolin also serves as a director of CoinLedge Limited and Crypto Wesearch Media Limited. The former is a technology and finance website, and the latter is a blockchain information website. Regarding Guo Haolin, some reporters reported that they tried to interview Guo Haolin at his address but no one answered the door.

The building is empty

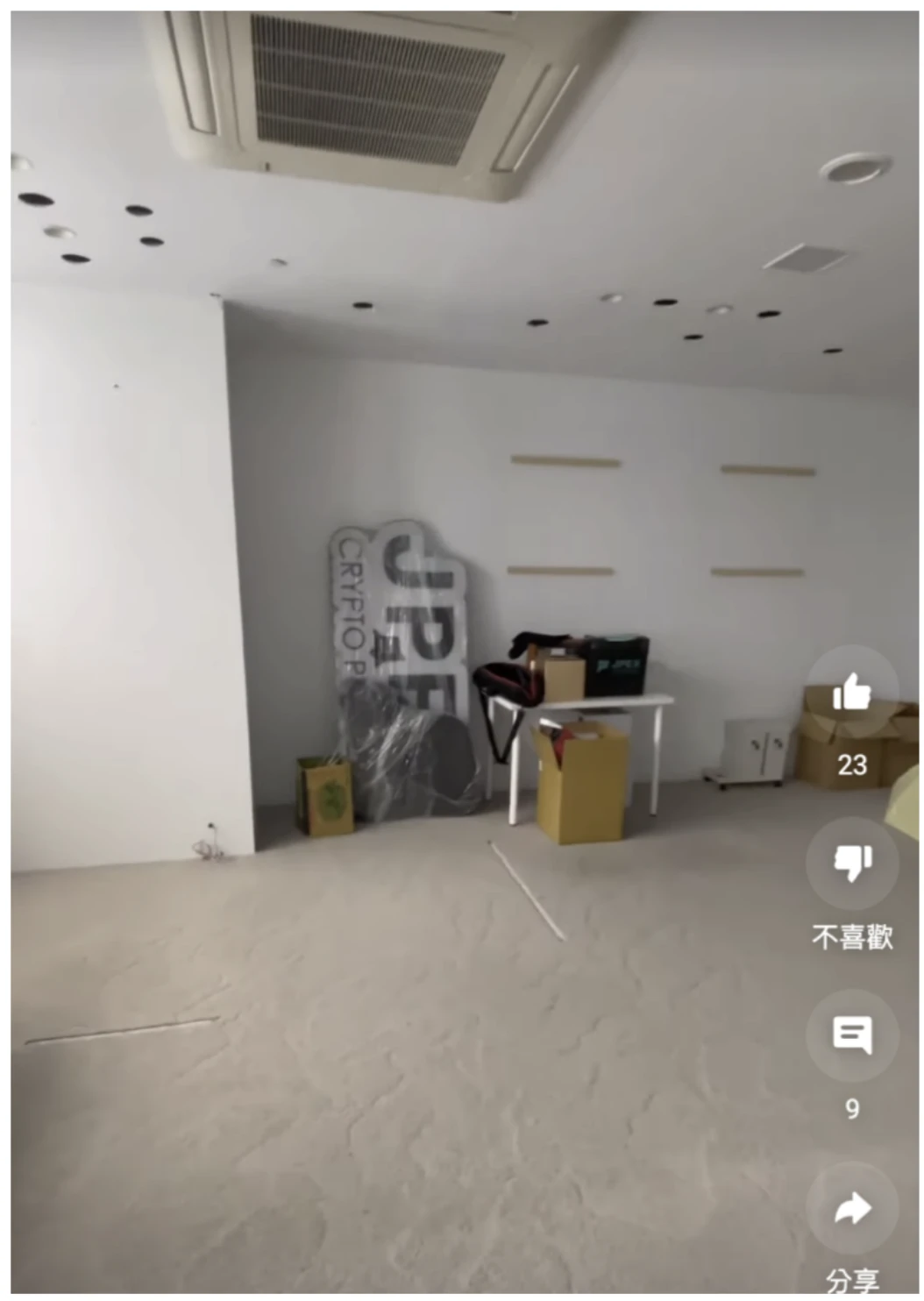

On September 13th and 14th, the Web 3.0 Encryption Summit Token 2049 was held in Singapore. In preparation for this crypto industry event, JPEX has specially launched the “Hold on to Bitcoin” event. During the event, just find JPEXs event booth in Token 2049 and complete the designated tasks to participate in the gashapon lottery and Hold the Bitcoins event. But when we arrived at the summit, we found that all JPEX’s booths at Token 2049 had already been cleared.

Echoing this is the Asia Blockchain Building located in the core area next to SOGO in the East District.

In mid-June this year, the JPEX Asia Blockchain Building, which boasted a monthly rent of 3.4 million, was highly publicized by JPEX, and JPEX officials once made bold claims to build it into the core base of the Asian blockchain. At that time, each of the 13 floors of the building was planned in detail, including a coffee shop, VIP room, shared office, and even plans to create an exclusive music creation base for Taiwan spokesperson Chen Lingjiu on the 9th floor.

But in fact, since June, the interior of the JPEX Asia Blockchain Building has been under construction, and now that JPEX has been involved in a sky-high price fraud case, I am afraid that the former ambitions will most likely come to nothing.

Official announcement, long overdue

Regarding the Hong Kong Securities Regulatory Commission’s roll call, license and withdrawal issues, JPEX officials did not respond immediately. It was not until September 14 that the official announcement came belatedly. The announcement stated:

In view that the platform needs to make business and policy adjustments based on the statement issued by the Securities and Futures Commission of the Hong Kong Special Administrative Region, JPEX has adjusted the USDT withdrawal fee at 00:00 on September 14, 2023 (GMT+ 8).

Regarding the above matters, the platform has set up a task force on this matter. The members will be composed of professional legal professionals, former members of the Securities Regulatory Commission and financial industry elites to discuss future development directions and make adjustments, and await further guidance from the Securities Regulatory Commission.

Based on the CSRC’s response, the platform will gradually adjust the currency withdrawal fees in the near future and gradually open the currency withdrawal limit.

If users have urgent currency withdrawal needs, they can fill in the form below to apply for priority currency withdrawal sorting. The platform will make arrangements as soon as possible to solve users with special needs.

Through the above announcement, JPEX did not respond positively to focus issues such as excessive withdrawal fees, suspected transfer of user assets, and licensing issues.

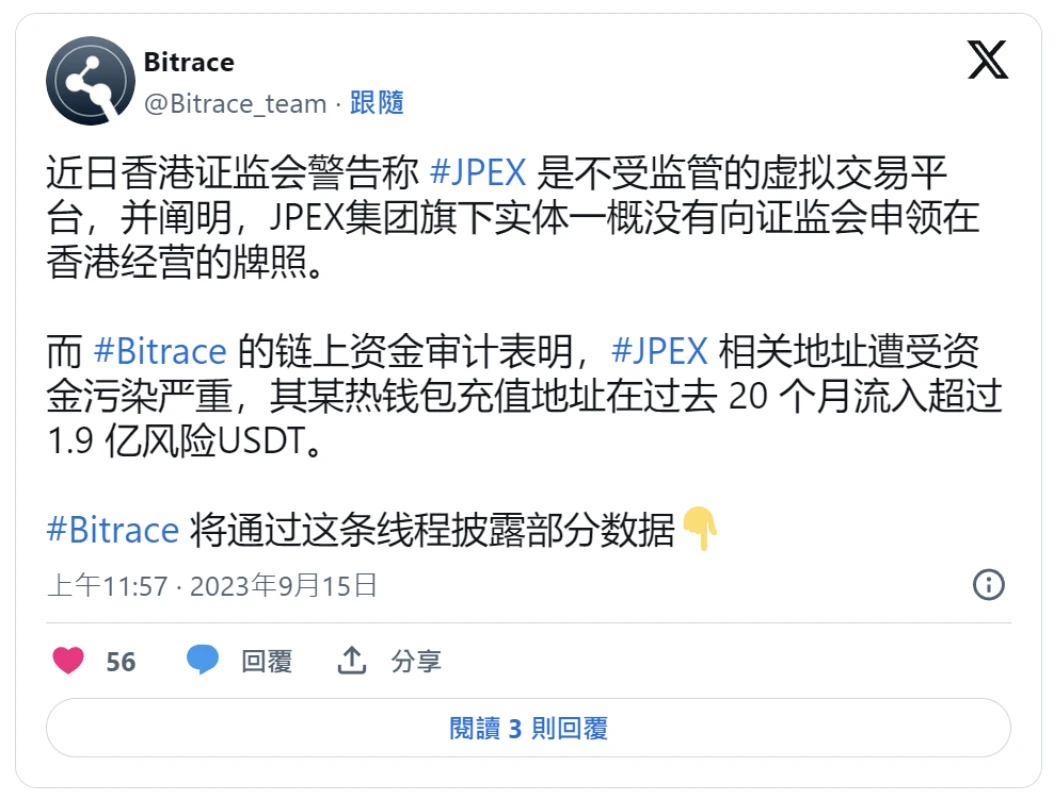

On September 15, blockchain data analysis company Bitrace tweeted that the flow of funds behind the Tron address related to JPEX was opaque. One of its hot wallet recharge addresses had inflows of more than 190 million USDT at risk in the past 20 months. All 22.04% of the funds were classified as risk funds, and the risk types were identified as black and gray assets, online gambling, and money laundering.

As the situation continued to intensify, the cryptocurrency exchange CoinW also issued an announcement late at night on September 15, deciding to delist the JPC/USDT trading pair starting from 22:00 on September 15, 2023 (UTC + 8).

Another announcement, delisting and reorganization

Even though JPEX issued a response announcement on September 14 in response to recent events, it still could not prevent the situation from deteriorating. At the same time, the issue of withdrawals has not yet been properly resolved. Therefore, JPEX issued another special announcement at 21:19 on the evening of September 17, which stated:

Recently, due to the unfair treatment of the JPEX cryptocurrency trading platform and a series of negative news issued by relevant institutions in Hong Kong, the third-party market makers that the platform cooperates with have temporarily locked funds and required the platform to provide more Information is used for negotiation, which limits the liquidity of the platform and greatly increases our daily operating costs, resulting in operational difficulties.

JPEX also stated that due to third-party market makers restricting the platform’s liquidity and complying with policy guidelines, the platform will delist all transactions on the financial management page at 00:00 (GMT+ 8) on September 18, 2023.

At the same time, the announcement also stated:

At this stage, structural reorganization is necessary to redefine the direction of operations.

JPEX claims that it will publicly collect user suggestions and adopt some suggestions and plans to discuss with the task force to select a reasonable plan and conduct a user referendum.

latest progress

As the situation gradually escalated, Hong Kong Chief Executive Lee Ka-chiu also met with reporters before attending the executive meeting on September 19. He said that he was always paying close attention to the JPEX case and pointed out:

The Hong Kong SAR government’s policy stance on virtual assets is to have an effective regulatory system, the dissemination of information related to virtual assets must be open and transparent, and investor education must be valued and promoted.

In addition, Li Jiachao also mentioned that this incident fully reflects the importance of supervision, including the need to invest in regulated and licensed trading platforms, and the importance of personal understanding of virtual assets and related risks. He emphasized:

The current licensing system is to protect investors. The Securities and Futures Commission will monitor market changes to ensure that investors interests are fully protected. The authorities will also vigorously promote investor education.

After the arrests ended on September 18, the Hong Kong police immediately held a press conference on this major social incident to inform all sectors of society about the case and progress.

According to Meta Era, the Hong Kong police held a press conference at 4 pm on September 19 to inform JPEX about the arrests and the latest investigation progress. Hong Kong police said that due to the huge public interest involved in the incident, the Commercial Crime Investigation Bureau launched a law enforcement operation yesterday and arrested eight people, a total of four men and four women, including KOL Lin Zuo who claimed to be a partner of JPEX.

As of last night, the Hong Kong police had received reports from 1,641 victims, involving approximately HK$1.187 billion. The Commercial Crime Bureau also conducted an asset investigation on the arrested persons and related companies, and froze bank balances of approximately HK$15 million and three properties with a total value of approximately HK$44 million.

However, compared to the progress of the case, all sectors of society are obviously more concerned about the situation of JPEX victims. According to the Hong Kong Economic Journal, lawyers are currently not optimistic about the situation of JPEX victims. Chen Tingqian, a lawyer in the field of financial market supervision and virtual assets, said in an interview:

The current difficulty is that we do not know which legal entity of JPEX holds customer assets, nor do we know where the legal entity is registered. At this stage, Hong Kong users will have certain difficulties if they consider civil claims.

However, Chen Tingqian pointed out that in addition to the company, if there is sufficient evidence that someone is involved in illegal or breach of contract, depending on the relevant evidence and the circumstances of the case, civil compensation claims may also be filed against these individuals.