Original author: Jonas@Foresight Ventures

The story originated from the bottom of the last bear market. A friend once established the Zeroing Fund, which dispersed the funds to buy 50 altcoins with small market capitalization. It was expected that with the mentality of returning to zero, small and big gains could be realized. In the end, I bet on AAVE, LINK and other coins with a small probability of increasing by hundreds or thousands of times, and achieved a huge return of dozens of times in the bull market. This successful investment experience is impressive, but it also reminds us that catching a hundred times the coin involves a lot of luck, and it is more suitable to catch it with probability through the fishing net method.

In view of the fact that the Feds interest rate hike cycle is coming to an end and the time for the market to bottom out is almost ripe, we plan to replicate the successful experience of the Zero Fund and have selected nearly 50 potential projects to focus on. The goal is to seize altcoins that can survive a bear market and rise dozens to hundreds of times.

Main screening criteria (several of them met):

Technical aspect: The high point has fallen by more than 90%, and the market value ranks around 100-1000.

Fundamentals: GITHUB is still updating and the community is still operating.

Chip surface: Full change of hands, chip release completed, major market makers present.

Narrative: If you have new concepts, priority will be given to new coin issuance projects during the bear market.

Liquidity: Binance, Coinbase, OKX and other compliant legal currency exchanges.

1. Defi

Decentralized derivatives may be the main battlefield of Defi in the future. With the increase in bull market speculation demand and the improvement of the second-layer expansion plan, it will bring more composable gameplay to the Defi ecosystem.

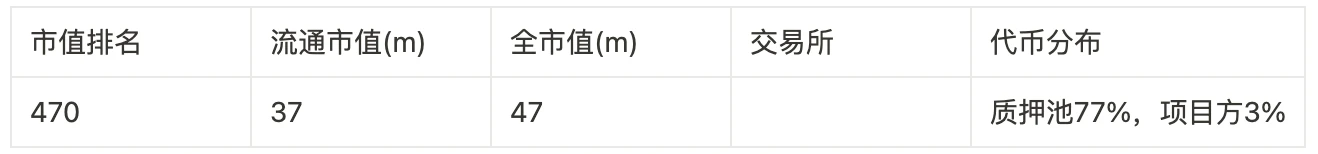

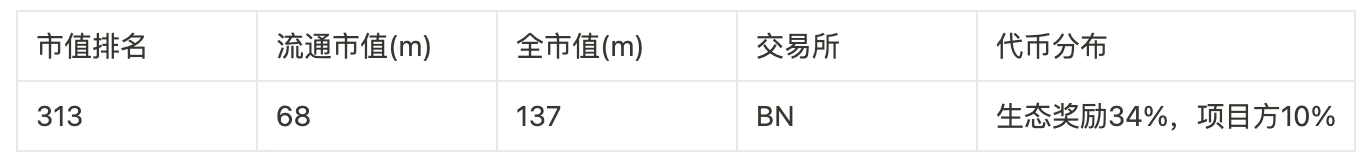

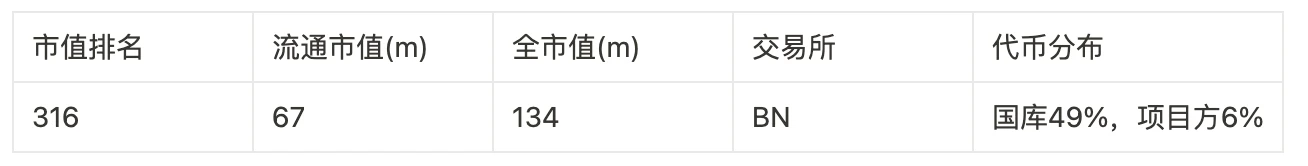

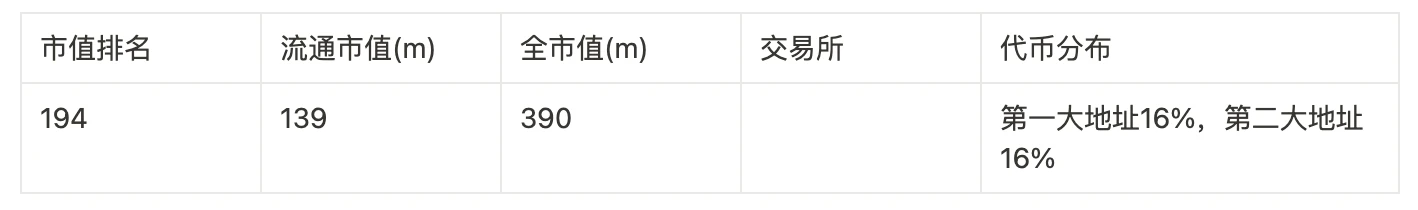

1.VELO: The DEX leader on the OP chain, using the VE33 model liquidity incentive

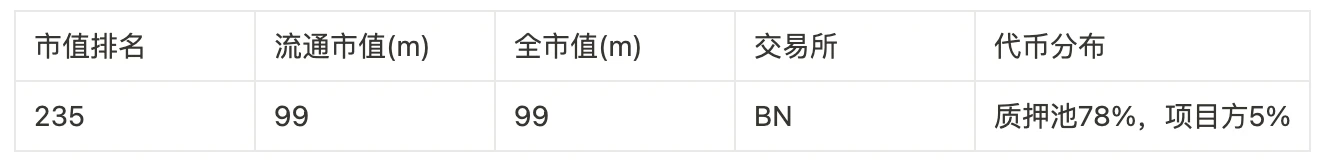

2.GRAIL: The DEX leader on the ARB chain, the largest new platform

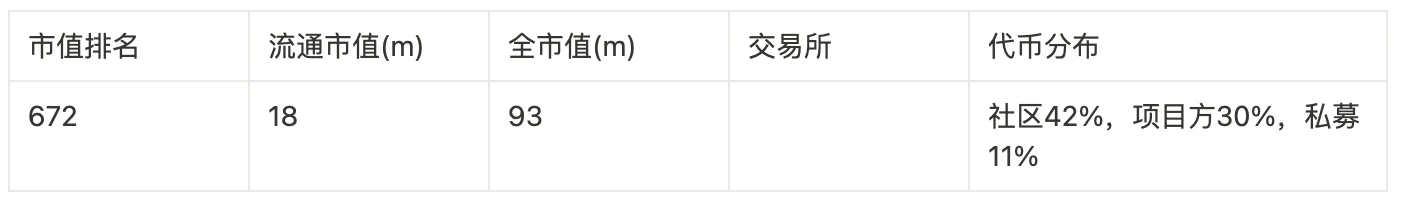

3. JOE: AVAX and ARB are the leading DEXs on the chain, doing bribery based on price ranges

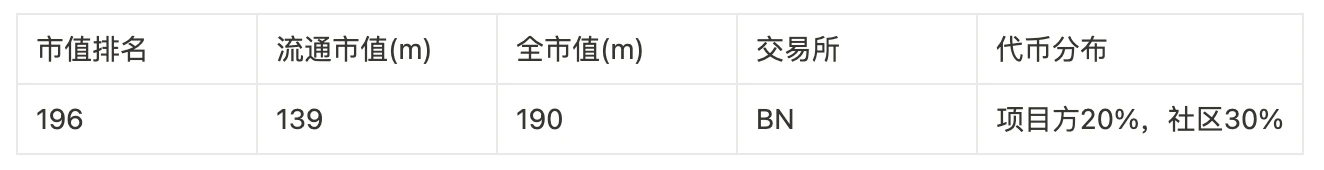

4.ORCA: The head DEX on the SOL chain, the SOL chain still has a strong consensus in Europe and the United States

5.MCB: Contract platform aggregator MUX on the ARB chain

6.GNS: Synthetic asset derivatives DEX, including encryption, foreign exchange, stocks and other categories

7.LYRA: European options platform on OP and ARB chains

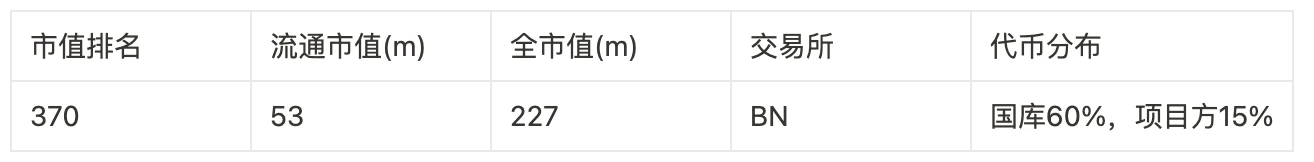

8.RDNT: The leader in cross-chain lending on ARB, the economic model has a Ponzi effect

9.GMD: GLP’s Delta neutral mining machine gun pool

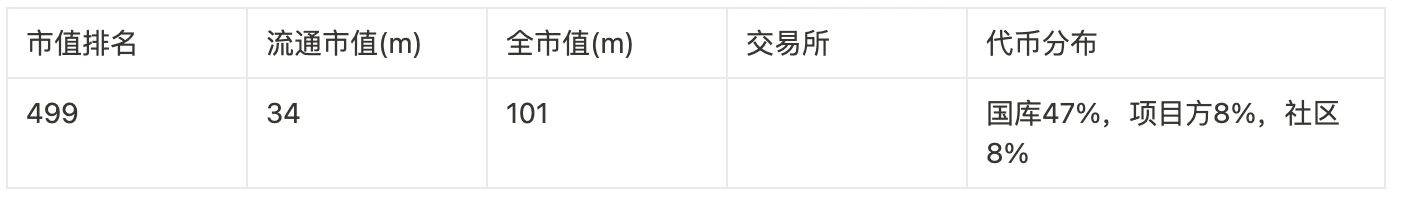

10.PENDLE: The interest rate derivatives track is in its early stages, liberating future cash flow

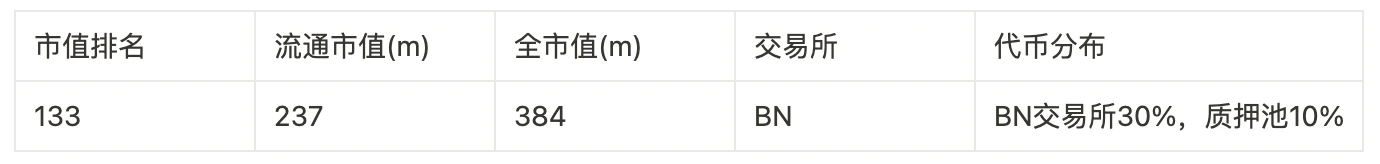

11.SSV: Decentralized staking infrastructure, recognized by the ETH Foundation

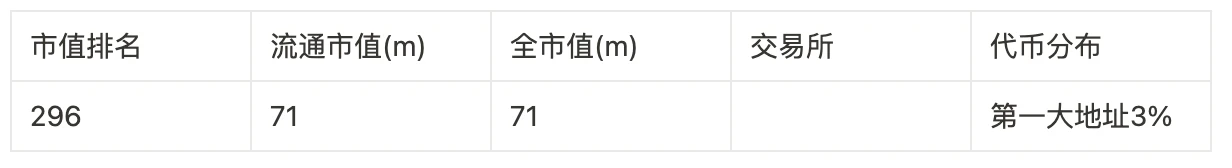

12.SD: Multi-chain liquidity staking protocol

13.UNIBOT: The leading telegram trading robot with rapid user growth

2. Chain Games and Metaverse

Chain games break the business logic of traditional games and return benefits and value to players. The games currently released are generally not very innovative and have average playability. Referring to the development rules of the Web2 game industry, platform projects have a better future.

14.MAGIC: ARB Chain’s chain gaming platform

15.AGLD: Develop LOOT chain and make full-chain games

16.YGG: Decentralized Game Guild, Transformation Game Investment Fund

17.MC: From a game guild to an incubator, venture capital fund and trading market

18.RLB: The leading gambling platform, with high income and a repurchase mechanism

19.HALO: Provides a visual DID protocol in the metaverse, a project incubated by the Lifeform team

3. NFT

The utility of NFT collections is to clarify the attributes and ownership of digital cultural assets and promote the transaction of digital assets. In the future, as the demand for assets on the chain expands, NFT collections will continue to grow and new ecological industries such as creation, trading, and financial services will be formed.

20.BLUR: The leading NFT trading aggregation platform, meeting everyone’s expectations

21.SUDO: NFT trading platform using AMM protocol

22.BEND: The leader in NFT mortgage lending, adopting a peer-to-pool approach

23.JPEG: NFT mortgage lending platform, using NFT as collateral to mint stable coins

24.OPUL: Music NFT royalty investment platform, integrated with Defi to provide mortgage loans for musicians

25.ORDI: BRC 20 leader, with first-mover advantage

4. Socializing

According to the development pattern of the Internet, with a huge base of native users, the Web3 social graph is expected to begin to explode. However, most of the existing projects on the decentralized social track are imitations of the traditional Internet, and the new paradigm of real phenomena has not yet emerged.

26.GAL: Web3 credential data network, designed to build a DID system to help project parties better build products and communities

27.RLY: Can provide financial support to online creators, such as issuing fan coins

5. Artificial Intelligence

The combination of AI + blockchain is still in its initial stages of exploration and may bring new business models and opportunities.

28.AGIX: AI service platform, using Ethereum to create a payment and registration system, and a new IDO launch platform

29.FET: A public chain deeply integrated with AI, including smart contracts that can write AI models

30.ALI: The AI-generated avatar project invested by Binance, invested by Mark Cuban, has exceeded expectations

31.RNDR: GPU computing network for decentralized rendering, which can be used in the Metaverse and AI

32.OCEAN: Transaction big data protocol and public data market based on this protocol

6. Meme

In the last bull market, people witnessed the stories of getting rich by tens of thousands of Meme coins such as DOGE and SHIB, and emotional narratives are also valuable.

33.XEN: POP mining mechanism, established ecosystem

34.BITCOIN: Harry Potter Bitcoin is the leader in MEME

35.TSUKA: Tibetan Buddhism-related MEME, related to the founder of SHIB, planning to build ecological projects

7. Payment

As more institutions adopt crypto payments, crypto payment providers will be in demand in the long term.

36.ACH: A decentralized open source payment protocol that provides enterprises with mixed payment solutions for cryptocurrency and fiat currency. It is one of the best-developed projects in the payment industry.

8. Infrastructure

Decentralized infrastructure helps ensure that the mainstream public, not just blockchain innovators, joins the Web3 world.

37.DAO: Daomaker is a Web3 community incubator that helps with financing in the initial stages of projects

38.RAD: Decentralized Github code collaboration infrastructure, Web3 developer DAO

39.POND: A layer 0 protocol dedicated to helping the underlying blockchain achieve expansion, drawing on CDN acceleration technology

40.CTSI: An infrastructure platform based on layer 2 Linux, bridging the gap between mainstream software and blockchain

41.STG: The first Dapp built based on the LayerZero protocol, designed to help users achieve cross-chain asset transfers

42.AXL: Universal cross-chain basic protocol, based on Cosmos technology, using its own public chain as the relay chain

43.SIS: Similar to the V2 version of Cbridge, DWF makes markets for it

9. Public chain

Building a public chain is like building a railway. It requires huge initial investment, but collecting fees from users in the later period will bring sustainable income, and the more prosperous the ecology is, the stronger the innovation force will be. This explains the reason for the high valuation of public chains as the core value carrier of Web3.

44.CANTO: Defi public chain on Cosmos, cooperating with Polygon on ZK technology

45.KAS: The top three POW public chains in terms of mining power, using DAG technology

46.CFX: The only compliant public chain in China, cooperating with domestic mainstream APPs, Hong Kong’s concept leader

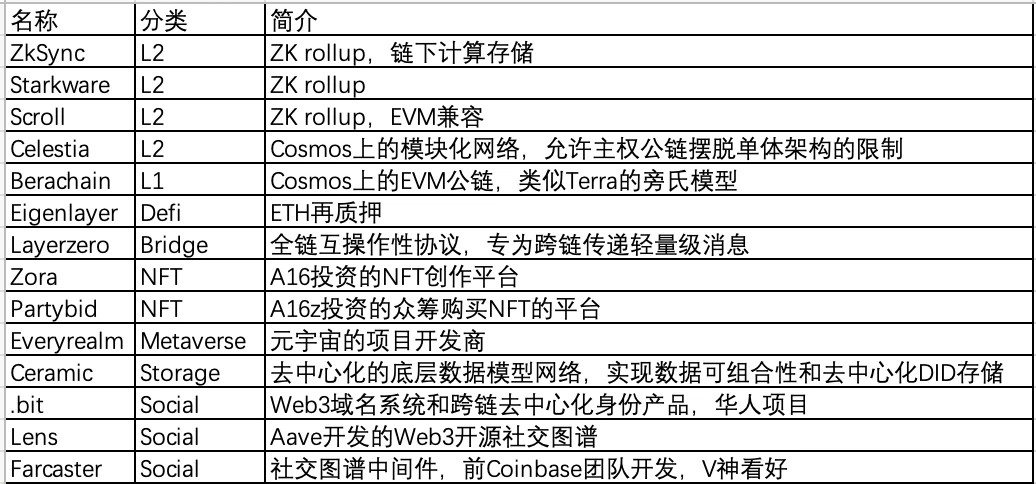

Web3 likes to speculate on the new rather than the old. There are still many good new projects that have not yet issued coins and will issue coins in the next 1-2 years, so they deserve our long-term attention. The future bull market will be the time when everyones work during the bear market will be rewarded, especially for those who persevere and keep building. I sincerely hope that we will all get a good profit in the new round of bull market.

Pay attention to unissued currency projects:

About Foresight Ventures

Foresight Ventures is betting on the innovation process of cryptocurrency in the next few decades. It manages multiple funds: VC funds, secondary active management funds, multi-strategy FOF, and special purpose S fund Foresight Secondary Fund l. The total asset management scale exceeds 4 One hundred million U.S. dollars. Foresight Ventures adheres to the concept of Unique, Independent, Aggressive, Long-term and provides extensive support for projects through strong ecological power. Its team comes from senior people from top financial and technology companies including Sequoia China, CICC, Google, Bitmain and other top financial and technology companies.