Original text - Uniswap

Compile - Odaily

Since its birth, Uniswap has been committed to creating the best trading experience. As the crypto market develops, our understanding of user experience continues to deepen.

To be the best trading platform, Uniswap must have the best price and the best liquidity. The optimal price seems easy to measure, but finding the best path requires strong liquidity. Liquidity is best when there is a flexible but reliable combination of tokens, pools, and fee levels that attract liquidity providers to deeper markets.

Each subsequent version of Uniswap has supported more complex pool functionality, and v4 will take it to another level. While great for liquidity, the customizable nature of pools makes it difficult for traders to find the best route that gives them the best price. As the market evolves, routing and liquidity have become two separate but related problem areas.

To make progress on both fronts, we separate them. Uniswap v4 introduces hooks that can build custom automatic market maker (AMM) functions, such as periodic investments or oracles. UniswapX outsources complex routing to an open network of third-party fillers, who then search for the best prices among liquidity sources. Together, these complementary protocols help provide users with the best trading experience.

Uniswap v4 provides the best liquidity

Uniswap v1 is a liquidity creation experiment designed to test whether automated market makers (AMMs) can have a place in the cryptocurrency space. However, AMM unlocks powerful new tools that allow anyone to create permissionless marketplaces. Uniswap has become the most popular venue for long-tail tokens such as MKR and DAI. The next question is what does it mean to be the best place for liquidity.

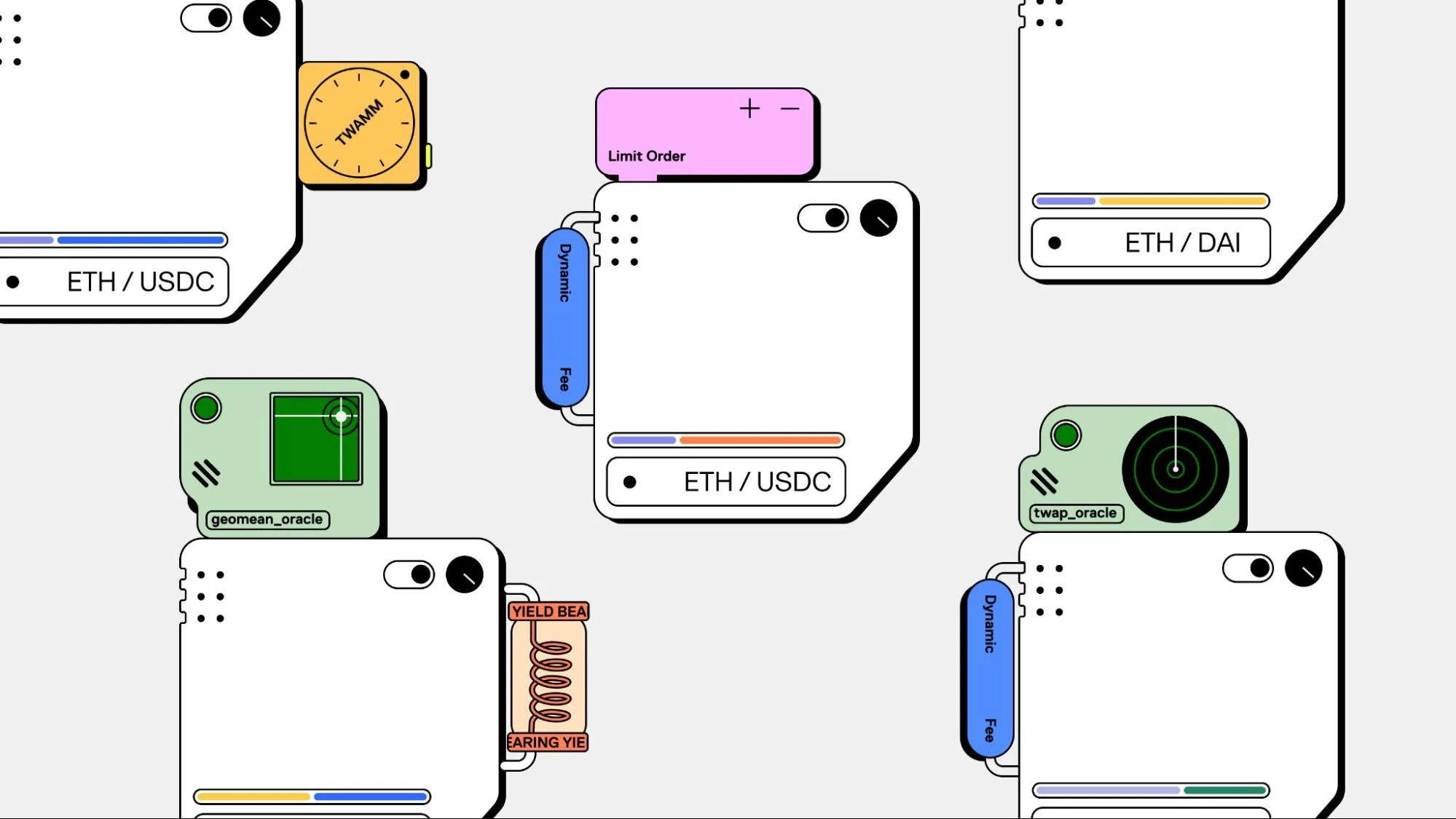

Subsequent versions of Uniswap became more expressive. Uniswap v2 and v3 introduced ERC 20 trading pairs, centralized liquidity, and custom fee levels, making liquidity deployment more customizable. Uniswap v4 goes one step further. V4s hooks act like plugins, allowing pool deployers to introduce arbitrary code - code that can be run at key points throughout the pools lifecycle (such as before or after a transaction).

With hooks, developers can innovate on top of the liquidity and security of the Uniswap protocol, creating custom AMM pools integrated with v4 smart contracts. Because each pool is now defined by more than just tokens and fee tiers, we will see a wide variety of pools of all sizes and shapes.

All this customization and expressiveness also spreads Uniswap’s liquidity across three (soon to be four) different versions and nearly a dozen chains. Finding the best price on a trade means checking more pools to find the best path. This means more computation, more jumps, and more gas. Custom AMM functionality will make Uniswap the best place for liquidity, but it becomes more challenging to find the best path to get the most tokens to traders.

UniswapX is a protocol focused on routing issues. It outsources the problem of finding the best path to a competitive marketplace—which learns about other on-chain resources and private inventories to find traders’ optimal prices.

UniswapX Find the best price

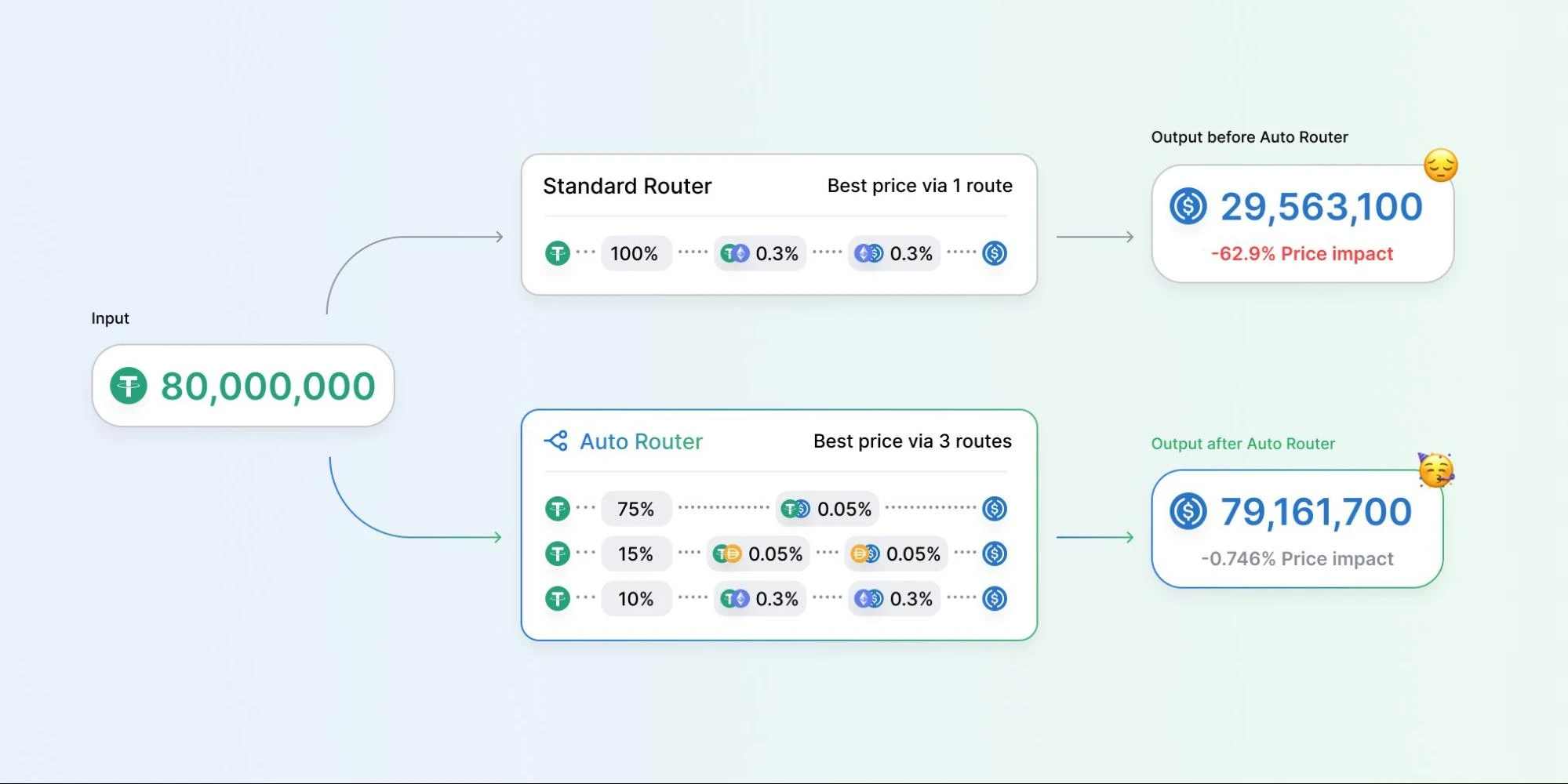

Finding the best path depends on the breadth of liquidity coverage. The more we understand about mobility, the more options we have for finding the best path. Uniswap autorouters, DEX aggregators, and meta-aggregators are popular precisely because of their broad liquidity coverage.

Uniswap automatic router vs. standard router

But as the liquidity pool expands, manually maintaining a single routing engine becomes unsustainable. Aggregators hit bottlenecks as they require ongoing maintenance. With Uniswap v4, maintenance will become more difficult. Liquidity will exist behind custom hooks, and routing engines will need to find, review, and use them.

Our solution to the routing problem is to create a marketplace that gamifies liquidity discovery. Rather than accepting bids from a single source, transactions are conducted through an auction system. Fillers will compete to find the optimal route and provide traders with the best price.

This market is very competitive. “Fillers” look like today’s block builders and traders, who are incentivized to use any strategy at their disposal to provide lower prices. They can return MEV to traders, find unknown sources of liquidity, leverage private inventories, or save gas through batching—anything that gives them an advantage in winning auctions. UniswapX transforms routing from a one-to-one problem to a one-to-many problem with a permissionless protocol that regulates market participants, sets ground rules, and lets fillers compete against each other to return value to traders.

Creating a swap fulfillment market also prepares us for a multi-chain future. Cross-chain trading of tokens needs to simulate the user experience of trading on a single network. Routing requires abstracting the complexity and latency of bridging. Fillers can leverage cross-domain MEV, private inventory, and user intent to earn the right to maximize output tokens for traders.

With existing liquidity pools spread across four Uniswap versions and more chains, the UniswapX population network will actively discover new liquidity sources to maximize liquidity coverage and provide optimal prices.

parallel complementary protocol

Uniswap v4 and UniswapX are parallel and complementary protocols. Each focuses in a specific direction: Uniswap v4 optimizes pool customizability for maximum expression, UniswapX optimizes routing for maximizing output tokens.

The two combine to provide traders with the best trading experience while maintaining our commitment to a decentralized, censorship-resistant and permissionless market.