The market, project, currency and other information, opinions and judgments mentioned in this report are for reference only and do not constitute any investment advice.

macro market

Walk to a water-poor place and sit down to watch the clouds rise.

In September, the market was in despair and secretly brewing clues of recovery.

The global macro-financial market is not optimistic. The Nasdaq, which is highly correlated with the crypto asset market, even experienced its largest decline of the year. After falling 2.17% in August, it recorded a 5.81% drop in August. There has been no dovish statement from the Federal Reserve on raising interest rates, and some market voices predict that there will be one more interest rate hike this year. In addition, high valuations have also continued to put pressure on the market.

Nasdaq monthly trend

In contrast, the crypto asset market, which adjusted before Nasdaq, took the lead to stabilize. In September, the BTC amplitude decreased from 17.6% in August to 10.03%, achieving a 3.97% increase during the month.

BTC monthly trend

There have been certain positive changes at the funding level. The overall outflow of stablecoins in September was about US$900 million, which was significantly lower than the outflow of US$1.4 billion in August, but the outflow trend has not yet been reversed.

On-chain data continues to show positive signs, with the second-highest number of new addresses ever recorded on September 15.

The game between long and short hands continues to from short to long and continues to reduce liquidity.

Based on multi-dimensional information, EMC Labs maintains its optimistic estimate for August and predicts that Q4 bulls will take active actions to challenge the years high of $32,000 again, and is expected to win.

Crypto Market Trends

In September, BTC opened at US$25,931 and closed at US$26,961. On September 11, it tested the effectiveness of the support at the lower edge of the box through a heavy volume decline. The next day, it fully recovered the lost ground with a heavy volume attitude, and continued in the following week. rise. The lower edge of the box was marked on June 14, and it recovered strongly again after a dip in March, indicating that the funds on the market have reached a relatively sufficient consensus on US$25,000 as the mid-term bottom.

BTC daily trend

In April and June to July this year, BTC launched two rounds of impact on the upper edge of the box of $32,000. However, against the background of macro market instability, funds on the market continued to flow out.The short-handed giant whales that entered the market at the beginning of the year have taken profits., causing BTC to be trapped in a box of $25,000 ~ $32,000 for half a year.

This time, the lower edge of the box was tested again and then rebounded quickly (it has rebounded quickly to US$28,000 as of the writing of the report), indicating that under the condition of full market adjustment, funds on the market are ready to take active actions in Q4, or may challenge the year in the near future. High point $32,000.

Long and short game

The position structure is the anchor of the market. In order to judge the long-term trend of the market, we continue to focus on the position size of long and short lots.

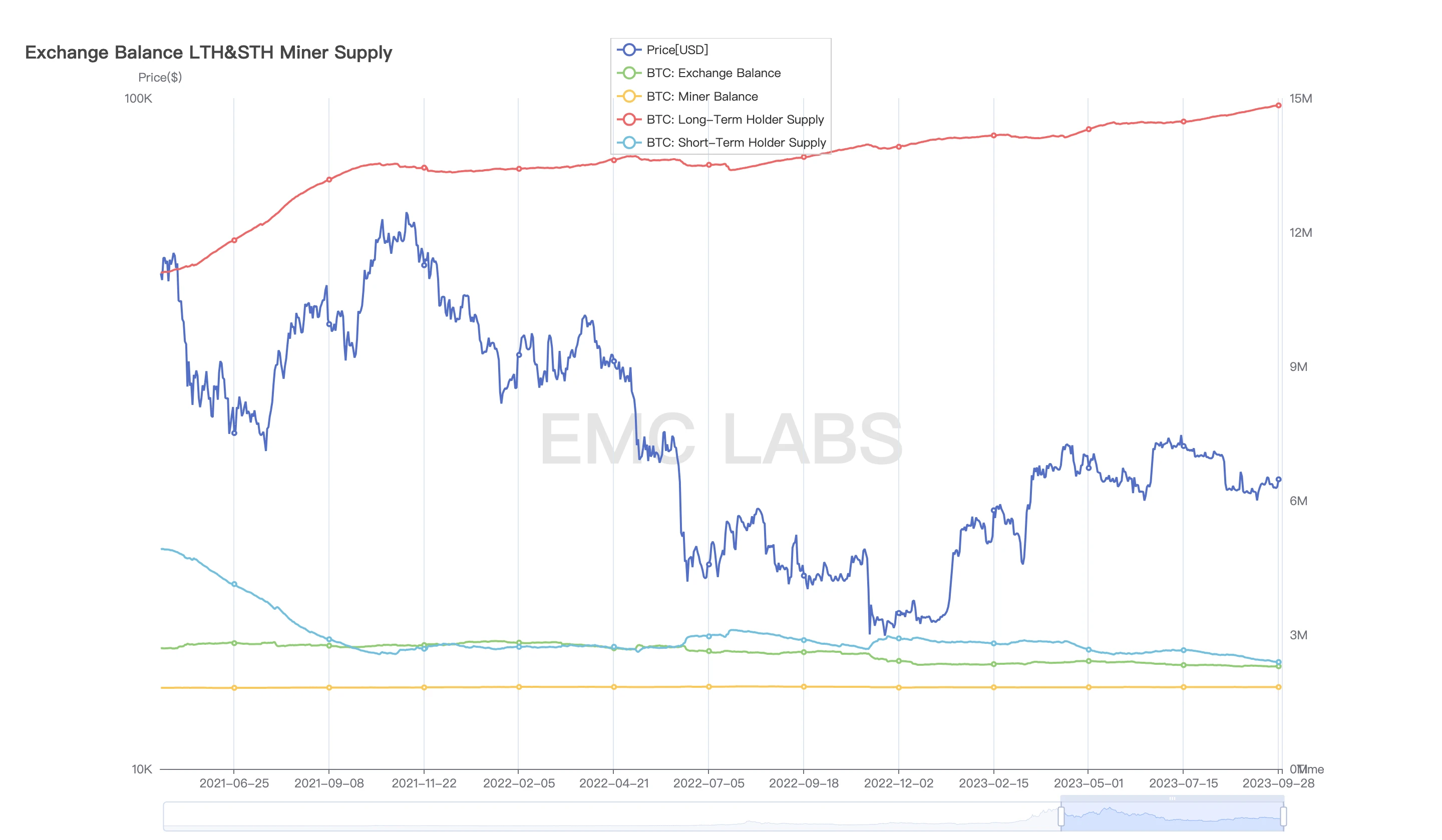

Position size of market parties

In August, long-term holdings increased from 14.69 million coins at the end of July to 14.84 million coins, with a net increase of 150,000 coins.

Short-term holdings decreased from 2.52 million coins at the end of July to 2.39 million coins, with a net reduction of 130,000 coins.

The balance of the exchange decreased by 2,000 coins, leaving 2.29 million coins.

The increase in long-term holdings was 96,000 coins in July, 150,000 coins in August, and another 150,000 coins in September. The short-term traders sold another 130,000 coins on top of the 90,000 coins they sold last month.

Comparing the two phases, it once again shows that the essence of the repair period is that the market continues to fall in price to achieve a position change from short (lot) to long (lot).

The continuous loss of liquidity is one of the driving forces of market rise. The effect of moving from short to long is to realize the loss of liquidity through changes in the market position structure.

supply trends

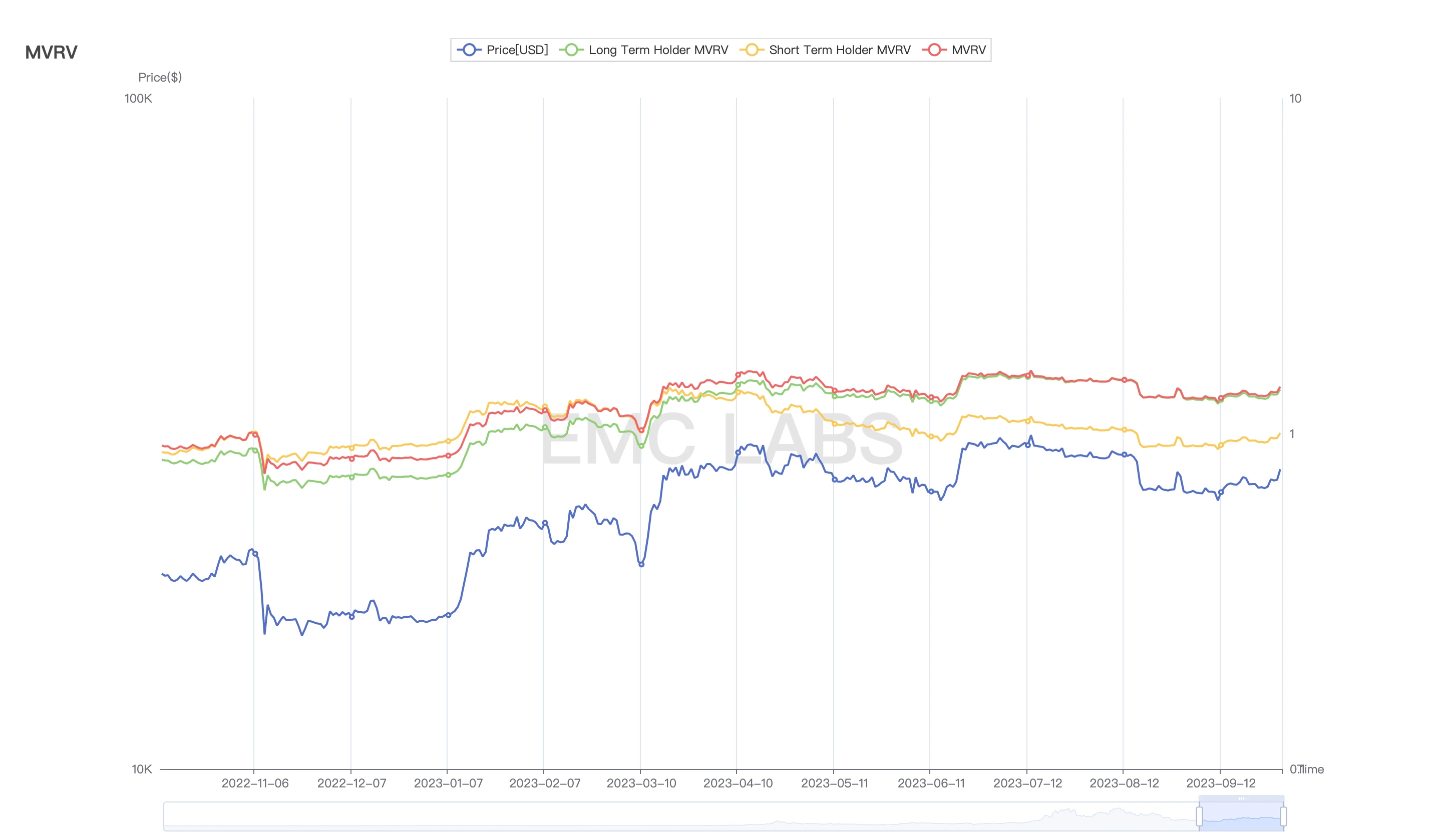

As of the end of September, the overall floating profit situation of the market has gradually recovered, rising from 27% to 33%. The floating profit of long-term stocks rose from 27% to 30%, and the floating losses of short-term stocks rose from 8% to 3%.

Market supply pressure

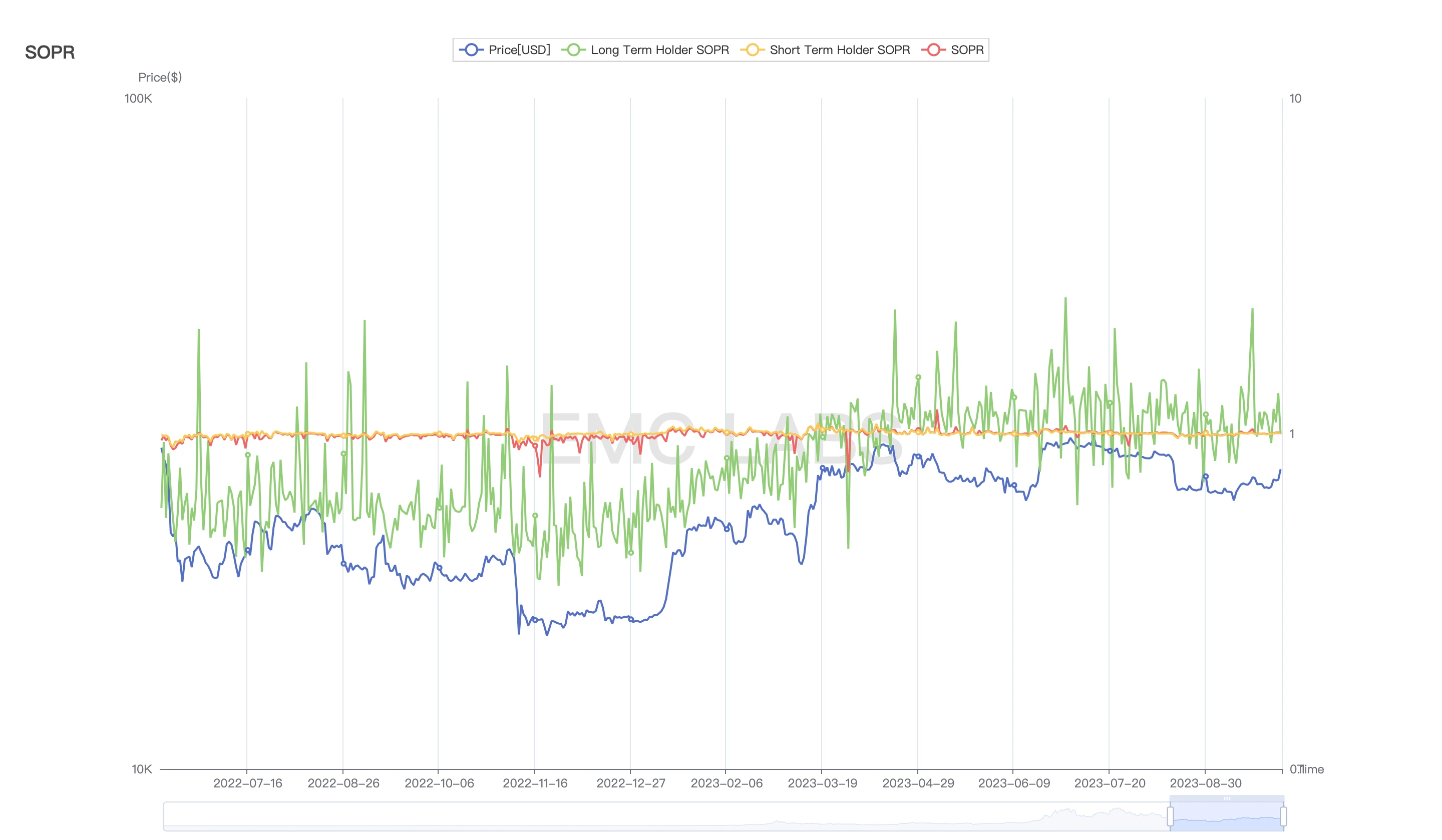

We further examine the profits or losses when selling BTC between long and short hands.

Profit and loss status of selling BTC

In September, short-term traders spent most of their time trading at losses and small profits, while long-term traders diverged. The decline in the first half of September caused some long-term investors to choose to sell out at a loss, while most long-term investors in the second half of September traded at a profit.

It is worth noting that on September 19, Longshou achieved a profit of 137% in a single day. In April and July, Changshou sold twice under high profit conditions, and since then the market has chosen to gradually decline. This time in September is slightly different. So far, the market has chosen to rise rather than break.

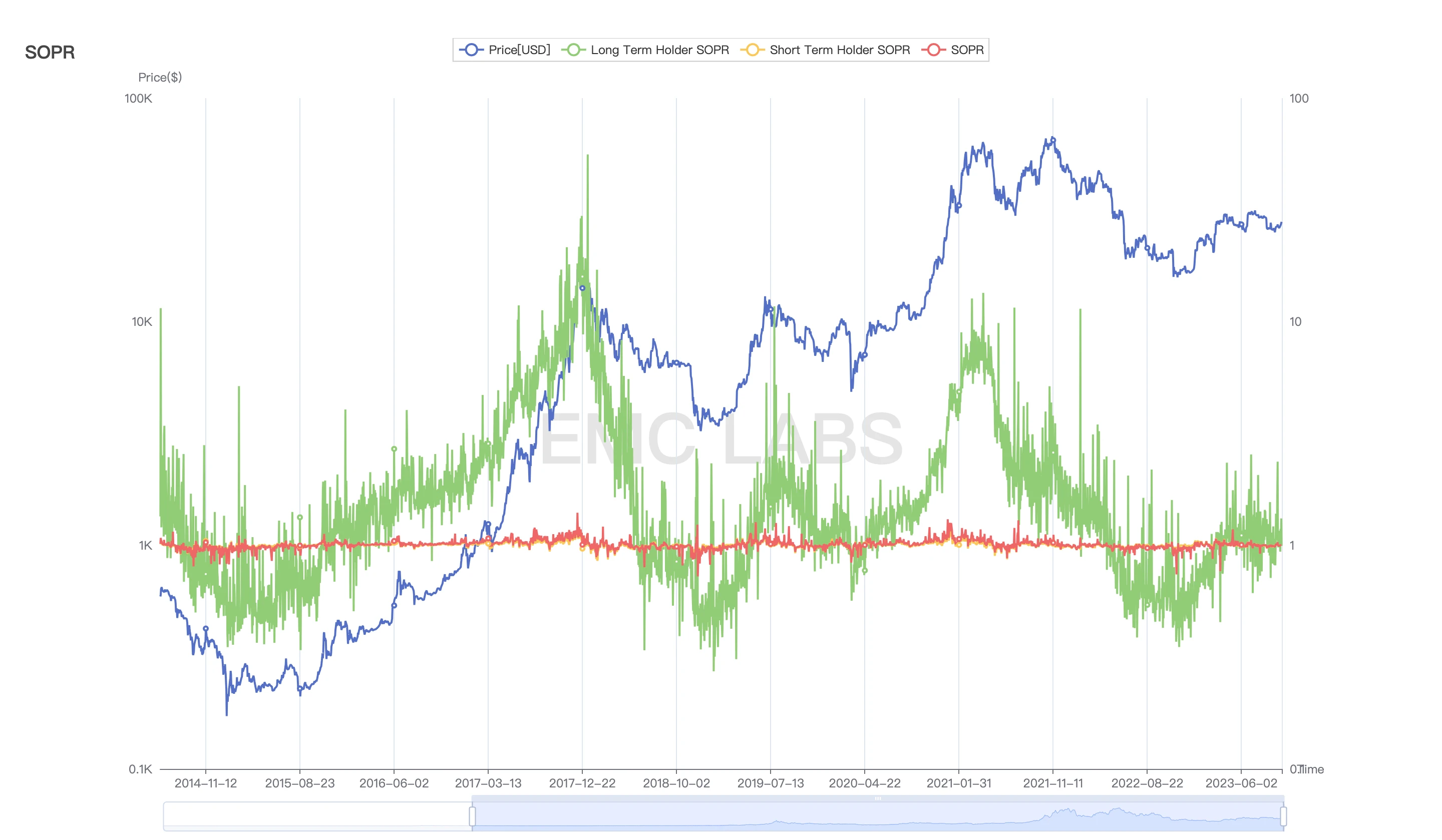

BTC parties SOPR

During the recovery period, in order to clear liquidity and prepare for the bull market, not only the short hands must hand over their chips, but also the short hands of the long hands must hand over their chips. At the same time, the profit ratio of Changshou is also the basis for judging the stage of the market. The market has entered the repair period from the bottom area, and Changshous SOPR (sold profit margin) has begun to turn positive. After a period of shock (it even briefly turned negative in 2020) , the long-term SOPR began to rise steadily. At this time, the market had entered the bull market. Depending on the strength of the will, the long-term investors began to line up to take profits.

For now only, the long-term SOPR fluctuations are within the normal range, and the upward period has not yet come.

whale for sale

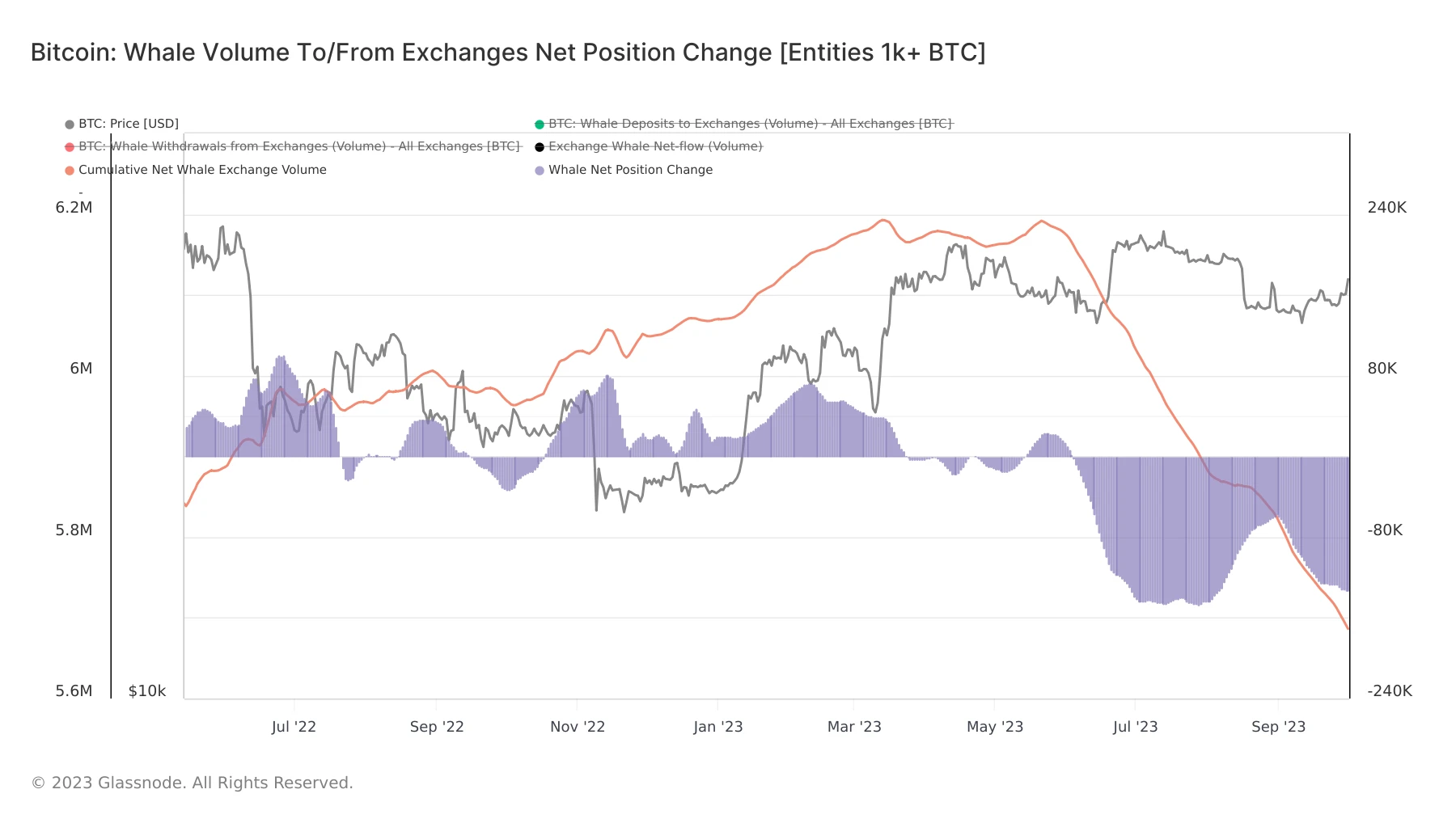

in July andAugust Briefing, we believe that the whale group (entities holding more than 1,000 coins) dominated the adjustment in July and August. After a decline in August, the giant whale group re-increased their selling efforts in September, and the daily selling volume gradually approached that of July.

The size of whale transfers in and out of exchanges

It is worth noting that since September 11, whales have increased their selling efforts, while the market has begun to rebound and the intensity has gradually increased.The only positive we observed was that stablecoin outflows shrank to $0.9 billion in September, slowing down from August’s $1.4 billion outflow.

EMC Labs believes that with everything in place, if the Q4 crypto bulls want to take active actions, the biggest obstacles will still be capital outflows and an uncertain macro-financial environment.

Like the move from short to long, the growth of stablecoins is another important means of reducing liquidity.

On-chain activities

Back to the foundation of long-term market support - on-chain activities. We observed positive performance in the two dimensions of new addresses and Memepool queued Transactions.

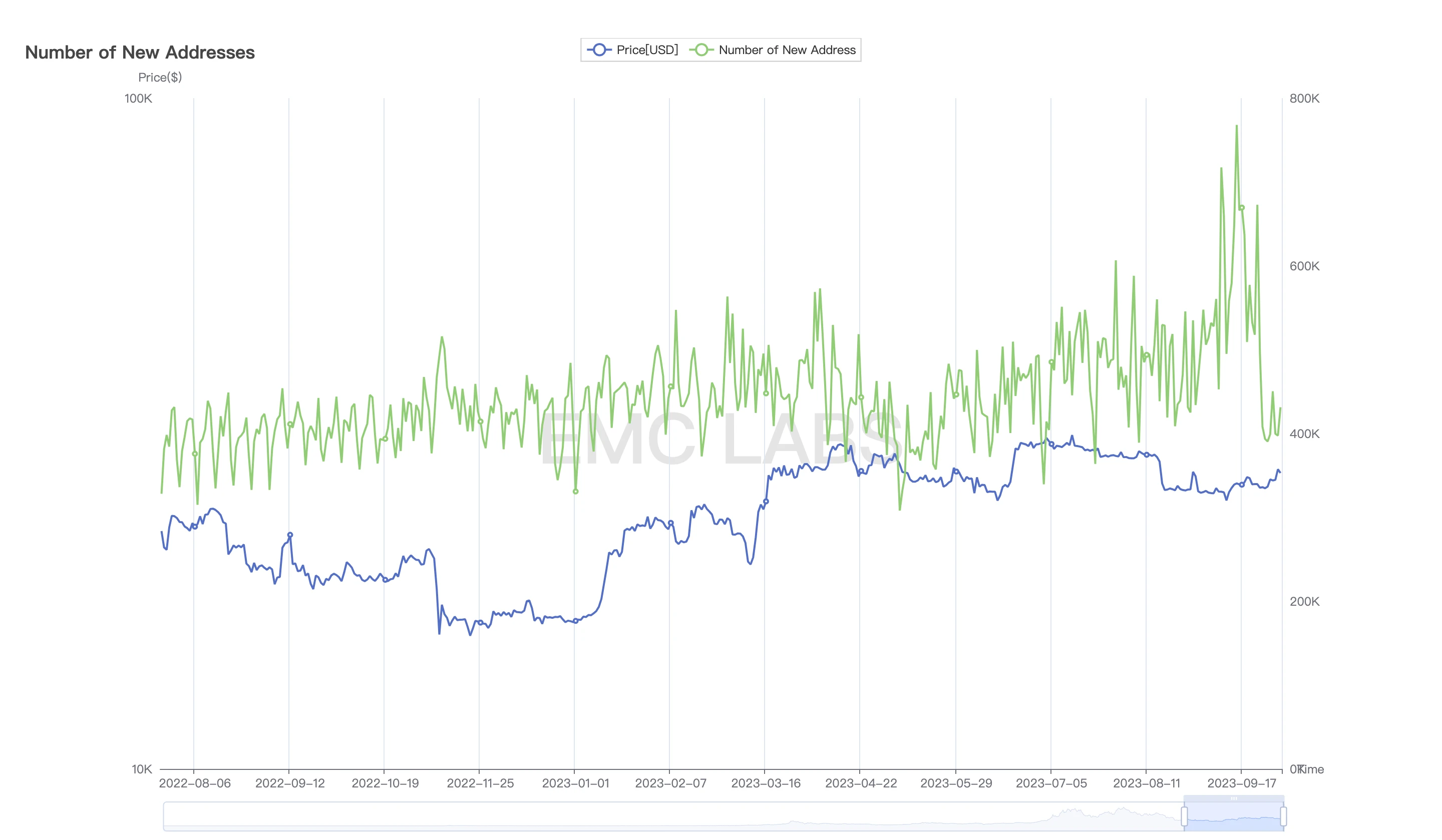

BTC daily new addresses (2022 ~ 2023)

The number of new BTC addresses fluctuated violently in September, reaching the second-highest figure in history at nearly 770,000 on September 15, surpassing the highest point of the bull market in 2011 and second only to the historical high reached at the end of the bull market in 2017. However, by the end of the month, the number of new addresses per day dropped to 390,000, and continued to hover there for several days. The decline in this data may be related to Chinas double festival holidays.

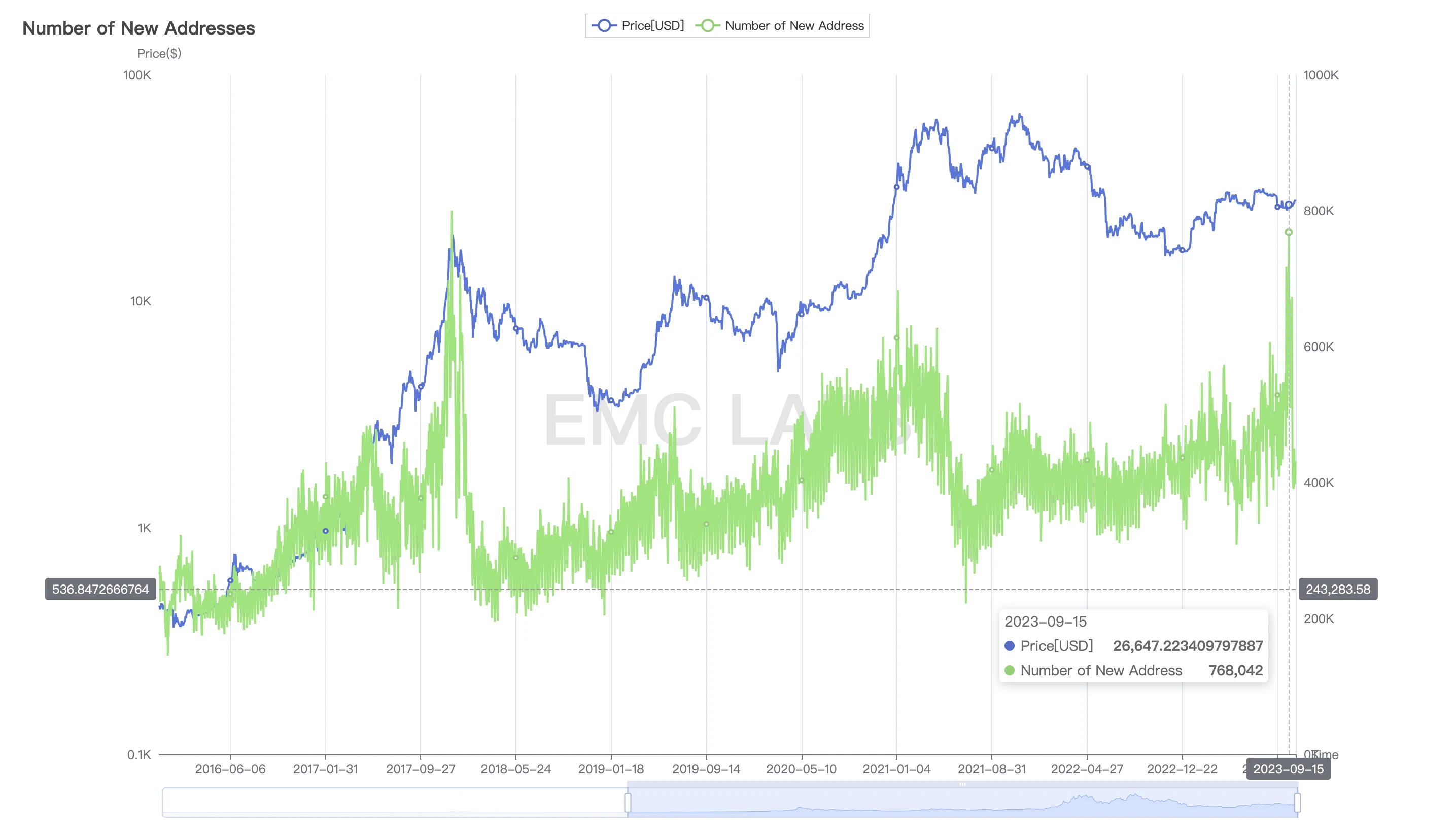

If we exclude this factor, and we compress the time and observe within a few years, we can find that the situation of new addresses perfectly follows the historical cycle and is in a continuous recovery.

BTC daily new addresses (2016 ~ 2023)

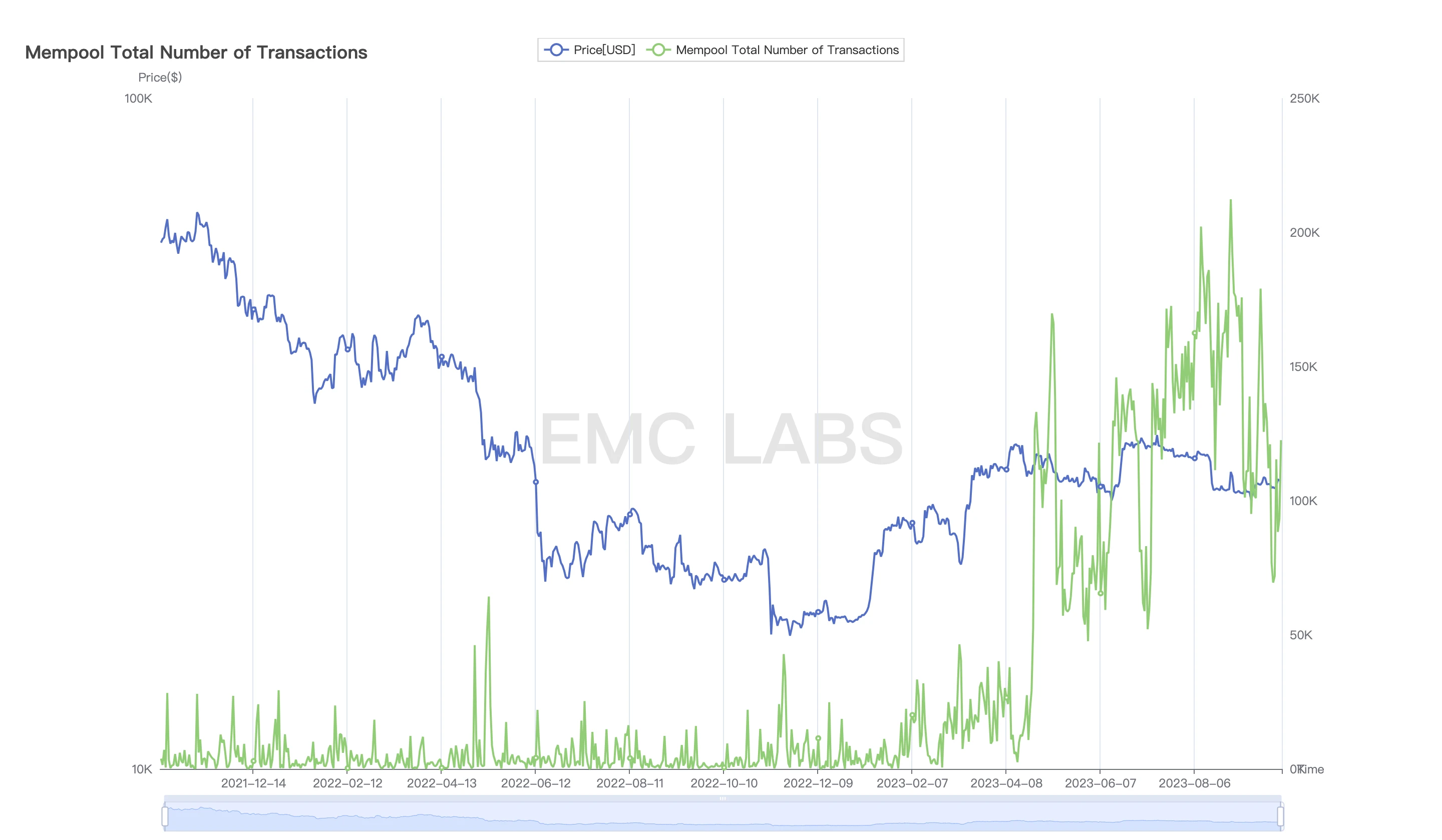

Mempool Transactions daily queue size

Mempool Transactions daily queue size

For Mempool Transactions, September data fell from August, which was a more volatile month, but remained firmly at higher levels since April. This shows that on-chain activity remains relatively positive.

Conclusion

existAugust Briefing, EMC Labs judged that BTC falling below $25,000 is a small probability event, and the possibility of a rapid and substantial rebound in the short to medium term still exists, and the probability is not low.

Regarding the market situation in October, we maintain our previous judgment and believe that as the interest rate hike cycle comes to an end, there is a high probability that the long forces in the Q4 market will actively take action to push the market to challenge the years high of US$32,000 again, and there is a high probability that it will be historic. Breaking through the upper edge of the box that has besieged BTC for half a year, ending the recovery period, although it was a bumpy but difficult year.

At the time of writing this report, the lawsuit against FTX founder and CEO SBF was being heard for the first time.

Thousands of sails pass by the side of the sunken boat, and thousands of trees spring in front of the diseased trees.

In this market, there are many heroes who grow wildly, but they are also tempting to fall into the abyss of disillusionment. Only by putting construction first, being unswerving in determination, and respecting common sense can we achieve success.

EMC Labs (Emergence Labs) was founded in April 2023 by crypto asset investors and data mining engineers. Focusing on blockchain industry research and Crypto secondary market investment, with industry foresight, insight and data mining as its core competitiveness, it is committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and encrypted assets as Blessings to humanity.

For more information please visit: https://www.emc.fund