Original source: Ouke Cloud Chain Research Institute

Original author: Hedy Bi

Grayscale Fund, which won a lawsuit against the U.S. Securities and Exchange Commission in August, used a clever strategy of interest rate spreads to attract a large inflow of funds from financial institutions into the U.S. BTC market. In the past few years, it has become the dingpin in the BTC market. In early October, Grayscale noted in its monthly market report that Bitcoin performed strongly in September compared with traditional assets, highlighting the diversified nature of cryptocurrencies. The author also observed that the correlation between BTC and the SP 500 has dropped to the level before 2020 and no longer has a statistically significant correlation. In addition, leading high-frequency quantitative funds such as Jump have reduced their operations in the market.BTC seems to have entered a vacuum state again.

Additionally, the report highlights that strong fundamentals played a key role as Bitcoin’s on-chain metrics improved during the month. On-chain data has become an indispensable indicator for many giants in the industry. As the focus on on-chain data gradually increases, more and more companies and investors use it as an important reference for decision-making and investment. In this article, we will take a closer look at BTC based on the data on the OKLink chain.

1. BTC has market flexibility, but the on-chain data is not that optimistic.

Overview of address changes: New addresses exceeded the Q3 monthly average by a slight advantage of 0.02%, and the number of active addresses increased by 7.24% in September

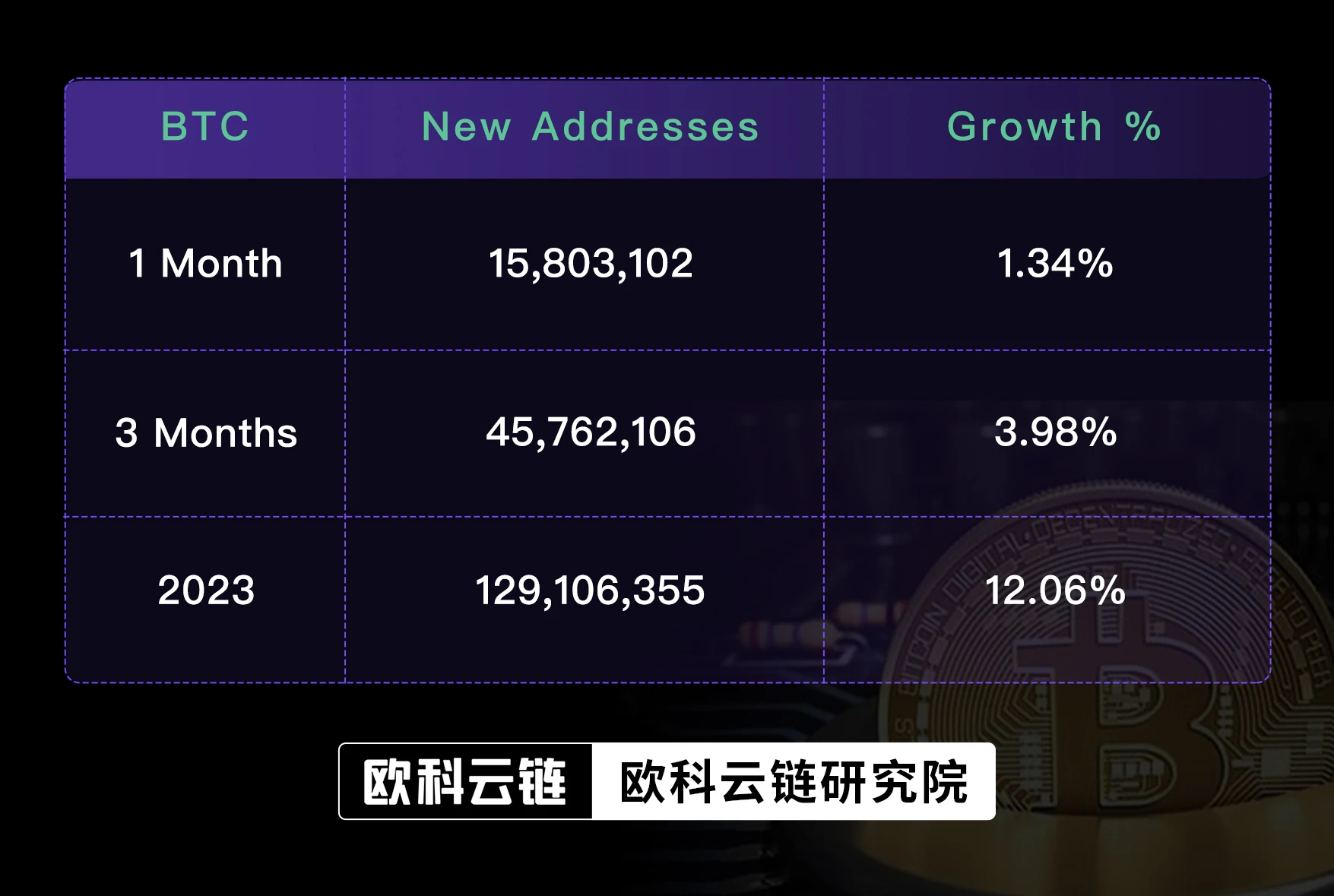

This year from January 1 to October 8, 2023, the number of addresses on the BTC chain increased from 1,070,107,188 to 1,199,213,543, achieving a growth rate of 12.06%. This shows that the Bitcoin network has attracted more users and participants this year, showing a continued growth trend.

In the data for the third quarter of 2023 (Q3), the new rate of Bitcoin addresses in September was 1.34%, exceeding the Q3 average monthly growth rate by only a slight margin of 0.02%.

Source: OKG Research, OKLink

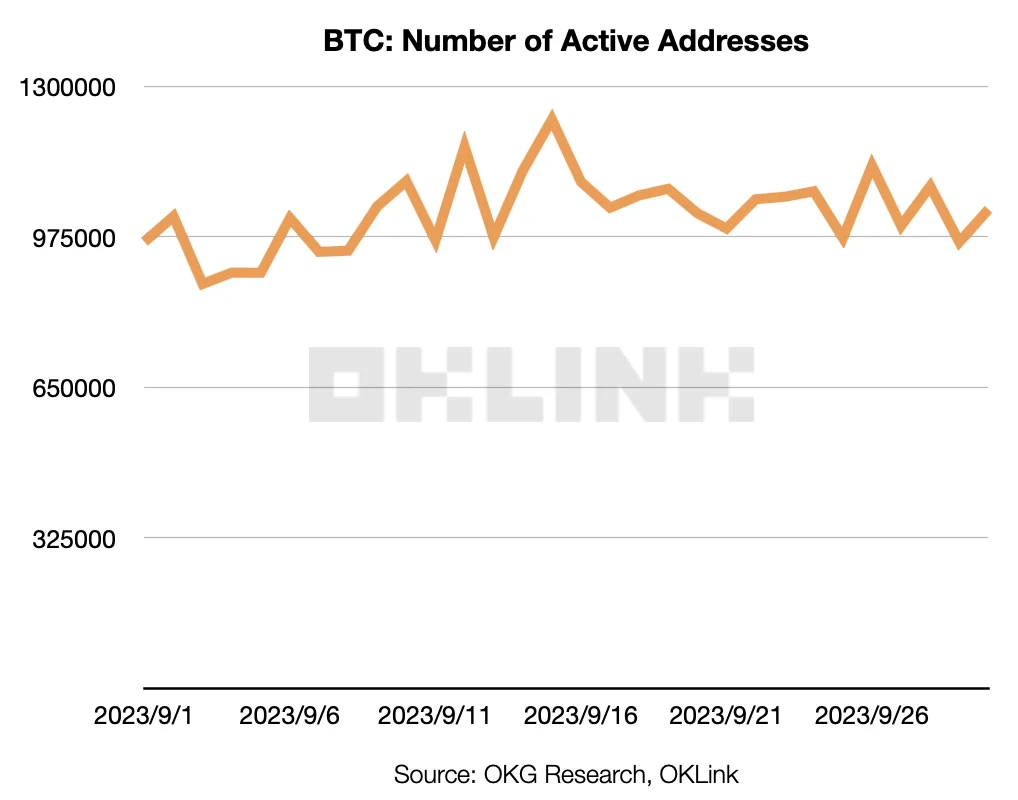

In terms of active addresses, as Grayscale said, there was an increase of 69,783 in September, an increase of 7.23%. But when it comes to October, since September 30 to the present (October 8), the number of active addresses has dropped by 160,275, a decrease of 15.50%.

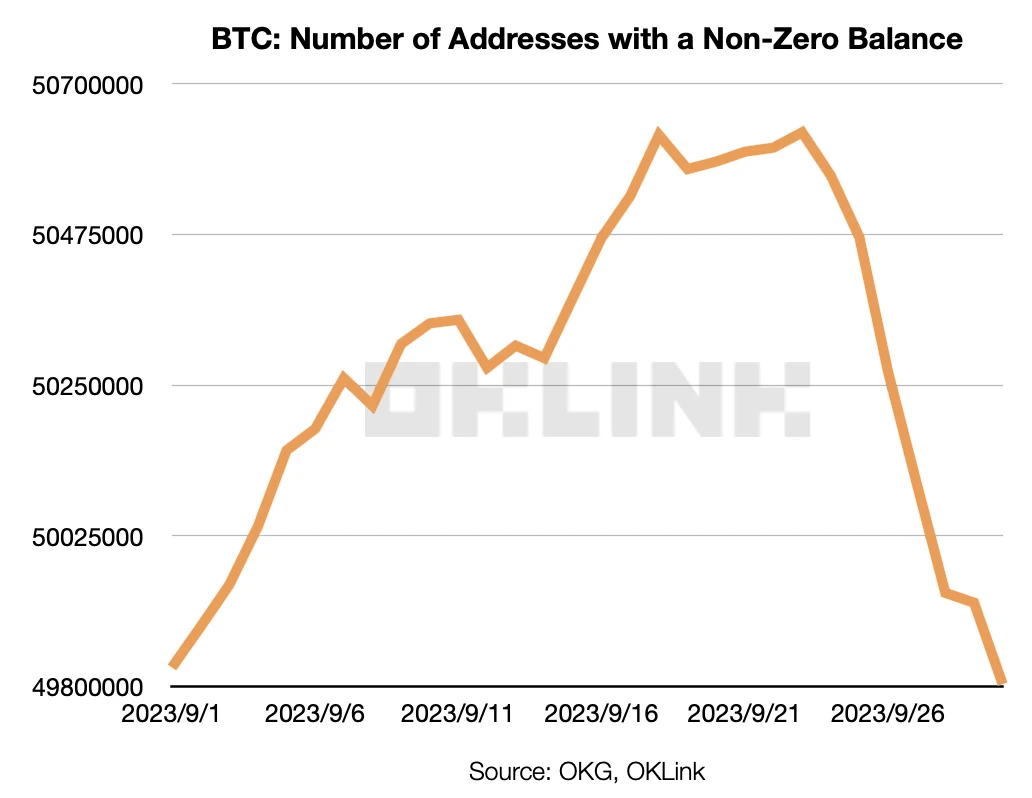

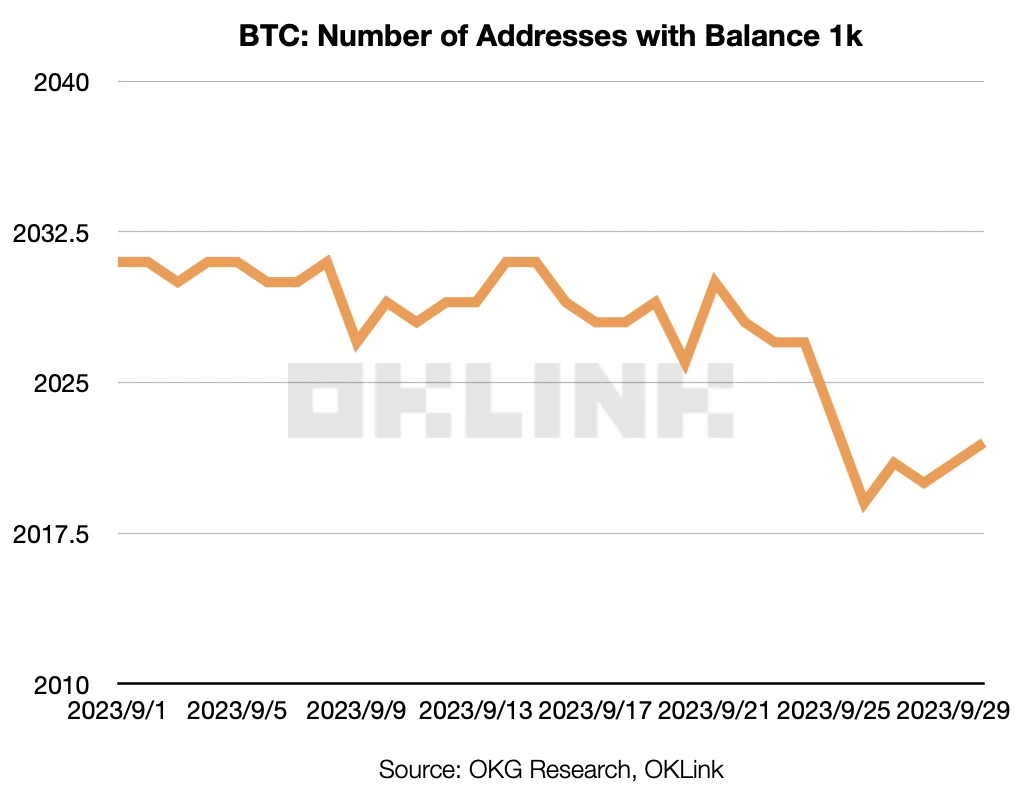

After excluding 0 assets, both the number of addresses and the number of whale addresses showed a downward trend in September.

After excluding 0 assets, both the number of Bitcoin addresses and the number of whale addresses showed a downward trend in September. According to OKLink data statistics, after excluding 0 asset addresses, the number of Bitcoin addresses in September decreased by 24,817 compared with August, which is inferior to the number of new addresses in August of 456,217. good.

At the same time, in terms of whale addresses, there were 9 fewer addresses in September, compared with 10 new whale addresses in August. This means that in September, there was a certain decrease in the number of Bitcoin addresses held by whales.

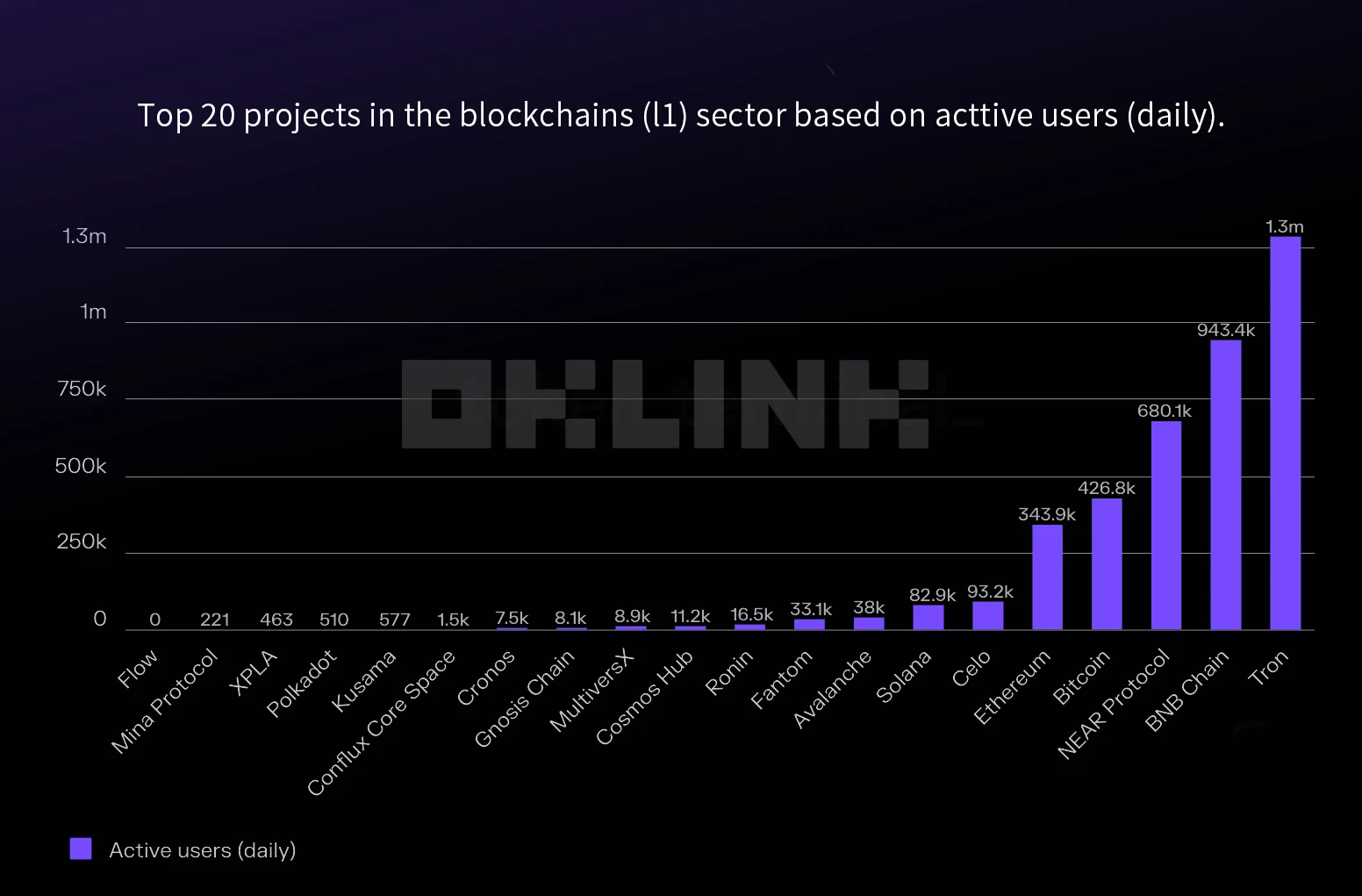

Comparison with other L1 market performance: BTC, which performs better in the number of daily active addresses, is not the first in the industry. ETH is better than BTC in terms of new non-zero asset addresses.

Looking at the comparison of the entire industry, BTC, which has excellent performance in terms of the number of active addresses, ranks fourth in the industry, second only to Near.

Source: OKG Research, OKLink

ETH, which has been compared with BTC by the market, we can observe that ETH is slightly lower than BTC in terms of new addresses. However, when zero-asset addresses are excluded, ETH has achieved significant growth in the number of addresses compared to BTC, while BTC showed a downward trend in September.

Source: OKG Research, OKLink

2. Ordinals and Inscriptions are the main reasons for the active ecology of the BTC chain

Since the end of last year, Bitcoin Core contributor Casey Rodarmor created the Ordinals protocol, introducing the concepts of Ordinals and Inscriptions, thus giving rise to the first NFT on the Bitcoin network. On March 8, 2023, DOMO proposed using Ordinals inscriptions in JSON data format to implement token contract deployment, minting, and transfers. Since then, the BTC ecosystem has triggered heated discussions in the market.

Source: brc-20; Date: Oct 8, 2023

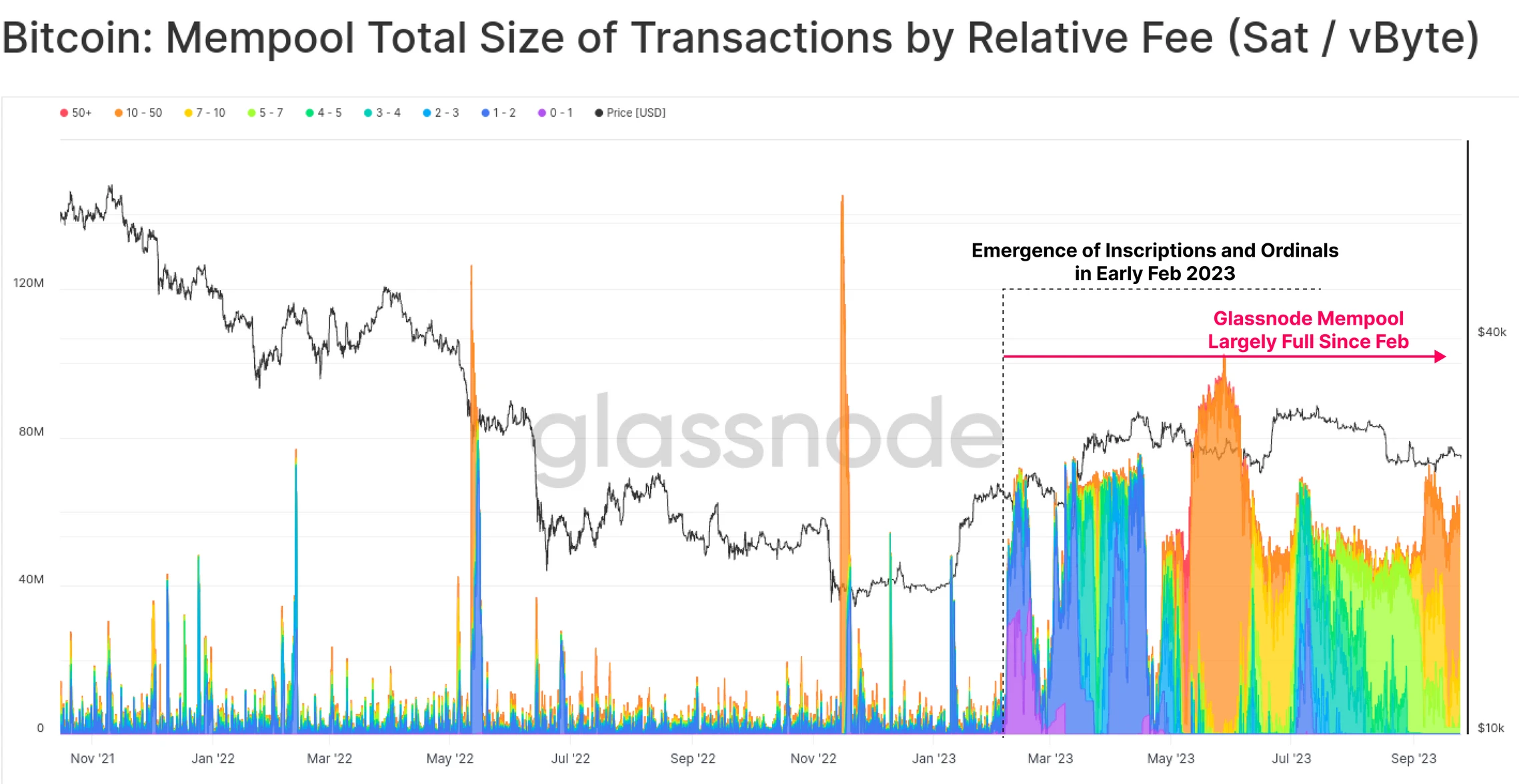

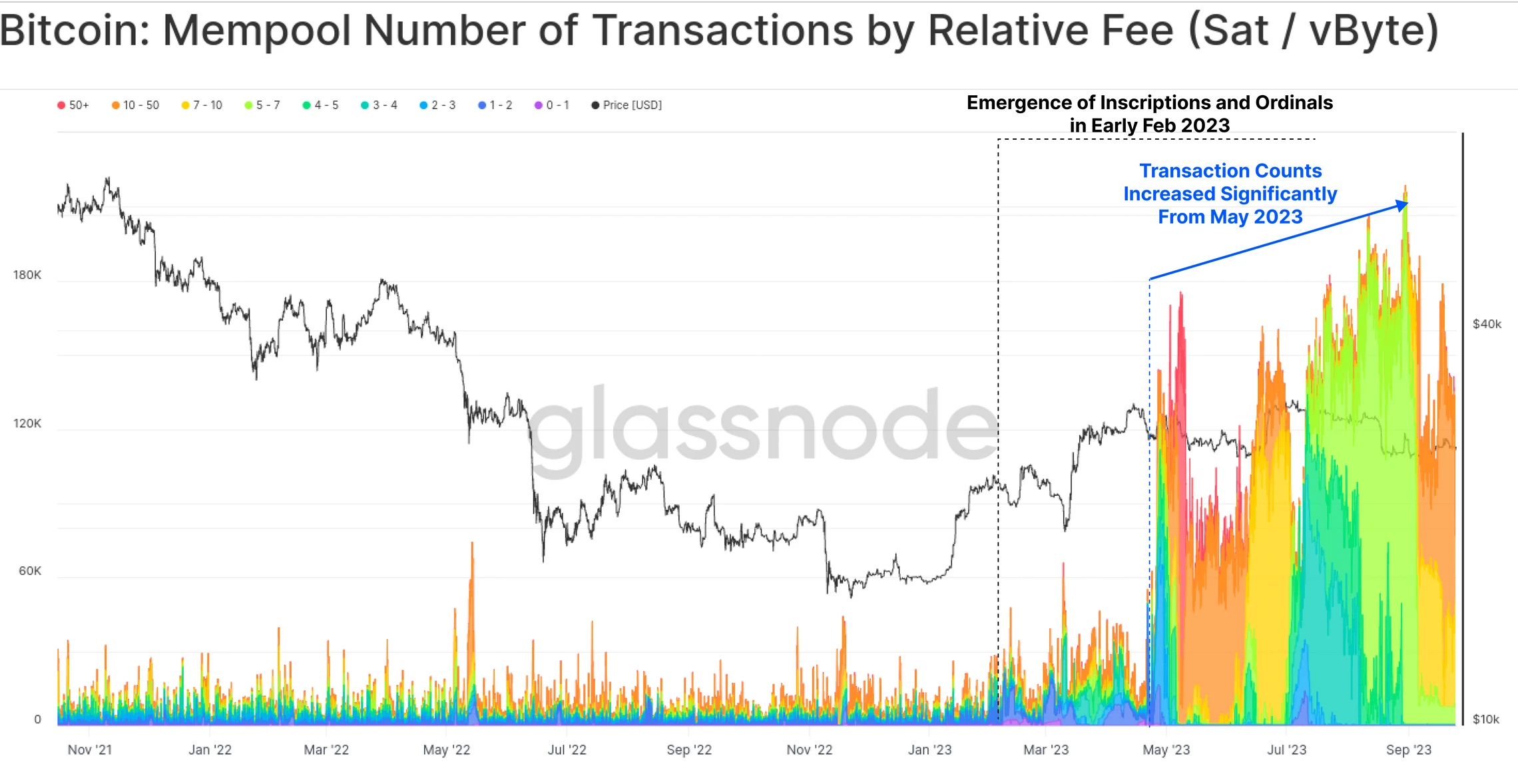

According to data from Mempool (mempool), since February, the ecological demand for Bitcoin has been in a state of short supply, which is the so-called"sellers market". The higher the number of unconfirmed transactions in Mempool, the more transactions are initiated and the higher the demand for on-chain usage. This high demand continues to this day and coincides with the release of Ordinals and Inscriptions.

Furthermore, by comparing the analysis of transaction size and transaction number, we can observe that in September, the amount of each transaction was relatively small, that is, mainly small-amount transactions. However, it can be initially seen from the chart that after September 23, the amount per transaction began to show an increasing trend. One factor is that it is possible that more investors have more confidence in the BTC ecosystem and are willing to conduct large transactions, thereby driving the growth of each transaction amount.

Source: Glassnode

3. Enlightenments given to us by on-chain data

By analyzing the on-chain data of Bitcoin itself, comparing it with other L1s, and in-depth study of the Bitcoin ecosystem, we have two main findings:

Active addresses and the like alone don’t tell the full story that BTC’s on-chain metrics have improved this month. The number of whale addresses and the number of addresses excluding 0 assets decreased in September.

The activity of on-chain addresses does not necessarily reflect the activity of BTC investors. After in-depth ecological analysis, it can be said that more activities on the chain indicate investors confidence in the BTC ecosystem. Ordinals and Inscriptions are the main reasons for the active ecology of the BTC chain. And through the analysis of the amount of a single transaction, we can observe signs that market sentiment is picking up.

On-chain data, as verifiable data that reflects blockchain transaction activities in real time, reflects more of the industry or more."Frontier Core"The direction of activities of a small number of people. For the public chain, all development of its core technology or application innovation occurs on the chain, just like Bitcoins Ordinals and Inscriptions. Its advanced nature can be said to be a kind of weather vane. Rather than saying that the data on the chain constitutes the fundamentals of this chain, it is better to say that this fundamentals is different from the ordinary stock market, and more emphasis is placed on advancedness. After all, the technological nature of blockchain technology has also brought benefits to participants. a certain threshold. As the proportion of mature investors in the industry increases, the analysis of on-chain data has increasingly become an important reference for investment decisions. It is like a market microscope that can penetrate deep into the ecology and reveal the inner world on the chain through various indicators. It is worth emphasizing that this data cannot be faked.

write at the end

Judging from the data on the chain, the story of BTC is gradually escaping from the setting of expensive payment tools. Ecological innovations including Ordinals, Inscriptions, BRC 20, etc. will become the main force in the continuation, providing more for the BTC ecosystem. possibility. In addition to the on-chain data analyzed in this article, the BTC halving (block reward halving) is also one of the important factors affecting the BTC market. Halvings effectively reduce the available supply by reducing the rate at which new Bitcoins enter the market. According to OKLink data, yesterday (October 8) we ushered in the 200-day countdown to the BTC halving. We will wait and see for BTC’s more open and innovative future!