Original|Odaily

Author|Jessica

Previously, Pudgy Penguins sold a series of NFT toys offline, and later, Yuga Labs laid off employees, and former OpenSea executives were also involved in NFT public opinion.

Wave after wave, NFT’s energy consumption and impact on the environment have attracted attention, and related legal issues and regulations are also surfacing.

Regulatory issues for NFTs

On September 13, the SEC accused Stoner Cats 2 LLC (SC2) of selling unregistered securities. SC2 raised approximately US$8 million from investors by selling NFTs of animated web dramas. This is the SEC’s second regulatory NFT case (at the end of August, the SEC accused Impact Theory, a Los Angeles-based media and entertainment company, of conducting unregistered crypto-asset securities offerings in the form of NFTs, attracting hundreds of investors, including those from across the United States. (who raised approximately $30 million).

At present, the regulation of the NFT field is still in its relative infancy. The following are some cases and trends of NFT regulation:

Financial regulation: Financial regulatory agencies in some countries regulate NFTs, focusing mainly on digital asset trading platforms and markets involving NFT transactions. They may require these platforms to comply with financial regulations such as anti-money laundering (AML) and know-your-customer (KYC) to ensure compliance and the safety of user funds;

Intellectual property protection: Since NFT involves the transaction and ownership transfer of digital content such as art, music, and video, related intellectual property protection is also an important issue. Some countries and regions are exploring the use of blockchain technology to ensure the copyright ownership and protection of digital creative works;

Consumer Protection: The NFT market is subject to risks such as fraud, false sales, and low-profile projects. In order to protect the rights and interests of consumers, consumer protection agencies in some countries may take measures to require platforms to provide transparency, warn of risks, and establish a complaint handling mechanism;

Tax requirements: NFT transactions may raise tax issues such as capital gains tax, sales tax, or value-added tax. Some countries are studying corresponding tax policies to ensure that NFT transactions are taxed and comply with relevant tax laws.

It should be noted that due to the rapid development and international nature of the NFT field, regulatory measures and regulations may currently differ across countries and regions:

United States: The United States has begun regulating the digital currency market and treats NFTs as digital assets. Additionally, the U.S. Securities and Exchange Commission (SEC) is reviewing whether NFTs should be considered securities;

European Union: The European Union (EU) is actively developing regulations for digital assets. The draft proposes treating NFTs as “virtual commodities,” but this has yet to be officially recognized;

China: China has been very cautious in handling cryptocurrencies and digital assets, imposing strict regulations on them. Currently, NFTs are considered virtual property in China;

Japan: Japan’s financial markets regulator, the Financial Services Agency (FSA), is considering regulating NFTs. Currently, NFTs are considered non-monetary goods in Japan and therefore are not regulated;

Singapore: The Monetary Authority of Singapore (MAS) defines digital currencies as commodities rather than currencies or securities. There are no clear regulations on the regulation of NFTs.

It should be pointed out that due to the rapid growth and constant changes in the NFT market, the regulatory status of NFT in various countries and regions is also constantly adjusted and updated. Therefore, more countries and regions will begin to regulate NFTs in the future.

Environmental costs of minting NFTs and trading NFTs

It is crucial to view NFT and environmental topics from a comprehensive perspective. Like many other digital technologies before them, the creation of NFTs consumes energy and creates carbon emissions.

The minting process of NFTs involves proving the uniqueness of the digital asset through transactions on the blockchain. Each mint consumes energy, just like any other operation in the digital realm, although the amount of energy consumed to mint an NFT with few use cases may be cause for alarm.

In order to feel it more truly,Research on dappGambl195,699 NFT collections were identified that had no apparent owner or market share. The energy required to mint these NFTs is equivalent to 27,789,258 kilowatt hours, resulting in the emission of approximately 16,243 metric tons of carbon dioxide.

Those are some big numbers, so let’s think about it… 16,243,017 kilograms of CO2 is 16,243 metric tons, which is equivalent to:

According to EPA data,Annual emissions from 2048 households are 7.93 per household.

Annual emissions from 3,531 cars — 4.6 per car, according to the EPA.

According to Air New Zealand, the carbon footprint of 4,061 passengers flying from London (UK) to Wellington (New Zealand) is 4 tonnes of CO2 per person.

Looking at the broader perspective: many daily activities and industries have an energy footprint. Banking transactions, everyday electronic use (such as watching movies or charging devices), and urban areas with lights on all night long affect our overall energy consumption and carbon footprint. It is critical to view the energy use of NFTs within the larger consumption picture.

As with any industry, thoughtful and responsible creation and consumption is critical to balancing the benefits against any potential drawbacks.

Can NFT be saved?

according todappGamblReports indicate that most NFTs are now worthless. According to the platform’s data, of the 73,257 NFT collections it identified, 69,795 have a market value close to zero. When dappGambl looked at the collection of the top 8,850 NFTs according to blockchain analysis site CoinMarketCap, it found that more than 1,600 of these top NFTs were dead, and blue-chip NFTs were no exception.

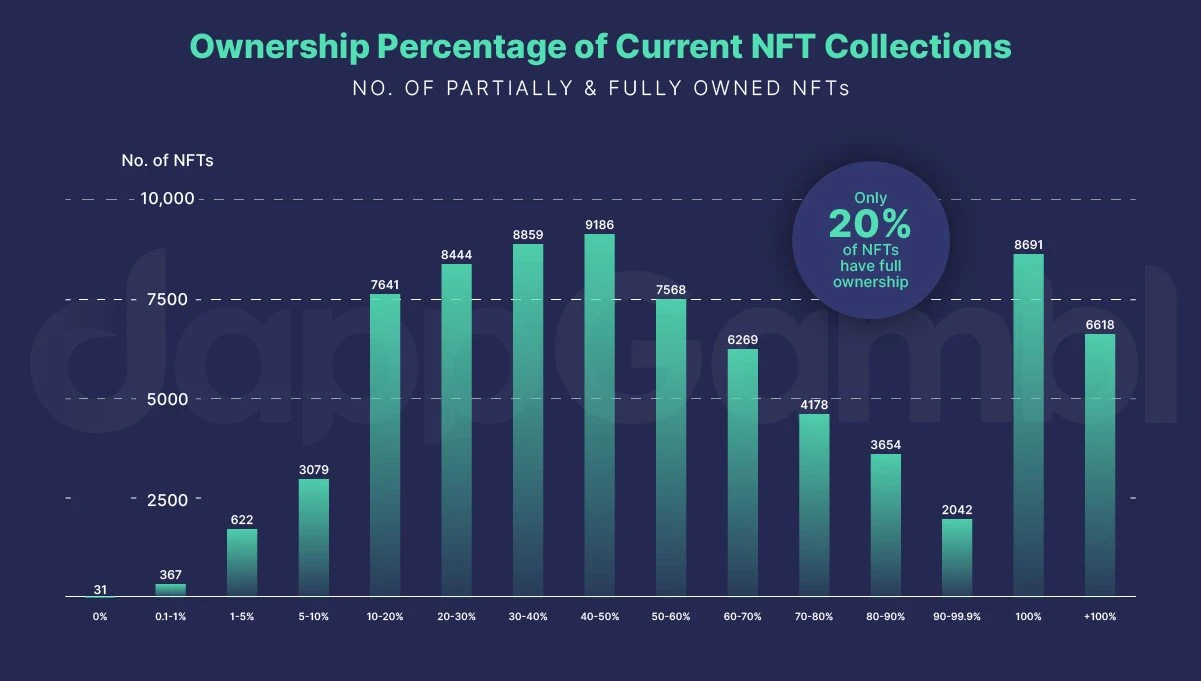

According to dappGambl statistics, supply exceeds demand. Only 21% of the collections have ownership rights, and the remaining 79% are waiting for fateful people to pay for them.

According to data from OpenSea on October 12, Justin Bieber spent more than $1 million to buy Bored Ape #3001, which has dropped to around $40,000 today.

Cryptoasset prices can change dramatically based on real-world events and cross-border technical factors, making it nearly impossible to pinpoint a single cause of NFT collapses.

Looking at real-world events, Russia’s invasion of Ukraine in February 2022 shocked traditional financial and cryptocurrency markets, causing investors to become more fearful and risk-averse.

Talking about the crypto economy, the cryptocurrency Terra (LUNA) crashed in May 2022 despite being in the top ten by market capitalization. This wiped out billions of dollars in value and triggered a liquidity crunch on cryptocurrency exchanges and lenders. Later that year, the FTX exchange collapsed and its CEO, billionaire Sam Bankman-Fried, was arrested. As Bitcoin hit multi-year lows in 2023, many investors panicked and sold their assets.

Inflation and mass layoffs in the technology industry are other factors that could reduce interest in experimental investment products.

The crypto economy is extremely volatile, so its difficult to predict whether the NFT industry will recover, let alone return to its bull market highs. While rising Bitcoin and Ethereum prices may help NFTs, the price ranges for both cryptocurrencies are also well below their 2021 all-time highs.