Original author: Daniel Li

As the Ethereum consensus mechanism changes from POW to POS, Lido is one of the biggest beneficiaries, and its growing market share has aroused concern and doubts in the Ethereum community. Especially in Lido rejection"self-limitation", and plans to further expand the market size, the threat to Lido has become a hot topic in the current Ethereum community. Some community members worry that Lido’s rise could undermine Ethereum’s decentralized nature. They are concerned that Lido’s market monopoly may lead to node centralization and pose a threat to the security and stability of the entire network. However, others believe that concerns about Lidos market share and concentration risks are more of a marketing ploy designed to slow Lidos growth and allow competitors to catch up. No matter which view you hold, there are reasons for it. This article will provide an in-depth analysis of Lido’s market share and centralization risks to objectively assess its impact on Ethereum’s decentralization and network security.

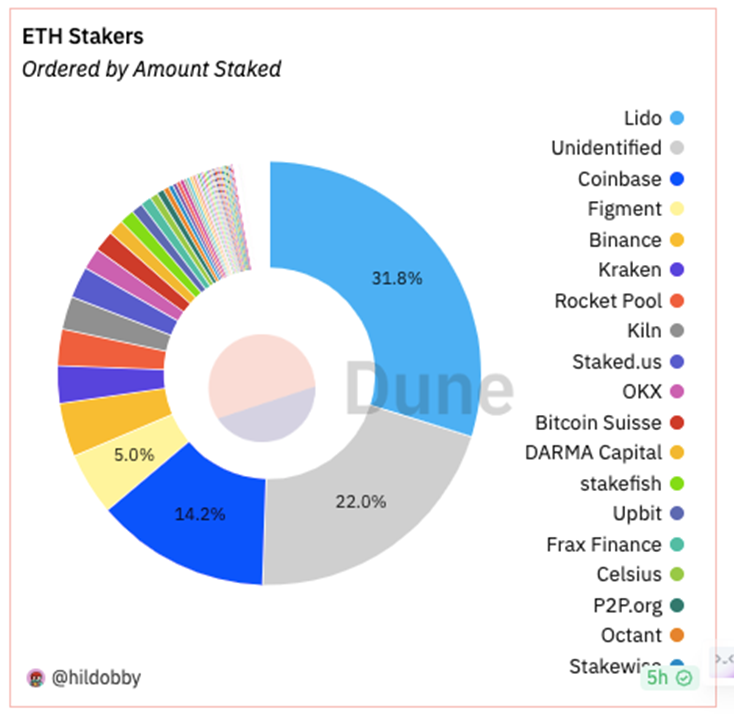

Lido dominates the Ethereum staking track, causing widespread concern

Lido is a project that solves the problem of insufficient liquidity of staked tokens on PoS blockchains such as Ethereum. In the traditional staking process, tokens are locked in pledges to protect the consensus mechanism of the blockchain, while Lido uses liquid pledges to allow users to receive tokenized versions of deposited funds, thereby increasing the liquidity of pledges.

Since its launch in 2020, Lido has become the preferred liquidity staking platform for Ethereum 2.0 and other layer-1 PoS blockchains such as Solana and Polkadot. Compared to the traditional 32 ETH minimum threshold for staking Ethereum, Lido allows users to stake any amount, lowering the financial barrier. However, as Lido has grown rapidly, concerns have arisen about its potential threat to Ethereum’s decentralization. To date, Lido has staked 8,813,670 ETH, accounting for 31.8% of the Ethereum staking market.

Lido’s high market share has also attracted the attention of Vitalik, the founder of Ethereum. He recognized the potential risks posed by the Lido. A long time ago, Vitalik recommended that all staking service providers limit their market share to less than 15%, and Lido’s current data has far exceeded this limit.

According to Asymmetry Finance co-founder Justin Garland, Lido operates more than 38% of validators, which is more than double what any single entity cannot control. This centralization phenomenon raises concerns about Ethereum’s centralization. Danny Ryan, chief researcher at the Ethereum Foundation, also highlighted the issue of Lido’s centralized staking of ether on Twitter. He pointed out that Lido, which controls a large amount of staked ether and accounts for more than 90% of the liquidity staking market, may be at risk from adverse events such as validator curtailment, governance attacks and smart contract vulnerabilities. Addressing Lido’s excessive market share becomes critical to ensure Ethereum’s decentralization and security.

The harm of Lido centralization is not as great as imagined

At present, Lido is approaching the first safety line of 33% of the total pledged amount. When F2Pool reached 1/3 of the computing power, it directly stopped registration to maintain network security. Last month, there were also four LSD project parties, RocketPool and StakeWise. , Stader Labs, and Diva have all announced their commitment to self-limit themselves below 22%, but Lido, as the industry leader, has refused to limit itself. This also caused community members to question Lido. At the same time, some KOLs also exaggerated online the harm of Lido’s excessive market share.

But they all ignore a key issue, which is how much of the market share information is truly public, and how much is based on reports from others? Since Lido is an on-chain protocol and the DAO only operates on the chain, it is completely open and transparent, so its data is authentic. Let’s take a look at the major staking platforms Coinbase and Binance, which are ranked after Lido. They are all centralized exchanges. Whether the staking data of centralized exchanges is disclosed depends on the specific exchange policies and transparency requirements. They can not disclose some of the data. Its unfavorable data, so there may still be some moisture in Lido approaching 33% of the total pledged amount.

If the data from all parties are true, then the 33% share of the Lido project does have some harm, but it is not as big as KOLs have promoted.

It can be understood from two levels. First, people concentrate their funds in Lidos pool and register as pledgers in units of 32 Ethereums. Lido then distributes these funds to 29 designated operators to perform the actual staking operations. So it can be roughly understood that each operator bears part of the risks on average, so the risk concentration is not that high.

Secondly, node operators have no motive to do evil. To change the finality of Ethereum, Lido needs to let 29 node operators do something very detrimental to the protocol itself, and node operators will face being cut[ Slash is a penalty for validators, in staking, if they misbehave in some way - the staked Ethereum will be slashed or removed. ] If they affect finality [and harm the network], they will be cut. When they are slashed, they lose Ethereum from validators, which means node operators are losing a revenue stream. So why do people actually try to do this? It doesnt make any economic sense.

In addition to the above possible risks, the biggest risk at present, and also the area where the public doubts Lido the most, is that node operators are designated by Lido and others cannot enter. In this case, if the node operators selected by Lido can reach a consensus on their interests, they may pursue higher interests, leading to the formation of a cartel or collusion among large stakeholders. These validators may join forces to manipulate the network, leading to undesirable outcomes.

However, the probability of this happening is not very high, because Lido has a set of public and strict standards for the selection of node operators, and will try its best to ensure the server diversity, geographical distribution, client diversity, etc. of the node operators. characteristics to avoid centralized aggregation. To take a step back, even if Lido’s 29 node operators join forces to harm their own business, the social layer can intervene to eliminate the malicious Lido node operators and transfer the business to the new one. on the chain.

Lido is a manifestation of Ethereum’s centralization problem

The emergence of Lido can be seen as a symptom of Ethereums centralization problem, and its current high market share in the market is just an opportunity. In fact, what happened with Lido may happen again with other projects. In the case of community autonomy, community members are the owners of project interests, and their choices may be more inclined to the direction that is beneficial to themselves rather than to the direction that is beneficial to the entire ecosystem.

Lido’s community managers were able to vote against 99.81% of users holding LIDO tokens after other institutions agreed to set limits. Project autonomy through community voting has long been viewed as an expression of decentralization. However, Lido DAO rejected restrictions on its centralization through decentralized community voting, which to a certain extent shows that complete decentralization is uncontrollable.

In fact, since Ethereum switched to a POS consensus mechanism, concerns about its centralization trend have emerged, because validators with large stakes have extensive influence on the network, and these large stakeholders may dominate transaction verification. , thus leading to the integration of power.

And Lido is clearly not the worst offender in this regard. Because Lido is not an entity, but an intermediate layer protocol, or simply understood as an alliance, there are currently 29 node operators. The node operators are entities that actually mortgage ETH, similar to the current POW mining pool. Node operators are managed by Lido DAO, which will screen the operators’ values to ensure diversity, thereby avoiding the risk of centralization. Lido DAO is managed by LIDO token holders. So to a certain extent, Lido is a decentralized organization.

In addition to Lido, the most noteworthy ones should be centralized staking platforms such as Coinbase and Binance. Without Lido, centralized exchanges will soon occupy most of the staking market, which will be detrimental to the decentralization promoted by Ethereum. will be a greater threat. Because a centralized exchange can serve as a single entity, once its market share exceeds 50%, it is likely to attract the attention of government departments. They may use policies to pressure the exchange to manipulate the Ethereum pledge market. This is important for The development of Ethereum decentralization is absolutely disastrous.

The transition of Ethereum to PoS has brought significant advantages such as environmental sustainability, higher participation and enhanced security, but it has also brought about centralization issues, such as the tendency of Ethereum network staking to be centralized and centralized. ization, this situation may pose a systemic risk to the Ethereum network. Lidos problem may be an opportunity to trigger discussions on the centralization issue of Ethereum and work together to strike a balance between the benefits of PoS and the centralization risks it brings.

How to solve Lido problem?

Lido issues have also attracted the attention of top-level designers of Ethereum. Starting from the stability of the overall ecosystem, Lidos excessive market size brings greater single-point risks. Any failure within Lido could further impact the entire Ethereum ecosystem and the entire industry that relies on it. Therefore, limiting Lido’s excessive market share has also become a wish of the top designers of Ethereum.

Recently, Ethereum co-founder Vitalik mentioned while participating in a Discord discussion of Reflexer Finance (RAI) that RAI can support non-popular liquid staking tokens (other LSD tokens besides stETH) as collateral. This move could solve the problem of Lido’s excessive market share. Although the current supply of RAI is still limited, if its scale expands in the future and even more new upper-layer applications begin to avoid stETH, Lidos market share will inevitably face the possibility of shrinking as demand decreases.

In addition to the upper consciousness of Ethereum starting to introduce some policies to limit Lidos market share, Lido can also take a series of measures to improve its impact on Ethereums decentralization and alleviate community members concerns about its excessive market share.

First, Lido could consider self-limiting its market share for a fixed period of time to promote the overall health and neutrality of the liquidity staking market. By setting a cap, Lido avoids over-centralization, thereby reducing system risk.

Second, Lido can work on improving its internal decentralization, ensuring each staker has adequate failsafes and countermeasures. This means Lido needs to take steps to deal with bad actors or vulnerabilities to ensure the stability and security of the system.

Additionally, Lido can take steps to fairly prevent systemic price gouging in order to maintain market fairness and transparency. This can be achieved by establishing effective regulatory and risk management mechanisms.

Additionally, Lido can continue to add node operators to its network to diversify staking capabilities and reduce centralization risks. By increasing the number and diversity of nodes, Lido can increase the resilience and resilience of the system.

Additionally, Lido can work on building the appropriate system guardrails to ensure it fulfills its role as a market leader in this critical area. This includes establishing reasonable regulatory mechanisms and risk management frameworks to ensure the security and stability of the system.

Finally, Lido could consider Vitaliks proposed approach to upgrading Lidos system, which would automatically increase end-user fees when market share exceeds targets. Such a mechanism can guide Lidos market share to remain within a reasonable range and avoid excessive concentration and single-point risks.

By taking these steps, Lido can mitigate its impact on Ethereum’s decentralization while alleviating concerns about its excessive market share. This will help protect the stability and security of the entire Ethereum ecosystem.

Summarize

Regarding the recent market controversy caused by Lido, some people in the Lido community have also responded to this matter. One of the answers is very interesting. When we discuss limiting Lido’s share of the market, do we consider that without a decentralized liquidity protocol like Lido, the staking market may be monopolized by centralized exchanges. At that time, how should we restrict these centralized exchanges? This perspective reminds us to comprehensively consider multiple aspects of the market, both to ensure the long-term development of the ecosystem and to maintain fair competition in the market.