Original source: Messari

Original compilation: PolkaWorld

key insights

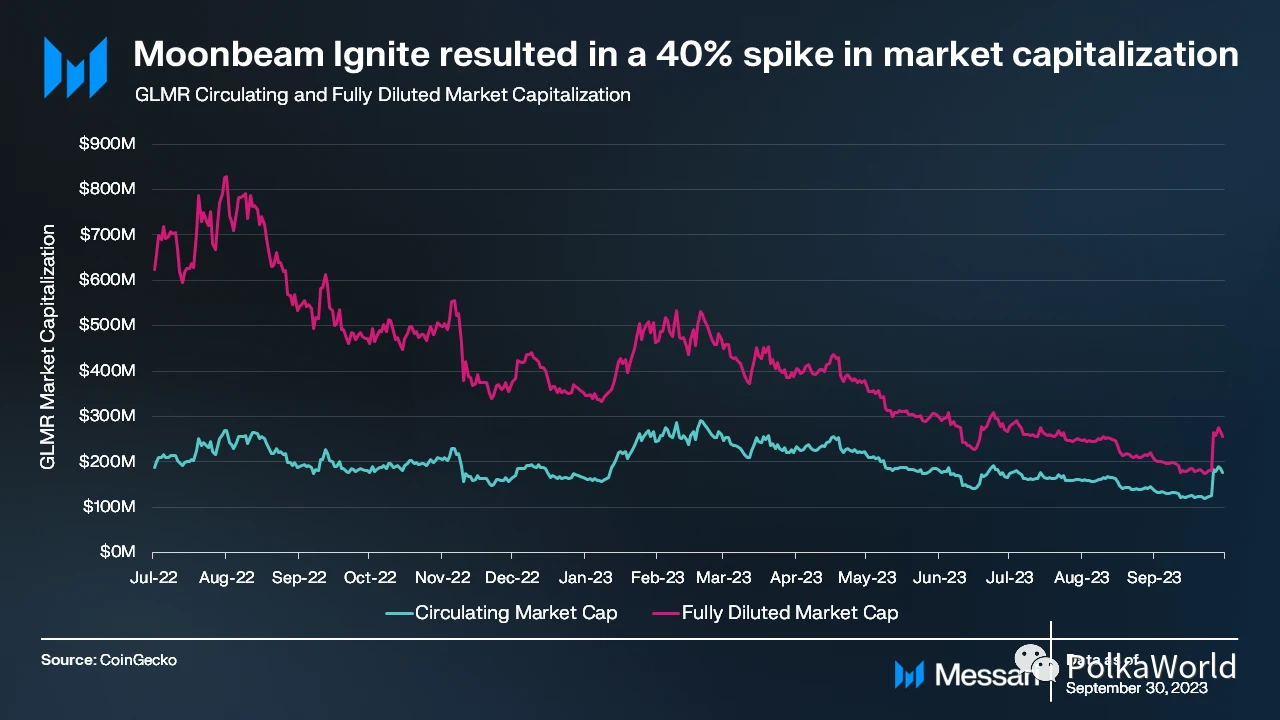

The launch of the liquidity incentive program Moonbeam Ignite and its listing on Upbit increased Moonbeams market value by 40% at the end of the third quarter.

The Moonbeam-Acala XCM channel is the channel with the most XCM traffic in Polkadot, with 9,500 messages registered. In addition to Polkadot, Moonbeam also maintains cross-chain interactions with multiple other chains.

Moonbeam posted Moonbeam Routed Liquidity (MRL), allowing other parachains to access bridged liquidity from other ecosystems without requiring a Moonbeam account or direct interaction with Moonbeam.

Uniswap V3Launched on Moonbeam in the last week of Q3.

Moonbeam Introduction

Moonbeam is an EVM-compatible smart contract platform for building cross-chain applications on Polkadot. As a parachain in the Polkadot ecosystem, it utilizes the security mechanism of the Polkadot relay chain and integrates with other parachains.

Moonbeam provides an EVM implementation and a Web3-compatible API that enables developers to deploy Solidity smart contracts and APIs with minimal modifications. In addition, Moonbeam also includes features such as on-chain governance, staking, and advanced cross-chain integration capabilities.

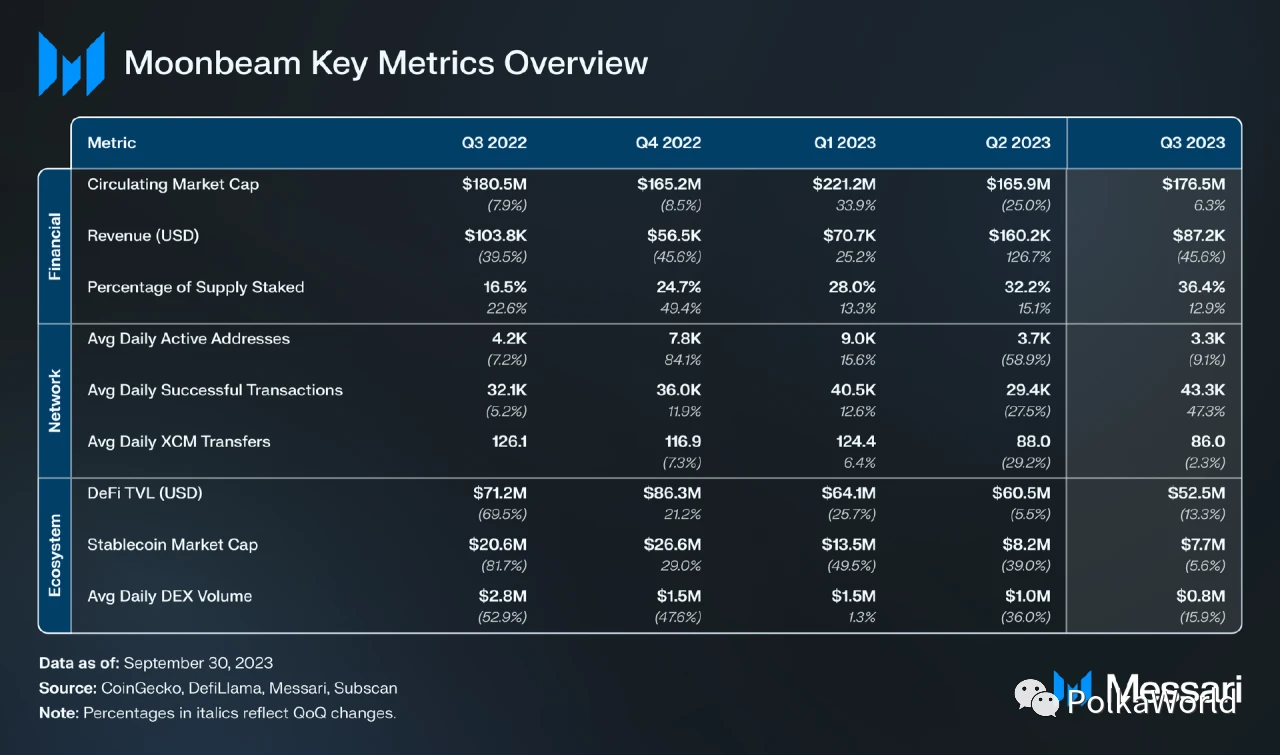

Key indicators

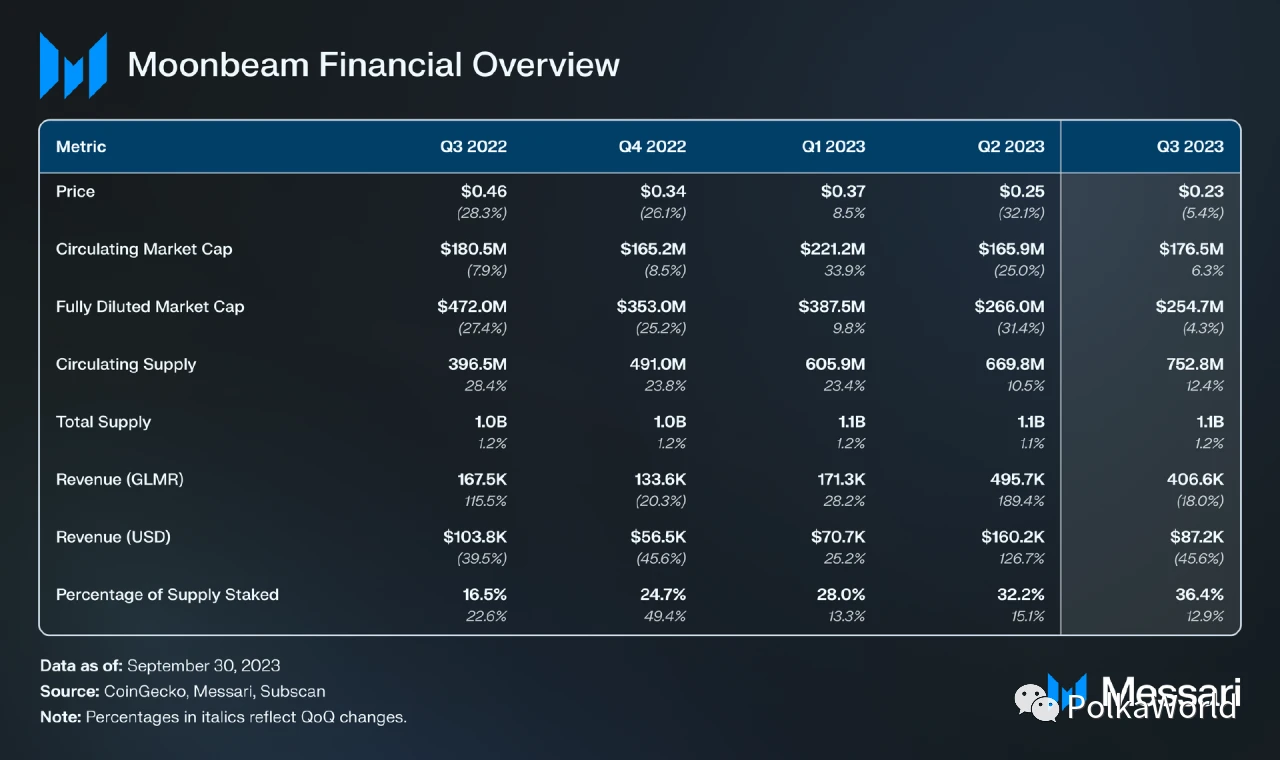

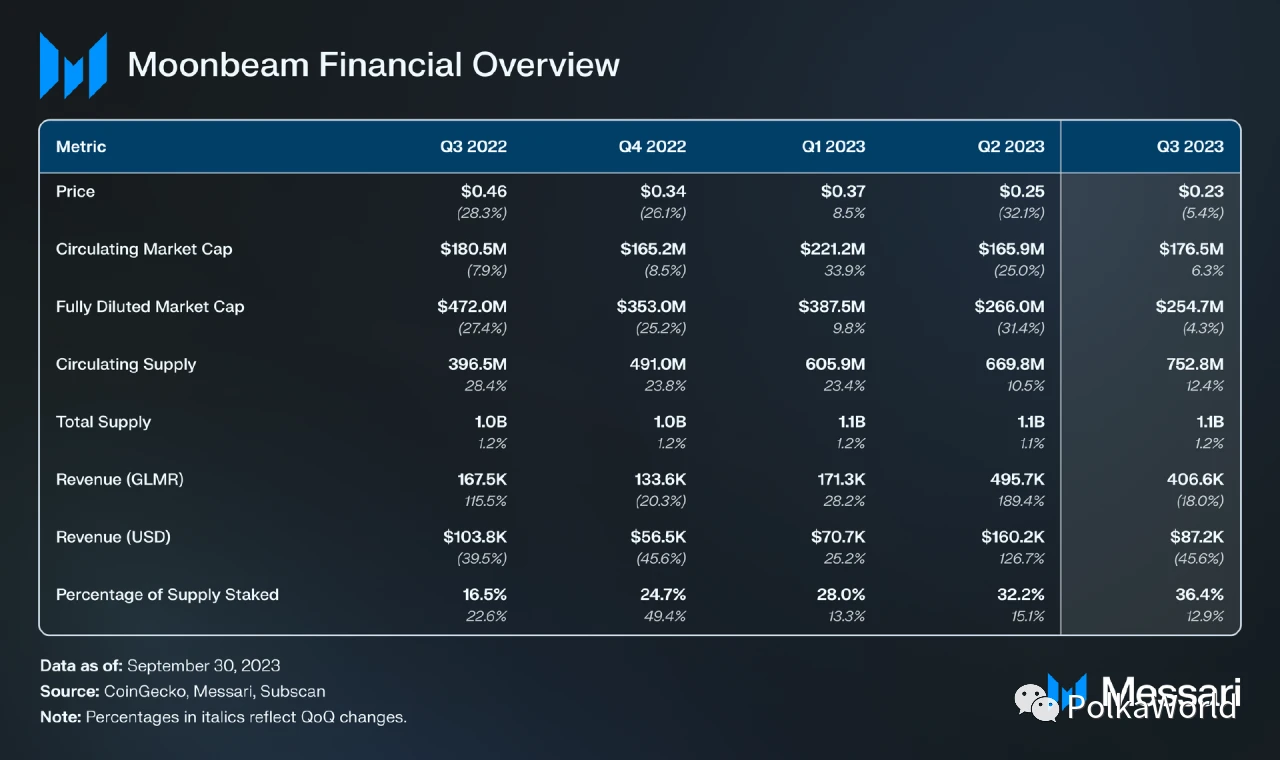

Financial overview

Market value

In the third quarter of 2023, although both XRP and Grayscale achieved favorable results in the court, the dynamics of the entire cryptocurrency market did not change significantly and remained in a relatively stable or inactive state. Moonbeam also shows this trend,Until the last week there was a significant 40% increase.This growth is due to the launch of Moonbeam Ignite, a program that provides liquidity incentives to protocols in the Moonbeam ecosystem. As the third quarter ended, Moonbeams circulating market capitalization reached $176 million, making it the 175th-ranked crypto protocol.

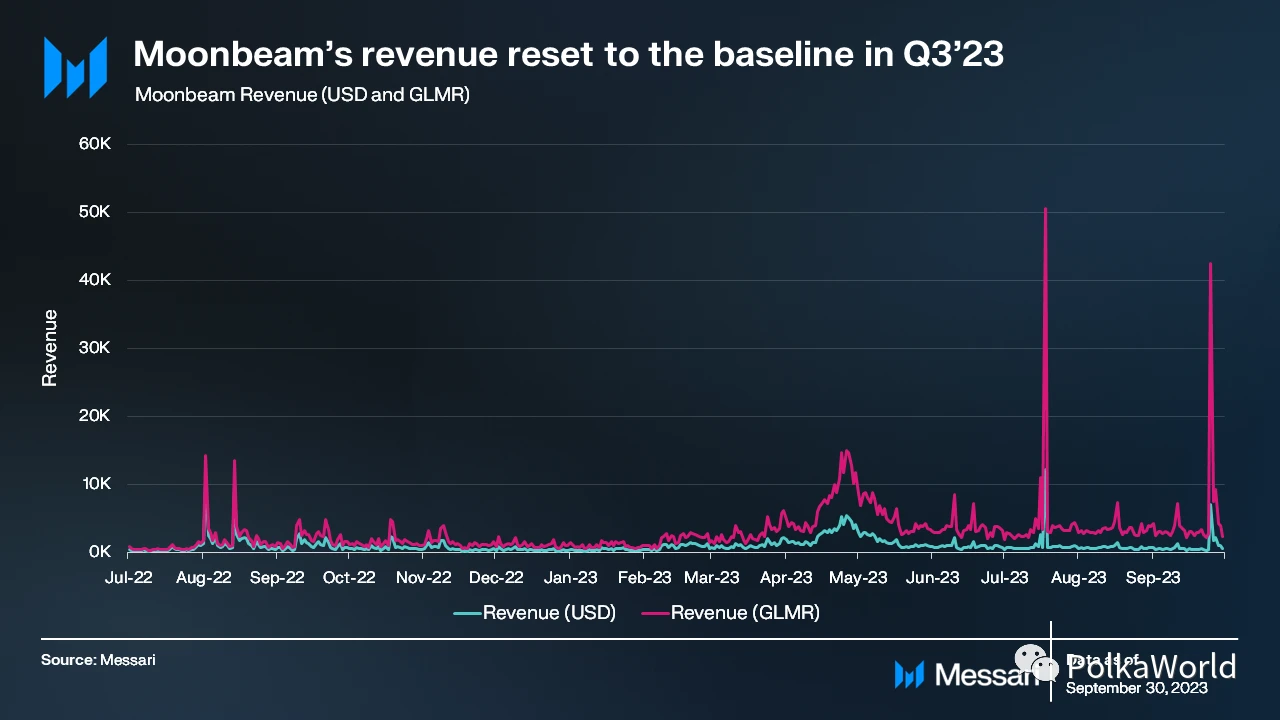

income

During the second quarter, Moonbeam experienced a revenue surge due to runtime 2302 and Xen Crypto deployments. However, in the third quarter, revenue fell 46% year over year, from $160,000 to $87,000. This puts third-quarter revenue in line with Moonbeams historical average.

GLMR Token

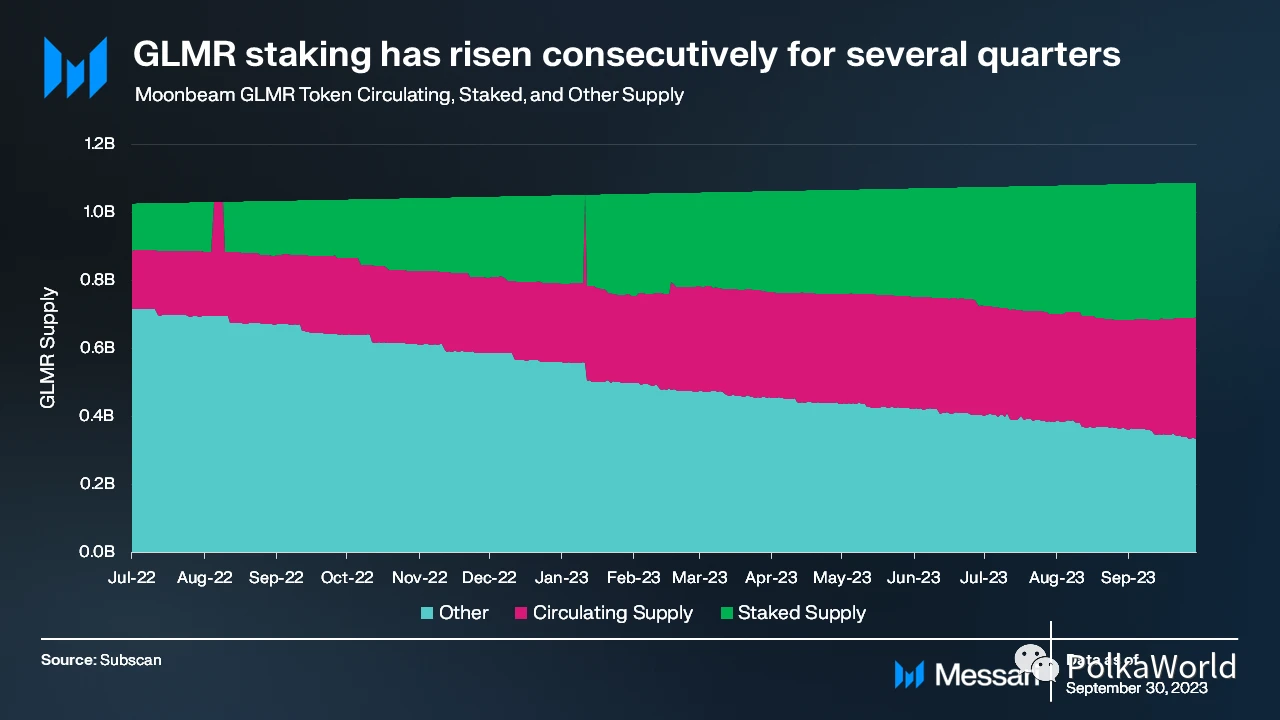

GLMR is the native token of the Moonbeam network. It has multiple functions such as rewarding collectors, enabling on-chain governance, and paying network transaction fees. The token has an annual inflation rate of 5% and has no maximum supply. Of the transaction fees generated on the Moonbeam network, 80% are destroyed and the remaining 20% are transferred to the networks treasury. GLMRs collateral ratio has been steadily increasing for several quarters, and by the end of the third quarter, its36% of total supply is staked. In Q3, Moonbeam launched a voting delegates feature.

Network overview

Usage

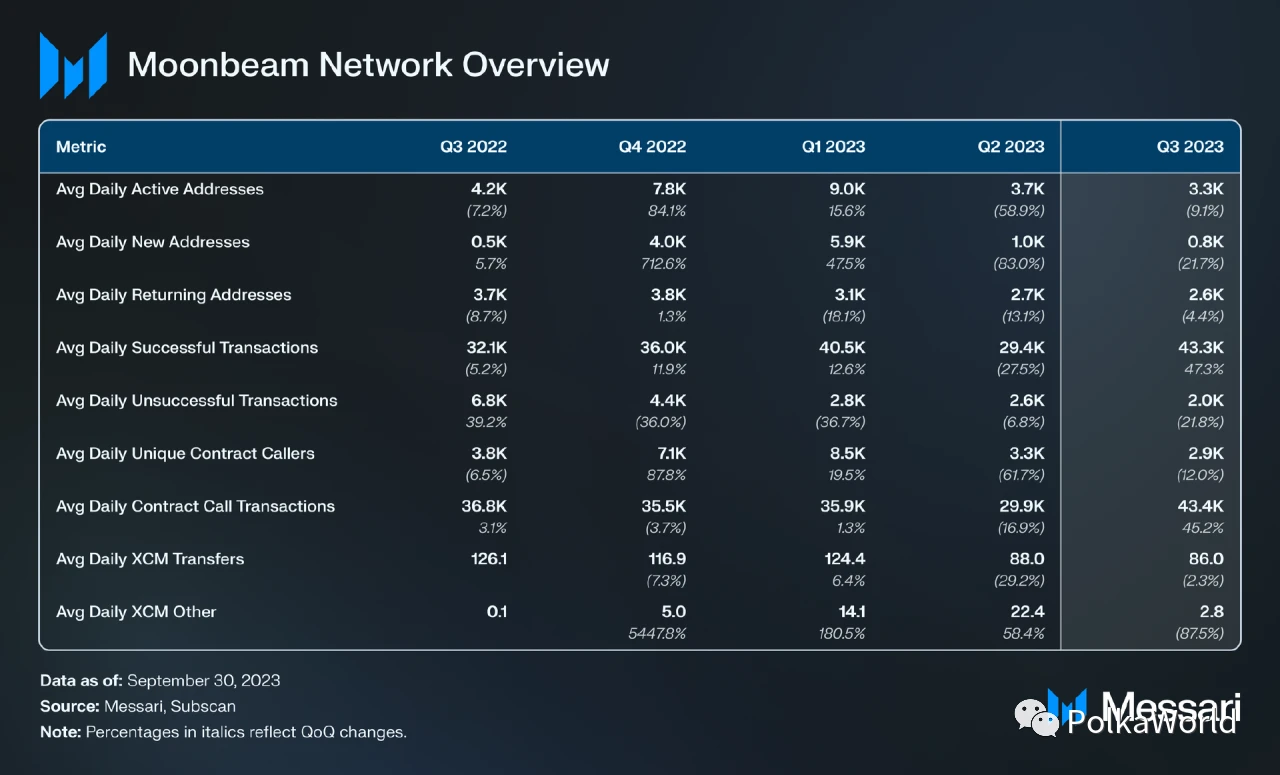

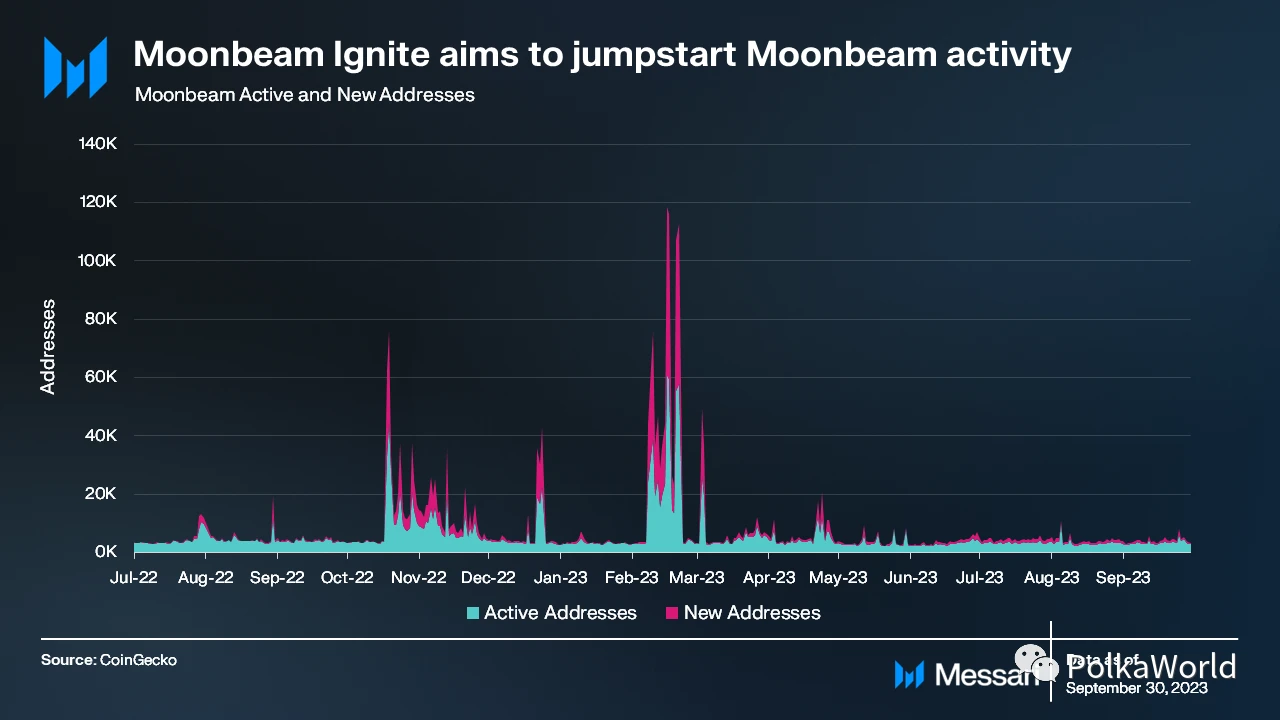

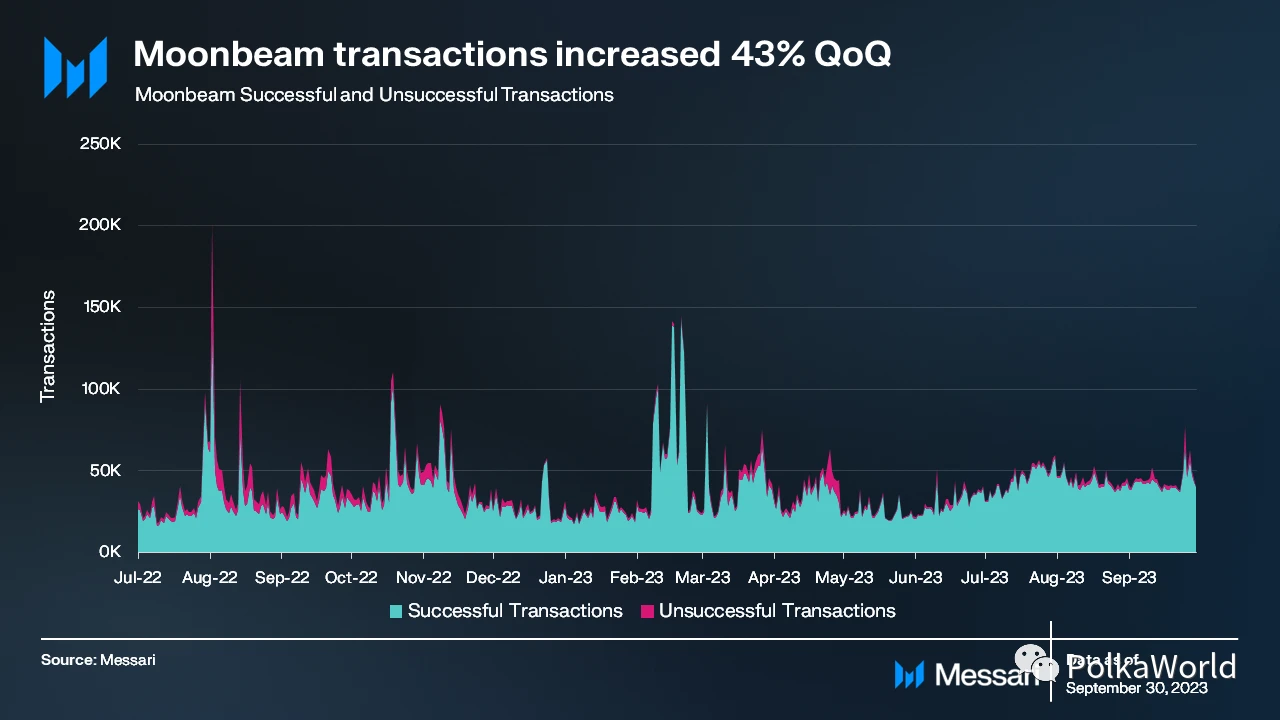

In the first quarter of 2023, Moonbeam experienced a surge in address activity. However, over the next two quarters, this activity declined, returning to the levels observed during the same period in 2022. on the other hand,Moonbeams transaction volume increased 43% quarter-on-quarter.This volume increase was predictable at the end of the quarter as it was impacted by the Moonbeam Ignite announcement.

According to Electric Capital’s developer report, Polkadot has the second-largest developer base among cryptocurrencies. In the Polkadot ecosystem, Moonbeam has the largest developer base, with more than200 peopleRegistered developer.

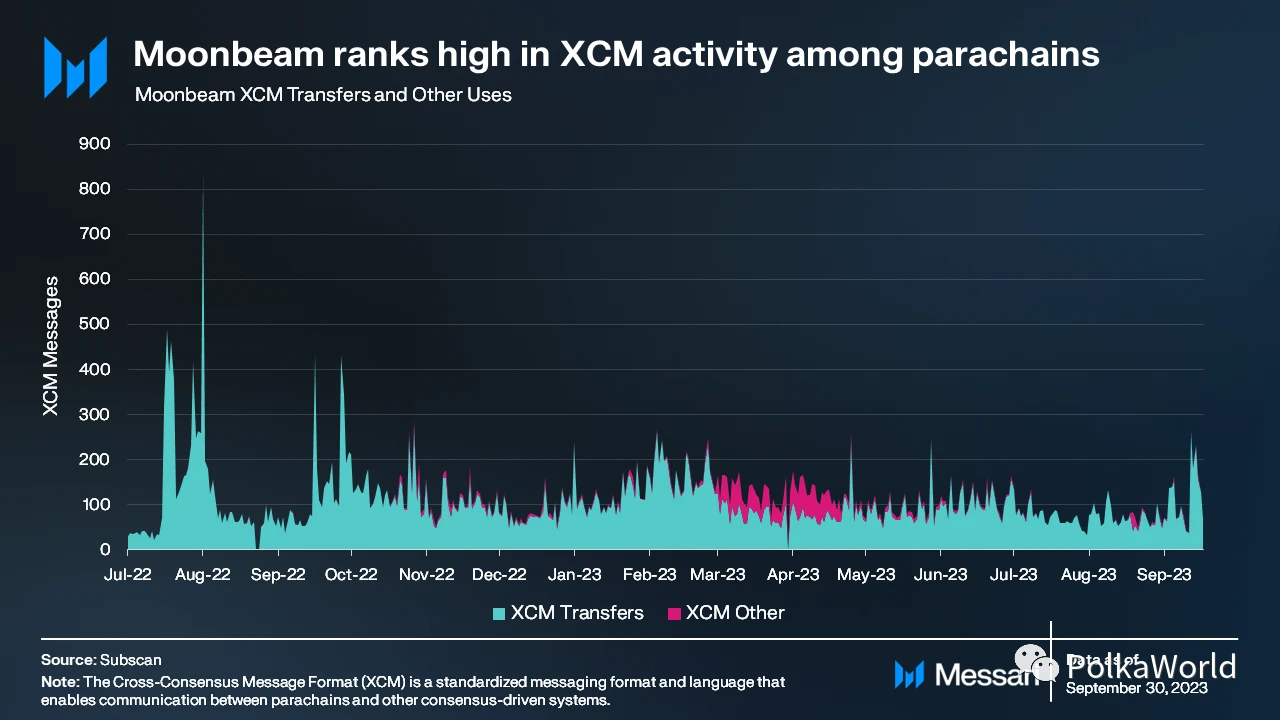

XCM

The Cross-Chain Consensus Message Format (XCM) provides standardized messages for communication between parachains and other consensus-driven systems, supporting asset transfers, operations, etc. Launched on June 15 XCM V3Brings advanced programmability, bridging to external networks, cross-chain locking, enhanced fee payments and NFT support.

In the XCM event, Moonbeam ranked higher among parachains. The Moonbeam-Acala channel is considered the most used XCM channel. During the third quarter, Moonbeam launched aCentrifuge、NodleandOrigin Trail New XCM integration.

During the third quarter, Moonbeam launchedMoonbeam Routing Liquidity (MRL). This allows parachains to draw bridging liquidity from the ecosystem, including Ethereum, Solana, Polygon, and Avalanche, without requiring a Moonbeam account or its direct involvement.HydraDXis the first parachain to use MRL, which facilitates cross-chain transfers of Wormhole-based tokens and simplifies liquidity transfers from Ethereum to HydraDX through Moonbeam. So far, Ethereum has provided HydraDX via MRL6.1 millionUSD liquidity. In addition, the parachain Interlay has also integrated Moonbeam routing liquidity.

Ecological overview

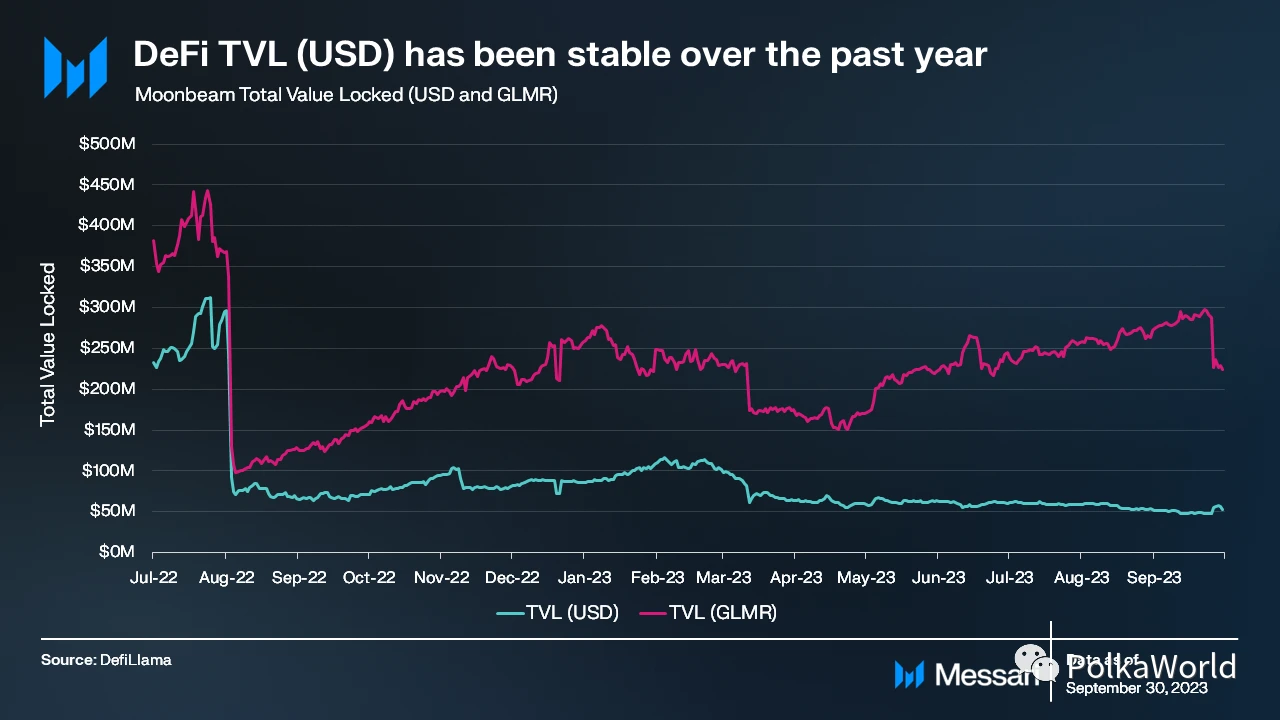

Total lockup

Over the past year, Moonbeam’s decentralized finance (DeFi) total value locked (TVL) in USD has been relatively stable, but TVL in GLMR has continued to rise. By the end of the third quarter, Moonbeam recorded TVL of53 millionUSD, ranking it around 30th among many chains.

Moonwell It is the largest lending agreement for TVL in Moonbeam. At the end of the third quarter, its TVL was $42 million, accounting for 79% of Moonbeams total TVL of $53 million. It is followed by StellaSwap and Prime Protocol, which have TVL of $3.8 million and $3.5 million respectively. In Q3, Moonbeam’s DeFi diversity score was three.

It is worth mentioning that,Uniswap V3Launching on Moonbeam during the last week of Q3!

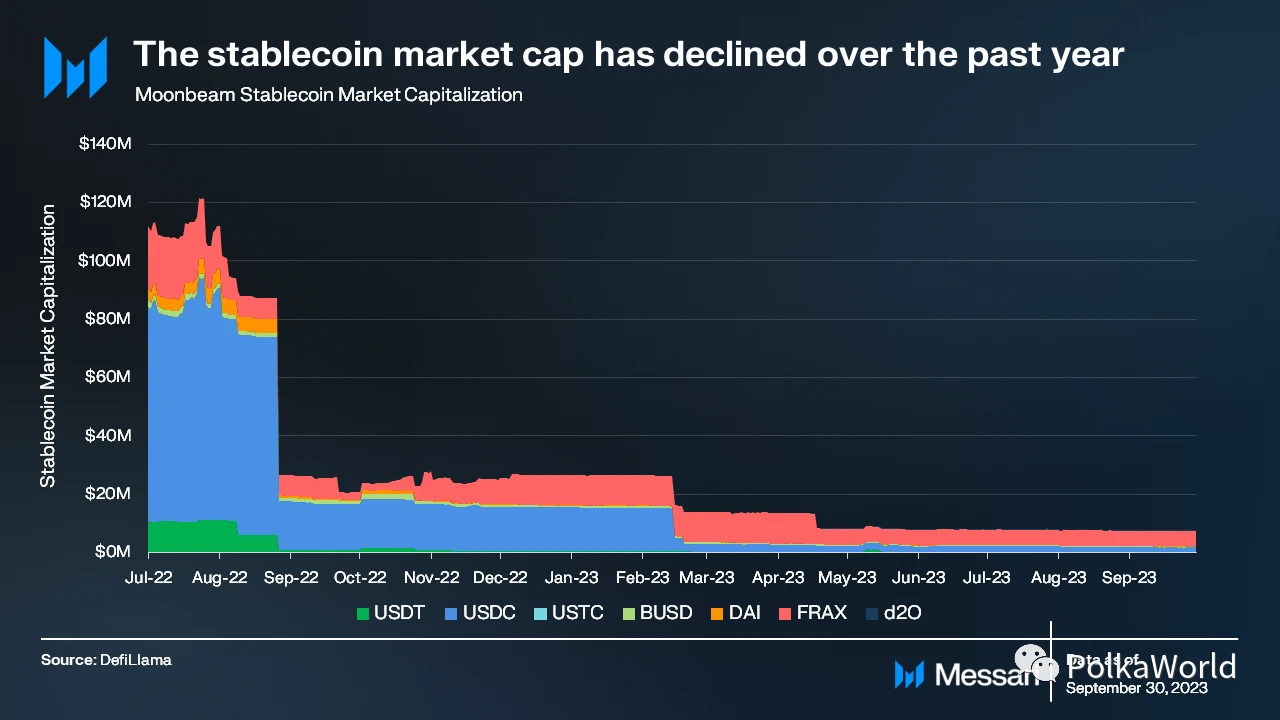

Stablecoins

By the end of the third quarter, Moonbeam’s stablecoin had a market capitalization of $8 million, ranking 40th in the chain. Native-Frax has a market capitalization of US$5 million, accounting for 70% of Moonbeam’s total stablecoin market capitalization. In Q3, Polkadot launched native USDC support, which may increase USDCs presence in Moonbeams development support market. It is worth noting that due to the Nomad vulnerability at the end of August 2022, the market value of Moonbeam’s stablecoin dropped sharply.

Summarize

In the third quarter of 2023, Moonbeam showed resilience in an unpredictable crypto market, with a significant increase in market capitalization in the final week of the quarter. Moonbeam showed a lot of hard work this quarter: although indicators such as revenue and TVL declined quarter-on-quarter, indicators such as transactions and the proportion of supply showed growth. Despite the decline in overall XCM news, Moonbeam maintained its lead in this important category.

Going forward, Moonbeam aims to enhance its network activities with Moonbeam Ignite. From a broader perspective, Moonbeam remains the main parachain in the Polkadot ecosystem, but it also faces huge competition from external competitors.