Original source:Geek Web3No public

Original author: 0xmiddle

Introduction

In the Web3 ecosystem, the cross-chain bridge is a very important part. It is a key facility to break the silos between chains and realize the interconnection of thousands of chains. In the past, people have been very active in exploring and practicing cross-chain technology. There have been hundreds of related cross-chain bridge products. Some are committed to building a unified interoperability layer, while others are trying to open up the circulation of multi-chain assets. Vision They are not the same, and each has its own choices in technical solutions.

What this article hopes to discuss is: What is the future of cross-chain bridges? What kind of cross-chain protocol is more promising? What cross-chain applications are more likely to gain mass adoption? How should developers build cross-chain applications? In the following, the author will discuss the development trend of cross-chain bridges and first lay out three core arguments:

A new generation of safe, high-performance cross-chain bridges will become mainstream

Full-chain applications will become the new dApp paradigm

Liquidity swap bridges will be replaced by official bridges from asset issuers such as USDC

text:

Cross-chain technology can be understood as an extension of capacity expansion. When one chain is not enough to carry all transaction requests, let multiple chains carry it and connect them with cross-chain bridges. To understand cross-chain bridges, we must first clarify what problems cross-chain bridges need to solve, and divide them into different levels.

Simply put, cross-chain bridges can be divided into protocol layers and application layers. The protocol layer is responsible for providing a safe and orderly platform for cross-chain messaging, while the application layer builds dApps based on this platform to meet users various needs in different scenarios.

The evolution of cross-chain bridges at the protocol layer

The core of the protocol layer is the security mechanism of cross-chain message transmission, which is the verification method of cross-chain messages. According to different verification methods and the ideas of Vitalik and others, the industry has divided cross-chain bridges into three types: atomic swap based on hash time lock, witness verification and light client verification. Later, Connext founder Arjun Bhuptani summarized the cross-chain bridge into three paradigms: local verification, external verification and native verification.

Among them, local verification is only applicable to cross-chain assets and cannot support any cross-chain message, and the user experience is not friendly (the user needs to operate twice to complete a transaction). Some of the earliest cross-link bridges to adopt this approach have since changed course and abandoned the route. Native verification is the most secure, but the cost is too high. On the one hand, the gas cost paid by users is too high, and it is even completely uneconomical in some cases. On the other hand, developers coding costs are too high. In order to access different blockchains, they need to develop corresponding light client verification programs separately. The amount of engineering is huge and the scope of adoption is extremely limited.

Finally, most cross-chain bridges still use external verification solutions. The users gas cost and development and implementation cost are relatively low, and they support any message cross-chain. But the most criticized aspect of external verification is security. Whether it is Multichian, which was hit by thunder this year, or RoninBridge (the official bridge of Axie Infinity) and HorizenBridge (the official bridge of Harmony Chain) whose keys were stolen by hackers, they all tell us that simple The external verification scheme cannot be the end of the cross-chain bridge!

The security risks of cross-chain bridges have hindered the development of cross-chain dAPPs. The application layer has become very cautious when designing corresponding services. Firstly, it is necessary to avoid links related to cross-chain interoperability as much as possible. Secondly, well-known applications will tend to build their own Cross-chain bridge (this is true for leading DeFi projects such as AAVE, Maker, Compound, etc.). It is conceivable that in a city with poor public security, people will choose not to travel as much as possible, and wealthy people will bring their own bodyguards when they travel.

But what is gratifying is that a new generation of safer cross-chain bridges is growing rapidly, including LayerZero, ChainlinkCCIPThere are such dual security layer bridges; there are ZK bridges that combine ZK technology and light clients (representative projects: Polyhedra, MAP Protocol, Way Network); there are optimistic verification bridges that use economic game mechanisms to protect cross-chain security (representative projects : Nomad, cBridge); and a bridge that combines ZK and TEE technologies (representative project: Bool Network).

If you want to understand their specific mechanisms, you can refer to the author’s previous articles.Multichain collapsed, what can be done to save the cross-chain bridge? 》

In short, the new generation of cross-chain bridge infrastructure achieves higher security without sacrificing performance, and provides a solid guarantee for the application layer in the design of cross-chain interoperability.

Paradigm changes in cross-chain interaction at the application layer

Initially, almost all dApps were deployed on Ethereum because there was no choice. However, with the prosperity of the application layer ecosystem, Ethereum has been overwhelmed, which has given other public chains opportunities to develop. Various ETH Killers, side chains, and Layer 2 have appeared successively.

From a dApp perspective, Ethereum is like a megacity like Shanghai, with a large population but tight resources and a high price for land. If my business scenario requires high throughput but low interoperability requirements, then it’s okay. Deployed on a less crowded sidechain. For example, a printing factory or plantation does not need to be located in Shanghai, but can be located in the suburbs. Everyone must be familiar with the story of dYdX leaving Ethereum.

At the same time, a dApp can be deployed on multiple chains to engage in chain operations to serve users on different chains and expand scale and revenue. For example, Sushiswap, the first successful vampire attack case, frantically deployed it on 28 chains. Sushiswap is basically included in the public chains with names that we can think of.

However, this multi-chain application ecosystem brings a poor experience to users: in order to interact with applications on different chains, one must understand the differences between different chains, register addresses on multiple chains, and recharge on each chain. Gas fees, and finally transferring assets around different chains - God, it’s so tiring!

What’s even worse is that many DeFi protocols involve the use of liquidity. If you deploy on multiple chains, you have to guide liquidity on multiple chains. This will cause liquidity to be scattered on different chains, and the depth will not be shared. Users will be unable to trade. When , it will produce a greater price impact. In this regard, some people have expressed concerns about the development of Ethereum L2, believing that L2 may break down the liquidity of Ethereum and cause it to lose its competitive advantage. Some researchers have also proposed a unified liquidity solution such as SLAMM, but this solution creates more problems than it solves. It is very lame and will not be described here. Interested friends can find relevant information.

The real core question is: How can the resources and ecology of each chain be brought together so that users do not need to perceive the existence of the chain? For example, if I have 1 ETH, can I use it wherever I want and hide the steps of automatically exchanging and paying gas for different chains? I want to use an application. Can it be used on any chain without having to transfer assets across it? At the same time, project parties no longer need to stand in line to select a chain, and do not need to deploy repeatedly on multiple chains. Instead, they can deploy on the most suitable chain, and then people on different chains can use it?

The application layer needs a new paradigm to hide the chain layer.Someone imitated the concept of account abstraction and created a new term called chain abstraction, which means exactly this. Let’s see how an LSD project is done?

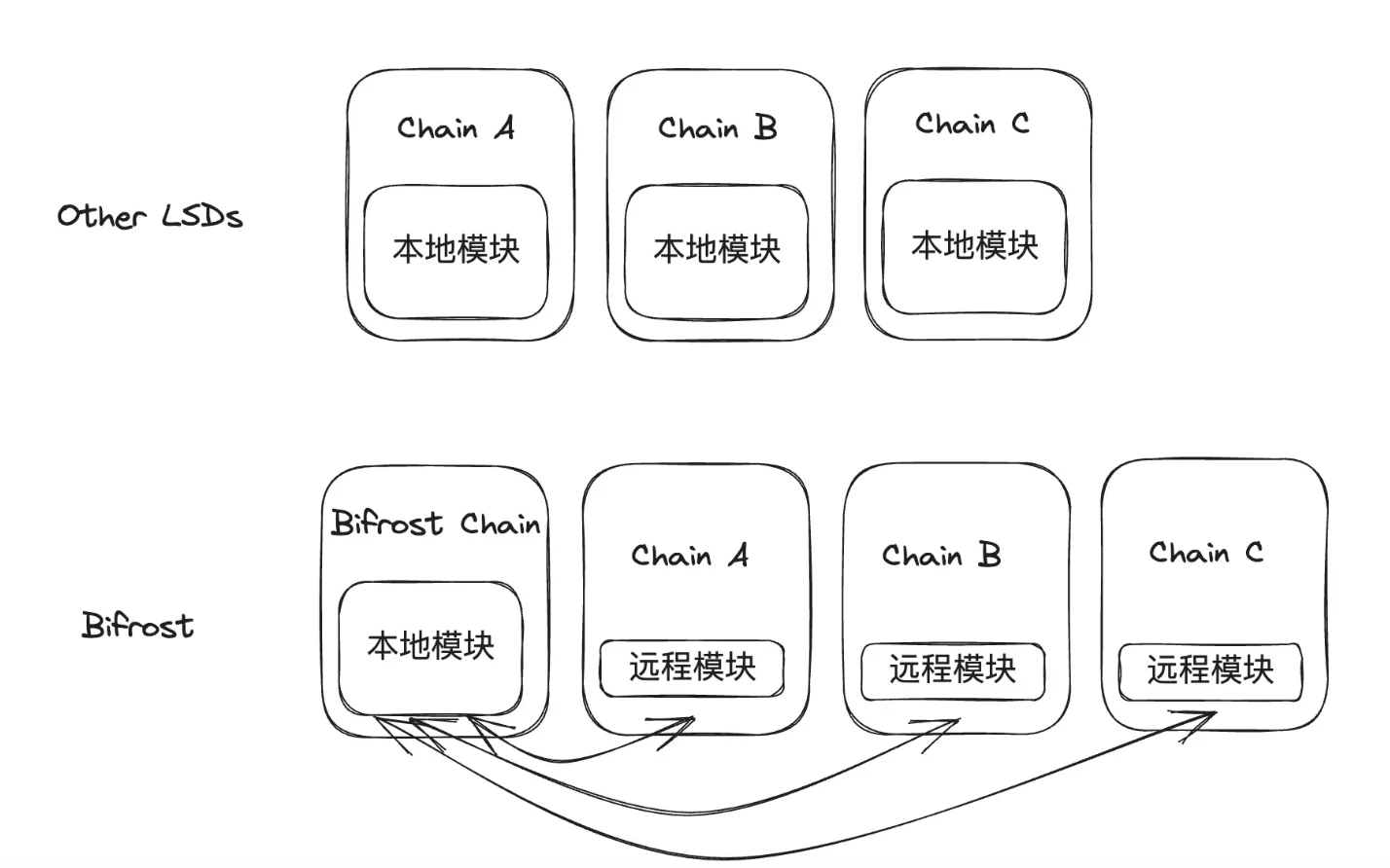

For example, Bifrost claims to be the pioneer of full-chain LSD, adopting an architectural design that is different from other LSD products. Bifrost has its own chain, Bifrost Parachain, which is a parachain of Polkadot. Bifrosts liquidity staking module is only deployed on Bifrost Parachain, and the liquidity of its LSD asset - vToken is also all on Bifrost Parachain, but other chains can use the liquidity staking module and liquidity on Bifrost Parachain through remote calls. . So:

Users can mint vToken in other chains;

Users can redeem vToken on other chains;

Users can exchange vTokens on other chains, but what is involved behind the scenes is the liquidity of the Bifrost chain;

Users can provide liquidity to the vToken/Token pool on Bifrost Parachain on other chains and obtain LP Token;

Users can destroy LP Tokens on other chains to redeem liquidity.

For these operations, users cannot feel the cross-chain transfer process behind them at all. Everything is as if it is done locally. You can useOmni LSD dAppGo and experience it. Omni LSD dApp currently supports remote minting/redemption/exchange of vToken on Ethereum, Moonbeam, Moonriver, and Astar.

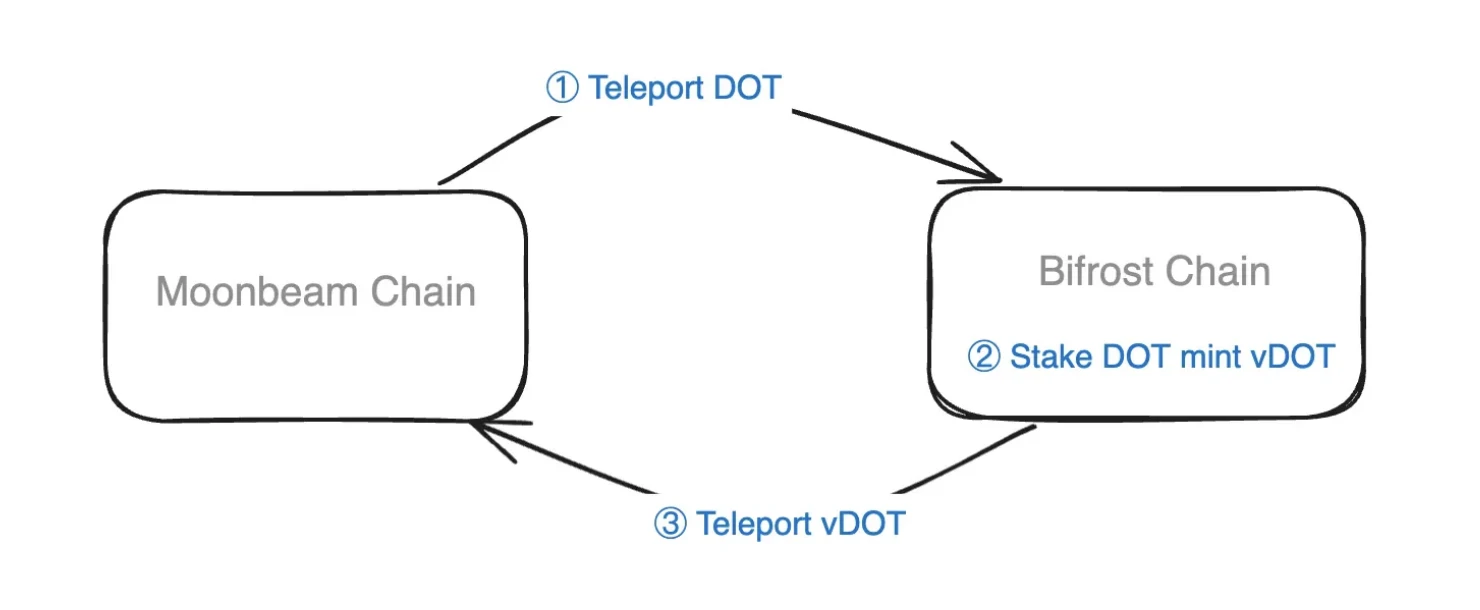

Without the above functions, if users want to mint vDOT on Moonbeam, they must manually perform three steps, which is very troublesome!

Cross-chain transfer of DOT from Moonbeam to Bifrost;

Stake DOT on the Bifrost chain to obtain vDOT;

Convert vDOT cross-chain back to Moonbeam.

Through the remote calling function, the users assets can complete the above three steps without leaving the Moonbeam chain, and convert DOT to vDOT directly on the Moonbeam chain. In other words, during the entire process, users experience the services on the Bifrost chain just like using the Moonbeam local application.

Sounds cool! But how to achieve this? In fact, it is not complicated. Bifrost has deployed a remote modular on other chains to receive user requests and pass them to Bifrost Parachain across chains. After the liquidity staking module is processed, the results are returned to the remote module across chains. . Users only need to initiate a request on the remote chain, and the subsequent process will be triggered and completed by Relayers.

Bifrost calls its architecture full-chain architecture. The comparison with the multi-chain deployment strategies of other LSD protocols is as follows:

The reason why Bifrosts architecture is discussed in such great detail is to let everyone fully understand what Bifrost calls the full-chain architecture. Bifrosts architecture actually represents a new general paradigm.

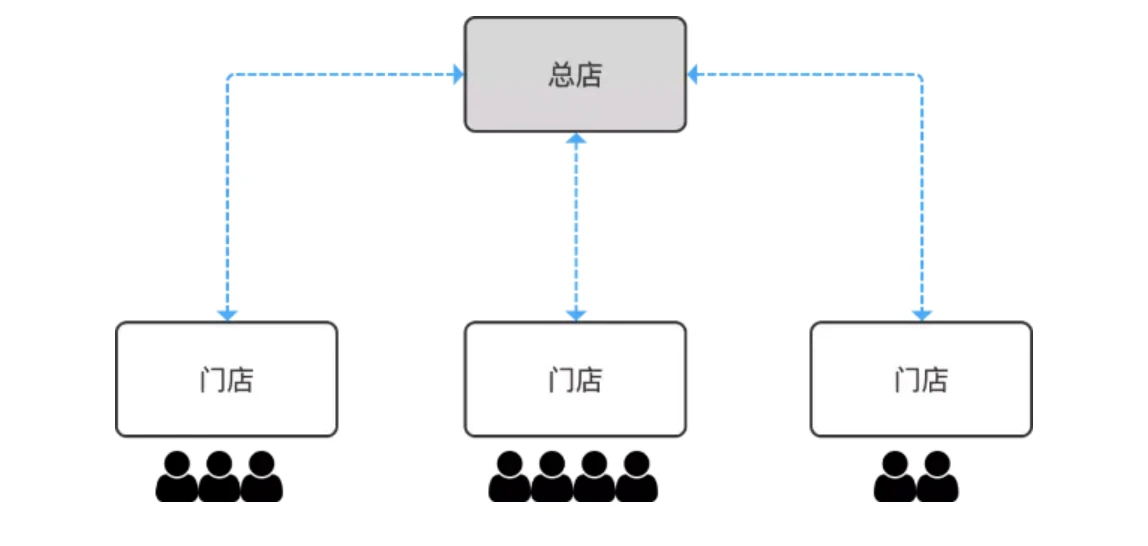

Chainlink stated in its blog post “Cross-chain smart contractsIn the article, this structure was described as the head office + branch store model. The main logic of the application is placed on one chain, like a head office, and then a remote access module is provided on other chains to achieve interaction with end users (obtain user input and output the results the user wants) , like stores one by one.

After the store obtains the users input, it passes the input across the chain to the head office. The head office processes it and inputs the result, and then passes the result across the chain to the store and outputs it to the user. In some cases, different modules of the main store may be split into different chains, and together they form a virtual main store. Under this architecture, the main logic of the program is in the main store, the application has a unified status record, and the problems of liquidity fragmentation and user experience fragmentation are solved. In addition, the applications of this architecture also have better cross-chain composability, and applications on other chains can also remotely access the functions of the main store like users on other chains.

Although Bifrost calls this structure full chain architecture, the author personally does not like the word full chain, that is, Omni-Chain, because it is a word with unclear meaning. It was originally invented by LayerZero to highlight it. That unparalleled scalability, but LayerZero has not fully explained what a full chain is. Is it the entire chain? Definitely not, there are no applications running on all chains. The author has a game project developer who said that he is making a full-chain game. After careful questioning, he found out that this full-chain means all the code is on the chain, which is different from some Web3 games that only put asset data on the chain. It has nothing to do with the full chain that LayerZero talks about.

I think a more appropriate expression is chain abstraction, Chain-Abstraction, or Chain-Agnostic (not related to the chain), both of which can express a state in which users do not need to care about the chain.

The inevitable decline of liquidity swap bridge

Finally, we want to talk about another important proposition in the cross-chain field - liquidity. First, let’s figure out which level it is. Liquidity does not belong to the protocol layer, because it has nothing to do with the safe and orderly transmission of cross-chain messages. It belongs to the application layer, and it is a special type of application - SwapBridge.

The largest category in cross-chain applications must be asset bridge. Asset bridge is divided into WrapBridge and SwapBridge. The former helps users realize asset transfer through lock-mint/burn-unlock logic and is also called asset transfer bridge. SwapBridge By storing liquidity on multiple chains, it helps users achieve direct swaps of native assets, also known as liquidity swap bridge.

Among them, SwapBridge has the widest range of applications and numerous projects. Different SwapBridge projects essentially compete for liquidity efficiency, who can provide users with the greatest depth with the smallest liquidity expenditure. To put it another way, liquidity is the core of the services provided by SwaqBridge. Everyone is competing to see who has the more cost advantage. This is the same logic as business competition in a general sense. What everyone needs to understand here is that the cost advantage created by the subsidy strategy is unsustainable. You must have an advantage in the design of the liquidity mechanism.

Many projects on the SwapBridge track, including Stargate, Hashflow, Orbiter, Symbiosis, Synapse, Thorswap, etc., are like eight immortals showing their magical powers in improving liquidity efficiency, and have also produced many remarkable innovations. The author has written before An article takes stock of this:Ten Thousand Words Report: Inventory of 25 Liquidity Swap Cross-chain Bridges and Their Liquidity Mechanisms。

However, the CCTP launched by USDC issuer Circle made many SwapBridge efforts meaningless. In other words, CCTP killed SwapBridge. It feels like the Three-Body Civilization spent hundreds of millions of years and more than 200 rounds of civilizations solving the Three-Body Problem, but in the end Circle tells you: There is no solution to the Three-Body Problem!

For example, in the cross-chain exchange of assets, USDC is the most widely used media asset. That is to say, when you need to exchange asset A on the X chain for asset B on the Y chain, you often need to exchange A on the X chain. First change it to USDC, then change the USDC on the X chain to USDC on the Y chain, and then change the USDC to asset B on the Y chain.

Therefore, the main form of liquidity that SwapBridge reserves on each chain is USDC. Then CCTP can support the USDC on the X chain to be directly replaced with the native USDC on the Y chain through burn-mint logic, without the need for liquidity reserves. In other words, CCTP has no liquidity costs at all, and the bridge fees experienced by users can be extremely low.

Maybe you will say, in addition to USDC, isn’t there USDT as a commonly used media asset? Not to mention that in the DEX field, the usage rate of USDT is much lower than that of USDC. Are you not afraid that Tether will also imitate Circle? So, what I want to tell you is: SwapBridge is dead, and the official bridge of the asset issuer will have an unchallengeable cost advantage in cross-chain liquidity. As for some SwapBridges that integrate CCTP, that is the logic of the aggregator.

summary

The cross-chain bridge protocol layer is becoming more secure and reliable, and the era of multi-signature bridges is ending. The unsafe impression caused by cross-chain in the past will be eliminated with the popularization of the new generation of cross-chain infrastructure;

Cross-chain applications are iterating through paradigms and greatly improving user experience. Chain abstraction is no less significant than account abstraction and is creating conditions for Web3s Mass Adoption;

The CCTP launched by Circle ended the Warring States Period of SwapBridge liquidity competition and allowed us to see the end of cross-chain asset exchange.

In short, the cross-chain field is undergoing drastic changes! Only when you understand the road ahead can you walk more confidently.