introduce

LayerZero is a full-chain interoperability protocol designed for lightweight messaging across chains. Stargate is the official bridge launched by the LayerZero team.

deBridge is the liquidity internet of DeFi, focusing on speed, security, and user experience, driving real-time value and information delivery across the entire DeFi space. By enabling unified liquidity, free information exchange, and open access, deBridge transforms DeFi into a unified open market.

This article will conduct an in-depth analysis of layerzero and its cross-chain products Stargate and debridge, including a comparison of technical models, TVL models, protocol activity, revenue, protocol activity, etc.

About Trading Volume and TVL

First, we understand that TVL and transaction volume are not the most accurate indicators of value capture for the following reasons:

Bridges must continually distribute incentives to maintain TVL in the pool.

A bridge that charges no fees can attract any volume.

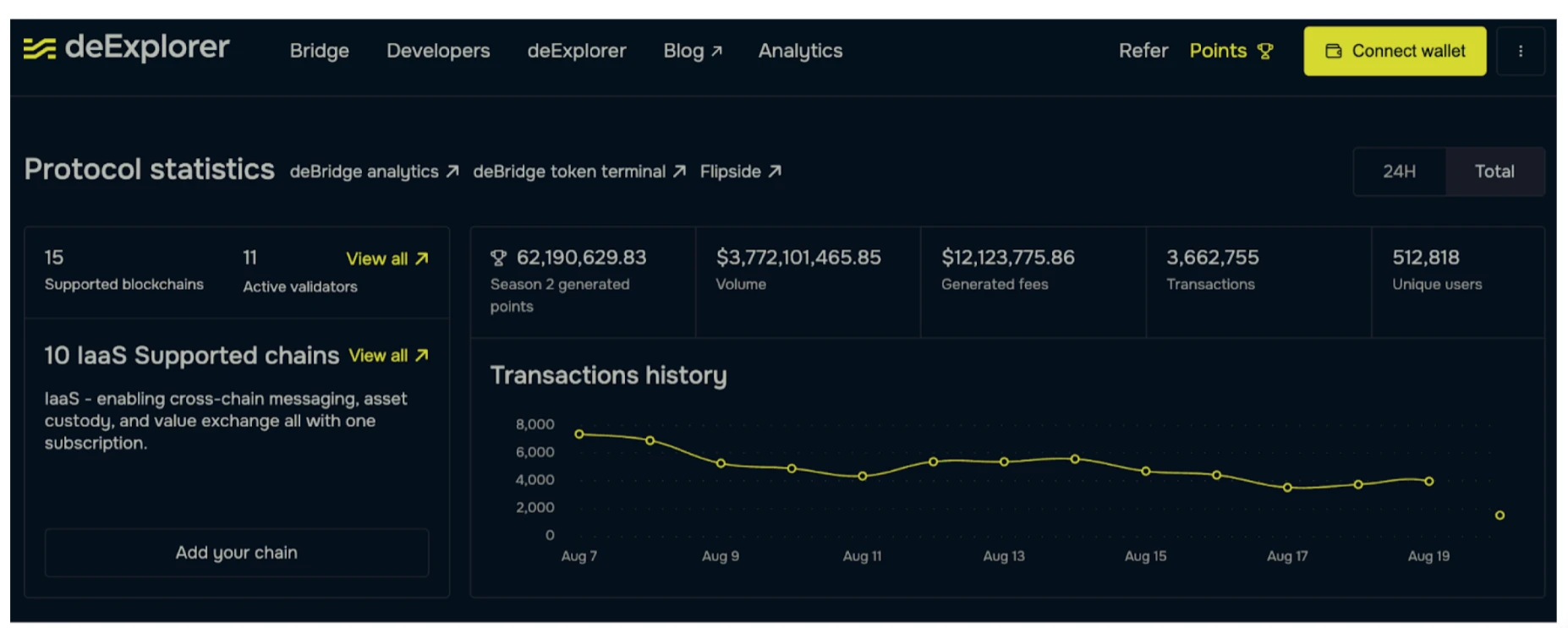

Therefore, protocol profits are a more useful metric. If you compare deBridge to other projects, it is the only scalable and profitable infrastructure, earning $12 million through transaction fees so far without any liquidity incentives. They deliberately chose not to conduct liquidity mining activities to ensure that they can focus on building sustainable revenue sources and believe that this approach will bring long-term success to the project.

deBridge’s lack of TVL enables it to design a more secure architecture and have a scalable business model that taps into the entire non-custodial spot and OTC markets.

To provide some insight into the potential benefits:

Currently Stargate is valued at $330 million FDV, LayerZero is valued at over $3 billion, with a total FDV of $3.3 billion, and deBridge is expected to launch at just $250 million.

deBridge has the following advantages:

Scalability (with unlimited throughput)

Security (shared security model, off-chain verification, 0 TVL)

Gas efficiency

Compared to LayerZero, deBridge also offers:

Capital efficiency (minimum fee 4 bps)

Zero Slippage and MEV Protection

Instant Settlement

deBridge allows for rapid scaling of transaction volumes and creates massive network effects.

How to achieve zero TVL?

deBridge is an asynchronous value transfer protocol that uses a new paradigm, “on-demand liquidity”, through which any cross-chain transaction can be settled natively without the need for TVL.

deBridge consists of two types of market participants: market makers (users and protocols that want to trade across chains) and order takers (any liquidity owner who is motivated to complete a cross-chain order).

You can think of it as a cross-chain limit order protocol, or a cross-chain exchange, that simply matches cross-chain orders and incentivizes takers to fill market makers’ orders.

With deBridge, liquidity is more sustainable and efficient than any locked liquidity pool approach, as any order can be fully or partially filled by any market participant. Order takers can leverage centralized exchanges and private liquidity networks to efficiently rebalance liquidity between chains to quickly meet demand and complete cross-chain limit orders.

With this design, there is no need to continuously lock liquidity in the liquidity pool, thus achieving zero TVL. Liquidity is directly owned by its owner rather than being pooled in a shared state.

How does deBridge’s “on-demand liquidity” model address the challenges of the “continuously locked liquidity” approach in traditional cross-chain value transfers? What benefits does this paradigm shift bring to market makers and order takers in the DeFi ecosystem?

To answer this question, we can roughly divide bridges into two categories: regulatory and non-regulatory. It is generally believed that both types of bridges must hold assets in liquidity pools to facilitate cross-chain transfers. This is not only wrong, but also dangerous.

All non-standard bridges attempt to solve both custody and value transfer problems simultaneously, inevitably locking liquidity in smart contracts and transferring all value through their shared liquidity pools. In addition to ecosystem risks, the TVL of these bridges adds additional security assumptions to the underlying cross-chain infrastructure and creates a honeypot for hackers as the attack surface is magnified.

The liquidity pool approach also brings up sustainability issues. Classic cross-chain protocols must constantly incentivize liquidity providers in all pools, regardless of liquidity utilization, and once the incentives stop, liquidity will leave to seek higher-yielding opportunities.

Fundamentally rethink the current space and bridging issues to avoid the inefficiencies and security risks of using liquidity pool bridges.

deBridge is an asynchronous value transfer protocol that uses a new paradigm, “on-demand liquidity”, through which any cross-chain transaction can be settled natively without the need for TVL.

This eliminates the attack vector that has resulted in over $2 billion being hacked in the past 12 months, providing a fundamentally more secure, faster, more scalable, and more capital-efficient liquidity transfer protocol that brings a CEX-like user experience to cross-chain liquidity transfers.

In addition to security, deBridges performance advantages include:

Native assets (no wrapped asset risk)

Ultra-fast transactions (no need to wait for finality on the target chain)

Ultra-capital efficient (no AMM fees)

No AMM slippage or MEV

Rapidly scalable (deBridge can support new chains without running liquidity mining activities)

Deep liquidity (not limited by TVL in the target chain pool)

deBridge provides infrastructure for non-custodial spot trading markets, including all types of market participants such as users, protocols, wallets, centralized exchanges, market makers, arbitrageurs, MEV searchers, hedge funds, and OTC desks, providing a cross-chain trading and non-custodial way to monetize liquidity without the risk of locking in liquidity.

Unreplicable functionality, deBridges P2P platform

Powerful new primitives designed for advanced users and institutions

deBridge P2P enables fully non-custodial cross-chain OTC trading, enabling anyone to choose the counterparty for their cross-chain transfers.

Users and institutions can also conduct compliant cross-chain transactions, where they need to understand the source of liquidity used to complete transactions and confirm counterparties.

Through P2P, deBridge ensures that users will never lose custody of their assets in a trade or OTC transaction. This is especially helpful for traders and holders who want to sell their assets across chains to a specific counterparty trader at an agreed price without involving the liquidity pool of a CEX or DEX (anonymity).

P2P Use Cases

Institutions conduct compliant transactions with known counterparties

Anyone can conduct OTC transactions without worrying about counterparty risk, as parties never lose custody of their assets

Anyone can participate in OTC trading of any asset before it is listed on any exchange. For example, you can exchange a newly created token on Solana for an illiquid token on Arbitrum without relying on a written agreement or an OTC desk.

For privacy-oriented large transactions, users who do not want to disclose transaction data to centralized counterparties can conduct P2P on-chain transactions.

The non-custodial P2P OTC business is still a gap in other bridges, but it is a very necessary platform. Decentralized OTC is crucial to the development of DeFi because it provides a more convenient, secure and controllable path for traditional large funds and more capital to flow into the Web3 industry. This helps bridge the gap between traditional finance and the decentralized ecosystem and promotes greater liquidity and adoption of DeFi solutions.

Security Model Comparison

deBridges isolated security model:

Risk propagation prevention: deBridge adopts an isolated security model, which means that problems in one supporting chain (such as vulnerabilities or consensus issues) will not affect liquidity or integration on other chains. This isolation ensures that if a hack occurs on one chain, the impact will be contained, and only orders from the damaged chain may not be completed or require a higher premium to compensate for the increased risk.

LayerZero/Stargate’s shared security model:

Risk propagation across chains: LayerZero/Stargate uses a shared security model, and a problem on one chain may lead to a loss of liquidity on all chains because security is interconnected.

2/2 consensus mechanism: LayerZeros validation layer relies on a 2/2 consensus mechanism, which requires both the oracle and the relayer to agree. However, this setup carries the risk of collusion between the oracle and the relayer, which could undermine security.

deBridge’s validator consensus:

12 Validators with Financial Risk: Compared to LayerZero, deBridge uses a consensus model with 12 validators. These validators receive financial risk and rewards through a delegated staking and penalty mechanism, making the consensus more robust and secure.

Off-chain verification: deBridge validators sign messages off-chain, ensuring three main advantages:

Unlimited Throughput: There is no intermediate consensus layer (like a blockchain), so there is no throughput limit.

Ultimate security: Validators do not communicate with each other and do not expose their IP addresses, thus reducing the risk of attacks.

High gas efficiency: Validators do not broadcast transactions, so no gas fees are incurred, while LayerZeros gas fees are borne by the message sender.

Scalability and compatibility with non-EVM chains

Support for Solana: deBridges validation layer is designed to be easily extended to non-EVM chains such as Solana. It enables EVM smart contracts to interact seamlessly with Solana programs, while LayerZero faces challenges in this regard due to the need to modify its validation layer or wait for new Ethereum improvements (such as EIP-665) to be implemented.

Challenges of the LayerZero model:

Gas price fluctuations: LayerZero’s model requires oracles and relayers to relay proofs and broadcast transactions, exposing them to risks associated with gas price fluctuations. These costs are ultimately borne by the message sender, increasing the cost of each message.

Summarize

Compared with LayerZero/Stargate, deBridge provides a more secure, efficient and scalable cross-chain transaction solution. deBridges isolated security model prevents risk propagation, and its off-chain verification mechanism provides high throughput, enhanced security and lower costs. deBridge has also demonstrated its ability to support non-EVM chains such as Solana, while LayerZero is inferior to deBridge in terms of security and gas efficiency due to its reliance on a 2/2 consensus mechanism and a shared security model.

Protocol Activities

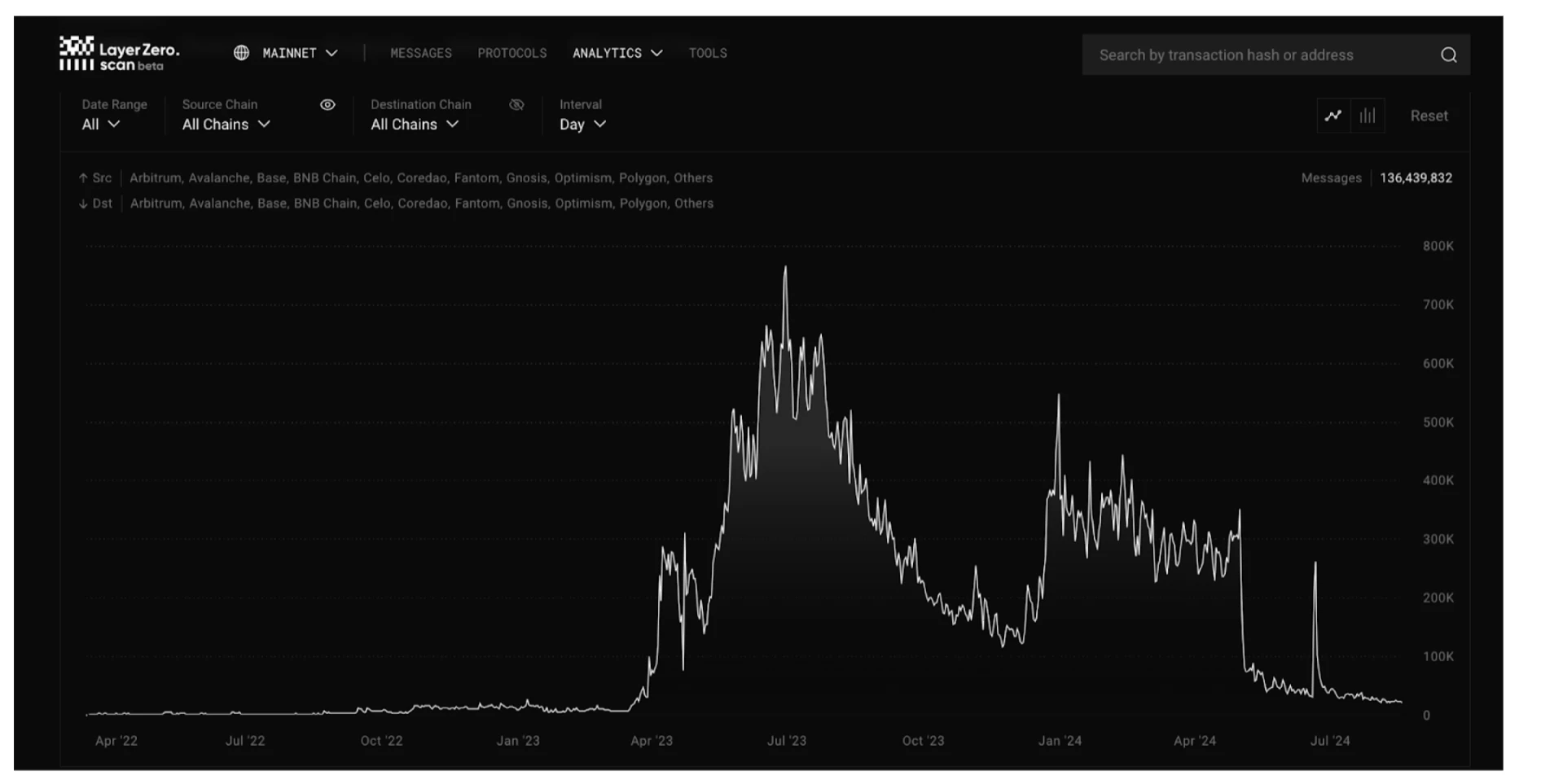

Layer Zero Protocol Activities

Data source: https://layerzeroscan.com/analytics/overview

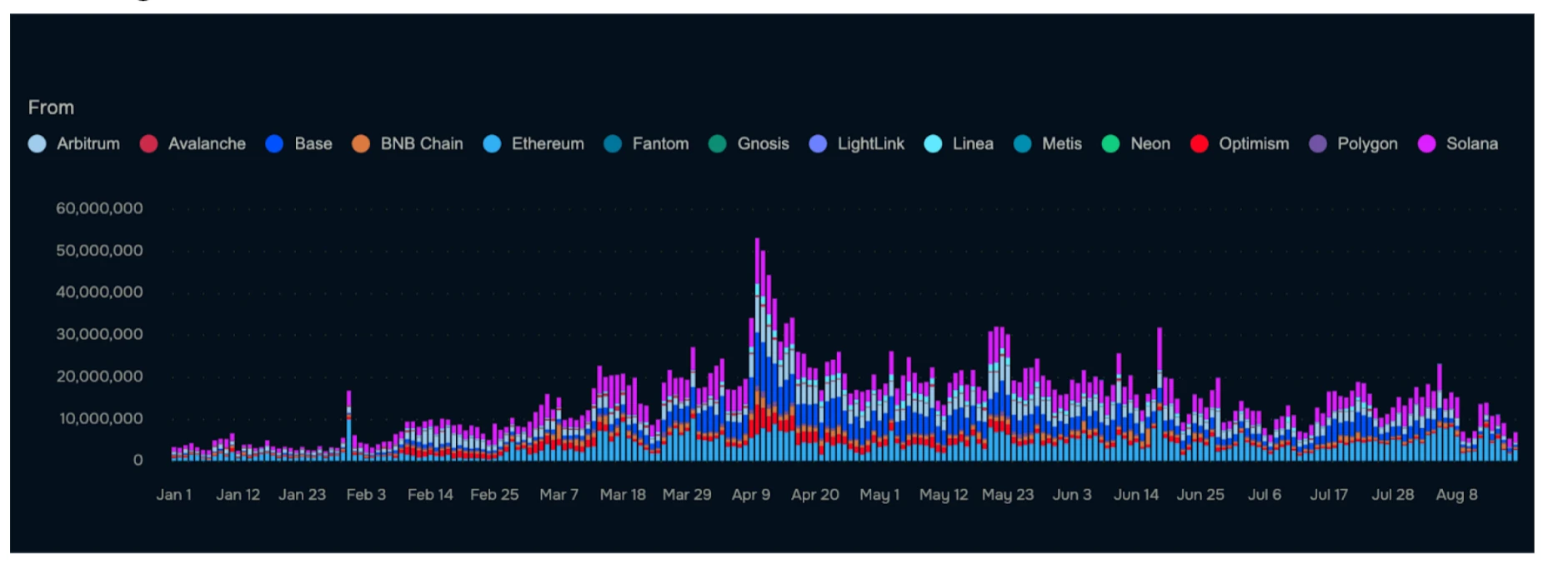

deBridge Protocol Activities

Data source: https://app.debridge.finance/analytics?start=01-01-2024end=18-08-2024

As can be seen from the chart, deBridge has maintained a stable trading volume for a long time, and the fluctuation of trading volume is relatively small when the overall market fluctuates. In contrast, LayerZeros trading activity has dropped significantly after several peaks, indicating that its trading activity may be more susceptible to market changes.

The stability of deBridge’s transaction volume means that its user base is more solid, the application scenarios of the protocol are more extensive, and its market adaptability is stronger.

Since deBridge uses a liquidity on-demand model, capital efficiency is greatly improved without the need for continuous liquidity mining incentives. This makes deBridge more sustainable in the long run. In contrast, LayerZero may need to maintain its liquidity through continuous incentives, which will lead to inefficient use of funds and may face the risk of liquidity depletion.

Cross-chain fee comparison

We all know that stable income is the cornerstone for cross-chain protocols to survive, develop and gain a foothold in the fierce market competition.

Long-term profitable products are particularly critical for bridging ecosystems and product iteration.

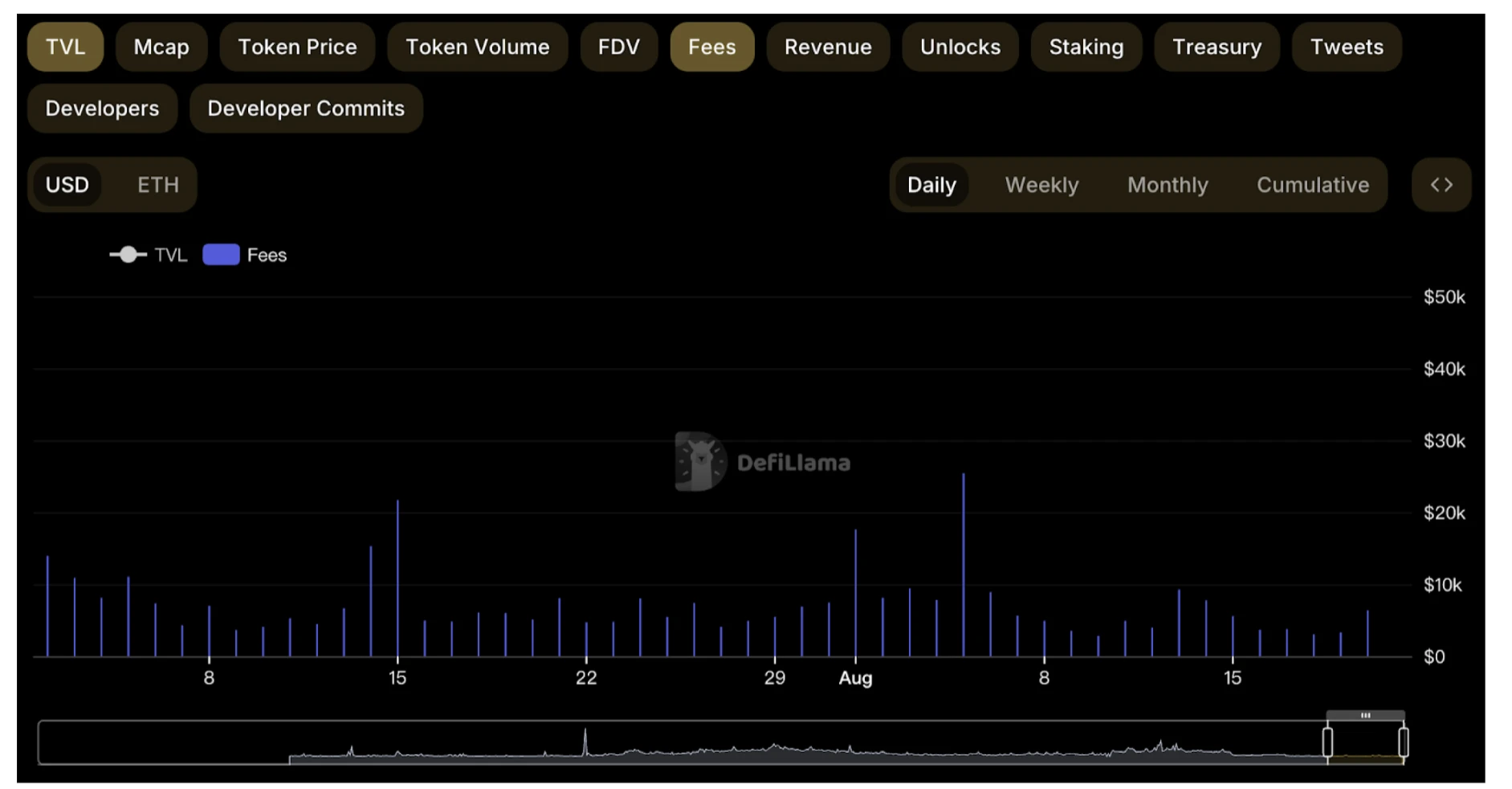

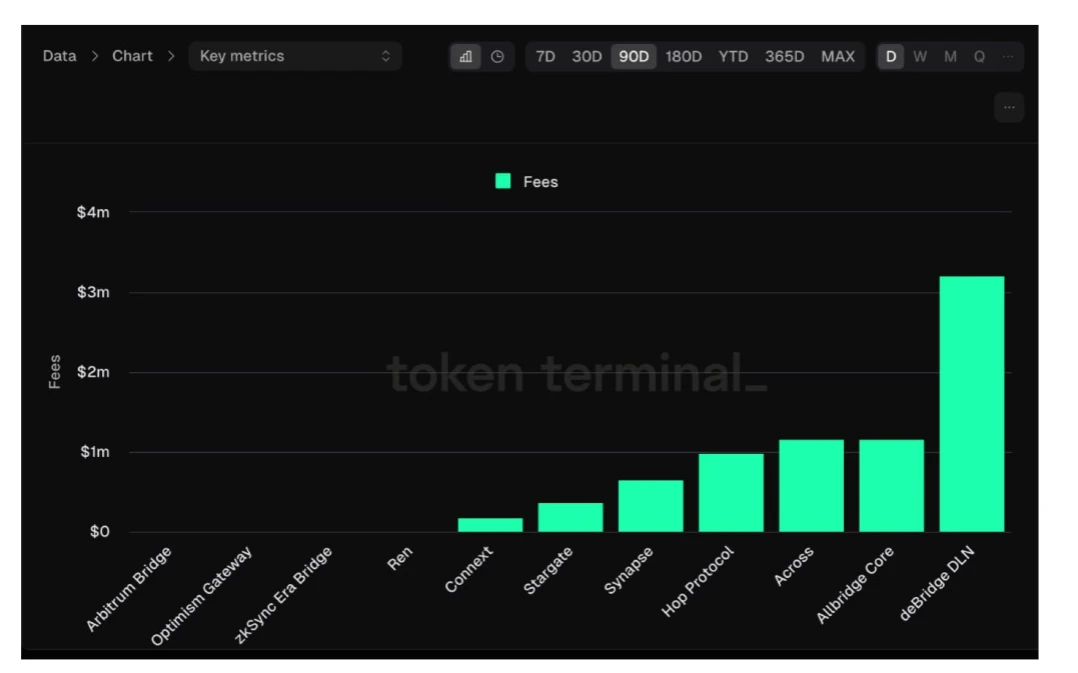

Stargate users generate cross-chain fees (60 days)

Data source: https://defillama.com/protocol/stargate-finance?fdv=truefees=true

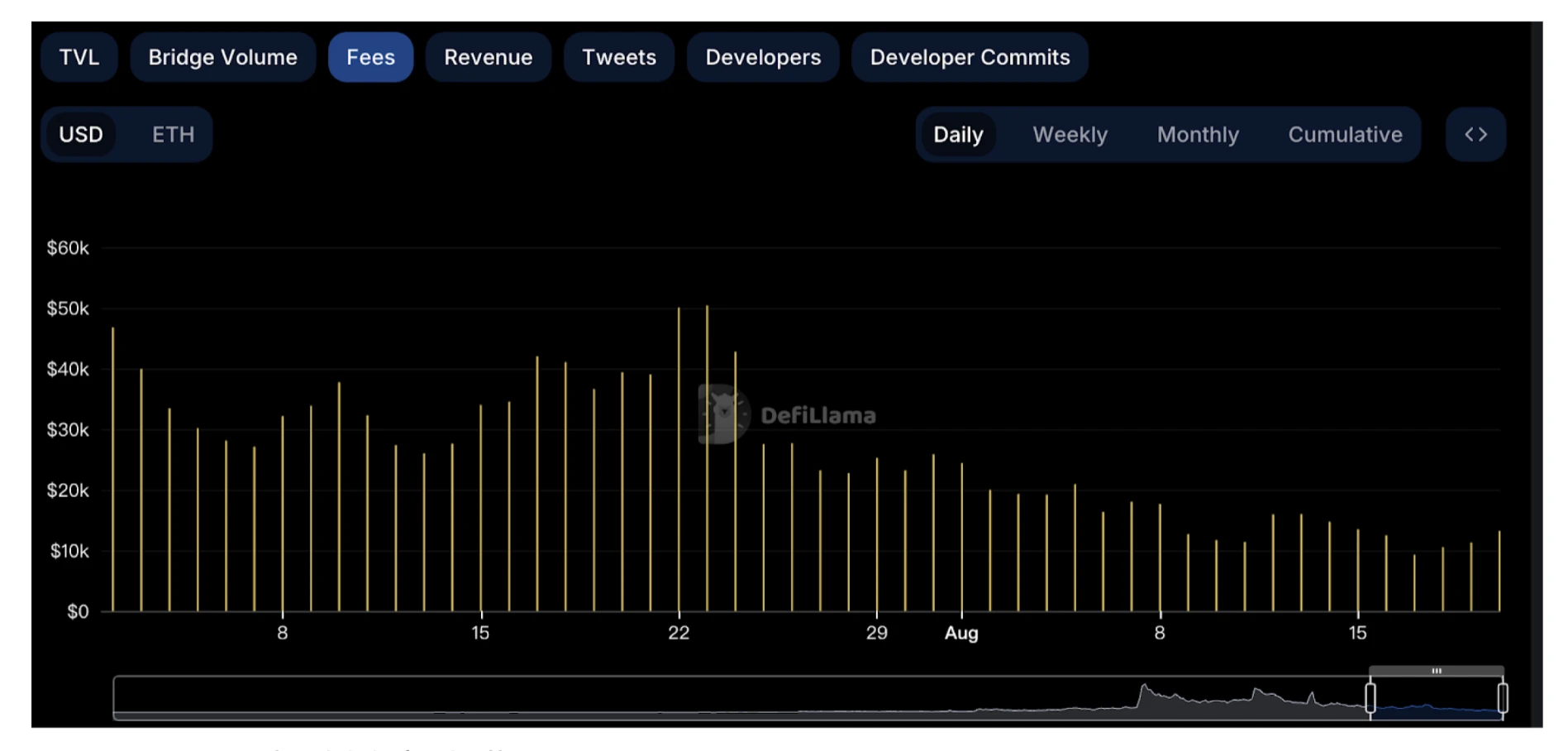

deBridge user cross-chain fees (60 days)

https://defillama.com/protocol/debridge?fees=true

It is clear from these two charts that there is a significant difference in the cross-chain fee revenue between deBridge and Stargate over the past 60 days.

deBridge: The chart shows that deBridge’s fees remain stable, and the higher average fees mean that the stability and profitability of its products are enduring.

Stargate: Stargate’s cross-chain fee income chart shows that its fees fluctuate greatly. Although there are occasional peaks, the average is lower than deBridge.

analyze:

Stability: Compared with the larger fluctuations of Stargate, deBridge shows a more stable revenue trend, indicating that its user base is more stable or has stronger risk resistance.

Potential Revenue Advantage: Although deBridges peak performance is lower than Stargates, its stable and consistent revenue could be a boon for long-term growth.

This chart shows the fee revenue of each cross-chain bridging protocol over the past 90 days, with deBridges DLN product significantly outperforming its competitors. DLNs fee revenue exceeded $3 million, far exceeding the second-ranked Altbridge Core. Other well-known protocols such as Synapse and Stargate had significantly lower revenues, highlighting DLNs dominant market position and strong growth potential in the cross-chain bridging field.

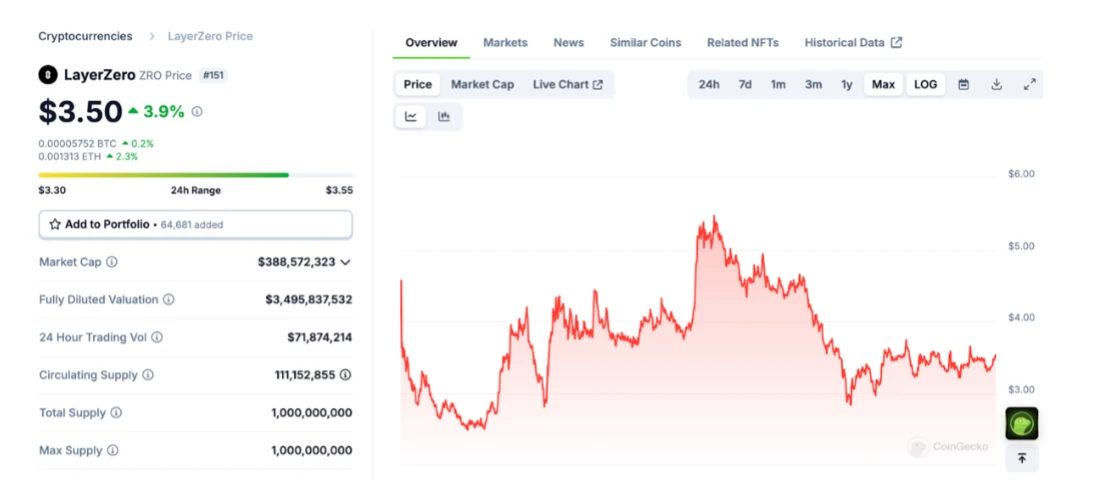

Token FDV Comparison

Layer Zero

FDV: $3,495,837,532

Total Supply: 1, 000, 000, 000

Data source: https://www.coingecko.com/en/coins/layerzero

Stargate

FDV: $324,111,490

Max Supply: 1, 000, 000, 000

Data source: https://www.coingecko.com/en/coins/stargate-finance

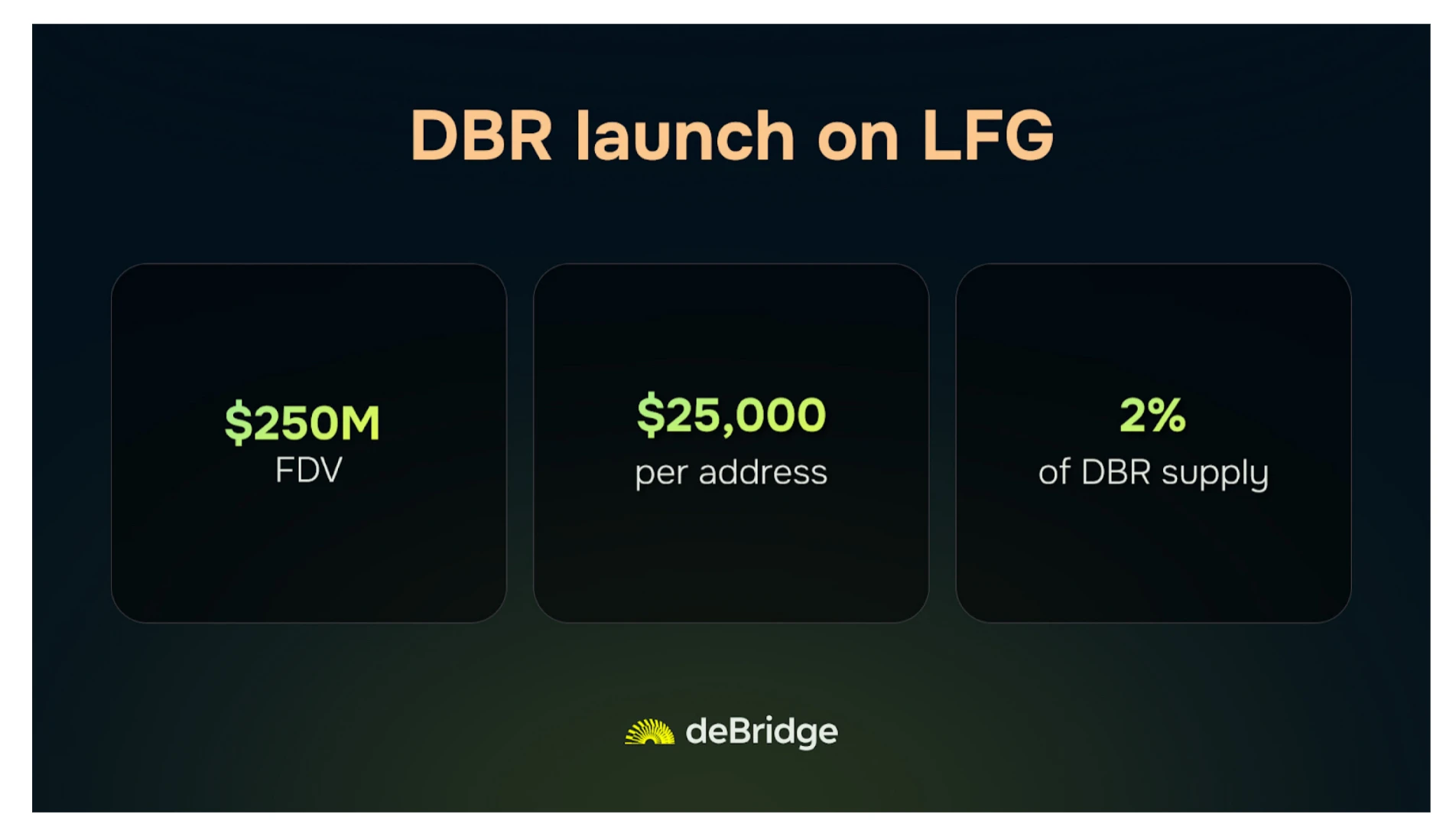

deBridge

FDV at launch: $250, 000, 000

Max Supply: 10, 000, 000, 000

Source: https://www.jupresear.ch/t/everything-you-need-to-know-about-dbr-s-launch-on-lfg/20893

LayerZero’s $ZRO token has a fully diluted valuation (FDV) of $3.4 billion, and its cross-chain product Stargate’s $STG token has an FDV of $320 million. Together, they represent a huge amount of value. However, deBridge’s $DBR token has an FDV of only $250 million, but shows superior protocol activity and stable cross-chain fee income.

It is worth noting that while LayerZero has raised $315 million through three rounds of funding, deBridge raised less than $10 million in its early stages and has not received further investment. Despite this, deBridge’s protocol revenue has reached $12 million, highlighting its lower FDV and higher intrinsic value.

When comparing the LayerZero and deBridge projects, the lower FDV highlights the advantages of deBridge:

Stability and efficiency: Despite an FDV of only $250 million, deBridge’s protocol activity and cross-chain fee revenue outperform LayerZero and Stargate, suggesting that $DBR may be undervalued and have greater growth potential.

Prudent Fundraising: deBridge raised less than $10 million initially, demonstrating its efficiency and autonomy, avoiding the risk of price drops due to the release of a large number of tokens.

Revenue Performance: With protocol revenues reaching $12M, $DBR’s actual market value is more attractive.

deBridges unique approach emphasizes efficiency and value creation over high valuations. Unlike LayerZero, which raised a large amount of funding and has a high FDV, deBridge has only raised less than $10 million. This streamlined funding model has enabled deBridge to build a stable and efficient protocol that outperforms its peers in terms of activity and revenue. Despite an FDV of only $250 million, deBridges strong revenue and controlled token supply highlight the intrinsic value of its $DBR token, indicating significant long-term growth potential.

The deBridge protocol has achieved an impressive revenue milestone with a small amount of funding, highlighting the inherent strength of the project. As more users and developers recognize the embedded value of deBridge, its market position is expected to improve, providing greater investment return potential compared to other capital-excess projects. This makes $DBR a high-potential asset with considerable room for appreciation in the secondary market.