Can the man behind TRB’s surge help its price continue to soar? Can I still buy TRB? This article provides you with an in-depth analysis of TRB’s price trends. do not miss it!

TL;DR

TRBs surge in September was mainly due to the whale pull; the rise in mid-October was due to macro market sentiment.

The Tellor protocol itself has no obvious highlights. Its token price is not directly proportional to the development of the project. The overall value is overvalued and the bubble is large.

There are currently three whale addresses controlling approximately 25.7% of the total supply of TRB, worth over $65.3 million.

The price of TRB is likely to continue climbing to $110-130 in the short term. But a plunge due to whale liquidation could happen at any time.

What is Tellor?

TellorIt is a decentralized oracle protocol. Its main service content is to provide users with access to off-chain data outside the Ethereum network (such as API or transaction data on the Polygon chain).

Tellor aims to solve the currentEthereumThe problem of network information isolation. It creates an independent in-network data system. Users can request data from the system through contracts. After receiving the request, Tellor will query and correlate relevant data within the system based on the users different needs.

At the same time, Tellor allows data submission. The submitter will receive TRB as a reward, but needs to pay Gas fees and pledge TRB to ensure the accuracy of the submitted data.

TRB

TRB is Tellors native utility token, which is mainly used to motivate users within the network to submit data. TRB has no fixed supply and its total supply increases with rewards for submitting data.

According to Tellor, users who provide data to the system can receive TRB as a reward. But before that, users need to pledge a certain amount of TRB to guarantee the validity of the data.

In addition, TRB is also used in Tellor’s dispute mechanism. When the accuracy of the data is challenged, TRB will be used for voting arbitration. Only if the arbitration is successful, the user will receive the reward. At the same time, TRB is also used for the upgrade management of the Tellor protocol.

Analysis of the causes of TRB surge

initial starting point

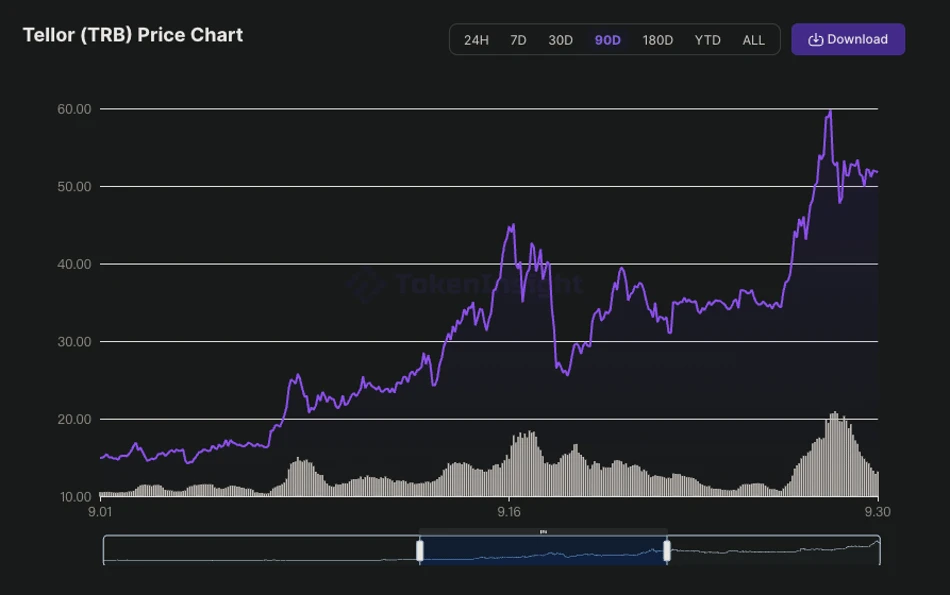

TRB’s initial surge began in September 2023. According to TokenInsight data, the price of TRB began to rise significantly on September 7, soaring from more than a dozen US dollars to a maximum of 45 US dollars within a week, and finally exceeded 60 US dollars at the end of September, with a single-month increase of 275%.

TRB price trend in September

So what caused TRB to skyrocket?

According to our research, the main reason for TRBs sharp rise in September was the whales pull.

fromEtherscanAccording to the data, the address currently holding the most TRB is:0xCcE7300829f49B8f2E4AEe6123b12DA64662a8b8. It is worth noting that this address is an anonymous address and there is no evidence that it belongs to any exchange or institutional entity.

Since August 30, the whale has accumulated approximately 441,813 TRB, which is equivalent to approximately 41.44 million US dollars (calculated based on the Oct. 25 TRB price), accounting for 17.39% of the current total supply of TRB.

In fact, this address has been the address holding the largest number of TRB since September. According to on-chain transaction records, the address conducted a series of suspected pull-and-pull transactions in September, which directly led to the rocketing rise in TRB prices.

Next, let’s take a look at the specific trading operations of this account in September:

From August 30th to September 13thBinanceandOKXThe exchange transferred TRB multiple times, totaling 755,350, accounting for approximately 30% of the total supply of TRB.

From August 31st to September 3rd, TRB was transferred out to anonymous addresses in 8 times.0x50Cbc6faeEE68FB63e0A3c8ac8Cda8A8505c960B, a total of approximately 213,538.

On September 15th, first transfer 100,000 TRB to the Binance address0x04D8626775e95CecB44DCa386027def00Aa45C62; and then transferred 99, 999 TRB from Binance.

Most of the TRB in the 0x 50 C...60 B address has been transferred out. On September 4th, 5th and 15th, the TRB in this address was transferred back to Binance address 0x 04 D...C 62 three times, totaling 331,825 TRB.

It can be seen from these trading operations that there is a high probability that the whales behavior is to promote TRB. Through self-buying and self-selling, multiple transactions with huge trading volume successfully caused the price of TRB to nearly quadruple from a dozen dollars. Since TRBs market value was low at the time, the impact of the whales pull on its price was quite obvious.

second rise

TRB price trend from September to October

TRBs price stabilized at $45-50 in early October after an initial surge. Then, subject to a series ofBitcoin Spot ETFAffected by the news, the sentiment of the entire crypto market continued to rise, forming a small bull market. The price of TRB has also risen, rising from US$50 to a maximum of US$95 between October 15th and 25th, an increase of approximately 90%. Compared with the markets average rise of 20-30%, TRB has become one of the clear biggest beneficiaries of this bull market triggered by market sentiment.

The future of TRB

As investors, I believe the most curious question for everyone is how the price of TRB will develop next. Is there room for TRB prices to grow? Is there any risk of a plunge in the short term?

Let’s talk about the conclusion first. The price of TRB will most likely follow the market sentiment in the short term, and may even continue to rise to $110-130. However, a plunge due to whale liquidation can happen at any time. Therefore, we recommend investors to consider carefully when trading TRB and avoid holding large amounts of TRB for a long time to reduce potential risks.

Specific analysis

First of all, excluding the two factors of macro market and giant whale pull, if you only consider the project itself, the Tellor protocol is essentially one of the many decentralized oracle protocols in the market, without any obvious highlights. Like utility Dapp-type projects, the growth of its token value is directly linked to the development of the project itself.

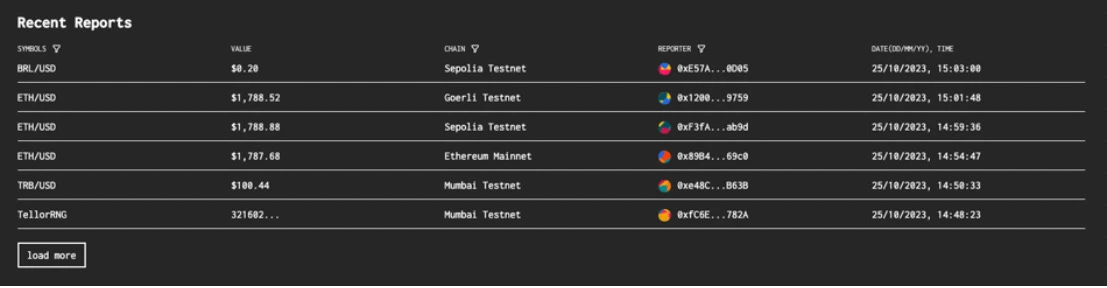

Judging from the current usage of the Tellor protocol, due to the current popularity, the average daily number of users submitting data to the Tellor system is 200-300. However, very few users receive rewards.

For example, only 4 users who submitted data on October 24 received TRB rewards.

Tellor data submission statistics interface

According to the token economy released by Tellor, the issuance of TRB is linked to data submission rewards. Therefore, judging from the current situation, the total supply of TRB is growing relatively slowly, and its price will not suddenly drop due to a large number of additional issuances.

So what are the factors that will have a major impact on TRB prices? The answer is obvious, whales holding TRB.

In addition to the whale mentioned above, which ranks first in the TRB Top Holder List (it holds 17.39% of the current total supply of TRB), there are two anonymous addresses that currently hold a large amount of TRB.

The address was transferred from Coinbase to TRB multiple times between September 8 and 25, totaling approximately 111,892, worth US$9.85 million. Currently ranked third on the TRB Top Holder List, holdings account for approximately 4.4% of the total supply of TRB.

This address has been transferred from Binance to TRB multiple times since October 20, totaling approximately 85,805 and worth US$7.5 million. Currently ranked sixth on the TRB Top Holder List, holdings account for approximately 3.4% of the total supply of TRB.

According to statistics, these three whale addresses control a total of TRB close to 25.7% of the total supply. At current market prices, the holding is worth more than $65.3 million.

Since TRBs current circulation is low, its price is more susceptible to manipulation by whales. Whether they are pulling orders or liquidating, these whales will have a significant impact on the price of TRB. Judging from the current upward trend of TRB, it is very likely that these giant whales will suddenly liquidate their assets one day. This could cause a sudden plunge in TRB price, causing an overall collapse.