LD Capital: STORJ funding update

1. Project Introduction

Storj is an open source decentralized cloud storage network. Its main goal is to provide censorship-resistant, secure, and cheap storage services, mainly for enterprise-level customers. The Storj network is characterized by the introduction of a satellite role to connect users and storage nodes and act as a coordinator in the network. Storjs technical architecture mainly revolves around data storage, data retrieval, and data repair. It also designs data auditing and reputation management for satellites and storage nodes. In terms of storage technology, Storj uses erasure coding to ensure file integrity, and uses satellites to manage and track data location and data auditing. Storage services can be paid using their tokens.

2. Funding situation

According to Coinmarketcap, the total supply of STORJ tokens is 425 million, and the circulating supply is approximately 371 million, accounting for 87.29% of the total supply. The remaining circulating tokens are mainly concentrated in the hands of the team.

spot data

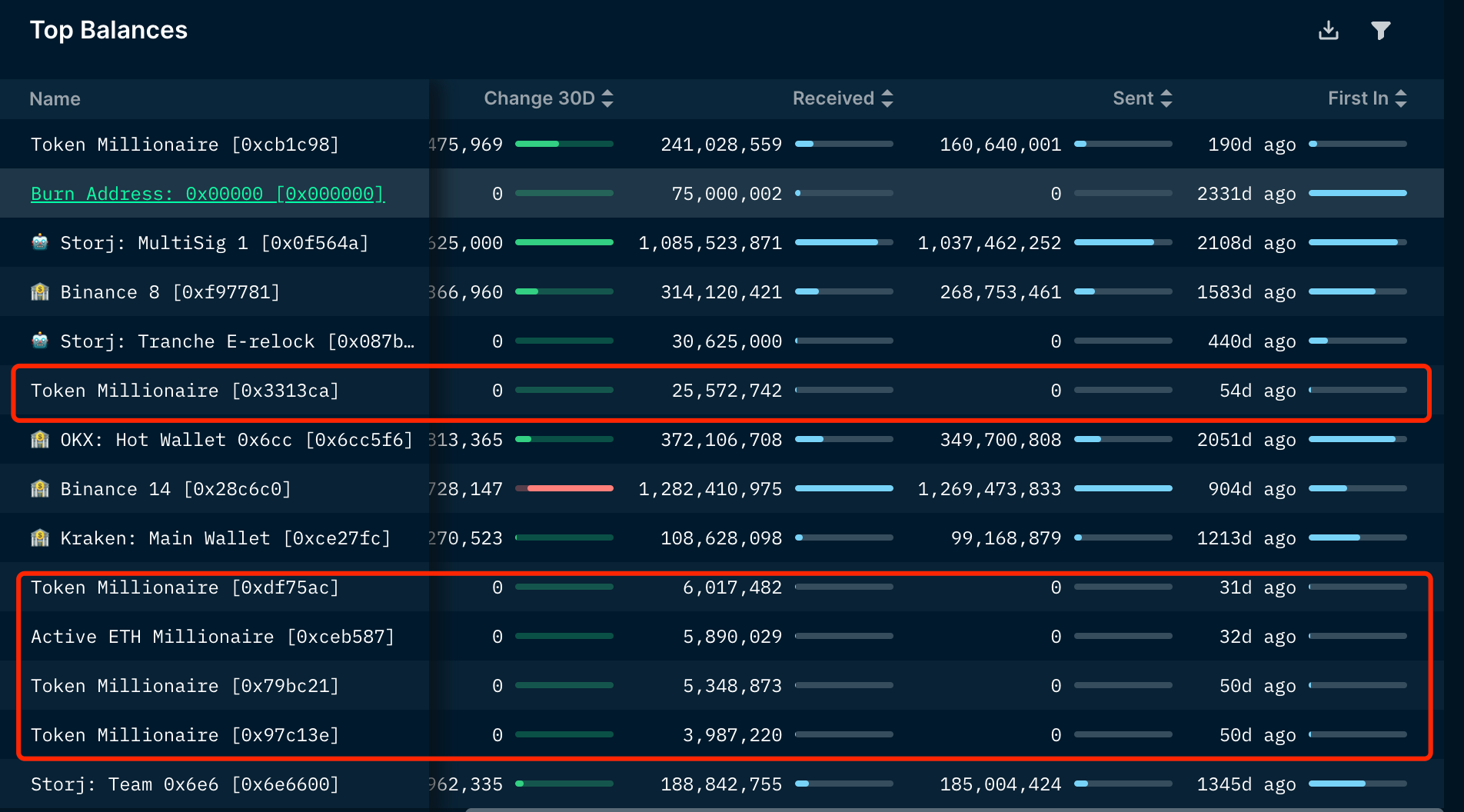

The top 10 token holdings account for 66.96% of the total token supply. Among them, upbit holds 18.91% of the currency, ranking first in currency holdings; team multi-signature and time lock addresses hold a total of 18.5% of the currency; other exchanges hold 20.65% of the currency; large households hold 8.80% of the currency.

According to historical tracking, there are multiple newly created addresses among the top 50 currency holding addresses that have continued to withdraw large amounts of currency from the exchange in the past 60 days, and the amount of tokens held accounts for 10.7% of the total.

Source: nansen, LD research

Judging from the weekly K cycle, STORJ has broken through this years price high and bottom ranges. The average price of intensive transactions at the bottom is US$0.5353, and the chips above are evenly distributed.

STORJ’s trading volume on Binance in the past 24 hours was $84 million, accounting for 32% of the circulating market capitalization. Judging from the current Binance spot orders, the main orders are concentrated in the market, and the upper and lower funds are relatively evenly distributed. The price of large orders below is concentrated at $0.6, and the resistance for short-term large orders above may be concentrated at $0.75. (You need to be wary of market price selling and the withdrawal of orders placed at the bottom.)

Contract data

It can be seen from the STORJ 1-day level K-line data that STORJ active buy orders began to increase on September 9, and the price rose accordingly. Since October 10th, STORJ has been consolidating for one month without increasing volume. We believe that the main force still exists during this period. STORJs active buying volume increased rapidly on November 9, driving the price to rise rapidly and break through the long-term consolidation range. At the same time, as the long-short ratio of large investors positions increased, the long-short ratio of all accounts decreased, and large investors and retail investors formed rival orders.

Summary: As the overall market sentiment is improving, the market as a whole is in a bullish trend. In the last wave of market conditions, STORJs main spot withdrawals were from the exchange to cooperate with the opening of contract positions to complete a wave of gains. During the consolidation range in October, there was no spot selling behavior, and there was no increase in heavy-volume selling at the contract level. Therefore, the current increase may be completed by the same group of main funds. It should be noted that the team holds a large number of tokens and is constantly selling tokens in small amounts.