Original author: Steven, Dongzhen@zhendon g20 20

Preface

During this period, the market has been repeatedly pulling around the Bitcoin spot ETF. The price of Bitcoin has reached its highest point since the bear market in May 2022. It just happened that a few days ago it was the 15th anniversary of the Bitcoin white paper. Let’s briefly review Bitcoin. The recent situation of spot ETFs.

Many people compare Bitcoin to digital gold. Some people also find that every time something good comes out, even if it turns out to be a rumor, Bitcoin has increased after the fluctuation. On the contrary, everyone in the currency circle is looking forward to future gossip about Bitcoin.

Why are spot ETFs so important for BTC? Will the adoption of Bitcoin Spot ETF usher in a prosperous era for the cryptocurrency industry? How did the market develop subsequently when the Bitcoin Futures ETF was passed? How to judge market sentiment?

Note: Some of the introductions to concepts, KOL opinions, etc. are quoted from other articles, and the sources have been indicated.

1. Overview of the recent Bitcoin ETF timeline

1.1 Background introduction - The plot of Bitcoin futures ran out of profits and mad cows fell into deep bears has been staged twice

As early as July 2013 (when Ethereum didnt even exist), Cameron Winklevoss and Tyler Winklevoss applied for a Bitcoin ETF.

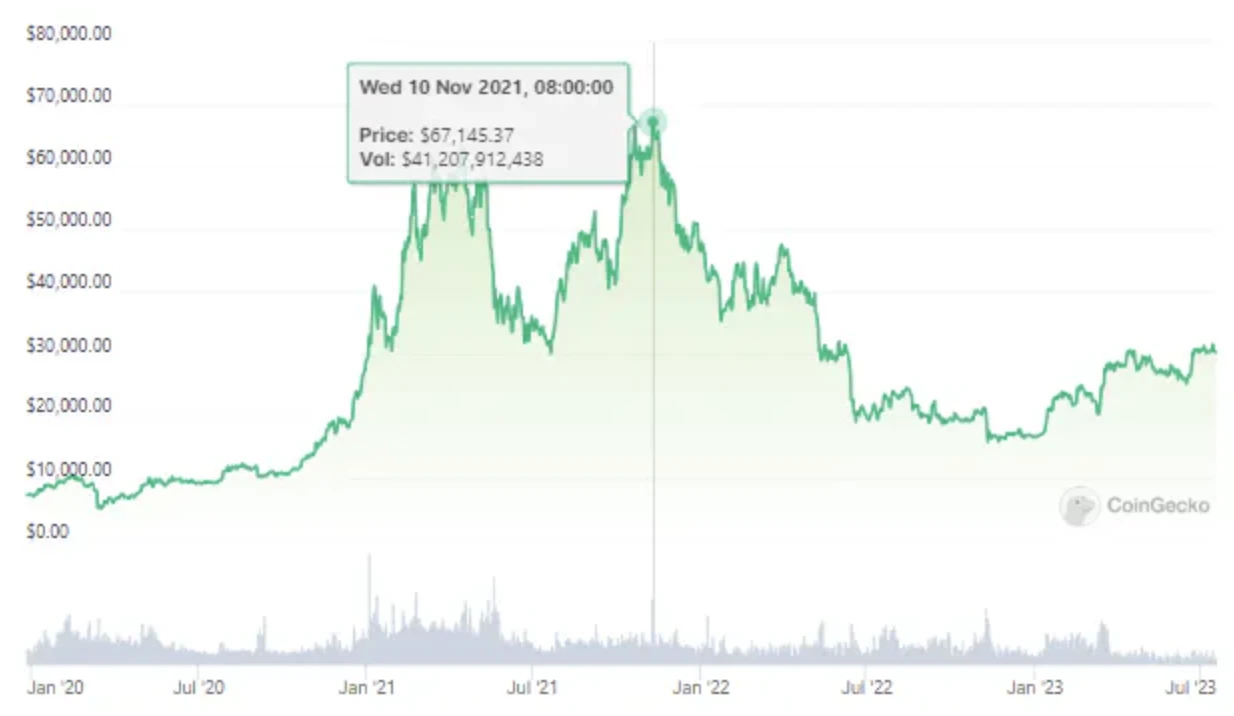

After the outbreak of the COVID-19 epidemic in 2020 and 2021, in order to alleviate the economic recession, central banks of various countries implemented unprecedented scale interest rate cuts and water releases, triggering hot money flows into various risky assets, including several waves of explosive growth in the crypto market.

At 9:30 on October 19, 2021, Eastern Time, the first Bitcoin futures ETF-ProShares Bitcoin Futures ETF was officially launched on the New York Stock Exchange High Growth Market (NYSE Arca, the second largest electronic stock exchange in the United States, specifically Engaged in the listing business of ETF, ETN and ETV.) Listed under the code BITO. The opening price on the first day was US$40.89, and the trading volume in the first 20 minutes was as high as US$280 million, making it one of the top 15 first-day offerings in history. The final closing price on the first day was US$41.94, a 4.9% increase from the opening NAV. Bitcoin price breaks through $62,000. According to Bloomberg data, more than 24 million units of the ETF changed hands, and the total trading volume on the first day was close to US$1 billion. This size was second only to BlackRock’s carbon neutral ETF and became the second highest first-day trading volume in history.

Driven by market sentiment, Bitcoin rushed to its highest price in history in November 2021, once exceeding $69,000, breaking through the highest price before 5.19 (around $63,000).

https://www.coingecko.com/en/coins/bitcoin

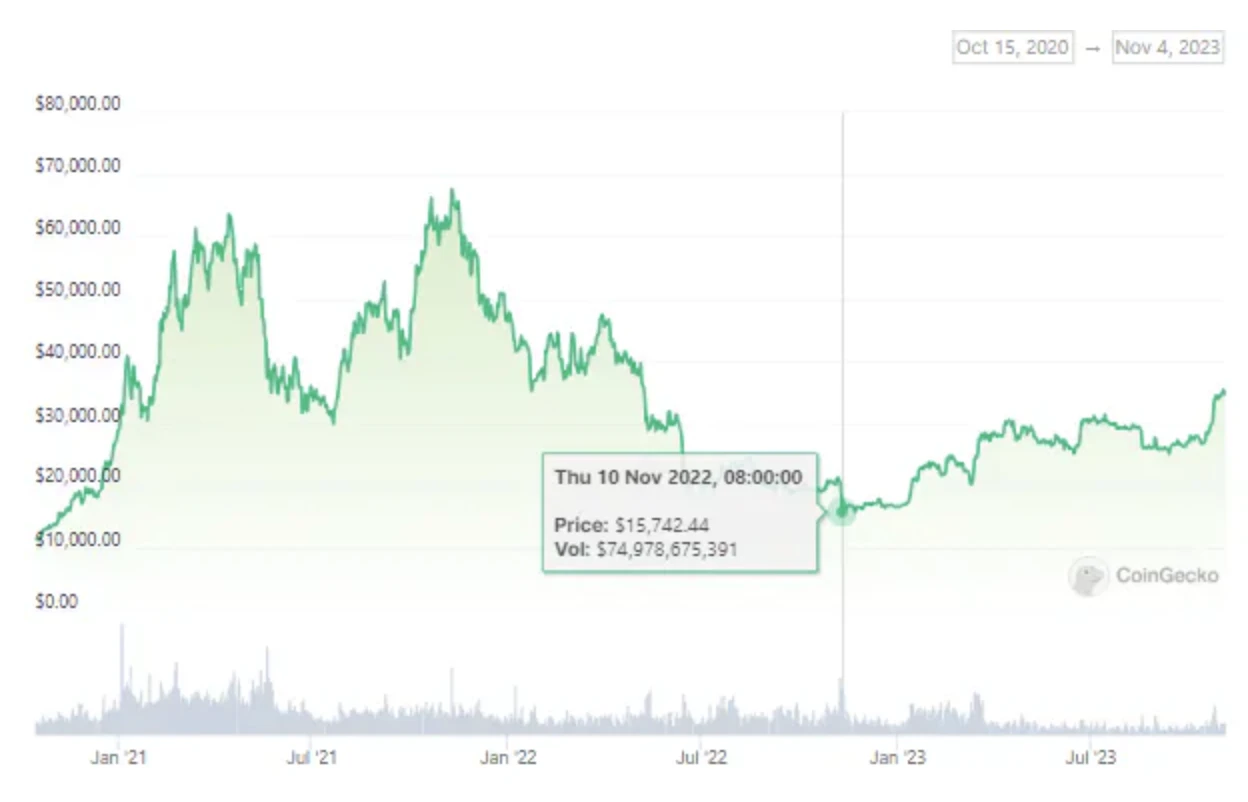

However, the prosperity of the crypto market did not last. There was no time to relax, and the bear market came instantly. At the beginning of 2022, the Federal Reserve began to raise interest rates in order to curb economic overheating. The Russia-Ukraine war that broke out in February became a catalyst, accelerating inflation in Western forces. Central banks of various countries continued to raise interest rates. The crypto market and even the entire macro economy ushered in a long bear market. The entire currency circle, led by Bitcoin, has plummeted. The market value of cryptocurrency has gone from a high of US$3 trillion at the end of 2021 to a low of over US$846 billion in December 2022. The price of Bitcoin once fell by US$16,000 in November 2022. .

https://www.coingecko.com/en/coins/bitcoin

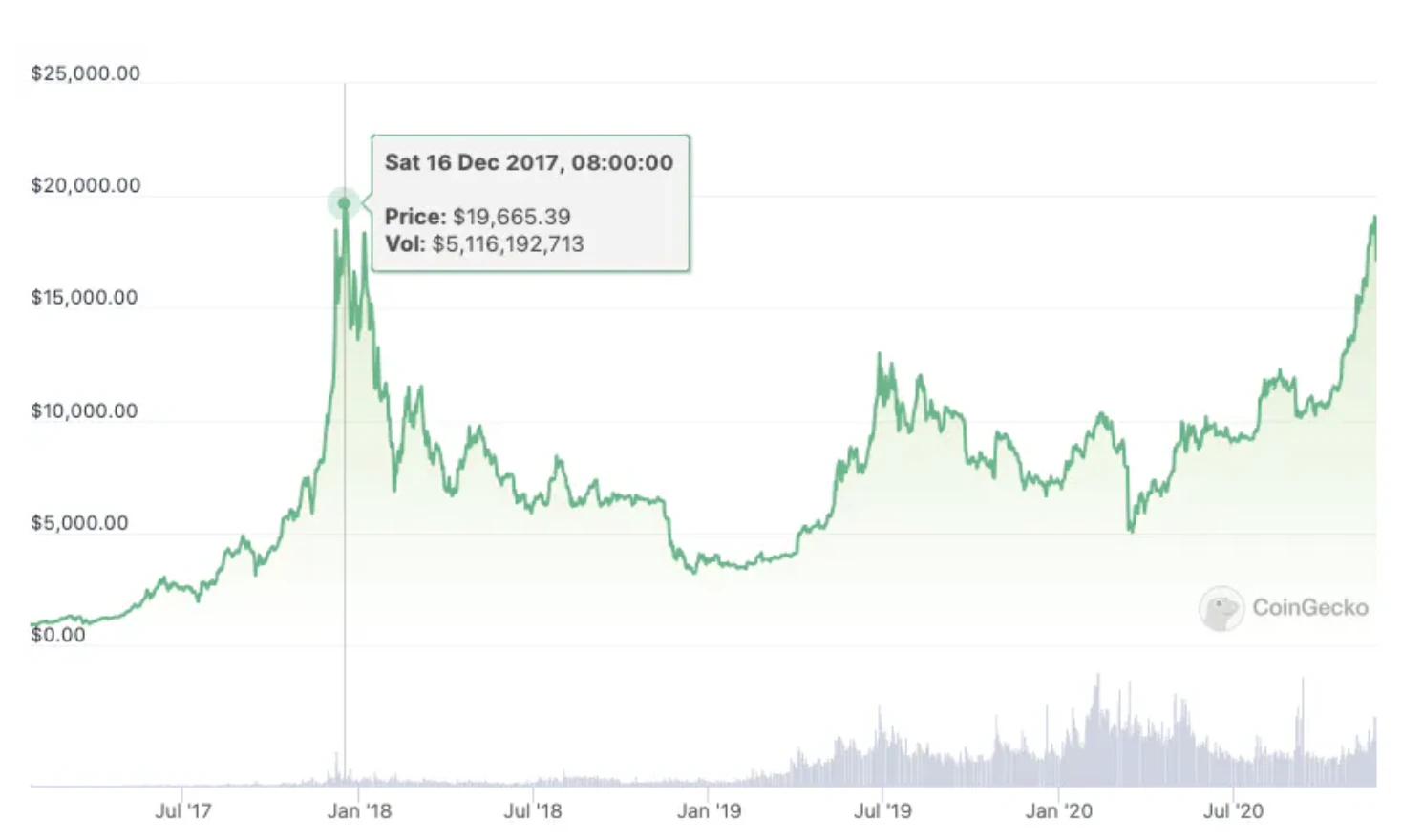

This is not the first time that the story of the approval of compliant Bitcoin futures-related products, the impact of Bitcoin prices on ATH, and the entry into a bear market after all the good news has been staged. The last time was the launch of ATH and compliant Bitcoin futures at the end of 2017.

On December 11, 2017, the Chicago Board Options Exchange (CBOE) launched Bitcoin futures for trading, with the stock code XBT. A week later, on December 18, the Chicago Mercantile Exchange (CME) launched Bitcoin futures. The $19,665.39 reached on December 16, 2017, was within the week when CBOE and CME launched Bitcoin futures. It did not return to this price until the end of December 2020 three years later. The lowest price of Bitcoin in the bear market once fell to $3000.

https://www.coingecko.com/en/coins/bitcoin

Against the background of the bear market and the repeated defeats of Bitcoin spot ETFs, on June 15, 2023, BlackRock, one of the worlds largest asset management groups, submitted a submission to the U.S. Securities and Exchange Commission through its subsidiary iShares. File application for spot Bitcoin ETF. According to the application documents, the ETF is named iShares Bitcoin Trust and its assets consist primarily of Bitcoin held on behalf of the trusts custodian. Since the “custodian” of the collaboration was not disclosed at the time, feedback provided by U.S. securities regulators to spot Bitcoin ETF applicants reportedly stated that the filing was “inadequate” without monitoring the names of partners in the sharing agreement. ”, and surveillance sharing protocols are supposed to help prevent market manipulation (perhaps none except Binance can prevent market manipulation). Following previous SEC rulings, sponsors of Bitcoin trusts must enter into oversight-sharing agreements with larger regulated markets to obtain regulatory approval.approve。

On July 4, Nasdaq resubmitted the BlackRock Bitcoin ETF listing application and disclosed that the custodian was implemented through the cryptocurrency trading platform Coinbase.

BlackRock, Vanguard Group, and State Street were once known as the Big Three and controlled the entire index fund industry in the United States. In addition, BlackRock submitted 576 ETF applications, approved 575 times, and only one was not approved. Therefore, BlackRock submitted a spot Bitcoin ETF document application to the U.S. Securities and Exchange Commission, which caused a lot of heated discussion in the community. Bitcoin prices briefly exceeded $30,000 that day.

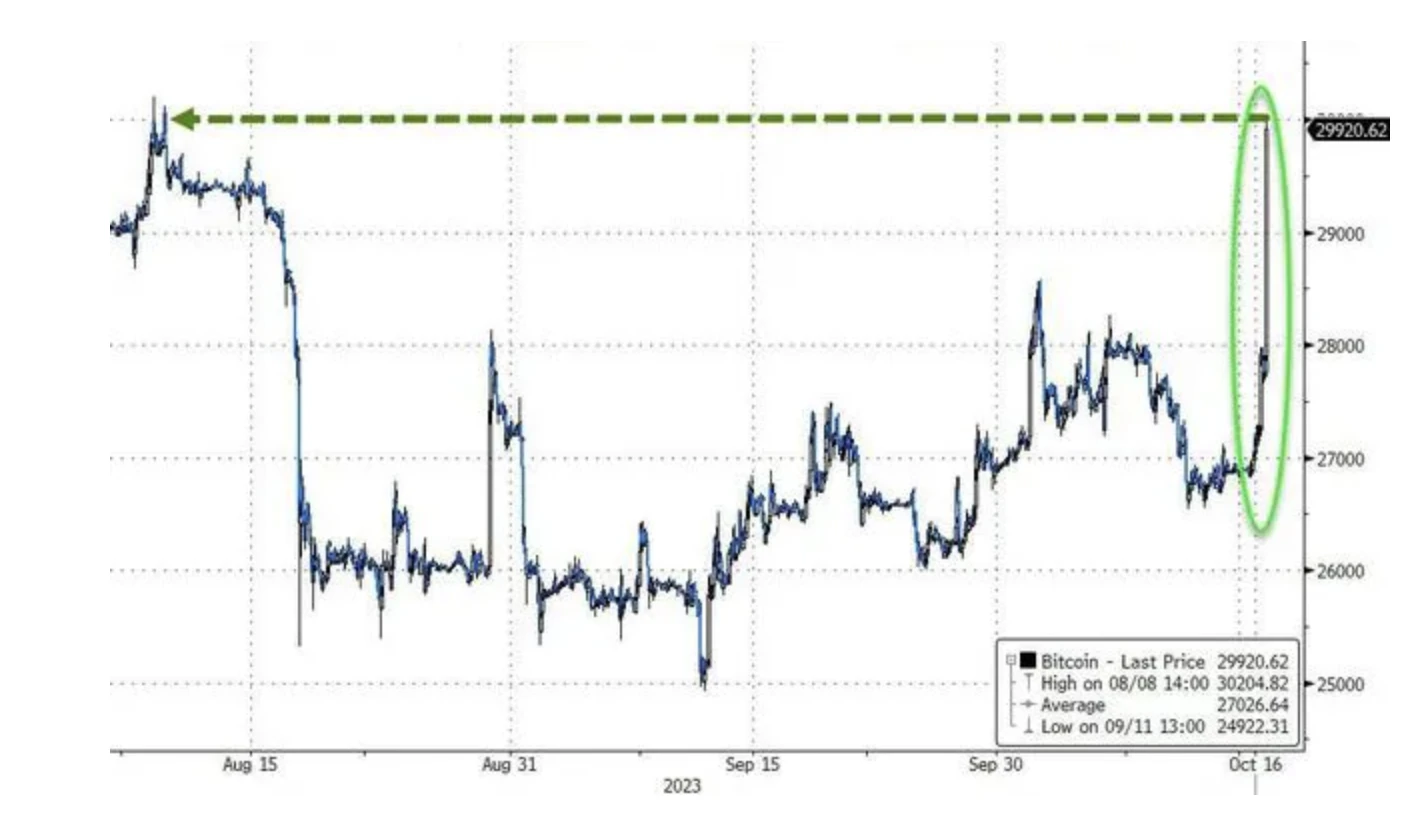

Then October 16th came in a blink of an eye.

1.1 October 16th - I traveled through the bull and bear in one hour

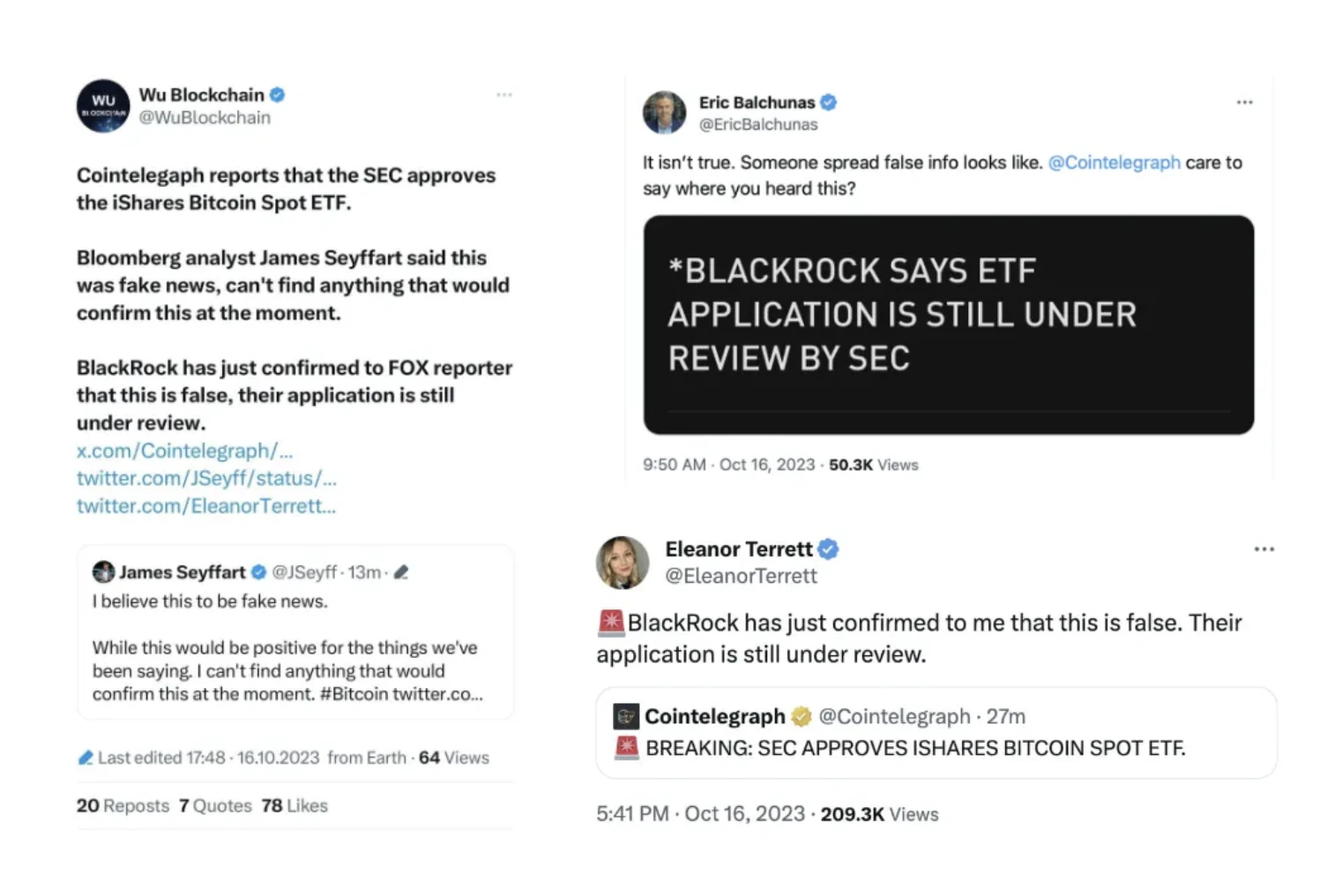

Beijing time, 21:21, according to the well-known encryption media Cointelegraph, the U.S. Securities and Exchange Commission has approved BlackRock’s iShares Bitcoin Spot ETF.

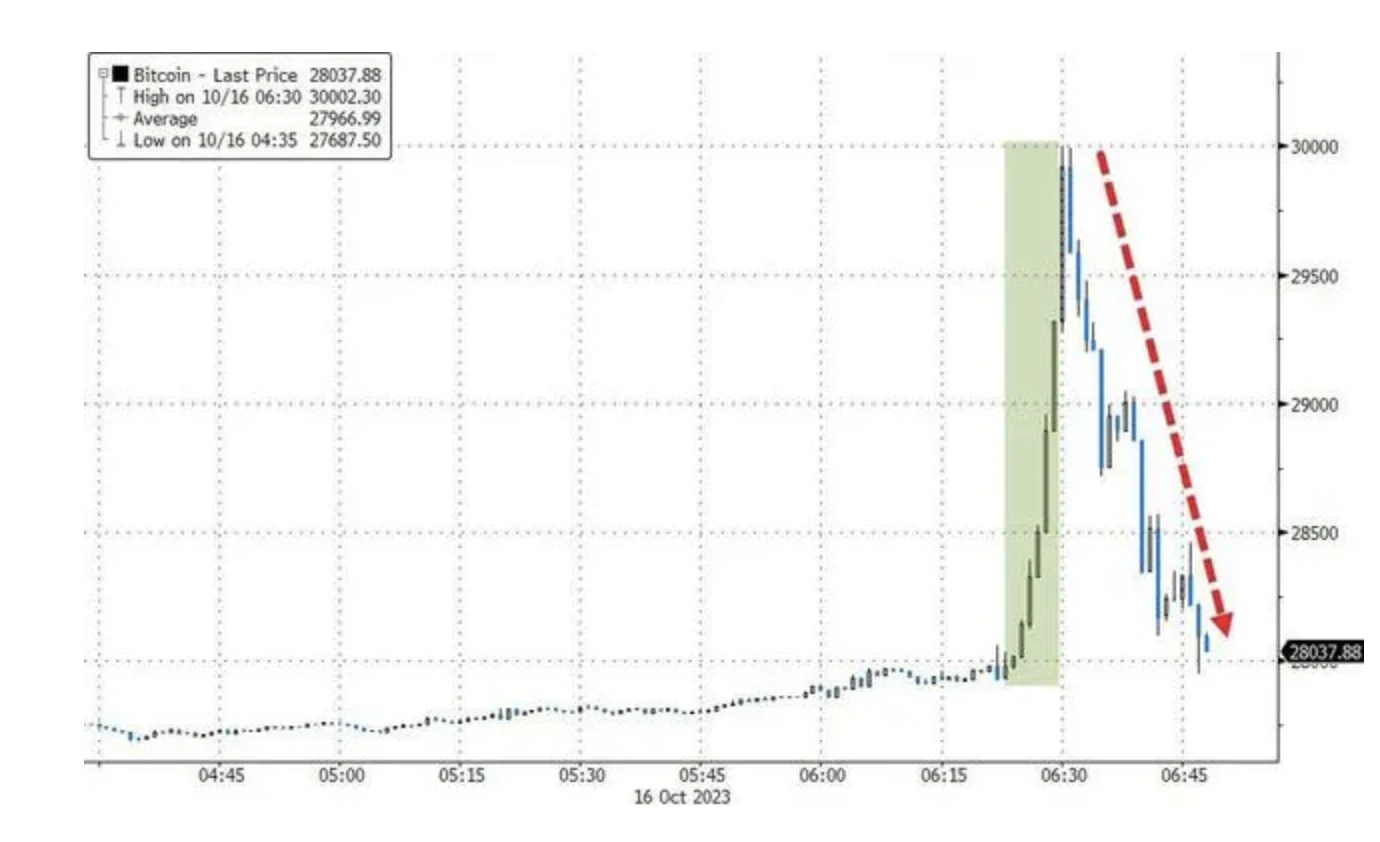

In less than half an hour, Bitcoin went from below $28,000 to above $30,000, breaking through the $30,000 mark for the first time in two months.

Soon, Bloomberg ETF analyst James Setffart questioned the authenticity of this news. Shortly after the U.S. stock market opened, well-known Forbes reporter Eleanor Terrett and Bloomberg ETF analyst Eric Balchunas both tweeted that BlackRock informed the ETF that it was still under review.

The news was eventually refuted by many parties. According to Bloomberg terminal information, BlackRock stated that its Bitcoin spot ETF application is still under review by the U.S. Securities and Exchange Commission.

This comes less than half an hour after Cointelegraph tweeted this news.

The price of Bitcoin plunged rapidly. Within half an hour, it fell from over US$30,000 to below US$28,000 with the same momentum, fell to more than US$2,000, a drop of more than 7%, and finally regained US$28,000, with an increase of less than 5% in the last 24 hours. .

The farce ended with an apology from Cointelegraph.

In just 10 minutes, nearly $100 million was paid for CoinTelegraph’s “own news”, with short positions liquidated at $72 million and long orders liquidated at $26 million.

Related Reading:A piece of fake news worth $100 million that could go down in history》

1.3 October 24th - DTCC also comes to trade? Crossing bull market again in less than two weeks

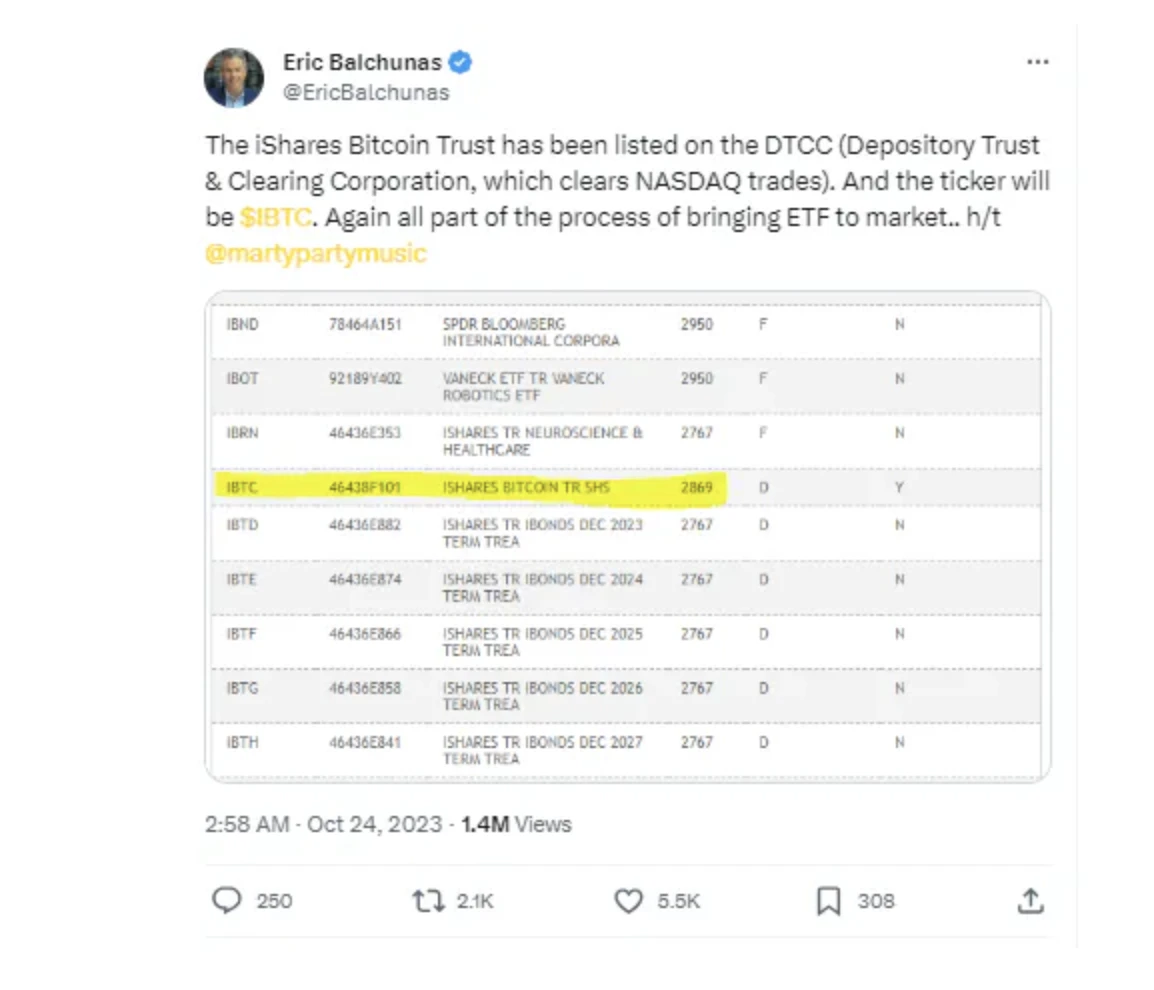

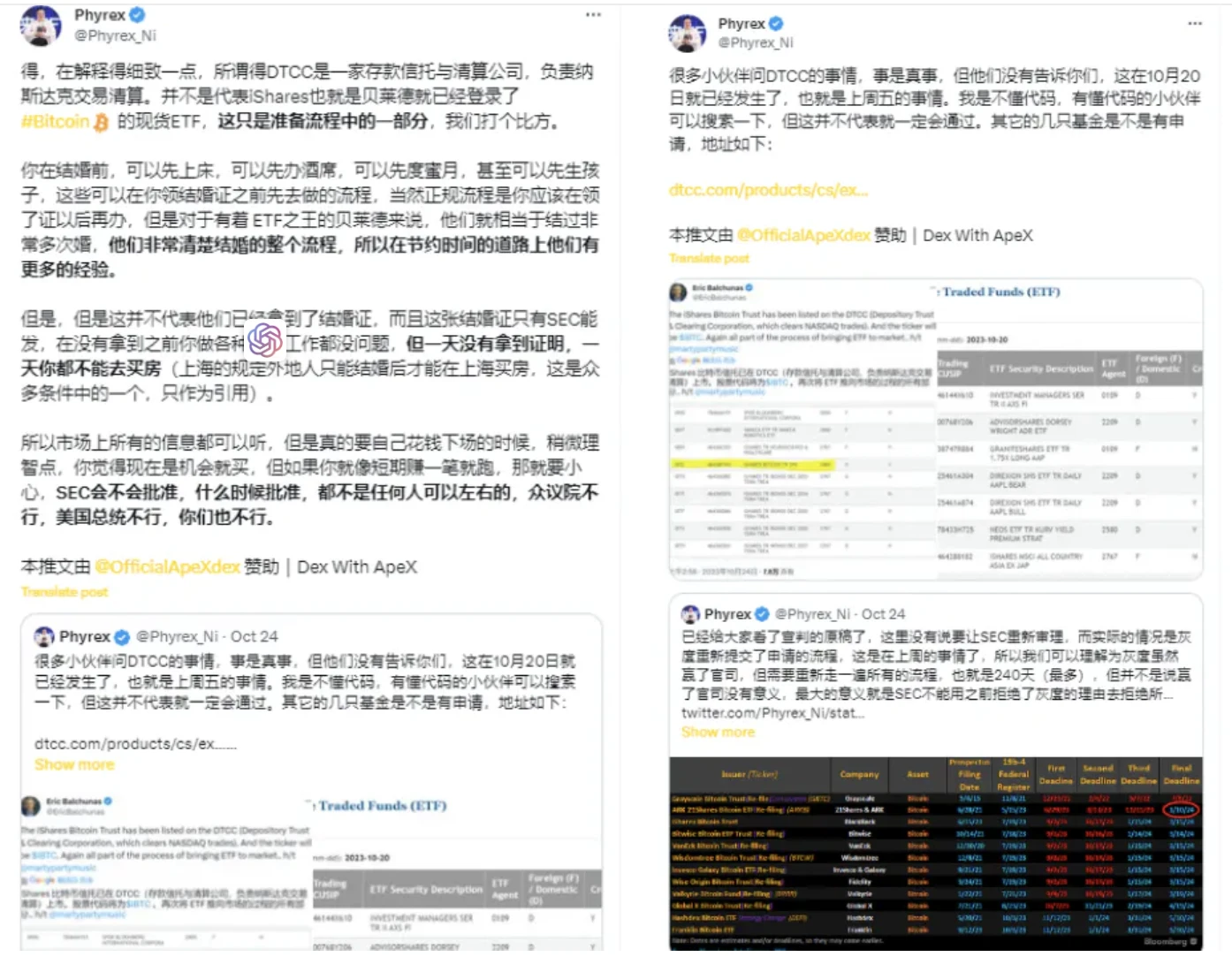

Beijing time, 2:58 am, Bloomberg ETF analyst Eric Balchunas tweeted that iShares Bitcoin Trust (a subsidiary of asset management giant BlackRock) has settled in DTCC (Depository Trust and Clearing Corporation, responsible for Nasdaq trading clearing), The listed stock code is$IBTC。

(DTCC is the custody and settlement center for stocks, bonds, and asset securities in the United States. It is responsible for the settlement and delivery services of eight major exchanges including the New York Stock Exchange, NASDAQ, American Stock Exchange, and Chicago Stock Exchange. Its integration The operational effectiveness of settlement, delivery and centralized custody has become the mainstream trend in the development of the settlement and custody system in the international securities market.)

This process is one of the necessary procedures for a Bitcoin spot ETF to enter the market. It is interpreted by the market as one step closer to the passage of the Bitcoin spot ETF. Market sentiment is enthusiastic, and Bitcoin has hit a new high of $35,000 in 18 months. .

Some users also believe that no matter how the process progresses, there is no need to be overly optimistic until the US Securities and Exchange Commission announces its approval, no matter how smooth the process is and how complete the materials are prepared.

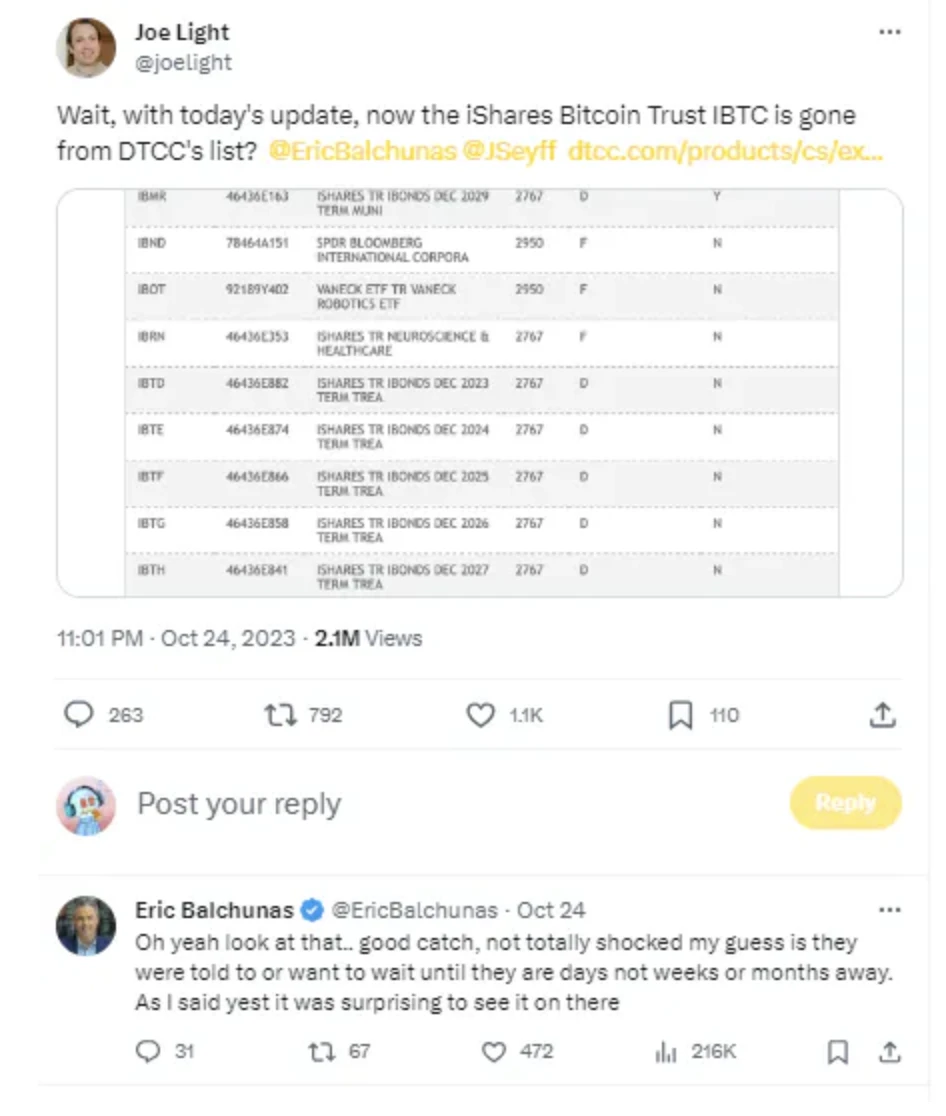

Less than a day later, Barron’s editor Joe Light tweeted that he discovered that BlackRock’s “IBTC” had disappeared from the official website. Bloomberg ETF analyst Eric Balchunas speculated that “IBTC” was told to wait until it was only days away from the implementation date before announcing it, rather than weeks or months.

Within one hour of this incident, the entire crypto market liquidated $47.5109 million in positions, including $41.3639 million in long orders and $6.147 million in short orders. The community is in an uproar, believing that DTCC is manipulating the market, just like what happened a week ago. During this process, the DTCC official website went down many times, and panic spread in the market.

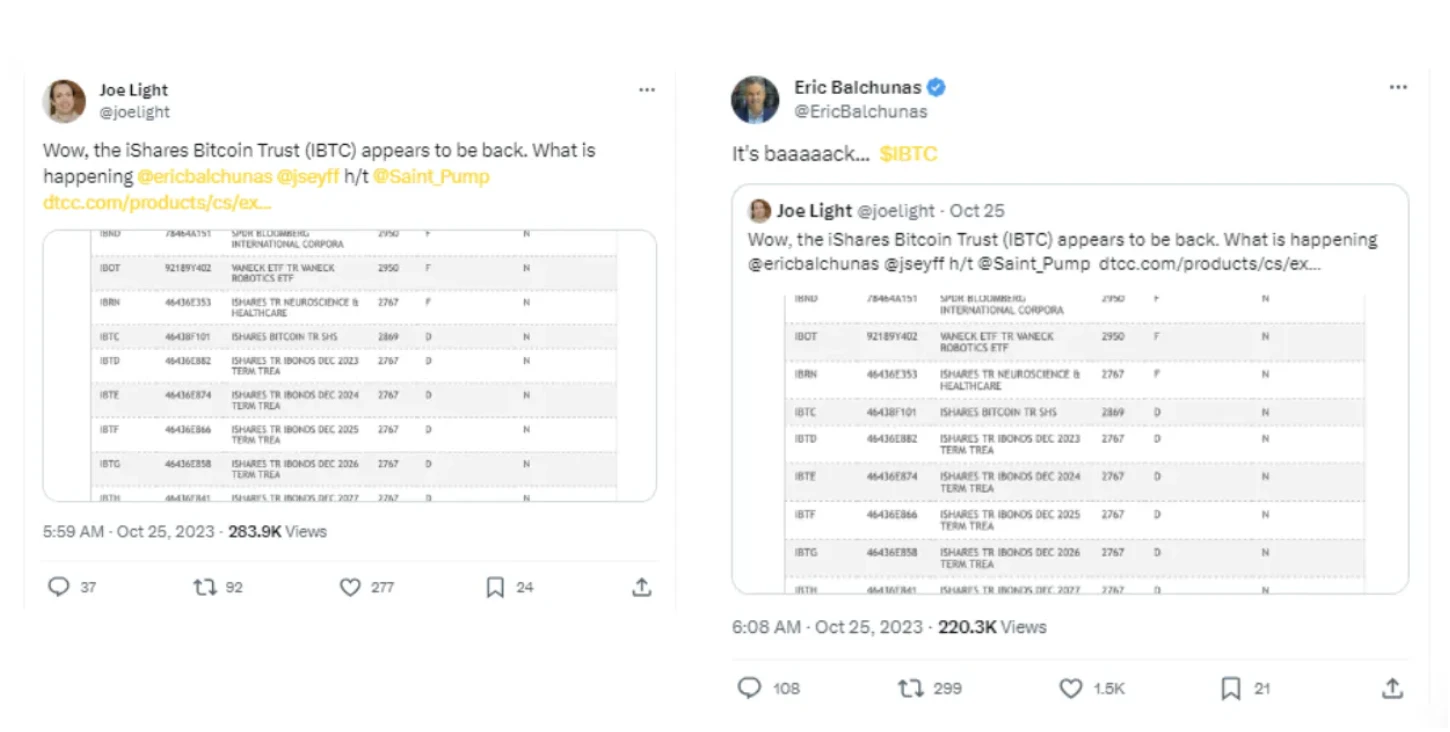

A few hours later, the iShares Bitcoin Spot ETF, a subsidiary of the asset management giant BlackRock, reappeared on the DTCC (Depository Depository and Clearing Corporation) website.

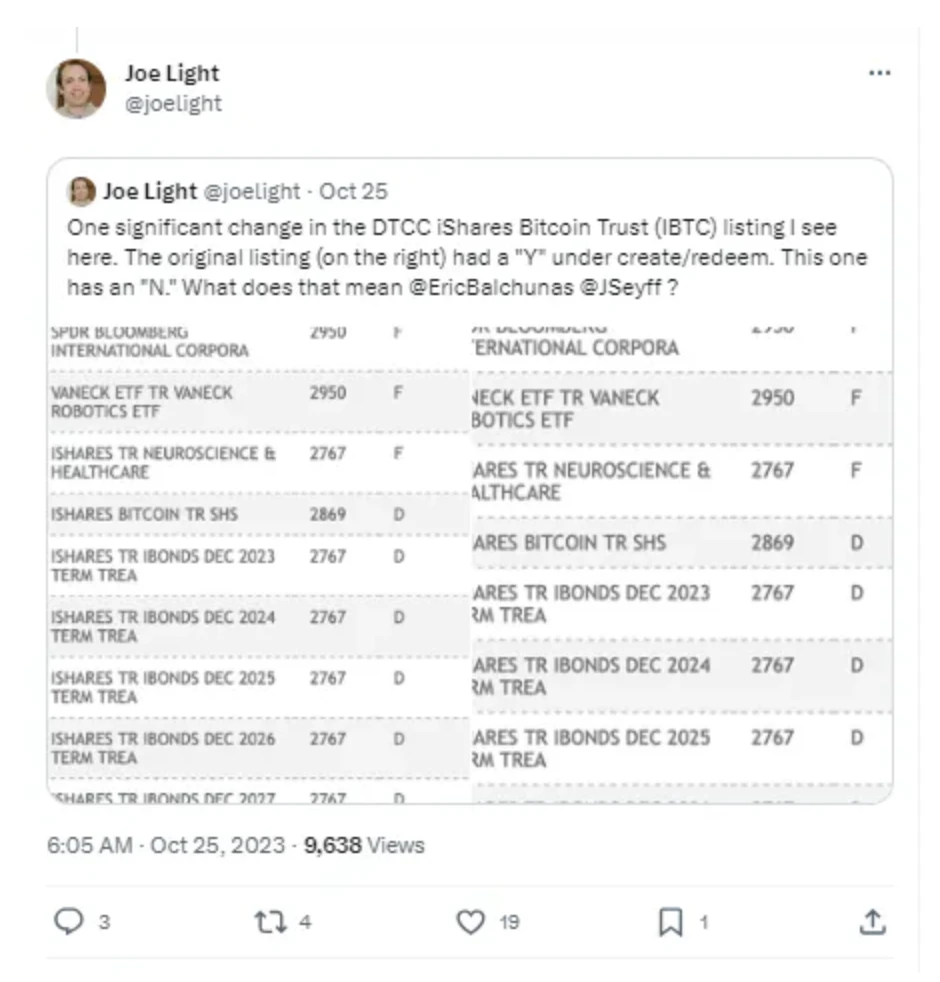

But in the Create/Redeem item, the original Y changed from the earliest Y to N.

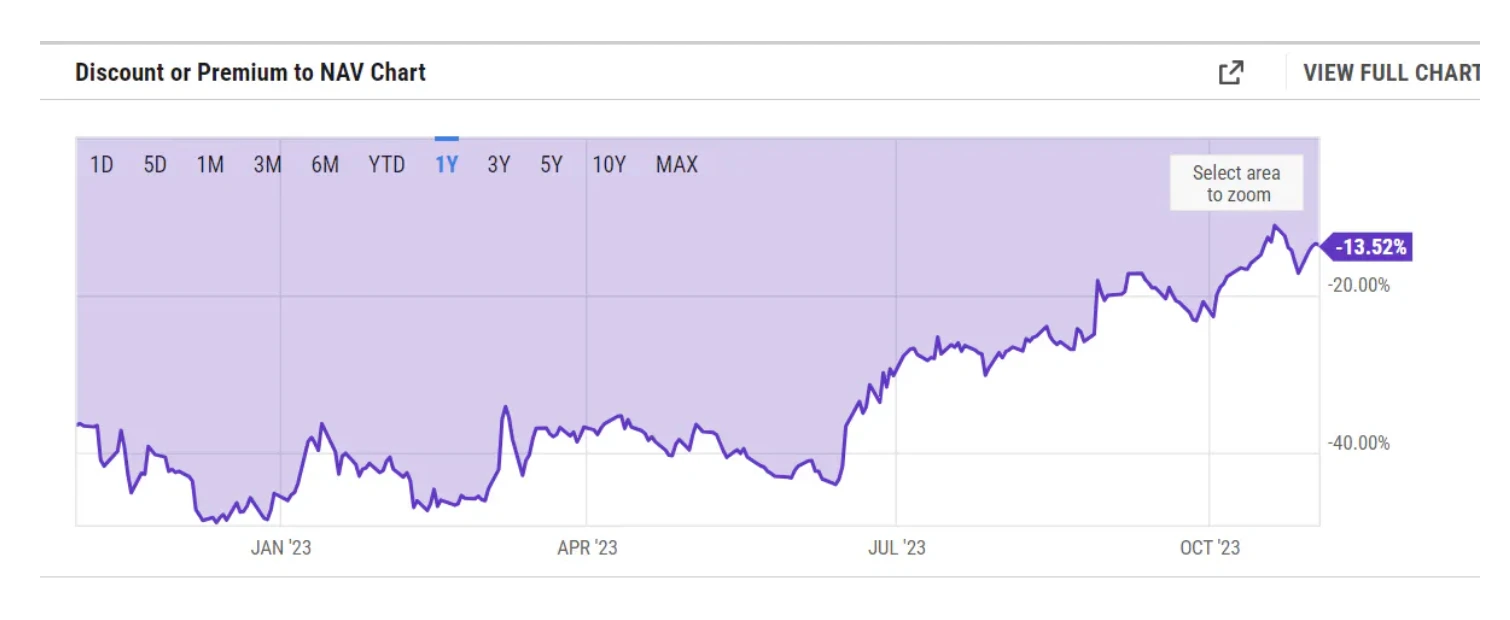

To simply understand, if it cannot be redeemed by users, it is essentially an index ETF. Like Grayscale, there will be a large price difference, and there is one-way arbitrage space. As the market believes that the probability of the Bitcoin spot ETF passing has increased and its confidence has increased, the discount rate has dropped from 44% on June 15 to 13.52% on November 3.

https://ycharts.com/companies/GBTC/discount_or_premium_to_nav

Further reading:

ETF, the full name is Exchange Traded Fund, exchange-traded fund, designed to track the performance of a specific index (such as the SP 500 Index) or asset (such as the price of gold).

In the normal ETF process, investors can create or redeem ETF shares through the ETF management company or broker, thereby ensuring that the difference between the market price of the ETF and its net asset value is kept small through the possibility of arbitrage. In the range:

Creating ETF shares means that investors contribute capital to the ETF management company in exchange for ETF shares;

Redeeming ETF shares means that investors return ETF shares to the ETF management company and receive corresponding cash;

That is to say, the users cash is directly bought into Bitcoin as ETF shares, which can be directly converted into Bitcoin purchases in the secondary market, affecting the price of Bitcoin; the same is true for selling, directly selling the corresponding share of Bitcoin and redeeming it. Cash back.

Once the creation/redemption function is turned off, it becomes an irredeemable Bitcoin ETF and lacks the arbitrage mechanism used by ETFs to prevent prices from getting out of control: users cannot freely create and redeem ETF shares, that is, they cannot directly To buy and sell Bitcoin in the secondary market, you can only enter or exit through the secondary market of ETFs.

Related Reading:With multiple additions and removals from BlackRock Bitcoin Spot ETF, is DTCC manipulating the market?

2. What does it mean for the Bitcoin Spot ETF to pass?

2.1 Applicants for spot ETFs have a promising background

Among these applicants for spot ETFs, what needs to be understood is BlackRock, Fidelity, and Invesco. The sum of the size of all institutions in the crypto market, and even the sum of the assets in the crypto market, is not as large as the management scale of any of these three companies.

Take BlackRock as an example. Although we don’t know how much Bitcoin BlackRock currently holds, according to BlackRock’s 2023 Q3 financial report, BlackRock’s management scale is US$9.1 trillion. What is the approximate concept? You must know that Grayscale’s management scale is only tens of billions of dollars, of which more than 20 billion U.S. dollars are Bitcoin trusts. A few numbers may make it clearer:

Top 5 GDP in 2022: US$25.5 trillion, China US$18.0 trillion, Japan US$4.2 trillion, Germany US$4.1 trillion, India US$3.4 trillion

Top 2 crypto market shares: Bitcoin US$724.2 billion (accounting for 50%), Ethereum US$216.4 billion (accounting for 16.3%)

The entire crypto market is not enough for BlackRock and Fidelity, so if BlackRock and Fidelity’s Bitcoin spot can pass, and attach importance to Bitcoin asset allocation, use it as a safe haven asset or a regular If assets are allocated, the price of Bitcoin will undoubtedly reach a new level.

There is a vivid metaphor for this: The two thick water pipes Signature and Silvergate were removed, and a strait was opened directly.

2.2 Why hasn’t a Bitcoin spot ETF passed yet?

The Bitcoin futures ETF was approved at the end of 2021. Why has the spot been unable to be approved?

To understand Bitcoin spot ETFs, we first need to understand the concepts of ETFs and Bitcoin futures ETFs. An ETF (Exchange Traded Fund) is an investment vehicle designed to track the price and performance of a specific asset. They can be traded on stock exchanges, and investors can buy and sell ETFs like stocks.

The Bitcoin Futures ETF is a fund that holds futures contracts linked to the price of Bitcoin. In fact, the Bitcoin Futures ETF does not hold any Bitcoin directly. Their investment strategy is to track Bitcoins price movements by holding futures contracts. Through Bitcoin futures ETFs, investors can buy, sell and trade to participate in the rise and fall of Bitcoin prices.

The Bitcoin Spot ETF is a fund that allows investors to buy and sell real Bitcoin at the current market price. In fact, the foundation buys, sells and holds real Bitcoin directly. This allows investors to hold Bitcoin without having to manage their own Bitcoin wallet. Through Bitcoin spot ETFs, investors can conveniently participate in the Bitcoin market and benefit from the rise and fall of Bitcoin prices.

Currently, there are many Bitcoin futures ETF products in the U.S. market alone, including ProShares Bitcoin Strategy ETF (BITO), VanEck Bitcoin Strategy ETF (XBTF), and Fidelity Bitcoin Strategy ETF (FBTC), but the market is still not interested in spot ETFs. There was a considerable response to the approval of the ETF, because even though spot ETFs and futures ETFs are very similar in terms of price fluctuations, both can provide investors with market exposure to Bitcoin. However, from a product perspective, futures ETFs generally have higher fees and more cumbersome operations. From a psychological perspective, allocating spot ETFs means that investors are actually holding Bitcoin, while allocating futures ETFs is more like short-term speculation.

The main differences between Bitcoin spot ETFs and futures ETFs can be divided into the following four points:

Asset holdings: Spot ETFs hold Bitcoin directly, while futures ETFs track the price of Bitcoin by purchasing Bitcoin futures contracts.

Fee Structure: Futures ETFs typically have higher fees because they require managing futures contracts, while spot ETFs may have lower fees.

Price tracking efficiency: Spot ETFs are usually able to track the price of Bitcoin more accurately, while futures ETFs may be affected by the futures market, resulting in certain deviations in price tracking.

Liquidity: Spot ETFs may offer higher liquidity because they hold Bitcoin directly, while the liquidity of futures ETFs may be limited by the futures market.

cited from:Uncovering the charm of Bitcoin spot ETF: new investment scene and market reaction

First of all, futures prices are forward prices, which reflect the supply and demand relationship in the future market and have an anticipatory effect. The spot price is the spot price, which reflects the current supply and demand relationship in the market. Although future prices are related to current prices, it is reasonable for them to behave differently. In a sense, futures ETFs are actually a waste of the advantages brought by the ETF itself.

To put it simply, the Bitcoin futures ETF has not yet come into contact with physical Bitcoin. It is more of an index and will be restricted by the futures market. The adoption of Bitcoin Spot ETF means that traditional investors can actually hold Bitcoin in disguise, and it also means that regulatory agencies recognize the further value of Bitcoin. Bitcoin spot ETFs have a far greater impact on Bitcoin liquidity than Bitcoin futures ETFs.

2.3 When will the Bitcoin spot ETF be approved?

If we refer to the current environment of Bitcoin Futures ETF passing through the currency circle, the market has gradually emerged from the impact of the 5.19 black swan. First, interest rate cuts + policy releases, market sentiment is high, and institutional bullets are sufficient. As Bitcoin Futures ETF passes Bitcoin, Here comes a new high.

According to Tokeninsight, the key time points for review of Bitcoin spot ETF applications are mostly at the end of the first quarter of 2024, and the final response dates for applications from the three most important institutions, BlackRock, Fidelity and Invesco, are all March 2024. On March 15, the political influence of these three financial giants cannot be ignored in promoting the application for Bitcoin spot ETF.

A clear positive for the market during that time period was the Bitcoin halving (April 2024), while the macroeconomic situation was still uncertain, including the Russia-Ukraine war, the Israel-Kazakhstan war, and potential financial crisis risks. However, it is not ruled out that with the outbreak of economic black swan events one after another, Bitcoin will be recognized by institutions and the U.S. Exchange Commission as a strong safe-haven asset equivalent to gold, thereby passing the Bitcoin spot ETF.

Rationally speaking, without inside information, it is impossible to predict the time of passage.

Related Reading:The U.S. SEC postpones all BTC ETF resolutions, providing an overview of the current BTC ETF application status and approval time predictions

Related Reading:What can the first BTC futures ETF bring to the crypto market?

2.4 What will a Bitcoin spot ETF change?

Current channels for investing in Bitcoin:

Involving Crypto: spot purchase on centralized/decentralized exchanges, contract opening on centralized/decentralized derivatives exchanges, over-the-counter transactions

We will find a problem with Bitcoin Futures ETF. If you want to have a strong correlation with the price of Bitcoin, you must contact Crypto. Contact with Crypto means regulatory issues, traditional funds cannot enter the market and other limitations. If institutions change their charter, etc. Ways of trying to hold Crypto face huge resistance. Directly purchasing Bitcoin futures ETFs or crypto-indexes does not have enough correlation with Bitcoin prices. Bitcoin futures often imply an annualized price difference of about 4-10%, while many traditional stock and bond ETF management fees are less than 0.1 %, Bitcoin spot ETF can reduce the cost of institutions holding Bitcoin-compliant products by 1-2 orders of magnitude. In addition, although everyone in the Web 3.0 circle has a consensus on Bitcoin, most people in the traditional market still inevitably think it is a scam. So in fact, some of the advantages brought by the adoption of Bitcoin spot ETF are also obvious:

Giving traditional institutions exposure to participate in Bitcoin transactions: In the past, if traditional institutions wanted to allocate Bitcoin assets, they had to go through more or less complicated processes: such as modifying the institutions charter, exchanging stable coins, safely storing digital assets, etc. This has isolated a large portion of traditional institutions. After the adoption of the Bitcoin spot ETF, traditional institutions can allocate digital products that are strongly related to the price of Bitcoin without having to come into contact with Crypto, which can greatly improve the liquidity of Bitcoin, drive the price of Bitcoin, and ultimately increase the price of Bitcoin. Bitcoin market capitalization.

Improve the reputation of cryptocurrencies: If the U.S. stock exchange can approve a Bitcoin spot ETF and recognize it as an alternative investment asset, it will have the same supervision as other spot ETFs, which means that the supervision recognizes the value of cryptocurrencies and the overall value of cryptocurrencies. Reputation should improve.

Improving the crypto market environment: Large institutions that are regulated and have sufficient funds can participate in the crypto market, which can also improve the current situation of excessive volatility in the cryptocurrency market and easy manipulation of the market to a certain extent.

Bitcoin’s security is highly improved: Investors’ cryptocurrencies will be hosted in multi-year spot ETFs to solve the problem of insufficient security of crypto assets.

There is a lot of room for Bitcoin price appreciation: the price of the first gold ETF rose by more than 400% within ten years after its entry in 2003. As a reference to the gold spot ETF, the Bitcoin spot ETF itself has a strong deflationary economic model. , in conjunction with ETF fund management, has greater potential.

Benefits of the RWA track: The biggest benefit of the adoption of the Bitcoin spot ETF is actually a regulatory stance on the RWA track. More digital banks, payments, etc. can be combined with traditional finance, or projects that can solve traditional financial scenarios can gain more Provide regulatory support.

https://twitter.com/USFunds/status/1024065872762167296

2.5 Risks that will still exist after passing

Of course, although the passage of the Bitcoin spot ETF will definitely be beneficial to the crypto market, it does not mean that as long as it is passed, Bitcoin will break through 70,000 US dollars and the bull market will return quickly. We still need to look at the development of the macro economy. And there are other risks worth noting.

The benefits are digested in advance: If the market consensus is that Bitcoin will be halved in 24 years, and the Bitcoin spot can pass, does it mean that everyone will make arrangements in advance, so that the market value-added brought by the benefits will be digested in advance?

The macroeconomy is still sluggish and black swans are frequent: refer to the Bitcoin Futures ETF. After the adoption of the Bitcoin Futures ETF, due to interest rate hikes and wars, the encryption market took a sharp turn. Is the war over when Bitcoin spot ETF passes? Has the Fed begun a series of interest rate cuts? These are all points that require close attention. Especially after the adoption of spot ETF, it will only be more closely related to the macro economy.

Web 3.0 itself still has limitations: with the adoption of the Bitcoin ETF, what we most hope to see is not how the currency price increases significantly, but more Web 3.0 project parties like the RWA track try to break the information cocoon and no longer Work behind closed doors to embrace the traditional industries of Web 2.0, make Web 3.0 truly mainstream, and break the Ponzi limitations of Web 3.0.

3. Bitcoin indicators worth paying attention to

In addition to the sharp rise and fall of prices, as well as various black and white swan events, how can we judge some trends of Bitcoin in the short term (or long term) from the data level?

Here are some simple science indicators that you can refer to:

3.1 Bitcoin halving countdown

The node launched by Bitcoin in 2009 was just after the financial crisis. The original idea was to become a safe haven asset for global inflationary fiat currencies.

Each block produces 50 Bitcoins, and halving occurs every 210,000 blocks (roughly every four years), which is a relatively crude deflation model.

As the correlation between the crypto market and the macroeconomy becomes stronger and stronger, the correlation between Bitcoin price trends and cycles will weaken. For speculators who want to get rich overnight, it may not be so satisfactory, but as a part of large institutions, Asset allocation would be a more appropriate choice.

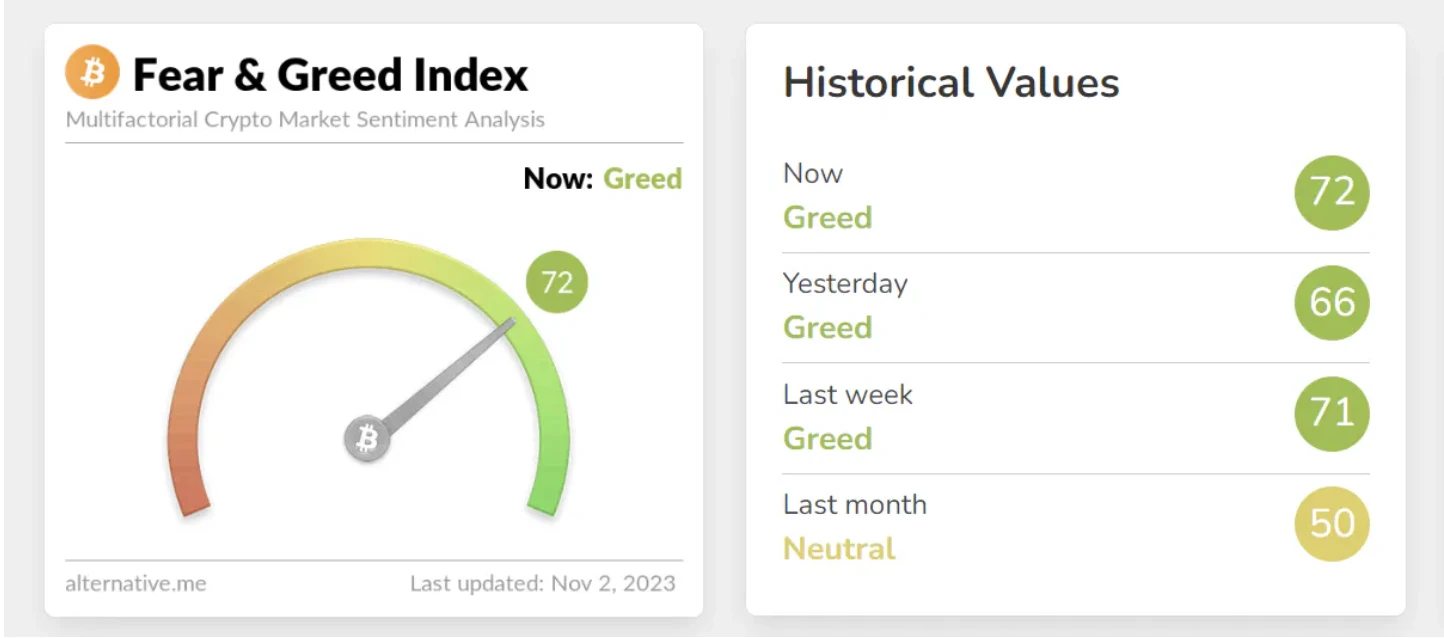

3.2 Fear Greed Index

Investors can use the Fear and Greed Index as a reference when deciding to enter or exit the cryptocurrency market in the short term.

Originally created by CNNMoney with the goal of analyzing market sentiment for stocks and shares. Later, Alternative.me tailored its own version for the cryptocurrency market and began measuring investor sentiment on February 1, 2018.

https://alternative.me/crypto/fear-and-greed-index/

The index is weighted by five components (see https://alternative.me/crypto/fear-and-greed-index/):

Volatility: Measures the current value of Bitcoin based on averages over the past 30 and 90 days. An unusual rise in volatility is a sign of market panic.

Market Momentum/Volume: Bitcoin’s current volume and market momentum are compared to the previous 30-day and 90-day averages and then combined. Sustained heavy buying indicates positive or greedy market sentiment.

Social Media: Focus on the number of Twitter hashtags related to Bitcoin, especially the engagement rate. The unusually high interaction rate leads to growing public interest in the token, which corresponds to greedy market behavior.

Bitcoin Dominance: This metric is used to measure Bitcoin’s market dominance. Increased market dominance indicates new investment in Bitcoin and a possible reallocation of funds from altcoins.

Google Trends: This index looks at Google Trends data for Bitcoin-related search queries, providing insights into market sentiment. For example, an increase in searches for “bitcoin scam” indicates greater fear in the market.

Survey (Currently Paused): A weekly cryptocurrency poll with strawpoll.com, a fairly large public polling platform, and asks people what they think of the market. Typically, 2,000 - 3,000 votes are seen in each poll, so there is a real sense of the sentiment among a group of cryptocurrency investors. Very useful at the beginning of our research.

https://alternative.me/crypto/fear-and-greed-index/

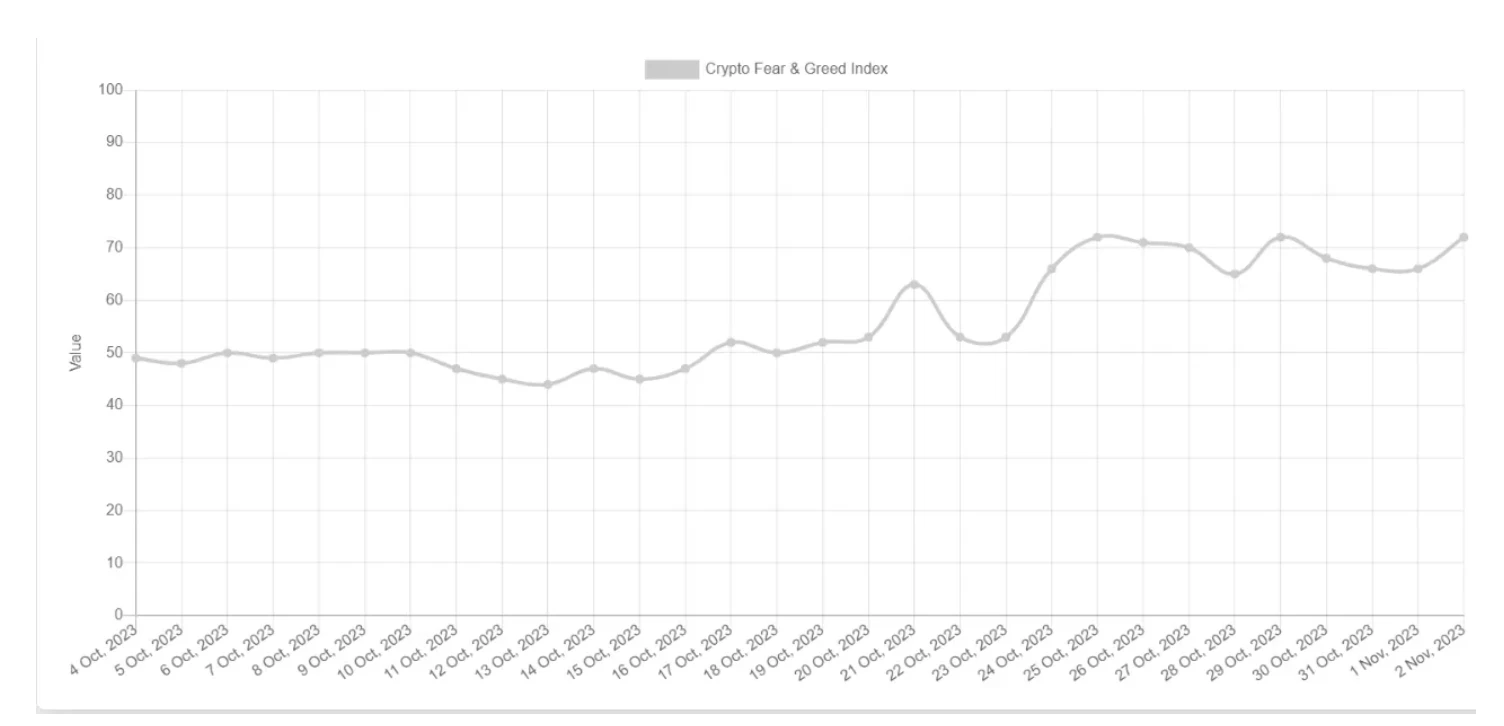

It can be seen that the rumors related to Bitcoin ETF in the past month have driven the market situation to a certain extent. The fear and greed index has fluctuated from around 50 to 70, and a large number of purchases have occurred, making investors become greedy. But not to the point where valuations are so high that the bubble is at risk of bursting.

3.3 Bitcoin holdings of traditional institutions

To see the BTC holdings of publicly traded and private companies, ETFs, and countries, you can go to:https://buybitcoinworldwide.com/treasuries/, so as to have a general understanding of the Bitcoin holdings of various forces.

https://buybitcoinworldwide.com/treasuries

It can be seen that the current holdings of ETFs on the market account for 3.9% of the total number of Bitcoins (including those in circulation and mined), which is close to 820,000.

Grayscale holds 640,000 Bitcoins.

What is more interesting is that the United States ranks first among national holdings (this should refer to the government) with more than 200,000 Bitcoins, and China ranks second with 194,000 Bitcoin holdings.

It is worth noting that some behemoths are not counted here, including the well-known Binance (public holdings of 500,000 Bitcoins), Bitfinex (public holdings of 190,000 Bitcoins), BlackRock (public holdings of 190,000 Bitcoins), not disclosed).

4. Summary

The public is still paying attention to the absurd and bizarre crimes of SBF and others that have been gradually revealed in the judicial process. The currency circle institutions seem to be still stuck in the bear market after the burst of the last round of bubbles. The label of scam has never been Have left the crypto asset industry. However, as financial giants such as BlackRock join hands to develop Bitcoin spot ETFs, the market has begun to pick up significantly recently. Empiricists may be hesitant about the market from the view that all the good is bad derived from the history of the last two bull markets, but empiricists cannot deny the grand narrative put forward by the This time is different party .

The crypto market is still a highly risky market. At a time when the Bitcoin spot ETF has not settled and the macro economy has not improved, the most important thing is to endure, settle, and learn.

references

nft://undefined/undefined/undefined? showBuying=true&showMeta=true

https://foresightnews.pro/article/detail/45759

https://foresightnews.pro/news/detail/31514

https://foresightnews.pro/article/detail/45752

https://foresightnews.pro/article/detail/45721

https://foresightnews.pro/article/detail/45711

https://foresightnews.pro/article/detail/45702

https://foresightnews.pro/article/detail/45598

https://foresightnews.pro/article/detail/2

https://www.theblockbeats.info/news/46641

https://www.theblockbeats.info/news/46629

https://www.theblockbeats.info/flash/188159

https://www.theblockbeats.info/news/46744

https://www.odaily.news/post/5173435

https://foresightnews.pro/article/detail/36733

https://foresightnews.pro/article/detail/42975

https://www.moomoo.com/hans/news/post/5805863?level=2&data_ticket=1698285922213422

nft://undefined/undefined/undefined? showBuying=true&showMeta=true

About E2M Research

From the Earth to the Moon

E2M Research focuses on research and learning in the fields of investment and digital currency.

Article collection:

Follow on Twitter: https://twitter.com/E2mResearch