Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

At 2 a.m. on April 14, the price of OM, the native token of Mantra, a star project in the real-world asset (RWA) sector, suffered a heavy blow, plummeting from $6.15 to $0.37, a drop of 90% , and the market value evaporated by $5.5 billion in an instant. This drastic fluctuation caused a liquidation of more than $65 million across the network, and the liquidation volume in the past 12 hours was second only to BTC. The crypto community was in an uproar and quickly pointed the finger at the possibility of insider trading and market manipulation.

On-chain data reveals: Who is driving the crash?

On-chain data provides key clues to the crisis. According to Lookonchain monitoring, at least 17 wallets deposited 43.6 million OM (worth $227 million at the time) into exchanges before the OM crash, accounting for 4.5% of the circulating supply. Among them, the two addresses marked by Arkham are related to Mantras strategic investor Laser Digital, indicating that institutional behavior may be behind the scenes.

In addition, Spot On Chain disclosed that three days before the crash, the newly-established OM whales transferred 14.27 million OM (about $91 million) to OKX at an average price of $6.375. These addresses had purchased 84.15 million OM from Binance at the end of March this year, at a cost of about $565 million (average price of $6.711). After the crash, their remaining holdings were only worth $62.2 million, with a floating loss of up to $406 million.

Spot On Chain suspects that these addresses may have hedged, or even been behind the crash.

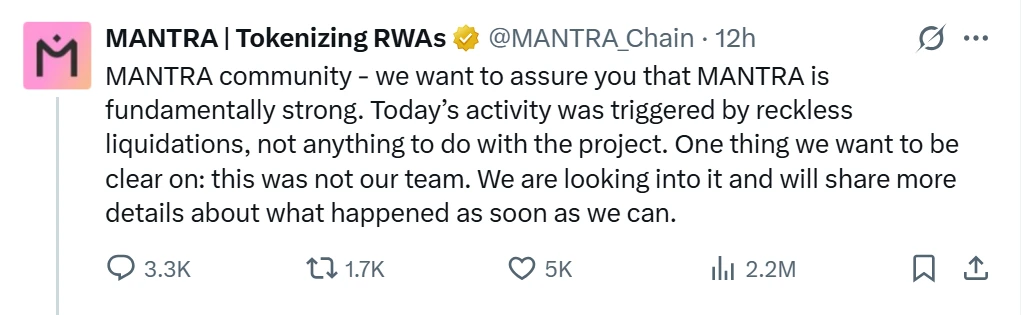

The project owners and the exchange are blaming each other, and the fierce confrontation is full of gunpowder

After the incident, Mantra officials spoke out quickly at 4:50 a.m. to try to stabilize market sentiment. They insisted: MANTRA is fundamentally sound, and todays chaos was entirely triggered by some reckless liquidations, which has nothing to do with our project. We want to clarify: this is definitely not done by our team. We are fully investigating and promise to release more details as soon as possible. In their words, the project party was eager to distance themselves from the matter and put the blame on the free market.

Later, Mantra co-founder JP Mullin responded more bluntly and aggressively. He publicly accused: The violent fluctuations in the OM market are entirely caused by the reckless forced liquidation of OM account holders by centralized exchanges (CEX). He emphasized that the crash occurred during the extremely low liquidity period in the early morning of Asian time, and the account positions were suddenly closed without warning, which at least exposed the serious negligence of CEX and may even hide a conspiracy of deliberate market manipulation. JP further pointed out that CEX plays a key role in providing liquidity for projects, but the discretion they hold will lead to disasters if there is no effective supervision, just as the market dislocation in front of them has not only damaged the project, but also caused huge losses to investors. He repeatedly emphasized that the crisis was not caused by the Mantra team, the chain association, the core consultants or investors selling tokens. The tokens are still strictly locked, the token economics are not affected, and the relevant wallet addresses are open and transparent, and all faults are firmly pinned on the exchange.

The exchange did not show weakness either. CZ, the former CEO of Binance, took the lead in hitting back on the X platform, advising investors to not chase narratives and to choose stable projects with users, revenue, and profits to avoid similar disturbances. He implied that the Mantra project itself lacked fundamentals. In response to the communitys sharp questioning of whether the OM flash crash was due to Binances failure to conduct due diligence, CZ hit back, saying: CEX should no longer take the blame for the listing process, and investors should decide on their own trading products. The implication is that the project owners and investors themselves were confused, and the exchange was just a scapegoat.

Later, Binance also issued a statement, saying that it had noticed the sharp fluctuations in OM prices, and preliminary investigations showed that the fluctuations were mainly caused by cross-trading platform liquidations. Since October last year, Binance has implemented a number of risk control measures for OM, including reducing leverage levels, and since January this year, it has enabled pop-up prompts on the spot trading page to remind users that the OM token economic model has undergone major changes and the supply has increased. Binance emphasized that it will continue to monitor and take action to protect the interests of users, which is both a self-defense and a clear point that Mantras fundamentals have changed significantly.

OKX CEO Star also fought back strongly on the X platform: OMs flash crash is a major scandal for the entire crypto industry. All unlocking and recharge data on the chain are public, and the mortgage and liquidation data of major trading platforms can also be verified. OKX will prepare all relevant reports and welcome questions. Stars response was both self-defense and an indirect counterattack against Mantra, vaguely suggesting that the project party may have concealed key information.

The two sides are at loggerheads, and the atmosphere is full of gunpowder. Mantra insists that it is innocent and blames all faults on CEXs recklessness; the leading CEX retorts, emphasizing transparency and hinting that Mantra may have major shady dealings. This fight has not yet subsided, and both sides may be waiting for the others next move. Where is the truth that investors want?

Undercurrent of interest game: economic adjustment or power struggle?

Although the blame game between the project and the exchange has not yet been concluded, it has revealed a key clue: Mantras economic model adjustment may be the real fuse of this crisis.

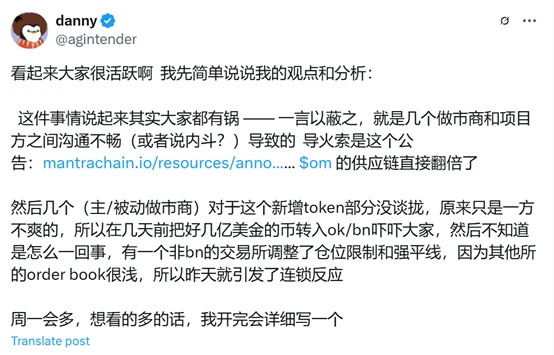

According to KOL danny@agintender , everyone is responsible for this crisis. The root cause lies in the conflict of interest and communication errors between the project party and the market maker, and there may even be internal fighting. The fuse was the announcement Understanding $OM released by Mantra on April 8 .

Danny analyzed that the market makers (active/passive) did not reach an agreement with the project party on the distribution plan of the new token part, and one party was dissatisfied, so they transferred hundreds of millions of dollars of OM to OKX and Binance a few days ago to protest and try to put pressure. As a result, an exchange other than Binance adjusted the position limit and forced liquidation line. Because the order books of other exchanges were shallow, a chain reaction was triggered, which eventually led to the crash in the early morning. The implication is that the collapse of OM is an unexpected result of the game of interests among multiple parties.

In fact, the adjustment of the economic model is not a sudden event . As early as January 2024, the Sherpa communitys governance proposal was passed to abandon the two tokens, one ecosystem model and use a single OM as the native asset of MANTRA Chain (for staking and -gas fees), which was almost unanimously supported in February 2024. To achieve this goal, Mantra destroyed the ERC-20 OM on Ethereum through the mirror bucket mechanism and released an equal amount of tokens on the mainnet, doubling the total supply from 888, 888, 888 to 1, 777, 777, 776.

In fact, the adjustment of the economic model is not a sudden event . As early as January 2024, the Sherpa communitys governance proposal was passed to abandon the two tokens, one ecosystem model and use a single OM as the native asset of MANTRA Chain (for staking and -gas fees), which was almost unanimously supported in February 2024. To achieve this goal, Mantra destroyed the ERC-20 OM on Ethereum through the mirror bucket mechanism and released an equal amount of tokens on the mainnet, doubling the total supply from 888, 888, 888 to 1, 777, 777, 776.

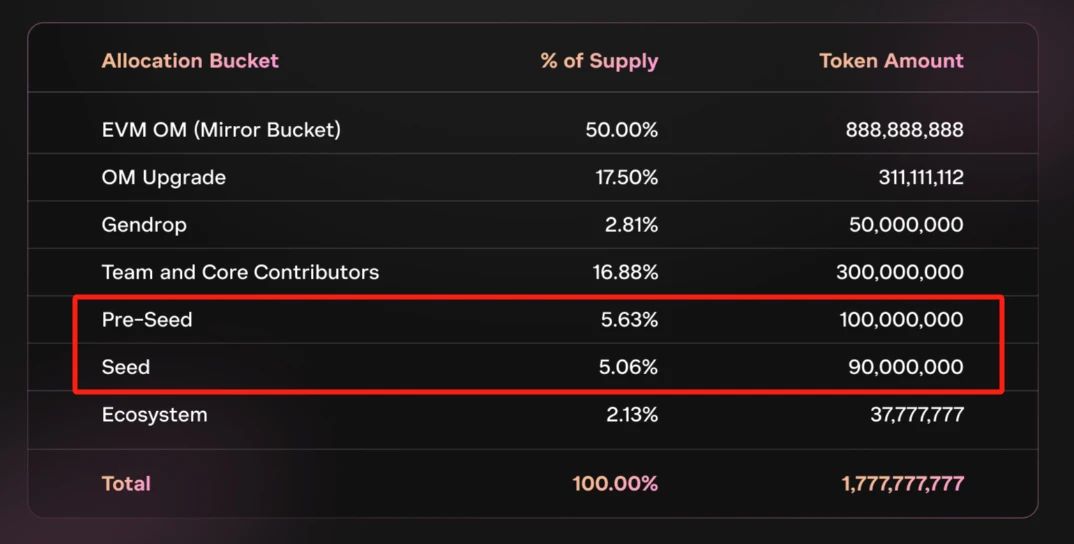

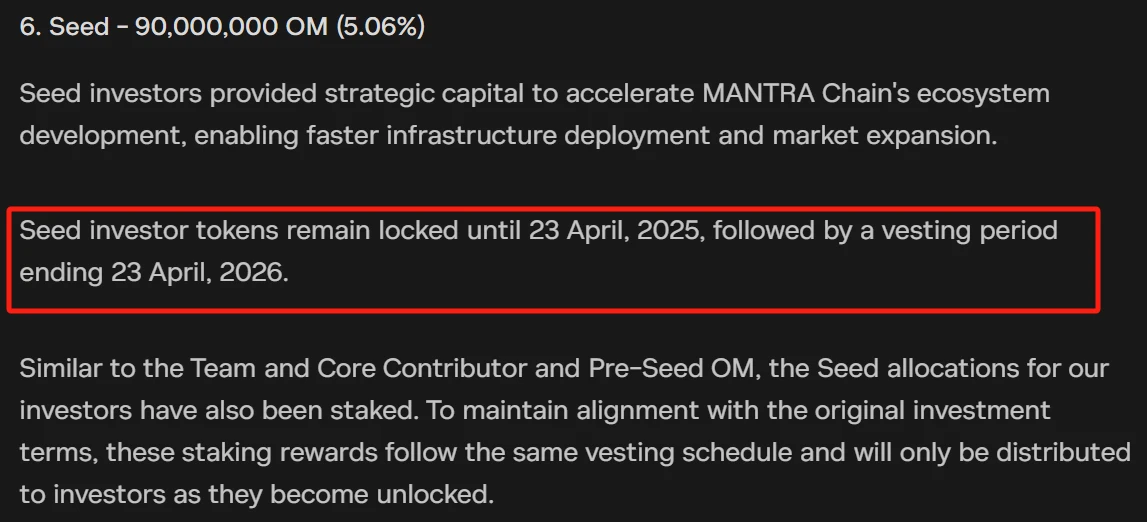

The community has no objection to upgrading OM from a fixed supply model to an inflation model and doubling the supply, but the problem may lie in the announcement on April 8. The announcement lists in detail the token distribution and unlocking schedule for various stakeholders, among which early investors (including Pre-Seed and Seed) are allocated 5.63% and 5.06% respectively, which will be released this year, especially the tokens of seed round investors will be unlocked on the 23rd of this month .

The timing of the disclosure of this announcement was extremely sensitive, which makes people suspect that it was the difference in interest distribution that ignited the crisis.

Meanwhile, Daniel@_founderdan , an analyst at data management platform Tokenise, provided another layer of insight. He pointed out that an initial transaction from a wallet associated with Mantra to OKX seemed to have become the trigger for panic selling. The transaction raised market concerns about possible insider involvement or mismanagement.

Further investigation revealed that the majority of $OM tokens, especially those allocated to early investors and Mantra itself, were already unlocked and tradable, with additional token allocations scheduled to unlock starting April 21, 2025, which would undoubtedly exacerbate future selling pressure. The timing was therefore particularly suspicious: the sudden and massive sell-off just before this major unlock was about to begin made people wonder if there was an inside job, although there is no definitive evidence yet.

Daniel proposed two possible scenarios: one is that a centralized exchange or market maker recklessly sells because it holds too much liquidity, causing market panic; the other is that insiders or early investors deliberately sell before a wider range of tokens are unlocked to avoid risks or seek profits. Regardless of which scenario is true, the violent and unnatural nature of the crash strongly suggests that this is not a natural market fluctuation, but the result of some kind of human manipulation. He called on the project to strengthen token management and transparency to prevent similar incidents from happening again.

Mantra’s Trust Stain: History and Community Questions

In fact, Mantra has long been dubbed by the community as a stand-alone coin or powerful monster coin. Its trust crisis did not happen overnight, but is the result of long-term accumulation. Behind this label are the projects many controversies in market operations, token management and community commitments.

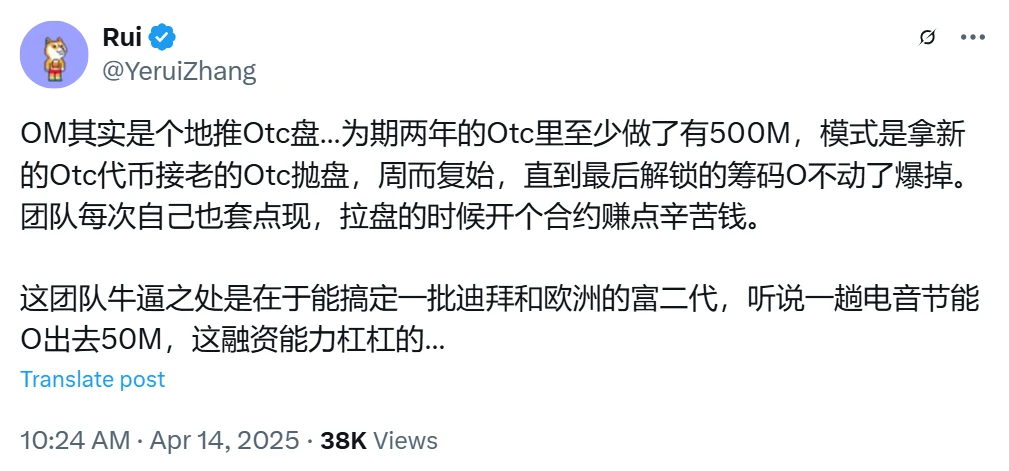

According to HashKey Capital member Rui and ArkStream Capital Founding Partner Ye Su, OM is a ground-pushing OTC plate with an OTC scale of US$500 million. It operates in a cycle of new OTC tokens take over old OTC selling plates until the last unlocked chips OTC does not move and cause a collapse. In 2023, when OM FDV fell to US$20 million, a Middle Eastern capital intervened, retaining only the CEO position and packaging OM as an RWAfi project.

Under this high degree of control, OM achieved an astonishing 200-fold growth in 2024, but it is still promoting its OTC business recently, which has aroused widespread market doubts about its manipulation.

Mantras repeated changes to the airdrop rules further deepened the communitys doubts. In November last year, the project promised that the airdrop rules would be initial liquidity distribution after a 3-month cliff period and linear unlocking in 9 months to attract user participation. But soon after, they changed the rules to a 1-month cliff period and 11-month linear unlocking. Initially, they announced that 50 million OMs would be distributed, 20% would be unlocked upon launch, and the airdrop would be completed within a month. However, in actual implementation, Mantra repeatedly postponed the fulfillment of its promise, changing unlocking upon launch to linear release starting one month later, and further extending it to 10% first-phase release, and the rest of the vesting period is up to three years. This capricious behavior essentially locked the communitys traffic as a long-term bargaining chip , arousing strong dissatisfaction.

The trust crisis is also reflected in the experience of early investors. @Phyrex_Ni invested in RIODeFi, the predecessor of OM, in his early years. After being affected by the flash crash, he clarified on X: I have left OM for many years. I was an early builder at the beginning, but I have nothing to do with OM and RIO since 2021. I am still in a lawsuit with OM in Hong Kong. They owe me no investment tokens and fees. Even if they win the lawsuit, it is useless because the team has moved to the United States. His revelations not only reveal Mantras historical debt problems, but also echo the current OTC model and highly controlled strategy, which may indicate that the project partys opacity and dishonesty have long been deeply rooted.