LUCIDA: How to build a strong crypto asset portfolio using multi-factor strategies?

Preface

In June last year, I conceived the simple idea of using a multi-factor model to select currencies.

Related Reading:LUCIDA: Use multi-factor models to select tracks and currencies》

One year later, we have begun to develop a multi-factor strategy for the crypto-asset market, and have written the overall strategy framework into a series of articles Building a Powerful Crypto-Asset Portfolio Using Multi-Factor Strategies.

The general framework of this series is as follows (the possibility of fine-tuning is not ruled out):

1. Theoretical basis of multi-factor model

2. Single factor construction

Factor data preprocessing

Data filtering

Exception value handling: extreme values, error values, null values

standardization

Neutrality: industry, market, market capitalization

Factor validity judgment

Information ratio IC, rate of return, Sharpe ratio, turnover rate

3. Synthesis of major categories of factors

factor collinearity analysis

Orthogonal elimination factor collinearity

Classic weighting method→synthetic factor

Equal weight, rolling IC weighting, IC_IR weighting

Test of synthetic factors: rate of return, group rate of return, factor value weighted rate of return, synthetic factor IC, group turnover rate

Other weighting methods (non-linear relationship between factors and returns): machine learning, reinforcement learning (not considered due to the particularity of the cryptocurrency industry)

4. Risk portfolio optimization

The following is the text of the first **#Theoretical Basics#**.

1. What is “factor”?

Factors are the indicators in technical analysis and the features of artificial intelligence and machine learning, which determine the rise and fall of cryptocurrency yields.

Our team combines the common factor types in the cryptocurrency field: fundamental factors, on-chain factors, volume and price factors, derivatives factors, alternative factors and macro factors.

The ultimate goal of mining and calculating factors is to accurately calculate the value of assetsexpected rate of return。

2. Calculation of “factor”

(1) Derivation of multi-factor model

Origin: One-factor model—CAPM

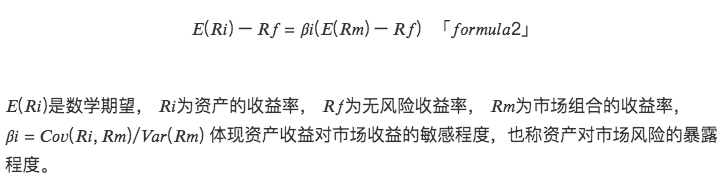

Factor research can be traced back to the 20 C and 60 S, with the advent of the Capital Asset Pricing Model (CAPM), which quantified how risk affects a companys cost of capital and thus its expected rate of return. According to the CAPM theory, the expected excess return of a single asset can be determined by the following linear model:

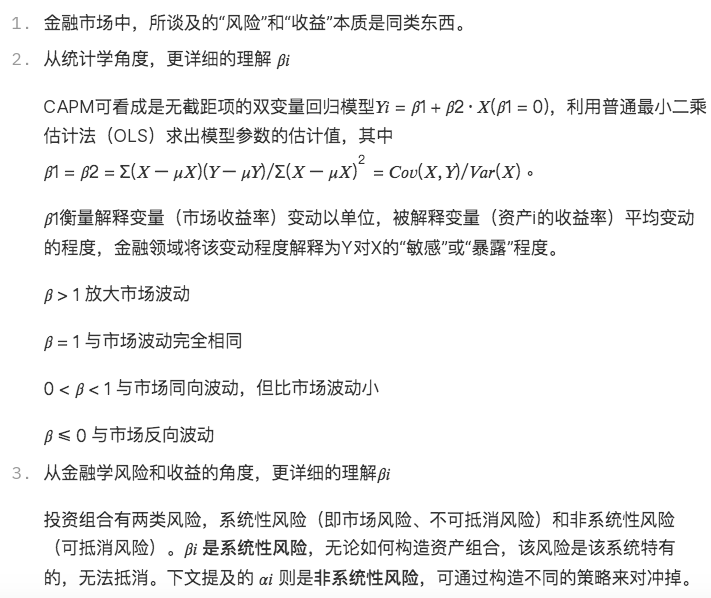

Additional understanding:

The CAPM model is the simplest linear factor model, pointing out that the excess return of an asset is determined only by the expected excess return of the market portfolio (market factor) and the assets exposure to market risk. This model lays a theoretical foundation for subsequent research on a large number of linear multi-factor pricing models.

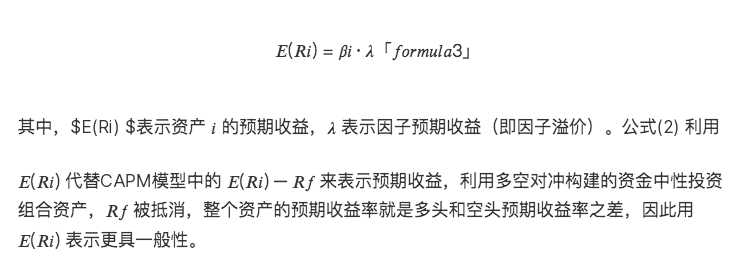

Development: Multifactor Model—APT

Based on CAPM, people found that the returns of different assets are affected by multiple factors. Arbitrage Pricing Theory (APT) came out and built a linear multi-factor model:

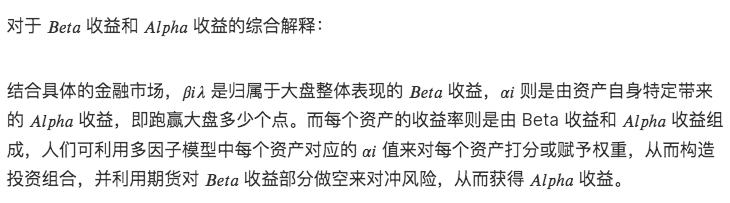

Mature: Multi-factor model—Alpha returns Beta returns

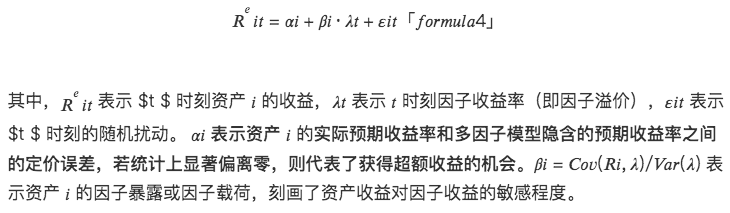

Taking into account the actual pricing errors in the financial market and the APT model, from a time series perspective, the expected rate of return of a single asset is determined by the following multivariate linear model:

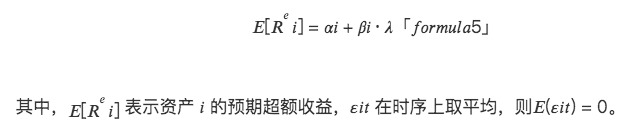

The multi-factor model focuses on the cross-sectional differences in the expected returns of assets. It is essentially a model about the mean, and the expected return is the average of the returns in the time series. Based on (3), the multivariate linear model of the cross-section angle can be derived:

Additional understanding:

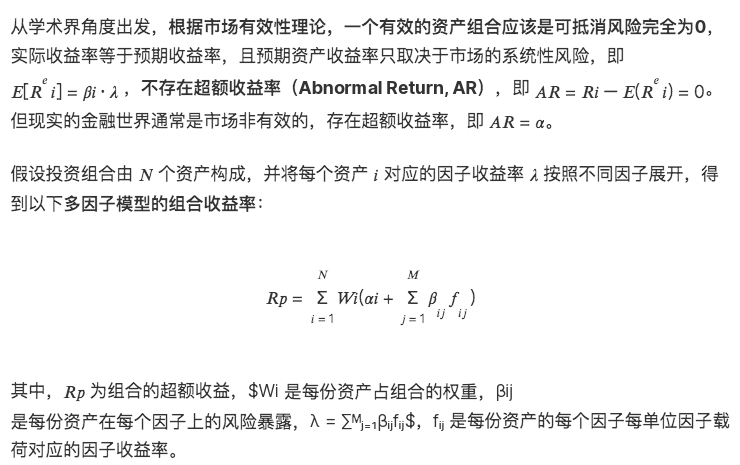

Combined with statistical knowledge, this model implies three layers of assumptions:

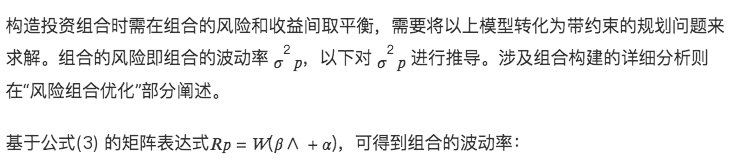

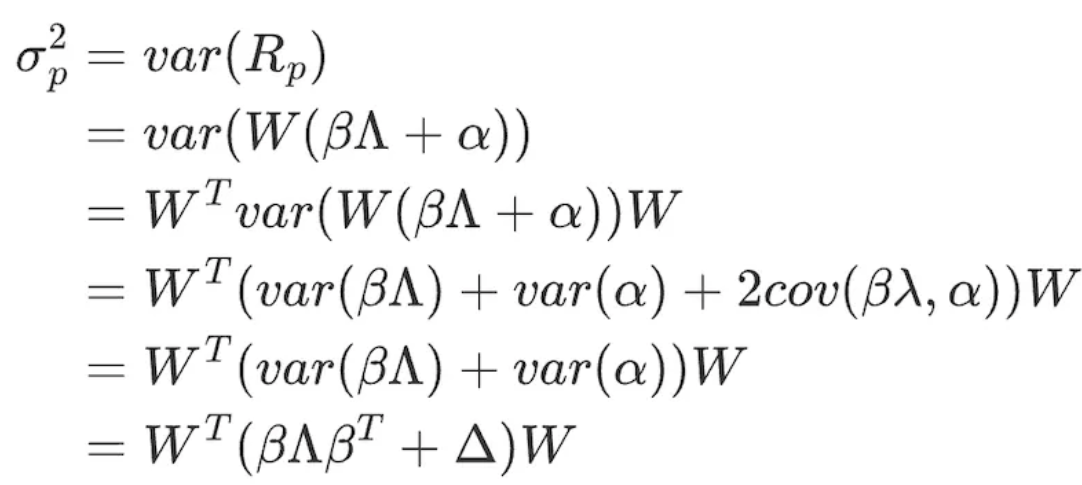

(2) Volatility of multi-factor model

formula 7

formula 8

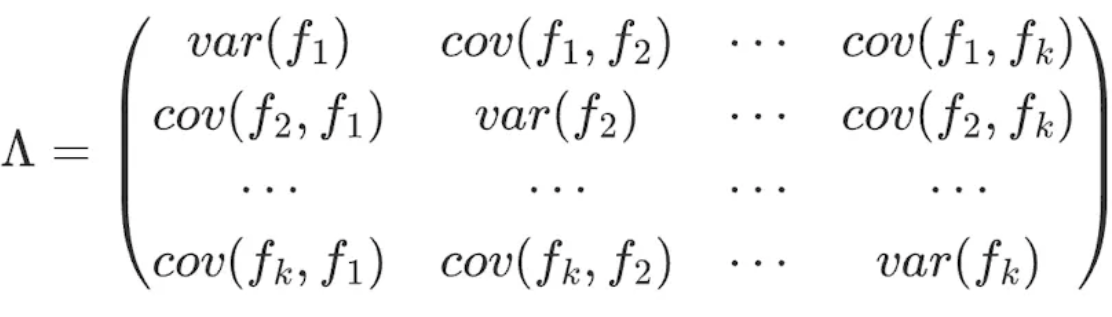

∧ meansKThe factor return covariance matrix of factors (K×K):

formula 9

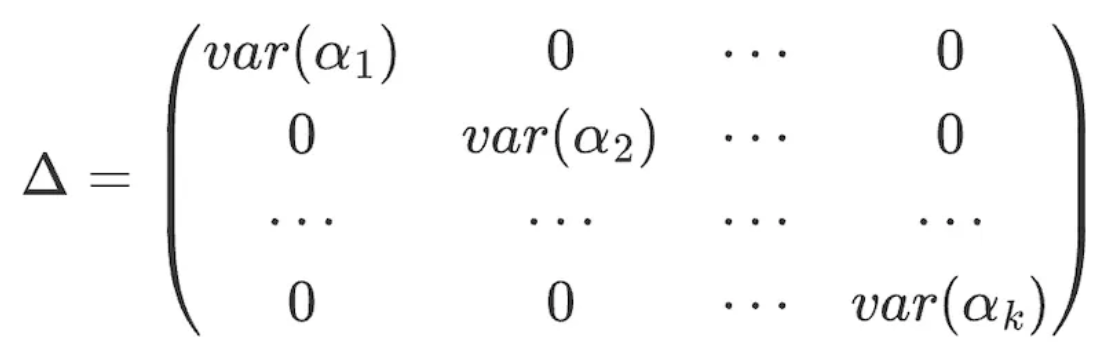

According to Assumption 3, the idiosyncratic returns of different assets are not correlated, and the Δ matrix can be obtained as:

formula 10

ABOUT LUCIDA FALCON

LucidaIt is an industry-leading quantitative hedge fund that entered the Crypto market in April 2018. It mainly trades CTA/statistical arbitrage/option volatility arbitrage and other strategies, with a current management scale of US$30 million.

FalconIt is a new generation of Web3 investment infrastructure, which is based on a multi-factor model to help users select, buy, manage and sell crypto assets. Falcon was hatched by Lucida in June 2022.

More content can be found at:https://linktr.ee/lucida_and_falcon