Original author: Keng Ying Sim, Nicholas Tan Yi Da

Original source: Binance Research

Key takeaways

Data Insights: Cryptocurrency Financing Overview is a compilation of funding charts and insights from the past year by Binance Research.

1. Overall trend: As financing gradually stabilizes, there are signs of optimism

Despite the downward trend in 2023, the market has shown resilience, with transactions and investments maintaining steady growth. Chain games and infrastructure projects account for a considerable share of this continued growth.

2. Detailed description of venture capital: traditional venture capital enters Web3

Since the beginning of this year, the proportion of investment participation by traditional VCs has increased to 45%, and the gap between traditional VCs and Web3 investors has gradually narrowed. Hack VC is a leader among traditional venture capital firms with diversified investments in areas such as gaming and infrastructure.

3. Popular projects by sector: Infrastructure financing still tops the list

Over the past four quarters, infrastructure projects have been the most funded track, with total quarterly financing gradually increasing from 26% in Q422 to 44% in Q323.

Overall trend

A look back at funding trends over the past few years

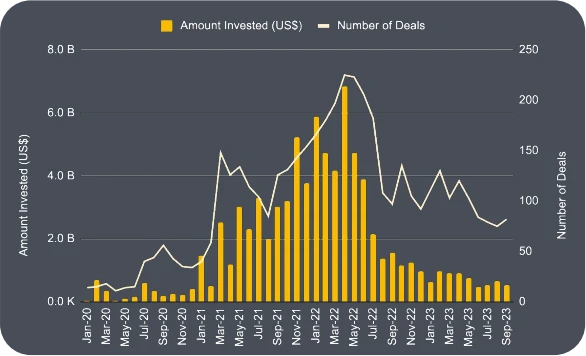

Number of transactions and capital invested during a specific time period

Source: Messari, RootData, and Binance Research. Data snapshot as of September 30, 2023.

During the hot bull market of 2021 and early 2022, total funding continued to grow. The amount of financing peaked in April 2022 at $6.8 billion, an increase of 361.8% compared to the amount in January 2021.

However, affected by the FTX thunderstorm, financing funds plummeted between the second and third quarters of 2022, with total investment funds in the third quarter being only US$2.4 billion. After this decline, the level of financing funds stabilized.

Nonetheless, the volume of transaction funds increased in January and February 2023, mainly due to substantial growth in the infrastructure and Web3 gaming sectors.

Seed rounds account for more than 30% of investments

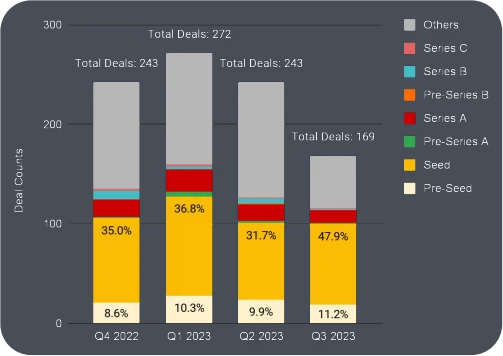

Number of deals by financing round by quarter

Source: Messari, RootData, and Binance Research. Data snapshot as of September 30, 2023 Others refer to undisclosed financings, private token offerings, mergers and acquisitions, etc.

The total number of transactions peaked at 272 in the first quarter of 2023 and fell to 169 by the third quarter of 2023, a decrease of 37.9%.

The proportion of seed round financing surged to 47.9% last quarter. While the overall number of deals declined, seed-round projects increased from 77 to 81 between Q2 and Q3 of 2023.

The popularity of seed rounds may be due to the fact that there are so many unproven technologies on the market today. Seed rounds usually support ideas that do not have mature products or customers, so the investment risk is higher, but the valuation of seed round projects is usually lower, so the risk can be spread across multiple projects.

Although pre-seed funding is the highest risk, it is the second largest investment round and is critical for research and minimum viable product (MVP) development in the cryptocurrency space.

Gaming, payments and trading platforms lead the way in financing

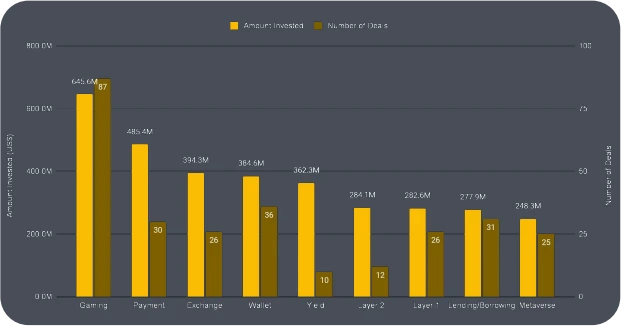

Top 10 Financing Sectors in the Last 4 Quarters

Source: Messari, RootData, and Binance Research. Data snapshot as of September 30, 2023.

Please note that a project may involve multiple sectors, only its major sub-sectors are considered

The revenue segment had only 10 financing deals, but it had the highest average financing amount. This is mainly due to the fact that Amber Group, a centralized financial company specializing in asset management, received US$300 million in Series C financing.

Although the game field has the highest cumulative amount of financing, its average investment amount is also the smallest, only $7.42 million.

This may indicate that investors see opportunities in the gaming industry. But due to the speculative nature of Web3 games and the possible lack of true gaming enthusiasts, investment amounts remain conservative.

Venture capital remains optimistic about opportunities in the gaming sector

Breakdown of sectors with the most financing in each quarter

Source: Messari, RootData, and Binance Research. Data snapshot as of September 30, 2023.

Gaming continues to attract venture capital interest, a sign of the excitement around this emerging sector, with investment in artificial intelligence and data also rising in recent quarters. The third quarter of 2023 mainly shifted to four major sectors including DEX.

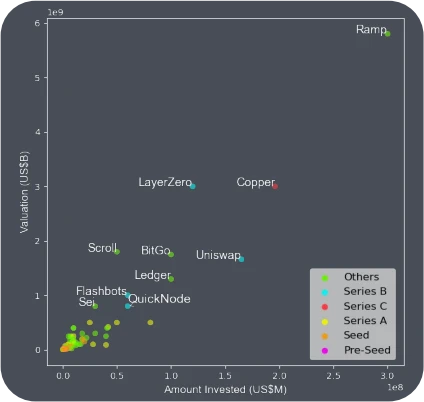

There are 6 unicorn projects (valuation over US$1 billion)

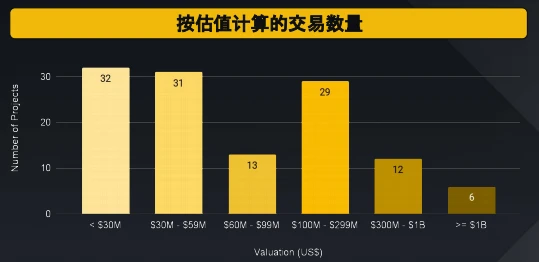

Project valuation and financing over the past four quarters

Source: RootData and Binance Research. Data snapshot as of September 30, 2023

The projects mentioned are those for which valuation data is publicly available on RootData.

3,There are similar numbers of projects in the three valuation tiers: below $0 million, $100 million to $299 million, and $30 million to $59 million.

Payments solution Ramp tops the list with a $5.8 billion valuation. It’s followed by full-chain interoperability protocol LayerZero and institution-focused infrastructure project Copper, both valued at $3 billion.

Venture Capital (VC) Details

Investment news

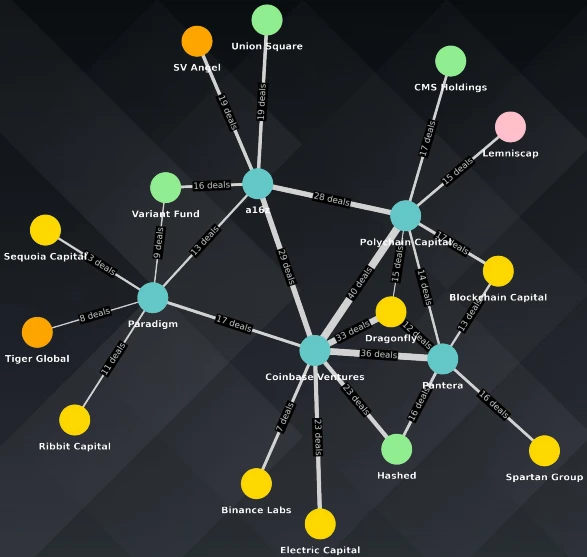

List of well-known investment companies

Source: RootData and Binance Research. Data snapshot as of October 10, 2023

The data shown above is not limited to the past four quarters

The reputation and participation of other investors are important considerations for many venture capital investors when making investment decisions, which highlights the importance of “social proof.”

The chart illustrates some of the projects that well-known VC firms such as Pantera Capital, Dragonfly, Coinbase Ventures, a16z, and Polychain Capital often co-invest in.

The chart shows that Polychain Capital and Coinbase Ventures have the largest number of co-investments (40). This may be because Polychain founder Olaf Carlson-Wee was the chief risk officer of Coinbase.

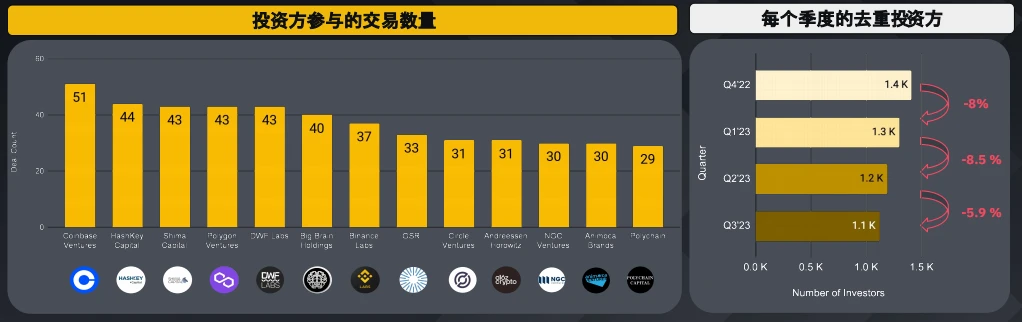

Most active VC firms closed 51 deals

Some of the most active investors over the past four quarters

Source: Messari, RootData, and Binance Research. Data snapshot as of September 30, 2023. Please note that a project may involve multiple sectors, only its major sub-sectors are considered

In the past four quarters, Coinbase Ventures has ranked first in the number of transactions, with 33.3% going to DeFi and another 39.2% investing in infrastructure. DWF Labs is a new investor on the list, having only started its investment activities in October 2022. Additionally, while the number of deduplicated investors has decreased each quarter, the decline slowed to 5.9% last quarter.

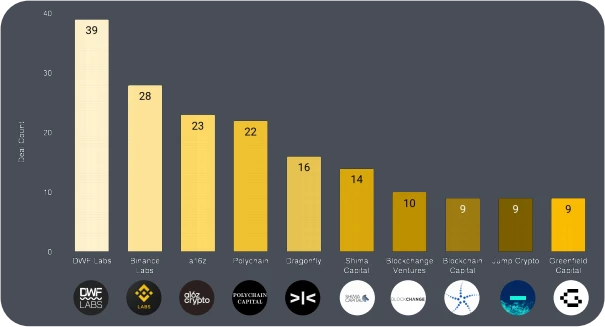

DWF Labs leads investment in 39 projects

Top 10 leading investors over the past four quarters

Number of deals led by investors

Source: RootData and Binance Research. Data snapshot as of September 30, 2023.

The * on Rootdata indicates the lead investor, as well as the sole investor in the deal. Some transactions may not indicate the lead investor.

*Certain investment amounts are not disclosed, so the total stated may actually be higher

A lead investor is the investor that provides the most money in a round.

DWF led 39 investments, the majority of which were solo investments, totaling more than $323.8 million*.

Binance Labs has also independently invested in multiple projects such as Xterio, Helio Protocol, and Radiant, respectively involving game development, LSTFi protocol, and lending fields.

Projects led by a16z accounted for 74% of its total investment, and its most recent investments in September include near-field communication (NFC) tokenization project IYK, and game studio Proof of Play.

Coinbase Ventures has 36 non-lead investments

Top 10 non-lead investors over the past four quarters

Number of deals by non-lead investors

Source: RootData and Binance Research. Data snapshot as of September 30, 2023

Non-lead investors are investors who participate in the financing but are not required to set the terms.

Coinbase Ventures is the largest non-lead investor, and its strategy appears to be to diversify its portfolio and allocate less money to more projects. This is in stark contrast to companies like a16z, which choose to spend more money leading fewer projects.

Recent projects that Coinbase Ventures has invested in include the cross-chain oracle Supra and the interest-bearing stablecoin Mountain Protocol.

Second-ranked Hashkey Capital allocates 22% of its portfolio to infrastructure projects such as self-hosted solution PrimeVault and Metaverse/gaming project Aethir, indicating increased infrastructure needs in the gaming industry.

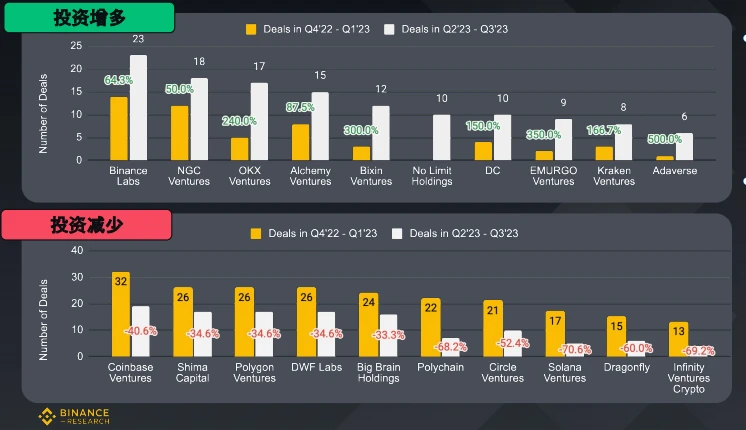

A dynamic investment environment against a difficult backdrop

VC firm deal count varies across time periods

Source: RootData and Binance Research. Data snapshot as of September 30, 2023

Despite tough market conditions, VC firms such as Binance Labs and NGC Ventures are showing bullish sentiment and increasing investment numbers. Binance Labs has seen the largest increase in absolute investment value, with a total of 23 investments in the past two quarters.

At the same time, the number of investments from companies such as Coinbase Ventures and Shima Capital has decreased, which may indicate that these companies have become more stringent in their investment screening. Despite this, both remain active investors, with Coinbase Ventures closing 19 deals and Shima 17.

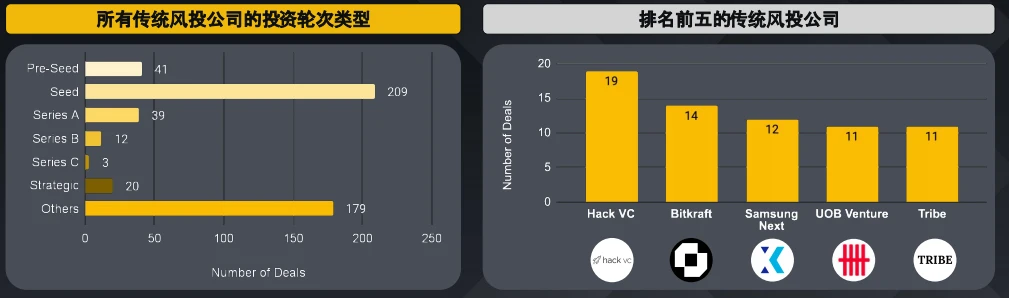

Traditional venture capital enters Web3

Funding round types and leading traditional VC firms

Source: RootData and Binance Research. Data collected is for the last 4 quarters ending September 30, 2023

41.6% of traditional venture capital firms participate in seed rounds.

Of the top five traditional VC firms listed, only Bitkraft is primarily focused on investing in gaming. HackVC has the largest number of deals and diversifies investments across sectors ranging from gaming to infrastructure. Projects include GRVT, a hybrid derivatives trading platform, and DeGame, a GameFi platform that utilizes a proof-of-contribution mechanism.

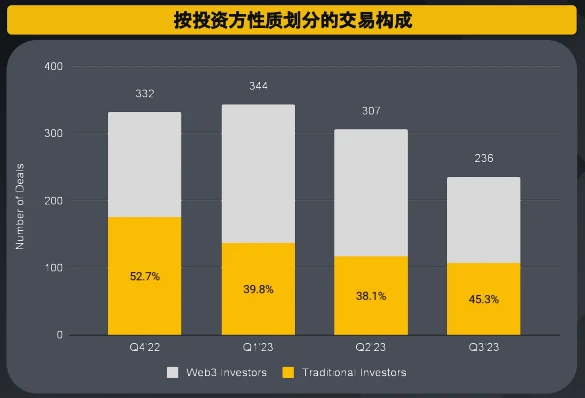

Traditional VC firms remain loyal to the industry

Nature of investors in financing in the past four quarters

Source: RootData and Binance Research. Data collected is for the last 4 quarters ending September 30, 2023

While the number of deals has trended downward over the past four quarters, the share of deals from traditional investors has remained fairly stable, between 40% and 45%.

Compared with the fourth quarter of 2022, the gap in the number of deals between Web3 investors and traditional venture capital firms has narrowed significantly, demonstrating the latters strong commitment to the industry.

Investment strategies of traditional venture capital firms

Breakdown of sectors with the most financing in each quarter

Source: Messari, RootData, and Binance Research. Data snapshot as of September 30, 2023.

Infrastructure-related projects seem to be the most popular among traditional venture capital firms, followed by DeFi and the gaming sector. Interest in NFT projects has declined, with the share of transactions falling from 11.4% in the fourth quarter of 2022 to 4.6% in the third quarter of 2023. But tool-related projects have grown significantly in appeal, with the share of deals surging from 4% in Q4 2022 to 14.9% in Q3 2023.

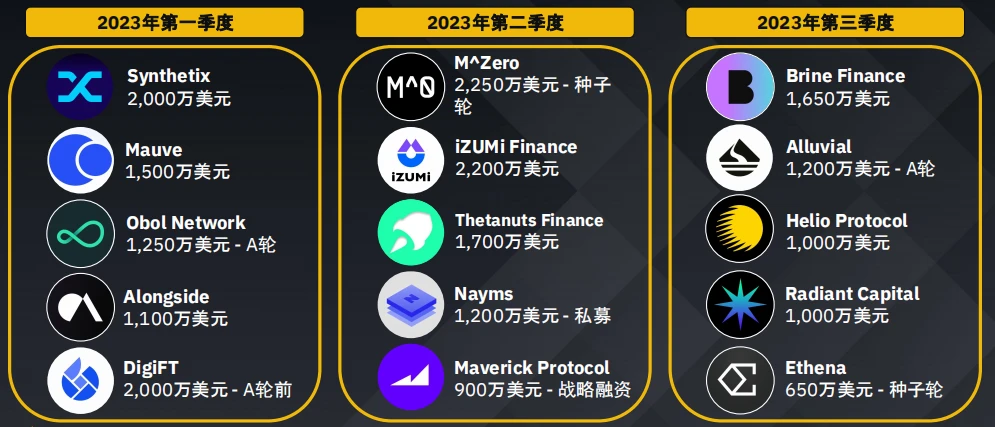

Projects in each sector

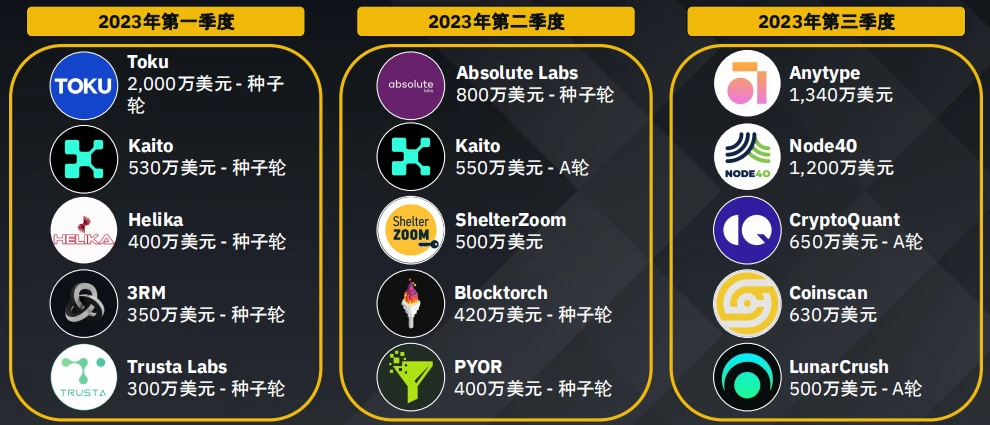

Top five funding rounds by quarter in 2023

DeFi sector

CeFi sector

NFT sector

Game section

Social and entertainment section

Tools and information section

Layer 1/Layer 2 plate

Infrastructure sector

Note: The above list of items is not comprehensive. Binance does not recommend or endorse any specific projects mentioned.

About Binance Research

Binance Research is the research arm of Binance, the world’s top cryptocurrency trading platform. The team is committed to providing objective, independent and comprehensive analysis and aims to become the authoritative insights platform in the cryptocurrency space. Binance Research analysts regularly publish insightful articles on topics ranging from the cryptocurrency ecosystem to blockchain technology to the latest market buzz.

Disclaimer

This material was prepared by Binance Research and is not intended as a prediction or investment recommendation, and is not a recommendation, offer, or solicitation to buy or sell any security, cryptocurrency, or to adopt any investment strategy. The use of terms and opinions expressed are intended to enhance understanding of the industry and promote its responsible development and should not be construed as explicit legal opinions or the opinions of Binance. The views expressed are those of the author as of the date stated above and will change as circumstances subsequently change. The information and opinions contained in this article are derived from proprietary and non-proprietary sources that Binance Research believes to be reliable, are not necessarily exhaustive, and are not guaranteed to be accurate. Therefore, Binance provides no guarantees of accuracy or reliability and assumes no liability for errors and omissions in any other manner (including liability to others due to negligence). The contents of this article may contain forward-looking information that is not purely historical in nature. Among other things, such information may include forecasts. There is no guarantee that any predictions made will come true. Readers should decide for themselves whether to rely on the information provided herein. This article is for informational purposes only and does not constitute investment advice, or an offer or solicitation to buy or sell any security, cryptocurrency or any investment strategy, nor is it made available to any person in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful. or sell any security or cryptocurrency. Investment involves risks.