Original | Odaily Planet Daily ( @OdailyChina )

Author: Golem ( @web3_golem )

On April 11, Lista Lending, a new lending product of Lista DAO, a LSDFi project in the BNB Chain ecosystem, was launched and immediately caused a frenzy in the market. The first batch of BNB worth 10 million US dollars was fully lent out in less than an hour. After only 4 days of launch, Lista Lendings total deposits exceeded 189 million US dollars, and the total loan amount peaked at more than 120 million US dollars.

The product was so popular that even CZ couldnt help but repost and comment: Lista Dao is 🔥.

As a new generation of lending products of BNB Chain, Lista Lending has gained wide favor among market users such as CZ because it adopts an innovative P2P model to provide users with higher deposit rates and lower borrowing rates. In this article, Odaily Planet Daily will give a simple introduction to Lista Lending and explain why borrowing BNB on Lista Lending is a better choice.

Lista Lending Product Introduction

Lista Lending is a new generation decentralized lending platform launched by Lista DAO. It adopts an innovative P2P model and provides users with efficient financial management and lending services through advanced interest algorithms. The platform aims to improve capital utilization, reduce borrowing costs, and enhance protection for borrowers.

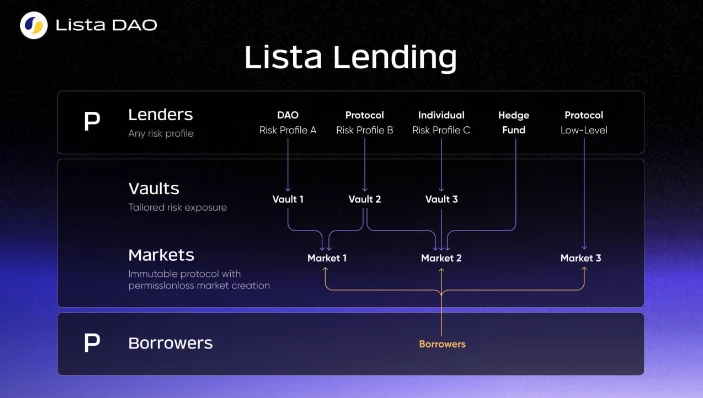

Simply put, Lista Lending will consist of multiple vaults and markets. Lenders deposit funds into the vaults to earn interest, and the vaults distribute funds to different markets so that borrowers can make over-collateralized loans in the market. In Lista Lending, lenders can be anyone, including individuals, protocols, DAOs, or hedge funds.

How Lista Lending works

Currently, Lista Lending has launched BNB Vault and USD 1 Vault. The deposits in BNB Vault have exceeded 169 million US dollars. Users can borrow BNB by mortgaging BTCB, PT-clisBNB and solvBTC; USD 1 Vault is the first application of Trumps crypto project WLFIs USD stablecoin USD 1 on BNB Chain.

Here is a little knowledge. Some DeFi novices may wonder why they need to pledge more funds on the chain to borrow part of the funds, such as pledging more BTCB to borrow USDC worth 70 BNB. This is actually mainly due to the recent short-term liquidity needs of users. For example, participating in Binance Launchpool or Binance Wallet IPOs is a guaranteed profit and no loss and has a short-term demand for BNB. At the same time, using loans to obtain BNB instead of directly choosing to buy has another benefit, which is to avoid profit loss caused by short-term price fluctuations.

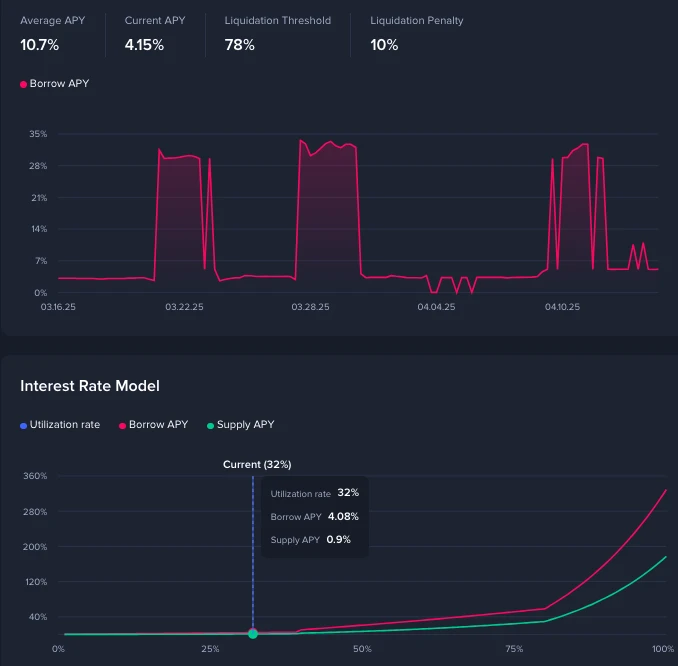

The world has suffered from Venus for a long time?

Venus is the largest lending protocol on BNB Chain, with a TVL of over 1.583 billion USD. It is also an important BNB borrowing channel for users to participate in Binance Launchpool and Binance Wallet IPOs. Although it is growing stronger with the support of Binance, Venus is still not friendly enough in terms of lending mechanism. Not only is the capital utilization rate low (about 32%), but it also increases the lending rate (up to 30%) when there is a large short-term demand for BNB, but the deposit rate does not increase by the same amount, and all the money goes into their own pockets.

Venus BNB borrowing rate changes and capital utilization curve

The world has suffered from Venus for a long time, and users expect new competitors to break the monopoly of Venus. This is indeed the case. After Lista Lending went online on April 11, Venuss BNB borrowing rate plummeted to 5%. The well-known KOL Tuao Dashixiong also said on social media that Lista has done a great thing and broke the monopoly of Venus on BNB lending in the past few years. CZ also said in the comment area that the market needs competition. 😆

Why is Lista Lending a better option for lending BNB?

According to the official data of Lista Lending, the interest rate for BNB loans in different markets is currently as low as 0.84% and as high as 2.05%. In comparison, Venuss BNB loan interest rate is 4% to 5%, and its interest rate model will surge to more than 28% after exceeding a certain loan amount. For ordinary users, Lista Lending will be a better choice.

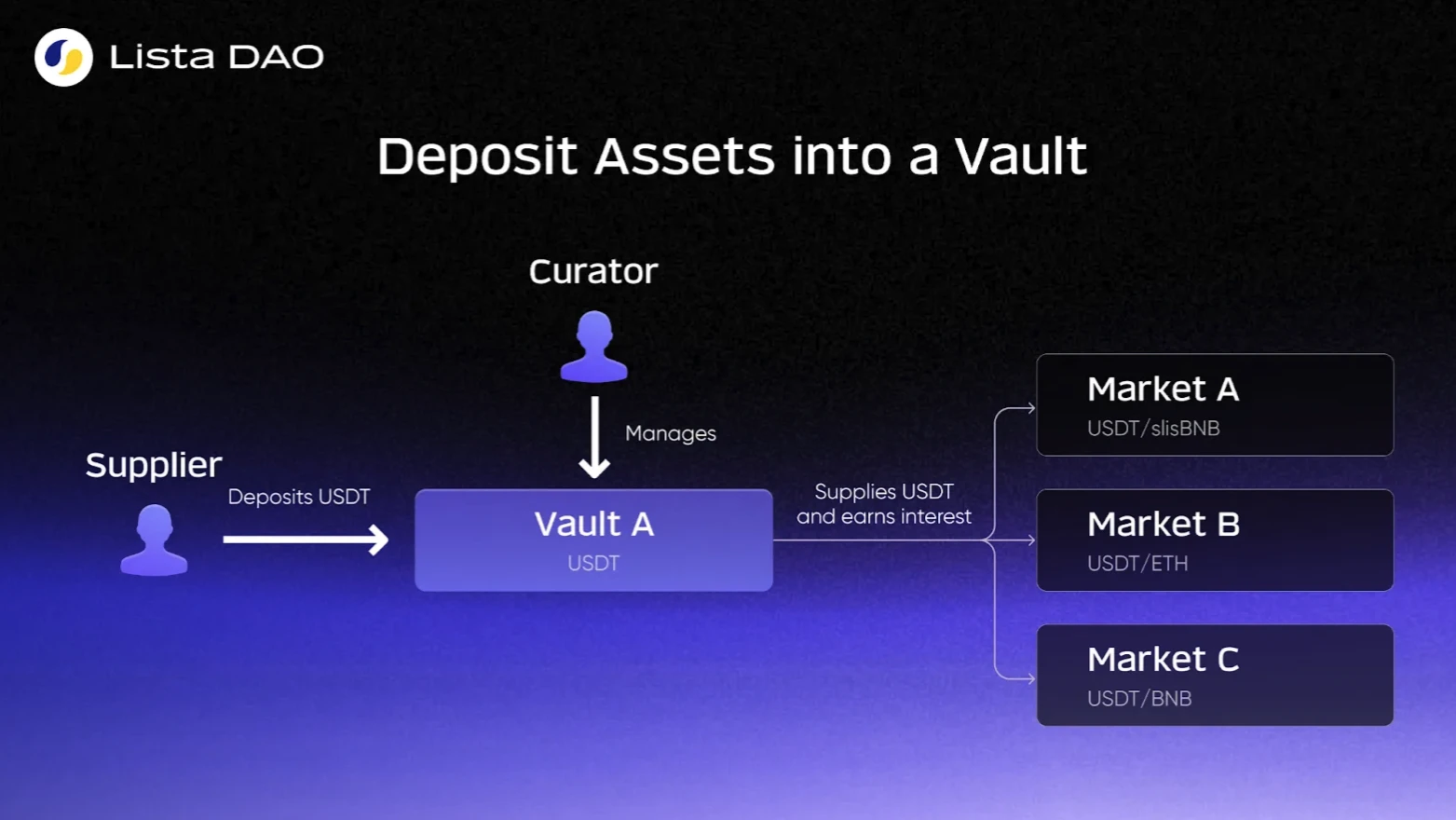

P2P lending mechanism significantly reduces user costs

So why can Lista Lending offer such a low interest rate? In fact, this is due to its innovative P2P lending mechanism.

Traditional DeFi lending protocols (such as Venus, etc.) adopt a peer-to-pool lending model, that is, all liquidity is concentrated in a shared pool. The core of this model is the low matching degree of funds deposit and borrowing. The total deposit amount of the fund pool often far exceeds the total amount of borrowing, so that the interest of deposit users is diluted by idle funds, and borrowers need to bear the interest cost for the entire fund pool, rather than just paying the interest on the part they actually use. The result presented to users is high borrowing interest rates and low deposit interest rates.

Lista Lending adopts a peer-to-peer lending model. The funds in the vault can be directly and effectively matched with borrowers. Through its multi-oracle system, a dynamic interest algorithm can be implemented to adjust interest rates in real time according to market supply and demand. The result presented to users is lower borrowing interest rates, higher deposit interest rates, and a fund utilization rate of up to 90%.

Freely create vaults and markets, and increase lending flexibility

In the early stages of the protocol development, Lista Lending only has BNB vaults and USD 1 vaults, but as the protocol matures, Lista Lending will open more vaults and allow users to create vaults and markets without permission. Users can create vaults and markets for any token, including assets that are not recognized by traditional DeFi platforms (such as Venus, etc.) but are guaranteed to be redeemable by smart contracts.

In contrast, in traditional DeFi lending protocols, the platform or DAO basically votes to decide which lending assets or collateral to support, which has low flexibility and efficiency.

Provide stronger risk resistance for both borrowers and lenders

The core pool assets of traditional DeFi lending protocols usually share risks together, and liquidation may have a chain reaction. However, each vault in Lista Lending has separate liquidation parameters, and the risks between vaults are isolated from each other. Such a humanized design enhances the risk resistance of both borrowers and lenders, and ensures a fairer and safer trading environment.

Lista Lending becomes Lista DAO’s new growth flywheel

Lista DAO is a DeFi project running on BNB Chain that combines liquidity staking, CDP system and lending. It is invested by Binance (YZi Labs) and has been held on Binance TGE in June 2024.

In Lista DAO, users can not only pledge BNB to obtain the liquidity pledge certificate slisBNB and earn POS income, but also borrow the stablecoin lisUSD by over-collateralizing native crypto assets such as ETH and BNB and liquid pledge tokens such as slisBNB, wstETH and solvBTC. At the same time, if you use BNB to pledge and borrow lisUSD, you can also obtain the loan quota of clisBNB and participate in the Binance Launchpool.

As of now, Lista DAO’s total TVL is as high as $1.108 billion, ranking third in BNB Chain, second only to Venus and PancakeSwap. Among them, the collateral value exceeds $362 million, and the liquidity pledged assets are worth about $390 million.

Lista DAO is a staunch builder of BNB Chain and is deeply involved in BNBFi. Previously, users could only use Lista DAO to mortgage and borrow stablecoin lisUSD. Not only was the lending product single, it could not meet the diverse needs of users such as BNB to participate in Binance IPOs, but the mortgaged assets could not generate income. The emergence of Lista Lending has made up for this shortcoming, and it has also become a new growth flywheel for Lista DAO.

Lista Lending has already produced a chemical reaction with the existing Lista DAO product. In terms of the price of the currency, since Lista Lending went online on April 11, the price of its token LISTA has been rising all the way. On April 13, it was forwarded by CZ and the price reached a maximum of $0.2.

At the same time, PT-clisBNB is the main collateral of Lista Lending. PT-clisBNB is the yield token of clisBNB on pendle, with an APY of 14.86%. The emergence of Lista Lending allows users to borrow BNB while getting pendle annualization. Users can choose to participate in short-term activities such as Binance IPOs, or continue to participate in revolving loans in Lista DAO to increase DeFi yield leverage.

In short, through Lista Lendings flexible lending market, it is expected to form a synergy with Lista DAOs original products to increase the overall TVL of the protocol, provide users with more playability, and revitalize the BNB Chain lending ecosystem.

Lista Lending brings BNB Chain lending into a new era

According to DeFiLlama data, lending is the category with the highest TVL in DeFi, with 508 protocols engaged in lending business, more than 1 times more than the liquidity staking sector, which ranks second in TVL. This shows that its market demand and competition are still fierce.

However, the proportion of the lending sector on BNB Chain is relatively low. BNB Chains DeFi TVL reached US$5.4 billion, and the loan amount was only US$1.9 billion, accounting for about 35%, which is far lower than the lending share of over 50% on Ethereum.

It is undeniable that as the big brother of DeFi, the Ethereum ecosystem has a more complete infrastructure in the field of lending. Morpho has already used the peer-to-peer lending mechanism to improve the utilization rate of Ethereum ecosystem lending funds. This visible gap requires the BNB Chain ecosystem project to work together to make up for it. However, Venus, as the largest lending protocol on BNB Chain, has a LTV (loan-to-value ratio) of only 78%, while the LTV of BTCB and ETH is 80%. Obviously, the liquidity of BNB on BNB Chain is better than that of BTCB and ETH, but BNB is still inferior in terms of lending. As an important lending infrastructure on BNB Chain, Venus should have taken positive measures to establish advantages for BNB, but the results were not satisfactory.

As the first P2P lending product on BNB Chain, Lista Lending is taking on the responsibility of the new generation of BNB Chain lending infrastructure. Not only can BNBs LTV be as high as 90%, but compared to Morpho in the Ethereum ecosystem, Lista Lending uses a multi-oracle system and upgradeable smart contracts to ensure more accurate and fair pricing and timely upgrade contracts to meet development needs.

Today, with low-risk free-to-play opportunities such as Binance Launchpool and Binance Wallet, the BNB Chain DeFi lending market already has sufficient liquidity and user base. Lista Lending will become an important catalyst, and is expected to bring BNB Chain lending into a new era.

Conclusion

In this on-chain world where liquidity is king and efficiency is life, every iteration of technology and innovation of mechanism may bring about a new order. The birth of Lista Lending is a shot in the arm for the market as the BNB Chain ecosystem gradually matures.

It is not only a powerful challenge to the traditional lending mechanism, but also brings real benefits and freedom of choice to users - lower borrowing interest rates and higher capital utilization. This born for users design concept reflects the determination of BNB Chains ecological self-evolution and is also an echo of the original spirit of DeFi.

In the future, Lista Lending may not only be a supply station behind Binances new listings, but will also become the core hub of on-chain lending liquidity, supporting a more efficient, open and fair financial order in the entire BNB Chain ecosystem.

Just as spring buds will not immediately turn into a forest, Lista Lending will also take time to grow. But it has already stood at a starting point worth looking forward to, providing a new solution for users, developers, and the entire BNB Chain DeFi ecosystem. Whether Lista Lending can take on this responsibility, we will wait and see.