Original author: Ginger Lao Qin @Starbase (X: @ASuperGinger), Blocklike CEO

Words written before the article:

I decided to start writing this article in the New Year of 2023, more than a month after the collapse of FTX. Because I was very curious about how CZ could promote the end of FTX through a few tweets, I began to look for the development context of Binance. It took nearly 3 months to sort out the development history and business focus of Binance. Because some key issues were incomplete, it has not been released.

Until I saw the latest news from Binance: Binance to Pay $ 4.3 B to Settle US Criminal Case; Changpeng CZ Zhao Resigns as CEO and Pleads Guilty in Seattle. (from Coindesk 2023.11.22)

The regulatory sword on Binance has fallen. The story of Binance in the CZ era has been settled. The core missing parts of the article have been completed and can finally be published.

Table of contents

Binance’s thrilling debut and many twists and turns to gain a foothold

Build a business moat

Expand the traffic pool and enrich trading scenarios

Capital operation stacks BUFF and increases FOMO effect

Stepping on the right cycle, the gears of destiny roll rapidly

The market slack period is Binance’s hunting time

Resolutely abandon China and thrive in the face of global challenges

Under the public chain war, BNB’s decentralized transfer

Seize the security vulnerability of FTX assets and kill your competitors with one blow

Compliance constraints are difficult to break, and you can use your own body to get out of the game

What’s the future of Binance?

Conjecture 1: What crisis will Binance face in the future?

Conjecture 2: The track that Binance may focus on in the next stage

Preface

Binance has become an enviable and awe-inspiring company in the crypto industry.

This 6-year-old company, under the leadership of CZ (Changpeng Zhao), has become an unparalleled superstar team in the history of encryption through its global layout, fast lane of market cycles, skilled and decisive decision-making, and high-level but pragmatic vision. .

As of December 2022, Binance Global has 120 million users, and it accounts for more than 70% of the entire cryptocurrency trading market share.

Thunderbolt incidents occurred frequently in the blockchain industry in 2022, and the markets uncertainty about asset security reached a high point. In addition, Binance founder CZs promotion of the FTX incident catalyzed a new round of collapse, and the industry suddenly entered a deep bear. Many institutional and individual investors have not yet woken up from the shock of losing their assets in half a day. The dominoes of FTX blockchain companies collapsed at lightning speed, and the aftershocks in the industry are not over yet.

It’s hard to disagree. After this round, there are no institutions that can compete with Binance. A joke quietly circulated in the industry can prove its status, “Exchanges are divided into two categories, one is Binance, and the other is Binance.” Class is not Binance”. Perhaps there is a vague uneasiness among many market participants. This uneasiness comes from: Why does a centralized institution occupy an influential position in the industry in the decentralized field? Is this a delicate balance?

However, today’s Binance is more than just an exchange.

Looking back at Binance in the past few years, almost all of Binance’s decisions at most important nodes have been positive and effective. With the bull market in 2017 and the following two cycles, we seem to be able to clearly feel the excitement of Binance. and growing strength.

This article focuses on sorting out Binance’s business actions and development path from its establishment to the present. From the perspective of the development rules of the encryption industry, it deeply dissects the important nodes of Binance’s entrepreneurial path. If you have different opinions, please feel free to correct and discuss them.

Binance’s thrilling debut and many twists and turns to gain a foothold

CZ is good at trading. Before founding Binance, he was already a very mature player in the trading field. From Tokyo Securities to Fuxin, from OK to Binance, trading has been with him for more than ten years.

If All in Blockchain and his experience at OK in 2014 allowed him to understand the gameplay of decentralized finance, then founding Binance was his practice of understanding the rules of the game. In this new industry with ups and downs, there is nothing better than creating it with his own hands. A complex and huge business empire is even more adventurous.

On July 2, 2017, the initial coin offering (ICO) completed US$15 million in fundraising.

On August 30, 2017, the server was moved abroad

On September 4, 2017, the People’s Bank of China officially announced a ban on ICOs

In September 2017, affected by the 94 ban, Binance compensated users of four ongoing ICO projects for nearly $6 million in losses.

In September 2017, Binance, which was only online for 50 days, already has users in more than 180 countries around the world.

On January 10, 2018, the number of registered users of Binance exceeded 5 million, and the trading volume exceeded 10 billion US dollars, becoming the world’s largest digital currency exchange.

Binance’s debut was not an easy one, it was even very thrilling. CZ is very excited about the issuance method of ICO. Its advantages can avoid problems such as excessive institutional investors holding too many shares in the project, uneven distribution, and too much interference from investors. This crowdfunding model similar to the Internet was very popular in the encryption market at the time. Investors were basically individuals, and the investment chips were relatively dispersed. Based on user beliefs initiated by the community, it could gather more people with common cognition, and they would generally Because of the project founders personal experience and project concept, he casts a valuable vote (funding), thereby sending a recognized project to debut.

Turning point 1: Token breakout

ICO has shifted the projects fundraising from institutional to community-based. Binances first round of fundraising was a great success, raising $15 million in equivalent Bitcoin and Ethereum. A month later, Binance officially launched BNB, but the tokens broke. The community gradually began to express distrust. This was mostly due to the fact that the price of BNB was lower than that of the ICO, which made users who participated in the first round feel that they had lost money. At that time, Binance’s exchange products were not yet online. Users could not obtain specific information on whether Binance would fulfill the product plan in the white paper. There was no way to know what the former Lianchuang and CTO, who had an embarrassing breakup with OK, could do. What achievements have been made.

Binance exchange was successfully launched 10 days later. Even so, it could not dispel the doubts that users had accumulated in the past. In the blockchain industry, 10 days is like 10 months, and many extreme situations can change. CZ even invested his own funds to subscribe BNB, but the effect was minimal (some people later pointed out that it was CZ who left the window period to buy BNB at the bottom), and the price of BNB fell from 0.15 $ in the ICO to the lowest of 0.0997 $ in August.

Turning point two: He Yi joins

Judging from the actual situation, Binance urgently needs a shot in the arm to give users a shot in the arm. After more than 20 days of being under tremendous pressure, good news came. Binance announced the joining of He Yi. Prior to this, He Yi, as a senior media person, led OK to successfully break out of the circle and enter the public eye. She played a non-negligible role in OKs acquisition of traffic in mainland China. She was highly praised by early domestic blockchain users. Her joining is a timely help for Binance. Based on users trust in He Yi, the price of BNB has gradually stabilized.

However, the crisis of Binance’s start-up was not completely resolved. In August 2017, just two months after the completion of the ICO, the news on the eve of 94 spread to Binance’s office in Shanghai. For safety reasons, CZ moved the entire team to Japan. Leave China completely. At that time, Japan was the first country in the world to recognize cryptocurrency as a financial asset. A moderate regulatory environment could become fertile ground for the development of decentralized finance.

Turning point three: ICO restrictions

In September 2017, Binance, which debuted with ICO, is using the same method to launch multiple new projects. The 94 ban has had a very big impact on it. The Peoples Bank of China officially announced a ban on ICO. These new projects have been affected by the sudden policy. It fell very badly. In order to maintain its reputation, Binance decided to reimburse users for all losses of US$6 million. Binances brand has just begun to be established.

Turn 4: Leaving Japan

In January 2018, $530 million worth of cryptocurrency was stolen from Coincheck, making it the largest digital currency theft at the time. Not long after, the Japan Financial Services Agency issued eight clearance orders to inspect 32 cryptocurrency exchanges in Japan. Many exchanges were either fined, ordered to make corrections, or shut down.

Binance, which has just established its foothold in Japan, was warned by the Japanese government on compliance and fund security issues due to hacker phishing attacks. Japan’s attitude is ambiguous, its business situation is unclear, and its policies are too strict. Binance Instead of considering Japan as a key country for global business, Binance accepted the invitation of Malta, which is open-minded. Since then, Binance has embarked on the path of global compliance exploration.

Turning Five: Crisis Resolved

Excellent partners join countries that boost confidence, build brands, recover currency prices, and adopt open policies, allowing Binance to cross the first threshold of a start-up team. Solving the problem of market confidence, sufficient cash flow, the bull market opportunity at the end of 2017, breaking away from the restrictions of regional policies when going overseas, good market reputation, and explosive growth in user volume and transaction volume gave Binance the confidence to expand significantly.

As the raging bull market that industry practitioners talk about so far has slowly begun, in January 2018, the secondary market reached the peak of that cycle, and it only took Binance just 6 months. , taking advantage of the east wind of the market to complete its first overtaking in a corner, the number of registered users exceeded 5 million, and the transaction volume exceeded 10 billion US dollars, taking the top spot in the digital asset trading platform.

Build a business moat

If it hopes to replicate the Malta Olive Branch global national compliance landing, Binance must have a more complete industrial chain, which can not only help local governments obtain economic income, but also solve local employment problems, while bridging the blockchain industry and Distrust and confrontation in traditional industries.

Martial arts in the world are fast and unbreakable.Binance’s business is expanding rapidly. The essence of trading is the realization of traffic. The thing to make the realization more efficient is to add investment leverage. Binance only needs to do three things to quickly complete the basic business. Closed loop: Obtain more traffic through the brand, improve more transaction scenarios, increase the efficiency of traffic monetization and strengthen the brand;

We classify Binance’s existing business structure according to the triangular structure, and we can find that no matter which line, it ultimately serves transactions. Trading is the same as selling water, traffic is everything. Binance is not willing to fight in its parallel business development. The core goal is still to obtain traffic to serve the transaction itself.

Traffic amplification business:Listing, BSC ecological projects, external media, community, wallet, live broadcast, Feed, digital identity (BABT), market data platform, Binance Academy (Academy);

Transaction scenario business:CEX, DEX, NFT platform (IGO chain game), Launchpad, derivatives trading (contracts, futures, leverage), cloud services, Binance Financial Management, currency earning business, Staking business (mining pool, fixed investment, pledge), financial business (Exchange and payment, gift cards), institutional users (asset management, lending, brokerage, OTC, API services), stable currency (BUSD);

Branding business:Incubator Binance labs, BSC Ecological Fund, Binance Research (Binance Research);

Expand the traffic pool and enrich trading scenarios

In December 2022, CZ said in a video interview with TechCrunch that 90% of Binance’s revenue comes from transaction fees. According to Bloomberg analysis, Binance’s revenue for the entire year of 2022 is approximately US$20 billion.

Where does the traffic come from?

The first thing to bear the brunt is the asset’s own attractiveness, raising the threshold for spot currency listing, allowing assets with high flow and popularity to be listed online, and the transaction volume of transaction undertaking projects. According to general market expectations, Binance’s listed projects will have a 20 times bottom line. There is room for growth, and the instantaneous traffic in the spot field is very high.

Secondly, there is the layout of wallets and data platforms. These two categories are generally considered to be the gathering place for traffic in the blockchain market. The former can help the market accumulate trading users of different values, and the latter can help the market reach crypto enthusiasts.

Furthermore, in addition to launching more popular spot assets and trading scenarios with existing functions within the platform, more trading channels have been expanded for assets that cannot be selected by Binance Exchange, such as using payment products to connect to project parties, and embedded The payment channel uses BNB to exchange assets, so that many assets do not need to be listed on the exchange, but can also obtain handling fees through BNB transactions.

In addition, KOL is a role that Binance attaches great importance to, because they are the only ones with large traffic, and there are many policies and benefits for KOL. Trading rebates, KOL benefits, and CZ’s attention can all allow KOL to provide services for KOL in their own social arena. For Binance communication, apart from brand PR in the early years, Binance only has KOL gatherings for any conferences or lively industry weeks in the later years.

KOLs, content, wallets, and data platforms help users lower the threshold for understanding and using crypto products. From a long-term perspective, if Binance can get its position right from the traffic entry end, then the Binance brand will become a global user’s entry into the crypto market. first stop.

Interestingly, Binance has added live broadcast and feed functions to its APP, which corresponds to the market demand for AMA and Twitter promotion. This move is tantamount to the birth of Ant Forest in Alipay, which not only improves user activity and user stickiness, but also provides Become a flow channel within the ecosystem.

Colleges and research institutes undertake the work of basic and in-depth user education, and convert those users who are most difficult to become active through content.

Where does the traffic go?

Binance has successively seized the spot, new currency Launchpad, and derivatives trading businesses, and captured the mainstream trading crowd in its own hands. At the same time, it will gradually open compliant cryptocurrency exchanges and legal currency exchanges around the world, update products in more than 40 languages, and capture global transaction traffic.

Binance has not been absent from the rise of encrypted Lego DeFi. It has decisively launched Dex, stablecoins, and lending services, along with financial services including exchange, payment, and financial management, and gradually penetrated into more market-oriented and traditional trading scenarios.

For large amounts of funds, Binance provides institutional user scenarios and launches bulk trading, asset management, lending, brokerage, OTC, API and other services to facilitate market making and institutional entry and exit, and the trading business is expanded to low-frequency and high-value scenarios.

Binance has not missed the hot spots of NFT and GameFi. It was the first to open an NFT trading section in the Cex exchange, the first exchange to blindly combine trading with IGO, and acquire active users in the global Web3 direction. The trading scene has once again expanded to include NFT, which is popular in everything. track.

Binance’s trading landscape has covered more than a dozen fields and more than 30 trading scenarios. These trading scenarios can maximize the digestion of trading users with different needs from various fields.

Capital operation stacks BUFF and increases FOMO effect

Scenario + traffic + brand is the stable structure for Binance’s business expansion. The best way to get traffic is to start with a project, plant a seed, water it, bloom it, and harvest the fruits. In this financial game market, using capital to strengthen your brand is undoubtedly the amplifier of all businesses.

Traffic assets/KOL/brands reach a wide range of markets → Global Hackathon → Public Chain (BSC) Access Project → Support Fund (MVP) Acceleration → Binance Labs Investment Incubation → Binance System Resource Introduction → LaunchPad (IGO) / NFT Market (IGO ) → Cex / Dex secondary circulation → encryption use cases

No matter which link a project (team/developer) enters from, it can be labeled with the Binance label, and this label allows it to ride on the high-speed train brought by the Binance brand in its development path. Once all links of this business logic are connected, Binance can become a mature dream factory and obtain more realizations on projects. In this process, the power of capital can be fully exerted.

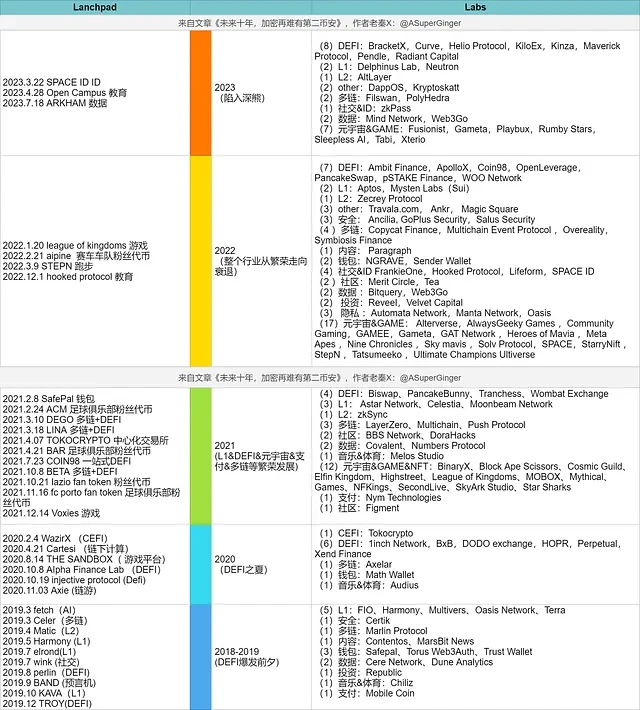

Binance Labs is a business segment formed after the release of Binance products. Investments and mergers and acquisitions have run through all paths of Binance’s development to date. Comparing Lanchpad to analyze Binance’s investment direction and investment decisions in the market, you can clearly feel its rhythm of grasping the context of the market.

(The following are all public data, and unpublished investment information is not included in the analysis)

Judging from Binance’s past acquisition cases alone, from the acquisition of Coinmarketcap despite the controversy, the acquisition of contract trading platform JEX, to the Indian cryptocurrency exchange WazirX, etc., they are all part of its efforts to build a complete cryptographic landscape. At that time, among the top exchanges in the world, there was no single dominant one. Binance’s acquisition case and each traffic portal opened accordingly give it an advantage in global layout. The hot spots in each cycle interact with the investment trends and publicity campaigns of investment institutions.

To sum up, Binance Labs mainly focuses on two main lines. One is the industry ecological occupation, which has the layout of a large traffic explosion trend; the other is the Binance ecological expansion, which has external short-term traffic effects and traffic flow capabilities;

Industry ecological position

Binance Labs invests in many fields and concepts, and it does not just stay in the areas it is familiar with.

2018 – 2019

Binance Launchpad Binance Labs accurately grasped the L1 track and launched Harmony, KAVA, Terra, Oasis Network and other public chain projects that are well known to this day. Most of them will achieve glory in the 2020-2021 stage.

2020 ushered in the summer of DeFi

Binance Labs has invested in many well-known DeFi projects such as 1inch Network, DODO, etc. At the same time, Binance Launchpad tried the GameFi track, which was not mainstream at the time, and launched Axie Sand Box, paving the way for the subsequent explosion of GameFi and Metaverse concepts.

Binance Labs’ massive investment phase in 2021 – 2022

There are many traffic-based projects such as NFT and GameFi. However, during this period, except for a few projects such as StepN, it has been difficult to reproduce the glory of 2019. The possible reason for this is that Western capital, including A16Z, Paradigm, Coinbase and other large-scale investments, has gained a large share of the say.

Binance ecosystem expansion

Binance Labs invests in many platform projects, including encryption infrastructure, compliant exchanges in various countries, financial platforms, investment platforms, quantitative platforms, etc. This is an extension of its own market and business, and it is also an investment behavior that shows its strength.

around 2018

Its investment infrastructure, such as wallet Safepal, Trust Wallet, etc., are deeply tied to Binance.

2020 – 2021

The holdings and liquidity of the crypto asset market have a certain foundation, and the derivatives market has become a battleground for exchanges. The internal testing of Binance Futures products and the acquisition of JEX were carried out simultaneously, successfully entering the derivatives market. In the same year, there were also cases such as WazirX and Tokocrypto, which helped Binance expand the Indonesian and Indian markets;

2022

WOO Network, the investment target of Binance Labs, provides liquidity in the form of a dark pool (WOO Network is able to channel large amounts of liquidity through its market maker Kronos Research and internalize order flows from other crypto exchanges through API integration, helping Binance achieve management of liquidity.

2023

Major projects such as Open Campus, Hooked Protocol, and CyberConnect invested by Binance Labs have been launched on BSC Chain and are more deeply integrated with the Binance ecosystem, triggering the communitys imagination about the exchange of interests. Binance has taken advantage of the trend to launch a low-threshold Web3 wallet that integrates 1inch. In theory, it can open up the barriers between Binance exchange users and DeFi users.

Binance Labs has invested in a large number of projects around GameFi, which has greatly helped traffic growth and enriched Binances asset types.

From this point of view, the ecological expansion of the Binance system is extended horizontally and vertically at the same time: one direction is the expansion that is beneficial to the Binance trading platform,

Broaden the boundaries of Binance’s strength and stabilize its cryptographic territory; one direction is to promote concepts that may develop into trends, which includes the deduction of future markets, and promotes popularity and trends, ultimately bringing Alpha benefits and giving back to the entire ecosystem. .

Binance Labs’ investment in the past six years, due to the nature of the platform itself, is different from other native crypto investment institutions in that Binance’s investment does not entirely focus on the return on investment in the pure secondary market, but more on the effect of seizing pits and generating traffic. First, Make money, let’s talk about ideals. But it has to be said that the short-sightedness of a single goal during the business expansion period is a strategy.

Stepping on the right cycle, the gears of destiny roll rapidly

Combining the development cycle of the blockchain industry and Binance’s announcements and media reports over the years, we have sorted out Binance’s business schedule over the years. We will find that: starting from transactions, it has expanded to multiple business lines such as investment, underlying, ecology, and brand charity. , Binance has almost stepped on every suitable opportunity in the encryption cycle, and its business moat has been built up year by year under the design of its business structure.

2017 – 2018

Crypto market keywords: ICO, stable currency, public chain Dapps

The bull market in 2017 was driven by the ICO craze, with more than 2,000 new projects around the world, and policies in various countries began to tighten in the middle of 2018;

As a value anchor, the stablecoin market is booming;

The top 30 mainstream digital currencies in terms of market capitalization have the highest growth rate in the public chain field, and the explosion occurred in the second half of 2017.

DApps take over the popularity of public chains, but security issues make them cash machines for hackers;

80% of the computing power of Bitcoin and Ethereum is concentrated in China. Due to the migration of computing power caused by the policy in September 2018, market funds have been significantly deposited in bubble projects. The fork of Ethereum and the price of Ethereum have driven the use of ETH as a fundraiser. Income projects are heading towards a death spiral, and the market has dropped to freezing point.

Binance keywords: transaction flow, BNB, basic business construction

Binance only has spot and futures contracts. In order to expand trading users, Binance has implemented two very simple and effective policies: new currency listing activities and BNB value establishment.

BNB has captured the active users of the crypto market through 0 handling fees, generous trading gifts, rebates, project token rewards, trading competitions, development ambassadors, etc. BNB has begun to participate in the trading platform’s handling fee discounts, profits, and distribution with users. , voting for currency listing, participating in trading platform decisions and other functions are linked.

The basic business structure developed by Binance, such as Labs, Binance Chain, Launchpad, DEX, Charity, Acadamy, Research, Trust Wallet (acquisition), Uganda, etc., played a key role in capturing market traffic and providing brand value in the later period;

2019

Crypto market keywords: institutional entry, first year of DeFi

The IEO led by Binance drove the hot spots in the first half of the year. However, the ICO bubble dominated by the Ethereum ecosystem continued to burst, and the siphon effect of Bitcoin accounted for up to 70% of the market share;

Native crypto VCs have experienced a wholesale demise, and more than half of the top ten active crypto funds are in the United States;

Traditional institutions represented by Grayscale and Fidelity Funds have attracted more than US$20 billion in venture funds;

Huobi Global, OKEX, Binance, Coinbase and BitMEX occupy the top positions;

The liquidity of the spot market is exhausted, blockchain applications are developing in the direction of Defi, financial services (settlement and clearing, cross-border payments, insurance, securities) are gradually maturing, and the DeFi triumvirate (stable currency market, lending market, Dex market) is Under the competition with supervision, it has gradually shown its scale;

Binance keywords: IEO, derivatives, BSC, compliance

After Launchpad was launched in 2017, there were not many projects. The first project launched in 2019, BTT, began to drive a new round of market conditions;

Only 33 tokens were launched in 2019. Due to the sluggish liquidity in the spot market, Binance launched contract trading and deployed derivatives businesses such as lending, futures, and financial management to increase the frequency of deposits and withdrawals for user transactions;

Binance Chain. (Binance Chain) and Binance DEX (decentralized trading platform) were launched. 121 trading pairs were launched on Dex throughout the year, and a total of 165 BEP 2 tokens were issued based on Binance Chain;

BNB global application scenarios have expanded to 180+;

Binance Incubator has incubated 21 blockchain projects and directly invested in 14 blockchain projects;

In September, the compliant stablecoin BUSD was issued. This stablecoin anchored to the US dollar in cooperation with Paxos was licensed by the New York Department of Financial Services (NYDFS);;

Binance has opened 5 legal currency platforms around the world, covering 170+ countries and regions around the world, and supports 300+ payment methods;

2020

Crypto market keywords: Return of Bitcoin value, King of Ethereum public chain, rise of Polkadot/NFT

In 2020, the total market value of cryptocurrency increased by nearly 400% year-on-year. Various institutions and companies, led by Grayscale Trust, continued to increase their positions in Bitcoin, and the total market value of Bitcoin accounted for up to 69% of the market;

The total locked-up position of the Defi protocol is 23 times that of 2019, and markets such as Dex, lending, stablecoins, and aggregators are having a crypto Lego carnival;

Layer 2 expansion plans emerge, 2.0 beacon connections are launched, and the prosperity of DeFi makes Ethereum an application chain;

Polkadot, NEAR, Cosmos, Solana, Avalanche, BSC, and OKEXChain are also entering Defi;

Since September, the sales quantity and amount of NFT have increased significantly. The main applications and transactions are concentrated in games, virtual worlds and encrypted art collections, with the leading exchange being OpenSea.

Binance keywords: DeFi, smart chain (BSC), comprehensive business

Binance’s total trading volume exceeds US$3 trillion, and 184 currencies are listed on the spot;

BSC project growth deployment, US$100 million seed fund was established; BNB shifted from platform currency (anchored by centralized business) to decentralized business support, with total market value reaching US$5.3 billion, and the number of application cases/platforms supporting BNB increased by 27 ;

The total trading volume of Binance contracts, options, and spot leverage trading exceeds 1.7 trillion, the total legal currency order volume exceeds 31.9 billion U.S. dollars, the total C2C order volume exceeds 6 billion U.S. dollars, and the total trading volume of the OTC commodity trading platform is 700 million U.S. dollars;

BUSD ranks 4th in the global stablecoin market, Trust Wallet users exceed 5 million, and Binance Mining Pool ranks 3rd in the world in computing power;

Binance Launchpad sold tokens 6 times, raising US$14.72 million; Binance New Coin Mining Launchpool provided 22 liquidity pools for 8 issuance projects, with a total TVL value of US$900 million;

2021

Crypto market keywords: mining migration, Meme coins, NFT, regulatory tightening, institutional reshuffle

The total market value of cryptocurrency once reached US$3 trillion, the primary market is booming, and mainstream capital has entered the market;

The price of Bitcoin is as high as $64,000 per coin. China’s severe crackdown on Bitcoin mining has caused the price of Bitcoin to fall by 50%, and the mining industry has experienced a large migration rarely seen in history;

The leading Meme has jumped to the top 10 of cryptocurrencies, and blue-chip NFTs such as NBA Top Shot, Beeple, CryptoPunks and BAYC have flooded into the market;

The NFT market and infrastructure explode, the new public chain ecosystem rises, GameFi and DeFi continue to evolve, and leaders in various sectors such as Metaverse and DAO are born;

The U.S. SEC passed the Bitcoin Futures ETF; Bitcoin became a legal currency in El Salvador; compliant encryption companies such as Coinbase were listed; NFT continued to break through the traditional field; Chinese institutions gradually lost the main battlefield of encryption;

Binance keywords: BSC, NFT, investment

DeFi summer is an opportunity to support Binance in promoting BSC, and active projects on Ethereum will gradually join BSC;

Within one year after BSC’s mainnet was launched, the number of daily transactions surpassed Ethereum by nearly 7 times;

The NFT market is officially launched. A total of more than 2.5 million NFTs will be issued on Binance in 2021, including more than 1 million blind contracts involving art, sports, entertainment, fashion, virtual land and other fields, and 100 NFTs listed in cooperation with more than 60 game projects. Multi-million game NFT;

After Steam delisted blockchain games, Binance launched IGO with a total transaction volume of US$188 million;

Binance Labs invests in Layer 1, DEFI, payment, multi-chain and other fields, with Metaverse GameFi NFT projects as the main targets;

2022

Crypto market keywords: Federal Reserve interest rate hike, hacker attack, Ethereum upgrade, new public chain, Hong Kong opening

In January, as StepN’s market value reached its peak, it suddenly entered a death spiral;

The largest hacker attack in history, Ronin cross-chain bridge, Horizon Bridge, Nomad Bridge and other projects, a total of 3.8 billion US dollars was stolen;

The collapse of Luna and Terra plunged batch lending institutions into a liquidity crisis. Three Arrows Capital went bankrupt and liquidated, and Celsius, Genesis, etc. were severely affected;

The collapse of FTX, including Grayscale, DCG, Amber Group and other platforms and institutions, encountered serious liquidity crises;

Ethereum POW has officially shifted to POS, and new public chains led by Aleo and Aptos have become a hot topic in the market narrative;

Binance issues soul tokens; Web2 brands led by Starbucks and Nike explore Web3; Hong Kong, China, announces its embrace of the virtual asset industry;

Binance keywords: chain games, RWA, investment

The NFT sector is more community-oriented, entering the blockchain game track, supporting IGOs, using it to cast and list 2.6 million NFTs by itself, and has reached top-level cooperation with some well-known figures in the sports, music and entertainment industries.

In addition to the continued activity of Binance Live, Binance will launch Feed in 2022, providing a platform for more than 1,000 crypto content creators, covering more than 1 million daily active users;

Binance has launched and tested Binance Card in 6 countries. Users can directly use Binance wallet to make cryptocurrency purchases at merchants that support Visa or Mastercard; Binance Payment has added 7,983 merchants and partners, and supports There are more than 70 cryptocurrencies available for users to use in 70 different markets, with use cases covering recharge, travel, consumption, accommodation, ticketing, tipping and other scenarios.

Binance Labs invests in Layer 1, Layer 2, DEFI, security, multi-chain, content, wallet, social and other fields. Metaverse GameFi NFT projects are still the main targets;

In the ups and downs of history from the development of blockchain technology to encrypted finance, the years Binance has been in have been brilliant years in the world of decentralized finance. They have also been years in which grassroots surprise attacks have accompanied the battle of the gods. CZ led the currency An has found opportunities to overtake in corners in different fields:

In 2018, IEO started to form a wealth-creating effect

In 2019, relying on spot contracts to become the top exchange

In 2020, DeFi broke out, BSC grabbed traffic, and ecological funds grabbed new projects

In 2021, the NFT craze injects blood into the trading sector, and IGO ignites GameFi’s high-frequency traffic

In 2022, use payment to embrace compliance and tradition, and kill the largest competitors from fund security loopholes.

The market slack period is Binance’s hunting time

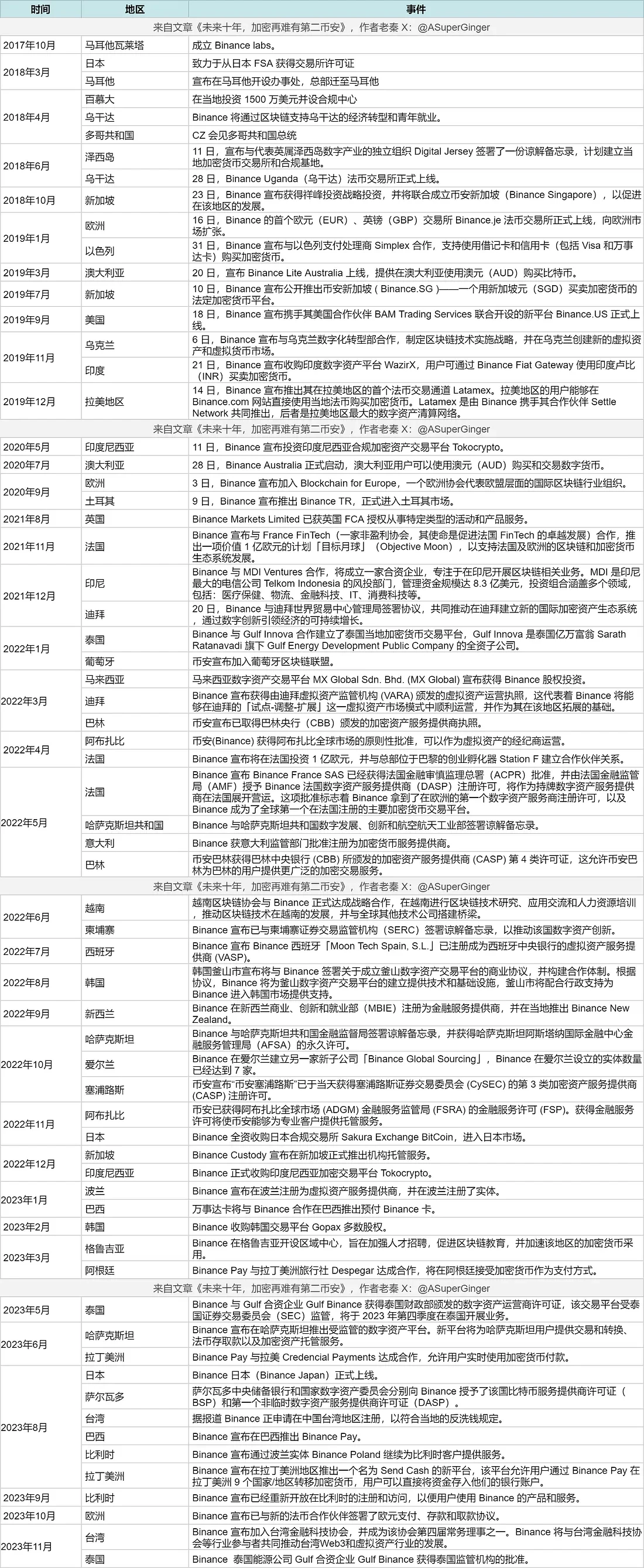

Resolutely abandon China and thrive in the face of global challenges

In the early days of the development of the blockchain market, China, as a demographic dividend market, has always been the core position of the active global cryptocurrency market, and it also has the largest group of Bitcoin mining and transactions.

The 94 ban made Binance determined to go out of China. At this point, other exchanges that rely on the Chinese user market are hesitant. Once they come out, there is no way to go back. Many exchanges have claimed to remove Chinese users, but the actual business is tacitly carried out in China, and the core team has not directly moved out of China like Binance. Until the 2021 policy, it broke the domestic exchanges’ presence in mainland China. After realizing the dream of regional management, they gradually left China completely.

In May 2021, China launched virtual currency “mining” rectification and removal activities

In September 2021, China completely banned virtual currency trading

Completely cutting off the connection between the company and the mainland, and comprehensively expanding the world and users, both in the past and now, are very correct, but it is also very difficult. CZ, which has experienced the stamp and coin card period, is well aware of the unpredictable domestic trading environment. Although its overseas development is also limited by compliance issues, at least it will not destroy the group. Under the suppression of various domestic policies, Binances overseas expansion has instead gained more living space for it in the exchange circuit.

In the first few years when it first went overseas, Binance had few major competitors in terms of business expansion. Various factors such as relatively loose global policies, slow work pace of overseas teams, fast product updates and simple operation of Binance, Huarenju, a user who relies on centralized exchanges, and the trust of Chinese crypto founders in CZ, gave Binance its first batch of core users.

Although it is not easy to update products in multiple languages, recruit employees from more language regions and countries, conduct research on policy communication in various countries, and apply for licenses when opening localized accounts, Binance has left-hand transactions, right-hand users, and a global perspective. It has come a long way from exchanges restricted by domestic policies. While other competitors are still tied up, looking forward and backward, and trying every possible means to grow domestically, Binance has already relied on legal affairs and business to expand its branches around the world.

Under the public chain war, BNB’s decentralized transfer

Binance has been attacked by so-called decentralization is absolutely correct investors for not being decentralized enough and the BNB token being arbitrary. However, the rise of BSC in the public chain war stage, coupled with the periodic transition of BUSD, has caused the value of BNB to change from one Exchange tokens turned into platform tokens, and there were active and passive processes in the process, but it is undeniable that the exchange public chain drives the ecology toward decentralization, and Binance has delivered a relatively perfect answer.

In 2019, Binance launched a public chain, and the DEX based on Binance Chain was also officially launched. For Binance, the purpose is very simple, which is to obtain more projects and traffic on the chain. However, because there is no mature business model and the operation method is relatively centralized, the competition among public chains is very weak, and the leading decentralized public chains are still accounts for an absolute portion of the traffic. However, it is a trend to obtain on-chain traffic through the underlying batch, and the problems existing in Ethereum limit the market performance. Binance will not give up its attempts in this field. In September 2020, Binance restarted its underlying layout and launched the smart chain BSC, which supports EVM, is compatible with Ethereum, supports cross-chain interoperability, and is fully connected with Binance DEX.

The DeFi market started with Ethereum in 2021. At the beginning of the year, the total locked-up volume of the DeFi protocol exceeded US$22 billion for the first time. Liquidity mining and other methods brought in more than 1.2 million user addresses. Ethereum was congested due to the outbreak of DeFi, and the expansion plan Continuous optimization. Polkadot has received the highest attention for its innovation in management collaboration mechanisms, with more than 320 ecological projects, and the number of projects using Binance Smart Chain in the same year was 60. Important players on the DeFi track have completed their initial positions:

Chain (bottom layer): Layer 1: PolkadotCosmos (double chain), NEAR (sharded network), Solana (PoH clock mechanism), Avalanche (three-chain structure); Layer 2: Optimistic, ZK-rollup, etc.

Stablecoins: DAI (encrypted asset-backed), USDT, PAX, Basis Cash, etc.

Protocols/Applications: Compound, Aave, Synthetix, UMA, etc.

Automatic market maker (AMM) is Dex: Uniswap, Sushiswap, Curve, Tokenlon

DeFi tools: aggregators (machine pool Yearn Finance, exchange aggregator 1inch, etc.), oracles (Maker, ChainLink), wallets (Metamask), etc.

The crypto market is rapidly heading towards a bull market due to the craze of DeFi. This is also the year when exchange smart chains have joined the battle. The protagonists of DeFi summer are already in place. The Ethereum ecosystem has spilled over and divided the traffic to form several major factions, including Polygon, which focuses on capacity expansion; Polkadot, which focuses on mechanism innovation; Avalanche, Near, and Solana, which focus on consensus innovation; BSC, OKExChain, and Heco, which focus on exchanges ;

BSC’s first ecological expansion is coming. With faster transaction experience, lower gas and Metamask support, two key applications of AMM and lending protocols are taking the lead: PancakeSwap and Venus, and Uniswap and Compound. The BSC ecosystem can capture the hot spots of DeFi in a short period of time. In terms of operational methods, Binance has also made great efforts to add an MVP program under the US$100 million ecological fund to provide financial support to developers; it also launched the Farmers Day to stimulate on-chain interaction. ; Organize global hackathons to mine ecological projects through Dorahacks; NFT market sector is increasing sales of NFT and GameFi.

Since BSCs iteration and deployment applications are similar to those of Ethereum, ecological projects have been implemented almost in a copy-and-paste manner. It has gathered track projects such as Dex, Swap, banks, machine gun pools, stable coins, insurance, oracles, etc., which is more attractive to Ethereum. Projects on it were continuously connected, and later because of their support for GameFi’s rapid and hot trend, they took over the DeFi market enthusiasm.

The congestion of Ethereum is the most accurate entry point. Coupled with the immaturity of Layer 2, the slow development of the public chain ecosystem, and the weak brand effect of other exchanges, Binance has found the right opportunity to accelerate. In this round of DeFi, the currency An has formed an unstoppable trend through large-scale operations, and the encrypted Lego carnival is based on the BSC atmosphere.

BNB is no longer the original exchange token. It has developed into a currency that circulates throughout the entire blockchain ecosystem like other public chain tokens. It even has a wider range of application scenarios and plays an important role both inside and outside the Binance ecosystem. These application scenarios include but are not limited to: using BNB as transaction fees on the Binance exchange; used to pay transaction gas fees; used to participate in on-chain governance; and provided for the BSC on-chain ecosystem including hundreds of DApps, protocols and games. Transaction support; participate in the Binance ecosystem, such as IEO on Launchpad, staking on Launchpool, donations to Binance Charity, etc.; make payments in thousands of online and offline consumption scenarios through Binance Pay/Binance Card.

After continuous expansion, BNB has become the fourth largest cryptocurrency in the market: the total market value exceeds 36 billion US dollars, the market circulation exceeds 150 million coins, the total number of BNB addresses held exceeds 100 million, and the price has also developed from the initial launch of 0.1 US dollars to the current of $237.

Seize the security vulnerability of FTX assets and kill your competitors with one blow

In the second half of 2022, the crypto market, which had just experienced an industry black swan event, had not yet recovered from the aftershocks of the previous crash, and was hit hard again - FTX, the worlds second largest CEX, in the world Declared bankrupt in the eyes of the crypto community. FTX, as the biggest competitor of Binance at that time, fell from the top of the mountain to the abyss in just a few days. With the collapse of the SBF encryption empire, SBF fell from the altar, the encryption circle ushered in the Lehman moment, and Binance reached the top.

On November 2, 2022, Coindesk published an article stating that most of the net assets of Alameda Research, a cryptocurrency trading company owned by SBF, are composed of FTX’s platform token FTT and tokens “controlled” by FTX, while the company’s 8 billion Of the US dollar liabilities, US$7.4 billion are actual US dollar liabilities. This means that not only does FTX and Alameda have an unusually close relationship, but once these tokens experience liquidity shortages and price fluctuations in the market, they will both face the risk of insolvency. This article from Coindesk became the trigger for the whole thing, and in the following days, CZ exploited this vulnerability to quickly attack FTX, accelerating the death of FTX.

In the early morning of November 6, a Twitter user named Autism Capital stated that Binance transferred the remaining 23 million FTT on its account to the trading platform and seemed to be preparing for sale. The news spread quickly after it came out. On the evening of the 6th, Alameda CEO Caroline denied the rumor that Alameda/FTX will be insolvent. Later, CZ tweeted that due to the recently exposed news, Binance decided to liquidate all remaining FTT on its books. The FTT price quickly fell from around $24 to 21 dollars near. Although Caroline issued an urgent message to reduce the impact on the secondary market, nearly $1 billion in assets flowed out of FTX and Alameda-related wallet addresses that day. CZ ridiculed on multiple Twitters, and under the questioning and encirclement and suppression of KOL and the community, SBFs rhetoric seemed feeble.

The aftermath of Lunas collapse has not completely dissipated. Users simply cannot bear the consequences of the collapse of the leading exchange that controls the economic lifeline of a large number of users. With an attitude of rather trusting it, a large amount of assets continue to be transferred out of FTX, resulting in the collapse of FTX platform assets. Reserves were quickly depleted, and the prices of FTX-based FTT, SOL and other currencies fell off a cliff and continued to fall below key prices. On the evening of November 8, FTX suspended withdrawal requests on Ethereum, Solana and Tron. Not long afterward, SBF and CZ announced that Binance would acquire FTX. On November 10, WSJ reported that FTX faced a liquidity gap of up to US$8 billion. Subsequently, Binance officially issued a statement stating that based on the results of the company’s due diligence and the latest relevant reports, it decided not to pursue a potential acquisition of FTX.com. The FTX thunderstorm directly caused large-scale losses to investment institutions such as Sequoia Capital, Temasek, Tiger Global, SoftBank Group, and Paradigm. Many platforms related to FTX encountered liquidity crises. The cryptocurrency market fell as a whole, and a large number of funds that originally belonged to FTX Users flocked to Binance.

At this point, the war is basically a foregone conclusion. If CZs previous attacks only served to fuel the flames, then after announcing the acquisition of FTX and then stopping at a critical moment, it dealt a fatal blow to SBF. From an objective point of view, even if there was no thunderstorm at the time, FTXs capital security issue might have a crisis in the same situation at some point in the future. CZ happened to have completed hunting its opponents on the premise that Binances own business was strong. kill.

In fact, CZ and SBF have a long history of grievances, and both parties have gone through different stages from allies to friends to enemies. In addition to the conflict and competition in business and ecological layout, the struggle between CZ and SBF is also said to be that the struggle between the two parties is actually a collision between the forces/interest groups they represent. SBF has shaped the image of the white elite on Wall Street, which represents the traditional financial power dominated by Wall Street, while CZ represents an emerging crypto force that is not officially favored by the United States and is dominated by ethnic minorities (Chinese), with global Use your thinking to build your own encryption empire.

Looking back on the entire process, CZ showed a calm demeanor from start to finish. As a leading exchange, it controls the lifeblood of a large number of users. When the market is crusading against FTX, Binance cannot stay out of it. CZ will not be unprepared, but it still chooses to attack decisively. Subsequently, although Binance experienced a certain degree of backlash - On December 13, Binance announced that it would temporarily suspend USDC withdrawals, and market panic intensified. Between December 12 and 14, net withdrawals from the Binance platform reached US$6 billion. On December 14, CZ issued a statement calling this large-scale withdrawal event a stress test, which helps establish credibility for exchanges that pass the test. This reflects CZ’s full confidence in its own abilities, sufficient funds in Binance, and its ability to “escape unscathed.” This was partially validated by the subsequent regulatory and trust crisis that descended on Binance.

Compliance constraints are difficult to break, and you can use your own body to get out of the game

Binance once cooperated with local governments or local compliance companies around the world to obtain legal status within a certain window period, but it still closed many businesses because it did not have local compliance licenses. The heavy hammer of compliance fell on Binance. The Sword of Damocles. There is not much time left for it. It must build the moat of its own crypto empire on a global scale through the accumulation of capital and the integrity of its business in a short period of time.

From 2017 to the present, Binance has been trying to obtain a phased partially legal status in some regions around the world through diplomacy, acquisitions, joint investments, charity funding, etc.

Starting in June 2021, as a new bull market is in full swing, the DeFi summer craze has caused frequent asset thefts, global supervision has become tense, and the Chinese government has promulgated the strictest encryption ban in history, Bitcoin and Ethereum computing power is in a state of global migration. On the other side, the Fomo sentiment driven by Meme in the secondary market has created a market bubble that is gradually bursting. Various exchanges around the world have been affected to varying degrees, and Binance has also begun to come under regulatory pressure from various countries.

With global crypto regulation