Editors note: This article was written in early November 2023. As of today, November 28, BTC has repeatedly impacted and tried to stabilize the chip concentration distribution area of 38,000 points. The fourth point of the new narrative of this bull market mentioned in this article, Bitcoin Ecology, is the leading track that drives this round of surge. Ordi, which was listed on Binance, was the best, with a 4-fold increase in 10 days. So will RWA, which is the third point of the new narrative mentioned in this article, hope to get full performance opportunities in this bull market? Will there be any sparks when it collides with games?

1. Is the bull market coming?

If you stand two years later in November 2025 and look back at the spectacular cryptocurrency market over the past two years, you may be surprised to find that October 23, 2023 may be a typical sign of the start of this bull market: Within 24 hours, BTC Directly pulled from 30000 U to 34000 U. Many friends around me who have heavy positions around 20,000 U rejoice: Look, look, I say the crypto bull market will definitely come! There are also some fans who are confused and confused are still plausible: there is no new money entering the market according to the current on-chain data, and the total amount of stable coins such as USDT is still at a low level. This is a fake bull after the news of Bitcoin ETF is amplified. There will be a Wave pullback!

The positive view of The bull has arrived is very clear, and the three major benefits in the future are enough to support the bull market:

1. Bitcoin ETF accelerates the entry of funds from traditional financial institutions;

2. Bitcoin will be halved in May 2024, and the mining cost will rise to more than 28,000;

3. The United States will not raise interest rates or even lower interest rates;

Regardless of whether it is a real bull or a fake bull, what I have been thinking about is: to be able to sustain a real bull for at least 12 months, there must be a new narrative of the entire industry evolving forward. The above three benefits that support the bull market, the first and the third Three are external forces, and the second is the four-year halving rule that everyone on earth knew when the BTC white paper appeared. So what are the new industry narratives that can support this bull market? If you dont develop well and rely only on external information and policies, it will most likely be short-lived.

Let’s take a look at the development trajectory of the last bull market: the Summer of Defi started in July 2020, and Bitcoin began to take off from around 10,000 U. Defi is a major innovation in the industry, using smart contracts to simulate the real-world financial system. Some functions can be mortgaged to earn interest, decentralized trading, derivatives, etc.; then Musk and other big Vs began to place orders; then NFT and Gamefi 1.0 application products appeared, allowing many novice users to join the circle. You need to learn DEFI, which has a certain knowledge threshold, and then you can play it. The key point is that you can also get rich. Finally, the concept of the metaverse has become popular, and Facebook has changed its name to Meta. The bull market reached its peak in November 2021, with the Bitcoin price reaching 69,000 U.

2. The new narrative of this bull market

see it? At least the four innovations of Defi, NFT, Gamefi 1.0 and Metaverse are the evolutionary points of the encryption industry itself in the last wave of bull market. So what are the new evolutionary points of this bull market, that is, what are the new narratives we often talk about? Let us summarize:

1. SocialFi decentralized social networking, the case is the recent rise of Friend.Tech;

2. Chain Games 2.0 is the chain games of web2.5: assets are put on the chain and the games are centralized, focusing on games with strong playability, and then making a fuss about the assets on the chain;

3. RWA (Real World Asset), a huge track that can link the huge amount of old money in WEB2 and the encryption industry. Depin, which has been mentioned repeatedly in the HK encryption circle in the past two days, is also one of the RWA tracks;

4. The rise of the Bitcoin ecosystem. After all, no matter in WEB2 or WEB3, BTC is already expected to become a value deposit similar to gold. Why cant we do something on it? Gold can be used as various derivatives in the financial industry.

Today we will focus on the third point, RWA, because I have always felt that RWA is an extended narrative of Defi, the engine of the previous bull market. Think about it, DEFI uses code to generate a bunch of virtual coins, then uses smart contracts to play with them, and simulates the real financial system. Its like children playing house, with a father and a mother, pots and pans, firewood, rice, oil and salt, BUT, does this have any impact on the real world? No! Among the current virtual currencies, except for BTC, which has a certain consensus in the WEB2 world, other currencies are all air in the eyes of outsiders. So what is the meaning of a bunch of extremely complicated operations based on air?

Does that mean Defi is meaningless? No! It can only be said that DEFI, which started the last bull market, is only the first half of this new narrative. It lays down the venue, rules and direction for participation. Just like if you want to have a full banquet, DEFI will help you prepare the kitchen, cooking utensils and chefs. Now, just wait for the ingredients to arrive and you can start frying. Therefore, I understand that RWA is the second half of DEFI, just like the two parts of Westward Journey, Moonlight Box and The Marriage of the Monkey King. The two must be linked together to be beautiful.

3. How to play with RWA

What is a RWA? The full name is Real World Asset, and the complete translation is real world asset tokenization. Corresponding to real-world assets, RWA can also be divided into tangible assets and intangible assets based on the type of underlying assets. Tangible assets mainly include real estate, commodities, art, etc.; intangible assets include bonds, stocks, carbon credit points, etc. Since RWA is based on real-world assets, it must have an off-chain operation process with legal support to confirm asset ownership and value, and then tokenize it through the DeFi protocol and circulate it in the on-chain market, and at the same time through the oracle machine Monitor the value changes of off-chain assets.

In fact, RWA already has some practical application cases. The stable coins we often use (USDT, USDC, etc.) are RWA. For example, in the Satoshi Island of physical assets, the most popular RWA among financial assets this year is U.S. bonds. Etc., these are all cases of on-chain token issuance backed by physical assets. In fact, the idea of Bitcoin ETF is a reverse financial RWA, which allows WEB2’s funds to participate in Bitcoin investment through a compliant ETF financial product; while RWA U.S. bonds allow WEB3’s funds to participate in Bitcoin investment without the need to withdraw funds. Participate in U.S. debt investments and earn about 5% a year.

The STO craze that went viral in 2018 was an early attempt by RWA. During that period, there were a number of attempts to make traditional assets compliant and on-chain, and there were also a number of attempts to achieve this goal. Web3 entrepreneurial projects, such as tZERO, Polymath, Aspen, etc., have also made some case attempts, such as Aspen REIT, Resolute.Fund, Fundament Group, etc. However, due to various reasons such as market environment, economic cycle and supervision, the STO market has not developed as smoothly as imagined.

The current mainstream gameplay of RWA is relatively simple, which is to allow funds in the crypto circle (such as various stable coins) to have ownership or income of real assets or financial assets in the real world through tokenization similar to securitization. right. This is a simple one-to-one correspondence, and ownership is restricted by real-world laws. If you want to diversify the gameplay of RWA and allow more users to participate, you also need to design application scenarios for RWA with better experience. In this regard, we believe that it will perform well in this bull market and can be defined as RWA. basic application facilities.

Imagine that in a game scene similar to Monopoly or The Sims, you enter a stock exchange and link your wallet. You can really use the game token or U in your wallet to buy Tesla. stocks, and then enjoy the benefits that Musk gives you, or through gamification scenarios, when we go to a certain city for a virtual tour, we can buy REITs shares of the citys landmark buildings and become one of the investors in real assets. Not happy with Wai Wai? Of course, we only consider the user experience of the product here. As for laws and regulations and how to connect to the real securities department, this requires a long-term project manager.

In fact, the RWA basic application settings described above are part of the metaverse in a broad sense, but it is more hard-core in terms of security and connectivity with WEB2, so it needs to be separated into a new narrative. At present, it seems that the game scene-based RWA should attract more users to join. Not only can it link the tokens in the wallet to the real world for WEB3 players, but it can also allow WEB2 players to experience WEB3 products. The unique features: there is no need to sign as many documents as in the real world, just a wallet link; the shares held are always reflected on the chain and can be traded at any time.

So the question is, how can Web2 players enter Web3 more smoothly and recognize the new gameplay of RWA+ games? We can put ourselves in their shoes and think about it. When a Web2 user in the real world wants to enter the virtual world of RWA+Web3 or even the prototype of the metaverse, what difficulties will they face, and what kind of inner demands will they have?

First of all, they will be confused by the Web3 information that they have never come into contact with before. Some basic knowledge such as public chains, wallets, DeFi, etc. may seem simple and clear, but they are bottomless and complicated to learn. I dont know how to start. Then they will be attracted by various innovative projects and models of Web3. Seeing the myths of getting rich one after another, they are always ready to make a move, but they are afraid that they will become leeks and have their pants cut off, so they are looking for advice everywhere. , hoping to learn the truth about Web3 investment or find reliable investment advice. Furthermore, they hope to find a truly enjoyable gaming experience in the virtual world of Web3. They also hope that the noble status of the virtual world can be extended to the real world, allowing them to participate in some high-end activities with a sense of ritual and achieve online Full integration with offline.

The above imagination seems too beautiful, but it is indeed the simplest and lowest desire in the hearts of most players who enter Web3 from Web2. So are there any such products or games on the market today that can meet or partially meet the above needs? We specifically searched the market and found the following cases for your reference.

4. Cases of RWA+ games

1.DeFi Kingdom

I want to learn Web3 knowledge, but I feel that reading articles, studying white papers, and doing Desktop Research is too boring. Is there such a product that can learn Web3 knowledge while playing games? There are indeed such projects, and DeFi Kingdom is one of them.

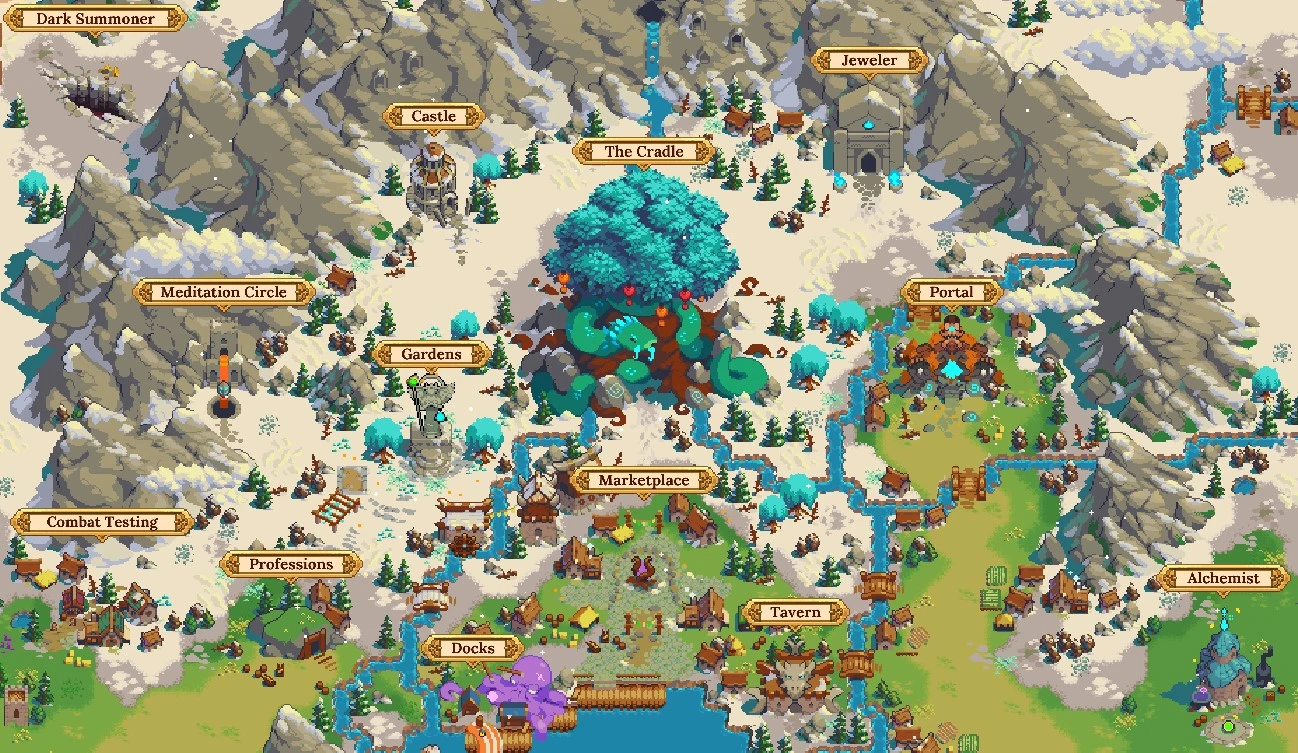

DeFi Kingdom is a product of the last bull market and is a game based on the Play 2 Earn of the Harmony public chain. But it’s not just a game, it’s a Dex, an NFT trading market. The entire game map can be said to visualize and gamify the functions of Dex and NFT. For example, in Gardens, you can provide LP through Druid and receive Jewel token rewards. In the Marketplace, users can purchase the main game token Jewel and pledge it in the Jeweler Bank to obtain xJewel tokens, enjoy a series of rights and governance privileges in the project, and participate in voting. Players can also use Trader to complete the exchange between Jewel tokens, Harmony tokens, stable coins and various other mainstream currencies.

Another part of the game is the gameplay based on hero NFT, including hero blind boxes, completing tasks to get rewards, PVP battles, etc. Users can buy or rent heroes in the Tavern and produce offspring heroes through breeding. Heroes have different attributes such as lineage, profession, rarity, and ability value, and the quality and attributes of the offspring produced by breeding are also related to these attributes. The higher the lineage level, the more times it can be reproduced and the lower the cost of reproduction. The profession, rarity, and attributes of the next generation of heroes from hero breeding all have certain probability distributions, which requires some effort to study. After having a hero, you can perform various tasks in the kingdom, including garden guarding, Jewel mining, dungeon assault, etc. You can defend the garden from attacks or dig new treasures; you can also regularly hold tournaments in groups of 3 to compete for prizes. .

The game will later launch land, buildings, equipment, PVP and other functions, forming a more complete game ecosystem. Overall, DeFi Kingdom is a successful game integrating Dex and NFT market functions. Through the game, players can learn, use and initially experience the knowledge and operations of Dex and NFT transactions. At the same time, they can also earn game tokens through Play 2 Earn, staking, mining, etc. It can be said that they serve multiple purposes with one stone.

But like most games, too strong financial attributes lead to rapid development of the game, but at the same time, a death spiral cannot be avoided. According to Defi Llama data, at the peak of the game in early 2022, TVL once reached more than 900 million U.S. dollars, becoming the traffic star of the Harmony public chain. However, as the last wave of bull market and chain game boom receded, the latest TVL data is only There is about 2.2 million US dollars left, which is just over 0.2% of the peak.

DeFi Kingdom is a gamification attempt in the Dex and NFT markets. Its successful combination of DeFi and games has profoundly affected the Web3 market. The exit of RWA+ games is essentially similar to DeFi Kingdom. It needs to create a gamified scene to seamlessly integrate RWA into the game, so that players can learn relevant finance and investment through the unconscious experience. knowledge, and can directly participate in the investment process through games, which will definitely be a great innovation and breakthrough for RWA.

2. Monopoly board game

Real estate is one of RWA’s main asset classes, and games in the real estate category are easily reminiscent of the Monopoly board game. I believe that all of you have been exposed to Monopoly-type games since childhood, whether it is an online or offline version. Like Web2, Web3s Monopoly-type games are also enduring. There are currently two more influential Monopoly games on the Web3 market, one is Meta World (Tiantian Monopoly 2) and the other is Mhaya.

Monopoly 2 is a new game from Netmarble, South Koreas largest mobile game. It is a land-building chess strategy game based on the Monopoly gameplay. In addition to the basic Monopoly gameplay, that is, the process of playing chess, building houses, upgrading, collecting tolls, and finally winning, Web3 content has also been added. Players can connect to the Web3 wallet to exchange for diamonds, and further exchange for crystals and game props.

The biggest highlight of the game is the addition of a virtual island gameplay. Players can build real estate on the virtual island, which can bring continuous income to players. The higher the value of the real estate, the higher the income; if you purchase land NFT, then Token income can be obtained. Players obtain trophies by participating in games and competitions. The more trophies there are, the higher the investment level will be, which can further increase game income. Heroes have also been added to the game. As the game continues, more and more heroes will be unlocked, which can bring additional bonuses during the game, such as special dice points, free buildings, etc.

Generally speaking, the game quality of Tiantian Tycoon 2 is at the upper level in Web3. The games painting style, smoothness and overall experience are not much different from traditional Web2 games. However, after adding Web3 elements, it instantly ignited players interest. Passionate about making money, I saw that many people in the community are studying how to make money by masturbating according to the rules of the game, and have made good profits.

Another Monopoly game, Mhaya, is still in closed beta. The project completed a $5 million Pre-A round of financing in May this year. It just completed an airdrop of NFT assets some time ago. There are 4 levels (F1-F4), corresponding to different values, pledge income and output income. High-level NFTs are produced within the game, and their production efficiency will be many times higher than that of ordinary NFTs.

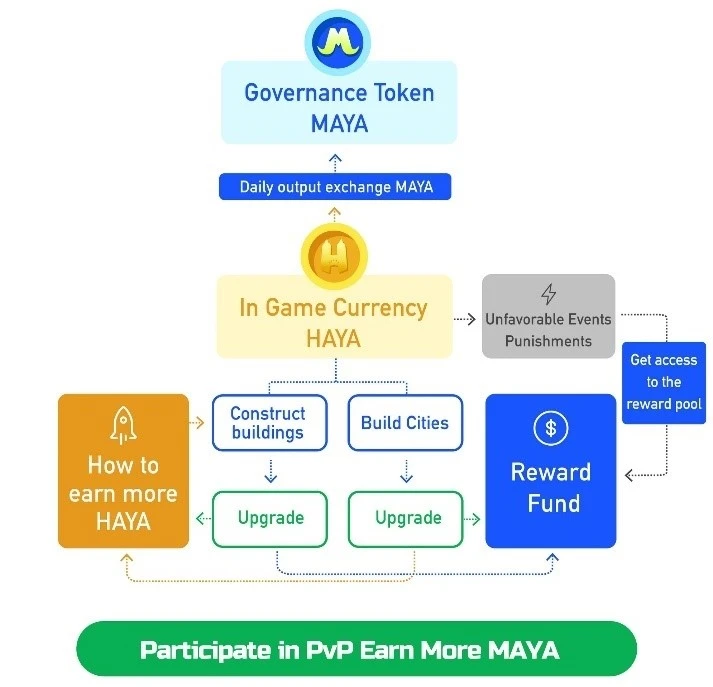

Mhaya focuses on concepts such as free, easy to use, making money, and anti-monopoly. It has two modes: single-player and multiplayer. Players can build various buildings, collect tokens, explore lucky events, and create their own cities in the game. A series of random and entertaining reward mechanisms have been added to the game, and are all open and transparent. The total number of events in the game is 40, of which 82.5% are favorable events, 2.5% are unfavorable events, and 15% are random events, which are determined by the number of events distributed on the board. In random events, the overall probability of a player triggering a favorable outcome is 64.44%, while the combined probability of triggering an adverse outcome is 35.56%. The main profit of the game comes from building buildings, and buildings are divided into commercial buildings or miracle buildings. The higher the level of the building, the higher the profit bonus. When players step into a building unit, they can receive corresponding HAYA rewards. The reward value is determined by the character level and building level. The higher the level, the higher the reward value.

The game has two tokens, MAYA is the governance token, and HAYA is the in-game token. The HAYA token can be generated through games, staking and other rewards. A major feature of the game settings is that it has two fund pools, free and pledged, corresponding to 10% and 60% of the total token volume respectively, which can be said to be full of sincerity. The staking incentive of 60% of the tokens will greatly encourage players’ staking behavior and reduce the pressure of short-term mining, raising and selling. There are also character NFTs in the game. Through MAYA tokens, you can obtain character NFTs of different levels, corresponding to different output rates.

The above two Monopoly games that have attracted high attention are a concentrated expression of Web3 financial simulation game products. In fact, Monopoly games are most suitable to be transformed into RWA concepts, because the entire model of the game is based on real estate investment, and it can be transformed through Web3 and integrated with Web3 gameplay, allowing everyone to enjoy it while also making money. However, the disadvantage of this type of game is that it is too inclined to the entertainment aspect of the game and downplays its educational capabilities, including the gameplay, which cannot well restore the process and details of real investment. To put it simply, it has not yet entered the process of linking to real-world real estate. It can only be played as a game and cannot give you more education, nor is it a real RWA.

3.AssetClub

Recently there is a game called AssetClub on the market. At first glance, I thought it was a Monopoly-type chess Web3 game. Later, when I had the opportunity to play the closed beta version, I suddenly realized that it turned out to be an online version of a wealth streaming game. I believe many friends have participated in offline wealth flow board game activities. For example, the world-famous bestseller Rich Dad Poor Dad also published an offline wealth flow board game. Generally, such an activity lasts for at least 2 days. -3 hours, but everyone enjoys it, because in every game, through the simulation of investment, wealth and various life events, every game of chess is like experiencing a virtual life. And when everyone summarizes and communicates at the end of each activity, everyone will be filled with emotions, including joy, regret, and reluctance. They will always think about how if I play it over again, I will make different decisions at several key points. Decision, what will the result be like? AssetClub is such an online version of the wealth streaming game. Compared with the slow-paced offline game process, AssetClub speeds up the entire game process. It takes about 10-20 minutes to play.

The main interface of AssetClub is also a board-style game interface, but unlike the game purpose of Monopoly (to build more buildings to collect more tolls and achieve final success), the goal of AssetClubs game is to achieve financial freedom, that is, monthly investment income >Monthly expenses. The game truly restores the investment experience of the golden 40 years of life between the ages of 25 and 65. From a novice who just graduated from college and entered the workplace, he was promoted and raised salary, got married and had children, and went through a series of life, career, and investment practices. , and finally achieve the goal of financial freedom at a certain stage of life. The game places great emphasis on randomness. The events of each grid stepped on are random, and the map composition also has a certain degree of randomness. This ensures that players will experience a very different game every time and have different perceptions of life.

Another major feature of AssetClub is that it incorporates a lot of Web3 knowledge. Through answering questions, investing, conducting digital currency transactions, etc., players can quickly come into contact with the concept of Web3 and form a preliminary understanding through simulated operations. Through the rise and fall of assets in the game, players can be more intuitive and vivid, have close contact with the assets they are interested in, and learn in advance the opportunities and risks that assets may encounter through simulation deductions.

In terms of Tokenomics, the game has two tokens, ACC and FLC. ACC is a game token, which is mainly used for in-game output and empowerment, such as drawing professions, fighting, purchasing props and equipment, etc.; FLC is a governance token. Have the rights to pledge, vote and share platform income.

Another major narrative of this project is to build a global investor community through games and build a decentralized, borderless, and fully shared investment world for global users to fully learn, share, explore, and practice digital assets. This actually combines the first point of the new bull market narrative mentioned at the beginning of this article: social interaction.

In fact, compared with the Monopoly games introduced above, what is more eye-catching about this project is that the project side will actually do RWA. Because in its external introduction, the main members of the project team were originally engaged in the financial education industry in the Web2 industry, and are now trying to use AssetClub, a Web3 product, to link the team’s existing real-world resources and establish a shortcut path for investment (brokerages, Banks, investment consultants, etc.), and based on game data and players’ investment preferences, more accurately recommend investment products suitable for them. Maybe in the future it will be possible to directly buy and sell global stocks and bonds through cryptocurrency in AssetClub.

Subsequent project parties will also empower game assets, link more game resources offline, and hold more investment exchange parties, cocktail parties, VIP services, etc., to attract Web2 players while also achieving real feedback. To break the circle.

Overall, AssetClub is an investment education game that uses games as its form, financial education content as its backbone, and investment resource grafting as its essence. Players can practice Web3 investment skills in the game, understand life, obtain wealth passwords in the community, and through investment, realize more links between the virtual world and real life. At present, it seems that the concept of AssetClub is relatively new, and it is most likely to achieve the breakthrough and integration of RWA+ games. It is also a key case in the new narrative of this bull market that we are exploring. The project has completed angel round financing, but the financing information does not seem to have been announced yet. The game will be launched on Google Play and App Store in the near future. Interested friends can try it out.

5. Summary and Outlook

In this long investment research article, we discuss the favorable conditions for the new round of bull market that is about to start, and compare the basis for the launch of the previous round of bull market; then we preliminarily discuss the four new narratives of the new round of bull market, and further analyze It discusses the RWA track and its evolution; finally, through four cases: DeFi Kingdom, Daily Rich 2+Mhaya, and AssetClub, the possible break-out form of RWA+ games is discussed.

RWA is not a new proposition. When blockchain was first established, people hoped to empower the real economy and finance through blockchain technology and its naturally transparent and non-tamperable transaction attributes. It’s just that after so many years of hard work and many rounds of attempts by practitioners, the only track that can truly break out of the circle and be widely used is transaction payment. In such a vast world of real assets like RWA, which category will be the next to emerge from the industry? Some people say it is U.S. bonds because it is the most standardized financial product; others say it is real estate because it is the most important window to the real world. We believe that in addition to financial assets and tangible assets, the introduction of web2 business models is also a very important direction to explore.

On the other hand, as the most important functional and scenario-based application track of blockchain technology, games have the opportunity to become a bridge between blockchain technology and RWA. Through gamification scenarios, complex and boring numbers and financial principles can be presented to users in an image and interesting form, allowing people to better understand and apply them. DeFi Kingdom is a good scenario-based case of Dex, while Daily Rich 2 and Mhaya are scenario-based attempts at real estate investment. AssetClub is more comprehensive. On the surface, it is a wealth streaming game, but in fact it is to create a Web3 investment, Communication and resource grafting platform. The three models all have the potential of RWA to break through the circle, and they correspond to finance, real estate and comprehensive investment platforms respectively.

In the Web3 industry where there are many opportunities, one of the goals that many people strive for is to achieve financial freedom. The game is like this, and so is life. I hope that through continuous self-study, everyone can seize the new narrative RWA track of this bull market and complete their own breakthroughs.

This article ends.

Disclaimer:

The information in this material is derived from public information or other information that we believe to be reasonable and reliable. Guatian Laboratory does not make any express or implied guarantee for its accuracy, adequacy, completeness and appropriateness of use.

The information, introduction, data, etc. in this material are for readers’ reference only. Under no circumstances should any content in this material be considered as any solicitation or recommendation and does not constitute investment advice. Various risks that investment-related project assets may face (including but not limited to: investment risk, management risk, legal risk, tax risk, liquidity risk, credit risk, policy risk, economic cycle risk, interest rate risk, operational risk, force majeure factors The resulting risks, etc.) shall be borne by the investors themselves. Guatian Laboratory and/or its associated personnel do not assume any legal responsibility for any consequences caused by relying on or using this material.

Without the written consent of Guatian Laboratory, no institution or individual may copy, disseminate or modify the content of this material in any form.

W Labs other completed long article links:

1. Revelation of the Economic Model of Chain Games

https://www.notion.so/wggdao-creators/W-Labs-d4e7a7a2254f4e61a6b217d1ede8b57e?p=4b4aecd126dc4144bb4e7afa768711d0&pm=s

2. The future path of Gamefi chain game economic model

https://www.notion.so/wggdao-creators/W-Labs-d4e7a7a2254f4e61a6b217d1ede8b57e?p=4a00654d87ae415fb7cfb564c53493ce&pm=s

3. Traditional games enter the blockchain game GameFis exploration path

https://www.notion.so/wggdao-creators/W-Labs-d4e7a7a2254f4e61a6b217d1ede8b57e?p=02253c55d69a4d7aa18d7d5d2cbf0269&pm=s

4. How to find the next StepN? ——Start by establishing the X to Earn classification system》

https://www.notion.so/wggdao-creators/W-Labs-d4e7a7a2254f4e61a6b217d1ede8b57e?p=a769ef01e92e4f499d5998609cd714ab&pm=s

Welcome to reprint, originality is not easy, please indicate W Labs.

Guatian Laboratory website: http://www.wlabsdao.com/

Guatian Laboratory Discord: https://discord.gg/wggdao

GuaTian Laboratory Twitter: https://twitter.com/GuaTianGuaTian

Guatian Laboratory’s in-depth research article on Mirror: https://mirror.xyz/iamwgg.eth

Guatian Community Medium: https://medium.com/@wggdao