originalLink, Author: Hal Press

Since we proposed Stacks argument, there have been several key developments that make the theory clearer. We’ll elaborate more on this later, but at a high level, demand for Bitcoin block-space is already solidifying, which will further increase demand for the products Stacks is building.

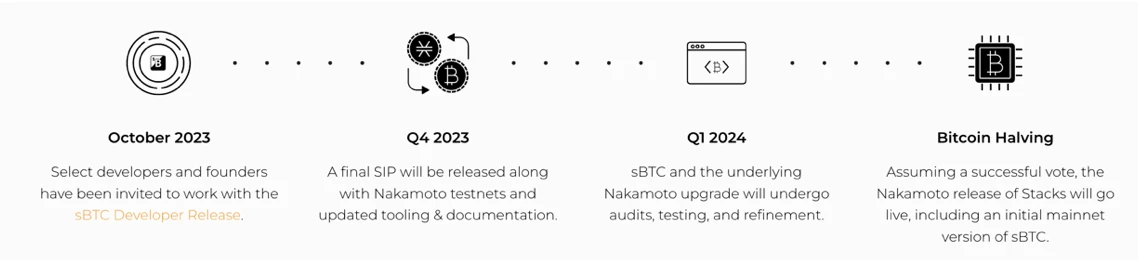

we are sureStacks is creating a platform that will be used to explore more complex and sophisticated Bitcoin-denominated utilities, with the ultimate goal of transforming them into a true Bitcoin second layer when technology conditions allow in the future ( L2).This vision has gradually made progress, and the Stacks development team plans to complete the Nakamoto upgrade before the Bitcoin halving event next April.

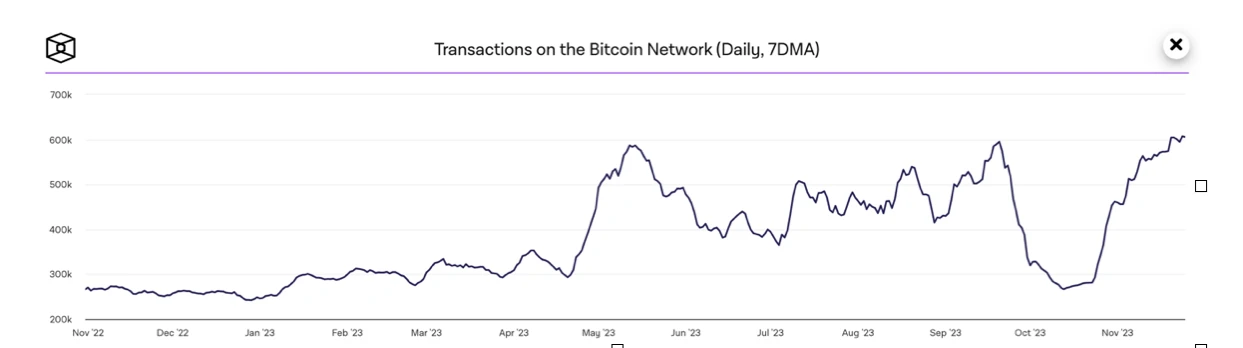

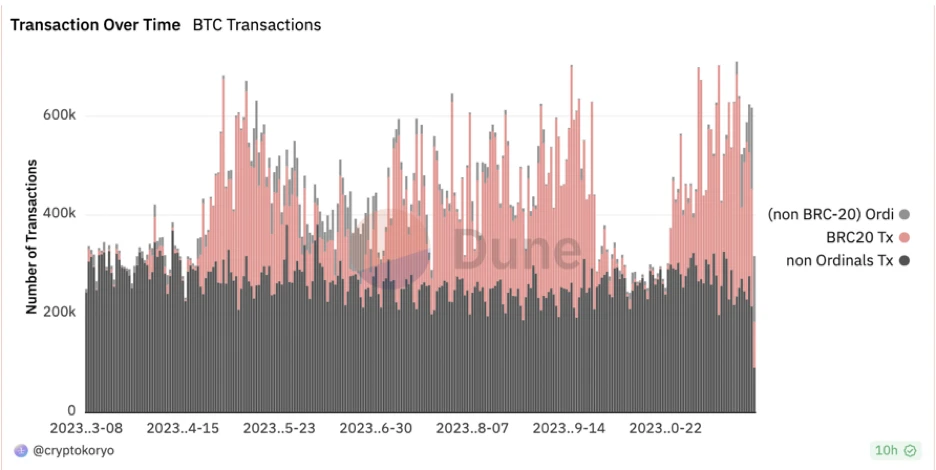

Despite these exciting developments, Stacks has received less recent attention as other, more immediate catalysts in the market gain more attention, but as several key milestones are about to be achieved. , the strength of Stacks has been increased. Demand for block space remains strong in the Bitcoin space, as average gas costs on the Bitcoin network have soared 50x this year (compared to 2x on Ethereum). The continued growth of Ordinals is further evidence that people want to do more with Bitcoin than simply hold it. Bitcoin’s dominance is growing as the asset itself strengthens its position as a global macro asset and demand for alternative stores of value (SOV) increases. Demand for Bitcoin is driven primarily by its more stable price performance as a store of value, as well as broader regulatory clarity brought about by the anticipated approval of a U.S. spot Bitcoin exchange-traded fund (BTC ETF). The combination of all these external forces increases demand for what Stacks is building: a high-performance, flexible and secure BTC-denominated environment for exploring more complex BTC applications and completing a true second layer of Bitcoin ( L2) conversion.

Number of transactions on the Bitcoin network

BRC-20 and the resurgence of Ordinals trading

The growth of BTC dominance

Meanwhile, despite all the Stacks resources being absorbed into the development of the Satoshi upgrade (Nakomoto), Stacks has been mostly ignored over the past few months.The Stacks development team has now completed Mockamoto, which will be used to bring Satoshi nodes and RPC endpoints online.There is no denying that this is a very critical milestone, which will allow the Stacks team to launch the Satoshi Nakamoto mainnet as planned in April next year, and plans to coincide with the Bitcoin halving.

In our view, this upgrade will be the most significant of several compelling catalysts. The Stacks network is currently a bit cumbersome to use as its block times are the same as BTC layer one (L1) and does not support bridged BTC due to security concerns.

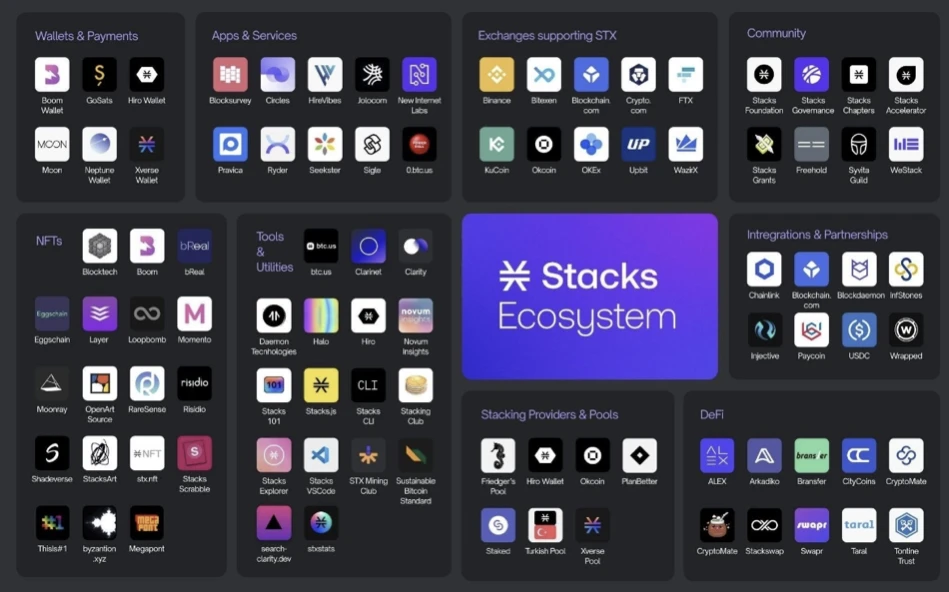

After the upgrade, Stacks will be greatly accelerated, with the block time shortened to 5 seconds (currently about 10 to 30 minutes), and will support sBTC, a safe and efficient version of wrapped Bitcoin, which is consistent with the Stacks consensus mechanism Natural integration.Despite current technical limitations, the Stacks ecosystem remains resilient, with several strong and expanding teams building in the space. Once the network is substantially upgraded with the Satoshi upgrade and sBTC, this will be something we are very excited to see develop in the future. After this upgrade, Stacks will be fully secured by 100% of Bitcoin’s hashrate, bringing it closer to Bitcoin’s second layer (L2).

Stacks Ecosystem Overview

We firmly believe that there are several upcoming big events that will greatly attract peoples attention to STX.

First, we predict that the approval of a Bitcoin spot ETF in January next year will lead to widespread Bitcoin-centric discussions and overwhelming advertising from many of the world’s very large financial institutions. This publicity is bound to directly affect the development of BTC, and may even affect other Bitcoin derivatives, such as STX (the native cryptocurrency of the Stacks blockchain).

Secondly Stacks is looking to expand its footprint globally through recent partnerships with Singapore’s Spartan Group and South Korea’s DeSpread. They will launch a marketing campaign in the first quarter of next year to raise awareness of Bitcoin L2. The focus of this campaign will be in South Korea, Singapore, Hong Kong and Dubai.

Third, Stacks will announce several key milestones ahead of the Satoshi upgrade next March and is expected to start gaining more attention in the coming weeks. The upgraded second testnet is expected to be launched before January next year.

Finally new Bitcoin L1 tools, such as BitVM, can enable minimal trust transfer between Bitcoin L1 and L2, bringing Stacks closer to the vision of becoming a true Bitcoin L2. Previously, this support for Bitcoin L1 required changes to Bitcoin L1 (difficult to implement), but with BitVM there is no need to make changes to Bitcoin L1.

Satoshi upgrade milestone

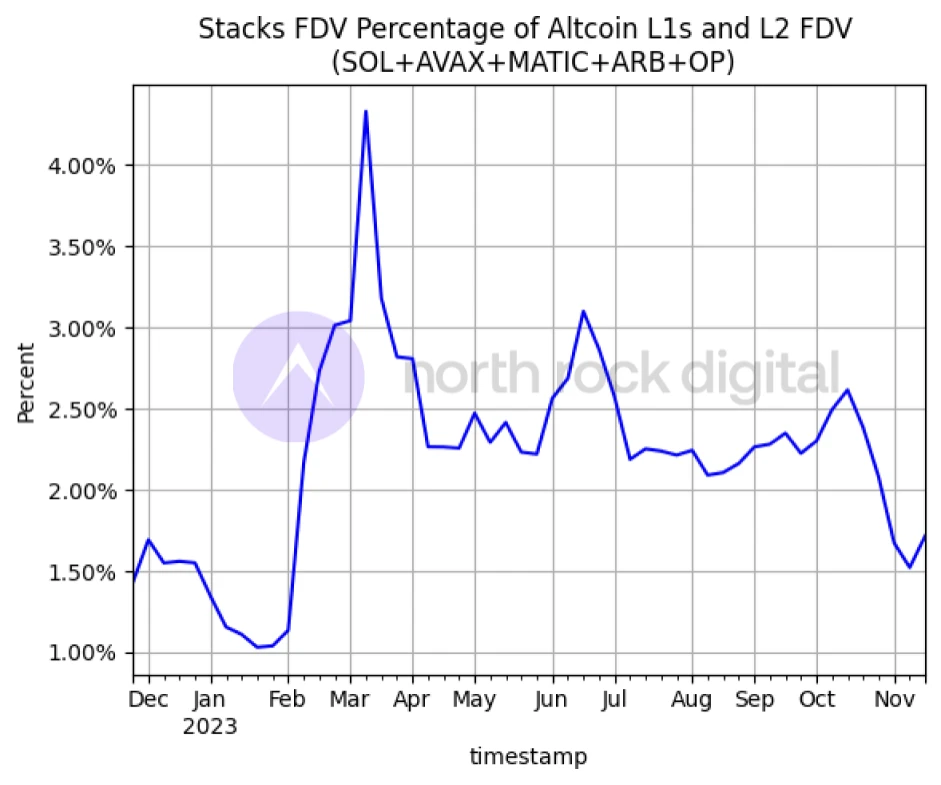

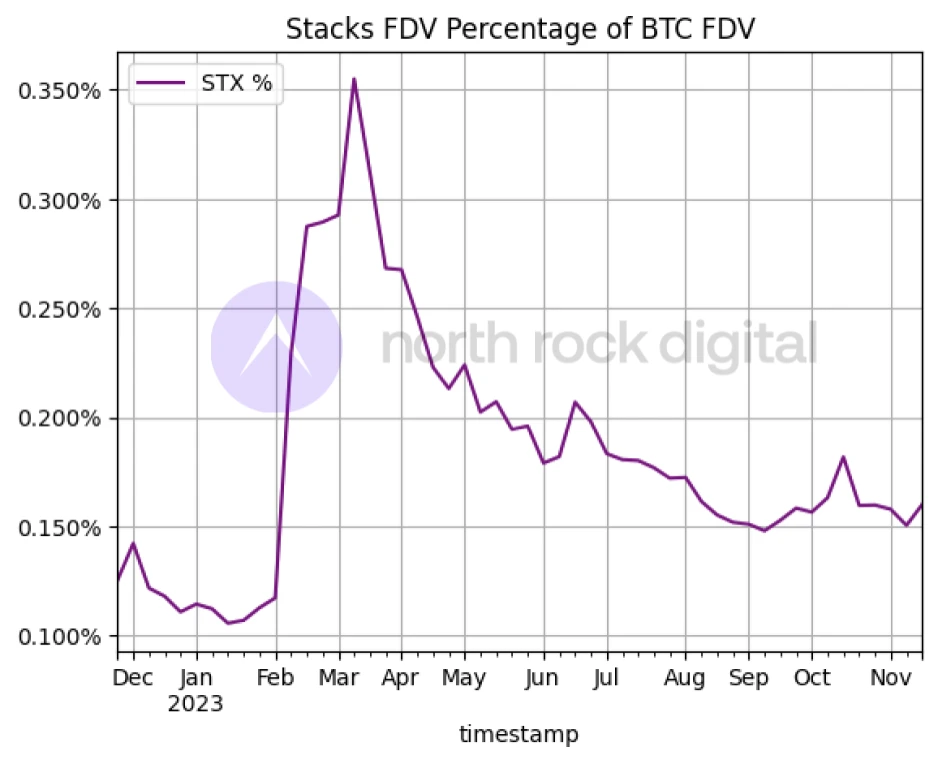

The relative valuation of STX versus BTC and the rest of the Layer 1/2 (L1/L2) ecosystem is also now reaching eyebrow-raising levels. By next April, Stacks is likely to have finally completed its Satoshi upgrade, allowing it to offer the first fully operational BTC-denominated ecosystem. At the same time we will be approaching the BTC halving and the Stacks ecosystem will be in the middle of its marketing campaign. This should provide a favorable environment for STX to narrow its valuation discount relative to these other assets.

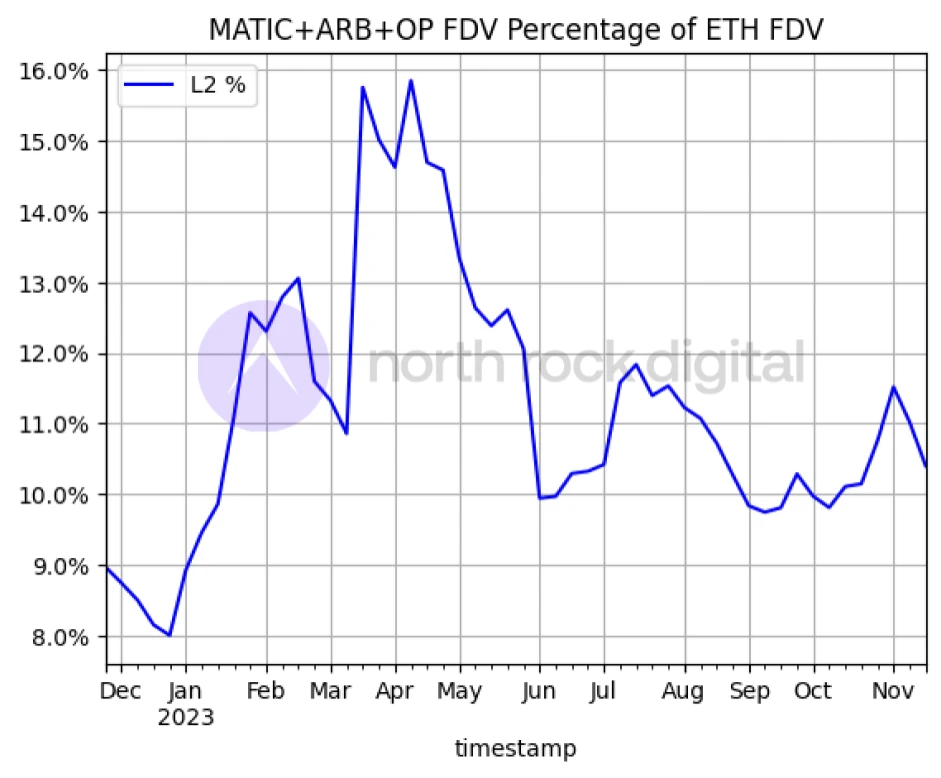

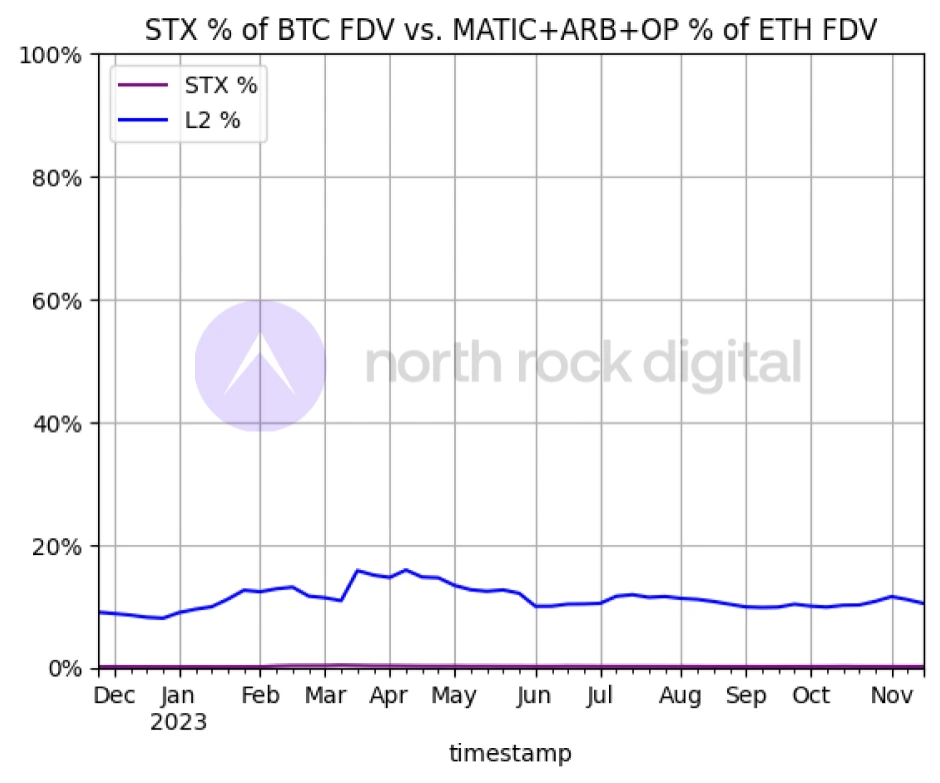

STX is currently trading at 0.15% of BTC’s fully diluted market capitalization (FDV), while Ethereum L2 is trading at a combined 10% of ETH’s FDV.While this difference is reasonable, the size of the current discount shows unlimited potential upside for STX as it dramatically increases its capabilities via Satoshi upgrades and becomes a true BTC second layer over time ( L2).

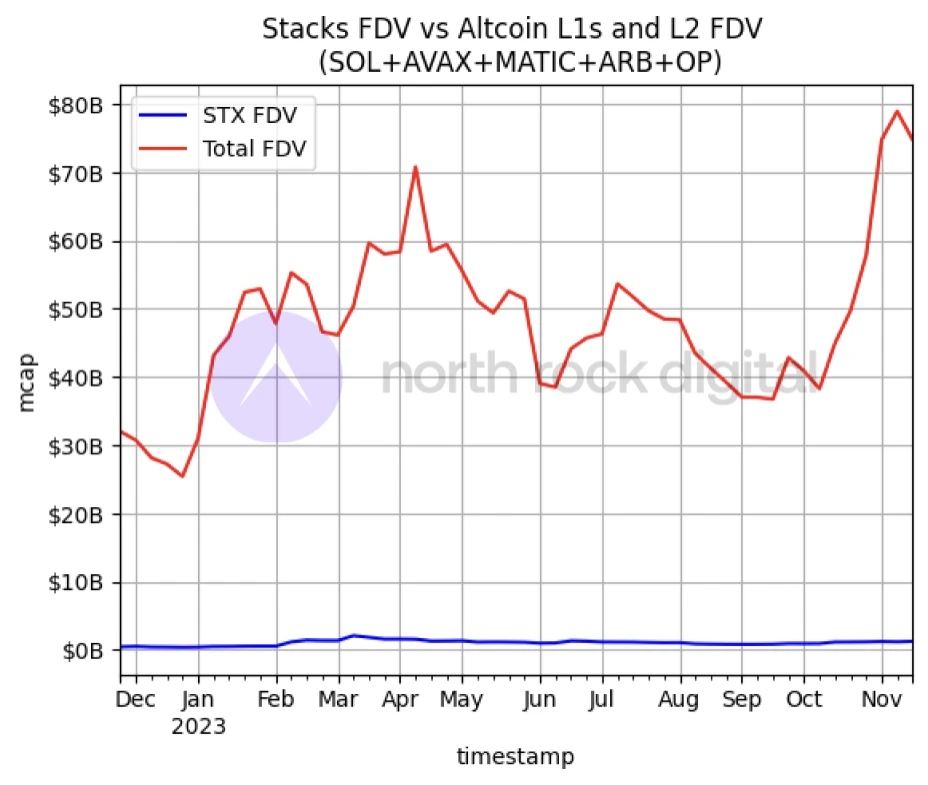

STX vs BTC vs L1/L2 ratio

Let’s imagine what exactly Stacks is capable of.

Before discussing specific cases in detail, some key factors need to be highlighted. Although these applications are possible in other forms, they are not yet widely available. We think there are many reasons why these applications will be more successful once they are implemented on Stacks.

The first is the community factor – Stacks has a strong Bitcoin-centric community of users who are already used to experimenting with Bitcoin, otherwise they wouldn’t be Stacks users at all. This is in stark contrast to products like wBTC that exist on Ethereum but belong to the Ethereum community.

Second is the incentive mechanism - the organizations in the Stacks ecosystem are planning to launch a series of initial incentives to attract Bitcoin users. One of the proposals is to provide an automated yield on all Bitcoin transferred to Stacks, enough to provide a 2-3% yield on the initial $100 million in total value locked (TVL).

Finally, with the implementation of the Satoshi Nakamoto upgrade, Stacks will not only be able to process existing block transactions on Bitcoin, but will also be upgraded to 100% Bitcoin reorganization (reorg) resistance, with plans to eventually transform into A true second layer for Bitcoin, providing additional motivation for members of the Bitcoin community to explore applications within the Stacks ecosystem.

After the Satoshi upgrade, Stacks will be able to provide a high-performance Bitcoin-denominated NFT market once fast blocks and sBTC functionality are implemented. This not only enables more efficient trading of Ordinals, but also includes its exclusive line of L2 NFTs. And through the sBTC mechanism, we can lock Ordinals on Bitcoin L1 and then trade on Stacks L2, which is not only faster and cheaper, but also more flexible in transaction methods.

In addition, using sBTC, we can also explore more traditional decentralized finance (DeFi) applications, such as lending - the Zest team has already begun development in this area on Stacks. Other sub-token exchange markets based on sBTC will also open, and ALEX has already laid the foundation for this. These different applications not only allow you to explore new features, but also automatically generate revenue. It is foreseeable that such products and services will gradually occupy the market and provide us with an ecosystem full of innovation and practicality.