Original author:stella@footprint.network

Cryptocurrency market activity was high in November as the prices of Bitcoin and Ethereum increased, and the market showed signs of further recovery. In the NFT field, Blurs transaction volume has soared, further consolidating its position; the debut of Blast has rewritten the Layer 2 landscape. At the same time, Binance CEO announced his resignation, marking the arrival of a mature market that embraces compliance and moves forward.

The data for this report comes from Footprint Analytics NFT research page. This page provides an easy-to-use dashboard containing the most key statistics and indicators to understand the latest developments in the NFT industry, updated in real time. You can clickhereFind the latest information on deals, projects, financings and more.

Key points overview

Crypto Market Overview

Bitcoin prices continued to rise, opening the month at $34,629 and ending the month with a 9.3% increase, reaching a closing price of $37,848.

The Binance settlement is generally optimistic because it reduces systemic risks in the crypto industry and enhances investor confidence.

NFT Market Overview

The cryptocurrency markets recovery in November also extended to the NFT market. NFT trading volume surged 50.7% to $644 million.

The increase in trading volume is more due to an increase in the price of the tokens used to price NFTs than a significant pickup in actual trading activity.

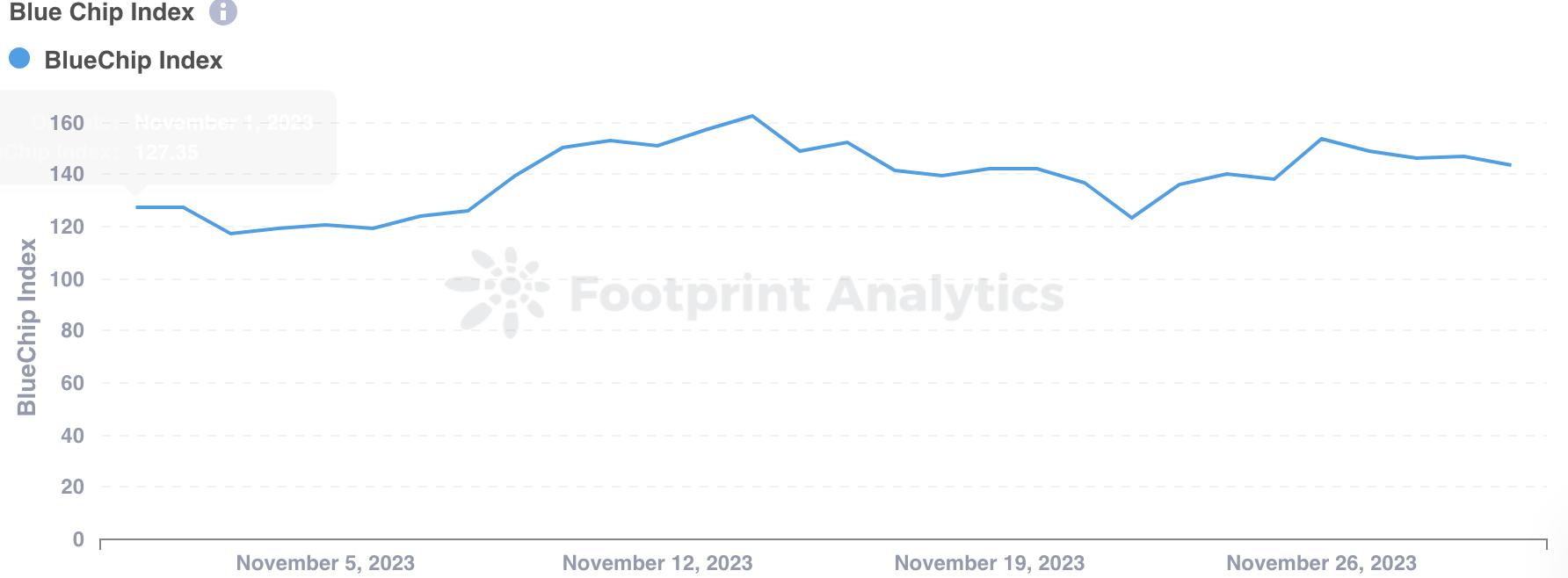

The NFT blue chip index grew 12.8% in November.

Public chain and NFT trading market

Ethereum continues to dominate the NFT market, with transaction volume reaching $630 million, accounting for 98.5% of the total transaction volume, an increase of 50.4% from October.

Blur maintained its lead, dominating with a 66.3% market share and transaction volume of $430 million.

OpenSeas trading volume fell to $150 million in November. This was a 16.8% drop from Octobers data, and its market share shrank from 41.4% to 23.1%.

NFT investment and financing situation

The NFT investment and financing market became more active in November, with two rounds of financing totaling US$11.5 million completed.

Taproot Wizards, an Ordinals project focusing on Bitcoin, recently announced the completion of US$7.5 million in financing, led by Standard Crypto.

Highlights this month

Yuga Labs will work with Magic Eden to launch the new Magic Eden ETH market by the end of the year.

OpenSea announced 50% layoffs.

Square Enix Announces Launch Date for Symbiogenesis, its First NFT Game.

Japanese gaming giant Square Enix has announced the release date of its first NFT game, Symbiogenesis.

Disney partners with Dapper Labs to launch NFT application.

Crypto Market Overview

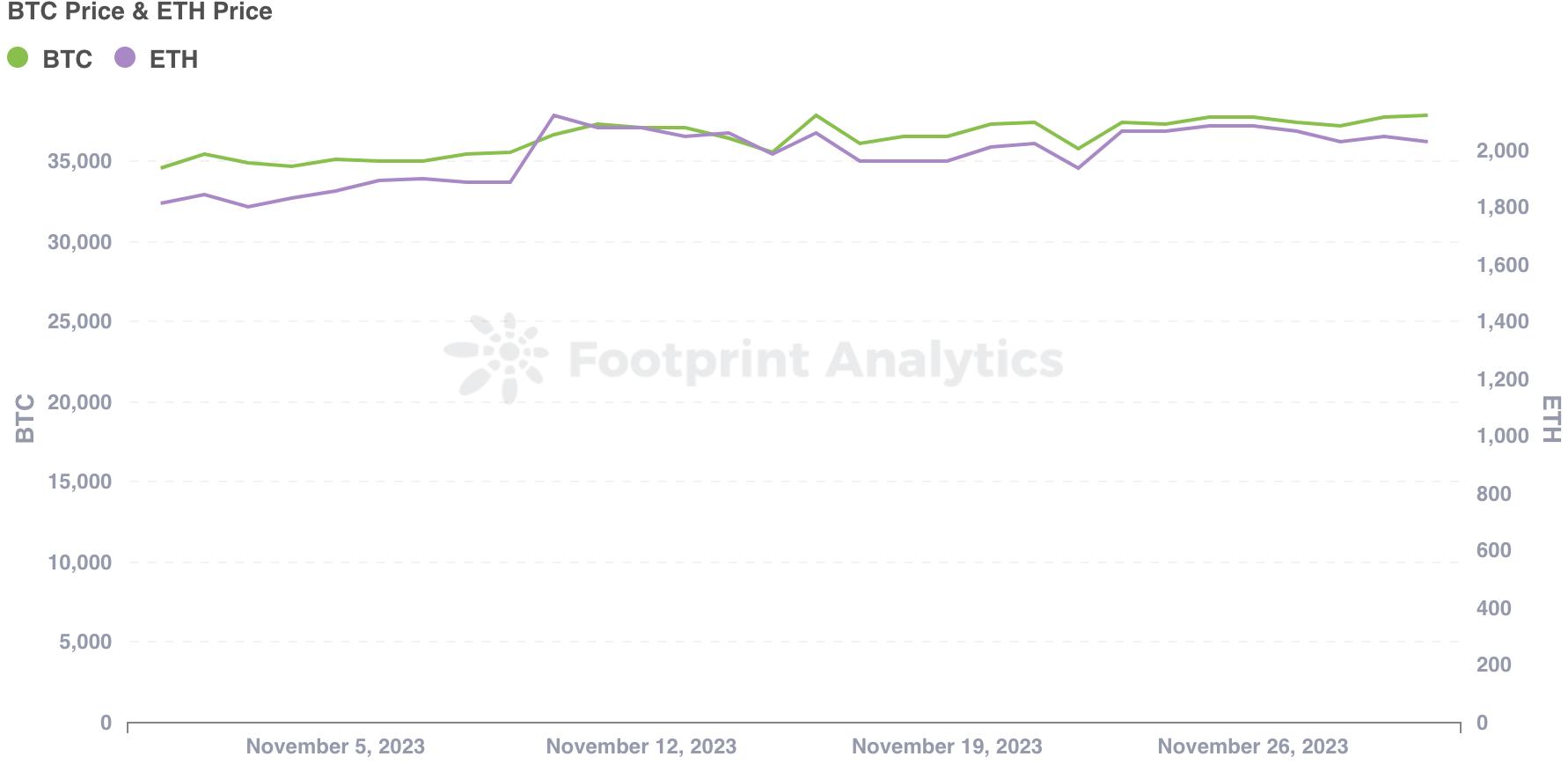

In November, the price of Bitcoin continued to rise, opening at $34,629 at the beginning of the month and ending with a 9.3% increase, reaching a closing price of $37,848. During the same period, Ethereum opened at $1,812 and grew steadily by 11.9%, closing at $2,028 at the end of the month.

Data Sources:BTC Price & ETH Price

Financial markets have reacted relatively modestly to a number of potential risks. Anticipations for the approval of a spot Bitcoin ETF have fueled bullish sentiment, while positive developments in the Middle East conflict have eased concerns about instability in the wider region. Similarly, the U.S. Consumer Price Index (CPI) maintained a downward trend, increasing the markets optimistic expectations that the Federal Reserve may cut interest rates and the U.S. economy may achieve a soft landing.

Changpeng Zhao (CZ) resigned as Binance CEO on November 21 as part of a $4 billion settlement with U.S. institutions. The settlement ends a wide-ranging investigation by multiple U.S. regulators including the Department of Justice into Binance’s alleged violations of anti-money laundering laws and other regulations. As soon as the Binance settlement news was released, the price of Bitcoin fell to $35,800, but stabilized to mid-$36,000 by the next morning. The market generally viewed the settlement positively, believing it reduced systemic risks in the crypto industry and increased investor confidence.

NFT Market Overview

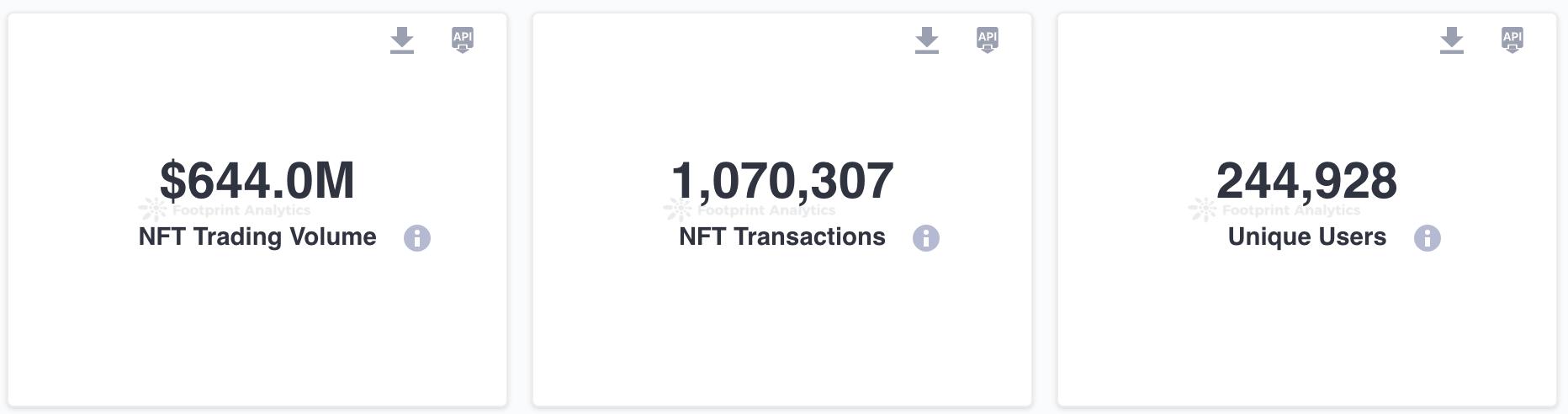

The cryptocurrency markets recovery in November also extended to the NFT market. NFT trading volume surged 50.7% to $644 million. The number of transactions remained unchanged at 1,070,324, but the number of unique users (wallets) fell by 12.9% during the same period, totaling 244,928.

Data Sources:NFT Market Overview

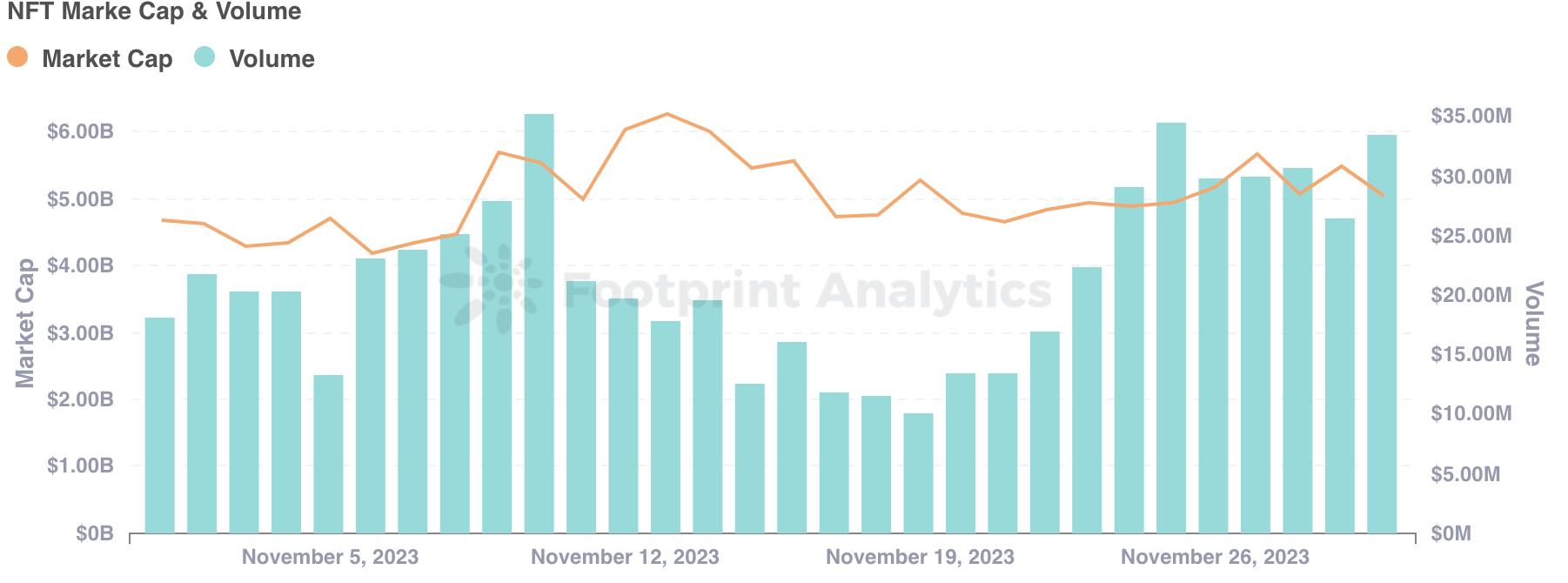

In November, the market value of the NFT market increased by 7.9% from US$4.68 billion at the beginning of the month to US$5.05 billion by the end of the month.

Data Sources:NFT Market Cap & Volume

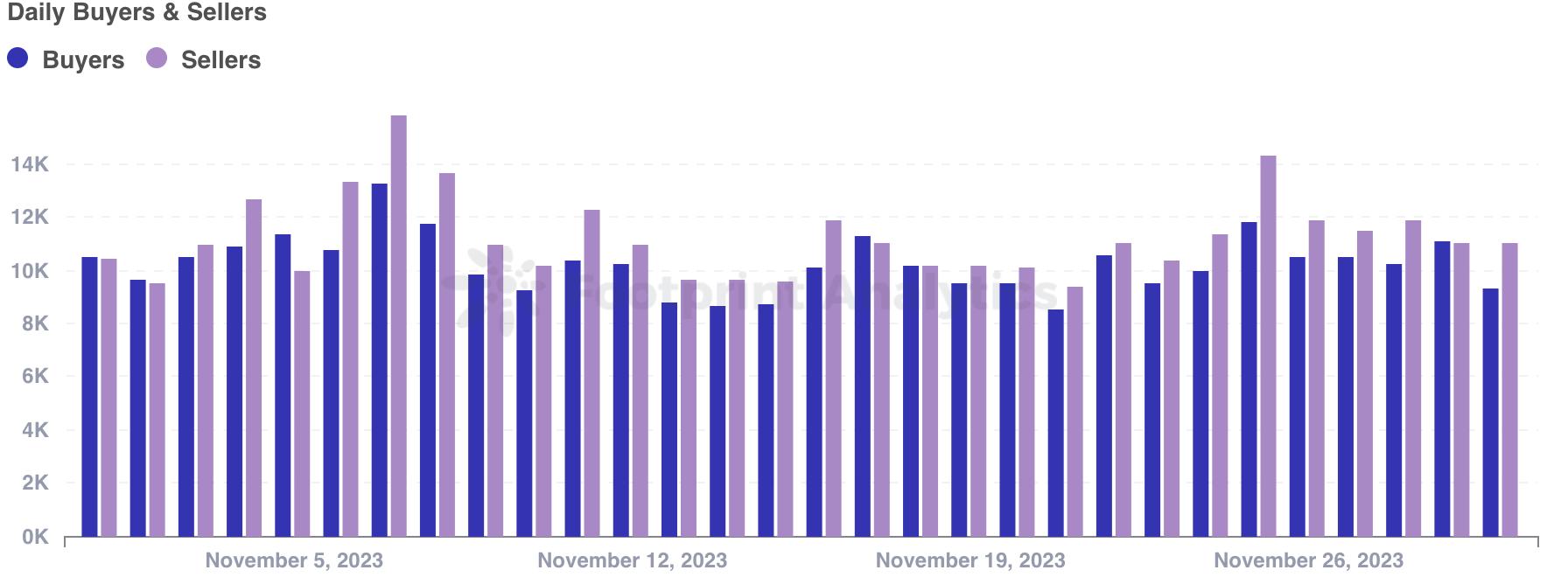

In November, the buyer/seller ratio in the NFT market was 100.6%, a decrease of 35.5% from October. There were 146,877 buyers and 145,956 sellers in November. Compared to the previous month, the number of buyers fell by 21.7%, while the number of sellers increased by 5.9%.

Trading volume in the NFT market increased by 50.7% in November, but the number of buyers decreased by 21.7%, indicating that increased trading volume does not necessarily mean a full recovery of the market. This increase in trading volume is more due to an increase in the price of the tokens used to price NFTs than a significant pickup in actual trading activity.

Data Sources:Daily Buyers & Sellers

The NFT blue chip index grew 12.8% in November.

Data Sources:BlueChip Index

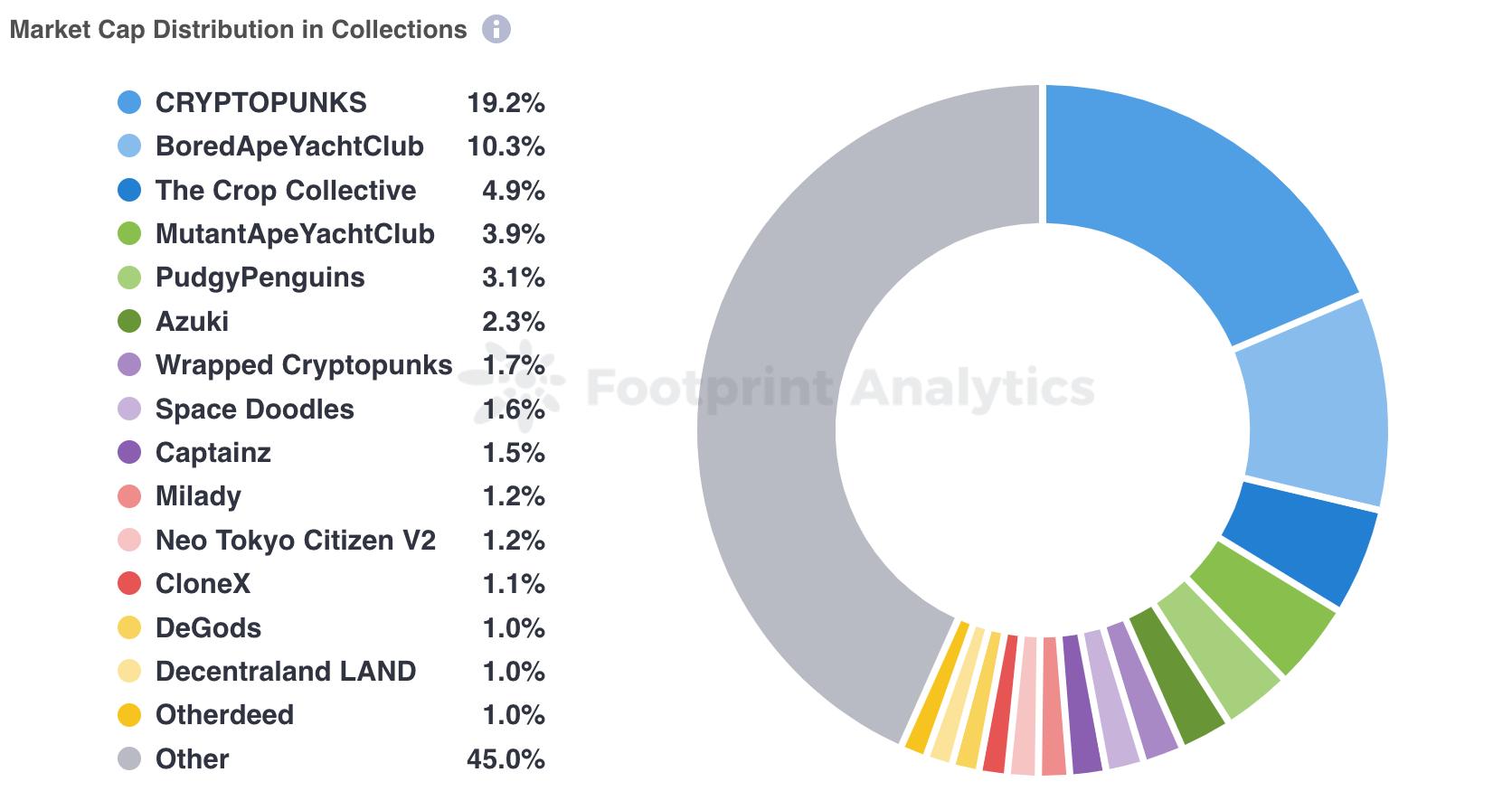

According to data from Footprint Analytics,CryptoPunksThe floor price increased by 18.4% in November, from 46.8 ETH to 55.5 ETH, reaching a peak of 70 ETH on November 14. CryptoPunks leads the NFT market with a market capitalization of $1.3 billion and a market share of 19.2%.Bored Ape Yacht ClubMaintaining the floor price of 30 ETH, the market value is US$670 million, and the market share is 10.3%.

Data Sources:Market Cap Distribution in November

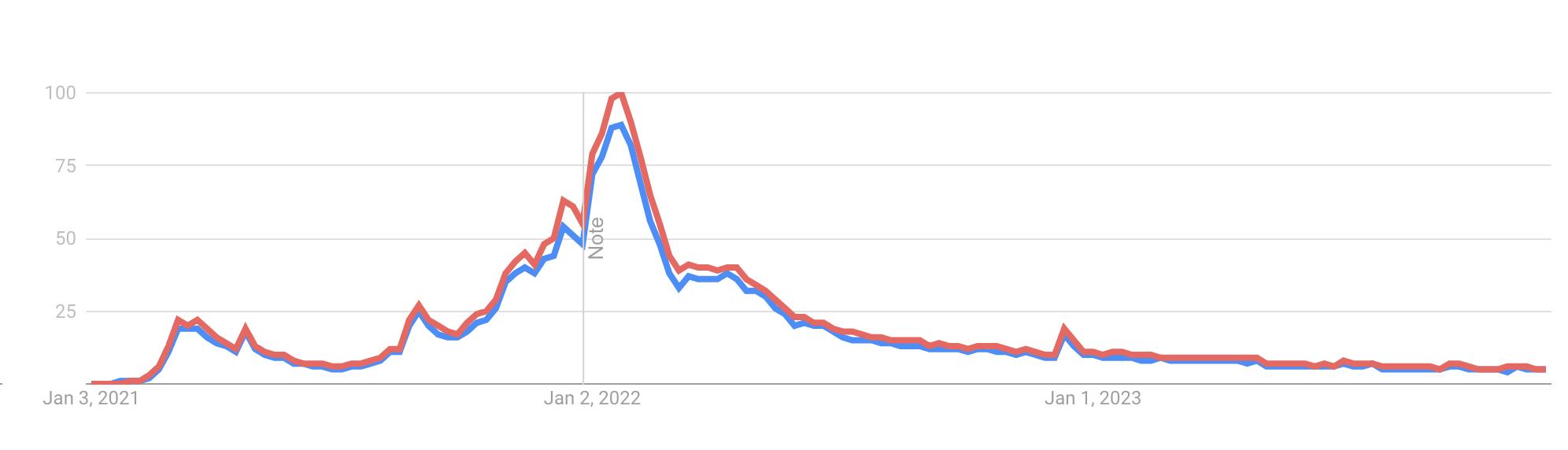

Looking at the NFT market from another perspective, according to Google Trends data, taking the highest interest point in January 2022 as a benchmark, it is set at 100; by the end of November, “NFT” (blue curve) and “Non- fungible token (red curve) has a public interest level of only 5. This shows that although the market has recovered, with trading volume and market capitalization increasing, the general publics interest in NFTs is still significantly below peak levels.

Data Sources:Google Trends

Public chain and NFT trading market

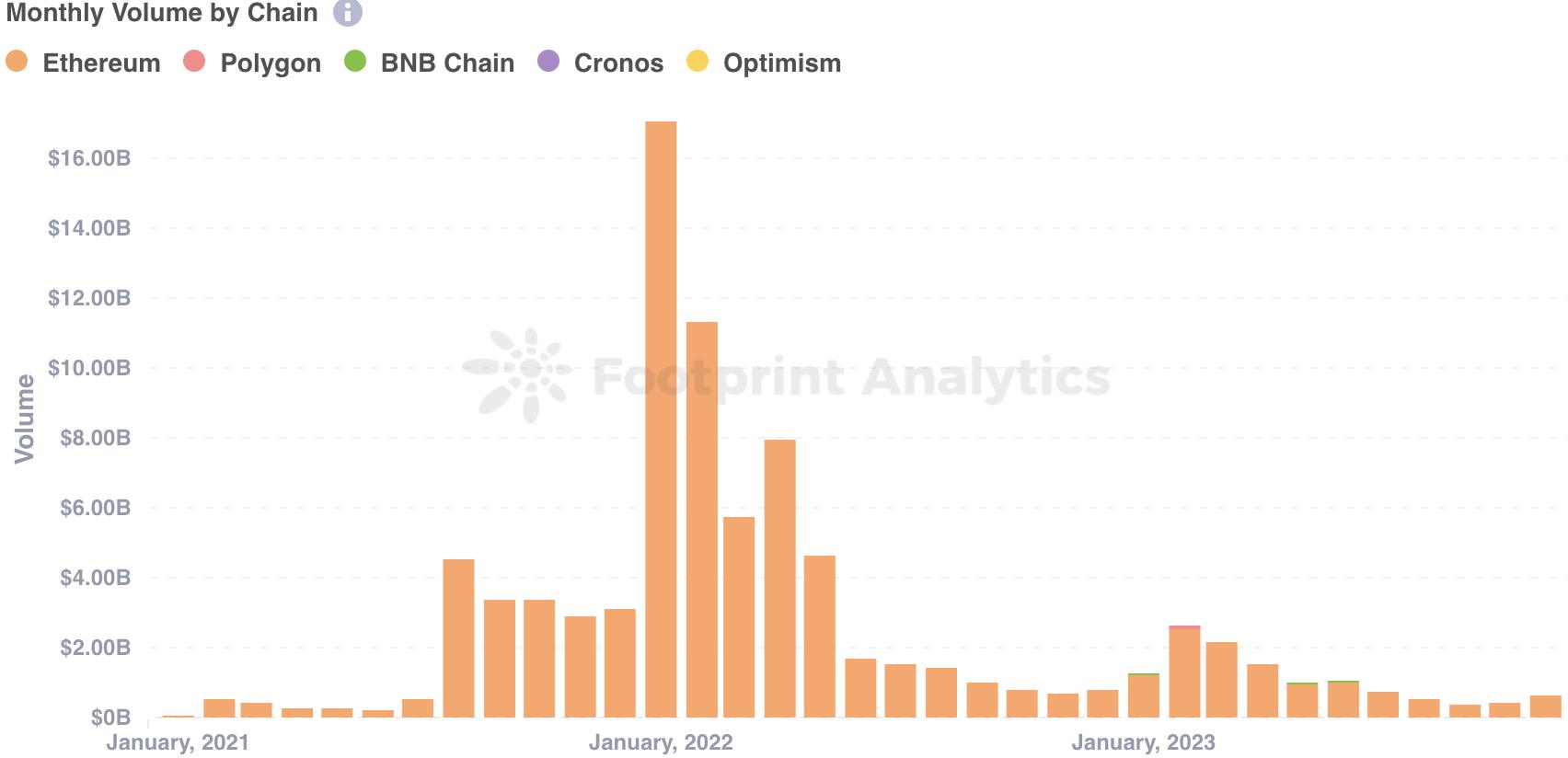

In November, Ethereum continued to dominate the NFT market, with transaction volume reaching $630 million, accounting for 98.5% of the total transaction volume, an increase of 50.4% from October.

Data Sources:Monthly Volume by Chain.

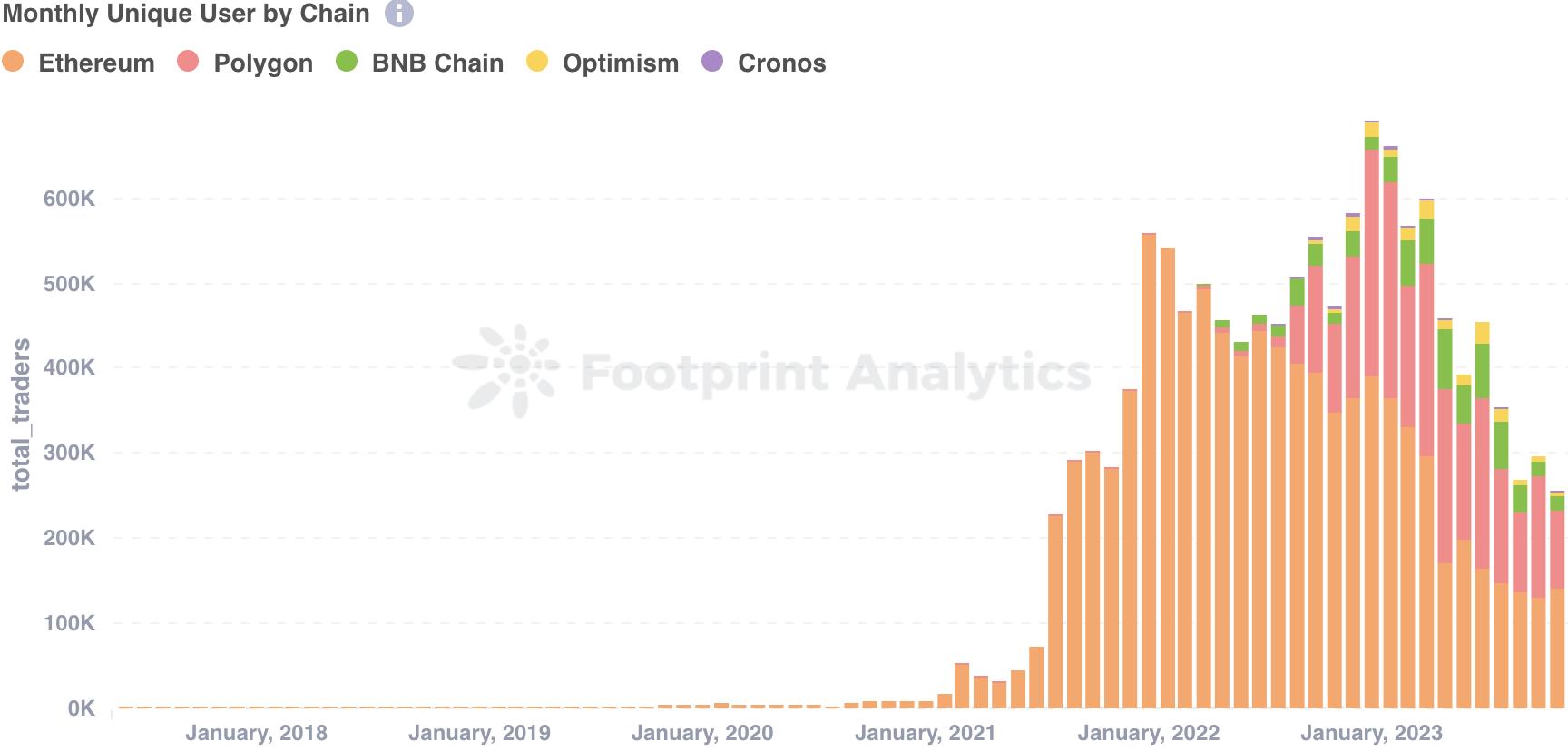

In November, the number of Ethereum users (number of wallets) increased by 7.6% to 140,000. In contrast, the number of users of the BNB chain dropped by 4% from October to 17,000, and by 73.5% from 63,000 in July. At the same time, Polygons user count dropped significantly by 35.3%, totaling 92,000.

Data: Monthly Uniques User by Chain

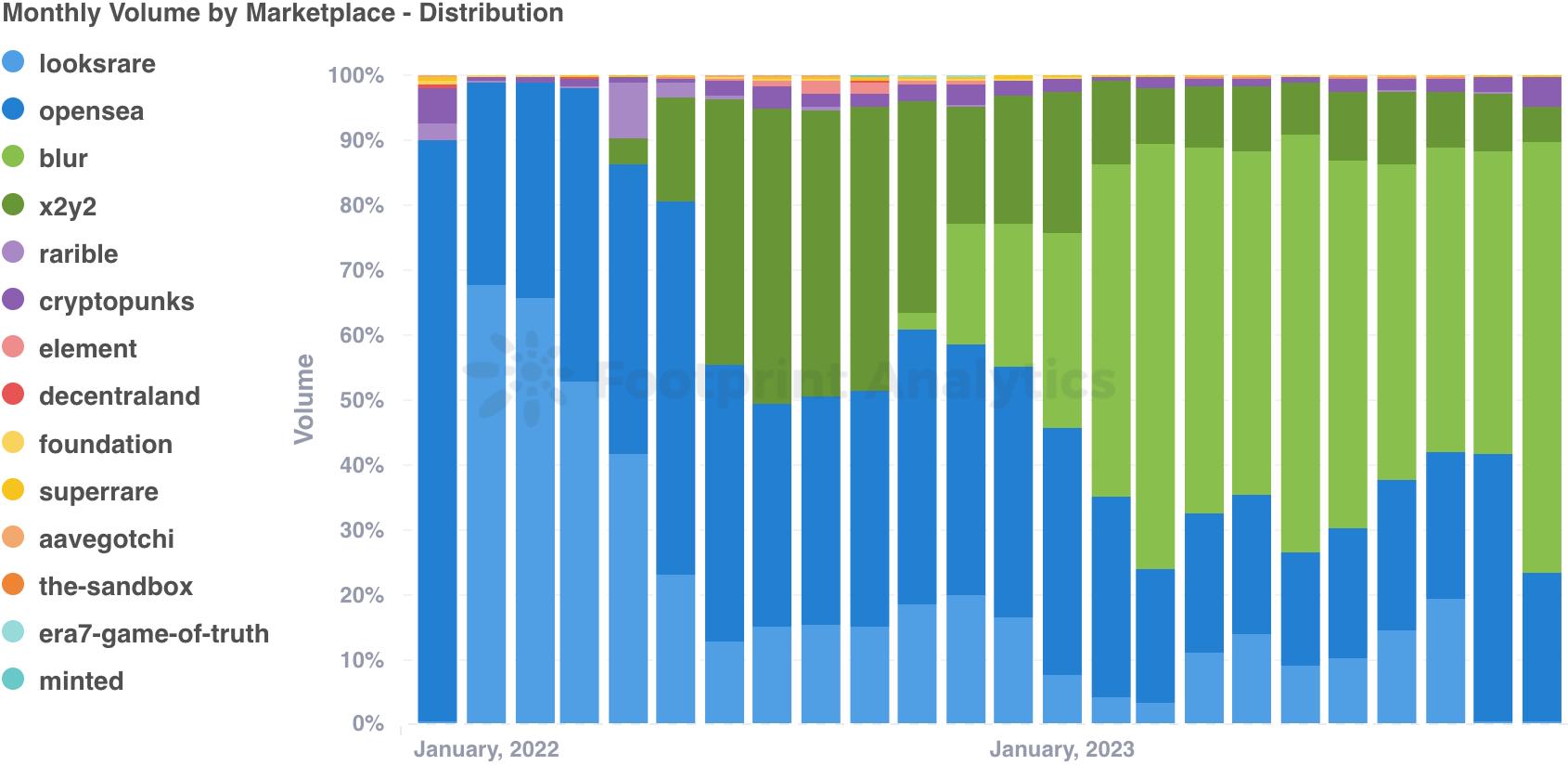

In terms of the NFT trading market, Blur remains in the lead, dominating with a market share of 66.3% and a trading volume of US$430 million. This transaction volume surged 112.3% from October, pushing Blur to an all-time high market share.

After listing on Binance to implement the exchange function and launching its Layer 2 network Blast, the price of Blurs native token $BLUR increased. The $BLUR price was $0.30 on November 21st, peaked at $0.68 on November 25th, and fell back to $0.50 at the end of the month.

Blast was developed by Tieshun Roquerre, one of the founders of Blur. After raising $20 million from Paradigm and Standard Crypto, it opened a closed beta version to invited users on November 21 to begin its early access phase. Positioned as the first Ethereum Layer 2 solution with a native revenue model, Blast quickly accumulated overUSD 600 million TVL. Despite generating buzz on social media, Blast has been criticized for its multi-signature contracts, withdrawal limits, and referral rules.

Blast

Meanwhile, OpenSeas trading volume fell to $150 million in November. This was a 16.8% drop from Octobers data, and its market share shrank from 41.4% to 23.1%.

In early November, OpenSea announced a significant reduction in its workforce, reducing its workforce by nearly 50%. The move is in line with OpenSeas strategic transformation as it prepares to launch a new version of its trading market, OpenSea 2.0, committed to embracing a leaner, flatter organizational structure to enhance flexibility and competitiveness in the rapidly changing NFT field. The layoffs are the second after OpenSea reduced its workforce by 20% in July 2022. The layoffs are seen as a reaction to OpenSea lagging behind Blur in NFT trading volume, highlighting OpenSeas efforts to adapt to changes and remain a key player in the market.

X2Y2s market position has also declined, with its market share falling to 5.4% in November. This is the lowest level for the platform since May 2022.

Data Sources:Monthly Volume by Marketplace - Distribution

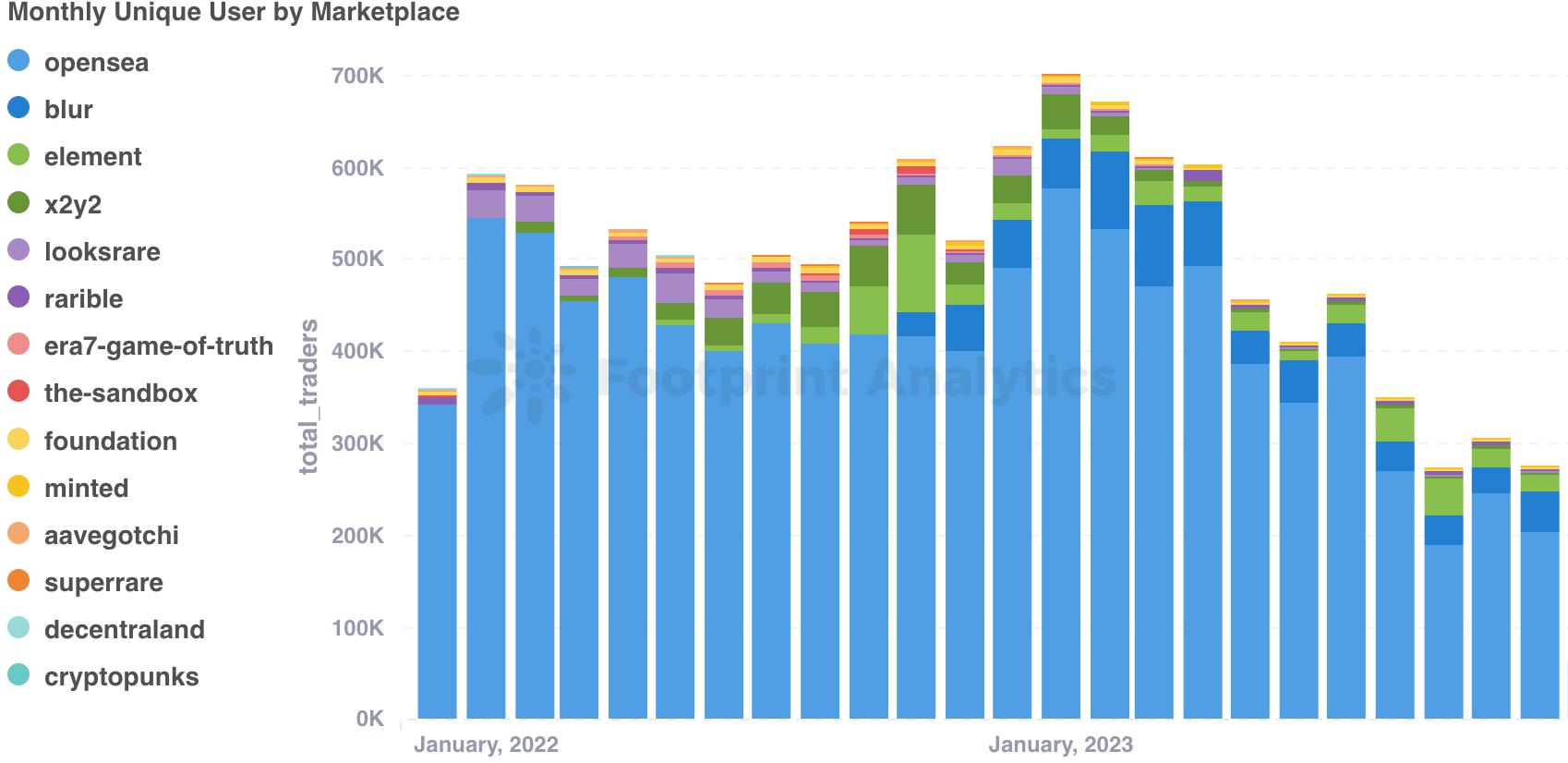

In November, the NFT market had a mixed performance in terms of user metrics. OpenSea maintains its leading position in attracting users (wallets), with the number of platform users reaching 204,000. However, this figure decreased by 16.9% compared to October. In contrast, Blur has seen significant user growth, with 44,000 users, a 50.3% increase from last month.

Data Sources:Monthly Unique Users by Marketplace

NFT investment and financing situation

The NFT investment and financing market became more active in November, with two rounds of financing totaling US$11.5 million completed.

Authentick received $4 million in seed funding from Menyala. Menyala is a venture capital platform founded by Temasek. Authentick is designed to help users purchase digital collectibles without a Web3 wallet or access to an exchange. They are enabling NFTs to be sold on traditional e-commerce sites like Lazada to help brands reach a wider audience.

Taproot Wizards, an Ordinals project focusing on Bitcoin, recently announced the completion of US$7.5 million in financing, led by Standard Crypto. The project is limited to issuing 2,121 Wizard NFTs, a number that represents 21 million of the total Bitcoin supply. Currently, less than 1% of Taproot Wizards Ordinals have been minted.

source:Taproot Wizards - Wizard #0001

The Bitcoin-related Ordinals project has been very popular recently. Udi Wertheimer, co-founder of Taproot Wizards, said they are keeping their release plans secret to maintain long-term interest.

We want to find people who have a sense of purpose, not people who are just looking at JPEGs, he said.

____________________

The above research report data includes:

Chain: Ethereum, Polygon, BNB Chain, Cronos, Optimism

Markets: OpenSea, LooksRare, Blur, X2Y2, Cryptopunks, Rarible, SuperRare, Foundation, Decentraland, Aavegotchi, Element, Era 7, the Sandbox, Minted

The content of this article is for industry research and communication only and does not constitute any investment advice. Market risk, the investment need to be cautious.

This article was contributed by the Footprint Analytics community.

The Footprint Community is a global, mutually supportive data community where members use visual data to work together to create communicable insights. In the Footprint community, you can get help, build links, and communicate about blockchain-related learning and research on Web 3, Metaverse, GameFi and DeFi. With many active, diverse, and highly engaged members inspiring and supporting each other through the community, a worldwide user base has been established to contribute data, share insights, and drive community development.

Footprint Analytics

Official website:https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

Telegram: https://t.me/Footprint_Analytics