Original author:stella@footprint.network

Data Sources:Ronin Dashboard

The popular Web3 game Pixels migrated from Polygon to Ronin, a blockchain designed specifically for games, in late October 2023. Pixels was previously the Web3 game with the largest number of active users (number of wallets) on Polygon, and its migration to Ronin has injected strong impetus into the latters recovery after the hacker attack in March 2022.

Since the migration, Ronins on-chain activity has grown significantly in November. While Ronin has previously relied primarily on its play-to-earn game Axie Infinity, its recent resurgence appears to be different from its past. Well analyze Ronins recent performance and explore its current development.

About Ronin

While Ethereum’s architecture is revolutionary, it is not optimized for the high-speed and low-cost gaming transaction needs. In 2021, this limitation has become a bottleneck for Axie Infinitys growth and player retention. In response to these challenges, Sky Mavis, the Vietnamese studio that launched Axie Infinity, took decisive steps to launch Ronin in February 2021.

Ronin is an Ethereum sidechain that has been carefully designed to specifically meet the needs of the gaming industry. Its goal is to provide a powerful, fast, and economical platform to promote the development of gaming applications. This strategic move aims to remove barriers that once impacted Axie Infinity’s gaming experience and transaction smoothness.

Sky Mavis has become a major force in the Web3 gaming space, and is one of the few teams that has truly achieved mass adoption of Web3 gaming. according toFootprint AnalyticsAs of November 2023, Axie Infinity has accumulated an astonishing 9.88 million users, of which 9.22 million users are attributed to Ronin, accounting for 93.3%. The success of this flagship game has brought Sky Mavis deep insights and valuable experience in the field of Web3 game development and operations.

Nearly three years after its launch, Ronin has carved out a niche in the Web3 gaming space. However, it remains to be seen whether it has become the blockchain of choice for Web3 games.

Advantages of Ronin

Ronin has already demonstrated its ability to scale individual games, such as supporting Axie Infinity to millions of users. Through Axie Infinity, Sky Mavis has gained valuable experience in product development, community participation and market expansion. This experience is very helpful for partners who want to launch projects on the Ronin network.

Ronin can support near-instant transactions with extremely low fees, and can support a large number of in-game transactions efficiently and seamlessly.

In March 2022, Ronin suffered a major security breach, and hackers stole 173,600 ETH and 25.5 million USDC. Following this, Sky Mavis has strengthened its security measures, adopting a zero trust framework. Initially, Ronin used the Proof of Authority (PoA) consensus mechanism, which relied on a selected group of trusted validators for transaction verification. This method was relatively efficient but less decentralized. To enhance decentralization, Ronin turned to a Delegated Proof of Stake (DPoS) system, which allows token holders to delegate the election of validators, thus decentralizing network control more fairly.

Ronin’s Ecology

The gaming industry occupies the most important position in the Ronin ecosystem. at present,RoninThere are eight running games on it, namely Axie Infinity, The Machines Arena, Bowled, Battle Bears Heroes, Wild Forest, Apeiron, and the recently added Pixels and Zoids Wild Arena. In addition, two games, Axie Champions and Tribesters, will soon be available on Ronin.

As of November, just two games, Axie Infinity and Pixels, accounted for more than half of Ronins daily transaction volume and nearly 90% of daily active users (DAU). This concentration of user engagement on a handful of games also highlights potential vulnerabilities in the Ronin ecosystem.

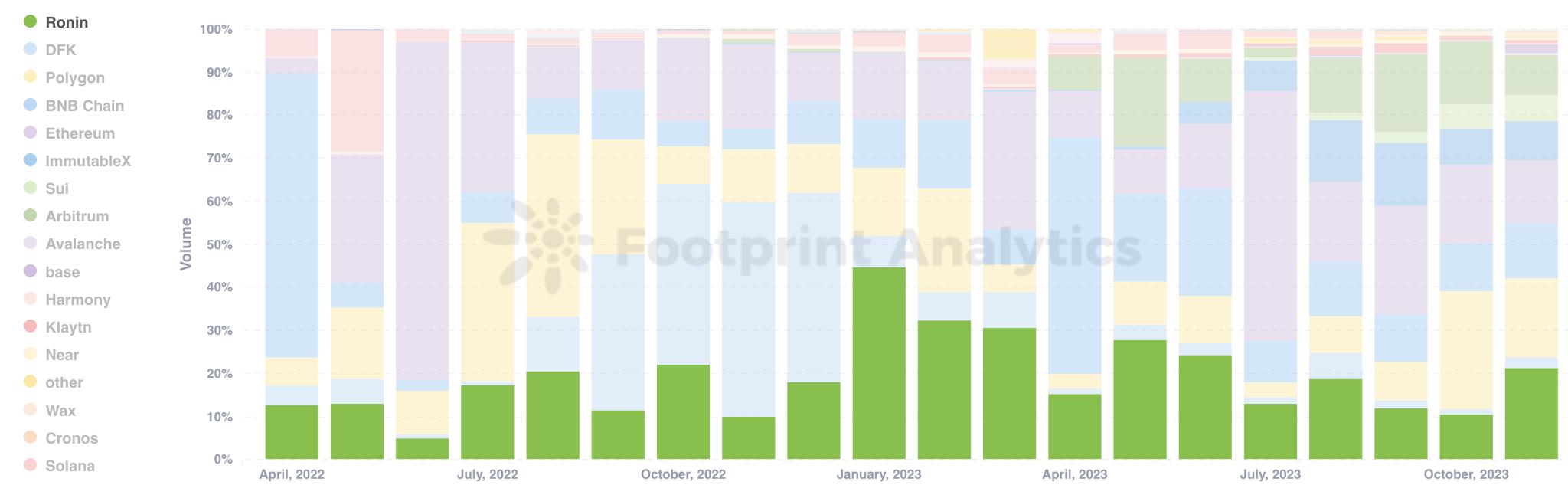

Ronin’s share of transaction volume in public chain games is currently 21.2%. This shows that despite Ronins focus on gaming, there is still room for improvement in its market presence. In order to gain a competitive advantage in the public chain field, Ronin needs to adopt a strategy of developing in multiple fields and further developing its game ecosystem.

Data Sources:Monthly Volume Distribution

In light of this, Sky Mavis is actively pursuing strategies to broaden Ronins appeal and further develop its gaming ecosystem. On November 2, Sky Mavis announced a strategic partnership with Korean game studio ACT Games, which is an important step in this direction. This cooperation will bring all ACT games into the Ronin system, starting with the blockchain card game Zoids Wild Arena. This move is expected to accelerate the growth of the number of Ronin games and increase developer and user interest in the platform.

In addition to games, Ronin currently has 23 decentralized applications (dApps) running on the platform. These include Katana (Ronin’s native DEX), Ronin Wallet, and Mavis Market (NFT trading market). As of November 30, Katana’s TVL has reached $92.8 million, but other dApps still have considerable room for improvement in terms of user acquisition and engagement.

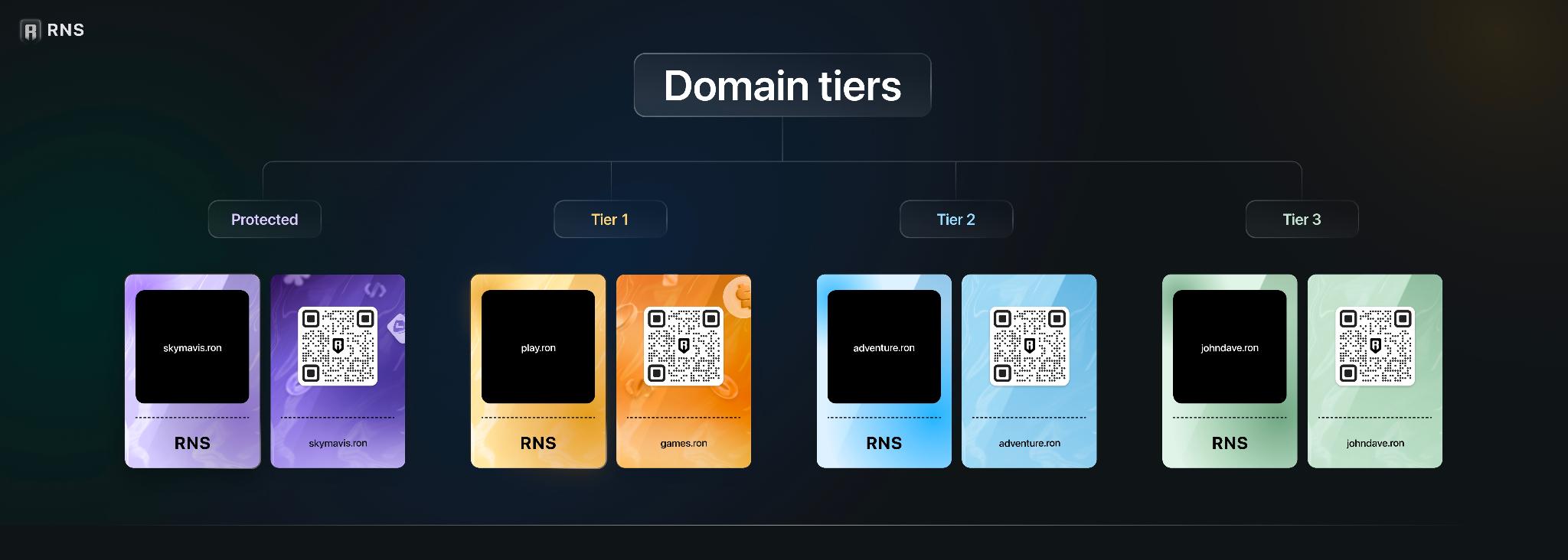

Ronin Domain Name Service (RNS) launched public sales on November 15, 2023, changing the way users interact with the Ronin chain. RNS replaces complex wallet addresses with intuitive, easy-to-read names, making transactions easier and more accurate. In addition, RNS will be integrated into the entire Sky Mavis ecosystem, including App.Axie, Mavis Market, and future platforms, optimizing the user experience across the entire network.

source:Ronin Name Service (RNS)

Ronin’s data performance

Let’s explore the latest developments in the Ronin ecosystem through data.

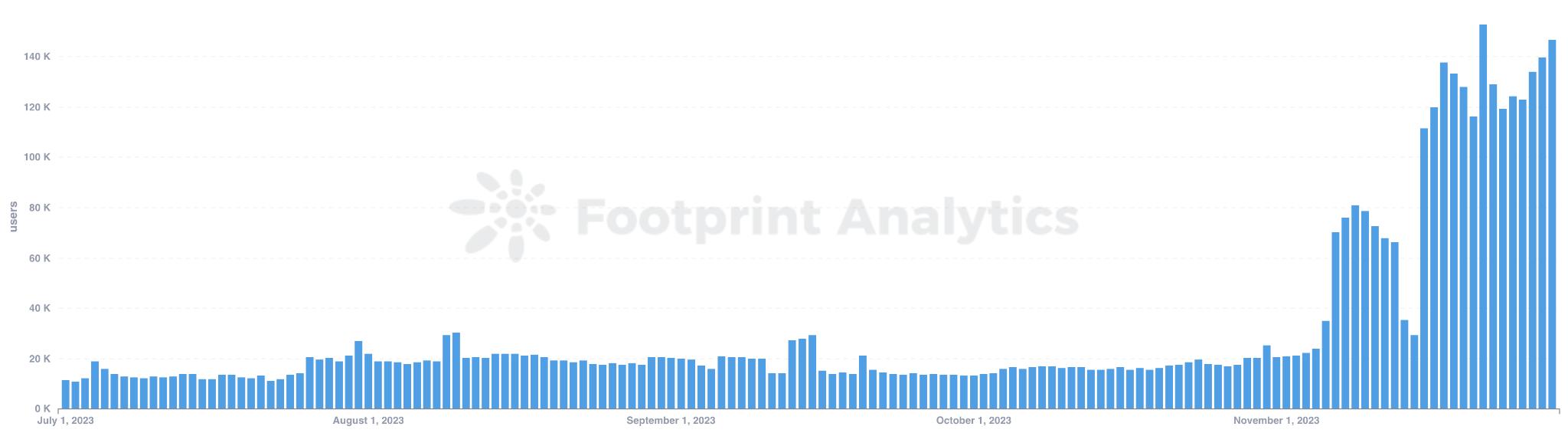

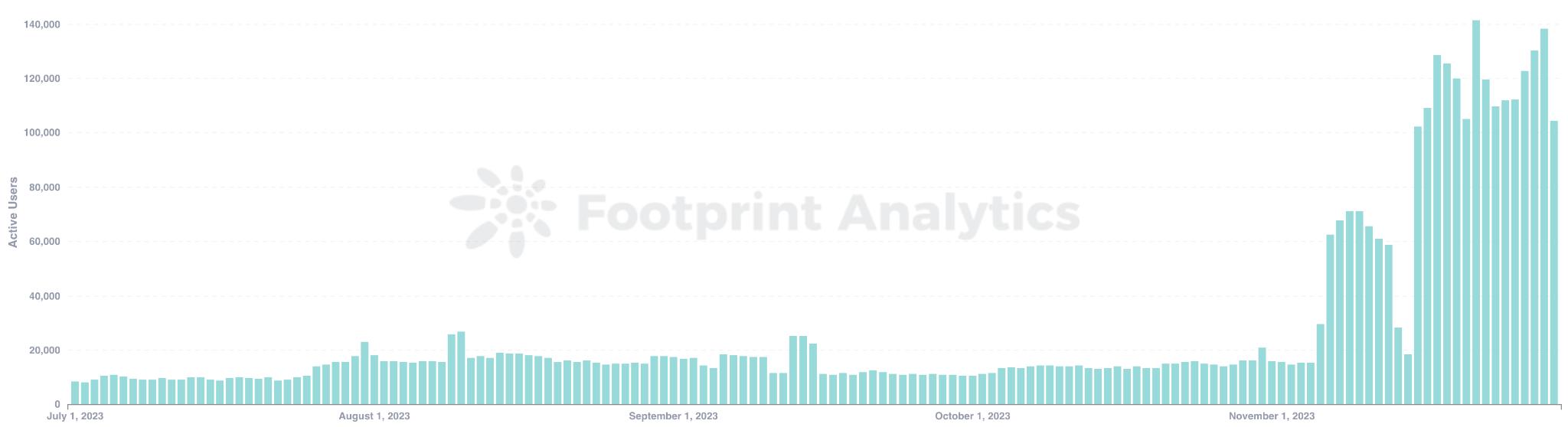

Daily active users (DAU)

From July to October 2023, Ronins daily active users (DAU, counting the number of unique wallets) remained stable, averaging about 17,400. However, Ronins DAU increased significantly in November 2023 as Pixels migrated from Polygon to Ronin. The number surged from 17,400 to 88,400, reaching a peak of 152,800 on November 22. It is worth noting that Ronin’s DAU exceeded the 100,000 threshold on November 16 and has continued to rise since then.

Data Sources:Ronin Chain Daily Users

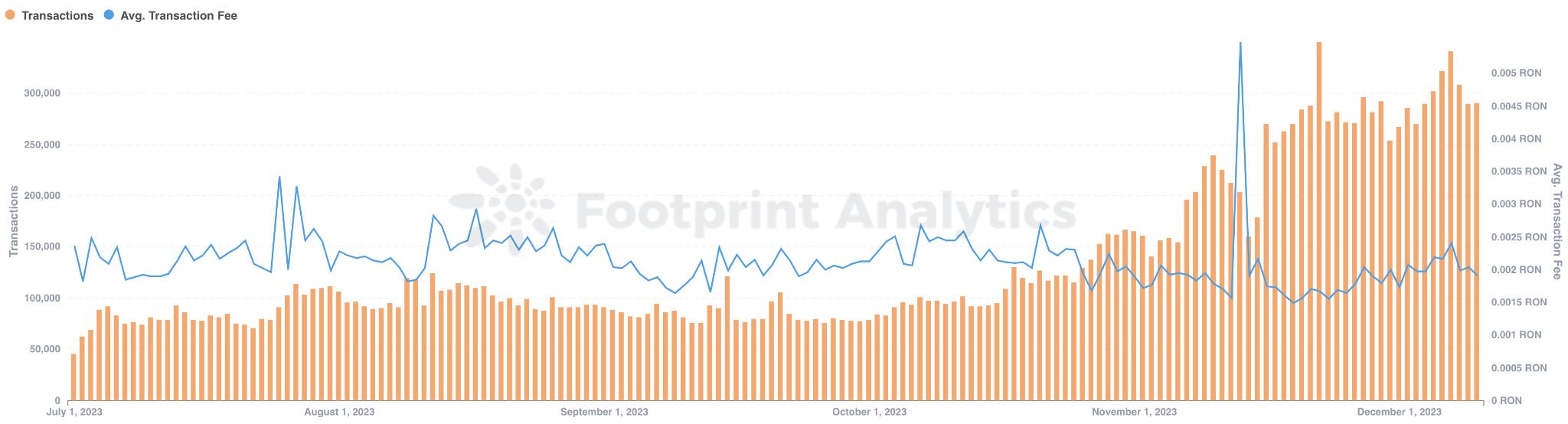

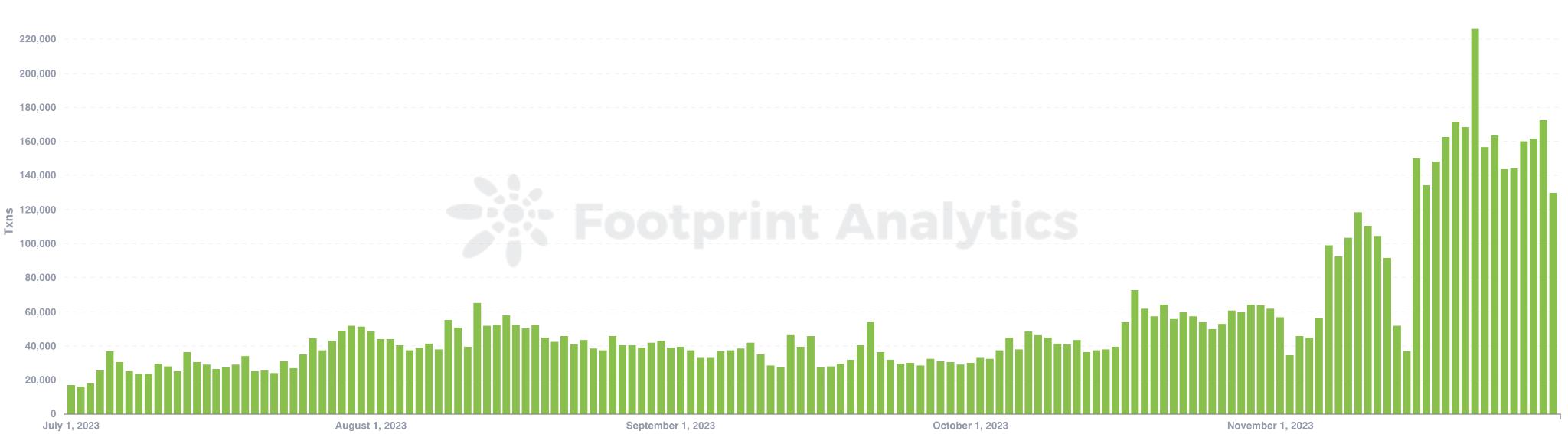

Number of transactions per day

From July to October 2023, Ronins daily transaction number remained at a relatively stable level, with an average of approximately 95,200 transactions per day. Starting in mid-October, Ronins trading activity increased significantly. By November 30, daily trading volume had surged to approximately 232,600 transactions.

The average transaction fee on Ronin has been declining as the number of transactions increases. From July to October 2023, the average transaction fee was 0.0022 RON. In November, the average transaction fee dropped to 0.0019 RON, a decrease of 11.7%.

Data Sources:Ronin Chain Daily Transactions & Avg. Transaction Fee

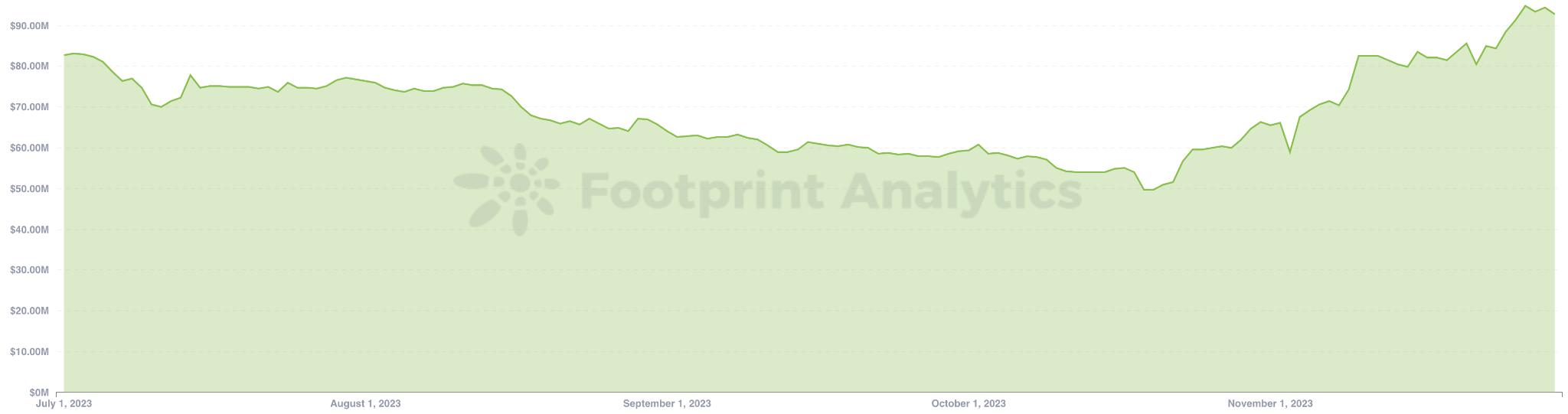

Total Value Locked (TVL)

Since the beginning of this year, bearish sentiment has prevailed in the crypto market. Ronins TVL has been on a downward trend since January. However, since mid-October, along with favorable trends across the cryptocurrency market and increased user activity in the gaming space, Ronin’s TVL has grown significantly, rising from $49 million to $92.8 million as of November 30 , an increase of 86.3%.

Data Sources:Ronin DeFi Data

However, Ronin’s native DEX Katana occupies almost all of the chain’s TVL. Although the gaming field has been booming, Ronin still has room for improvement and growth in other ecological areas.

Game data performance

Daily active users (DAU)

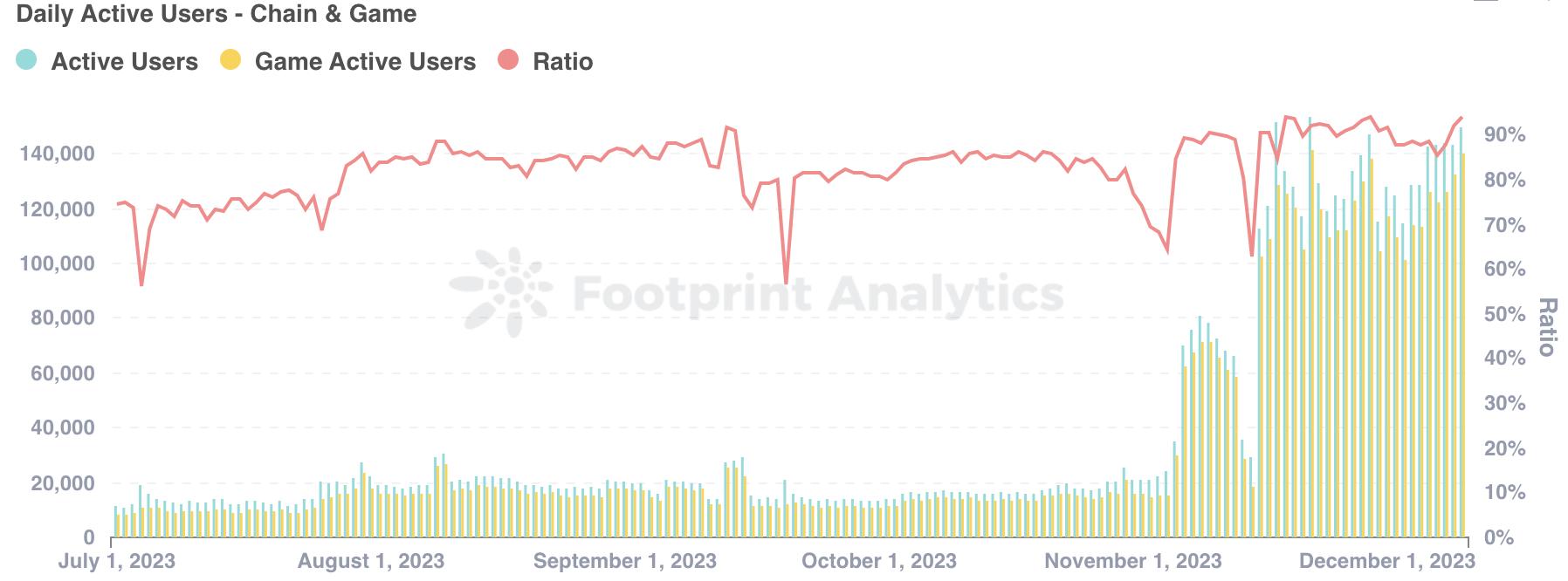

Data from Footprint Analytics shows that since July 2023, more than 80% of DAU on Ronin has come from the gaming field.

Data source: Daily Active Users - Ronin Chain. Game

Ronin DAU in the gaming space is consistent with its overall trend. With the addition of Pixels in November, there was a significant increase in DAU. From July to October, DAU averaged 14,300, but by November, this number jumped to 79,800, an increase of 458.0%.

Data Sources:Ronin Chain Key Stats

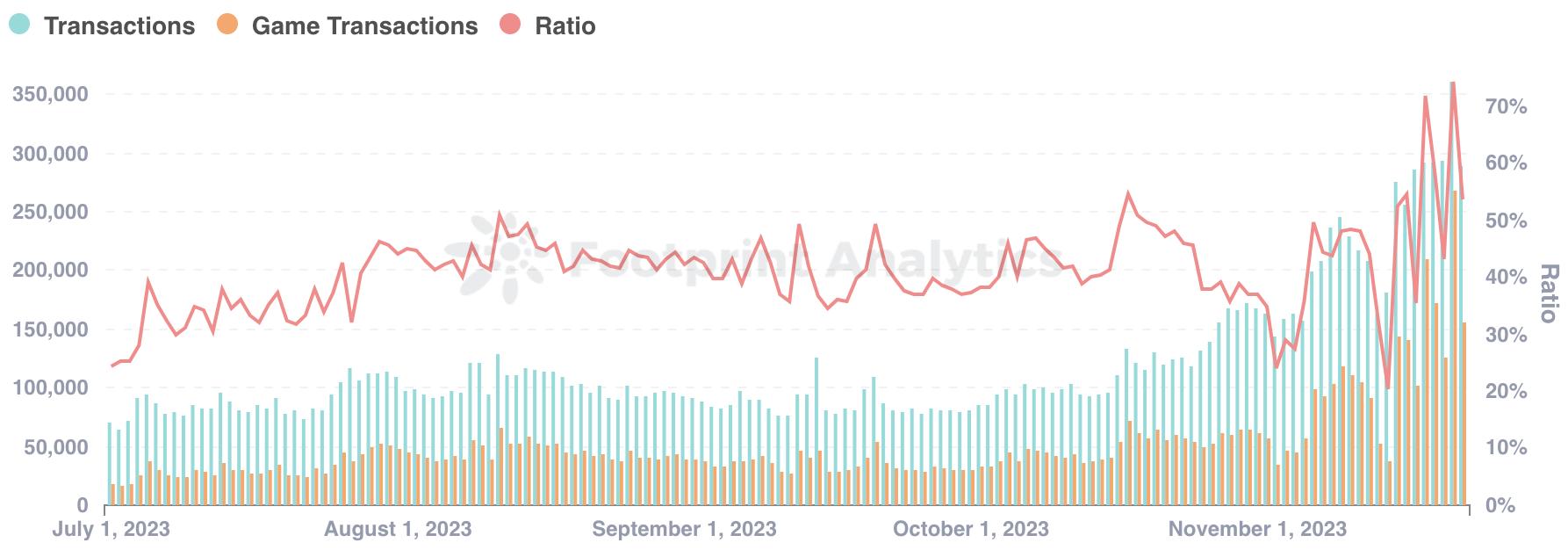

Number of transactions per day

From August to November, the gaming sector accounted for more than 80% of Ronins total transactions, and the figure was 74.7% in July.

Data Sources:Daily Transactions - Ronin Chain & Game

Daily trading trends in the Ronin gaming space mirror trends in its overall daily trading volume. Since mid-October, the number of daily transactions has been on an upward trend. The number of daily transactions increased from 40,100 to more than 100,000, reaching a peak of 226,000 on November 22.

Data Sources:Ronin Chain Key Stats

Key games

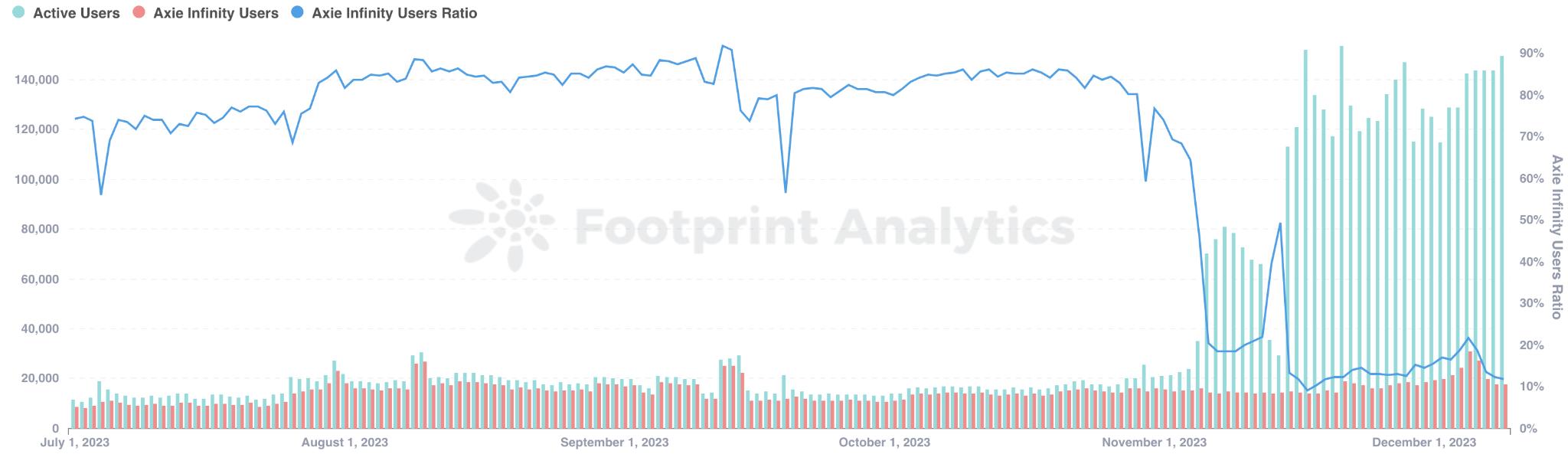

Axie Infinity

From July to October 2023, Ronins flagship game Axie Infinity has consistently contributed more than 80% of the platforms DAU. However, with the addition of Pixels to Ronin, Axie Infinitys user share fell to a record low of 9.12% on November 18. Despite the decline, Axie Infinitys DAU remains stable at around 15,000.

Data Sources:Daily Active Users - Ronin Chain & Axie Infinity

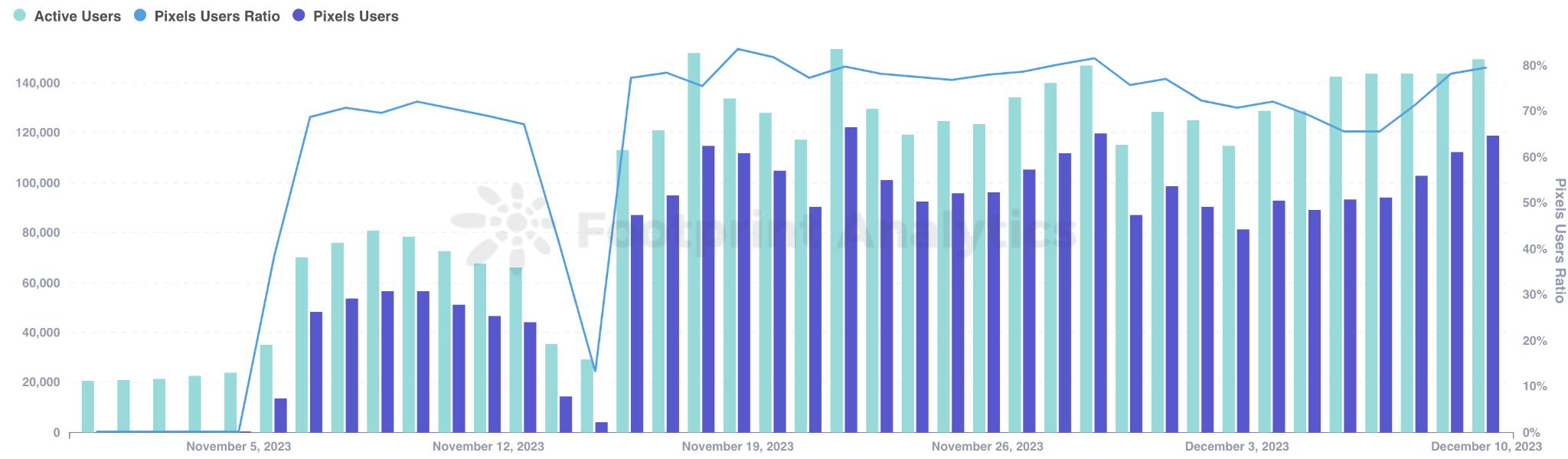

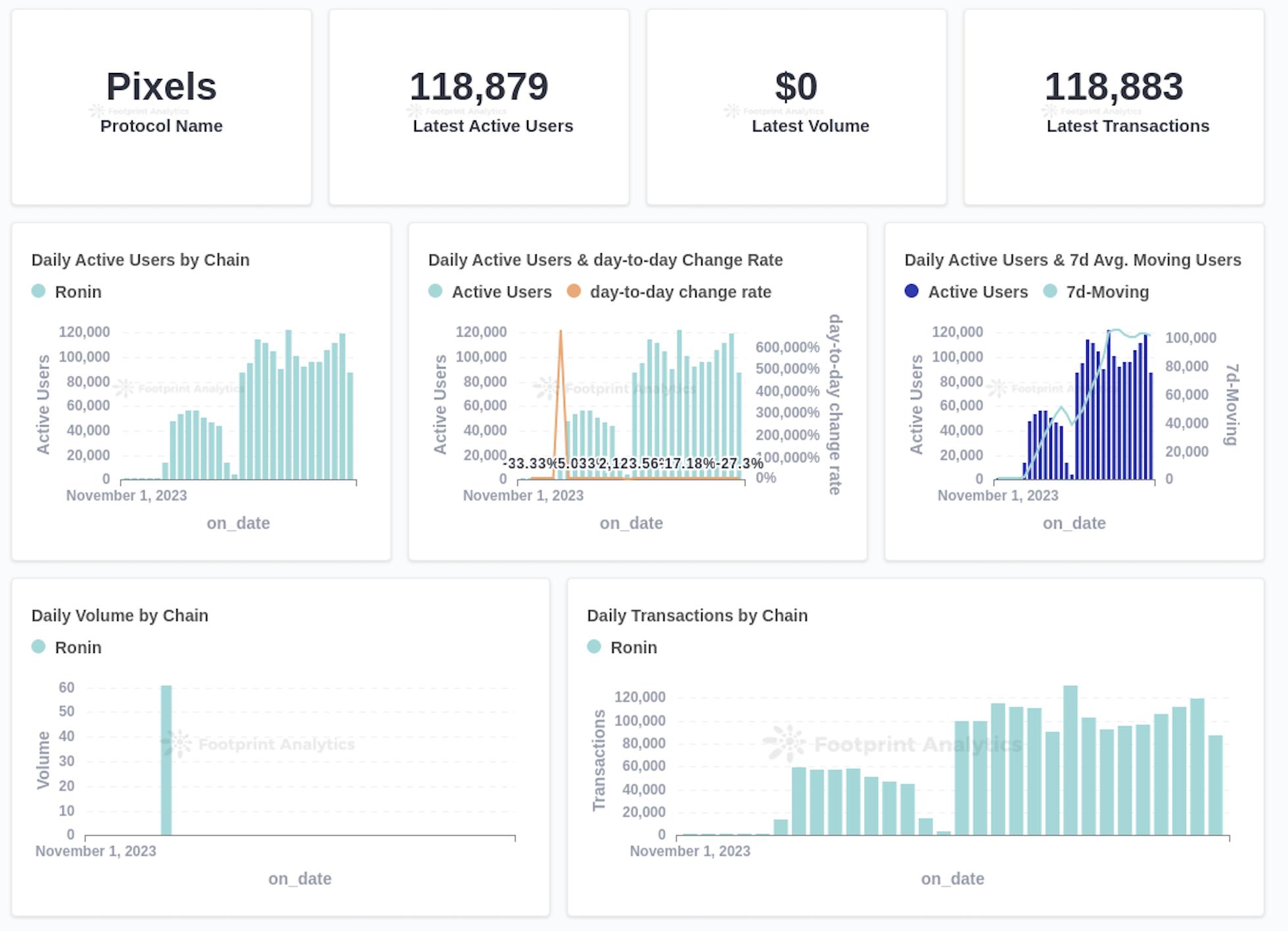

Pixels

After Pixels launched on Ronin, it quickly established itself as another flagship game, garnering over 70% of its DAU. Starting on November 6, Pixels’ DAU began to grow steadily. The games DAU peaked on November 19, accounting for 83.6% of Ronins total DAU, reaching 112,000.

Data Sources:Daily Active Users - Ronin Chain & Pixels

The gaming field is the core of the Ronin ecosystem, with Axie Infinity as the cornerstone, and the addition of Pixels enriches the diversity of the chain and enhances its appeal. The rapid expansion of Pixels demonstrates to developers Ronins strength as the best choice for Web3 games.

Data Sources:GameFi Project Summary - Pixels on Ronin

Overall, Ronin’s latest data shows a steady growth trend, indicating that it is expected to become the blockchain platform of choice for game developers and players. Ronin is committed to scalability in the gaming field and optimization of Web3 applications, and is moving towards creating an ecosystem with the best gaming experience, striving to create a new milestone beyond the success of Axie Infinity.

The content of this article is for industry research and communication only and does not constitute any investment advice. Market risk, the investment need to be cautious.

This article was contributed by the Footprint Analytics community.

The Footprint Community is a global, mutually supportive data community where members use visual data to work together to create communicable insights. In the Footprint community, you can get help, build links, and communicate about blockchain-related learning and research on Web 3, Metaverse, GameFi, and DeFi. With many active, diverse, and highly engaged members inspiring and supporting each other through the community, a worldwide user base has been established to contribute data, share insights, and drive community development.

Footprint Analytics

Official website:https://www.footprint.network

Discord:https://discord.gg/3HYaR6USM7

Twitter:https://twitter.com/Footprint_Data

Telegram:https://t.me/Footprint_Analytics