Original author: Jorn

Original compilation: Block unicorn

Adding functionality to Bitcoin is one of the biggest opportunities in crypto right now, and DeFi projects on the Stacks blockchain seem most likely to take full advantage of this opportunity. Here is an overview of some of the more promising projects.

With Bitcoin ETFs, Bitcoin halvings, early crypto bull runs, and exciting innovations like Ordinals emerging, it’s hard not to be optimistic about the Bitcoin economy. Despite what Bitcoin maximalists may try to tell you otherwise, for Bitcoin to become an asset of global significance, a thriving layer of financial applications must be built on top of and around it.

The leader and pioneer in the field of Bitcoin economics is Stacks. Stacks is Bitcoin’s second-layer blockchain network that is connected to the Bitcoin blockchain, but is a separate protocol that brings Ethereum-style smart contract flexibility to Bitcoin. This enables applications such as DeFi and NFTs to be built, with the ultimate goal of making Bitcoin more than just an asset to buy and store. We have high expectations for the future of the Stacks ecosystem, as providing a financial layer for Bitcoin is a huge gap in the market. Here are some of the top projects doing this on Stacks that you should know about before anyone else does.

Top DeFi projects in the Stacks ecosystem

1. Alex

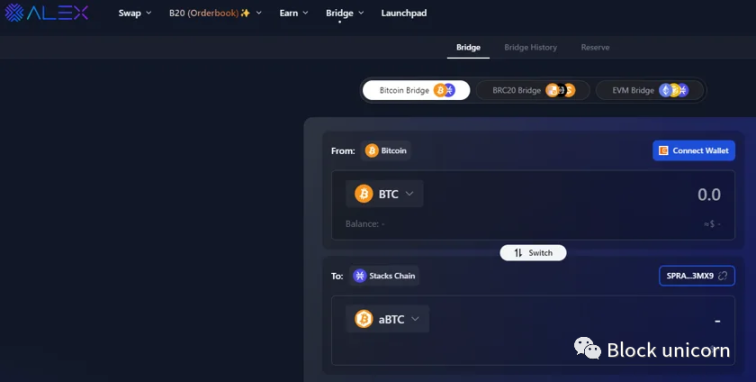

If you are looking for a one-stop platform covering all Bitcoin DeFi related matters, then choose Alex without hesitation. Alex is the leading project on Stacks, offering a full suite of DeFi products, including a decentralized exchange for exchanging Stacks tokens, a liquidity pool offering rewards, a launch platform for Stacks and Ordinals projects, and connecting to the Stacks block Chain’s bridge to other chains such as Ethereum, Binance Smart Chain, and soon Bitcoin.

All of this is tied to the project’s native token, $ALEX. Holders can stake their tokens to gain income, use them to participate in governance, or use them to purchase startup platform projects. The impressive Alex team worked tirelessly to build and launch products during the 2022-2023 bear market and now have a range of excellent DeFi products that meet many of the needs of Stacks users, including the BRC-20 Token Index and now Various bridges belonging to an independent entity, XLink, which is still governed by $ALEX holders. If Stacks continues to grow in terms of users and liquidity, Alex will likely continue to perform well.

2. StackingDAO

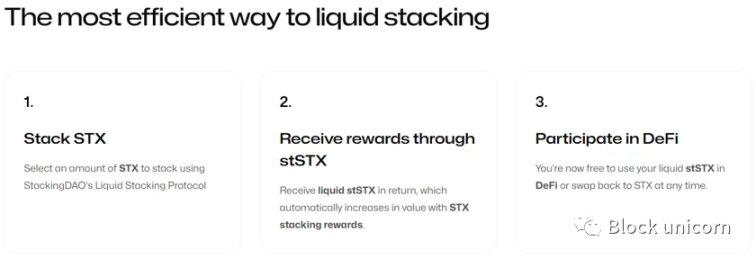

StackingDAO is a relatively new project that brings capital efficiency to $STX holders. It does this through a relatively new innovation in the crypto space called Liquid Staking. In this way, holders can continue to use their assets in DeFi while enjoying staking rewards, rather than locking their assets in a staking contract. With StackingDAO, this means you stake your STX tokens into their protocol and receive stSTX in return, which continues to earn significant Bitcoin returns, while you can still use these stSTX in other Stacks DeFi dapps.

Currently, the project is on the test network, engaging users in a private testing phase and conducting code audits. There is no information yet on whether the project will launch its own token. However, most liquid staking protocols on other blockchains like Lido, Stride, and Benqi have their own native tokens, have governance functions, and some even have dividend mechanisms. As the market clearly tells us, people are still passionate about Bitcoin, and Stack is unique in that you can earn BTC by staking STX. Being able to use staked STX in other DeFi protocols while still earning BTC is a product that is too valuable to ignore.

3. Arkadiko

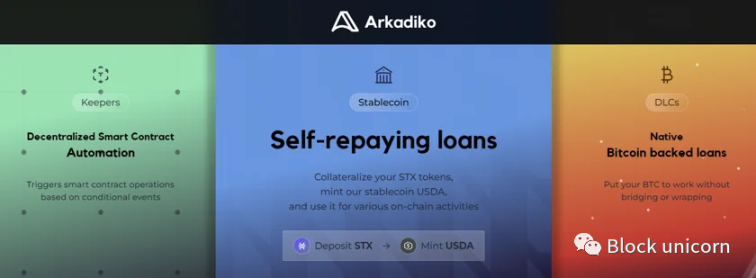

Always wanted a loan that you could pay yourself back? Arkadiko is an established protocol in the Stacks ecosystem, providing a unique approach to decentralized finance. It allows STX holders to use their assets as collateral to mint USDΔ, a stablecoin softly pegged to the US dollar. This innovative mechanism enables users to create self-paying loans, leveraging the revenue generated by PoX (Proof of Transfer) and STX-collateralized vaults.

In addition to offering stablecoins, Arkadiko also facilitates token exchange in a trust- and permission-free environment, allowing users to deposit tokens into its decentralized exchange’s liquidity pool and earn rewards, including DIKO tokens. currency. Arkadiko operates as a decentralized autonomous organization (DAO) and is governed by its native token $DIKO, which also supports staking to generate yields. Despite market volatility (the USDΔ stablecoin lost its peg and has yet to recover, a factor that every user must seriously consider when issuing a loan), the dedication of the Arkadiko team and the deep integration of the protocol within the ecosystem It shows that it is poised for good growth, especially with a stable stablecoin.

4. Velar

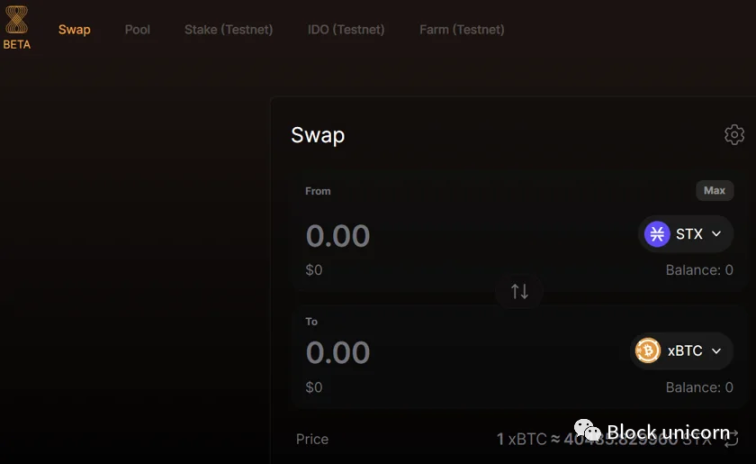

Velar Protocol is a multi-faceted DeFi platform on the Stacks blockchain designed to unleash the full potential of Bitcoin in decentralized finance. The platform includes a Uniswap-inspired decentralized exchange (DEX), trading platform, and IDO launch platform, with plans to introduce governance, cross-chain bridges, and perpetual derivatives exchanges in future updates.

Velar is currently in beta and has developed a multi-stage development roadmap, including Velar v1: Dharma, v2: Artha, v3: Kama and v4: Moksha, showing the progressive development of features and capabilities that will be implemented one after the other. Introduce the main network from the test network. The Velar token ($VELAR) is the core of the protocols economic system, and its allocation includes 35% for community rewards, 20% for financial reserves, 20% for founders and teams, and 5% for advisors. With strong support for the project and being the first to launch perpetual contracts on Stacks, Velar is one of the projects worth keeping a close eye on.

5. Zest

Zest Protocol aims to solve a key problem in the Bitcoin economy: the inefficient use of Bitcoin, which largely sits idle in cold storage, hampering economic growth. As an on-chain open source lending platform built on the Bitcoin blockchain, Zest Protocol leverages smart contracts to increase transparency and auditability. It contains two different types of pools: an earn pool, where users can earn Bitcoin earnings, and a lending pool, for lending and borrowing based on Bitcoin holdings. This design allows Bitcoin holders to securely access liquidity without selling their assets, reducing the need for trust in centralized finance (CeFi) platforms or custodians.

As one of the best Bitcoin lending platforms selected by Blockworks in 2023, Zest Protocols journey began in 2022 with the launch of the testnet. The teams collaboration with Hiro Systems and significant contributions to the releases of sBTC and Stacks Nakamoto underscore their commitment to innovation. With a successful smart contract audit, the Zest team is now ready for market launch. They are actively working with Bitcoin liquidity providers, borrowers, and preparing for the closed launch. Interactions with institutional players and large Bitcoin holders at various events around the world underscore their efforts to expand Zest Protocol’s influence in the DeFi space.

6. Uwu Protocol

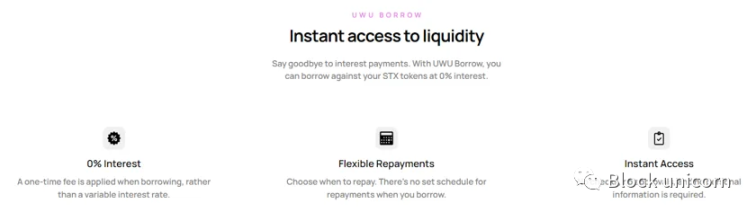

Uwu Protocol is an innovative Stacks project built around two main components: Uwu Cash and Uwu Share (xUWU). Uwu Cash is an over-collateralized stablecoin that is soft-anchored at US$1 and supported by STX tokens worth US$1.50, ensuring its stability and partial resistance to volatility. Uwu Share (xUWU), on the other hand, is a utility token that captures and distributes 100% of protocol fees to its holders every two weeks. This allocation occurs through a fee claim smart contract, enabling holders to claim their fees each cycle, with unclaimed fees rolled over to the next cycle.

Uwu is currently in beta and early users are welcome to test the protocol. While there are other crypto-backed stablecoin projects on Stacks, Uwu’s 100% revenue sharing mechanism could become a strong competitive advantage. However, the protocol comes with corresponding risks, as its stablecoin is backed by the highly volatile STX asset, which can fluctuate up to 30% in a single day. This could lead to massive liquidations among Uwu users when the price of STX drops rapidly, or potentially lead to the unanchoring of the projects stablecoin. Nonetheless, the protocol offers a valuable offering for long-term STX holders, and assets with revenue sharing mechanisms are always an interesting aspect in the crypto space.

7. Hermetica

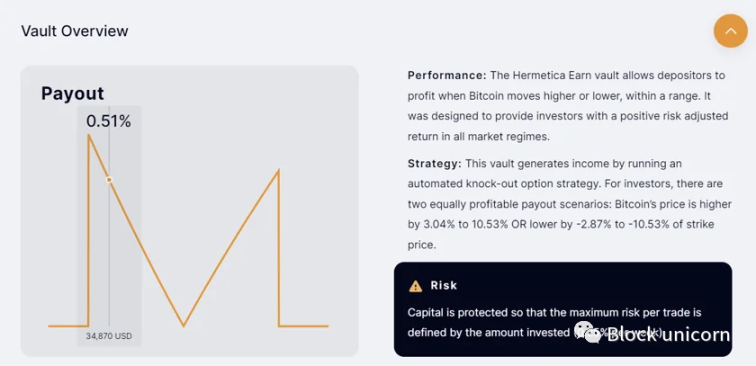

Hermetica is a unique and complex project designed to bring additional revenue to Bitcoin holders while they maintain custody of their digital assets. It provides a platform where users can earn, trade, and grow their Bitcoin holdings while maintaining complete control over their assets.

Central to Hermeticas appeal is its Hermetica Earn vault, which uses the innovative European Reverse Knock-Out (ERKO) option strategy. This strategy creates a profit mechanism by setting specific price barriers for Bitcoin such that within those barriers, a payout occurs if Bitcoin closes within those barriers. This strategy ensures profitability when the price of Bitcoin moves within a range of 1% to 20% above or below the predetermined execution price. The strategy is designed to emphasize capital protection and limit maximum risk per trade to 1% per month, effectively managing downside risk. This approach has proven successful, with post-test data showing Bitcoin’s average annualized return was 6.5% over a six-year period.

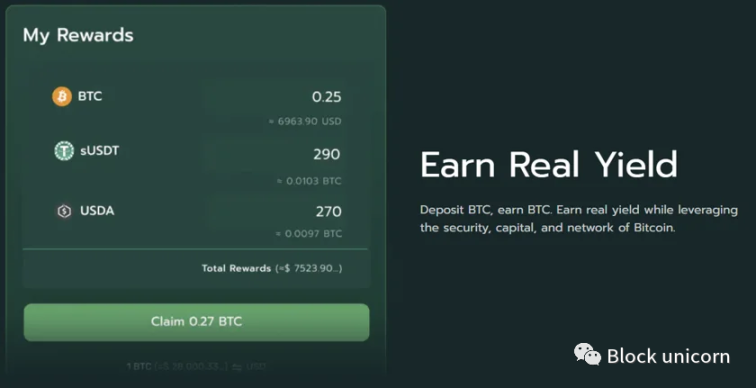

8. Bitflow Finance

Billing itself as a “decentralized exchange for Bitcoin holders,” Bitflow Finance is a protocol designed to bring together the liquidity and exchange of the Bitcoin economy. It provides a secure and transparent platform for users to trade Bitcoin and stablecoins from various Bitcoin second layers such as Stacks and Rootstock without custody risk, allowing users to trade in a decentralized manner BTC derivatives like sBTC and xBTC. In addition, Bitflow supports Bitcoin-based stablecoin trading, optimizing liquidity to reduce slippage and fees.

Users can deposit Bitcoin and stablecoins to earn real returns. The platform also allows for one-way liquidity. Bitflow is open source, including its smart contracts and front-end, ensuring transparency and community engagement. It is supported by the Stacks Foundation and the Bitcoin Frontier Fund and is currently in a testing phase. We can’t wait for the public launch of this project.

Summary thoughts

If you are reading this article, then you are an early adopter of the Stacks ecosystem. Despite the good price performance of $STX and $ALEX, this activity generally still happens on centralized exchanges, while the most interesting things happen on-chain. Admittedly, the current user experience of Stacks is not very user-friendly, with transactions taking 20-30 minutes to process. This is expected to change with the upcoming Nakamoto upgrade, which will reduce transaction processing speed to 5 seconds. Additionally, sBTC will also unlock Bitcoin on Stacks without relying on a centralized party, providing a significant opportunity to capture a portion of the hundreds of billions of dollars in Bitcoin market capitalization.

Stacks is currently the market leader in the Bitcoin second layer space, and the DeFi projects described in this article have huge potential. We hope this overview helps you get started on your DeFi journey on Stacks and the Bitcoin economy. As Stacks and its ecosystem project enter a new phase, you will have more opportunities to do more with Bitcoin!