1. Inscription has completely detonated the Bitcoin ecological narrative, but the popularity of Inscription has also brought issues such as insufficient Bitcoin ecological infrastructure and transaction congestion back into the public eye. After Inscription, the market has begun to explore the infrastructure and functional products of the Bitcoin ecosystem. Due to the limitations of the Bitcoin network itself, smart contract products can only be deployed in expansion plans.

2. Alex Lab is a DeFi infrastructure built on Bitcoin’s second-layer Stacks. The functions that have been launched and are being developed include Bitcoin Oracle, Bitcoin Bridge, AMM, order book, pledge, Launchpad and a series of other functions, building a complete DeFi basic suite.

3. From a competitive perspective, Alex Lab is the absolute leader on Stacks. Compared with other expansion solutions, Stacks is currently the second-layer expansion solution with the healthiest ecosystem and data growth, and is comparable to Rootst.

4. The Nakamoto upgrade and the issuance of sBTC are expected to be launched in the first quarter of 2024. The Nakamoto upgrade will bring comprehensive improvements to the performance of Stacks, sBTC will unlock new opportunities for Bitcoin DeFi, and Alex Lab will be the best place to lay out this upgrade. target.

5. Based on the valuation and TVL of ALEX, ALEX can be used as a leverage target to lay out the STX ecosystem. ALEX is currently not listed on large CEX and has a certain liquidity discount. Future listing may bring about an increase in currency prices.

1. Introduction: After Inscription, where is the next Alpha in the Bitcoin ecosystem?

The domino effect of Inscription’s explosion demonstrates the potential of the Bitcoin blockchain. If there was still a debate about the legitimacy of establishing the Bitcoin ecosystem a few months ago, now this issue seems to have been diluted by the extremely high market enthusiasm - people have higher expectations for the Bitcoin ecosystem. The attention of the Bitcoin ecosystem starts with inscriptions, but will not stop at Meme. After inscriptions, the market will begin to explore the infrastructure and functional products of the entire ecosystem.

First of all, the popularity of Inscription has also brought long-standing problems in the Bitcoin ecosystem back into public view. First of all, there is a serious lack of infrastructure construction in the Bitcoin ecosystem, which greatly limits the trading of BRC-20 tokens. Binance Research also mentioned in a research report on BRC-20: the deployment of decentralized indexes and fully functional DEX , will lead BRC-20 to the next level. Secondly, Bitcoin’s extremely low TPS and block capacity have resulted in extreme congestion and extremely high transaction fees, which have also restricted the issuance and trading of inscriptions. Discussions on Bitcoin’s expansion plan have returned to market focus.

Secondly, as the BTC halving approaches, the issue of sustainability of BTC miners’ earnings has once again triggered discussions. Miners income consists of transaction fees and mining rewards. Due to the limited ecological applications on the Bitcoin network, the vast majority of current income is composed of mining rewards. As the room for BTC market value to increase decreases, mining rewards after halving may not be able to support the security of the BTC network in the long term. The expansion of BTC ecological applications may introduce ongoing transaction fees and introduce a sustainable source of income for Bitcoin miners.

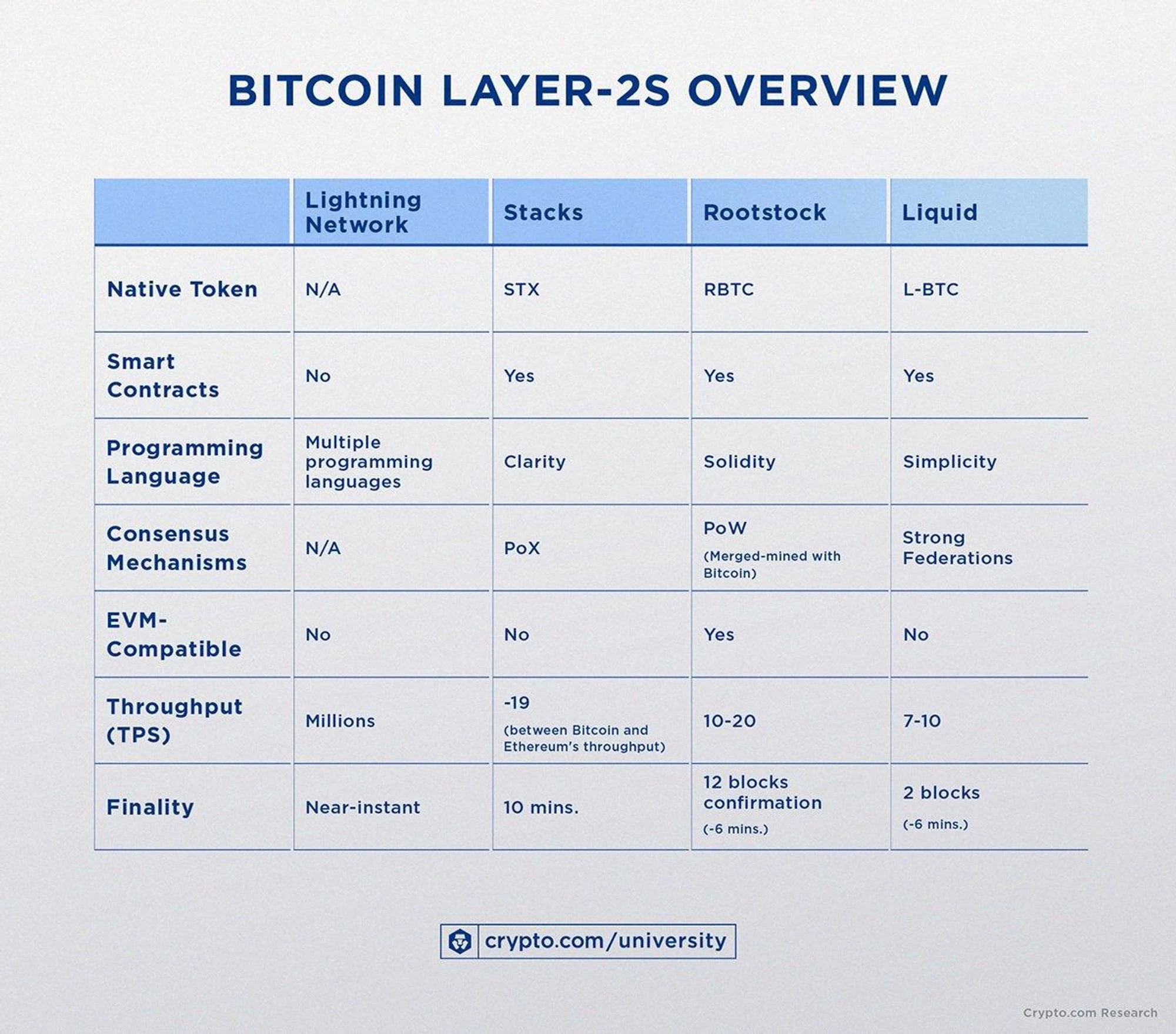

At the same time, the Bitcoin blockchain is the blockchain with the strongest consensus, legitimacy, security and decentralization. Building smart contracts on the Bitcoin network will be a very inspiring narrative. However, Bitcoin itself does not have Turing completeness, and smart contracts cannot be built on it. In order to expand the potential of the Bitcoin blockchain, we must now turn our attention to Bitcoin L2. Unlike Ethereum, the Bitcoin smart contract experience does not allow users to choose between L1 and L2. L2 is currently given to Bitcoin smart contracts. Necessary technologies for capabilities, the main L2 include Lightning Network, Stacks, Rootstock and Liquid.

Alex Lab therefore entered our field of vision. Alex is built on Stacks. Stacks, as the smart contract layer of Bitcoin, is currently the most prosperous ecosystem with the highest market value among the second layers of Bitcoin. Alex is the leading DeFi protocol on Stacks. Alex Lab is committed to building Bitcoins DeFi system. The functions it has launched and is developing include BRC-20 token index, Bitcoin bridge, AMM, order book, pledge, Launchpad and a series of functions, initially building a complete DeFi ecosystem. Function will provide a complete set of infrastructure guarantees for the development of inscriptions and BRC-20 tokens.

2. Deconstructing Alex Lab: the infrastructure leader of Bitcoin DeFi

Alex Lab provides a wealth of products around Bitcoin ecological finance. The core products include: AMM and Orderbook DEX for trading; Launchpad for discovering and participating in IDO in the Stacks ecosystem; staking and liquidity mining; connecting to Bitcoin Layer 2 and Layer 2 as well as cross-chain bridges between Stacks and other chains; a Bitcoin oracle for decentralized indexing of BRC-20.

AMM and order book

Alex Lab simultaneously launches AMM Swap and B 20 Market (Orderbook). We will not delve into the specific mathematical curves of AMM here. There are currently 5 pools on AMM with liquidity exceeding $1M, namely: STX-aBTC ($2.71M), STX-ALEX ($23.76M), STX-xBTC ($5.84M), STX-sUSDT ($1.49 M), ALEX-atALEX ($6.82 M).

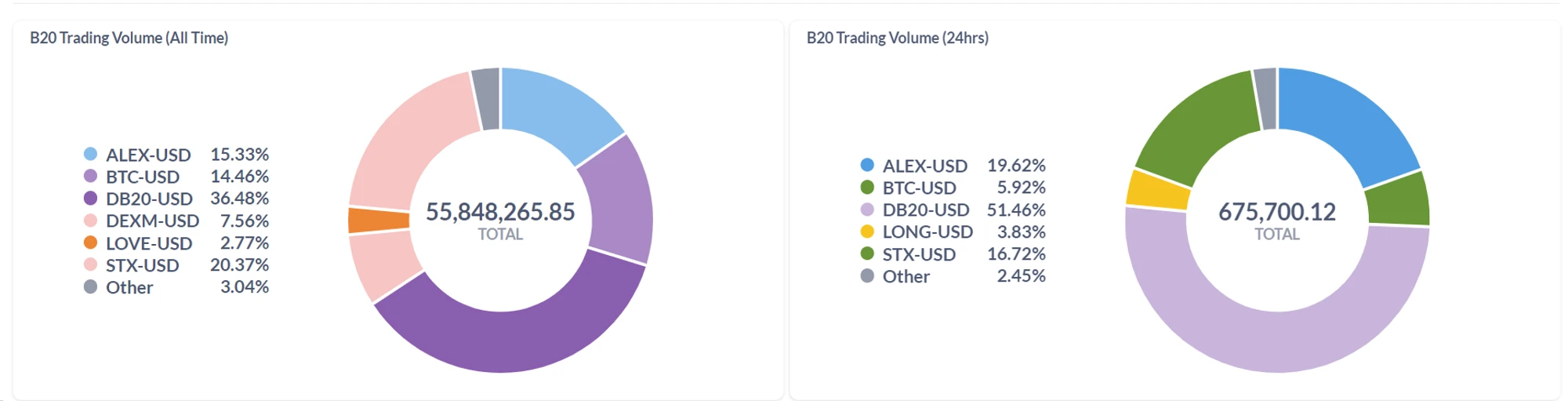

The B 20 market is in the form of an order book and adopts an on-chain/off-chain hybrid design. The commitment to buy or sell certain assets is transmitted through encrypted signatures and is matched by an off-chain matching engine before settlement on the chain, so users do not need to pay gas. Orders can be created and canceled for a fee, and multiple BRC 20 token-sUSDT trading pairs are currently online. The current 24-hour trading volume of the B 20 market is 675k, and the cumulative trading volume is 55.8M.

Launchpad platform

Alex Launchpad uses a hybrid on-chain/off-chain model to provide an IDO platform for BRC-20 tokens. All transactions related to user funds are on-chain, and the lottery part with higher computational cost is completed off-chain and submitted to the on-chain contract for verification. The community can decide on IDO projects through voting governance. Five IDO projects have been completed so far:

ALEX(2022.1.19)

BANANA(2022.6.21)

ORMM (2023.7.28, BRC 20 tokens)

Bluewheel Mining(2023.8.25)

CHAX (2023.11.13, BRC 20 tokens)

Currently, there are not many ecological projects on Stacks, and there are even fewer currency issuance projects. ALEX’s Launchpad has not yet shown much ecological value.

Recently, Alex upgraded to the multi-chain Launchpad, and projects can be issued on BRC 20, Stacks and ERC 20. Currently, the first ALEX multi-chain Launchpad candidate project is OrdzGames, a gaming project located on the Bitcoin network, and the community will complete voting on December 23.

Staking and Liquidity Mining

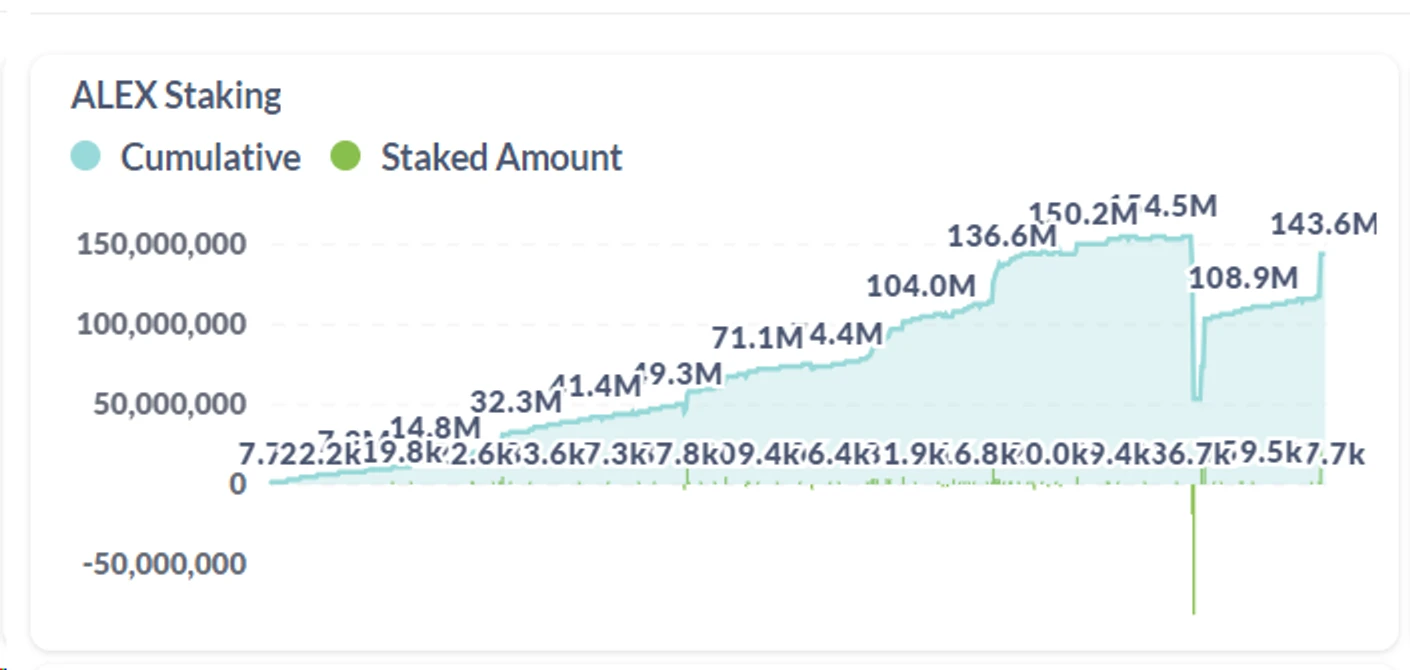

Alex Labs native token staking income has a great relationship with whether to choose automatic staking (see the Token Economics section). The current total pledged amount is 143.6 M, and the token circulation is 642.1 M, and the ratio between the two is 22.4%.

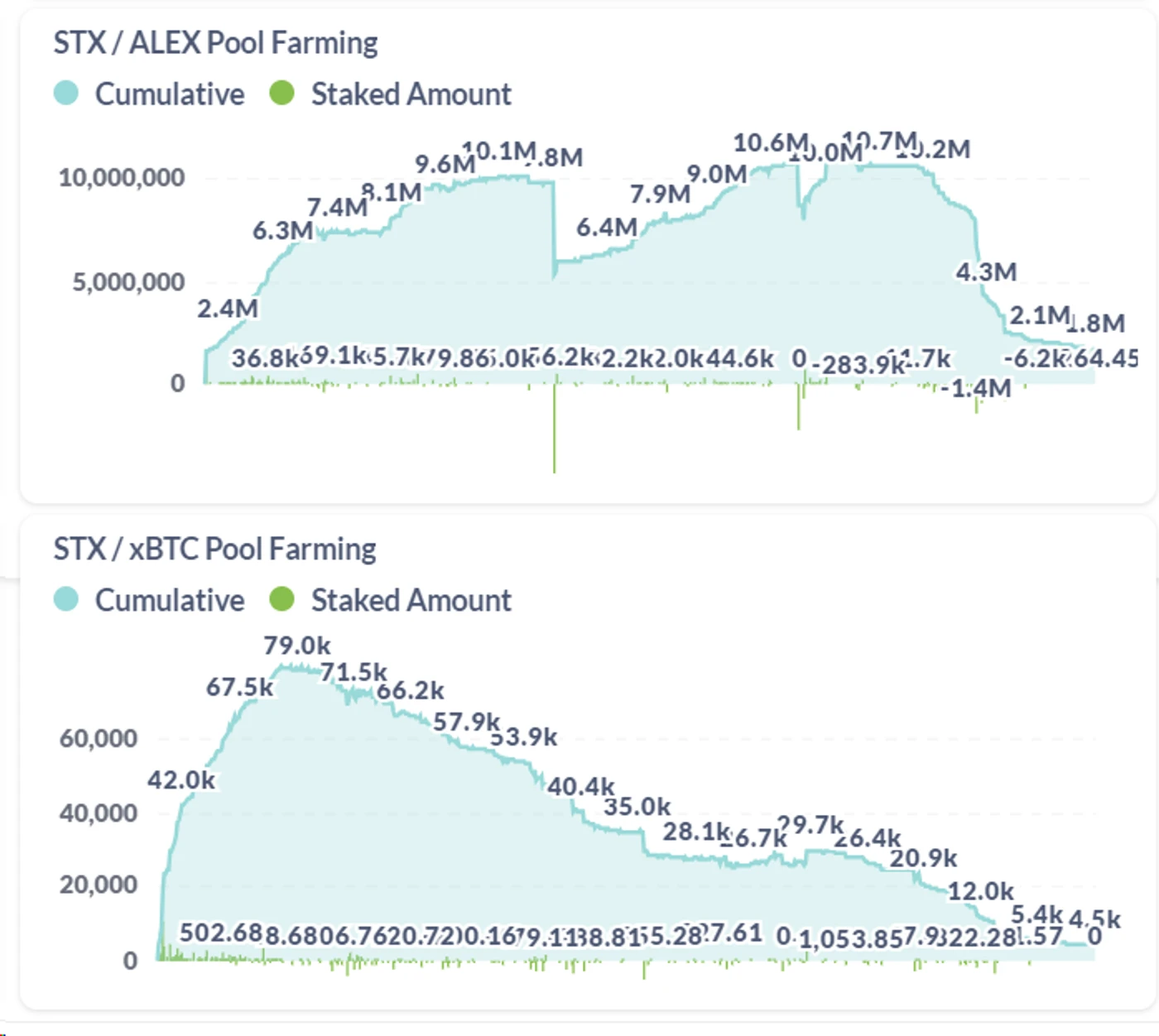

Users can also choose to pledge LP tokens for liquidity mining. The current main LP pairs are STX-ALEX and STX-xBTC. The current APRs are 34.94% and 63.6% respectively. They are issued in ALEX tokens, but the pledge volume performance is uneven. not ideal.

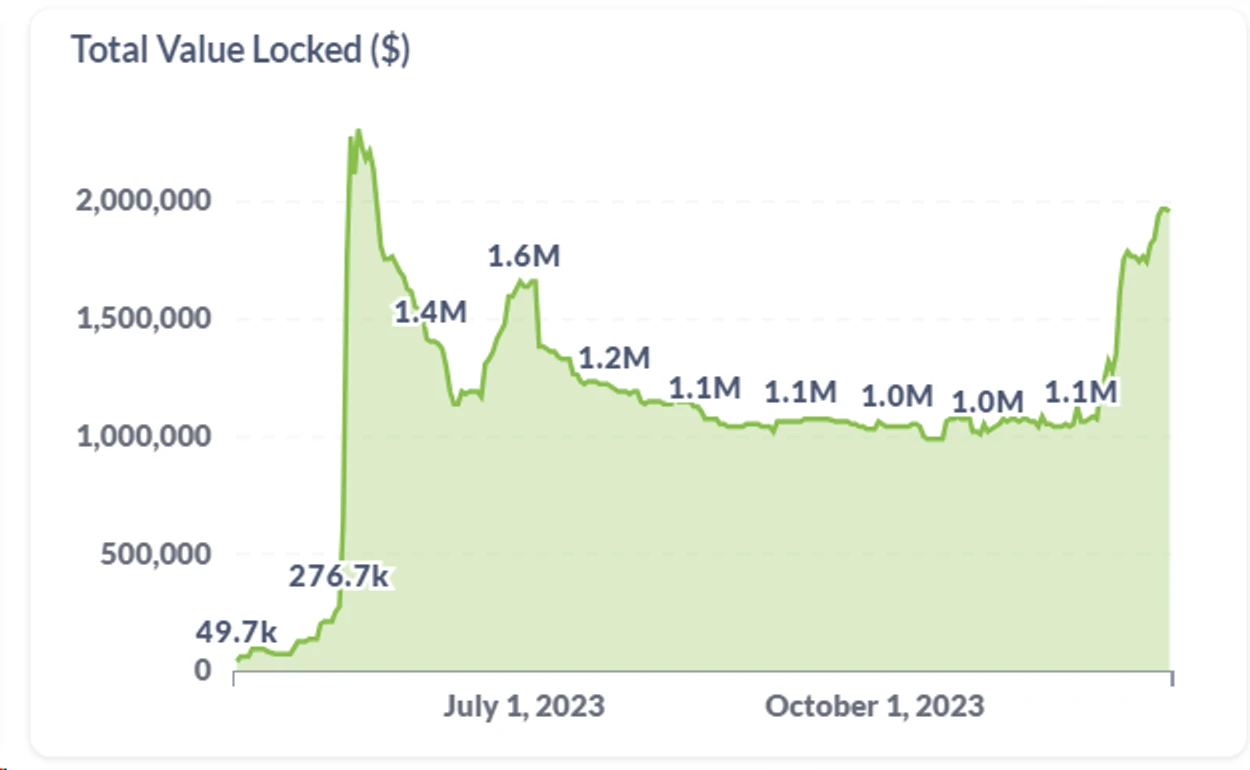

Cross-chain bridge

Alex Lab has currently developed a cross-chain bridge between Stacks and the Bitcoin network, Ethereum and BSC Mainnet. The cross-chain bridge with the Bitcoin layer supports BTC and BRC-20 tokens, and the cross-chain bridge with Ethereum and BSC supports USDT. , LUNR and BTCB (BSC)/WBTC (Ethereum) bridge. The current total cross-chain value accumulation is $11,568,749, the total cross-chain fees incurred are $76,067, and the current TVL is $2,324,830.

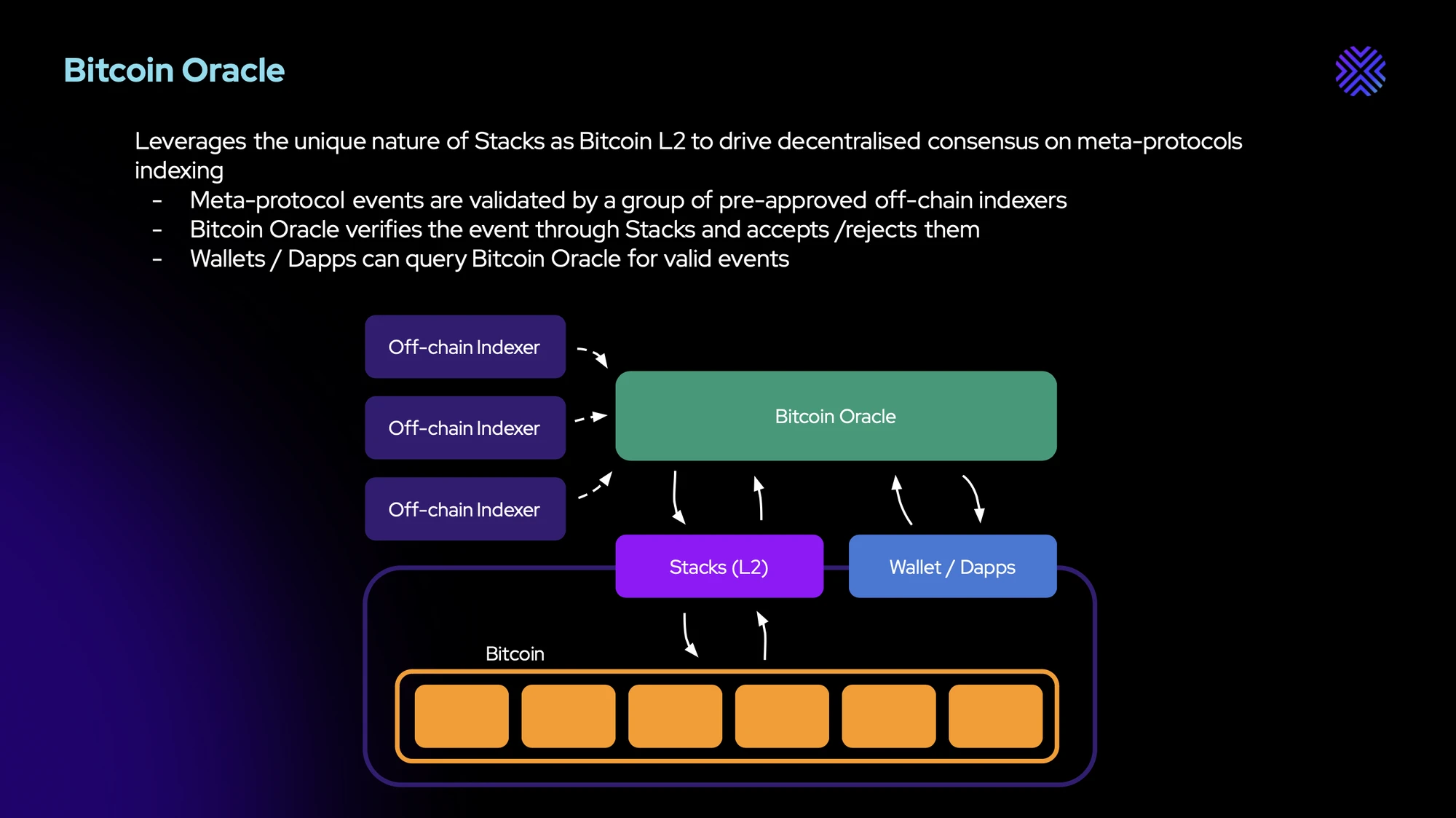

Bitcoin oracle

The Bitcoin Oracle mentioned here is different from the oracle we often mention on Ethereum. It currently refers to the establishment of a decentralized, tamper-proof and censorship-resistant BRC-20 on Bitcoin. index. Although BRC 20 exists entirely on the chain, Bitcoin L1 does not natively support BRC-20 tokens and cannot read inscription data.

Users who have played with inscriptions and BRC-20 tokens all know the importance of the index. The index will remind you which inscriptions have been completed, and record transfers and other operations, which is the basis for building the BRC-20 market. The current BRC-20 market relies on centralized off-chain indexers. Errors in a single indexer may come from performance issues or may occur due to censorship or even malicious behavior, putting user assets at risk.

Therefore, Alex Lab is working with Domo, the founder of the BRC-20 token standard, as well as existing major off-chain indexers (such as BestinSlot, OKX, Hiro system, Unisat, etc.) to build an on-chain index for BRC-20. Specifically, Bitcoin Oracle aggregates data from off-chain indexers and then validates each transaction through Stacks, choosing to accept or reject, to provide a single, reliable source of truth that Dapps and wallets can efficiently access and query Bitcoin Oracle’s data. and events. Recently, Alex’s official Twitter posted an announcement that the Bitcoin oracle will support STX 20.

3. Competitive landscape: Bitcoin is the absolute leader in DeFi

Alex Lab currently has no competitors on Stacks, so the analysis of the competitive landscape requires looking at the entire BTC Layer 2 to find Alex’s opponents. First, we must look for Stacks’ opponents.

At present, the main second-layer Bitcoin networks include Lightning Network, Rootstock, Stacks, and Liquid Network. According to a research report by Crypto.com, they mainly have the following differences in performance:

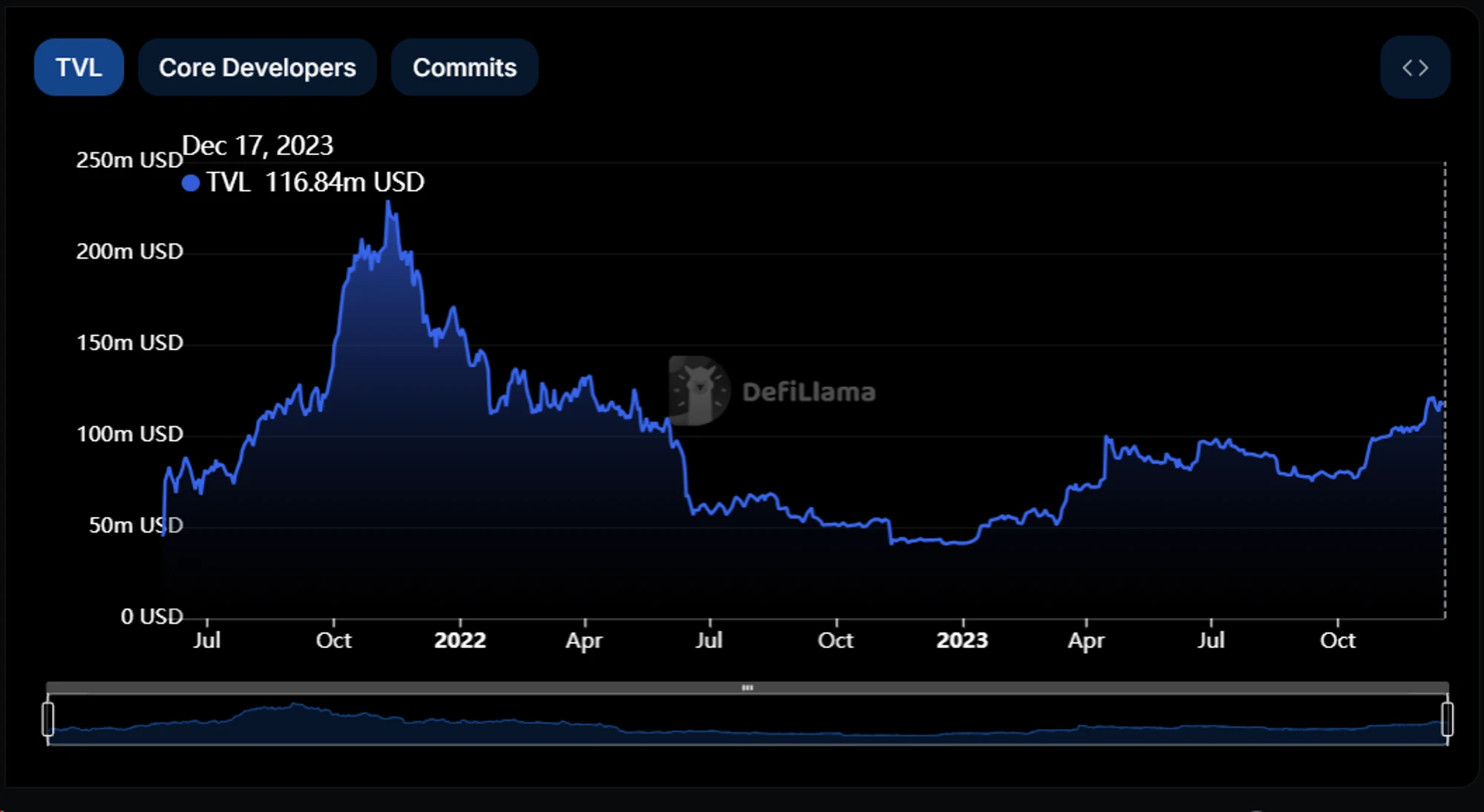

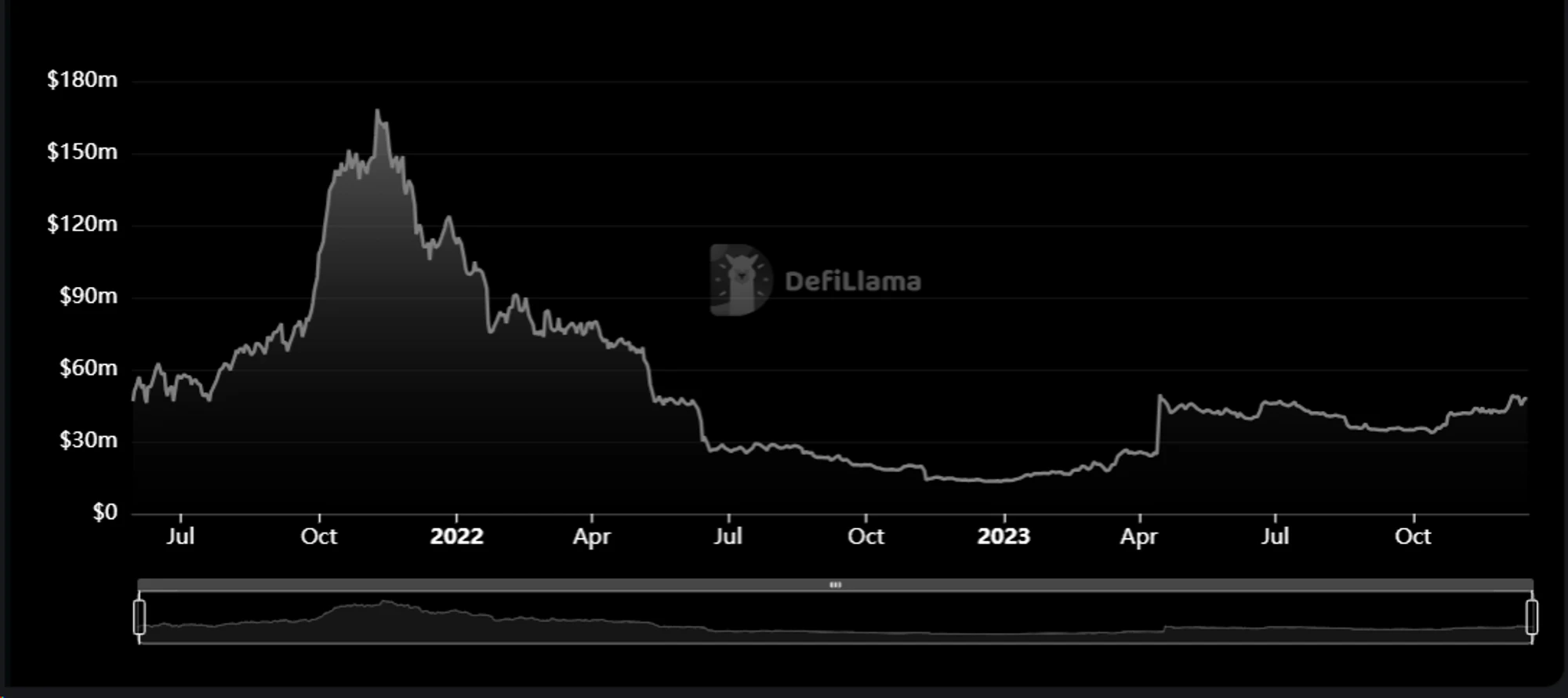

Stacks is the most prosperous ecosystem among Bitcoin expansion solutions. As a payment channel, Lightning Network itself cannot support the construction of smart contracts, so it is not a direct competitor of Stacks. Liquid Networks consensus mechanism causes it to be considered a highly centralized protocol, making it difficult to inherit the legitimacy of the BTC network. Currently, the most direct competitor with Stacks is Rootstock. Rootstock is an EVM-compatible side chain on Bitcoin. Bitcoin miners can perform merged mining when mining and obtain the transaction fees in Rootstock. income. The advantage of Rootstock is that it is compatible with EVM, started earlier, and currently has a higher TVL (as of 2023/12/17). However, in comparison, Stacks has the advantage of being more decentralized technically and with faster data Growth and ecological development speed.

Technically, Stacks will introduce decentralized anchored sBTC after the Nakamoto upgrade, while RSK’s BTC cross-chain relies on trust in a pre-set alliance, which has centralization issues. After the Nakamoto upgrade, Stacks will introduce subnets to support more languages and execution environments.

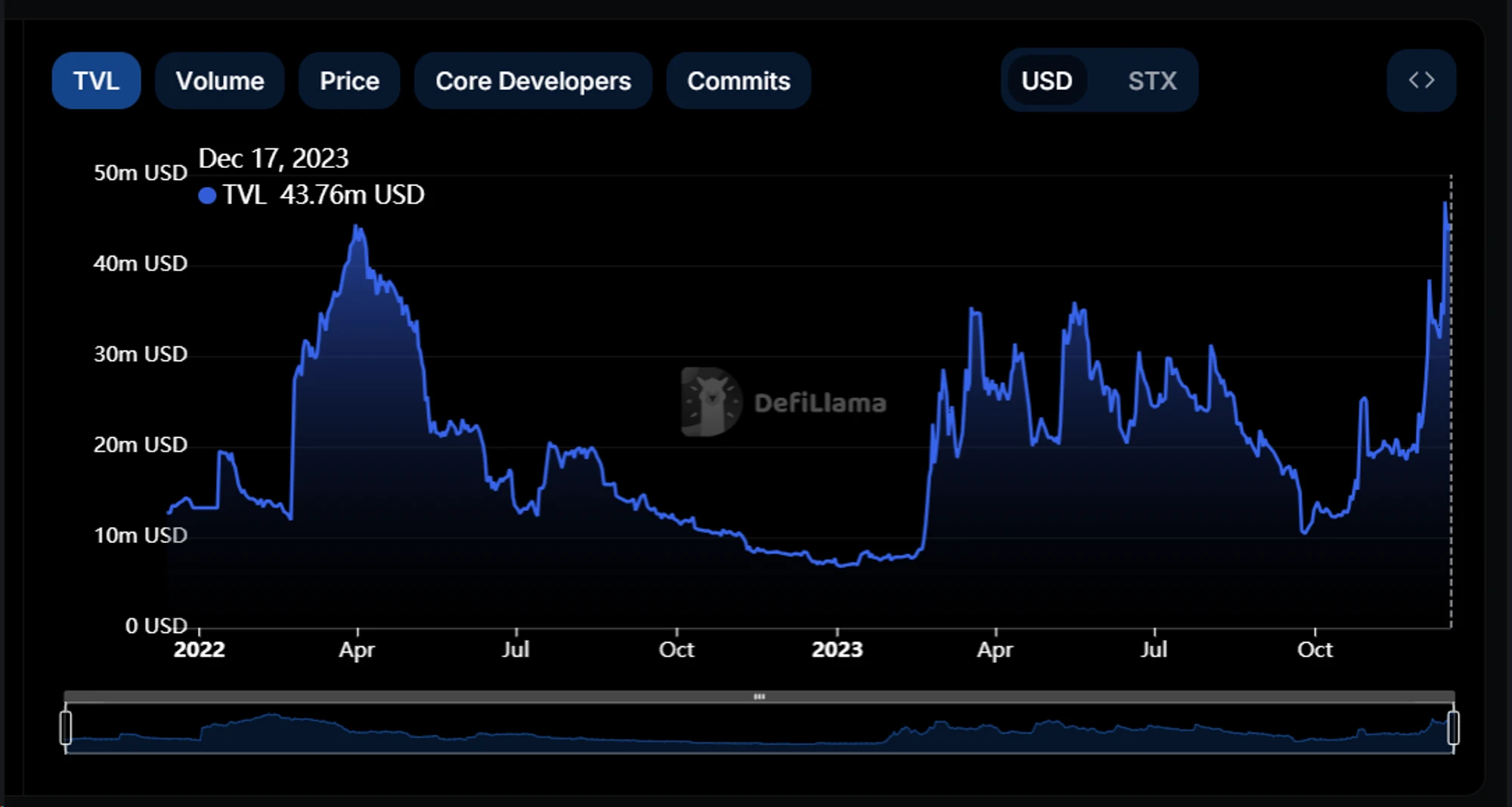

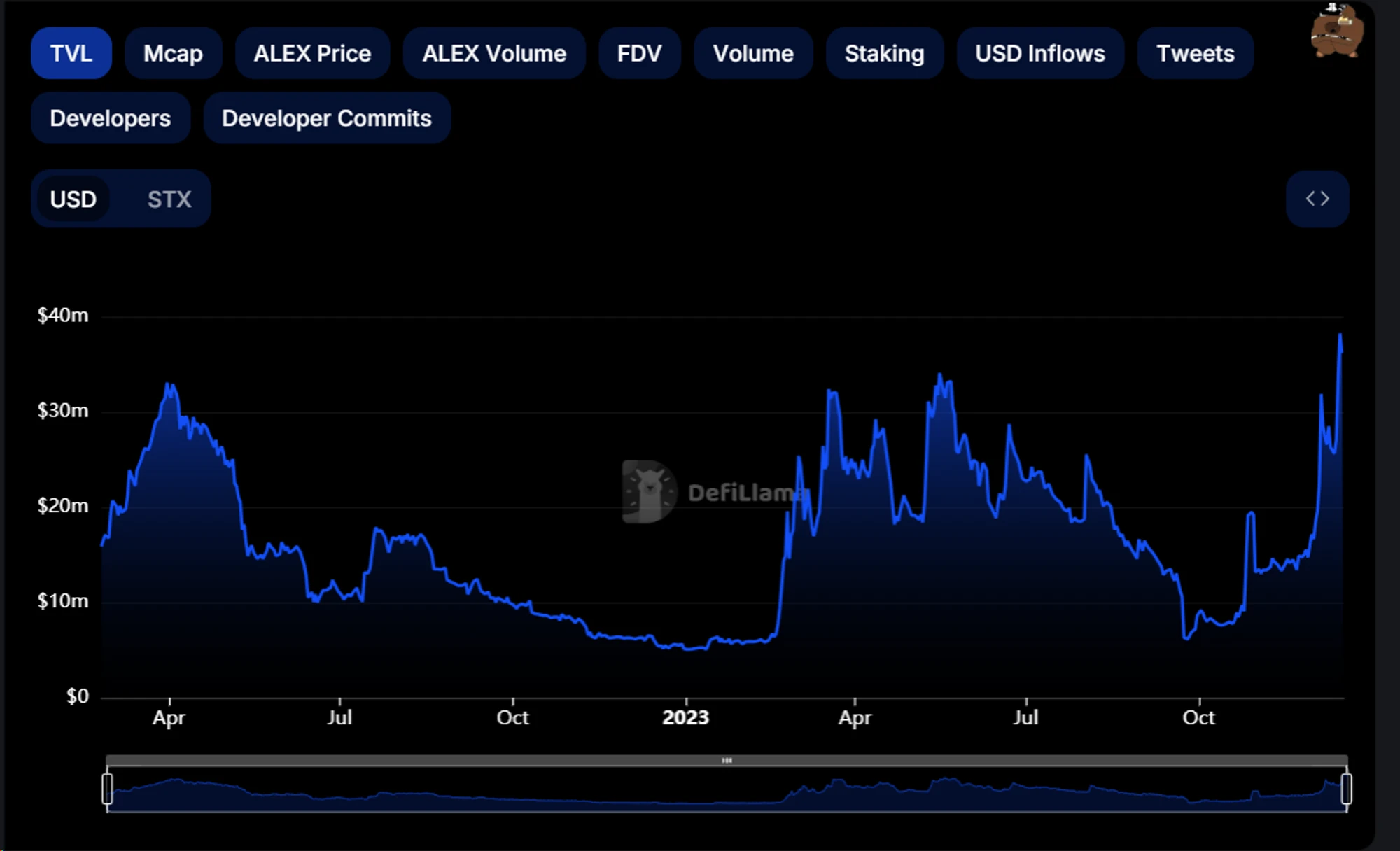

In terms of data, Stacks’ TVL has grown rapidly after 2023 and has reached the same level as the previous high. Rootstack’s data has grown more slowly and currently only reaches 50% of the previous high.

In terms of ecological development, according to veDAO’s statistics on the Bitcoin ecosystem (https://docs.google.com/spreadsheets/d/1DcGIbjZX3gDDwF2wqTHijOftss4j1UxeciJuT2Y6Ebk/edit#gid=1323064746), there are fewer projects on RootStack, and the main four Dapps include Sovryn , Money on Chain, Liquality and Tropykus, Liquality is the wallet infrastructure, and the other three are basic DeFi applications. The ecosystem on Stacks is flourishing. According to veDAO statistics, more than 60 Dapps have been released, covering DeFi, wallets, NFTs, games, social networking, etc.

The largest DEX on Rootstock is Sovryn, which can be seen as a competitor of Alex Lab. Sovryn provides almost a full set of DeFi services, including stablecoins, AMMs, lending pools, and margin trading. However, there are differences in business focus between the two. Sovryn mainly focuses on stablecoins in the Bitcoin ecosystem, while Alex’s recent development focus is on providing infrastructure for BRC-20 tokens. Judging from the data performance, Sovryns TVL growth rate is weak, while Alex Lab has followed the spring breeze of BRC-20 and has been rising.

4. Nakamoto upgrade: new opportunities for Bitcoin DeFi

In early 2021, Stacks is about to receive its next major upgrade in the first quarter of 2024: the Nakamoto upgrade. There are three main functional upgrades that this upgrade will bring: (1) decentralized two-way anchoring of Bitcoin, that is, the issuance of sBTC; (2) transactions guaranteed by Bitcoin finality; (3) Bitcoin blocks quick transactions between.The issuance of sBTC will unlock Bitcoin as a fully programmable productive asset, allowing smart contracts to be written into the Bitcoin blockchain without trust, unlocking the application of Bitcoin assets in DeFi.

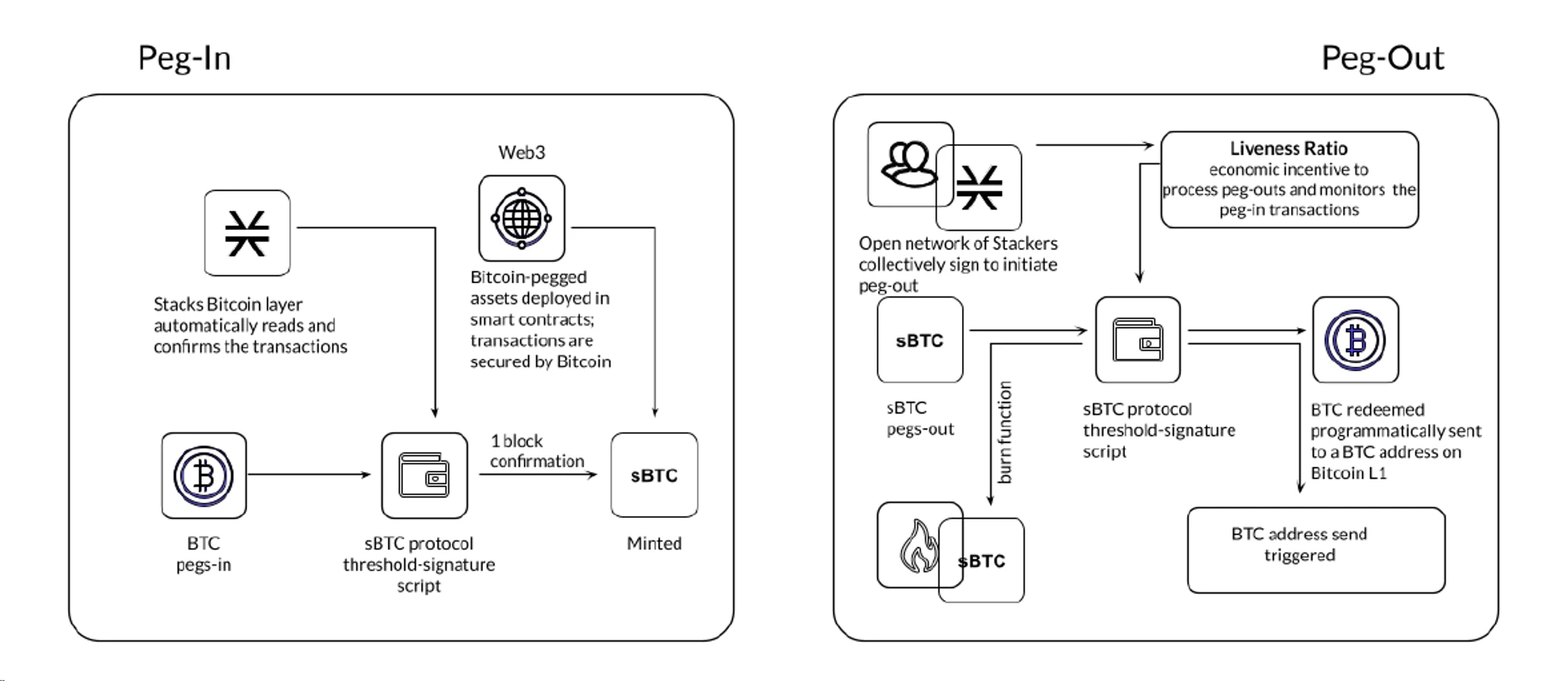

The main mechanism of sBTC is summarized as follows: the user sends BTC to the pegged wallet/script on the Bitcoin network, and the same amount of sBTC is manufactured and sent to the Stacks address selected by the user, maintaining a 1:1 peg; when the user wishes to transfer the asset Once sent back, the sBTC will be burned and the BTC will be transferred to the users address within the Bitcoin network. Since the Bitcoin network does not have Turing completeness, locking BTC on Bitcoin needs to be done through a managed wallet/script rather than a smart contract, and is managed by a group of Signers. When Peg-out (on the anchor chain) After burning the anchored assets), the release of BTC must be completed manually by Signers. Therefore, the Peg-in process ensures the release and transfer of assets by the smart contract of the target chain. Peg-out requires the manager to complete the release of assets. The key point of BTC anchoring lies in the Peg-out process.

The group that maintains the peg locks STX and then performs the threshold signature task of maintaining the peg (this threshold is determined by the proportion of STX locked by this group of participants). After the peg operation is completed correctly, BTC will be obtained as a reward. The permission to participate in maintaining the pegged transaction is open to everyone, and anyone can become a signer of the pegged transaction. As a security guarantee, sBTC requires two important thresholds: (1) The signature threshold is set at 70%, and more than 71% of Stackers must commit evil before security problems will occur; (2) Liveness Ratio: that is, the supply of sBTC and the locking of STX The maximum proportion of value, which is currently required to default to 60%.These two values ensure that the locked value of the STX signing the transaction is greater than the value of the BTC processed, avoiding evil behavior through economic incentives.In addition, signer selection, Peg-out requests, etc. occur in L1. Following Bitcoin’s censorship resistance, Stacks can directly read transactions on Bitcoin, so there is no need to rely on external oracles. These all make sBTC closer to Security of BTC.

How will Nakamoto upgrade and sBTC empower the development of Alex Lab?First of all, the Nakamoto upgrade will make Stacks transactions more secure and reliable, and greatly improve network performance. The introduction of subnets makes it possible to support other programming languages and environments, such as EVM subnets, making project migration more convenient and paving the way for the explosion of ecological projects. Provide conditions to strengthen Stacks’ leading position in the Bitcoin ecosystem,As the largest DEX in the Stacks ecosystem, Alex will directly benefit from this improvement. Secondly, BTC is the most decentralized and safest asset. Being able to unlock the huge market value potential of BTC and introducing BTC into DeFi will greatly enhance the security and legitimacy of DeFi. It should be pointed out that currently the assets anchored to BTC on the market (such as wBTC on Ethereum) are entrusted to centralized entities or a group of trusted managers, which inherently has trust issues and runs counter to the spirit of Bitcoin. In contrast, sBTC is operated by a permissionless, decentralized, and dynamic set of participants, with economic incentives designed to maintain the correct peg. Although it still introduces risk and complexity, it is very close to the security of BTC. Leveraging the huge value of BTC and maximizing the security of BTC will bring a new narrative to DeFi.As the leading DeFi application on Stacks, Alex will be the core direct revenue target of this upgrade. In summary, the Nakamoto upgrade will bring a great improvement to the performance of Stacks, and will greatly attract market attention in terms of narrative and fundamentals. Alex Lab is the protocol with the largest application and direct benefits. In view of the fact that the market value increase space of Stacks is already relatively small, Alex Lab It will be the best target for laying out this upgrade.What is the current status of the Nakamoto upgrade and sBTC? What will the future timeline look like?

In October 2023, Stacks launched a developer version of sBTC, allowing developers to build and test with early sBTC versions. On December 15, Stacks Lianchuang issued a document stating that the Stacks Nakamoto test network (codenamed Neon) has now completed code writing, and the launch of the test network at the end of the year has been locked.

According to the latest release from the Stacks Foundationtimeline, the Nakamoto upgrade will be released before the Bitcoin halving. After the mainnet release confirms stability, sBTC will be launched subsequently. In the initial version of the roadmap, Nakamoto and sBTC are planned to be released together, but will currently be planned to be upgraded separately. Implemented to reduce overall complexity to make upgrades more predictable and secure. The team plans to launch the public test network Argon in the first quarter of 2024 and launch the Nakamoto upgrade of the main network before the Bitcoin halving. sBTC is expected to be launched on Stacks about 2 months after the upgrade.

However, it should be noted that the Nakamoto upgrade has been postponed twice from the initial plan to be completed this summer to the end of 2023 and then to Q1 next year. If the Nakamoto upgrade cannot be completed before the Bitcoin halving, expectations will be disappointed again. , the upgrade narrative cannot be superimposed on the halving narrative, which may have a certain impact on the overall currency price of the Stacks ecosystem. It is necessary to pay close attention to the progress of Stacks upgrade in the future. The latest time node will be the launch of the test network Neon at the end of December.

5. Token Economics and Liquidity Distribution

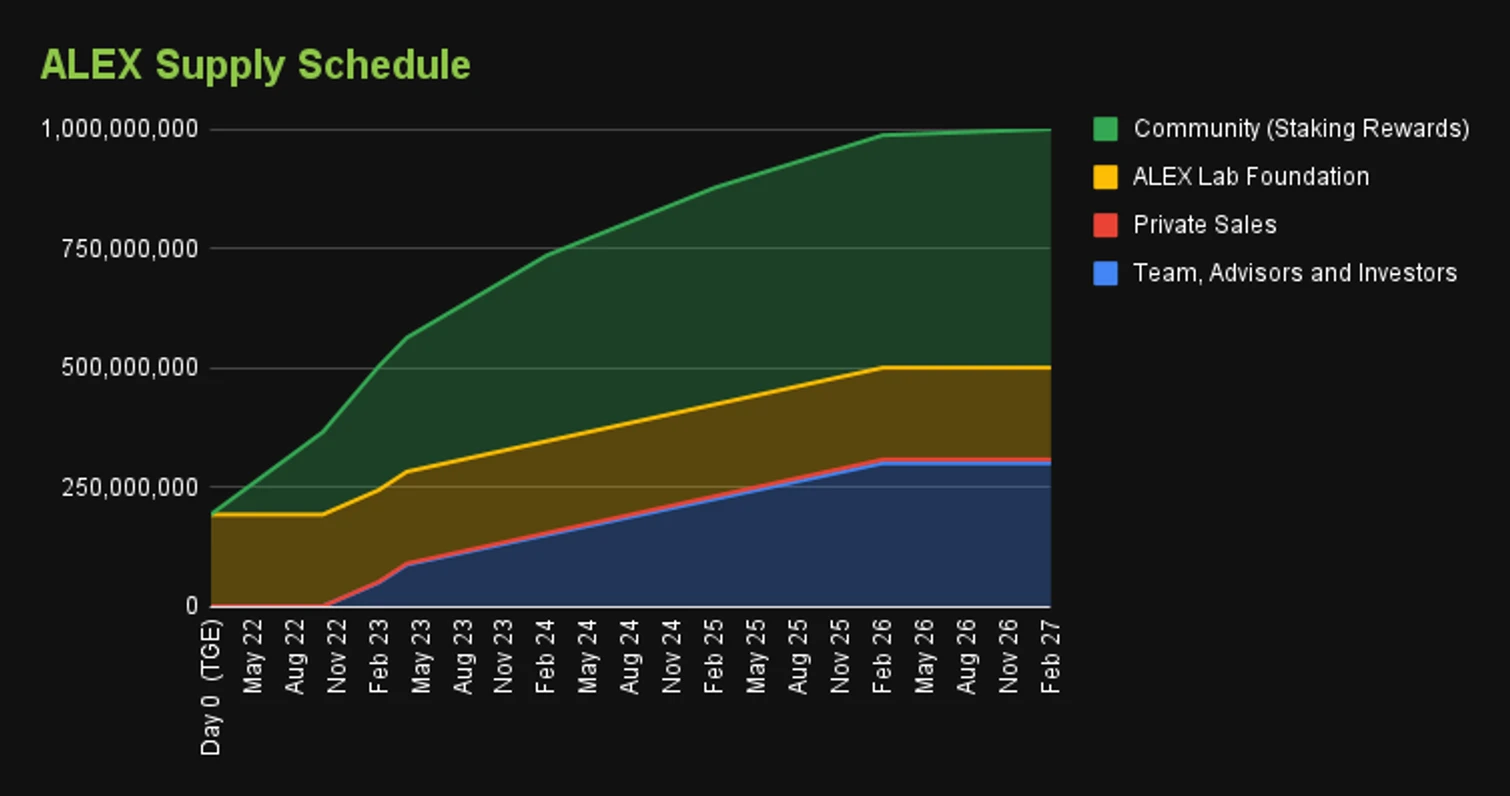

In terms of token distribution, Alex Lab will issue tokens in March 2022. The total number of tokens is 1, 000, 000, 000, which is expected to be fully unlocked within five years (February 2027). The distribution situation is as follows:

20% to the Foundation, allocated to the community reserve pool to support ALEX’s ecosystem, early adopters, and future development

50% reserved for the community to earn ALEX by staking or providing liquidity tokens

30% to employees, advisors and early investors and founding team

In terms of token usage scenarios, $ALEX can be used for staking and governance. The level of staking income has a great relationship with whether to choose automatic staking. Currently, a total of 140 million tokens have been pledged, and the APY is 7.25%. $ALEX and $atALEX (auto-staking ALEX) can participate in community governance voting, including token economics changes, IDO project selection, etc.

In terms of token performance, the current market value of $ALEX is $287,738,006, the FDV is $439,423,517, the MC/FDV ratio is 65.48%, and the token circulation ratio is already relatively high. In terms of market capitalization, ALEX currently ranks 181st in market capitalization. For comparison, Stacks currently has a market capitalization of $2,079,014,811 and an FDV of $2,645,163,967. The market capitalization is nearly 8 times that of ALEX. Although Stacks, as a second-tier public chain, has a higher valuation than ALEX, ALEX is the absolute leading protocol with the most complete construction on Stacks.In the medium term, ALEX can be used as a leveraged underlying for Stacks investments. (The above data time is 2023/12/21)

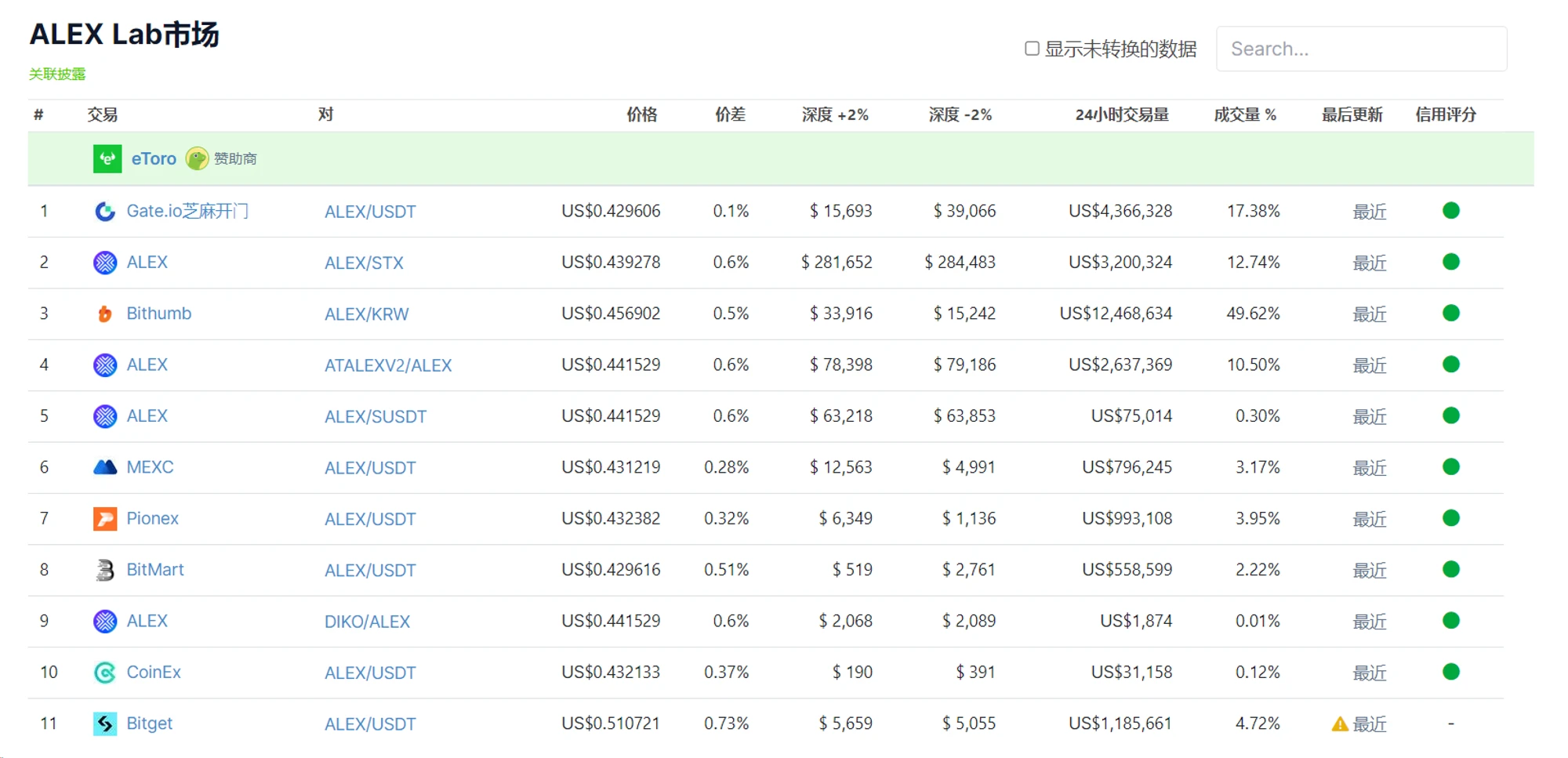

In terms of liquidity, ALEXs current main trading volume is concentrated on Bithumb, Gate and Alex AMM. The liquidity is relatively poor and it has not yet been listed on major exchanges. Recently, major BRC-20 tokens have been listed on Binance and OKX exchanges. It can be seen that the current mainstream CEX is paying attention to the Bitcoin ecosystem. The announcement of the information on the exchanges has triggered a substantial increase in tokens.As the leader of DeFi in the Bitcoin ecosystem, ALEX will have some room for listing in the future, and the hype and liquidity improvements it will bring will further increase the price growth space of $ALEX.

6. Conclusion

Based on the above analysis, our basic views on Alex Lab can be summarized as follows:

First of all, with the high popularity of Inscription and BRC-20 tokens, the BTC ecosystem has the conditions to become the mainstream narrative of the bull market. Coupled with the Bitcoin halving in April, this track will have a higher hype value. Considering the security and legitimacy of the Bitcoin network, as well as the sustainable incentive issues for miners, establishing a Bitcoin ecosystem is of great practical significance. DeFi is the cornerstone of the ecosystem. As the leader of Bitcoin DeFi, Alex Lab will provide the foundation for the subsequent expansion of the Bitcoin ecosystem.

Secondly, Alex Lab closely followed the development of BRC-20 tokens and quickly developed on-chain indexes, Orderbook trading markets and Launchpad for BRC-20, seizing the gaps in the lack of BRC-20 token infrastructure and quickly seizing the opportunity to become There are only a few projects in the Bitcoin expansion layer that are deeply involved in the narrative of BRC-20 tokens and have practical products on the ground, which will unlock more financial use cases for BRC-20 tokens.

Third, in terms of competition, Alex Lab is the absolute leading project on Stacks. After completing the Nakamoto upgrade, Stacks will further consolidate its leading position as a Bitcoin expansion solution. Compared with Sovryn, the leader on Rootstock, Alex Lab has significant advantages in data performance, development progress, and connection with the BRC-20 narrative. Therefore, Alex Lab has very strong competitiveness and absolute leading position in the Bitcoin DeFi field.

Fourth, the Nakamoto upgrade is an important event in the field of Bitcoin expansion. The release of sBTC will unlock the potential and value of Bitcoin DeFi and improve security and legitimacy. Alex Lab will be the core target of planning this event.

Fifth, based on the market capitalization and FDV of Alex Lab and Stacks, we believe that in the medium term, ALEX can be used as one of the leverage targets for the layout of the Stacks ecosystem. Major exchanges are seizing the Bitcoin ecosystem. The listing of ALEX tokens in the future will bring more liquidity and effectively increase the currency price.

The focus of follow-up observation of Alex Lab will include: the subsequent development of the Bitcoin ecosystem; whether the Nakamoto upgrade and sBTC linkage can meet expectations; the number of Alex Lab’s support for BRC-20 token trading pairs, and the BRC-20 financial infrastructure status; changes in data such as number of users, transaction volume, TVL, etc.; progress in token listing, etc.

about Us

Metrics Ventures is a data and research-driven crypto asset secondary market liquidity fund led by a team of experienced crypto professionals. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC cooperates with senior influential figures in the encryption community to provide long-term enabling capabilities for projects, such as media and KOL resources, ecological collaboration resources, project strategies, economic model consulting capabilities, etc.

Welcome everyone to DM to share and discuss insights and ideas about the market and investment of crypto assets.

We are recruiting, if you are good at crypto asset investment, please contact us, Email: ops@metrics.ventures.

Our research content will be published simultaneously on Twitter and Notion, please follow:

Twitter: https://twitter.com/MetricsVentures

Notion: https://www.notion.so/metricsventures/Metrics-Ventures- 475803 b 4407946 b 1 ae 6 e 0 eeaa 8708 fa 2 ?pvs=4