Original - Odaily

Author - Azuma

This past weekend, the Polkadot ecosystem seemed to have taken over the torch of sector rotation, and all major projects experienced soaring prices.

As of publication:

Polkadot (DOT) is temporarily trading at $9.05, with a weekly increase of 35.6%;

Kusama (KSM) is temporarily trading at $51.05, a weekly increase of 79.3%;

Moonriver (MOVR) is temporarily trading at $31.22, a weekly increase of 386.2%;

Moonbeam (GLMR) is temporarily trading at $0.543, with a weekly increase of 65.9%;

Acala (Acala) is temporarily trading at $0.12, up 56% in a week;

Astar (ASTR) was temporarily quoted at $0.105, down 13% in a week (it actually rose, but it was launched on Upbit exactly a week ago, doubling under the pickle effect);

Clover (CLV) is temporarily trading at $0.08, with a weekly increase of 52.5%.

So, what exactly drove this round of changes in the Polkadot ecosystem? We tried to find the answer from multiple angles such as fundamentals, secondary market structure, and market sentiment.

From a fundamental perspective, the most critical trend in Polkadot in the near future is undoubtedly the advancement of the 2.0 upgrade.

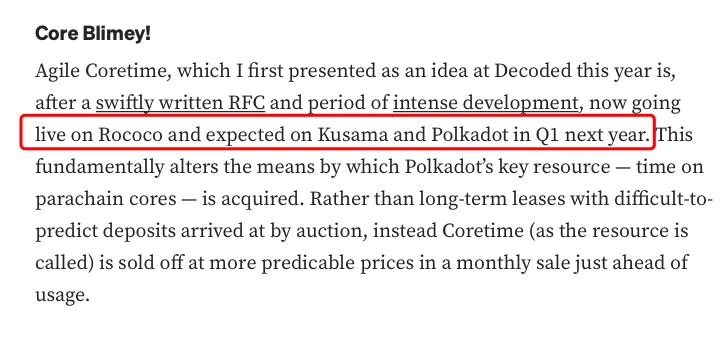

In the middle of this year, Gavin Wood proposed the idea of Polkadot 2.0 at the Polkadot Decoded conference, proposing to replace the existing parachain auction mechanism with Agile Coretime to optimize the allocation of Polkadot block space and lower the ecological entry threshold.

Previously, Agile Coretime has been successfully deployed on the Polkadot test network Rococo. According to the recent announcement by Gavin Wood,Polkadot 2023 Annual Summary,Agile Coretime is expected to be launched on Kusama, the pioneering network, and Polkadot, the main network, in the first quarter of next year. This progress is significantly earlier than the community’s general expectations for the upgrade.

Odaily Note: The general upgrade order of Polkadot is Rococo - Kusama - Polkadot.

In addition to architectural upgrades, Snowbridge, the cross-chain bridge between Polkadot and Ethereum, is also expected to be launched in the first quarter of next year. This move will also significantly open up the liquidity barriers between the two major ecosystems and improve interoperability.

In terms of secondary market structure, the Polkadot ecosystem is about to usher in a key node in the near future——The token incentives provided by the first batch of parachain auction winning projects are about to be unlocked in the final round.

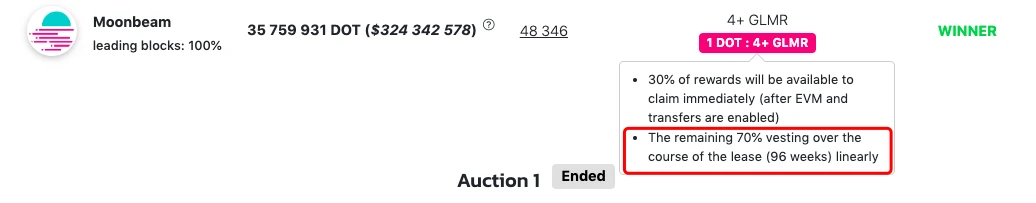

Starting in December 2021, Polkadot launched the first batch of parachain auctions that were called much anticipated at that time. Nearly 100 million DOTs were put into the auction, and the price of DOTs also touched ATH at that time. In the end, five projects including Acala, Moonbeam, Astar, Parallel and Clover won.

According to the auction incentive plan at the time, the own token incentives provided by the above projects will be unlocked in batches according to certain rules, and the unlocking period is about two years. For example, ACA and GLMR are unlocked in 96 weeks, and ASTR is unlocked in 22 weeks. Month to unlock.

Taking the BDOT auction product provided by Binance as an example, users who participate in the Polkadot parachain auction through this program can receive the last phase of ACA, GLMR and other incentives on December 27.

therefore,From the perspective of the structure of the secondary market, the current mainstream tokens in the Polkadot ecosystem are also a key node where chips are fully exchanged in the early stage and circulation is about to be reduced in the later stage. This may explain the current collective changes in the ecosystem.

From the perspective of market sentiment,Solana’s surge has also led the market to re-examine the limitations of Ethereum (EVM) and the possibilities of heterogeneous public chains.

Looking back at the development of Polkadot in the past few years, you can criticize it for insufficient ecological activity due to the closed nature of the auction mechanism, or you can accuse it of always being criticized at the governance level, but you have to admit that Polkadot has always been well received in terms of development support.

As the market begins to shift expectations for a new bull market to breakthroughs in the application layer, Soliditys ability to support the development of complex applications is being questioned, and Rusts reputation is increasing day by day.

While the voice of Solana flip Ethereum is getting louder, some people must have noticed the smart contract language ink that Polkadot strongly promotes! Coming from the same source as Rust, it also has the potential to take over the explosion of the application layer.

All in all, the above analyzes are only some conjectures about the recent collective changes in the Polkadot ecology. What are the real reasons, or is it a combination of multiple reasons? No one can give an absolutely accurate answer.

anyway,Polkadot, which once had unlimited expectations, seems to be facing an opportunity to re-introduce itself to the market, how the story goes, we will witness together in the new year.