Original - Odaily

Author-husband how

Recently, Meme in the Solana ecosystem has become very popular, and many representative projects have emerged, such as Silly Dragon and Knob.

Especially Solana, the first in the ecosystem"The dog token BONK has increased nearly 180 times in the past two months, and its market value once exceeded US$1 billion. It ranks third in the Meme sector, second only to DOGE and SHIB, and has been successfully listed on top exchanges Coinbase and Binance.

Who is Gotbit, the market maker behind Bonk? In addition to BONK, what other projects does Gotbit provide market making services for? Based on market news and communicating with participants in the market maker industry, Odaily reveals the development history of Meme token market maker Gotbit and explores its market making strategy.

In love with Meme tokens, active market maker Gotbit

As early as the last bull market, Gotbit began to provide market maker services. However, since the team mainly works in Europe, and the projects are mainly European projects, it has a certain reputation in Europe, but it is not well-known in other regions. The skyrocketing price of Bonk in recent months has allowed Gotbit to truly come into the public eye, and it has become a popular choice among project developers as a market maker.

Most traditional market makers assist the supply and demand of tokens based on market sentiment. The rise of tokens has little to do with market makers and mainly relies on major benefits of the project or bullish market sentiment. In its early days, Gotbit was also a traditional market maker, mainly providing liquidity to the market and charging corresponding fees from the project side and spreads during the transaction process.

Today, Gotbit adopts the more popular active market maker style, that is, the project party cooperates with the market maker to jointly earn profits in the secondary market, and the two redistribute the profits. This market-making style is to collect chips during the downturn of the project. When the project is favorable or the market is rising, more support is provided at key points to assist in pulling the market and shipping at a high point.

Gotbit is paying particular attention to Meme tokens this year, and the Meme token project party must be real. This has been repeatedly emphasized by Gotbit founder and CEO Alex Andryunin. Based on past experience, it seems that Gotbit was cut off 500 SOL tokens by an unknown Meme project party.

Why does Gotbit love Meme tokens? There are three reasons:

The rise of Meme tokens can easily cause FOMO sentiment in the market and attract retail investors;

Meme tokens are easy to attract attention. You can refer to Musk and Dogecoin;

Meme tokens do not have a strong opponent for Gotbit. After all, the project parties are all teammates.

Currently, in addition to Bonk, Gotbit also provides market making services for solana’s inverted MEME token analos and Bonk’s inverted Knob. Among them, analos has increased 3,800 times in less than a week. Gotbit also officially announced its investment in analos, which is self-evident; Knob just announced its cooperation with Gotbit yesterday, and you can look forward to the subsequent development.

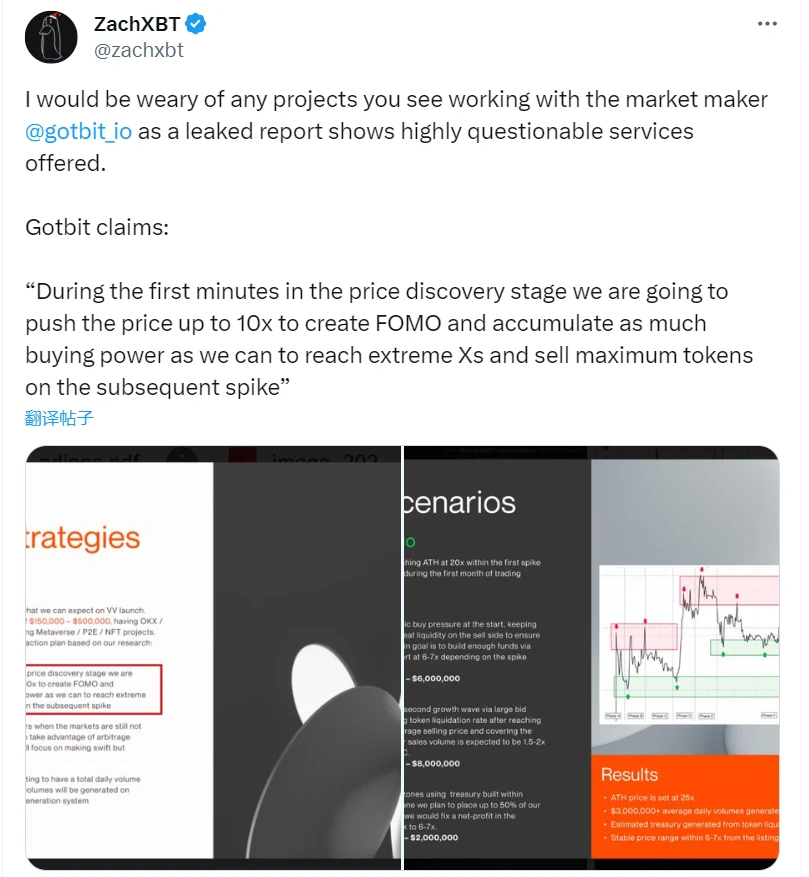

However, Gotbit has received mixed reviews on social media. On-chain detective ZachXBT once said that he is wary of any project that cooperates with the market maker Gotbit Hedge Fund and disclosed a report. According to the pictures shared by ZachXBT, Gotbit’s trading techniques can be glimpsed:

In the first few minutes of the price discovery phase, push the price up to 10x to create FOMO and accumulate as much purchasing power as possible to reach the limit and sell tokens in large quantities in the subsequent surge;

During the first 12 hours of trading, the goal is to take advantage of existing arbitrage opportunities and focus on making substantial profits quickly;

The target trading volume on the launch day is more than 50 million US dollars, which is generated on CEX for free through the transaction generation system;

Reach 20x ATH within the first peak on launch day and 25x ATH within the first month of trading.

The materials provided by ZachXBT can confirm the active market-making style mentioned above from a certain perspective. The market-making strategy provided by Gotbit for the project team is biased towards profit-based, by raising the currency price and shipping at a high point.

Gotbit’s market-making style is taking the crypto market by storm

From Odaily’s communication with market maker practitioners, we found that there are gradually more market makers with an active market making style similar to Gotbit.

Market makers are broadly divided into three categories in the market:

Passive market makers help project parties provide liquidity. Most market making strategies are loan+call optoin (borrowing currency from the project party + call options). They are more suitable in market stages with sufficient liquidity, represented by GSR and Wintermute.

A market maker between passive and active, that is, in the name of investment, OTC takes low-priced coins and then sells them in the secondary market. This type of market maker moves particularly frequently during the bear market phase, represented by DWF.

Active market makers, that is, they cooperate with market makers based on the actual situation of the project party. They usually intervene before listing on the exchange to earn profits in the secondary market, and the two then distribute the profits. Represented by Gotbit.

Similar to DWF type market makers, the market making style is too distinctive. At present, DWFs market making strategy has gradually become known to the public, and most on-chain data analysts have also disclosed the whereabouts of DWFs tokens on the X platform.

The rise of active market making style is influenced by DWF to a certain extent, which is more conducive to market makers increasing their marginal returns. In addition, project parties with smaller market capitalization or those that have not yet issued coins are more willing to cooperate with such market makers. The increase in currency prices will bring more attention to the project and increase the popularity of the project.

However, for traders in the market, the strategy of active market makers means that the short-term rise of a certain token can trigger a lot of FOMO among investors, leading to rash trading behaviors. Odaily reminds investors to invest rationally and not to blindly chase the rise.