Old Money Irresistible Aphrodisiac

US BTC spot ETF hangs in the balance, and Hong Kong can’t wait.On December 22, the Hong Kong Securities and Futures Commission issued four circulars in a row, the most significant of which was the announcement that it would approve virtual asset spot ETFs.

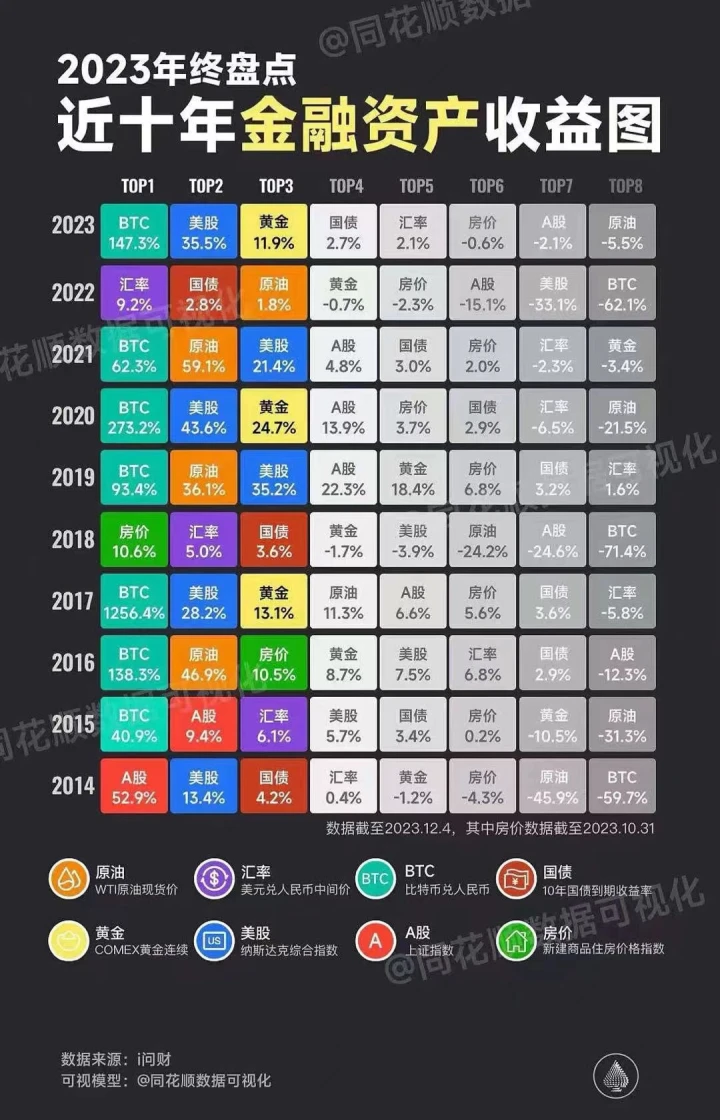

BTC spot ETF is the most coveted “aphrodisiac” in the crypto world. Just every discussion in history will cause market climaxes one after another. Now, Hong Kong is about to open this bottle of powerful medicine. The worlds best-performing financial assets in the past decade will be included in ETFs, which will inevitably lead to Old Money, which has been ready to move for a long time.

Many traditional funds have long been greedy for Bitcoin. However, because the risks are too high and there are no compliant entry channels, they can only watch Bitcoin soar. This is really uncomfortable, so some institutions can only If you cant get in or out, you have to give your money to Grayscale to buy BTC; some even set their sights on Microstrategy, a listed company that has a heavy exposure to BTC, and buy its stocks like crazy, indirectly enjoying the glory of BTC.

Although the Chicago Mercantile Exchange has long listed Bitcoin futures ETF, and Hong Kong also has a futures ETF launched by CSOP, it cannot quench the thirst of the old consortium at all. After all, most public funds cannot speculate in futures, and high-risk assets such as BTC cannot be added to the investment list. But spot ETFs are different. Whether they are public funds or private equity funds, spot ETFs are conventional investment targets. Regardless of whether they contain BTC or gold, they can be sold.

The increase of hundreds of billions of dollars brings double the growth

As Hong Kong and the United States liberalize Bitcoin spot ETFs, BTC ETFs will directly land on traditional securities markets. Funds, family offices, and listed companies can allocate BTC in their accustomed securities software without modifying their investment scope. At a time when high-quality assets are scarce in the market, Bitcoin, as the hottest and hottest new asset, is enough to rely on the aphrodisiac of ETF to become the top new investment target.

The 401(k) pension system in the United States is already eager to try. Steven T. Larsen, founder of Columbia Consulting in Spokane, Wash., said more companies will decide to offer Bitcoin ETFs in their 401(k) product lineups once the U.S. SEC gives the nod to a Bitcoin spot ETF.

Once huge funds like pension funds enter the market, the crypto market will see huge growth. Looking at the U.S. market alone, the current total asset management scale of the 14 spot Bitcoin ETF applicants is US$14 trillion. Even if 1% of these funds enter the market, it can bring in new funds of hundreds of billions of US dollars. The size of 401(k) pension funds exceeds $7 trillion and is also expected to bring in tens of billions of dollars.

Looking at the Hong Kong market, the market size of the Hong Kong Stock Exchange is nearly 5 trillion US dollars, and the AUM of many large-scale asset management institutions in Hong Kong reaches hundreds of billions of dollars. Under the background of the Hong Kong Securities Regulatory Commission’s efforts to develop Web3, investing in BTC spot ETFs will become an asset management institution. An important option, tens of billions of dollars of funds may gradually pour into BTC ETF.

It is expected that in a few years, hundreds of billions of dollars in global funds will be injected into BTC spot ETFs. The current market value of BTC is more than 800 billion U.S. dollars, and more than half of it is controlled by long-term holders. The market circulation is limited, and hundreds of billions of dollars of funds will enter the market. , BTC is expected to double rapidly again.

Who can get on the “card table?”

The huge potential scale of virtual asset spot ETFs will undoubtedly provide huge opportunities for ETF issuers. In the United States, asset management institutions such as BlackRock and Grayscale have already taken action. Which institutions in Hong Kong can seize this wave of financial dividends?

Among funds in Hong Kong, Harvest Fund and China Asset Management are strong. The former issued the Harvest CSI 500 ETF, and the latter issued the China AMC SSE 50 ETF. These two established Chinese funds have sufficient strength to issue BTC spot ETFs. However, the background of Chinese capital poses a certain constraint. Due to mainland Chinas strict supervision of virtual assets such as BTC, the approval process for Chinese funds to issue BTC ETFs is blocked.

There are currently thousands of No. 9 asset management institutions in Hong Kong, but traditional No. 9 license holders can only manage investment portfolios with a virtual asset investment ratio of less than 10%. Only after virtual asset upgrades can they manage a virtual asset investment ratio of 10%. % -100% of the portfolio. Currently, there are only a dozen or so institutions that have upgraded their No. 9 license plates, including established local securities firms Victory Securities, Pando Finance, EBO Capital Asia, and others.

Among them, Victory Securities is active in the field of virtual assets. Not long ago, it became the first securities firm in Hong Kong to provide virtual asset transactions for retail investors. It also cooperated with EMC Labs to issue the first compliant BTC fund that accepts stablecoin subscriptions. I believe it will not be missed. This opportunity to “serve”.

In addition, CSOP and licensed virtual asset exchange HashKey, which previously issued BTC futures ETFs, are also expected to get a share of the BTC spot ETF. As for this crypto wave in Hong Kong, exchange giants such as Binance have been silent and basically have no chance of it.

It is expected that Hong Kong’s first BTC spot ETF will be unveiled soon, and by then we will know how powerful this “aphrodisiac” is.