Original author: Daniel Ramirez-Escudero

Original compilation: Songxue, Golden Finance

Bitcoin could be in for a historic week, with the cryptocurrency market holding its breath as the U.S. approves a spot Bitcoin exchange-traded fund (ETF). Many believe the approval will fuel the next crypto bull run and wave of cryptocurrency adoption.

The list of issuers of spot Bitcoin ETFs that are expected to be approved continues to grow, and the relevant companies submitted the latest amendment to Form S-1 on January 8.

Analysts and observers predict that the U.S. Securities and Exchange Commission (SEC) will finally approve the first spot Bitcoin ETF on January 9 or 10. Eric Balchunas, senior ETF analyst at Bloomberg, believes there is “a 90% chance” that the launch of a physical Bitcoin ETF will be approved.

Whatever the decision, be it approval or rejection, the cryptocurrency market will undoubtedly be shaken.

The crypto industry may be preparing to pop the champagne in celebration, but what about its ripple effects? For the Bitcoin ETF market, the arrival of giants like BlackRock and Fidelity, which manage trillions of dollars in assets, could change the fundamentals of companies like Coinbase or MicroStrategy. Both trade on the open market, but how will they respond to the approval of a spot Bitcoin ETF?

MicroStrategy premiums may be negatively affected

Spot Bitcoin ETFs could open the door for traditional investors to enter the cryptocurrency market, putting negative pressure on Bitcoin proxies such as MSTR.

MicroStrategy has been buying Bitcoin since its co-founder, executive chairman and former CEO Micheal Saylor decided to acquire BTC as an inflation hedge and alternative to holding cash on the balance sheet.

MicroStrategy currently holds 189,150 BTC at the most recent purchase on December 27, 2023, at an average purchase price of $31,168. The technology company is the listed company with the largest BTC holdings, followed by cryptocurrency mining company Marathon with 15,174 BTC and Tesla with 10,725 BTC. MicroStrategy’s BTC buying spree has left the company holding nearly 1% of the total existing Bitcoin supply.

MicroStrategys extensive exposure to Bitcoin puts the company in a unique position by converting its shares into Bitcoin proxies.

Since MicroStrategy is listed on Nasdaq, traditional investors have investment tools to indirectly invest in Bitcoin.

However, if a spot Bitcoin ETF is approved, MicroStrategy could face stiff competition and lose its position as a Bitcoin proxy in traditional markets.

As Spencer Bogart, fundamental analyst and general partner at cryptocurrency venture Blockchain Capital, said on the Unchained podcast, the hypothetical approval of a Bitcoin ETF spot would clearly be a headwind for Saylors company.

Bogart said the approval could benefit MicroStrategy by boosting its stock price because of its large holdings in Bitcoin. However, MicroStrategy investors should question how a spot Bitcoin ETF affects the stock premium relative to their BTC holdings.

A premium occurs when a stock or shares are issued at a price higher than its par value. The premium for any stock is an abstract analysis; therefore, each issuers rates are different. A representative from private bank Julius Baer noted that its MicroStrategy premium is 9%.

Bogart rates MicroStrategys real premium at 30%, meaning investors would pay a 30% premium if they used it to track the price of Bitcoin.

“There must be a significant percentage of MicroStrategy holders using it as the best proxy for Bitcoin exposure,” Bogart said.

If some investors buy MicroStrategy stock with the sole purpose of getting as close to BTC exposure as possible without purchasing the asset itself, then approval of a spot Bitcoin ETF could mean those investors decide to sell the stock in favor of the ETF. Bogart explains:

“Once the Bitcoin ETF is approved, some of [MicrStrategy’s] investors may switch to the ETF product.”

Because of this shift in traditional markets, Bogart believes the additional value (also known as the premium) of MicroStrategy shares relative to the actual value of the Bitcoin they own may decline.

As of April 11, 2023, MicroStrategys BTC holdings turned green as the price of Bitcoin increased. Bogart said that even if MicroStrategy faces selling pressure, the technology company can still benefit from the growth in Bitcoin adoption.

Spot Bitcoin ETFs can promote cryptocurrency adoption, serving as a perfect cross-investment vehicle between cryptocurrencies and traditional markets. The existence of a spot Bitcoin ETF would provide an entry point for Wall Street capital into the Bitcoin ecosystem, driving Bitcoin adoption in the long run and potentially translating into buying pressure on MicroStrategy stock.

Another positive of holding MicroStrategy rather than a spot Bitcoin ETF is that investors dont have to pay management fees, which vary between Bitwises 0.24% and Grayscales 1.5%, according to the latest filing. Saylor emphasized this point in a December 2023 interview with Bloomberg:

“ETFs are unlevered and charge fees […] We give you leverage, but we don’t charge fees. We provide high-performance tools for long Bitcoin investors.”

Another positive is that MicroStrategy is a thriving business that provides business intelligence (BI), mobile software and cloud-based services. Additionally, the company is in good financial shape when it comes to Bitcoin investments, with an average purchase price of $31,168.

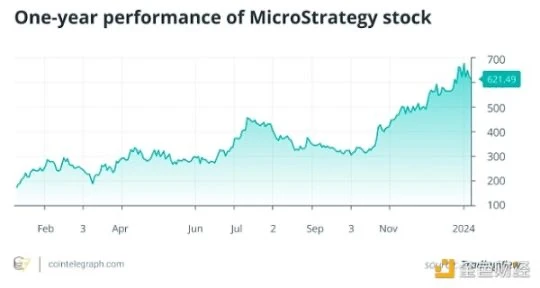

MicroStrategys stock price has soared more than 300% in 2023, outperforming Bitcoin, which has gained about 150% during the same period.

Coinbase: All-in as custodian of spot Bitcoin ETF

US cryptocurrency exchange Coinbase has struck deals with the worlds largest asset managers, including BlackRock, VanEck and Grayscale, to serve as custodians for its proposed Bitcoin ETF.

Competition will be fierce between Grayscale, Fidelity, ARK Invest, Franklin Templeton and others to be the most liquid ETF.

While different companies may tweak fee structures or other technical details to attract customers, being the first to launch on the public market is a major breakthrough.

Many consider BlackRock one of the most prominent candidates, but other companies such as ARK Invest, Bitwise, WisdomTree or Valkyrie all have experience with Bitcoin futures and a well-versed approach to cryptocurrencies.

Coinbase is going all-in in the Bitcoin ETF spot race, positioning itself as a trusted custody service. As the exchange becomes the preferred custodian of Bitcoin held by ETF funds, the exchange will earn more revenue and potentially generate more demand from other large players in the traditional investment space.

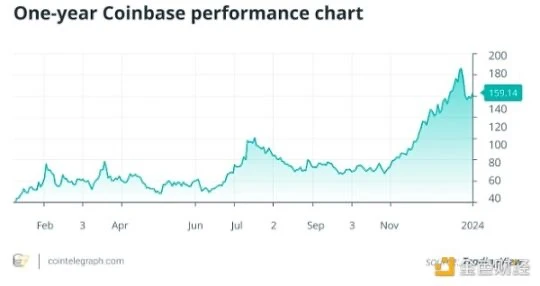

Coinbase can successfully expand its existing model to earn cash flow through various subscriptions and services in addition to revenue from internal trading volume. These factors have given Coinbase stock a solid foundation to attract investors, with its value soaring 370% in 2023, according to TradingView.

There are other factors that could put pressure on Coinbase shares. Currently, the U.S. Securities and Exchange Commission (SEC) has a pending case against Coinbase for failing to register its staking-as-a-service program. When the SEC first announced its lawsuit against Coinbase on June 6, 2023, the companys stock price fell 15%.

A volatile week for Bitcoin

BTC price is highly sensitive to the SEC’s decision to approve or reject a spot Bitcoin ETF.

On January 2, Markus Thielen, head of research at crypto platform Matrixport, said he believed the SEC would reject current Bitcoin ETF applications because the agency believed they “failed to meet key requirements.”

The SECs rejection of this recommendation and the reaction of the cryptocurrency community on X (formerly Twitter) was enough to send Bitcoins price down 7% on January 3.

Bitcoin price from January 2nd to 9th. Source: Cointelegraph

The rapid price decline highlights the volatility of Bitcoin prices and the news that many sellers are waiting to see the decision of the U.S. Securities and Exchange Commission (SEC).