Original author:stella@footprint.network

In 2023, the public chain field will demonstrate strong resilience and continuous innovation. This year, Bitcoin’s strong comeback, Ethereum’s steady growth, and Solana’s astonishing rise have together painted a vivid picture of market recovery. Against this background, the market value of public chain cryptocurrencies has reached US$1.3 trillion, revealing the fierce competition among leading public chains and the broad prospects for Layer 2 solutions.

Overview of public chain

Key Metrics Overview

During the year, we witnessed the initial recovery of the cryptocurrency market after a “hard winter”. Led by Bitcoin, its price and market capitalization both achieved a growth of more than 150%. Ethereum followed closely behind, with an increase of 80%. Solana has also rebounded significantly after falling in 2022.

As an important infrastructure for cryptocurrency, the development of public chains has a profound impact on the entire industry. according toFootprint AnalyticsAccording to data, in 2023, the total market value of public chain cryptocurrencies will reach US$1.3 trillion. Among them, Bitcoin accounts for 62.2%.EthereumOccupying 20.6%,BNB chainand Solana’s shares were 3.6% and 3.3% respectively. It is worth mentioning that during this year, Solana,Avalanche, ICP, Bitcoin and Cardanos market value growth has exceeded 100%, showing strong growth momentum.

Data Sources:Chain Overview

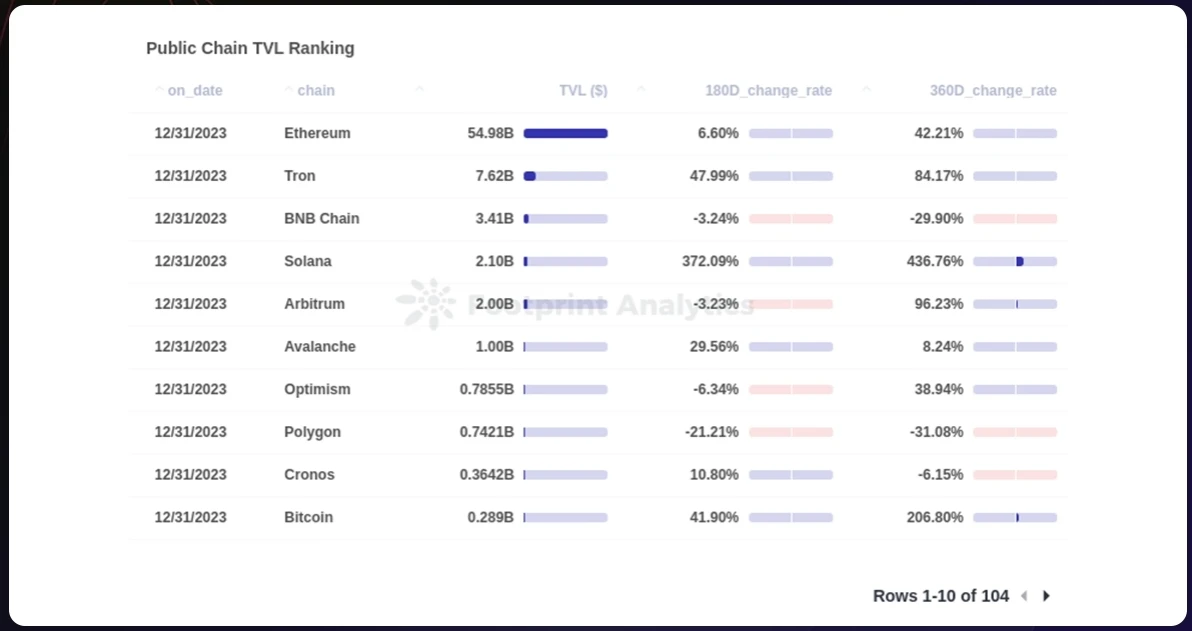

In terms of total locked value (TVL), Ethereum still maintains its leading position, with its TVL reaching $55 billion, accounting for 72.4% of the $76 billion TVL market share. Tron ranks second with $7.6 billion, followed by BNB Chain and Solana with $3.4 billion and $2.1 billion respectively. Comparing Solana and Bitcoin in 2022Arbitrumand Tron’s TVL increased by more than 80%, whilePolygonand BNB chain experienced a decline of more than 20%.

Data Sources:Chain Overview

Layer 2 Overview

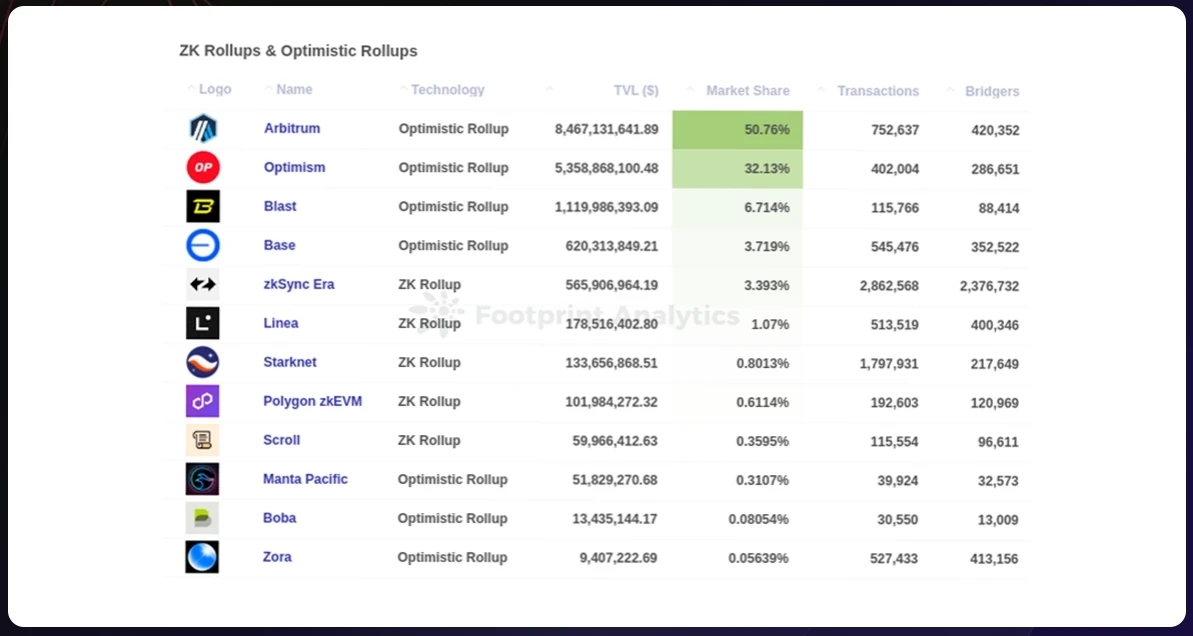

On EthereumLayer 2 In terms of solutions, Arbitrum leads the way with a 50.8% market share and a TVL of US$8.5 billion. closely followed byOptimism, occupying 32.1% of the market share and TVL of US$5.4 billion. Notably, rising star Blast achieved $1.1 billion in TVL in just 40 days, winning 6.7% market share. Other well-known projects such as Base andzkSync EraThe market shares are 3.7% and 3.4% respectively. In this diverse ecosystem, the gap between small players and traditional giants is getting smaller and smaller, which is like a vibrant coral reef - diverse, fiercely competitive, and constantly evolving. (“TVL” here refers to the cumulative amount stored and locked in the Layer 2 smart contract.)

In the development of Layer 2, user-centered strategies begin to transcend a purely technology-driven approach. The once leading zkSync Era,Starknetand Polygon zkEVM are lagging behind in TVL and development speed in 2023.

Data Sources:Layer 2 Overview

Financing

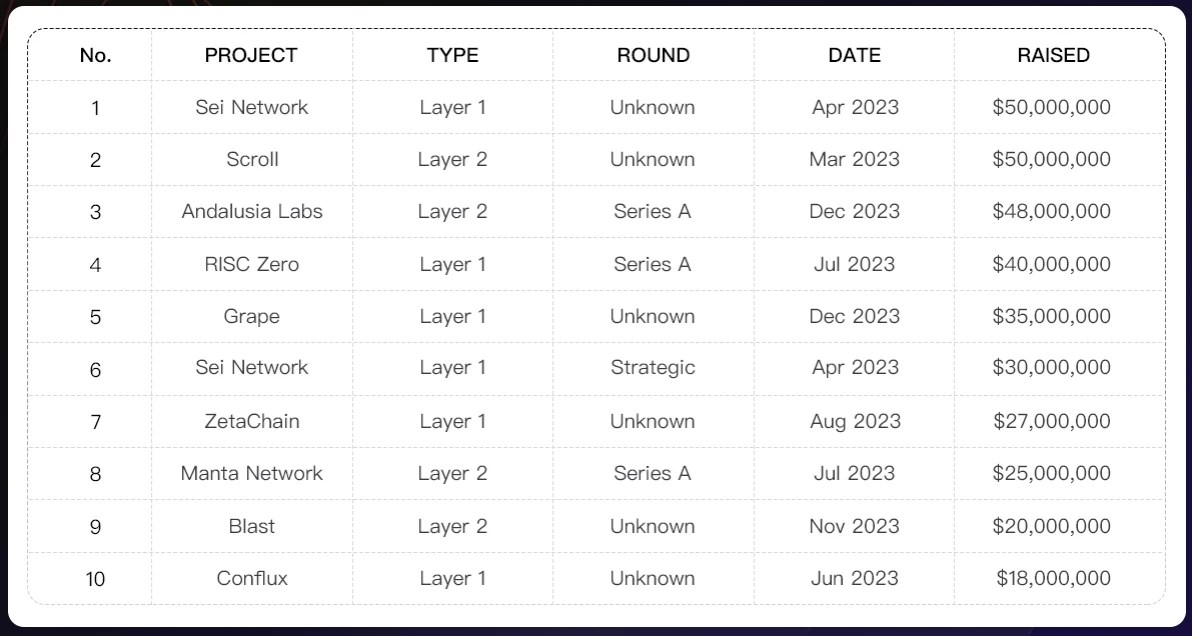

In terms of financing, the cyclical nature of cryptocurrency still exists - in 2023, public chain projects raised US$539 million in 70 rounds of financing, an annual decrease of 85.5% compared with the high of US$3.7 billion in 2022. However, despite wavering confidence, investors remain optimistic about Layer 2 infrastructure. Among the 70 rounds of financing in 2023, Layer 2 financing accounted for 41.4%, up from 34.5% in 2022. In 2023, the average financing amount of Layer 2 will be 15% higher than that of Layer 1. These data show that although the cryptocurrency market is in the midst of a cold winter, investors are increasingly focusing on professional builders and technological innovation rather than chasing short-lived hype and bubbles.

Top ten financing projects by financing amount (data source:crypto-fundraising.info)

Blockchain games and NFT

Blockchain games

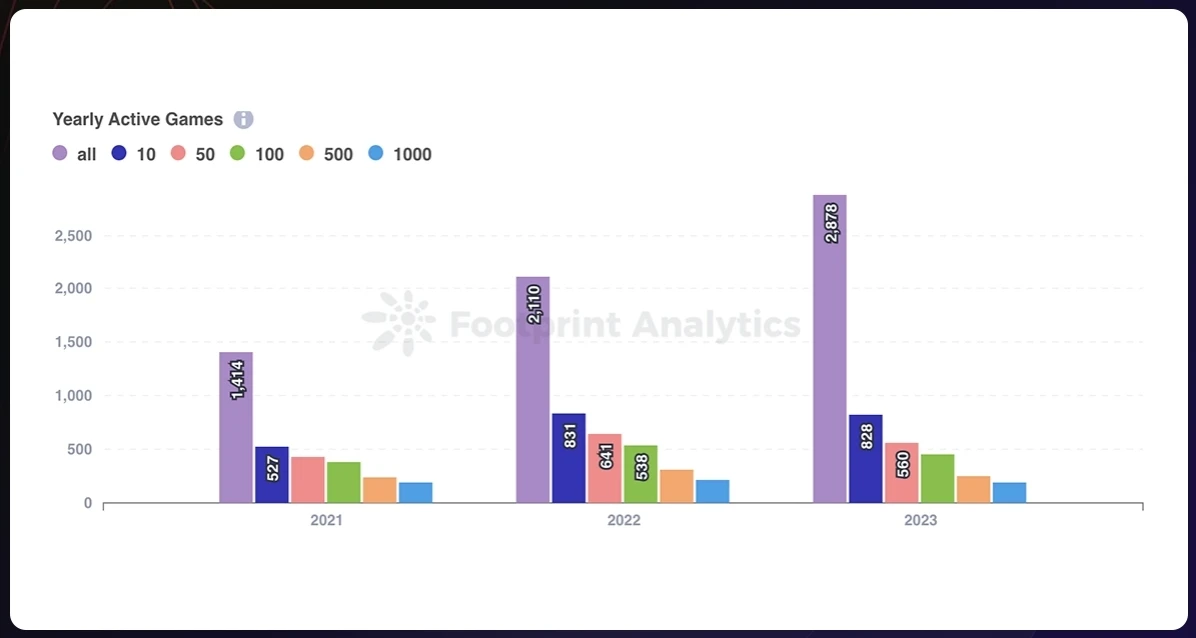

In 2023, the blockchain game market continues to expand, with the number of games increasing from 2,110 to 2,878. However, only 6.4% of games have more than 1,000 monthly active users (wallets), down from 10% in 2022. Among active games, dominant blockchains such as BNB Chain, Polygon and Ethereum account for more than 80% of the market share and have a significant impact on the market.

Data Sources:Yearly Active Games - Blockchain Game Annual Report

In addition, Layer 2 has also made significant progress in the field of blockchain games. For example, SUI has achieved a breakthrough in throughput, with SUI 8192s daily transaction volume reaching 20 million. Base has attracted market attention by integrating social and entertainment elements through friend.tech. Ronin Network also experienced rapid development in November, thanks to two games, Axie Infinity and Pixels.

NFT

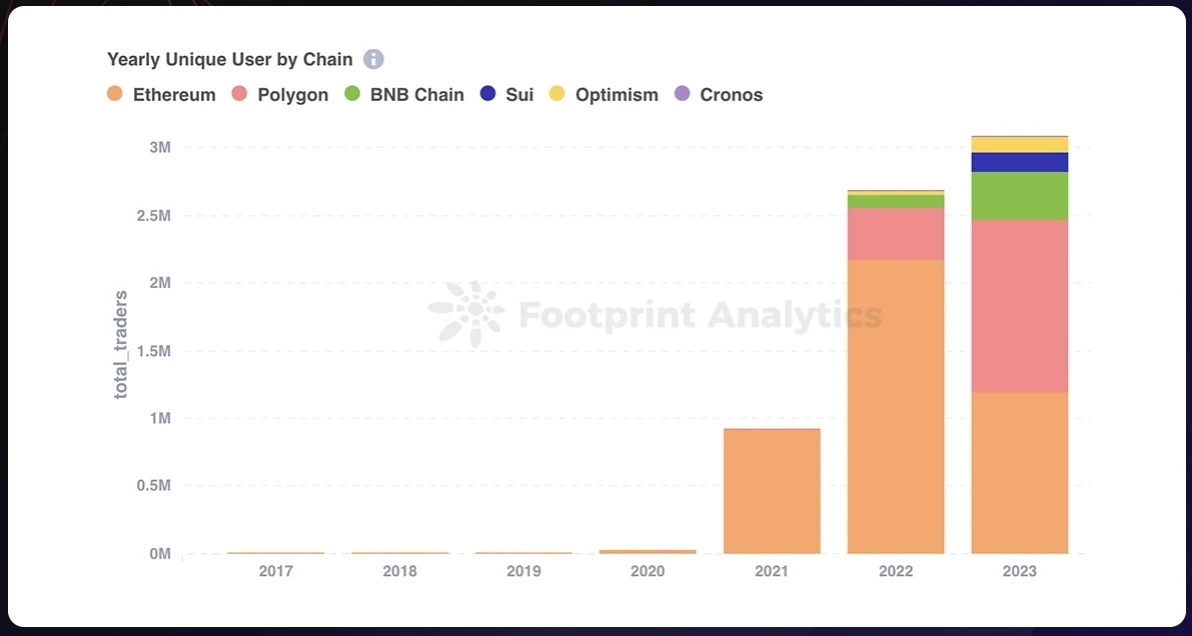

In the NFT field, although the market transaction volume reached 13.1 billion US dollars, it has declined from the peak of the previous year.EthereumStill dominant, with a market share of 97.8%, but slightly declining, indicating that the market is diversifying.PolygonThe number of users increased by 231.0% to 1.3 million; while the number of Ethereum users fell by 45.2%. at the same time,BNB chainThe number of users increased by 280.7% to 353,000. This year also saw major changes in the market due to increased trading volumes for Bitcoin’s Ordinals and Solana’s NFT transactions.

Data Sources:Yearly Unique User by Chain - NFT Research

2023 Highlights

As the cryptocurrency industry enters a period of maturity, 2023 brings both impact and new opportunities. Speculation is changing on all fronts, while real-world adoption is accelerating. As markets enter a skeptic-led pragmatism cycle, several key trends are leading the year.

Supervision gradually standardized after industry shock

The collapse of FTX and its $8 billion financial hole sent ripples through early 2023, requiring increased coordination among global policymakers to avoid regulatory loopholes. Following this, Binance paid $4.3 billion to settle an investigation by U.S. regulators regarding anti-money laundering procedures. After years of cryptocurrency boom-turned-bust, successive shocks have triggered responses that balance greater protections without stifling progress. Through regulatory clarity and improvements, barriers are lowered, allowing mainstream users to have a more accessible Web3 experience.

Layer 2 enters the forefront of development

In 2023, Layer 2 solutions are on the rise, and chains such as Base, Linea, and Blast have become very popular. By reducing user costs, Rollups have gained wide recognition, especially zero-knowledge technology Rollup. However, despite the attention Layer 2 receives, it still faces challenges. Scalability is still more of a slogan than a reality, with most chains unable to achieve their advertised throughput. Seamless interoperability between Layer 2 remains an ideal, not the norm. Additionally, many highly-hyped Layer 2 projects lack groundbreaking dApps or vibrant and diverse ecosystems.

Mass adoption accelerates across sectors

Cryptocurrency and blockchain technology are increasingly used in the real world, involving finance, media, games and other fields. In the financial sector, Visa expanded support for stablecoins in September 2023 by using Solana blockchain capabilities to settle transactions. Previously, Visa has integrated with USDC and provided a more convenient way to use cryptocurrency. The gaming field has also brought new users to Web3 by building player-oriented platforms that provide Web3 experiences (such as virtual worlds and true ownership of assets). However, despite the technology’s promising prospects, mass adoption has fallen short of industry expectations due to poor market conditions and consumer skepticism about collapsing token prices.

Bitcoin finds new narrative

In 2023, Bitcoin’s narrative has evolved beyond its traditional role as the digital equivalent of gold. The emergence of Ordinals, unique digital collectibles on the Bitcoin blockchain, has reshaped the discussion about the purpose of Bitcoin. This innovation marks Bitcoin as a base layer for emerging applications, increasing its relevance in volatile markets. December’s trading volume hit a record high, driven by Ordinals trading, signaling the expansion of Bitcoin’s market reach. This trend positions Bitcoin not just as a store of value, but as a versatile asset with ever-expanding applications.

Outlook 2024

Bitcoin will take center stage in the cryptocurrency narrative in 2024, especially with the upcoming halving event. In addition, other key topics such as Ethereum’s Dencun upgrade, the advancement of decentralization, and advances in artificial intelligence (AI) will also attract a lot of attention.

Layer 2 will continue to thrive

In 2024, with the implementation of EIP-4844, Ethereum and itsLayer 2 The coin is expected to surge on the back of lower fees and a renewed focus on scalability. Key topics include Sequencer’s decentralization, the debate over the merits of modular versus monolithic development, and interoperability. This growth is not limited to Ethereum. Layer 2 solutions of Bitcoin and BNB chains are also expected to experience a round of gains, reflecting the market’s interest in comprehensive expansion strategies.

Further development of public chains focusing on games

In 2024, game NFTs are expected to be more popular than art and collectible NFTs. The crypto gaming industry is expected to mature, intermittently attracting interest from mainstream players but mostly consolidating its position among professional players. Backed by advances in AI-generated technology, Web3 gaming will see positive progress. This growth will be further fueled by the continued improvement of gaming blockchain platforms dedicated to perfecting the blockchain gaming experience, such as ImmutableX, Ronin Network and Oasys.

The combination of AI and blockchain

In 2024, the combination of artificial intelligence and blockchain will become an emerging field full of disruptive potential. While the core infrastructure around computing power and reliable data will need to mature to enable large-scale adoption, increasing incentives to trade AI resources via crypto tokens are expected to see strong growth. Regulatory and product-market fit issues in this area are temporary rather than fundamental obstacles. Through a large amount of speculation and capital investment, the foundation of blockchain artificial intelligence has been solidified, and it is expected that more complex blockchain artificial intelligence applications will gradually rise.

Conclusion

This year, while price fluctuations may have been relatively mild, the public blockchain space has made significant progress in practical applications. Enhanced infrastructure paves the way for broader adoption, while new use cases in gaming, NFTs, artificial intelligence, and other areas herald a wave of industry disruption. These changes lay the foundation for technological advancements and market dynamics of various blockchain platforms.

_____________________

Footprint AnalyticsIs a blockchain data solutions provider. With the help of cutting-edge artificial intelligence technology, we provide the first code-free data analysis platform and unified data API in the Crypto field, allowing users to quickly retrieve NFT, Game and wallet address fund flow tracking data of more than 30 public chain ecosystems.