Original author:lesley@footprint.network

Data Sources:Blockchain Game Annual Report

Key takeaways

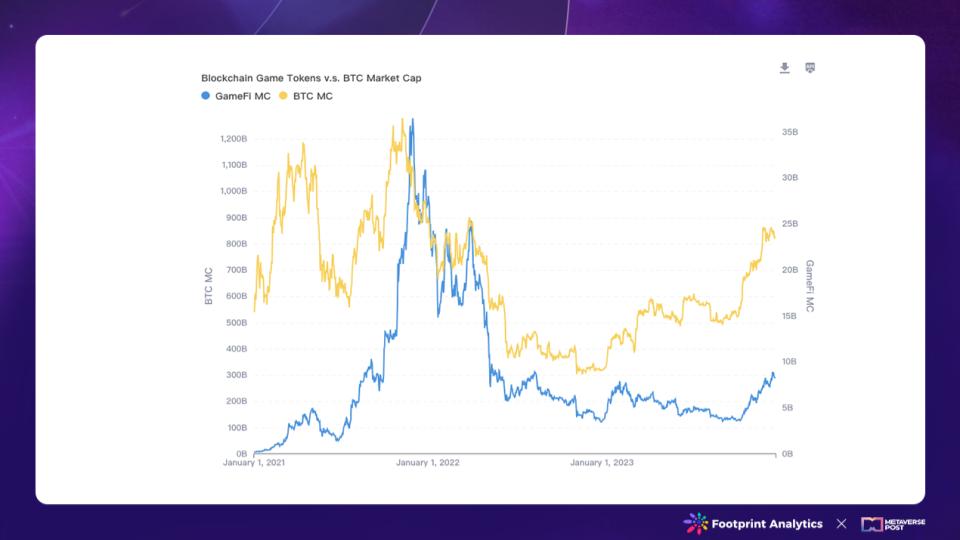

This year, the market value of Bitcoin (BTC) has rebounded strongly from the trough of the previous year. In comparison, although the growth of the blockchain game market has been relatively flat, it also ushered in a significant upward trend at the end of the year.

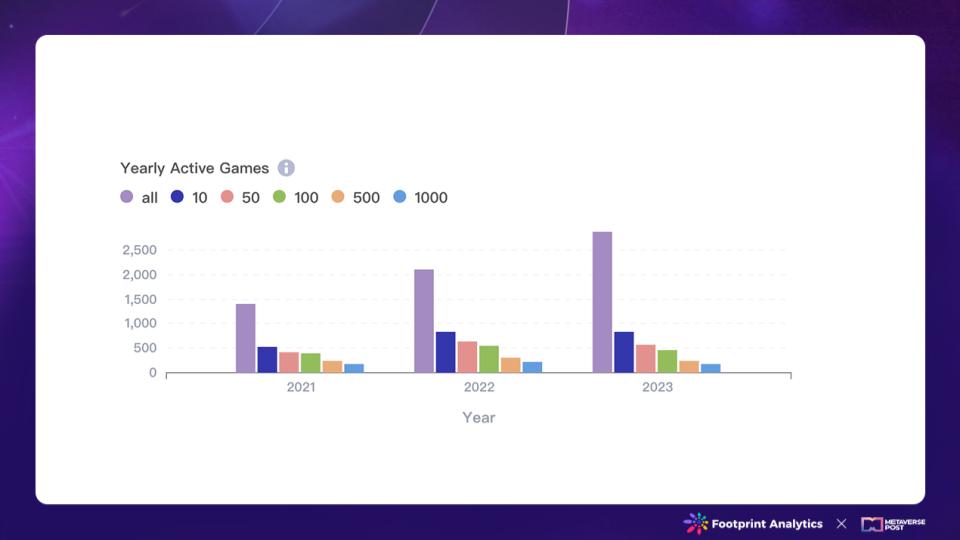

Only 6% of this year’s games have more than 1,000 active wallets, down from 10% last year.

In 2023, although overall transaction volume declined from the highs in 2022, the number of transactions remained relatively stable.

In 2023, the blockchain game industry is developing, and AI is also profoundly changing this industry. Layer 2 blockchain is also developing rapidly, but established blockchains such as BNB chain still occupy the market.

The market is looking forward to the emergence of top blockchain games, and GambleFi may see growth, but it still needs to face regulatory challenges.

In terms of user acquisition, it has become a trend to use social platforms such as Telegram and X (Twitter) to reach large user groups.

Blockchain games are an important catalyst for mass popularization in the Web3 field and play an important role in simplifying complex concepts and allowing people to understand blockchain technology. Different from other fields, the concepts of game currencies and props that already exist in traditional games make blockchain games a Web3 popularization solution that is easier for the general public to understand and accept.

Although the transaction volume of the blockchain game market in 2023 has dropped sharply by 83.8% compared with 2022 (from US$20 billion to US$3.2 billion), developers in the game field are still actively preparing for the expected bull market and focusing on improving games and The security, scalability and transaction processing capabilities of its infrastructure. In addition, developers are actively exploring strategies to attract more players through cooperation and learning from game giants in traditional fields.

according to a16zPredictions for 2024 indicate that blockchain games are shifting from a pure play-to-earn format to a play-and-earn model that focuses more on game fun. At the same time, artificial intelligence not only improves productivity, but also brings new possibilities to blockchain games.

Given these significant developments, we expect blockchain gaming to see explosive growth in this area in the coming years. Our report provides a detailed analysis of the performance of blockchain games in 2023 and a forward-looking discussion of trends in 2024, hoping to provide an important reference for the market.

Game data for 2023: Transaction volume is lower, but the number of transactions has not dropped significantly

Blockchain game market value

This year, the market value of Bitcoin (BTC) has rebounded strongly from the trough of the previous year, reaching $828.35 billion, an increase of 159%. In comparison, although the growth of the blockchain game market was relatively flat, it also ushered in a significant upward trend at the end of the year.

Number of active game wallets

Despite the increasing number of games on the market, there has been a significant decline in user engagement. The number of games on the market will increase from 2,070 to 2,780 in 2023, but only 6% of this year’s games have more than 1,000 active wallets, down from 10% last year. This reflects the challenges blockchain games face in attracting users and the quality of games has declined compared to last year.

Monthly transaction volume number of transactions

Major industry players believe that the market downturn in 2023 is only temporary, so they will spend time optimizing gaming infrastructure and wait for the arrival of the bull market.

In 2023, although the overall transaction volume has declined from the high point in 2022, the number of transactions has remained relatively stable. This trend highlights the determination of industry players in improving on-chain infrastructure and optimizing user experience. Take SUI as an example. Through games such as SUI 8192, it has successfully solved peoples concerns about the processing power of the blockchain. In July 2023, the daily transaction volume of the SUI chain reached an astonishing 20 million.

We can see that the blockchain gaming industry is making strategic adjustments to seize opportunities when market sentiment improves.

2023 Market Review: The gaming industry is developing, but on-chain data is not optimistic

The gaming industry is developing, and AI is also profoundly changing this industry

Play-to-earn is evolving into Play-and-earn

Web2 game studios are increasingly embracing Web3 technology

The combination of AI and blockchain gaming industry has taken a critical first step

Data from Footprint Analytics shows that although the number of active players of Web3 games will decrease in 2023, the industry as a whole is still moving towards large-scale adoption and improved user experience. The entire industry is gradually moving away from focusing solely on crypto-native players and towards the broader mass market.

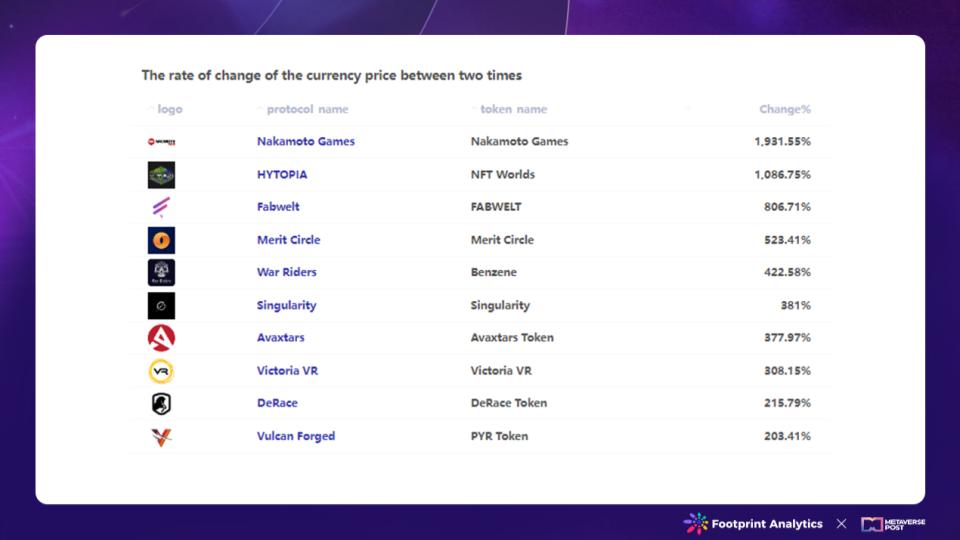

Game token growth ranking for 2023

With the expectation of the coming bull market, the development of the gaming industry has not stopped. In 2023, the prices of four game tokens achieved more than 500% growth, with the best performer being Nakamoto Games, whose tokens grew by a staggering 1931.55%.

In addition, gaming platforms such as HYTOPIA, Fabwelt and Merit Circle also saw token growth exceeding 500%. Even in difficult market times, projects with strong ecosystems continue to outperform.

A significant trend in 2023 is that the Play-to-earn of blockchain games is developing into Play-and-earn. Many Web2 companies have begun to increase their attention and investment in blockchain games, using their capital and experience to inject vitality into this emerging field. HYTOPIA is a successful example, with its token growing by 1086.75% this year. This game originated from the sandbox game Minecraft by Mojang Studios in the traditional gaming field.

In addition, the well-known AAA game Illuvium has also cooperated with many Web2 mainstream entertainment companies. Web2 Studios has a strong interest in entering the blockchain space. Even traditional gaming giants like Ubisoft and Square Enix are exploring this new frontier.

Looking forward to 2024, the trend of integrating AI into games will become even more obvious. Not only is AI significantly improving productivity, allowing small teams to efficiently create high-quality games, it also has the potential to quickly adjust game balance and mechanics to better respond to player needs by analyzing player data and real-time feedback.

Although AI is still in its early stages of development and its full impact on the gaming industry remains to be further explored, its potential is exciting.

Layer 2 blockchain is developing rapidly, but established blockchains such as BNB chain still occupy the market

Layer 2 blockchain is developing rapidly, attracting the attention of the entire gaming industry

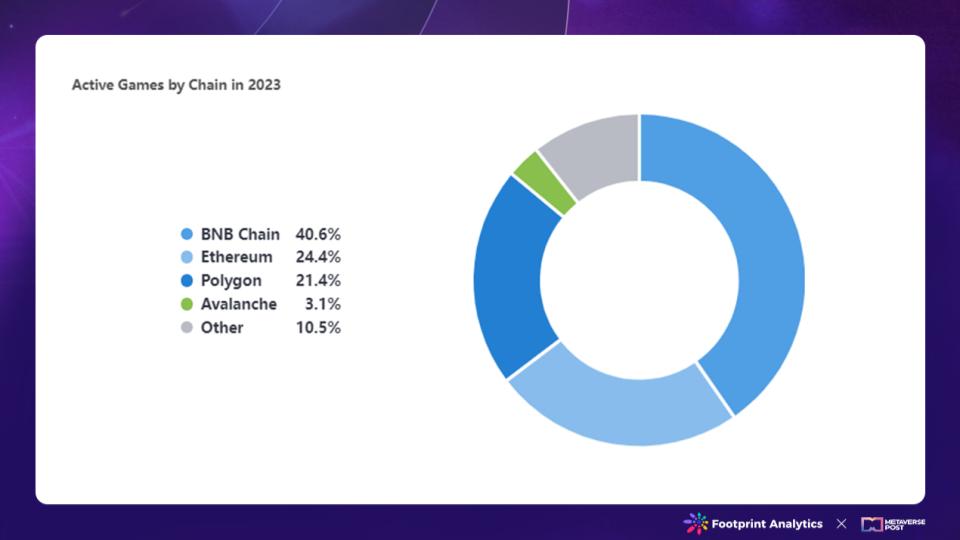

Games on established blockchains such as BNB Chain, Polygon, and Ethereum still account for 80% of all active games and dominate the current market

2023 is of great significance to the development of Layer 2 blockchain, with many major projects emerging. In July, SUI showed amazing results, proving to the world the powerful potential of Layer 2 blockchains to handle a large number of transactions. Then in August, Base combined social and entertainment elements and launched friend.tech, which quickly became a hot spot in the industry. By November, Ronin quickly attracted the attention of the industry due to the outstanding performance of Axie Infinity and the launch of Pixels on the Ronin chain.

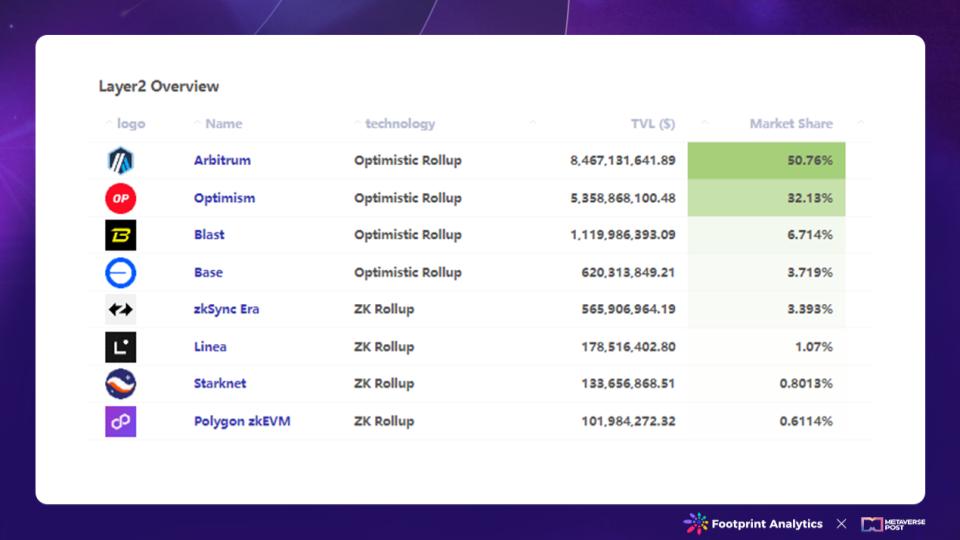

Layer 2 Overview

On December 31, 2023, Rollup technology has achieved rapid development, and the total locked value (TVL) of Arbitrum and Optimism combined accounted for up to 83% of the market share. Optimistic rollups are particularly popular in the DeFi space due to their user-friendliness. Layer 2 blockchain for games is still trying to find a direction and strive for a larger market share.

Active games on each chain in 2023

In 2023, established blockchains such as BNB Chain, Polygon and Ethereum still own 80% of active games on the market, showing that established blockchains still dominate the market.

Investment and Financing Situation in 2023

Ranking of large financing events in 2023

In terms of investment in the blockchain game industry in 2023, affected by the FTX incident and regulation, industry investment has slowed down rapidly. Throughout 2023, a total of 131 financings were completed in the gaming field, totaling US$983.9 million, a significant decrease from US$2.6 billion in the previous year. In the market environment of 2023, investors have become more cautious than before.

The annual financing amount of the game industry

Among these investment events, a highlight comes from gaming giant Nexon, which is currently valued at $27 billion. Nexon has invested $100 million to expand its Web3 intellectual property project, MapleStory Universe.

Outlook for 2024: Top games rise, more Web2 users enter blockchain games

The market is looking forward to the emergence of top blockchain games

As the markets expectations for high-quality games such as AAA games grow, the blockchain game industry is poised for development.

The development cycle of games usually exceeds two years. Therefore, following the substantial injection of funds in 2022, it can be speculated that the development of many games should have made substantial progress.

Web2 giants are gradually entering Web3. When the bull market arrives, they will have a profound impact on the blockchain game industry. These game studios with traditional game development experience can inject their expertise into Web3 to create better blockchain games. At the same time, the integration of blockchain technology is expected to improve the transparency of in-game assets and economic cycles, the security of the game, and bring more opportunities.

GambleFi may be poised for growth, but still faces regulatory challenges

Rollbit

In the context of a presidential election year, as the sports betting industry continues to grow, platforms like Rollbit will achieve significant results. Its 2023 revenue is reported to be approximately $300 million. The platform uses on-chain burning to track revenue, which has attracted attention but its accuracy has yet to be verified.

Despite regulatory challenges, GambleFi has become one of the most profitable applications in the crypto space, demonstrating the huge potential for blockchain-based gambling platforms.

Many people develop games based on encryption technology on traditional social platforms in an attempt to gain users

Animoca Brands

The blockchain industry is always looking to include more users. This year, it has become a trend to use social platforms such as Telegram and X (Twitter) to reach a large user base. Animoca Brands’ partnership with The Open Network (TON) blockchain is an important example in this area. As the largest validator of TON, Animoca Brands will help Telegram users switch to Web3. This cooperation will not only reach more users, but will also bring practical value and use to Web3 applications.

The continued development of blockchain games, making full use of the advantages of existing large platforms and combining them with the innovative capabilities of blockchain technology, will promote the popularization of the blockchain industry and play a key role in the future development of the industry.

Footprint AnalyticsIs a blockchain data solutions provider. With the help of cutting-edge artificial intelligence technology, we provide the first code-free data analysis platform and unified data API in the Crypto field, allowing users to quickly retrieve NFT, Game and wallet address fund flow tracking data of more than 30 public chain ecosystems.

Product Highlights

For developersData API

for GameFi projectFootprint Growth Analytics (FGA)

Big data batch download functionBatch download

All provided by Footprintdata set

Check out our Twitter (Footprint_Data)Learn more about product updates