The new year begins, and the Crypto party also starts from ETH Denver. Although the attention of ETH Denver 2024 has declined due to the booming market, as a benchmark for industry narrative, this conference still attracted tens of thousands of practitioners.

Judging from the number of discussions and surrounding activities, Restaking (re-staking), Modularity (modularity), Crypto+AI, and DePIN are undoubtedly the narratives that everyone is most concerned about, especially Restaking, whose ecological development has exceeded many people’s expectations. , catalyzed by the ecological talker EigenLayers lock-up amount exceeding 10 billion US dollars, Restaking Summer has also become a certain consensus.

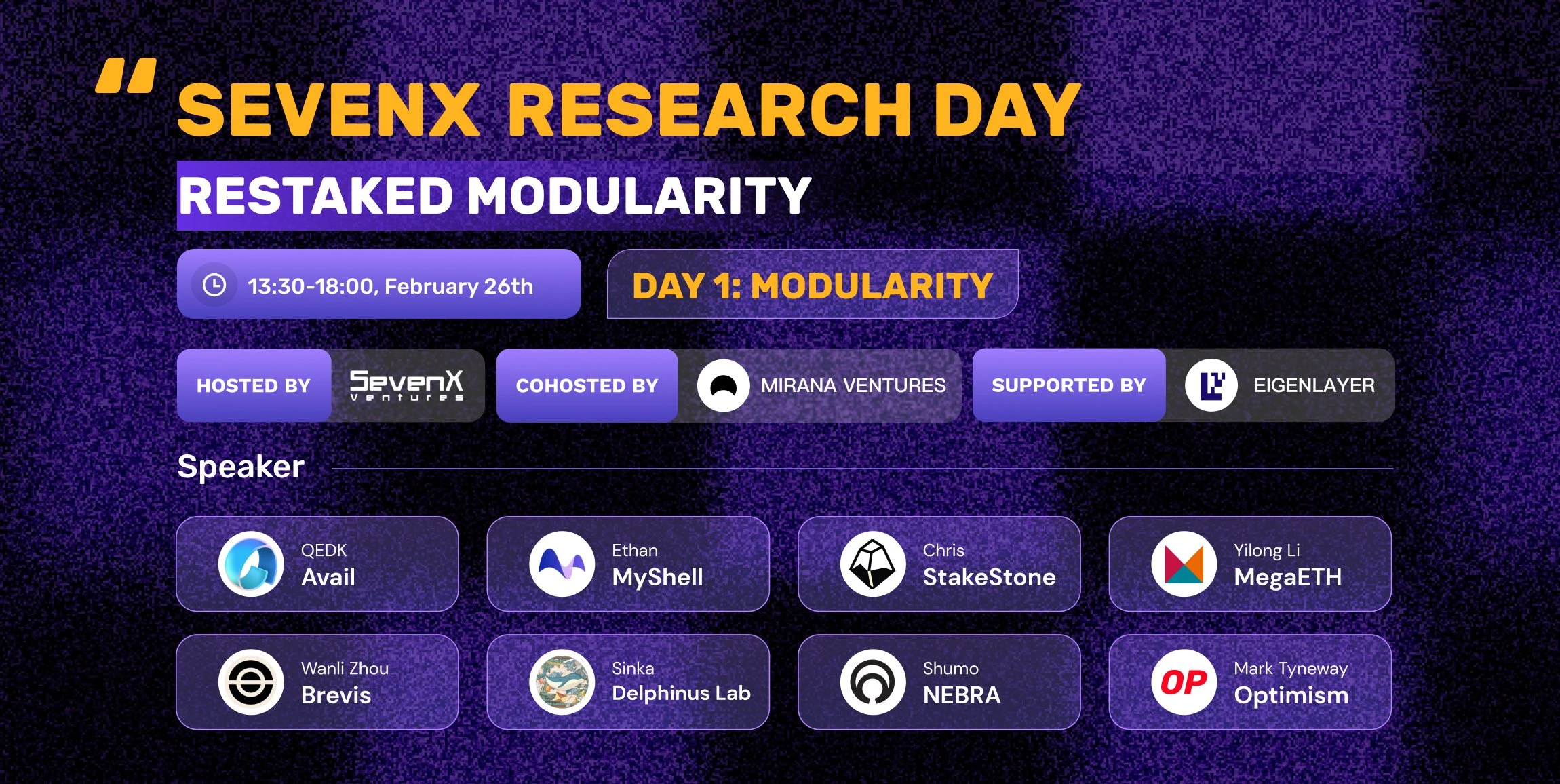

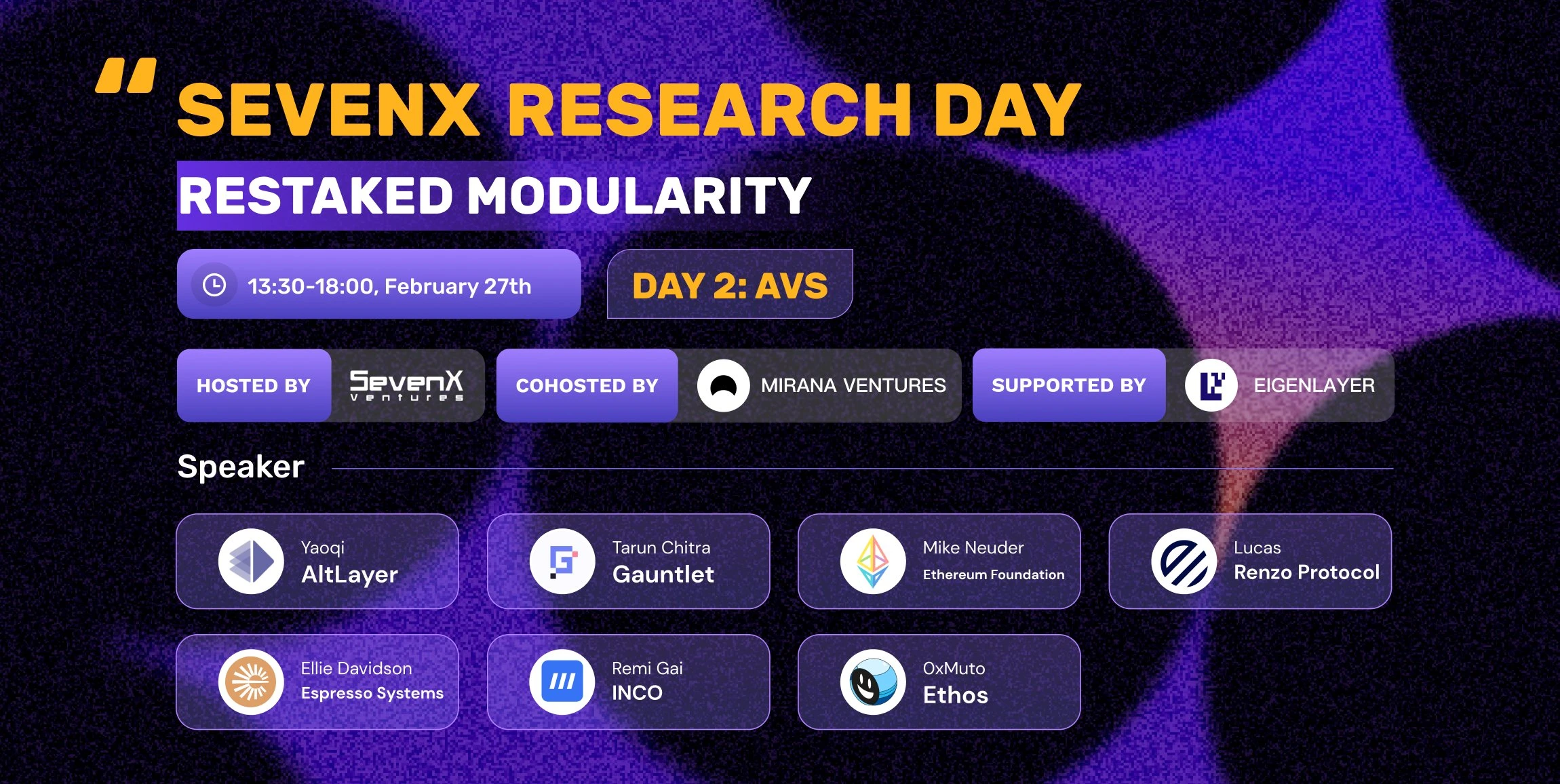

As a fund that has focused on and continued to track and research the Restaking and Modularity narratives from the early days, SevenX, with the support of EigenLayer, held a two-day Research Day with Mirana Ventures during ETH Denver 2024. Leading researchers in the fields of Restaking and Modularity, founders of first-line projects, and core members were invited to discuss related cutting-edge topics.

This Research Day is an invitation-only event and has won unanimous praise from guests and participants for its high-quality output of ideas and in-depth discussions. The following is a brief review of the wonderful speeches of the 14 guests.

Opening Talk - Arun, Research Fellow at Mirana Ventures

Last year, Vitalik mentioned that this year will be the year when cryptocurrencies must go to Rollup. Arun believes that this is largely due to the fact that designs such as modularity we are seeing are becoming a reality, and people are starting to start from almost every possible readable Build the Rollup in a block. With all the underlying innovations brought together, people can really start to explore the large design space that Web3 can provide. For the past year or so, his interest has been primarily focused on zero-knowledge proofs (ZK), and the market has seen an incredible acceleration over the past few months. Arun believes that ZKEVM has the potential to improve all consensus at a speed that is realistically feasible for one block type. One promising situation is that you can actually write any kind of program in almost any language and have it settle into a Rollup, which will produce results for games or any situation where the precipitation calculation can be verified. Creative implications through which people are able to spread funds and security to their applications. Finally, Arun mentioned that as the future of blockchain innovation, restaking and modularity are taking center stage. Mirana Ventures is excited to be one of the earliest backers of EigenLayer and Mantle (the first Layer 2 to use EigenDA for off-chain data availability, and continues to be an early adopter of AVS-based technology).

The future of the creator economy: How AI and Crypto drive innovation - Ethan, MyShell Lianchuang

Ethan said that generative AI technology allows everyone to become a creator and build interactive artificial intelligence applications. Modularization of the application building process requires a flexible financial system to incentivize creators and model contributors. At the technical level, MyShell uses state transition diagrams to coordinate different types of models, results, coding, etc. Creators can use different types of models to build more complex AI applications. In terms of token economics, MyShell is based on the Proof of Usage (PoU) model to encourage users to use and build AI applications. When users interact with applications, they receive token rewards; it incentivizes AI creators, model developers and investors to own and share and trading application models.

How Avail builds Rollups unified layer - QEDK, senior RD engineer at Avail

QEDK believes that as the number of rollups increases, the problem of fragmentation becomes more prominent. Avail Trinity will be able to solve this problem and build a more flexible and scalable blockchain ecosystem. Avail Trinity consists of three components: Avail DA, a scalable and trustworthy data availability layer; Avail Nexus, which solves Rollup interoperability issues and gradually decentralizes Sequencer; and Avail, a shared security economic layer that provides additional security. Fusion. Avail will launch the Avail mainnet and Avail unified framework (including Nexus and Fusion) in 2024. In the future, it plans to further improve the scalability of Rollup, reduce the cost of use during L2 congestion, and at the same time develop multi-level KZG proofs, optimize proof efficiency, and implement Batch verification service, supports recursive proof of blocks, interacts with vector bridge, etc.

The standard for Omnichain liquidity in the modular era - Chris, core contributor of StakeStone

Chris said that modularization is the future and an inevitable trend. As a comprehensive distributed infrastructure, StakeStone attaches great importance to competition and is highly concerned about growing with the emerging ecosystem. Therefore, it has also obtained 1 billion liquidity in the virtual reality field. When handling liquidity for users, StakeStone noticed that each chain has its own strengths and weaknesses, some focus on the community, and some build a solid technical foundation; some focus on games, some focus on social networking, and some focus on DeFi. “From our perspective, they have the same needs and pain points for liquidity on the cost side of their application layer, so they need liquidity to build their ecosystem, and that’s where StakeStone comes in.”

Understanding the performance of the Ethereum execution layer - Yilong Li, founder of MegaETH Labs

Yilong Li shared an analysis of Reth execution client performance, discussing bottlenecks in the execution phase and performance indicators of each opcode. Yilong Li proposed ideas to improve L2 execution performance. L2 is the best place to innovate in the performance dimension because it allows for different types of nodes that vary in number and hardware requirements. We came up with the vision of MegaRollup where every L2 is capable of delivering high throughput and large-scale state Support. Yilong Li also emphasized the importance of decentralized sequencers and proposed the idea of building L2 on high-bandwidth DLN. Finally, Yilong Li believes that if Ethereum becomes a bottleneck restricting the development of L2, a dedicated and highly optimized settlement layer can be established on top of Ethereum in the future.

Intelligent ZK coprocessor - Wanli Zhou, Brevis Ecosystem Leader

Wanli Zhou shared how Brevis ZK processor Brevis SDK supports data-driven DApps and enhances user experience. She believes that existing Ethereum and scaling solutions are not sufficient to meet the needs of data-intensive or complex calculations. Taking the trader loyalty program as an example, on-chain computing is limited, and co-processors can be the solution for such computing tasks. Brevis has built a Brevis SDK written in Go language for developers, which supports customized access to historical data on the chain and the construction of calculation logic. Developers don’t need to understand the details of circuits or zero-knowledge proofs to build data-driven DApps with Brevis’ simplified tools. Actual cases include: Uniswap V4 VIP discount hook built by Brevis in cooperation with Uniswap Foundation.

Convert WASM-based browser applications to Ethereum Rollup via ZKWASM - Sinka, founder of Delphinus Lab

In response to the plight of some emerging or niche blockchains that lack an ecosystem, Sinka introduced a method to introduce browser applications into the blockchain network ecosystem through the network component (WebAssembly) ZK virtual machine. This means that blockchain network developers can work directly with people who can only write HTML, JavaScript or Reth code to plug their applications into their own ecosystems by building browser applications, resulting in browser-based WebAssembly ZK proves and verifies that proof on its own blockchain, turning it into a small application in the ecosystem.

NEBRA: A shared settlement layer for the future Internet - Shumo, founder of NEBRA

Shumo believes that the next generation of blockchain will pay more attention to the application of zero-knowledge proof (ZK) technology. At the same time, the cost of ZK technology needs to be reduced before it can be applied on a wider scale. NEBRA is studying the use of ZK technology itself to reduce the cost of ZK certification. NEBRAs core technology, NEBRA-UPA, is a tool for aggregating and verifying various zero-knowledge proofs. It can reduce verification costs and simplify the use process. It is permissionless, censorship-resistant and gradually decentralized. The NEBRA team is continuing to develop the V2 version and plans to apply it to the shared settlement layer to solve the island problem between L2 and L3 and promote the interoperability and scalability of the blockchain ecosystem.

Modular interoperability and OP Stack - Mark Tyneway, OP Labs (Optimism) co-creator

Mark introduced the design philosophy for building an interoperability stack: first, it must be minimal and flexible, and needs to work with existing tools; this architecture is universal, and it should be able to work with different deployment frameworks. We have been developing this architecture specifically for OP Stack, but others can adopt it if they want. Secondly, functionality needs to be designed from a user perspective. If you dont first consider user experience when designing a feature, then you may not have room to survive, and users may not like it. Furthermore, do not force the design of key attributes to include cross-chain messages, otherwise it will add a lot of complexity. If you are forced to include any kind of cross-chain messaging, the best design approach is to use a queue. “Optimism’s approach is to simplify transactions because we want to be more scalable. There is no forced inclusion of cross-chain messages, (which is) simpler and easier to reason about.”

Restaked Rollup accelerates Ethereum, Yaoqi, founder of AltLayer

Yaoqi said that the emergence of various Rollup Stack solutions has made Rollup deployment easier and easier, and there may be thousands of Rollups by the end of the year. However, these Rollups have many problems such as a single sequencer and fragmented liquidity. In response to the above problems, Yaoqi introduced the concept of Resttaken Rollup based on EigenLayer. Restaked Rollup is not a Stack solution, nor a single Rollup network, nor a new Rollup proof mechanism, but a modular framework that can be used with any Rollup Stack to provide further decentralization. and security, achieving faster finality while ensuring economic security.

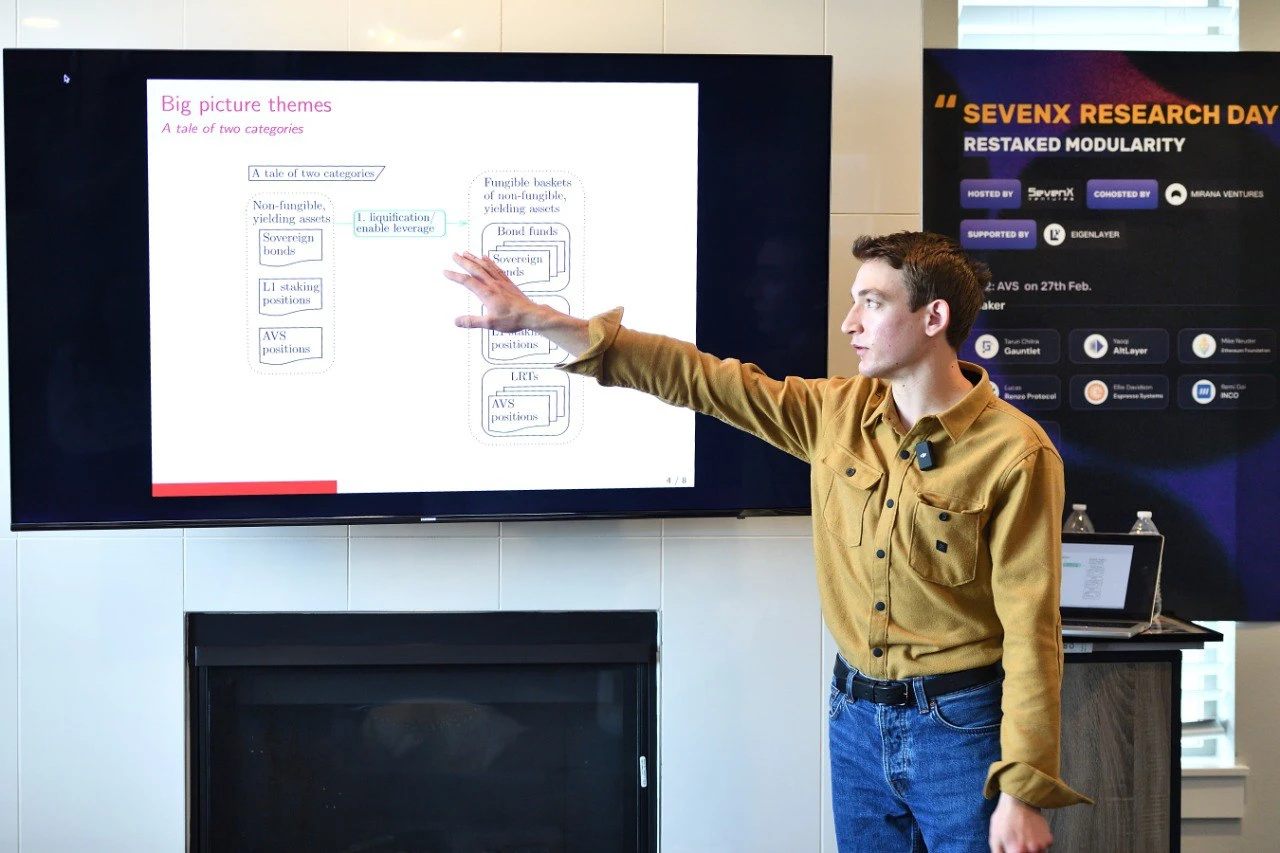

“The Risks of LRT” – Tarun Chitra, CEO and co-founder of Gauntlet Mike Neuder, researcher at the Ethereum Foundation

Tarun and Mike shared at the event that the Liquidity Re-pledge Token (LRT) came into being due to three factors: the difficulty of selecting AVS, the complexity of client operation, and the need for users to invest liquidity in DeFi. However, LRT also There are five levels of potential risks that require attention.

First, there are risks related to liquidity and leverage. Compared with AVS positions that are directly re-pledged, LRT has higher homogeneity attributes, so it is easier to be borrowed. There may be leverage hidden in it that many users are not aware of; 2. The third is the risk related to income. Compared with the AVS position that is directly re-pledged, the income model of LRT is more complex, and there may be interest rate issues. The third is the risk of persistence. Compared with the AVS position that is directly re-pledged, LRT The redemption is not only restricted by Layer 1 itself, but also by each relevant AVS and the LRT protocol itself; the fourth is the risk related to slashing. Since LRT will involve different AVS, different slashing needs to be considered. Conditions, in extreme cases the principal may suffer a more serious impact; fifth, regarding the risk of investment portfolio selection, LRT needs to consider different AVS, different AVS node operators, different Layer 1 node operators, different collaterals, etc. etc., which introduces additional complexity.

“ezETH Restaking” —Lucas Kozinski, founder of Renzo

Lucas introduced the utility of Renzos LRT token ezETH at the event. Lucas said that unlike some other protocols that only accept native ETH or LST tokens, Renzo also supports users to deposit native ETH or LST tokens, but will only generate ezETH, an LRT token. This is to prevent liquidity. Separation makes it easier for Renzo to build composability around ezETH in various aspects such as DEX, lending, and oracles.

“Preconfirmations” – Ellie Davidson, Espresso core developer

Ellie said that pre-confirmation is a service that is taking shape, and it may have a significant impact on different sequencers, rollup protocols, etc. At the current stage, pre-confirmation may just be a commitment obtained from a centralized sequencer (committing that a certain transaction will be submitted to Layer 1 by the sequencer), but in the long term, pre-confirmation needs to be done A clearer definition. Ellies definition of this is that pre-confirmation is a commitment with financial guarantees to ensure that the data will be finally confirmed on Layer 1 and meet the conditions set by the user.

Cosmos meets Ethereum: FHE Confidential Computing Network on EigenLayer - Remi, founder of INCO

Remi introduced the positioning of Inco at the event, saying that Inco is both a modular Layer 1 that integrates fully homomorphic encryption (FHE) and EVM, and can also be used as a universal privacy layer for Web3. Remi further explained the importance of privacy to blockchain. In addition to the public’s basic demand for privacy, many institutions are also unable to build on existing blockchains due to the need to properly handle sensitive data. In addition, some specific projects such as games types of applications also have a strong need for privacy. With Incos privacy services, developers will be able to explore more potential use cases around games, DeFi, commercial activities and more.

As a venture capital institution that focuses on cutting-edge innovation and research-driven development, SevenX Ventures hopes to connect and collaborate with frontline researchers, developers and leading project entrepreneurs through the Research Day series of activities, and spread advanced insights into focus narratives. The first Research Day was held in Istanbul during DevConnect 2023 to discuss the cutting-edge Infra that the Multi Rollup world needs. This event in Denver is the second stop, focusing on Restaking and Modularity. Let’s work together Looking forward to the next stop!

About SevenX Ventures

SevenX Ventures is a research-driven venture capital firm that mainly invests in the frontier areas of Web3, with approximately 300 million funds under management. Our portfolio team comes from more than 10 countries and regions around the world. Representative portfolios include Flashbots, Manta Network, Altlayer, Renzo, Matr1x, AI Arena, Curio, YGG, DODO, Mask Network, etc.

About Mirana Ventures

Mirana Ventures is a theory-driven, independent investment fund with a long-term perspective and a desire to continue to help our portfolio grow. Since its establishment, we have invested in more than 150 companies, such as Ethena (seed round), Scroll (seed round), Eigenlayer (Series A), and 27 funds (including established funds such as Dragonfly, Pantera, Folius Ventures, Bankless Ventures, etc. emerging funds).