This article comes from:Cointelgraph & Decrypt, original author: Ana Paula Pereira Sander Lutz

Odaily Translator - Moni

40 trading days after the listing of the spot Bitcoin ETF, Nasdaq-listed BlackRock IBIT ushered in an important milestone. The number of Bitcoins it holds has exceeded that of Michael Saylors listed company MicroStrategy. Number of Bitcoin holdings.

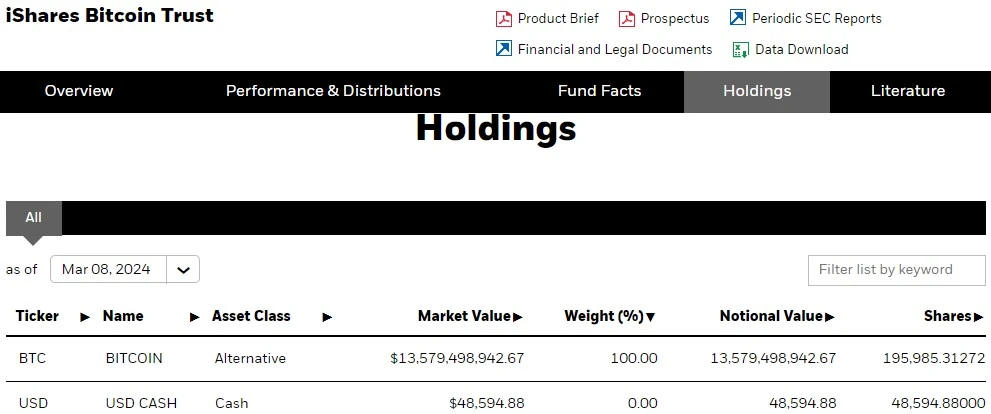

Data shows that as of March 8, IBIT held a total of approximately 195,985 BTC (as shown below), with a market value of more than $13.579 billion, while MicroStrategy’s Bitcoin holdings were approximately 193,000 BTC, and on the same day, Bitcoin Breaking through $70,000 for the first time in history.

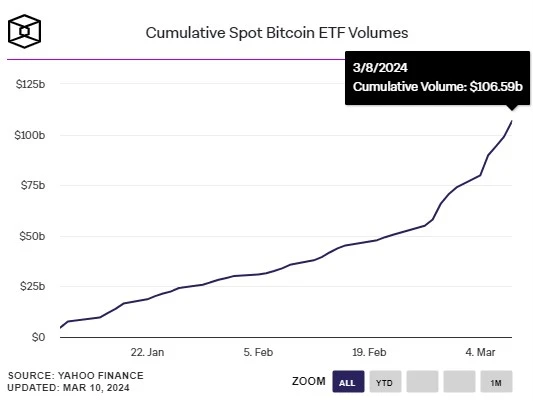

Not only that, but the cumulative trading volume of the spot Bitcoin ETF has “easily” exceeded $100 billion in less than two months since its launch. Data updated by Yahoo Finance on March 10 showed that as of March 8, cumulative spot Bitcoin trading volume had hit $106.59 billion.

In fact, unknowingly, a battle for Bitcoin reserves has begun among U.S. listed companies.

Will the Bitcoin reserves of U.S. listed companies/funds become the “three major forces”?

As the price of Bitcoin reaches an all-time high, companies/funds listed on the US stock market are also accelerating their accumulation of Bitcoin. They are devouring Bitcoin at a speed that even exceeds the speed at which Bitcoin is mined. According to the current market trend, US listed companies have formed a three-headed trend, and these three heads are: spot Bitcoin ETF, MicroStrategy, and Tesla (and SpaceX).

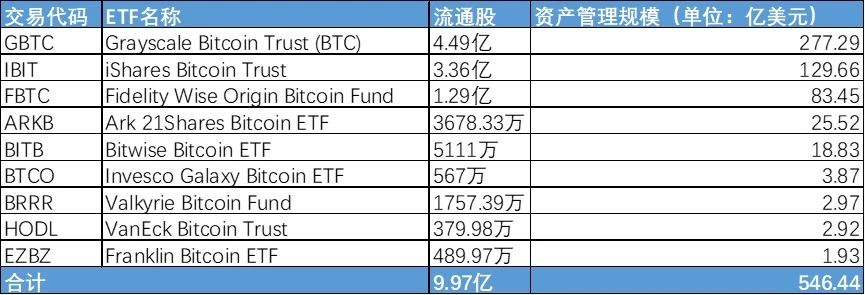

First, let’s take a look at the spot Bitcoin ETFs listed on the U.S. stock market, according to data compiled by BitMEX Research, with the exception of Grayscale’s GBTC, the remaining nine spot Bitcoin ETFs have been increasing their Bitcoin reserves since receiving approval from the U.S. Securities and Exchange Commission to list on January 11.

The reason why issuers of spot Bitcoin ETFs continue to accumulate BTC cannot be ignored, and that is regulatory requirements, because in the previous approval conditions for spot Bitcoin ETFs, the U.S. Securities and Exchange Commission required the creation of so-called cash rather than so-called physical objects. This means that fund issuers must use cash to buy Bitcoin when they create shares, or sell Bitcoin for cash when they have excess shares.

Of course, one thing is undeniable. ETFs, as stock-like products, not only provide more capital-efficient trading options, but also open the door to increased leverage. Institutions are expected to gradually enter cryptocurrencies while a large number of retail users flood into the market. Market, increasing positions will also bring more confidence to institutional and retail investors.

MicroStrategy, another US-listed company, can now be regarded as a veteran in the Bitcoin market., and every time you add Bitcoin, you can always hit the right time.

Just three days before Bitcoin exceeded $70,000 for the first time on March 8, MicroStrategy suddenly issued an announcement announcing plans to sell a total of $600 million in principal to qualified institutional buyers through a private placement, subject to market conditions and other factors. Convertible senior notes due in 2030. One day later, they announced that they planned to expand the issuance of convertible senior notes to US$700 million.

At the end of February, MicroStrategy and its subsidiaries purchased approximately 3,000 Bitcoins for approximately US$155.4 million in cash. According to the latest data from Coinglass, MicroStrategy’s current Bitcoin holdings are approximately 129,698 BTC. If based on At a price of over US$70,000, MicroStrategys Bitcoin holdings have gained approximately US$7 billion.

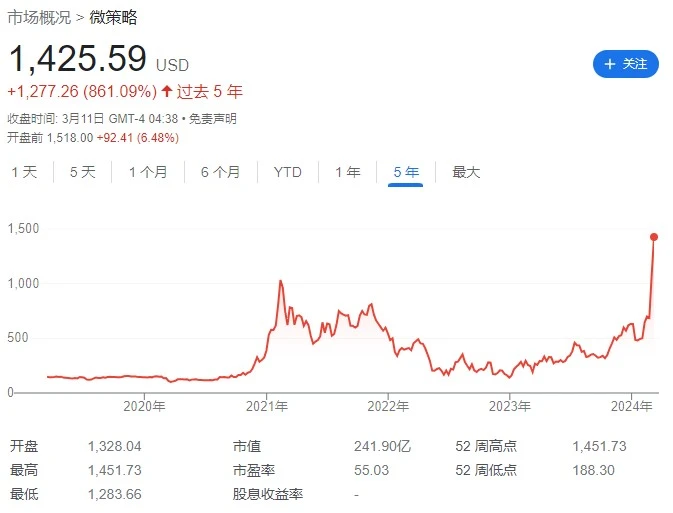

The reason why MicroStrategy is competing for Bitcoin reserves is likely to kill two birds with one stone, because in addition to the increase in value of the position itself, its stock price has also begun to rebound at an accelerated pace. According to U.S. stock data, benefiting from the price of Bitcoin exceeding $70,000, MicroStrategys stock price successfully exceeded $1,400 and rose to $1,425.59 at the close of last week. The increase in the past year has reached 538.82%, and the increase in the past five years has reached an astonishing 861.09%.

At least for now, MicroStrategy’s investment strategy seems to be successful. Since August 2020, the value of Bitcoin held by MicroStrategy has increased several times, bringing generous returns to the company’s shareholders. It is reported that MicroStrategy Chairman Michael Saylors personal wealth increased by about $700 million after the price of his companys stock and Bitcoin continued to rise. Michael Saylor is MicroStrategys largest investor, owning about 12% of the companys shares. He also revealed that he personally owned 17,732 Bitcoins in 2020, with holdings and positions climbing to $2.96 billion as a result, up from $2.27 billion at the start of the week.

Finally, compared to the high-profile spot Bitcoin ETF and MicroStrategy, Elon Musks Tesla and SpaceX seem to be much more low-key, although no relevant data has been disclosed in the recent financial reports (Note: Tesla and SpaceX have not announced their first quarter financial reports for 2024. ), but according to monitoring by the on-chain data analysis platform Arkham, Tesla currently holds approximately 11,510 BTC (worth approximately $780 million) in 68 addresses, and SpaceX holds approximately 8,290 BTC (worth approximately $5.6) in 28 addresses. billion), which means Tesla currently holds approximately 1,789 BTC more than the 9,720 BTC balance reported in its last financial report.

The crypto community has speculated that Tesla has started buying back Bitcoin, or whether the recent change in numbers is due to an accounting error, with some users suggesting that the company may have started buying Bitcoin after its last earnings call and possibly during its next financial call. Report new purchases in .

Why do we need to pay attention to the Bitcoin reserves of listed companies/funds?

Listed companies/funds are important participants in the market economy, and their investment behavior often serves as a benchmark. The holding of Bitcoin by listed companies shows that they are optimistic about the future value of Bitcoin, which may attract more investors to pay attention to Bitcoin, thereby driving up the price of Bitcoin.

Not only that, listed companies/funds holding Bitcoin can also increase the market circulation of Bitcoin and make it easier to trade, which is beneficial to the development of the Bitcoin market and can even demonstrate its openness to new technologies and enhance the companys image.

Market analysts believe that, driven by the increase in Bitcoin reserves by listed companies/funds, it may stimulate more crypto whales to enter the market. For example, shortly after MicroStrategy announced that it would continue to purchase Bitcoin, HOD L1 5 Capital We noticed the buying action of a mysterious whale. After recently adding positions frequently, this address now holds a total of approximately 51,064 BTC, worth approximately US$3.5 billion.

From this perspective, the investment strategies of listed companies/funds also demonstrate their confidence in the long-term value of Bitcoin, which may encourage other crypto whales to continue to hold or increase their holdings of Bitcoin, plus spot Bitcoin ETFs, MicroStrategy , and Tesla’s successful investments may attract other crypto whales to follow suit and may also lead to further increases in the price of Bitcoin.

Of course, Bitcoin is still an emerging asset class and the regulatory environment is not yet complete. Investors need to pay attention to the impact of regulatory policy changes on the Bitcoin reserves of listed companies. Overall, paying attention to the Bitcoin reserves of listed companies/funds can help us understand important information such as market trends, investment risks, company financial conditions and regulatory environment, thereby allowing ordinary investors to make more informed investment decisions.