From March 9 to March 15, a total of 45 investment and financing events occurred in the crypto market, including 12 infrastructure, 9 games, 7 DeFi, 6 NFT, 4 CeFi, 2 wallets, and 1 Depin. , AI 1 pen, Security 2 pen, Launchpad 1 pen.

There were 6 financings worth more than 10 million US dollars this week:

Ethereum layer 2 solution Eclipse completed a $50 million Series A round of financing, co-led by Placeholder and Hack VC.

Polyhedra Network, a provider of Web 3 infrastructure based on zero-knowledge proof technology, has completed a $20 million funding round led by Polychain Capital.

Web3 MMO game platform MetaCene announced the completion of a $10 million private placement Series A round of financing, led by Folius Ventures and SevenX Ventures.

MadWorld, a post-apocalyptic NFT shooting game launched by NFT game studio Carbonated, received $13 million in Series A financing, with South Korean mobile game publisher Com 2 uS leading the round.

Cryptocurrency clearing house ClearToken has completed a $10 million seed round of financing, with participation from Nomura Securities’ digital asset subsidiaries Laser Digital, Flow Traders, GSR, LMAX Digital and Zodia Custody.

Dutch cryptocurrency derivatives exchange D 2

The popularity of investment and financing in the crypto market continues to rise this week, with 12 financing events in the infrastructure field, followed by financing in the gaming field, with Defi, NFT, Cefi, wallet, depin, AI, security, and launchpad narratives attracting investor attention. This weeks financing areas are rich and diverse, and they are concentrated in currently hot tracks. Developing Ethereum layer 2 using the Solana Virtual Machine (SVM) has received the largest amount of funding this week.

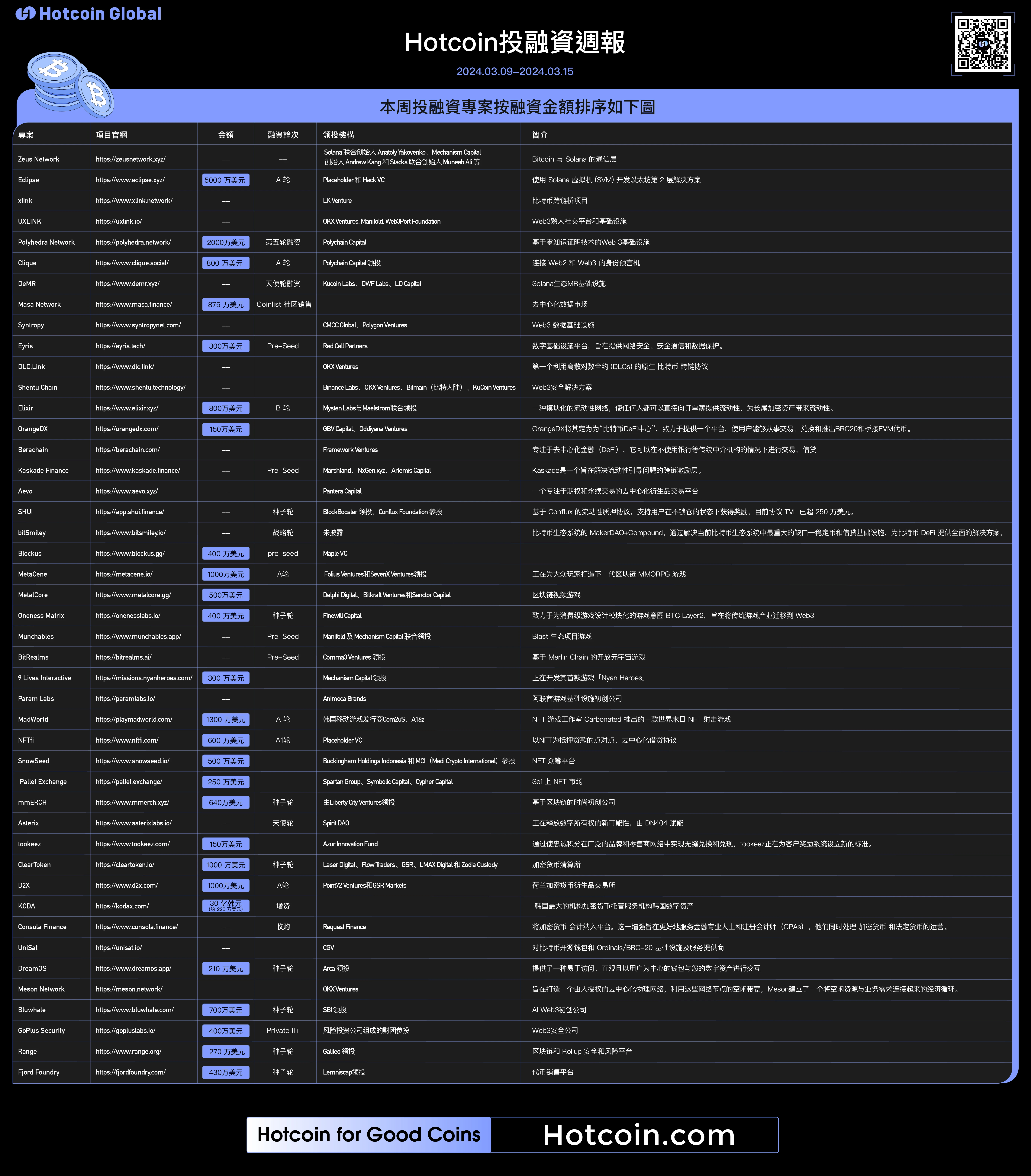

This week’s investment and financing projects are sorted by financing amount as shown below:

infrastructure

PANews reported on March 9 that according to official news, Zeus Network, the communication layer between Bitcoin and Solana, announced a lineup of angel investors, including Solana co-founder Anatoly Yakovenko, Mechanism Capital founder Andrew Kang and Stacks co-founder Muneeb Ali. The venture capital lineup has not yet been announced.

PANews March 11 news, according to The Block, Layer 2 developer Eclipse Labs raised $50 million in Series A financing co-led by Placeholder and Hack VC, bringing the total funds raised to $65 million. Other investors in this round include Polychain Capital, Delphi Digital, Maven 11, DBA and Fenbushi Capital. The project will use the newly raised funds to develop Ethereum layer 2 solutions using the Solana Virtual Machine (SVM). By combining the high performance of SVM with the liquidity of Ethereum, Eclipse aims to provide a differentiated layer 2 solution.

PANews reported on March 14 that LK Venture, a subsidiary of Hong Kong listed company Linekong Interactive, announced on the X platform that it has co-led the investment in the Bitcoin cross-chain bridge project XLink through the Bitcoin network ecological investment management fund BTC NEXT. According to reports, XLink is a Bitcoin cross-chain bridge developed by the AlexLabs team. It aims to connect Bitcoin DeFi with the liquidity of Ethereum and other ecosystems, and provide access to BRC 20, ARC 20, Runes, etc. based on the Bitcoin main network. Liquidity aggregation of protocol assets and Bitcoin Layer 2 ecological assets.

PANews reported on March 11 that UXLINK, the Web3 acquaintance social platform and infrastructure project, has recently completed a new round of financing, with a cumulative financing amount of more than 9 million US dollars. Investors in this round include OKX Ventures, Manifold, Web3Port Foundation, UOB Venture, Comma 3 Ventures, Cypher Capital, Kucoin Ventures, Gate Labs, Forgame (0484.HK), ECV, Signum Capital, 7 UPDAO, etc., and also participated in Stanford Blockchain Accelerator. According to Singapore company registration information, HongShan, Matrixport Ventures, and ZhenFund are also listed investment institutions. Judging from the distribution of investors, investors come from North America, Asia, and the Middle East, including first-tier crypto investment institutions, exchange-led funds, and listed companies as strategic partners. The community revealed that UXLINK will most likely complete another round of financing before TGE.

PANews reported on March 14 that Polyhedra Network, a Web 3 infrastructure provider based on zero-knowledge proof technology, completed a $20 million round of financing led by Polychain Capital, valuing the company at $1 billion. This round of financing also attracted participation from well-known investment institutions such as Animoca Brands, Emirates Consortium, Mapleblock Capital, Hashkey Capital, UoB Ventures, Symbolic Capital, Longhash Ventures, MH Ventures, Arkstream Capital and Web3Port Foundation. The financing was conducted through a token purchase agreement and is Polyhedra’s fifth round of funding in the past two years. The funds raised will be used for the companys global expansion and recruitment of new employees. Polyhedra Networks zkBridge protocol supports 200,000 cross-chain transactions between more than 25 blockchains, utilizing unforgeable zero-knowledge proofs to verify the state and consensus of the sending chain to enable interoperability between networks.

According to Foresight News, according to Cointelegraph, Clique, an identity oracle project that connects Web2 and Web3, completed an $8 million Series A round of financing, led by Polychain Capital, with Bankless, Robot Ventures, Santiago R. Santos, Balaji Srinivasan, as well as Lido, Polygon, Scroll, Other angel investors including the founders of Berachain, Monad, Gitcoin, Axiom, Succinct and Uniswap Foundation participated. Originally, the financing will be used to build a heterogeneous computing coordination network and change the way computing is done. Both on-chain and off-chain applications can access computing and data.

PANews reported on March 15 that according to official news, Solana ecological MR infrastructure DeMR announced the completion of angel round financing, with participation from Kucoin Labs, DWF Labs, LD Capital, JDI, Redline Labs, Meteorite Labs, and Paka. According to reports, DeMR is a decentralized MR infrastructure network (MR-DePIN) built on the Solana blockchain. DeMR said it is preparing for the upcoming airdrop and listing of the DMR token.

Foresight News reported on March 9 that Masa Network, a decentralized data market, announced that it had raised US$8.75 million in a Coinlist community sale, in which the initially allocated 63,554,660 MASA tokens were sold out within 17 minutes, with a total of $5 million was raised, and an additional $3.75 million worth of allocated tokens have also been sold out. In addition, the Masa token MASA will be listed on the centralized exchange on April 11.

According to Foresight News, Web3 data infrastructure developer Syntropy completed a new round of financing, with participation from CMCC Global, Polygon Ventures, HV Capital, Faculty Group, Wave Capital, Moonrock Capital, DVNCI Capital, TRGC Capital, Mapleblock Capital, AntAlpha and Public Works. . This round of funding will be used to build modular, interoperable data infrastructure on major blockchains. Additionally, Syntropy plans to launch its mainnet in the second quarter.

According to businesswire news, Red Cell Partners announced that it has provided Eyris with US$3 million in pre-seed funding. Eyris is a digital infrastructure platform designed to provide cybersecurity, secure communications and data protection.

prnewswire news, on March 14, 2024, OKX Ventures announced its investment in DLC.Link, the first native Bitcoin cross-chain protocol utilizing discrete logarithm contracts (DLCs) to enable Bitcoin to be held in self-hosted wallets Used in DeFi protocols.

Shentu Chain official Twitter reported on March 12 that the Web3 security solution Shentu Chain announced on the , DHVC, Draper Dragon, Fenbushi Capital, Matrix Partners and Lightspeed Venture Partners. This will strategically enhance Shentu Chain’s technical infrastructure and complete the components of Shentu Chain’s security ecosystem.

Decentralized Finance

PANews reported on March 12 that according to Crypto.news, DeFi protocol Elixir announced the completion of $8 million in Series B financing, with a valuation reaching $800 million. This round of financing was jointly led by Mysten Labs and Maelstrom, with participation from Manifold, Arthur Hayes, Amber Group, GSR, Flowdesk, etc.

PANews reported on March 14 that according to official news, Bitcoin DeFi platform OrangeDX announced the completion of US$1.5 million in financing, with participation from GBV Capital, Oddiyana Ventures, NxGen, Triple Gem Capital, x 21 Digital, Alphabit and Spicy Capital. According to reports, OrangeDX has designated it as the Bitcoin DeFi Center and is committed to providing a platform that enables users to engage in trading, exchange and launch BRC 20 and bridging EVM tokens.

PANews March 15 news, according to Bloomberg, people familiar with the matter said that the blockchain platform Berachain raised funds by selling digital tokens, and its valuation will reach 1.5 billion US dollars, in an investment jointly led by Brevan Howard Digital and Framework Ventures With more than $69 million in funding, Berachain is on its way to becoming a unicorn. Berachain did not immediately respond to a request for comment. It is reported that Berachain focuses on decentralized finance (DeFi), which can conduct transactions and loans without using traditional intermediaries such as banks.

Foresight News reported on March 12 that the DeFi incentive protocol Kaskade Finance announced the completion of a Pre-Seed round of financing. Marshland, NxGen.xyz, Artemis Capital, Andromeda Capital, Hercules Ventures, 369 Capital, Crypto Oasis Ventures, as well as VirtualBacon, Brian D Evans, CryptoJack and others participated in the investment, and the specific financing amount was not disclosed.

According to ChainCatcher news, Pantera Capital announced its investment in decentralized derivatives protocol Aevo. It is reported that Aevo is a decentralized derivatives trading platform focusing on options and perpetual trading. It runs on Aevo L2, a custom Ethereum Rollup built using the Optimism stack. This enables Aevo to support more than 5,000 transactions per second and has processed more than $30 billion in transaction volume to date.

ChainCatcher news, according to official news, SHUI, the Conflux ecological liquidity staking protocol incubated by BlockBooster, has completed its seed round of financing, with BlockBooster leading the investment and Conflux Foundation participating. This financing will support SHUIs project development and promote the further improvement of Confluxs ecological infrastructure. It is reported that SHUI is a liquidity staking protocol based on Conflux, which allows users to obtain rewards without locking up their positions. The current TVL of the agreement has exceeded US$2.5 million.

According to coincarp news, bitSmiley completed a strategic round of financing on 2024-03-09. No investors were disclosed in this round of financing. BitSmiley is the MakerDAO+Compound of the Bitcoin ecosystem, providing a comprehensive solution for Bitcoin DeFi by solving the most significant gap in the current Bitcoin ecosystem—stablecoins and lending infrastructure.

game

PANews March 11 news, according to VentureBeat, Web3 game technology stack and payment provider Blockus announced the completion of a $4 million pre-seed round of financing led by Maple VC, with Zhuoxun Yin of Altos Ventures and Magic Eden, Michael Ma of CreatorDAO and Angel investors such as Bryan Pelligrino of LayerZero participated in the investment. He has participated in a16z Crypto’s startup accelerator program. Blockus technology platform can help game studios attract players and build on-chain features for games, including wallet-as-a-service, white-label NFT, fiat currency and crypto payments, etc.

PANews March 12 news, according to Globenewswire reports, Web3 MMO game platform MetaCene announced the completion of a $10 million private placement Series A financing, led by Folius Ventures and SevenX Ventures, The Spartan Group, Mantle EcoFund, Animoca Ventures, Longling Capital, Comma 3 Ventures , IGG and others participated in the investment. The new funding will be used to expand the team and drive user acquisition initiatives.

PANews March 13 news, according to The Block, blockchain video games"MetalCore"Studio 369, the developer of , announced that it has successfully raised $5 million in a new round of financing with participation from Delphi Digital, Bitkraft Ventures, and Sanctor Capital. The funds will be used for the games continued development and upcoming features, such as a dynamic mission system that utilizes AI to generate unique missions and objectives. The game is expected to be open for testing in late 2024.

Foresight News reported on March 12 that Oneness Labs, the developer of Bitcoin Layer 2 Oneness Matrix, completed a US$4 million seed round of financing. This round of financing was participated by Dubai family fund The House of Maktoum and Finewill Capital, a gaming fund jointly established by Wemade and Mirana. . Oneness Matrix developed by Oneness Labs is committed to designing modular game intent BTC Layer 2 for consumer games, aiming to migrate the traditional game industry to Web3. Oneness Matrix will be released in beta in the second quarter of 2024, and the first game on the platform will be released in late 2024.

According to Foresight News, Blast ecological project Munchables completed a Pre-Seed round of financing, with Manifold and Mechanism Capital co-leading the investment, Selini Capital, Hidden Street, Duplicate Capital and other institutions, Selini Capital founder Jordi Alexander, CBB 0 FE, hype and L (rtrd /acc) and other angel investors to participate. The specific financing amount has not yet been disclosed.

According to Foresight News, BitRealms, an open metaverse game developer based on Merlin Chain, completed a Pre-Seed round of financing, led by Comma 3 Ventures, with participation from Bitvalue Capital, Big Brain Holdings, Negentropy Capital, Bscstation and Cogient Ventures. The specific financing amount has not yet been announced Disclosure.

According to Foresight News, according to VentureBeat, 9 Lives Interactive completed US$3 million in financing, led by Mechanism Capital, with participation from Delphi Digital, Sfermion, 3 Commas Capital, Momentum 6, Kosmos Ventures, Devmons GG and CSP DAO. This round of financing will be used to develop its first game Nyan Heroes.

According to Foresight News, Techinasia reported that Animoca Brands completed a strategic investment in Param Labs, a UAE gaming infrastructure startup, for an undisclosed amount. The funding will be used to accelerate Param Labs scalable Web3 infrastructure while expanding its ecosystem of more than 50 intellectual property partners. The investment also expands Animoca Brands’ presence in the Middle East and North Africa.

nftgators news, MadWorld, an apocalyptic NFT shooting game launched by NFT game studio Carbonated, received $13 million in Series A financing. South Korean mobile game publisher Com 2 uS led this round of financing, with A16z, Bitkraft Ventures, Cypher Capital, Blocore, Goal Ventures and WAGMI Ventures also participated.

NFT

PANews reported on March 11 that NFTfi, a peer-to-peer, decentralized lending protocol that uses NFT as collateral, raised US$6 million in Series A 1 financing led by Placeholder VC, bringing the total funding to US$15 million, according to the team Said: “It is worth noting that co-investors include Maven 11, Launch Labs Inc, Kahuna Ventures. Launched in 2020, NFTfi is a pioneer in NFT finance, facilitating significant on-chain lending. Future plans include enhancing dApp functionality, expanding SDK functionality and the creation of an open settlement layer for NFT finance. NFTfi allows NFT holders to borrow ETH, USDC or DAI from lenders in a trustless P2P manner, using their NFT as collateral.

Foresight News reported on March 12 that NFT crowdfunding platform SnowSeed announced the completion of a strategic round of financing of US$5 million, with participation from Buckingham Holdings Indonesia and MCI (Medi Crypto International).

According to Foresight News, TechCrunch reported that Pallet Exchange, an NFT market on Sei, completed a $2.5 million private placement round, with participation from Spartan Group, Symbolic Capital, Cypher Capital, and angel investors from companies such as Coinbase and MoonPay.

nftgators news, blockchain-based fashion startup mmERCH has raised $6.4 million in seed funding at a post-valuation of $25.7 million. The round was led by Liberty City Ventures, with participation from 6529 Holdings LLC, Christie’s Ventures and Flamingo DAO.

Asterix official Twitter news, Spirit DAO and others participated in Asterix’s angel round investment. Asterix is releasing new possibilities of digital ownership, empowered by DN 404.

Fintech news, Moroccan fintech startup tookeez has successfully secured $1.5 million in funding to enhance its technological capabilities and expansion efforts. The financial injection came from Azur Innovation Fund, a well-known public-private partnership seed capital program in Casablanca, Morocco. tookeez is at the forefront of using blockchain to solve the inefficiencies that plague traditional loyalty programs. By making loyalty points seamlessly redeemable and redeemable across a wide network of brands and retailers, tookeez is setting new standards in customer rewards systems.

optic fiber network

PANews reported on March 15 that according to crypto.news, Dutch cryptocurrency derivatives exchange D2X announced the completion of a $10 million Series A financing, jointly led by Point 72 Ventures and GSR Markets. The funding will be used to attract liquidity, develop new features and grow the business in the EU. D 2 X will be available later this quarter. It is reported that D2X has previously obtained a MiFID MTF license issued by the Dutch Financial Market Authority (AFM), allowing it to operate crypto futures and options exchanges within the EU.

According to Foresight News, according to CoinDesk, cryptocurrency clearing house ClearToken completed a $10 million seed round of financing, with participation from Nomura Securities’ digital asset subsidiaries Laser Digital, Flow Traders, GSR, LMAX Digital and Zodia Custody. The ClearToken scheme is fully regulated in the UK and has initiated the process of becoming recognized by the Bank of England Clearing House. The company plans to offer initial settlement services this year and central counterparty clearing (CCP) services within the next 12-18 months.

According to ChainCatcher news, Korea Digital Assets (KODA), South Korea’s largest institutional cryptocurrency custody service provider, announced that it will receive a capital increase of 3 billion won (approximately US$2.25 million). This is approximately twice KODAs capital, and the target company for the capital increase is unknown. It is reported that KODA is a joint venture of KB Kookmin Bank, blockchain technology company Hatchlabs and blockchain investment company Hashd.

prnewswire March 12, Request Finance is pleased to announce a major development: the acquisition of Consola Finance. This moment marks a significant expansion of Request Finance’s business capabilities to include cryptocurrency accounting into the platform. This enhancement is designed to better serve financial professionals and certified public accountants (CPAs) who handle both cryptocurrency and fiat currency operations.

wallet

Foresight News reported on March 11 that CGV, a Japanese crypto investment research institution, announced a strategic investment in UniSat, a Bitcoin open source wallet and Ordinals/BRC-20 infrastructure and service provider. The specific investment amount was not disclosed.

According to coincarp news, DreamOS completed a $2.1 million seed round of financing. The seed round is backed by visionary investors who believe in the mission of making web3 accessible to everyone. Arca led the round, with additional support from Hack VC, Mantle, Polygon Ventures, Karatage, Selini Capital and No Limit Holdings.

according to

PANews reported on March 15 that according to official news, the DePIN project Meson Network announced that it had received strategic investment from OKX Ventures. The specific amount was not disclosed. The investment will support Meson Network in expanding its current presence of 250,000 nodes in more than 150 countries. According to reports, Meson aims to create a decentralized physical network authorized by people. The Meson network DePIN node is developed using user-friendly technology and can accommodate various hardware, such as personal laptops, servers, IoT devices, etc. Utilizing the idle bandwidth of these network nodes, Meson establishes an economic loop that connects idle resources with business needs.

AI

PANews reported on March 11 that Bluwhale, an AI Web3 startup founded by alumni from Stanford, Berkeley and TikTok, successfully raised US$7 million in seed round financing. This round of financing was led by SBI (including SBI Ven Capital and SBI Decima), Cardano, Momentum 6, Primal Capital, NxGen, Ghaf Capital Partners, Spyre Capital, Baselayer Capital, Dragonfly’s managing partner Haseeb Qureshi, founder of “Guitar Hero” Charles Huang, Oculus founder Jack McCauley and cooperative funds of Animoca (Japan), Gumi, MZ Crypto, Sygnum and Azimut also participated in the investment.

Safety

PANews reported on March 9 that Web3 security company GoPlus Security announced the completion of a US$4 million Private II+ private equity round of financing. This round of financing was participated by a consortium of venture capital firms. GoPlus Security’s total funding now reaches $15 million, including investors such as Binance Labs, SevenX Ventures, Redpoint China Ventures, Avalanche, and Crypto.com. In addition, GoPlus also plans to launch SecWareX, an end-user service platform this month, which will work with third-party user security service companies such as Harpio, Webacy, Kekkai, Trusta and Wallet Guard.

According to Foresight News, blockchain and Rollup security and risk platform Range announced the completion of a US$2.7 million seed round of financing, led by Galileo, Robot Ventures, Volt Capital, Chorus One, Bitscale Capital, Fenbushi Capital, Monoceros, Reverie, Informal Systems, Caballeros Capital and Kahuna participated, as well as angel investors from Binance, Arbitrum and Skip.

Launch pad

PANews March 13 news, according to CoinDesk, token sales platform Fjord Foundry announced that it successfully raised $4.3 million in a seed round led by Lemniscap. The financing also saw participation from Mechanism Cap, Zee Prime Cap, Castle Capital, and several well-known angel investors. The team at Fjord Foundry said the platform offers a range of token sale methods, including its unique Liquidity Bootstrapping Pools (LBPs). LBPs are designed to achieve fair distribution and reduce the risk of market manipulation and robot trading by large traders. In conjunction with this funding round, Fjord Foundry is preparing to announce the launch of a comprehensive chain aggregation service and the upcoming launch of its native utility token FJO.