Original title: 2023 Cryptocurrency Gains by Country》

Original author: CHAINALYSIS TEAM

Original compilation: Yvonne, Mars Finance

2023 has been a year of recovery for the cryptocurrency market, with asset prices and market sentiment improving over the course of the year after a challenging 2022. But how are investors actually doing? In this article, we will share our estimates of cryptocurrency returns in 2023 based on investor interactions with centralized exchanges, including a breakdown of estimated returns by country.

Our approach: How to calculate cryptocurrency returns and estimate returns by country

We use on-chain data to estimate investor returns on cryptocurrencies based on the movement of cryptoassets into and out of services where cryptoassets can be transferred in and out of fiat currencies. Specifically, we first measure on-chain macro flows for a selected set of assets that represent approximately 80% of the total market capitalization of all cryptocurrencies and trade on major centralized exchanges that provide crypto-to-fiat conversion services. We then estimate the collective total return for each asset by measuring the difference between the dollar value of all withdrawals for that asset and the value of all deposits for that asset. This approach is based on the fact that any deposits made to offer offline withdrawal services have the potential to be converted into cash, thereby realizing any gains or losses on that asset. While this approach is not perfect, it provides us with a strong estimate of returns for popular assets traded on centralized exchanges.

Once we use this method to estimate how much users of each service we track are making on crypto assets, we allocate those gains to countries based on their share of web traffic on each services website . This combination of transaction data and web traffic is also the same framework we use to calculate our annual Global Cryptocurrency Adoption Index.

Estimated total cryptocurrency returns in 2023

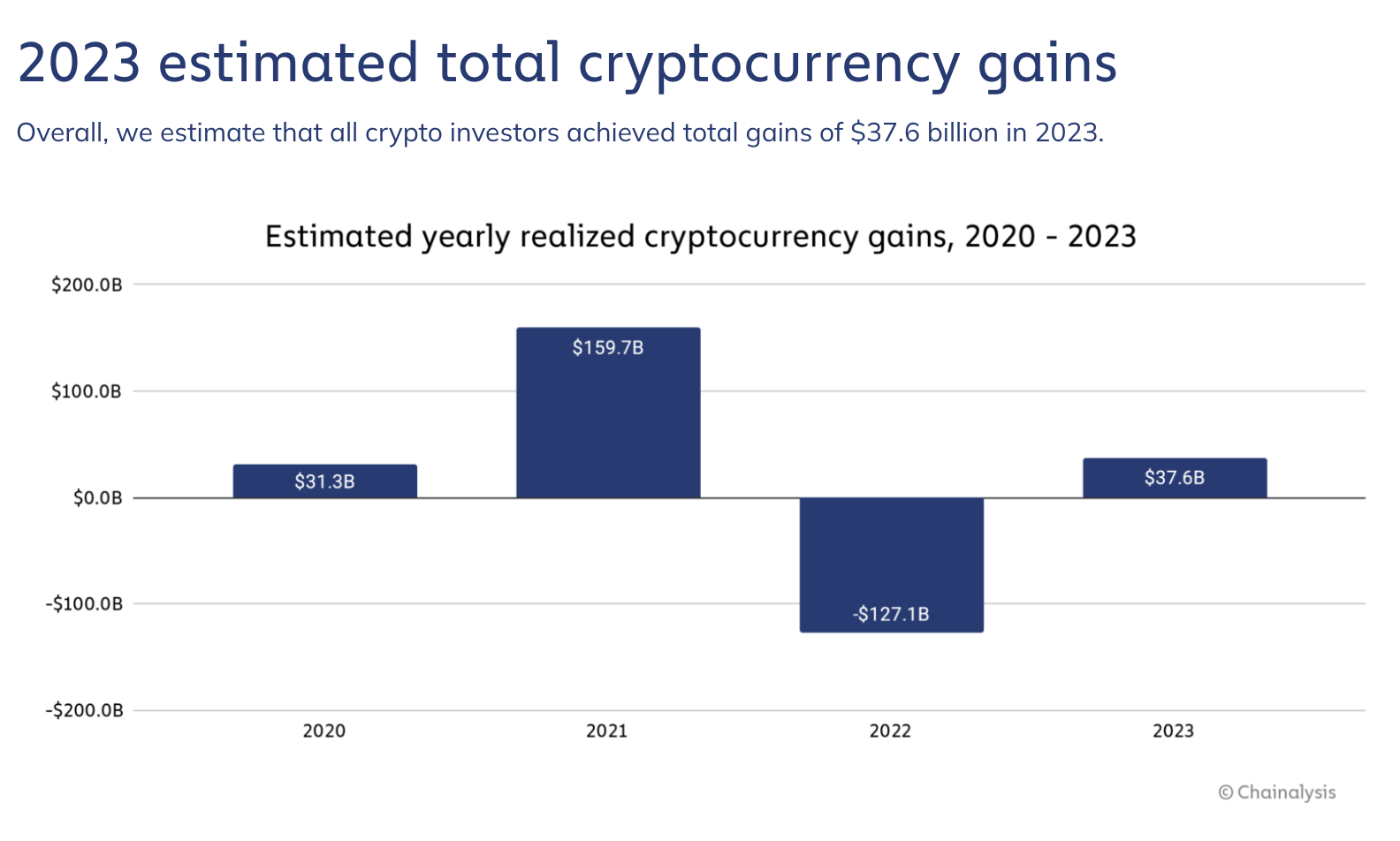

Overall, we estimate total gains for all cryptocurrency investors in 2023 to be $37.6 billion.

While this total is well below the $159.7 billion in gains during the 2021 bull run, it represents a significant recovery from the $127.1 billion loss estimate for 2022. Interestingly, our estimate of total returns for 2023 is lower than for 2021, despite similar growth rates in crypto asset prices in both years. One possible explanation is that investors in 2023 are less likely to convert crypto assets into cash because they expect prices to rise higher, as prices in 2023 did not exceed the previous all-time high at any time, which would One thing is different in 2021.

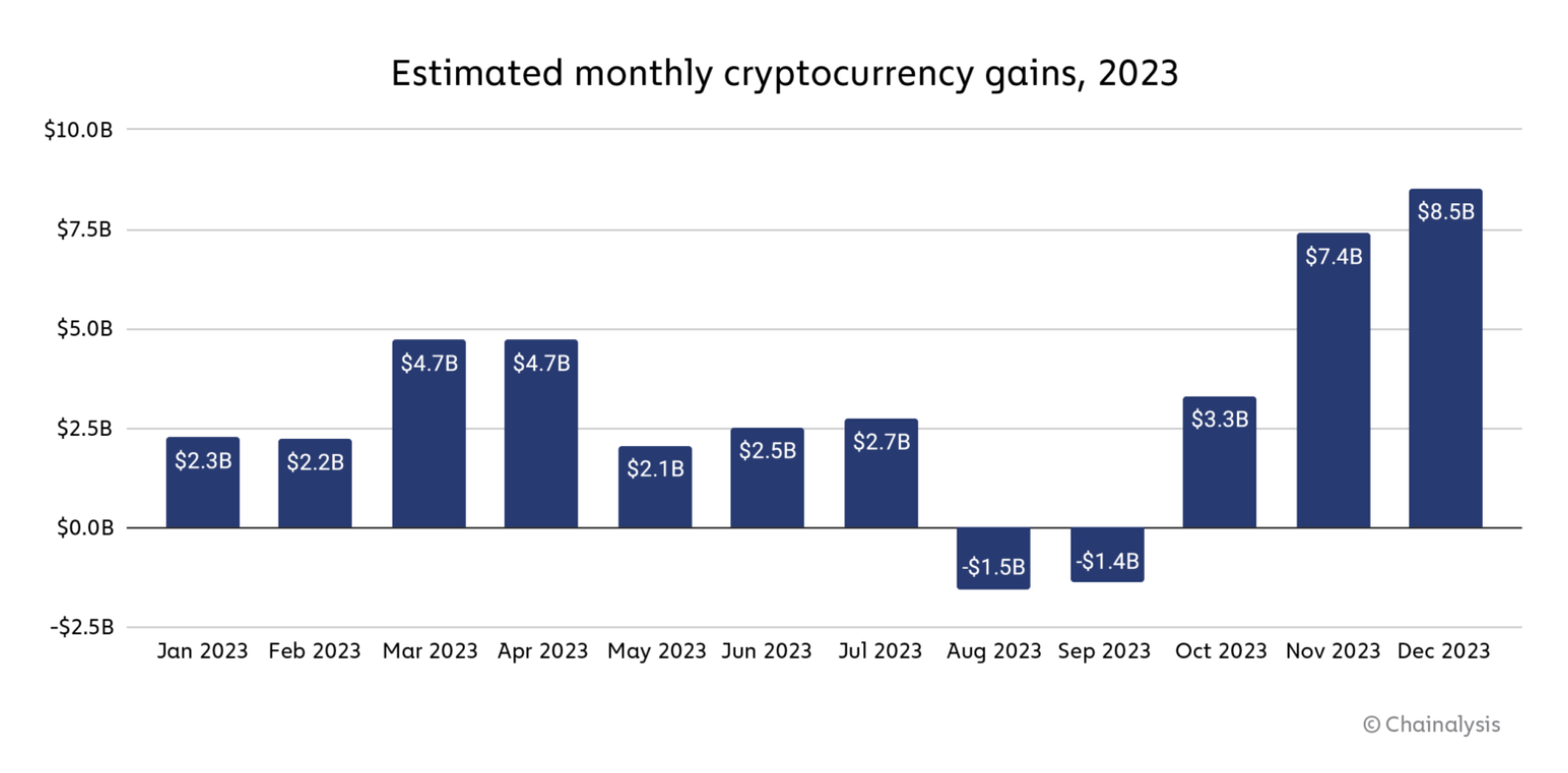

Cryptocurrency gains had been relatively steady throughout the year before two consecutive months of declines in August and September. Gains have since risen sharply, with gains in November and December dwarfed by previous months.

Cryptocurrency revenue estimates by country in 2023

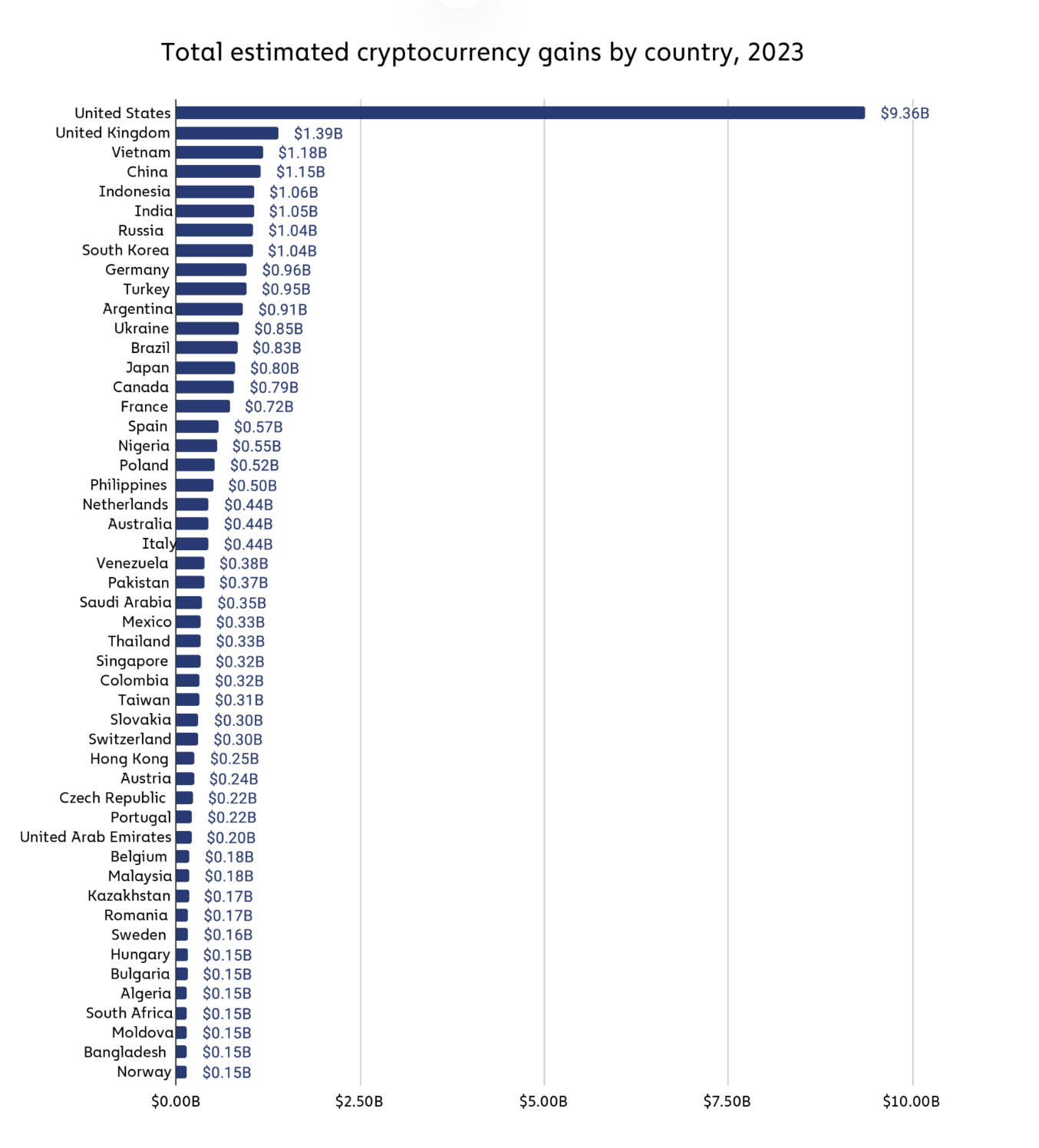

The United States leads the way in cryptocurrency gains in 2023, reaching an estimated $9.36 billion. The UK is in second place, with cryptocurrency gains of approximately $1.39 billion.

Interestingly, we also see residents in some upper-middle-income and lower-middle-income countries appear to have made outsized gains, particularly in Asia, with estimated gains in Vietnam, China, Indonesia and India exceeding $1 billion in all countries Ranked in the top six. As we pointed out in the 2023 Cryptocurrency Geography Report, countries in these income categories, especially low- and middle-income countries, have high rates of cryptocurrency adoption and have remained remarkably resilient even during the recent bear market. Our return estimates suggest that many investors in these countries have benefited from embracing this asset class.

What will happen in 2024?

The positive trends seen in 2023 so far have carried over into 2024, with well-known crypto assets such as Bitcoin hitting all-time highs amid the approval of Bitcoin ETFs and increasing institutional adoption. If these trends continue, we may see earnings more consistent with 2021. As of March 13, Bitcoin was up 65.4% in 2024, and ETH was up 70.2%.