Original author: Wyz Research, DetectiveTON

Why is a public chain that is not listed on Binance and whose ecosystem has not grown yet ranked among the top in terms of market capitalization? This may be a question that many practitioners want to ask.

On March 13, after the overall market fell slightly on 312, the TON public chain token Toncoin shot up to 4.5 U and then fell back. TON ecological projects also rose in response. For example, the TonUP token shot up to 0.95 U, an increase of 20%.

Since TON was listed on the exchange OKX, during the small cycle from 2022 to 2024, the K-line trend of Toncoin tokens formed a clear W shape, forming the W bottom that is the favorite of K-line enthusiasts.

In addition, judging from the transaction data, the price of TON rose by more than 200% in 2024 alone, and by more than 400% within half a year. As the price rose, the trading volume of the token increased sharply. The trading volume in the past three weeks was about 1 month ago. 4 times.

What is even more remarkable is that as the price surged by 4.5 U, TONs total market value exceeded US$15 billion, ranking 11th in the cryptocurrency rankings (excluding stable coins and anchor coins), and its value performance was outstanding.

When we compare these tokens in the top 30 rankings, we also find that TON is the only token that is not listed on Binance. Without the liquidity support of the world’s largest exchange, TON has taken advantage of the current circulation. Occupying the market value high ground.

Compared with other ecosystems, the number of TON ecological projects is not large. So what is driving up the token price and making TON and the ecosystem suddenly emerge?

Find the entry point for analysis from the logic of token rise

We try to find the reasons and explore its subsequent development space. According to basic logic, the rise in token prices is due to the large number of buying orders, which continues to push up the price of a single transaction. This can be clearly seen from the recent transaction volume.

In this process, one is external buying, and the other is promoted by market makers of TON tokens. In the cryptocurrency trading market, market makers can feel the market buying and selling trends at any time through market making data. As Market enthusiasm actively drives prices and keeps prices fluctuating within a relatively stable threshold.

Under this idea, market makers take the initiative to drive prices. In contrast, external investors will buy after making their own judgments, which will be driven by the external environment and some influencers.

Finally, there is another point. Compared with other ecosystems, TONs characteristics may have the ability to attract users and investors, or the ecosystem may form a self-driven trend to promote ecological valuation.

So we try to find the reasons from 3 parts.

They are:

1. Who are the influencers in the bull market context?

2. Who is the market maker?

3. What supports TON’s market value and liquidity?

TON Influencers

When searching for TON on Continuously updated, it currently has more than 2 million subscribers. It can be seen that although Durov has left the Twitter platform, his influence has become greater. Along with Durov’s influence, Telegram’s increasing number of users is growing. According to the latest official news, Telegram has more than 900 million monthly active users.

Before and after publication, most users were discussing the currency holdings of Durov’s account address, which was recently exposed, and held a large amount of TON tokens.

In addition, there are two biggest news clues recently. One is that Durov said he may lead Telegram to IPO. To the outside world, TON and Telegram are inseparable. Telegram is already the biggest trump card for TON users and business possibilities. If an IPO is held, it will give great support to the TON ecosystem from the perspective of value capture.

The second news is that Durov proposed a solution to solve the centralization impact of TON and investment income. Among them, after Telegram used TON tokens as advertising payment tokens, some users were worried that Telegram holding too many TON tokens would be decentralized. cause adverse effects.

In order to limit the share of TON held by Telegram to no more than 10% of the supply, Durov proposed a plan to lock TON at a price lower than the market price for 1-4 years and sell excess TON to investors who have invested in TON for a long time to stabilize TON. ecosystem and reduce volatility.

The above performance once again clearly illustrates that the founder of each project is the communication center of the entire ecology and the representative of ecological legitimacy. Durovs call for orders is the core of TONs strong display and a booster for the development of ecological trends. Judging from Durovs subjective behavior, it can be predicted that TON and Telegram will not divide and conquer under any circumstances in the future, and are closely related. Like the integration of Telegram and TON on Web2 and Web3 models.

When we use Web3 assets or wallets in Web2 Telegram for the first time, you will be surprised to find that the Wallet option will appear on your personal account page. Within Wallet, you can seamlessly exchange cryptocurrencies (using fiat currency or using stable coins, or transactions between other tokens), and in any Telegram chat page, you can fully use Web2 interactive methods to experience Web3 games or perform operations on the chain.

This was perhaps Durov’s most important and disruptive step in pursuing Telegram’s founding ideals.

Who is the TON market maker?

In the first paragraph, we talked about the main internal driving force for the rise of tokens being in the hands of market makers. So who is the market maker of TON? There is no accurate external confirmation, but the direction can be confirmed from the disclosure of the partnership.

Currently, most of the market makers in the industry have capital attributes. In April 2022, the TON Foundation announced the establishment of a US$250 million ecological fund, Toncoin Fund, which has received investments from Huobi, KuCoin, MEXC, DWF, etc.

In addition to exchanges, DWF is a well-known Web3 market maker in the industry. In addition to this investment, DWF Labs has sponsored the TON Hackathon and deployed two verification nodes on the TON blockchain.

By archaeologically reviewing the price performance of DWF Labs’ investment or market-making projects, we can predict the corresponding market-making style. The project list includes CFX, Mask, YGG, SNX, ACH, RSS3, etc., but this is only a general inference in the market.

According to informed sources, the TON Foundation is also cooperating with other mainstream market makers, such as GSR. But what remains unclear is whether any of these market makers have the ability to actively push up TON. Therefore, it remains a mystery who is the market maker pushing up TON.

TON’s ecological performance

Influencers and market makers are one of the main external manifestations, but what is more important externally is substantial growth and construction, which can be regarded as the internal repair of the public chain.

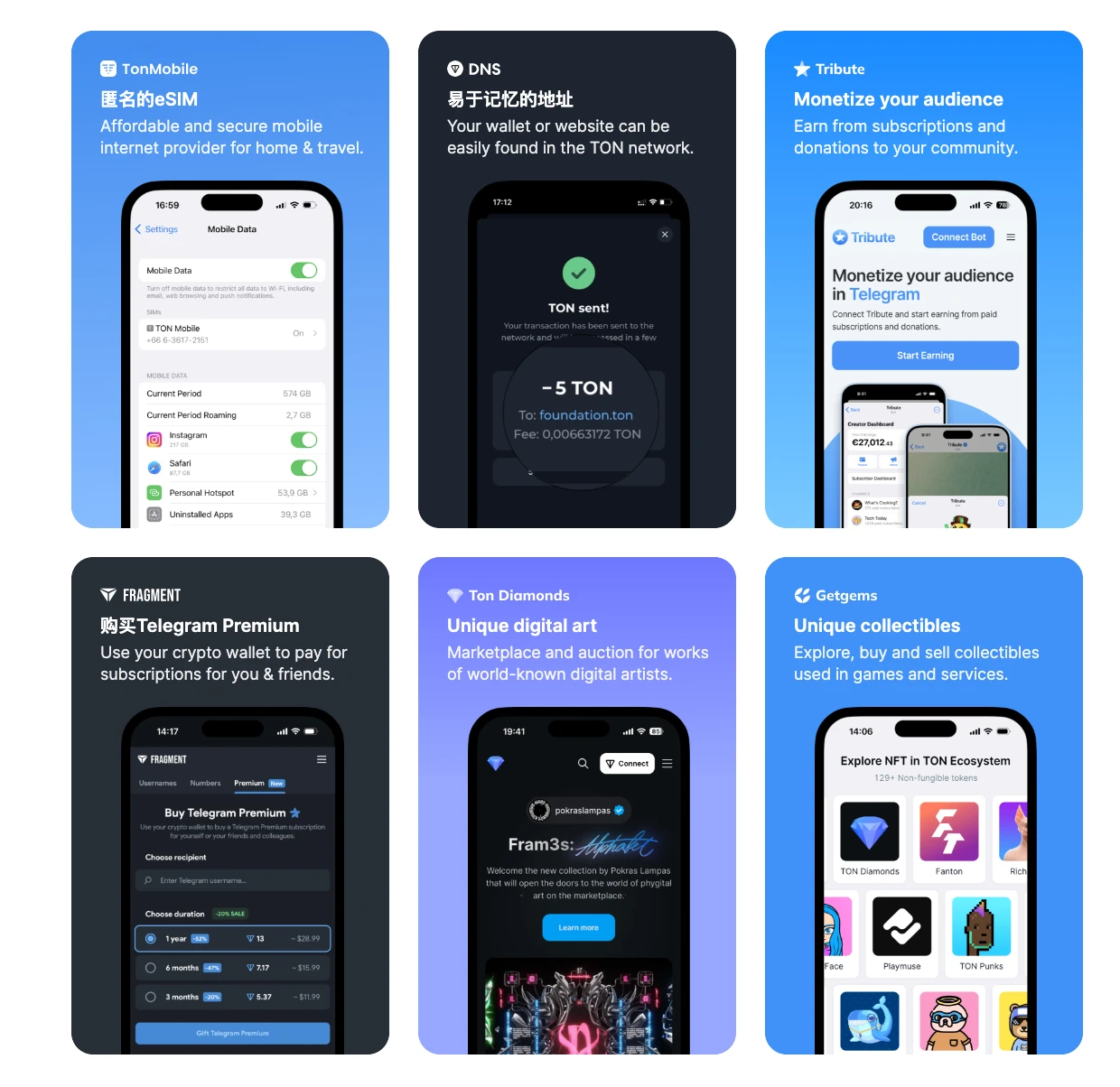

According to statistics from the TON official website, the following data can be obtained. Currently, the entire ecosystem contains 602 application projects, which are divided into centralized exchanges, decentralized exchanges, Staking, wallets, browsers, bridges, public tools, channels, and NFT collectibles. , chat, social, gambling, games, Jettons, NFT services, VPN, development tools, Shopping, Launchpads and other 19 categories.

Examples of DApps promoted by TON

When specifically calculating the number of items in each category, we can conclude that exchanges, wallets, browsers, channels, utilities, NFT collectibles, chat, gambling, and games account for a relatively large number, and if we only Calculating the ecological applications according to the attributes of the applications on the chain, the number is about 300, among which the application types are mainly games, bots, gambling, and Defi.

From the perspective of overall application types, most applications are a fusion of Web2 and Web3, but the corresponding functional boundaries are distinguished. It can be completely said that TON ecological applications integrate the attributes of Telegram and the attributes of Web3. .

And if you have experienced the application use and built-in wallet function in Telegram, you can obviously find that Telegram is the external entrance to TON, and entering Web3 from this entrance is extremely smooth.

The applications in the ecosystem all use Telegram as the entrance and interaction method, and the wallet as the interaction tool.

The wallet also has two transaction methods, Web2 and Web3. You can use USDT to exchange for TON, and perform independent account transfers and interactions with other applications. In addition, it can also support various calls and arouses.

In the end, it can almost be summarized that TON has completed a complete integration within the Telegram ecosystem. Telegram exists in the form of Web2, but it is a super application that exists in the spirit of Web3 and the decentralized core of TON. In Telegram, it has nearly 1 billion users around the world. , TON tokens will become an absolute value expression outlet, and it is these applications that support the value of TON.

After TON shows value as a native token, as applications support native tokens and ecological construction, Defi applications will carry the same value performance, such as Dex, Launchpad, lending, etc. The most obvious example is the skyrocketing period of TON tokens. , TonUP token UP, which is an ecological golden shovel attribute, also completed an increase of about 300% in a short period of time. The related response is fast and worthy of attention. For ecological projects such as games and social networking that are further away from the native token business, they will be the targets of back-end rotation in the correlation reaction.

In addition, the TON Foundation has recently been actively promoting the ecological construction of tracks such as Meme, and has also launched the Open Leagues liquidity incentive plan. The plan has selected core ecological projects including STON, DeDust, TonUP, etc. to jointly promote and provide 50 K TON of support. According to statistics, in the past 6 months, the number of TON ecological projects has increased by about 10%. After the price increased, more projects joined TON and chose Launchpad such as TonUP for IDO.

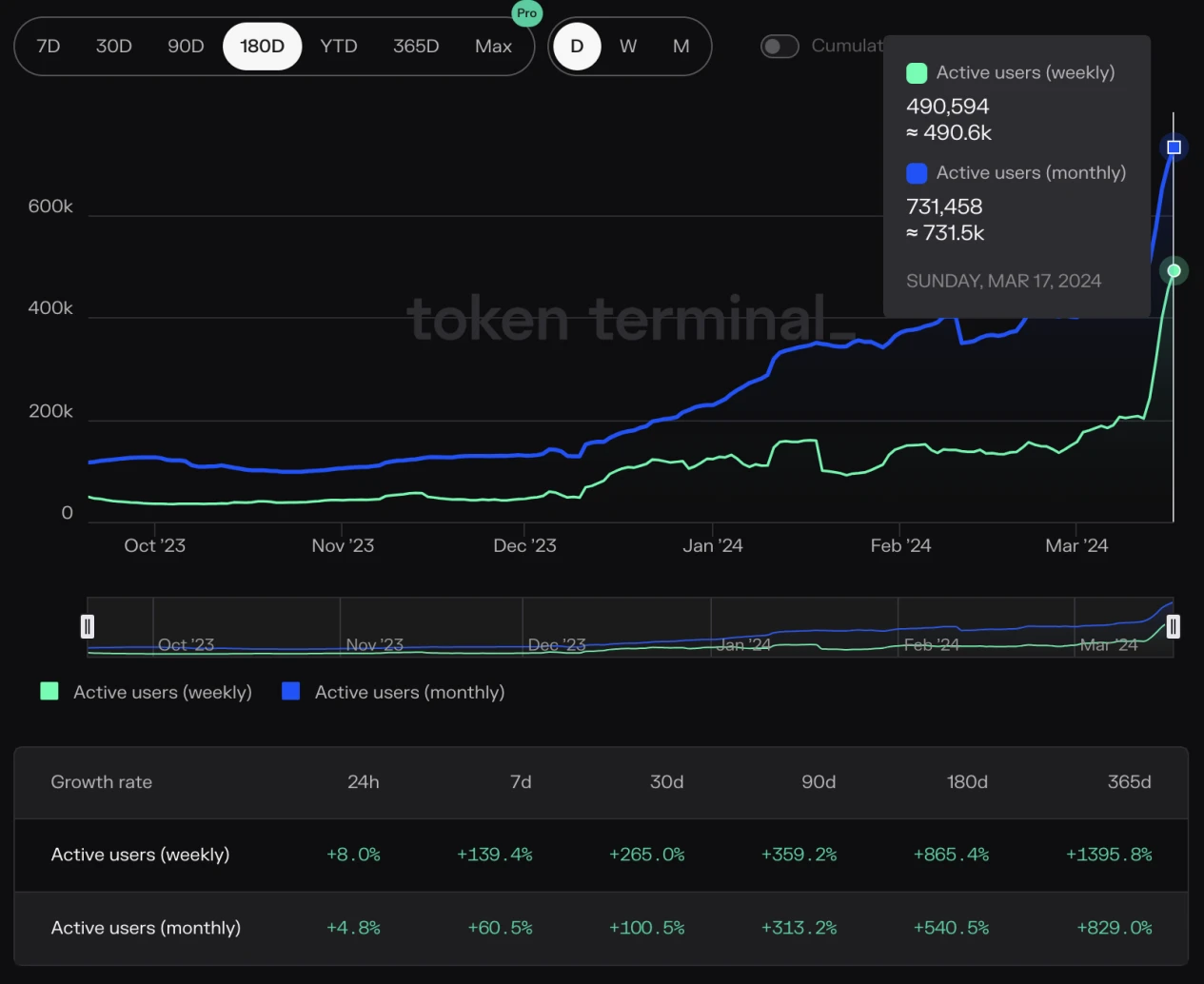

TON’s on-chain data verifies the current growth trend. First, according to DeFiLlama data, the amount of TVL locked on the TON chain reached a new high after the price of TON soared, with approximately 13.86 million TON locked in, with a maximum value of approximately US$56 million. Secondly, according to token terminal data, TON’s weekly active users and monthly active users hit new highs, with weekly active users exceeding 490,000 and monthly active users exceeding 730,000.

TON’s on-chain active user data

TON’s continued value capture in the future

Although TON already ranks among the top in terms of market capitalization, it currently has two obvious characteristics compared with other ecosystems.

First, the number of ecological projects is insufficient and there is huge room for expansion in the future. In addition, among ecological projects, there are not many related projects based on native tokens and mainstream token design businesses.

Secondly, TON currently lacks a huge trading potential. Recently, the news that TON will be listed on Binance has spread like wildfire. After the news is confirmed, TON’s trading potential will be released even more.

We are in a bull market, and expectations for the track and ecology will be converted into buying actions, that is, voting with your feet. The expectations given by TON range from Telegrams 1 billion users, to the performance of the founding team, to ecological expectations. Satisfied the market appetite.

And when we throw away the easily dazzling words from the outside, the core of TON’s value capture still comes from Telegram’s platform value:

1. Valuation of 1 billion Internet users.

2. The liquidity demand generated by using TON within the platform as advertising fees.

3. Telegram’s ability to acquire customers through convenient and smooth marketing communications.

4. Product integration design that completely breaks the entry barrier for Web3.

Referring to any platform with such characteristics, the value that TON wants to capture can be continuously provided by energy sources, and businesses closely related to TON and the ecology, whether it is the golden shovel TonUP mentioned above, or Dex STON, DeDust, or the game Notcoin Wait, you will benefit infinitely.

Of course, long-term gains lie in persisting in holding and building, and the biggest breakthrough point in the short term is still the listing on Binance. Currently, Binance has launched TON’s perpetual contract, and the news that TON spot trading will also be launched is still fermenting. Let’s see. The foundation seems to be actively preparing for its recent actions, and similarly, new and old investors in the market are eagerly awaiting it.

PS: This article mainly shows readers how to track the driving factors behind the skyrocketing price of a token. It does not constitute investment advice. This dismantling logic is more suitable for unilateral trends.