Original title: Weekly: Pause and Effect

Original author: David Duong (Institutional Research Director), David Han (Institutional Research Analyst)

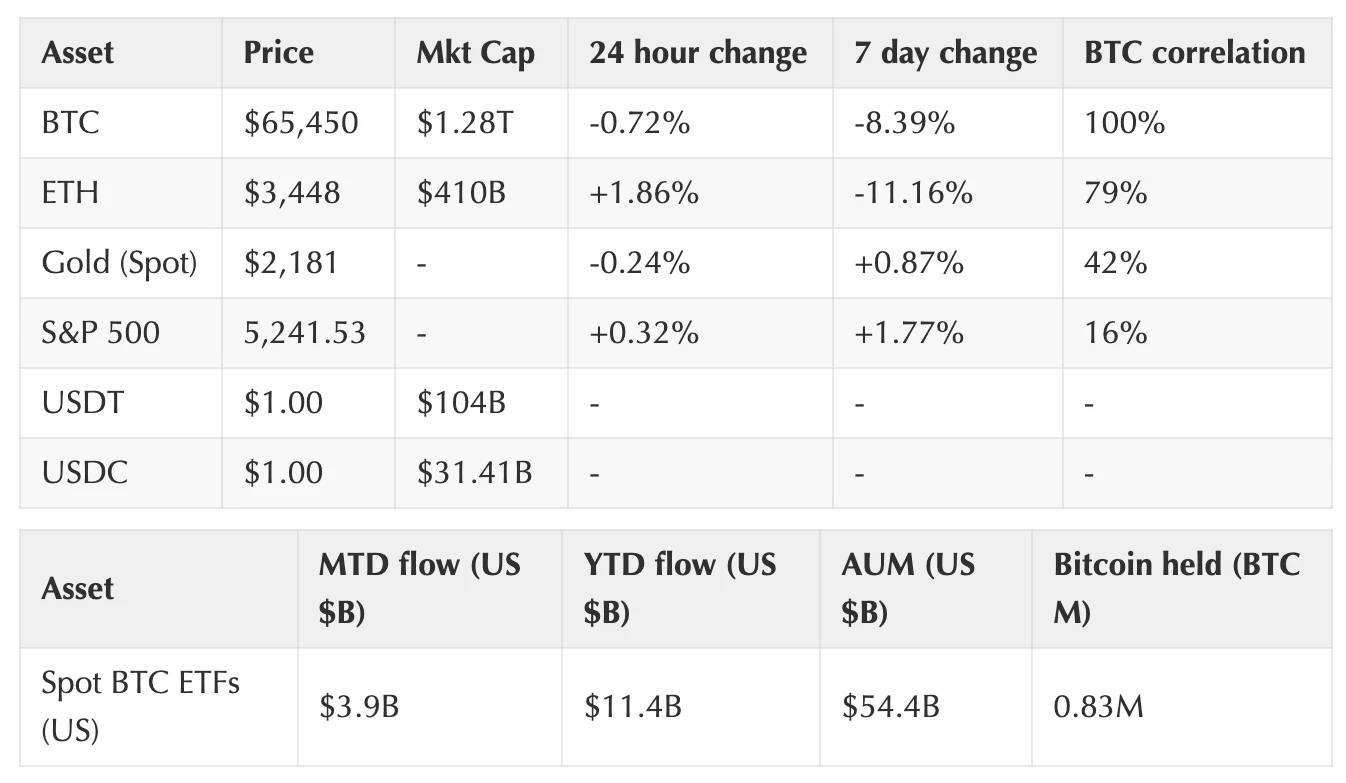

quick overview

In the U.S., spot Bitcoin ETFs saw their first weekly net outflows in two months centered around the Grayscale Bitcoin Trust (GBTC).

We expect that the current deflationary trend in the United States will remain unchanged, financial conditions in the United States will continue to be loose, and the market will be supported by the reduction of the Federal Reserves quantitative tightening program.

After the meme coin craze and the Dencun upgrade, many networks saw a surge in on-chain activity, especially on Solana and Ethereum’s Layer 2 (L2), such as Base, which led to a decrease in chain performance.

market observation

Cryptocurrency market attention remains focused on flows rather than fundamentals as U.S. spot Bitcoin ETFs posted their first weekly net outflows in two months ($836 million between March 18-21 ). Few people seem to understand what caused the surge in outflows from Grayscale Bitcoin Trust (GBTC), which saw net outflows totaling $1.83 billion over four days, with an average daily net outflow of $4.58 One hundred million U.S. dollars. In comparison, daily GBTC outflows over the past three weeks have averaged only around $290 million. Additionally, in previous weeks we saw positive inflows from other funds offsetting outflows from GBTC, suggesting we were witnessing some capital moves at that time.

One of the potential sources of selling pressure we have been anticipating since mid-February is the possible sale of 35.9 million GBTC shares (valued at $2.1 billion) by Genesis Global Holdco LLC. Recall that Genesis received permission from the U.S. Bankruptcy Court for the Southern District of New York on February 14 to sell its GBTC shares. Of these shares, approximately 31.2 million shares are linked to the Gemini Earn Program by the Gemini Trust Company. However, the court ruled that Genesis never properly pledged the shares as collateral to borrow money from Earn users, so Genesis could sell the shares at market value to repay creditors, either in cash or in Bitcoin. The Wall Street Journal reported on March 18 that there is a pending proposal supported by creditors that could return up to 77% of the stocks held by customers in kind.

Please note that this is not the same event as Genesis using 30.9 million GBTC shares as collateral to borrow 1.2 billion GBTC shares from 23.2 million Earn users during the third quarter of 2022. Gemini recently reached a settlement with Genesis to return all of these assets in kind, 97% of which will be paid within weeks and is currently pending court approval.

It is unclear whether the recent GBTC outflow is related to these sales, as there are no direct public documents announcing this information. At this time, we can only infer that the size and scope of changes in GBTCs outstanding shares coincide with recent developments in Genesis payment obligations. What’s more, given that the majority of creditor payments will be made in cryptocurrency rather than cash, we believe the market impact on Bitcoin’s performance should ultimately be net neutral.

So far, there does not appear to be any unusual activity in BTC spot trading volumes on centralized exchanges around the world, although the average trading volume on March 19 and 20 was around $35 billion, which is higher than the average of $25 billion in the previous four weeks. Average daily (working day) trading volume. If these GBTC sales are indeed completed, we believe that the macro environment is still suitable for more spot Bitcoin ETF inflows after the Fed meeting that ends on March 20. Interest rates are expected to remain unchanged, but at the same time:

Choosing not to change its forecast for three rate cuts in 2024 (despite raising the dots for 2025 and 2026), according to the dot plot,

The year-on-year real GDP growth forecast for 2024 is raised from 1.4% to 2.1%, and

Suggesting that the reduction of its quantitative tightening program will begin soon.

We believe that the Feds decision to cut interest rates in May or June is currently less important to the market than the direction it sets. We expect that as the Fed reduces the number of bonds it removes from its balance sheet each month, U.S. financial conditions will continue to ease and the deflationary trend will remain intact, and markets will be supported by this.

Meanwhile, ETH has performed slightly differently than BTC this week following news that the Ethereum Foundation received an inquiry from an unidentified national authority sometime around February 26, 2024. So far, no jurisdiction or content of the inquiry has been disclosed. On Twitter, a partner at law firm Willkie Farr Gallagher said: It is extremely common for the Crypto Protocol Foundation to receive obligatory requests for information. Public prediction markets have reduced the likelihood of a U.S. spot ETH ETF being approved by March 31 to 17%, down from 48% a month ago. However we think that despite the possibility of approval being effectively ruled out, ETH still seems to be doing quite well.

On-chain: scalability

After the Meme coin craze and Ethereum’s Dencun upgrade, many networks saw a surge in on-chain activity. The resurgence in activity has been most noticeable on Solana and certain Ethereum Layer 2 (L2) players, such as Base, where the Dencun upgrade in particular significantly reduced its fees. Generally speaking, during periods of low congestion, median transaction fees on these networks have remained below $0.01 (see Figure 2).

However, high transaction volume affects network performance in different ways. During the congestion, transaction fees on Base spiked to pre-Dencun levels, which left some underpriced trades pending until market fees returned to their target rates for execution (unlike Solana it did not trade to Expect). Overall, Ethereum and its many L2s can ensure that transactions are included in block space by outbidding other transactions, which results in higher median transaction costs during periods of congestion. In contrast, Solana is able to always maintain a low median fee because it does not have computing unit-based pricing (that is, the fee is not directly related to computing resource consumption) and lacks an effective priority fee mechanism. But this approach incentivizes people to spam the network to increase the likelihood of a transaction being packed, so as youve seen recently, its led to a lot of dropped and failed transactions on Solana.

During periods of high transaction volume, transactions on Solana may be discarded (i.e., never included in a block) if they are not included in a block before their block hash expires. Additionally, the relatively high number of failed transactions is often due to on-chain smart contract rollbacks (e.g. poorly set slippage tolerance). Long confirmation times from an overloaded network greatly increase the likelihood of prices moving outside of a predetermined range during exchange transactions, especially for volatile and illiquid assets such as Meme coins. Since these occur off-chain and cannot be traced back from the ledger history, precise metrics of discarded transaction counts and actual confirmation times are not easily available.

For both blockchains, their scalability roadmaps are still long, and there are different trade-offs in the routes they take. The Base team is considering directly increasing the target capacity of its chain in the short term, as data fees remain low (Ethereums blob count per block is still below target). The next big bottleneck centers on optimizing execution, specifically in handling state growth. However, resolving long-term state growth issues may take some time, meaning continued price spikes during periods of congestion may occur for some time to come.

The v1.18 client version that Solana Labs plans to release in mid-April can also solve some of their existing problems by upgrading the scheduler mechanism, although this scheduler upgrade is only optional. The Solana Foundation has been pushing for a more optimized architecture, including implementing priority fees (integrating them into dapps), optimizing the use of compute units, and other Sybil-resistant mechanisms that can improve overall network performance. That said, we believe Solanas uptime during these heavy loads is a testament to the progress the network has made over the past few years.

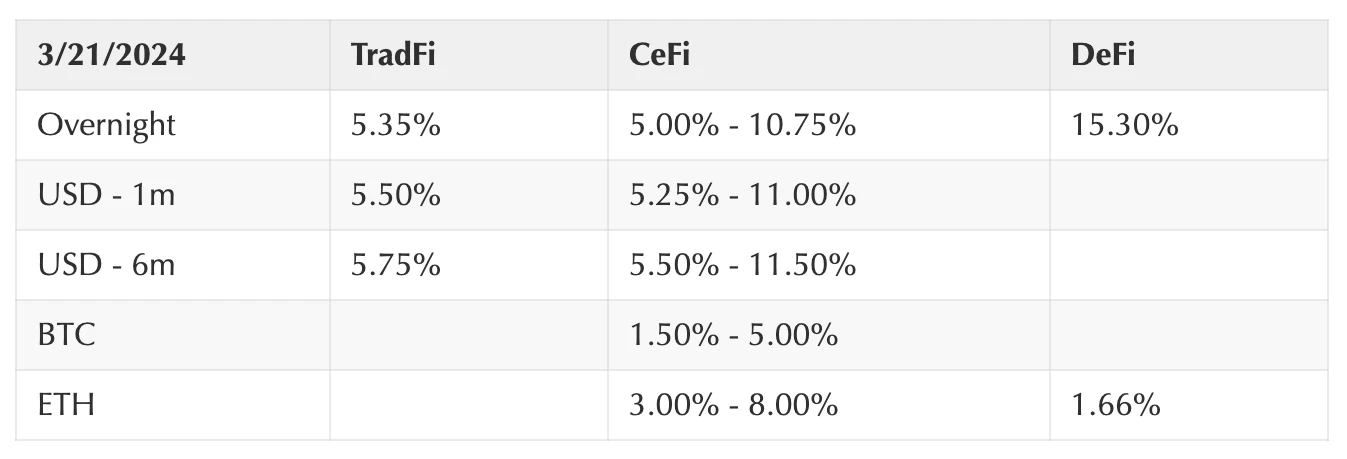

Crypto and traditional domain performance

(As of March 21, 4 p.m. ET)

Source: Bloomberg

Coinbase Exchange and CES Insights

The cryptocurrency market saw a sharp sell-off in the first half of the week. In the absence of a clear catalyst, many market participants blamed the weakness on the market moving too fast and needing a pullback. On the CES trading desk, buy-side liquidity was heavy as traders looked to capitalize on the weakness. By mid-week, enough leverage had been cleared out of the system through liquidations and long selling so that funding costs for perpetual futures returned to more reasonable levels below 20%. Cheaper funding and dovish signals from the U.S. Federal Open Market Committee (FOMC) meeting helped trigger a relief rally in both mainstream and altcoins.

Trading volumes on Coinbase platform (USD) Trading volumes on Coinbase platform (USD)

Trading volumes on Coinbase platform by asset Trading volumes on Coinbase platform (asset class)

funding rate

Notable Crypto News

mechanism

Bernstein’s year-end Bitcoin price target raised to $90,000 (Coindesk)

JP Morgan says Bitcoin remains in “overbought territory” despite recent correction (The Block)

BlackRock Begins Asset Tokenization by Launching Digital Liquidity Fund (Cointelegraph)

Supervision

SEC Is Deeply Analyzing Crypto Companies in Ethereum Investigation (Fortune)

conventional

Bitcoin Flash plunges to $8.9 on BitMEX (Coindesk)

Solana is declared the most popular blockchain (The Block) so far this year by CoinGecko Research

Coinbase

What exactly are cryptocurrencies used for? (Coinbase Blog)

global vision

Europe

The EU has released draft regulatory standards for stablecoin issuers and will serve as part of the MICA regulatory framework (The Block)

The UK’s Financial Conduct Authority (FCA) plans to introduce market abuse rules (FCA) for the cryptocurrency market this year

Asia

Hong Kong launches a new round of electronic Hong Kong dollar (e-HKD) pilot to study the programmability and tokenization of the central bank’s digital currency (The Block)

South Korean crypto exchange trading volume exceeds stock market (CoinDesk)

Japan’s Government Pension Investment Fund is exploring diversifying its investment portfolio through “illiquid assets” such as BTC, gold, forests and farmland (Bloomberg)

Thailand approves personal income tax exemption on token gains (CoinTelegraph)

Southeast Asia super app Grab launches cryptocurrency payments in Singapore (The Block)

Big events for the week ahead