Original title: Reexamining the Degens Playbook for the Bull Market》

Original author: IGNAS

Original compilation: Kate, Mars Finance

What happens when you expect?

How does the market treat your airdrop?

So far so good to me. The current top three airdrops are: JITO, STRK and ETHFI. Luckily, the fun isnt over yet.

In this blog post, I’ll cover where we are now and revisit my Degen bull playbook, as well as new and previously shared airdrop protocols that are still worth promoting.

I think the second phase of the bull market has begun:

In the first phase we:

Cleaned up the mess from the last bull market (won multiple lawsuits and eliminated leverage).

BTC ETF Passed

The SOL ecosystem is booming

Got a couple of big drops.

In the second phase we will see:

Further victory over regulators

Interest rate cut speculation

ETH ETF speculation or approval?

Bitcoin ETF is seeing increased inflows

Innovate more on BTC through Runes protocol, L2 and BTC native dApps

New leverage accumulation using Restaking/LRT/Ethena style protocols

Bigger airdrops: Eigenlayer, LayerZero, L2 airdrops, LRT protocol, and more.

Im not the only one who thinks phase two has arrived. For Yano, the second stage is to realize that we are in a bull market, but many friends still do not realize this.

https://twitter.com/JasonYanowitz/status/1762878513731002570

This is the calm before the storm.

Bitcoin price is currently in an accumulation zone and will rise when new catalysts emerge.

It just needs a spark—any catalyst will do—to keep momentum going. A halved narrative might suffice. Maybe its a rate cut, a big-name institutional player enters the space, or maybe its something unexpected.

The market wants to pump water and we will find reasons to keep going higher.

At least, thats what I (and most degens) expected.

What happens when you expect

I remember watching a presentation discussing the potential impact of a Bitcoin ETF on cryptocurrencies. Sorry, I cant find it now. Near the end, there is a comparison showing Bitcoin users before and after the ETF.

The before pictures show Bitcoin enthusiasts delving into the technical aspects of Bitcoin, such as Rodamor (creator of ordinal theory) here.

In contrast, the “after” photo shows retired Bitcoin holders with children.

The speaker’s main argument was that Bitcoin’s value will continue to rise due to continued fiat inflows, bringing wealth to Bitcoin holders.

The after scene reminded me of the what to expect when youre expecting movie (which I havent seen).

The movie is aptly named for another reason: we all expect the market to continue rising, that airdrops will continue to come, and peak in early 2025.

Right?

But the journey wont be easy.

Bull markets are more sluggish and unpredictable than you think. Who would have thought that SBF would steal users’ money for gambling?

So, we all hope that the market will continue to print millionaires and the airdrops will continue to arrive, but I am prepared for the unexpected.

However, similar patterns repeat themselves in every bull market.

The bottom line is that with every bull market, we find innovative ways to print money by issuing tokens backed by sexy new hot stories. These narratives are often made possible due to new technological advancements in the field, such as re-hypothecation or RWA.

In a bull market, opportunities are everywhere, but you need to find the Schelling point regarding cryptocurrency market share. Here are the lessons I learned from the past two bull markets:

Navigating the Crazy Bull Market to Come

As narratives come and go, my goal is to focus on thriving ecosystems that offer 1) technological innovation, 2) currency token printing opportunities, and 3) captivating stories.

I detailed how to identify a thriving ecosystem in my last post:

Three Pillars of Booming Crypto Ecosystems

With each bull market that passes, creating tokens becomes easier and easier.

Previously, Dogecoin required PoW hardware to mint coins, but now even unsuspecting influencers can mint coins in as little as 5 minutes.

As we continue this trend, I expect we will reach a point where the excessive influx into the coin will exceed the available attention and currency flow to maintain its price. This is when the party ends.

Luckily, the entire market isn’t here!

However, there are signs of increased leverage risk in the market, such as Ethenas sUSDe and LRT ETH derivative assets being accepted as collateral by major DeFi protocols.

But I think the market is healthy. We can increase leverage.

In fact, I think there is a lack of new high-quality tokens on the market.

Few people are interested in buying tokens from previous cycles. Theyre not exciting and most are overrated. Additionally, teams that are successful in early cycles lack incentives to market their tokens further. For example, Compound’s $COMP…

The team has stopped interacting on social media, and their proposed composite chain plan disappeared along with a deleted tweet.

Therefore, I expect the market to continue valuing new coins higher than those from the previous cycle.

The newer, the better.

The FDV of JITO and ETHFI is higher than LIDO. Ethenas ENA is 2.5 times more expensive than MKR.

This is good news for airdrops: higher valuations lead to more generous airdrops.

So, with all this in mind, I’m sharing my DeFi Degen’s Bull Playbook for December 2023: Part One, which includes over 60 protocols across 10 ecosystems.

Four months have passed since the original post. I expect these 10 ecosystems to outperform the market.

Therefore, it is time to update those ecosystems/protocols that are still worth farming. Additionally, I will include new protocols that were not mentioned in my previous article.

Revisiting Degen’s bull market playbook

Please note that this is not a Part 2 Playbook. The market is entering the second phase, but it is not much different from 4 months ago. A few things have changed:

BTC Rules, ETH Sucks: Luckily Ethereum has restaking, otherwise I would have considered selling most of my ETH

Meme coin craze just gets weirder

The protocol team has a never-ending points scheme that may inadvertently extend this bullish cycle by delaying token generation (and dumping) events

https://twitter.com/DefiIgnas/status/1775910200962088994

So, my degen strategy is still the same: deposit assets, click the button, and claim the airdrop.

NOTE: I am not a fan of meme coin trading. Since I stopped buying crypto with fiat in 2020, Ive gone up 100x. Now that Im chasing a 10x goal, focusing on an ecosystem that thrives through multiple airdrops is a safer approach. If you are looking for 100x opportunities, I shared some strategies to increase your opportunities in my previous article.

How to Find 10 0x Gems: 5 Strategies

First, I will share new airdrop strategies, and then I will review the ecosystem (with new airdrop protocols) that are still worth paying attention to.

new airdrop

Elixir: Order book liquidity network raises $8M at $800M valuation from Crypto Hayes, Sui, Amber and more. Elixir allows providing liquidity to order exchanges and earning rewards, including Vertex, Bluefin, and more.

Points (potion) can be obtained by depositing ETH and casting elxETH to obtain mysterious treasure chests. Your ETH will be locked until the mainnet launches in August.

Phaver: The best front-end for Lens. With the explosion of Farcaster usage and airdrops, the trend is coming to Lens. Phaver is severely undermined. You can earn Phaver points through various actions such as publishing and connecting NFT. Phaver raised $7 million from Polygon, Nomad Capital and others.

Zircuit: Another L2 with all the buzzwords: “AI-enabled modular zk rollup” and a nasty Blast-esque invitation-only marketing campaign. It sucks, but...

It is supported by Pantera and Dragonfly, and it integrates major LRT protocols, so you can do LRT + Zircuit airdrops at the same time. Deposit your LRT ETH to get 2x points. You can withdraw money at any time.

Mode network: Another Blast/Zircuit/Manta copy of L2, but its an Optimistic rollup. Once again, I bought it because it supports EtherFi weETH and Renzo ezETH, so it is twice as easy to mine.

The token will be released this month, but with $175 million in TVL, its not overdoing it.

Ethena: Needs no introduction, but if you’re sitting on a stablecoin, there’s probably no better airdrop than this.

I will share new airdrop protocols, as well as previously shared airdrop playbooks for DeFi Degen that are still worth joining in this bullish market.

1. Eigenlayer+ Liquid Staking Tokens+ Active Verification Service

The Eigenlayer mainnet will be launched as early as April, possibly accompanied by tokens. Additionally, I expect LRT protocols to launch their tokens around the same time.

EigenLayers TVL growth is staggering. Since my Degen script last December, TVL has grown from $262 million to $12 billion – 4480%! It is second only to Lido and surpasses AAVE.

Liquidity re-staking, only 13 protocols have accumulated $8.4 billion, which means that most EIGEN airdrop hunters prefer mining through the LRT protocol.

Whats more, everyone forgot about EigenLayers AVS airdrop. There are 14 more in the pipeline. Just this week, a new AVS Gasp cross-chain swap company announced that it has received US$5 million in seed-stage financing, with a valuation of US$80 million. Its a good sign that venture capital firms are funding AVS.

If you want to learn the AVS protocol, please check out my previous post.

Navigating Restaking: Your Guide to Eigenlayers Actively Validated Services

I expect the number of LRT protocols to continue to grow, but the market is already solid. There are only 7 companies with TVL exceeding US$100 million.

So, if youre sitting on native ETH, LRT is the best place to go.

what to do?

EtherFi: ETHFI’s TVL has increased even after the token’s launch, with the second quarter ending on June 30th. Strategies to consider:

(Easy) Deposit eETH into the EtherFi Liquidity strategy to get 20% APY, 2x EtherFi and 1x Eigenlayer Points

(Premium) Up to 10x leverage on Eigen and 20x EtherFi points on Fluid.

Renzo: The fastest growing LRT, with a TVL of US$2.3 billion. Binance Labs announced its investment, and Thor Hartvigsen calculated that Renzo is “the best place to park ETH right now.” The token release date has not yet been made public.

Choose any DeFi strategy that suits you across multiple L2s and protocols.

Swell: It is confirmed that the token will be launched in mid-to-late April, rswETH withdrawals are coming soon, and Swell will launch its own L2 with native staking yield. If you want to get in and out quickly, Swell might be a good choice.

Mint rswETH and get more pearls

Consider waiting for Swell L2 pre-deposits to open soon

Puffer: The third largest LRT, but TVL is declining. This is because Puffer currently does not support native ETH staking (unlike Renzo and EtherFi). Therefore, new stETH depositors cannot earn Eigen points on Puffer. However, it is powered by Binance Labs, so some exposure is in effect.

Join Crunchy Carrot Quest andhereEarn 2x points when depositing into the Curve/Convex pool.

Kelp: Did something that might annoy the Eigenlayer team: launched liquid EIGEN points as the KEP token. existhereView KEP prices.

Kelp has launched the Road to Billions TVL reward, with each ETH you can get up to 100 additional EIGEN (approximately US$17 per ETH, US$0.17 per KEP)

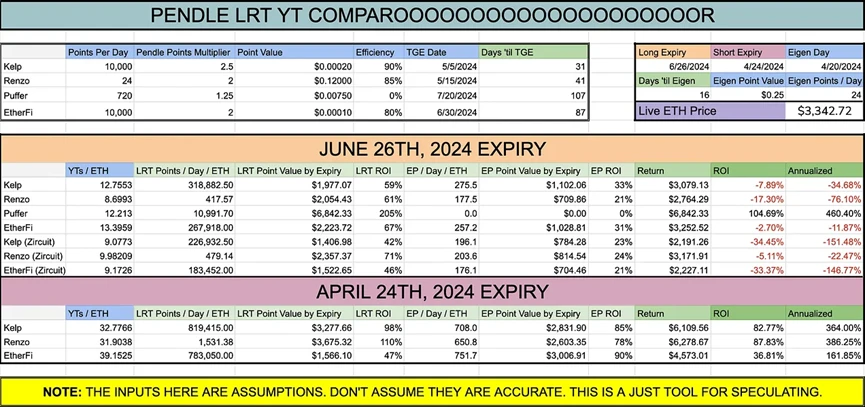

Important note: Eigenlayer and LRT tokens will be released soon, so to utilize your points, consider using Pendle YT tokens. The value of YT dropped to 0 at expiration, but my EtherFI airdrop was the largest ever due to Pendle.

You can view Thor Hartvigsens Pendle LRT calculation here and Stephen DeFi Dojos live calculation here.

https://docs.google.com/spreadsheets/d/1ijVL4sNJw1405ifvK3dps_1iuDGcXpndKszRuWQoF9I/edit#gid= 0

2. Stacks

Still one of my favorite dramas because:

1. Bitcoin L2 Narrative

2. Nakamoto’s upgrade will launch 5-second trading in April (trading on Stacks will finally become interesting)

3. The ecosystem is still small and there are few miners, so it is easy to position yourself in advance. In USD terms, TVL grew from $35 million to $176 million in 4 months, but this was due to STX price increases. In STX, TVL doubled.

very good. Still early.

If youre super lazy but want rewards, Stacks has two of your best opportunities:

Stacking DAO: stSTX liquidity staking of STX. Use my recommendation for points live streaming, if possible🙇♂️

Reward: Deposit stSTX/STX LP for 2x airdrop to Bitlow: Stacks DEX. Stacking DAO will provide additional points on top of the Bitlow airdrop.

Lisa: Another kind of liquidity Stacking has just been launched. Apply to the waitlist here. Staking and mining by Alex Labs.

Other farms to consider:

Arkadiko: Stake STX to mint USDA stablecoin. Bitcoin native loans will be launched. Exchange and hold some USDA.

Hermetica: Earn money on BTC using derivatives strategies. Use stack sBTC. Currently on testnet, but I will wait for mainnet to try.

Zest: Bitcoin lending. Currently being tested internally, but access can be requested here.

Velar: AMM. The ICOs of Gate and Bybit have just been completed. The points system for airdrops has been launched.

3. Starknet

I know many of you were disappointed not to get the airdrop and therefore left the ecosystem forever.

But I still like Starknet because of its unique Cairo development language (prevention of easy forks and less protocol → easy to focus on where to mine), scaling technology of STARK and SNARK, and STRK token utility for staking and gas.

Also, the second STRK airdrop is coming, and Starknets TVL ($314 million) is still low compared to STRKs FDV ($19 billion), so I can smell an airdrop coming.

However, I was disappointed with the zkLend airdrop: I only got a few hundred dollars in loans/borrows for 5 figures. Almost no one knows that the airdrop has started, click here to check it out.

I hope these three protocols can bring more rewards to users:

Nostra: Number one. TVL’s dApp ($200 million of Starknet’s total $314 million).

Ekubo: First, DEX. In addition to running the points system, the LP reward for most major assets is 50%, so you can get airdrop points + income.

Note: Ekubo LP withdrawal fees are ridiculously high (up to 1%), so choose a wide range of LPying assets.

Avnu: Jupiter of Starknet. In order to get more points, I often make small transactions.

4. Solana

Most of Solanas major dApps are releasing tokens (especially KMNO, PRCL, TNSR and DRFT?), but mining is not over. There is now a new trend to launch token and point campaigns immediately in the second season to prevent TVL loss. This works well because only half of the tokens in the first batch are airdropped.

Heres what Im currently focusing on:

Kamino: Season 1 is over and Season 2 is in progress. Expected to be available in April!

My favorite is 5x SOL times degen vault (but lower liquidation risk).

Sanctum: The new LST, or LST aggregator. JTOs airdrop is good, Sanctum is probably better. Received US$6.1 million in financing from Dragonfly, Sequoia, Solana Labs, etc. For a $100 million TVL, thats still too early. I deposited my money into INF (a basket of LST with an interest rate of 9.3%).

Marginfi: Posting tokens as a joke, but Im tired of their endless points campaigns. Additionally, they launched their native stablecoin YBX. To be honest, Aave and Curve launched stablecoins to attract TVL but failed to gain traction, so I don’t have high expectations for their stablecoins. Still, a bit of farming is needed.

Backpack: There are exchanges and wallets. KYC is required for exchange to prevent witches and potentially offer higher airdrops. Received US$17 million in financing led by Placeholder VC Wormhole.

Tensor: I still hold and stake Tensorian NFTs, but the price has dropped. Surprisingly, Solana NFT sales are still growing even though MagicEden is eating into Tensor’s market share.

Despite this, the Tensor team is still rolling out new features (price locking) and the launch of the token may trigger a resurgence of FOMO.

Grass: I passively earn points using my old phone. If you have limited funds, Grass is a cost-effective option.

It fits the Solana x AI narrative. They will launch their own L2. You need to install the Google extension to mine points. It just raised $3.5 million from Polychain Capital, Bitscale and other companies.

Parcl: Long/Short Real Estate Market. Im just sitting on USDC liquidity mining points.

Flash.trade: Perpetual Contracts for Cryptocurrencies, Commodities and Forex Trading. They have NFTs that will change based on your transaction history, you will receive a portion of the protocol fees, and they will most likely airdrop.

Drift: margin trading and lending.

5. SUI

Why SUI?

I joined SUI relatively late and my position is not large. But the experience was much better than I expected. TVL continues to grow, dwarfing SEI, INJ or Aptos. But major dApps still don’t have tokens.

I like that it is built with the Move development language because it prevents simple copy-paste Ethereum forks.

Consider these operations on the SUI

SUI has three LSTs available (probably the easiest way to play)

Stake some SUI on Headal for haSUI.

Note: SUI can be exchanged to haSUI on Cetus protocol for better speeds.

Stake some SUI here for a SUI LST.

Note: Provide liquidity up to 100% annual interest rate for mining.

Lend haSUI or/and afSUI and borrow stablecoins or SUI on Navi protocol (tokens available but APY up to 30%) and Scallop (Phase 2 airdrop points online)

Lending $SUIto Borrowing Bucket - Stablecoin $BUCK on Maker of Sui.

6. Bitcoin Ecosystem

Bitcoin ordinal is the second bullish thing in the crypto space. Just behind the re-pledge.

I purchased Bitcoin NFTs early on and not only did they appreciate in value, but they were rewarded in multiple airdrops, most notably RSIC and Runestone. In fact, I got so many airdrops that I didnt even know what they were for.

Now, the Runes protocol is launching on the Bitcoin halving block, which will bring more trading opportunities to Bitcoin.

There are more and more protocols out there, so I recommend checking this thread and learning before the fun begins.

https://twitter.com/DoggfatherCrew/status/1775546878836294102

Also, heres a great educational thread from peddy.

https://twitter.com/peddy2612/status/1775948393904308314

If youre new to ordinal numbers, Ive written a beginners explanation and some protocols for you to try:

Ordinals & BTC DeFi: Start Here.

7. SEI

I quit most of the SEI ecosystem. So far, lack of growth and very few dApps. SEI will launch EVM via SEI V2, but I expect it will be swamped by low-effort Ethereum forks.

However, one area I am bullish on is SEIs Silo Liquidity Staking. Just stake some SEI and wait for the airdrop.

Staking on Silo.

8. Injective

I recently completely quit the Injective ecosystem.

The ecosystem is littered with low-quality dApps (even their front-ends are riddled with typos), lacks a passionate community, and to make matters worse, the meager airdrops INJ stakers and dApp users receive are only worth a few hundred dollars. I have been mining for several months and have deposited almost six figures.

There seems to be a lack of innovation within Injective. My suspicion is that after the final token unlock, investors will look to cash out. Maybe an exit pump is on the way.

Overall, my expectations for the market are: after the accumulation is complete, cryptocurrencies will rise and airdrops will keep coming.

Then the market will undergo some structural changes (as it always does) and Degens playbook will change. So, subscribe for Part 2 when it happens.