Preface

After a long hiatus, we finally resumed farming, and I, the Fourteenth Lord, am back.

In the past six months, the author has completely transferred from the ETH ecosystem to the BTC ecosystem. From the application layer to the bottom layer of the chain, I have looked at the bottom layer of L2 public chains such as btc, merlin, babylon, and xion, and studied inscription symbols such as Ordinals, brc 20, atomic, Runealpha, and Runes. protocol source code.

If there is some precipitation, then continue to output. The author will bring you unique insights and market value from a technical perspective.

1. What are Runes?

In the past year, the biggest narrative of web3 has been the explosion of the inscription ecology. The initial starting point is Ordinals, which is a technology that gives a unique serial number to each Satoshi on Bitcoin. You can read more:Interpretation of the innovations and limitations of the Bitcoin Originals protocol and BRC 20 standard principles

Its core founder, Casey, submitted the basic version of Runes code in September last year, but has yet to release the mainnet online. Therefore, during the inscription craze in September, projects such as runeAlpha forked the code in advance and released it separately. Although there are some claims of plagiarism due to protocols such as RunesAlpha, the total market value growth of hundreds of millions in just a few months also makes people see the infinite potential of the Runes protocol.

Then the official Runes protocol designed by casey, the founder of the Ordinals protocol, will also be officially announced around April 20, 2024. And it will be directly launched on the btc main network. Therefore, various project parties who want to issue Runes assets, and various wallets and NFT/FT trading markets that want to support Runes will face one of the most difficult challenges in the blockchain industry. How to operate without a test network? In this case, you can directly sprint to the main network!

And the official Twitter statement is even more confident~ Learn a new word by the way: Seppuku

This article will systematically sort out the changes in the underlying fields of the Rune project, allowing everyone to fundamentally understand the differences between Runes and FT protocols such as Brc 20 and Arc 20, and compare the advantages and disadvantages for rational decision-making participation.

2. How is additional information recorded on Bitcoin?

There are two mainstream solutions for attaching off-chain data to the chain on Bitcoin, engraving and etching.

2.1. Basic principles of etching

Runes uses etching technology, which is a simple and intuitive way to record information on the chain: that is, writing it into the op-return field of UTXO (unspent transaction) in bitc. The function has been enabled since version 0.9 of the Bitcoin Core client. (14 years), OP-RETURN will create a clear verifiable non-consumable output, allowing the data to be stored on the blockchain, similar to utxo output, but cannot be consumed.

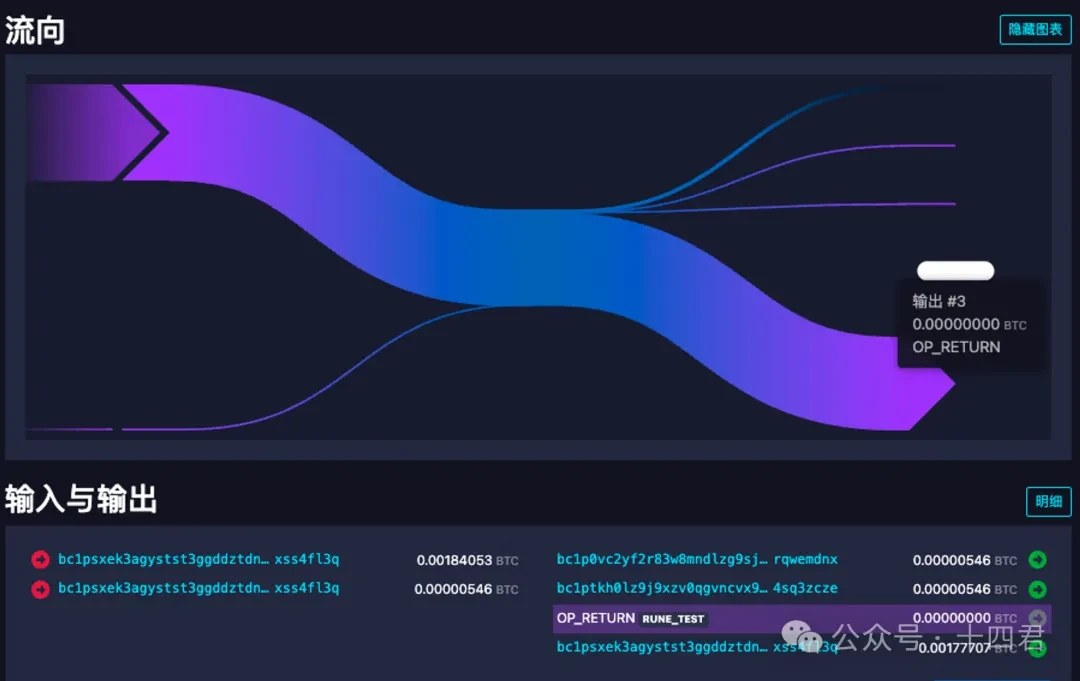

You can easily see in the btc blockchain browser that the transaction has an op-return information attached, such as the following picture:

It can be seen that the output #3 here is actually free. Although it occupies the output position of the utxo output, it is a closed round rectangle, which means that it cannot be transferred and consumed again. So it is just like a transactions remarks area, which is left in the Bitcoin storage space and can be found through the transaction hash area index.

If you are careful, you may find out why there is a RUNE_TEST after OP_RETURN. This is the result of decoding the specific content. After clicking the details button, you can find a coding string like 52554 e 455 f 54455354. In fact, it is a string of hexadecimal Encoded data, after decoding, you can get RUNE_TEST. Similarly, there are other encodings in the details. Finally, after decoding, it will become a string, probably in json format, thus reflecting the deployment, casting, issuance, etc. of Runes assets. Meaning.

2.2. Basic principles of engraving

In fact, in protocols such as Ordinals/brc 20, to embed metadata into the chain, it is written into the witness data (witness field) of the transaction. This inscription process is done through Segregated Witness (SegWit) and Pay-to-Taproot, P 2 TR is implemented, which includes two stages: commit and reveal, which are the final two transactions to complete.

In fact, P 2 TR is a transaction output type of Bitcoin. It was introduced in the Taproot upgrade in 2021. It allows different transaction conditions to be stored in the blockchain more privately. The reason why privacy is improved It is because only when it is revealed can the specific and complete content be seen. Specifically, script hash is used to generate the p 2 tr address, and the real script (including inscription data) is provided when spending. Therefore, in order to upload the inscription data, you need to first generate a utxo (commit) that pays to the p 2 tr address generated by this script. transaction), and then when spending this utxo, you need to provide the real script in the witness script, and the inscription data is uploaded to the chain (reveal transaction).

In fact, the Ordinals protocol is very easy to understand. After completing the inscription process (commit, reveal) and both transactions being uploaded to the chain, the Ordinals protocol defines that this inscription is bound to the first sat of the first input. Therefore, the process of binding is inscription, and the result of binding is inscription.

2.3. Compare the two data uploading solutions

Etching:

Advantages: The logic is simple, intuitive and clear, the transaction cost is low, and it does not occupy the full node memory pool.

Disadvantages: Limited to 80 bytes in length, requires highly compressed data encoding.

Inscribed:

Advantages: Almost no size limit, certain privacy protection capabilities, multiple ways to play (time lock, proof of work), etc.

Disadvantages: Transactions need to be uploaded to the chain twice, resulting in higher final costs, longer commit duration, and greater pressure on the full node memory pool.

3. Interpretation of the underlying design of Runes

The original code of the Runes protocol was released by Casey on Ordinals version 0.11. The latest Ordinals has evolved to version 0.18. The huge version changes also give us the opportunity to step into the design process of a top-level protocol, just like Fourteen Jun ERC 721/ERC 3525/ERC 3475 and other standards that have been interpreted before, further reading:

We might as well step into the field changes of the two versions of Runes starting point and end point to interpret the value rules of Runes.

3.1. Interpretation of Runes 0.11 version

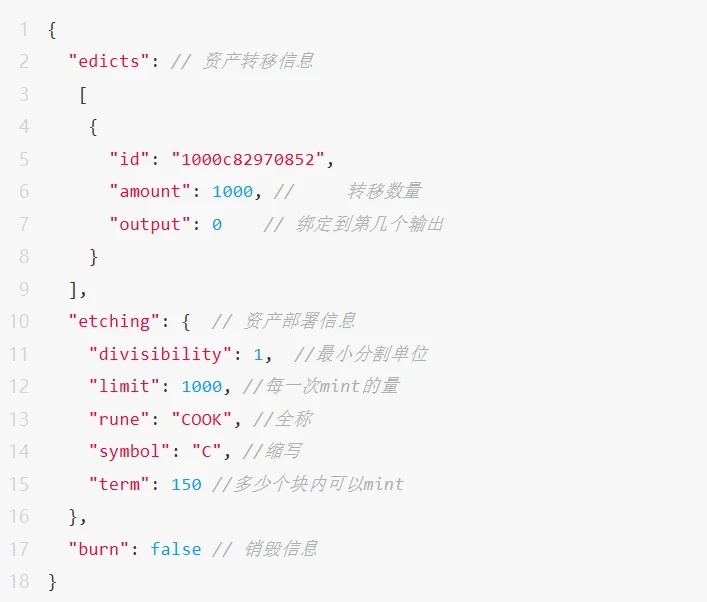

The overall fields of the initial Runes are divided into three parts, edicts (asset transfer information), etching (asset deployment information), and burn (destruction).

Specifically, when the op_Return of a transaction can present edicts information after decoding, and the format is correct, then the off-chain parser will calculate that the users assets have been transferred, and the output is the target of the transfer. land.

In the same way, the content of etching directly presents the main information of deployed assets. We can compare it with ERC 721. The biggest difference is that limit and term limit the number of mint and the range of mint. This is the fundamental difference between the Inscription and Rune projects and the assets issued by Ethereum smart contracts. Due to the lack of smart contract verification on the chain, there is a lack of real-time verification capabilities. If a project party issues assets on the chain If you also run a new set of Inscription Protocol to customize your own whitelist Mint, token economics release rate, royalty payment and other functions, there will be a lack of consensus, and no one will participate in this project, so Inscription Protocol ( brc 20, atomic, Runes), etc., have unified the way of asset issuance and unified the way for users to participate in mint. With the concept of fair launch, user participation is fully open, further eliminating the project partys excessive interference in the understanding of the asset market. Condition.

Even if the project has just controlled the market by scanning goods and accumulating assets, it still needs to pay a huge gas price. This process can be perceived and freely chosen by users.

The design of the original version of the Runes protocol was actually quite complete, so the evolved runealpha, even if it is a copycat, occupies a large market size, with a cumulative number of 82 W transactions and 312 BTC consumed in handling fees alone.

Users can easily use the design of the rune field itself to realize the compounding and splitting of assets. Even once Runes assets are compounded with Ordinals, atomic and other assets across protocols, they can also use op_Returns diverse language expressions to achieve splitting.

So what is the latest Runes protocol implemented in 0.18, and what are the considerations to have such a field?

3.2. Interpretation of Runes 0.18 version

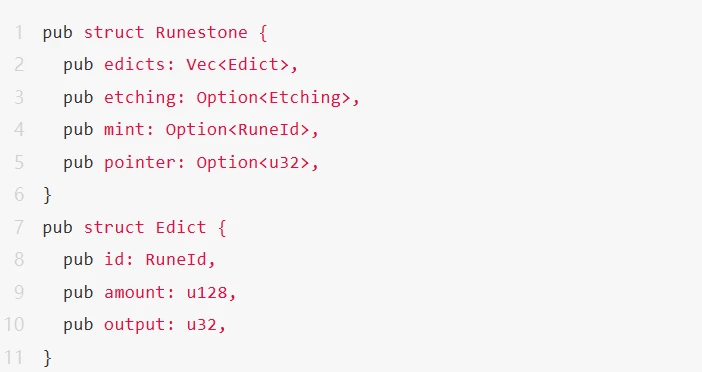

It is very difficult to understand Runes 0.18. Due to the lack of test network, you can basically only look at the logic from caseys source code. Finally, it was sorted out that the fields are divided into four aspects:

First of all, edicts still defines the direction of asset transfer, which is basically the same as runeAlpha. The difference is that there is an additional pointer parameter, which is used to modify the default transfer direction of assets. The original default transfer is position 0. With this parameter Finally, it can be set to 1 or other. The design concept is to adapt to the simultaneous transfer of multiple Runes assets and reduce the amount of op_Return coding, which can ultimately reduce the users transaction costs.

Secondly, the Mint field is added. Since its mint is placed in an object at the same level as edicts, this means that a transaction can only mint one asset. This is different from the previous RunesAlpha, which was deliberately designed at that time. It is possible to mint a large number of new assets in one transaction. This balances the starting point between technology and ordinary users. Everyone has to compete for gas to obtain it.

A sea change in the way assets are deployed

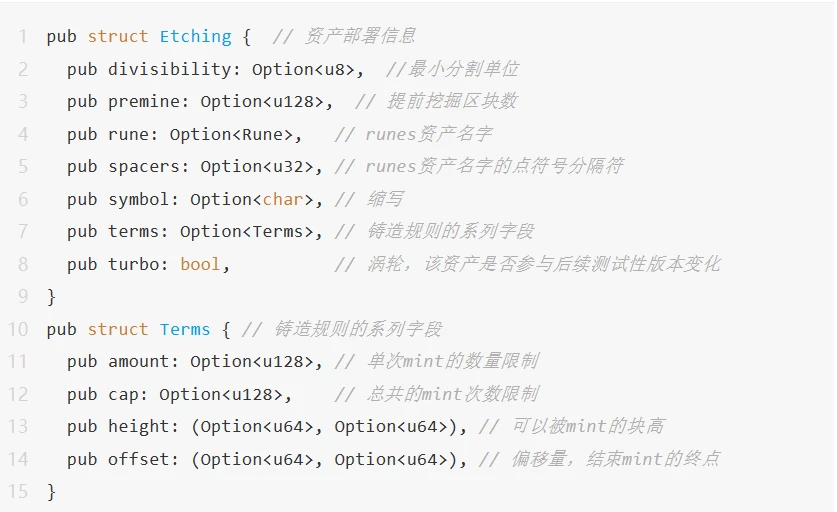

The last more important change is etching, which is the detailed design of the deployment assets. The complete field content is as follows:

You’re basically confused. It’s indeed a very complicated way to deploy new assets. Let’s explain it in detail~

First of all, the bigger change point is the design to reduce the encoding amount of op_Return. After all, op_Return limits the length of 80 bytes and every encoding space must be cherished. Therefore, Casey changed the asset ID from the simple block height + transaction serial number to the unique ID value generated by the block height + colon + transaction serial number in the form of a string. Since the Bitcoin main network is only over 80W in area Block height, so the final ID encoding is saved by half. Don’t underestimate it. In batch Mint, the cost of batch transfer scenarios is doubled.

Secondly, there is the terms field that ensures the fairness of participants. Now Mint starts deploying assets. It no longer starts with the height of the block on the chain based on the transaction of the asset deployment protocol like runealpha. Instead, it uses the height and offset specified by the issuer as the starting and ending points. In this way, users do not have to worry too much about accidentally falling into a phishing copycat project even if they do not keep an eye on the memory pool to explore the latest mint opportunities. After all, the project team can deploy the assets in advance, and then conduct a series of operational publicity activities, and finally allow users to participate. In addition to the interval height as a measure of participation time, there is also cap, as the total number of mints, to further control asset issuance. The scale of mint is no longer unlimited, but limited release, first come first served.

As an asset issuance agreement, how to control the size and equity of the issuer is a big challenge. For inscriptions, the most important thing is the asset name, so the name in Runes is a scarce resource, and there is a Runes name length that accompanies the halving cycle. Release rules, only longer names can be deployed at the beginning, and names with fewer characters can be deployed as time goes by.

It is conceivable that every time a name length is released, there will continue to be a trend of squatting similar to domain names. So how to prevent project parties from being squatted?

This introduces the most significant change in the deployment of Runes. The deployment process is no longer just an op_Return transaction, but an inscription. As mentioned earlier, the inscription technology can achieve certain privacy protection through commit and reveal. Then The new version of premine plays this role, requiring a certain interval between commit and reveal transactions. Only when it is revealed will the market know the name to be used by the issuer. At this time, even if other hackers want to create phishing assets, even if The expert has already seen the name in the memory pool. If he wants to counterfeit it, he cannot get past this advance limit. Today, the issuers control over the name is protected.

At the end of version 18, a turbo field was added. This has no clear public role yet, but it is meant to participate in other subsequent protocol layer changes.

4. How to evaluate the new version of Runes protocol?

Through the above interpretation of the underlying fields, Mr. Fourteen couldnt help but sigh. Casey has really unique insights into the gameplay of asset issuance. In just 2 months, he designed and implemented the content of the agreement that meets the pain points of market demand.

This is a market that measures value based on price. The Inscription Protocol started as a completely differentiated smart contract model, which opened up a lot of room for imagination. The truly fair Mint also allowed a large number of users to truly enter the Bitcoin circle, which further triggered the Bitcoin L2 d craze. However, the roughness of the Inscription Agreement at the beginning led to the proliferation of low-quality assets, and piracy and rugs all over the street made the Inscription ecology dusty. The emergence of runes and a higher degree of customized distribution management will make the market orderly.

Moreover, the Runes protocol is embedded in the Ordinals protocol itself. With the help of the user base of Ordinals itself, the release of the Runes protocol has stood on the shoulders of giants from the beginning. The positioning as an FT protocol makes up for the original dilemma of Ordinals being only an NFT and lacking market operation methods.

Finally, the use of op_Return to record on-chain data allows Runes assets to have almost any institution and the ability to reproduce the ledger. Further reducing its degree of centralization will allow Runes assets to have a certain level of security performance equal to that of btc.

What are the disadvantages of the Runes protocol? indeed

The first is the issue of market timing. Although Casey chose to launch simultaneously during the Bitcoin halving period, the highly tight development time, and even yesterday the content of the protocol was still being changed, which also allowed institutions on the market to access the Runes protocol as soon as possible. There are fewer and fewer, so the protocol ecosystem will need more time to ferment.

The second is the complexity of the rules. The rules for issuance management are already very complicated, but the name change allows the issuer to choose a longer name at the beginning. Combined with the special dot notation, the maximum name length of the Runes protocol even becomes : B•C•G•D•E•N•L•Q•R•Q•W•D•S•L•R•U•G•S•N•L•B•T•M•F•I •J•A•V

It is almost 55 bits in length, which in disguise amplifies the risk of users being phished, and it is also difficult to fully display interfaces such as the mobile plug-in.

Finally, there is the issue of future compatibility. The atomic protocol, which is also hot in the market, has now moved towards the AVM stage, allowing Inscription to get rid of the simple token hype stage and move further into the narrative of Bitcoin L2 or BVM. I have to say that Casey is slightly behind in this regard. , and also limits the rune project to only being played at the distribution level.

Reference materials for this article:

runes protocol encoding and decoding analysis: https://github.com/okx/js-wallet-sdk

Official source code of ruens protocol: https://github.com/ordinals/ord