Researcher: Steven, E2MResearch

Confuse

What will the future of cross-chain look like?

CM: Centralization is the mainstream solution! ! The security issue is not as serious as imagined.

As more chains emerge, how much greater will the demand for cross-chain operations be?

In a sense, since cryptocurrencies are pegged to the US dollar, does this mean that dollar-pegged stablecoins have the ability to control liquidity?

The current cross-chain solutions are basically:

Liquidity swap, prepare liquidity pool

(Source chain) lock + (target chain) wrap/map assets

And destroying/minting u essentially breaks the limitations of both.

Research intention

Whether it is the earlier full-stack services such as Op stack and Arbitrum Nova, or the recent modular blockchains such as Celestia, Dymension, and Cosmos, they have greatly reduced the threshold for creating a new chain, and the number of application chains in the foreseeable future will only increase compared to now. This trend brings a problem, which is the further dispersion of liquidity, and the data islands between chains can be linked through more efficient, cheap, and secure cross-chain.

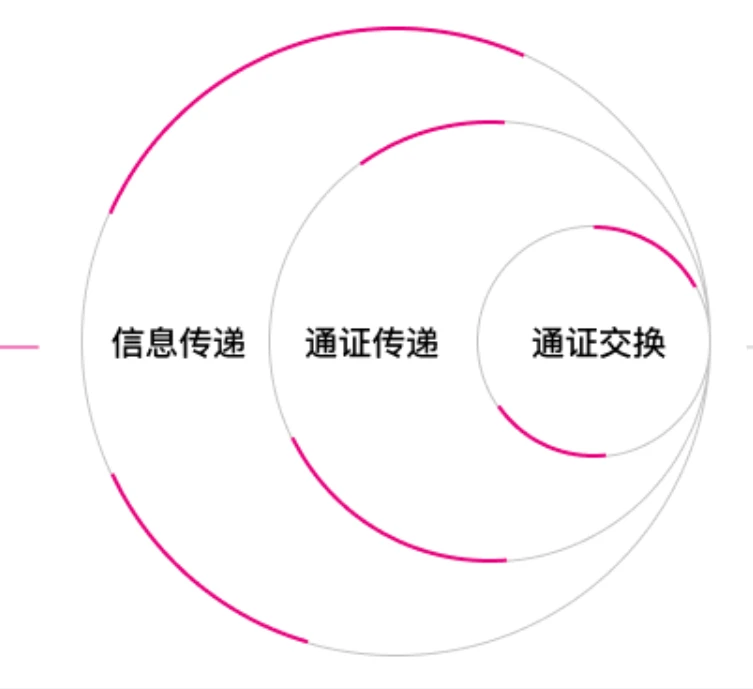

The essence of cross-chain funds

Token exchange: The simplest cross-chain exchange is the exchange of tokens on different chains. For example, A and B reach an agreement that A uses 1 BTC on BTC to exchange Bs 10 ETH on ETH. In order to ensure that both parties abide by the contract, the cross-chain technology of hash time lock allows both parties to trade at the same time. WBTC is the most typical example.

Token transfer: native assets on one chain are transferred to another chain. For example, assets on chain A can participate in DeFi applications on chain B (Aave V4s Portal, Compound V3) to build a more inclusive open finance. Tokens can also be transferred from an expensive chain to an economic chain to save transaction fees, or from a slow chain to a fast chain to achieve capacity expansion, or from a non-privacy chain to a privacy chain to achieve transaction privacy.

Information transmission: The native assets on one chain can be circulated to another chain while executing smart contracts at the same time, which is similar to the chain abstraction concept of projects such as LayerZero and Zetachain.

The three are inclusive, but depending on the actual situation, not all Dapps need to be large and comprehensive.

1. Cross-chain classification comparison

1.1 Common cross-chain bridge fund transfer schemes

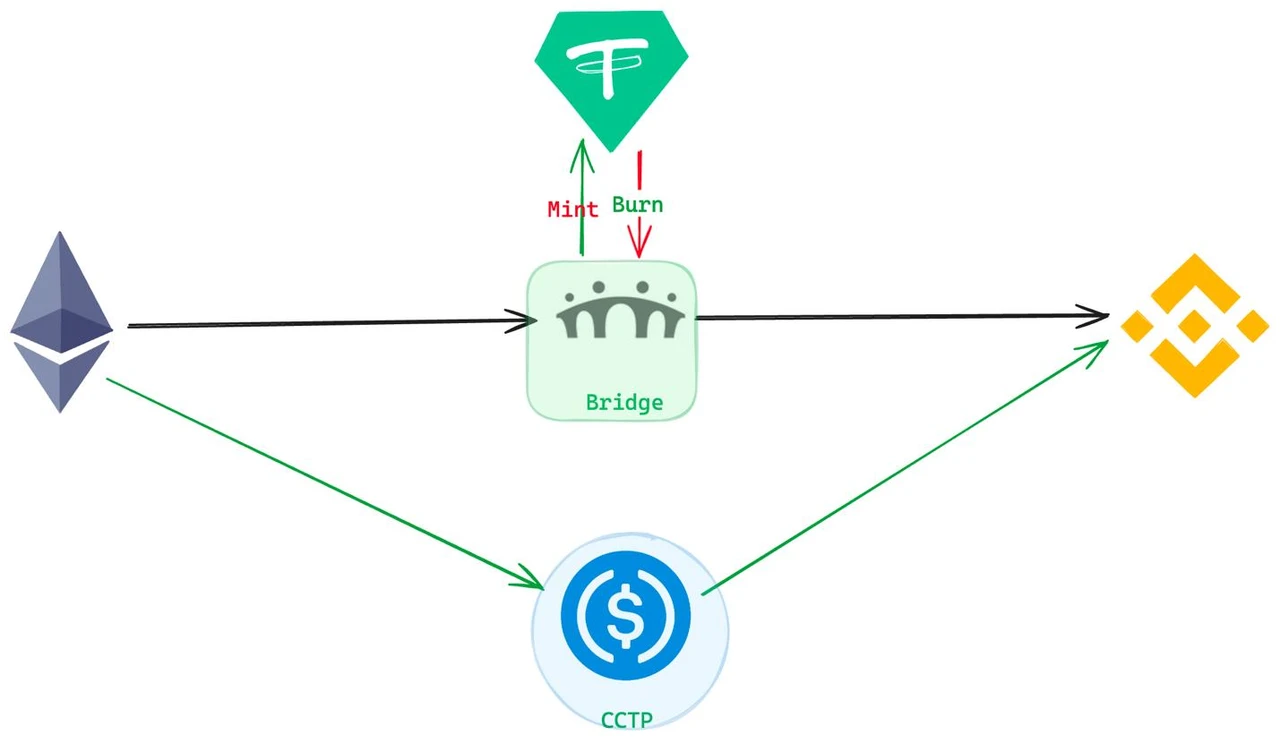

There are currently two common cross-chain bridge fund transfer schemes in the market: “lock/destroy + mint” and “liquidity swap”.

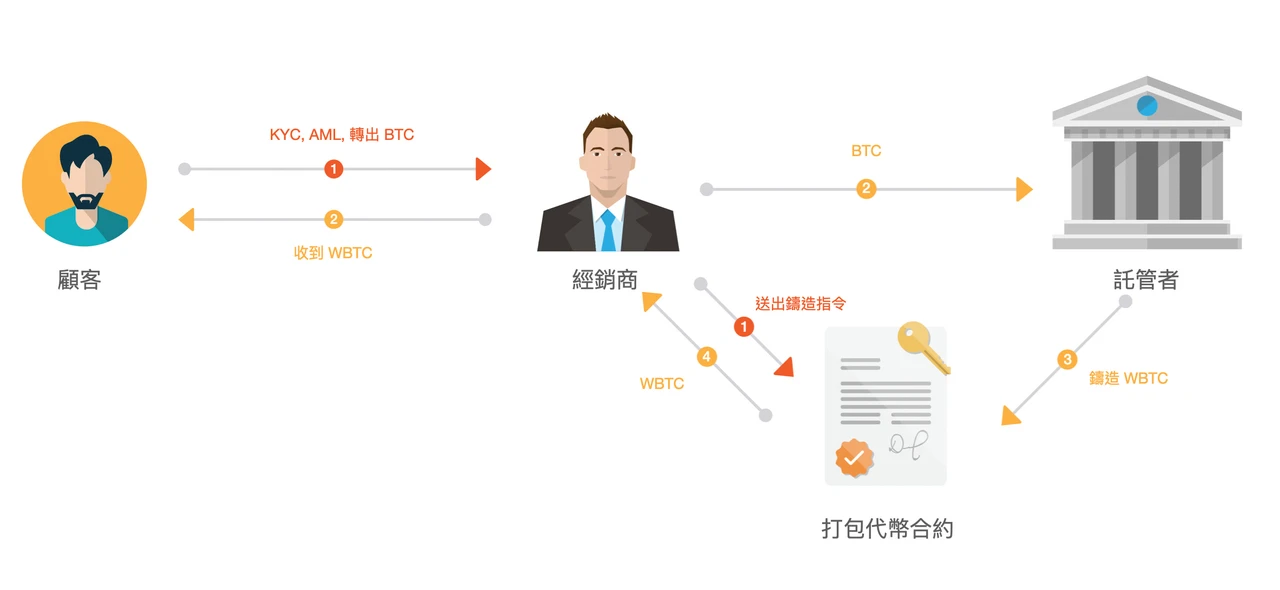

Lock/Destroy + Mint locks or destroys the native assets on the source chain, and mints an equal amount of wrapped assets on the target chain to achieve cross-chain transfer of funds. However, this solution does not achieve true cross-chain transfer of funds. The users wrapped assets on the target chain only represent the proof of the users funds on the source chain, and the native assets are not transferred.

Currently, cross-chain bridges using the “lock/destroy + minting” solution include WBTC, Multichain, and Wormhole.

The liquidity swap solution relies on smart contracts. The cross-chain bridge first needs to establish a liquidity pool on the source chain and the target chain. When transferring assets, the users funds will be deposited into the liquidity pool on the source chain, and then the equivalent assets will be withdrawn from the target chains pool. This solution truly realizes cross-chain funds, but it does not support non-smart contract platforms (Bitcoin) and assets that are not available in the target chain (XRP is not available in the Ethereum network).

Currently, cross-chain bridges using the “liquidity swap” solution include Synapse Protocol, Stargate Finance, and Hop Protocol.

1.2 Classification by cross-chain scope

Asset-specific cross-chain bridges: These bridges are mainly used for cross-chain transfers of specific assets, such as wrapping Bitcoin (BTC) to various x-Bitcoin assets on Ethereum (ETH). The wrapping process usually involves locking the asset on the source chain and creating an equivalent wrapped asset on the target chain. Since these assets have good liquidity and are relatively simple to operate, they are relatively easy to deploy in the market.

The encapsulation logic needs to be reimplemented on each destination chain, which limits their functional scalability.

WBTC, etc.

Chain-specific: This type of bridge focuses on the transfer of assets between two specific blockchains. Users can lock tokens on the source chain and mint wrapped assets on the destination chain. Chain-specific bridges can usually be brought to market faster due to their relatively simple structure.

They scale poorly and usually only serve a limited blockchain ecosystem. For example, Polygon’s PoS bridge allows users to transfer assets between Ethereum and Polygon.

Application-specific cross-chain bridge: This type of cross-chain bridge serves a specific decentralized application (DApp), allowing users to use the application between multiple blockchains. Application-specific cross-chain bridges usually have a smaller code base and deploy lightweight adapters on each blockchain instead of a complete application. This allows users on different blockchains to share the services of the same application, forming a network effect.

The functionality of such bridges is often difficult to scale across applications. COMP Chain and Thorchain are examples of such bridges, targeting lending and trading markets respectively.

Generalized cross-chain bridges: These bridges are designed to support extensive communication between multiple blockchains. They usually adopt efficient protocol designs, such as O(1) complexity, to handle a large number of cross-chain message transmissions. This design brings a strong Internet effect, that is, the integration of a single project can give it access to the entire cross-chain ecosystem.

To achieve this scalability, a trade-off between security and decentralization is often required, which can lead to some unforeseen complications. The Interconnection and Blockchain Bridge (IBC) is a typical example of such a bridge, which is used to send messages between heterogeneous chains with final confirmation guarantees.

For example: Zetachian, IBC

2. What is CCTP

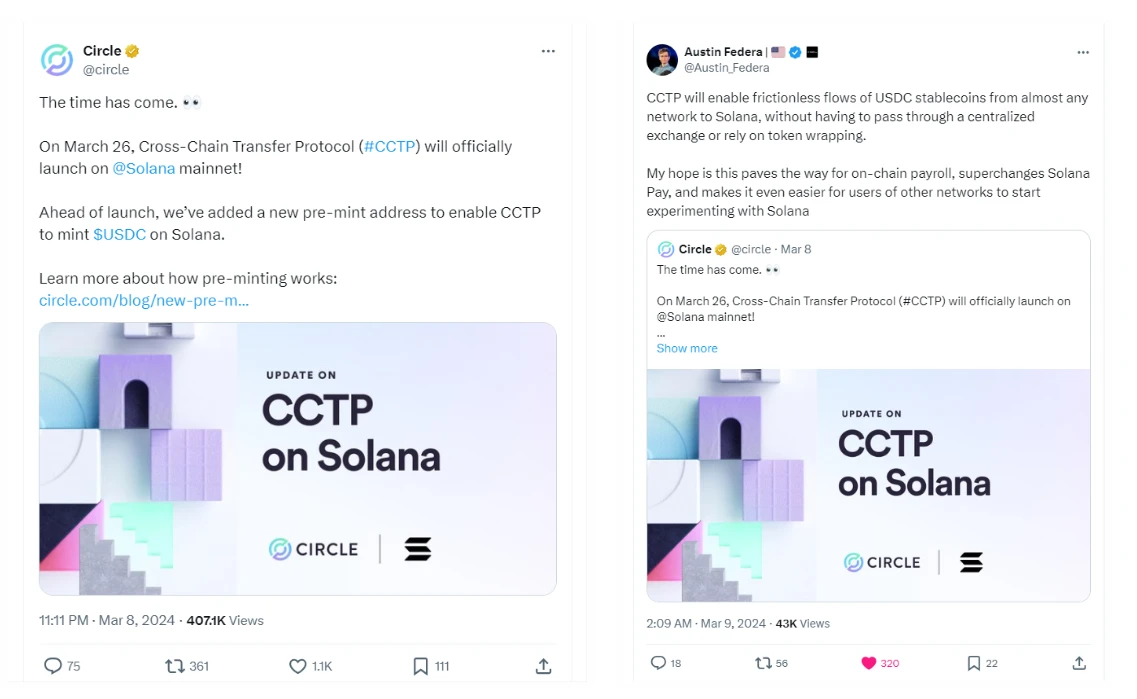

On March 8, 2024, CCTP announced that it would be officially launched on the Solana mainnet on March 26; Solana’s head of strategy, Austin Federa, tweeted: “CCTP will enable frictionless flow of USDC stablecoins from almost any network to Solana without going through centralized exchanges or relying on token packaging.”

Image source: https://twitter.com/circle/status/1766119655347745231?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1766164252820152602%7Ctwgr%5Ee18525ffb1b0d647ff560ab7fbfdabf0d1589886%7Ctwcon%5Es3

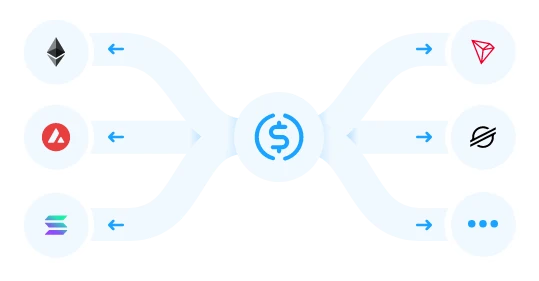

CCTP (Cross-Chain Transfer Protocol) is a permissionless on-chain tool from Circle that facilitates USDC transfers between different blockchains. Circle does not require liquidity on the target chain, but simply mints native USDC after destroying USDC on the source chain.

working principle

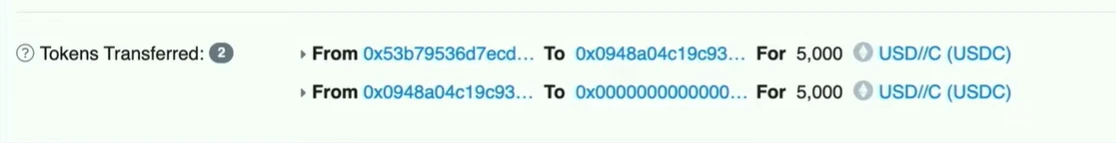

First, the user initiates a USDC transfer through any integrated portal on the source chain. The user can also specify a wallet address on the target chain. From there, the portal/wallet/bridge (dApp) destroys the USDC on the source chain.

Circle then proves the burn event on the source chain. The dApp then requests proof from Circle, which provides authorization to mint the burned amount of USDC on the target chain.

Finally, the dApp uses the proof to mint USDC on the target chain and send it to the recipient. As of now, 10 different partner SDKs such as Metamask, 5 Bridges, and Layer Zero and Wormhole have integrated with CCTP.

3. CCTP Partners

4. Comparison of advantages

In addition to opening up the circulation of USDC, CCTP has a greater prospect of becoming a universal cross-chain bridge with many advantages.

No packaging is required, like various xBTC and XETH, which greatly reduces the degree of centralization and increases security risks

No need to prepare a liquidity pool, eliminate liquidity demand, and destroy and mint in real time, greatly improving capital efficiency

The cross-chain cost is low, only the gas fee for destruction and casting is consumed, and there is basically no slippage

It is compatible with 55 public chains and is programmable, providing more possibilities for full-chain Dapps with better user experience.

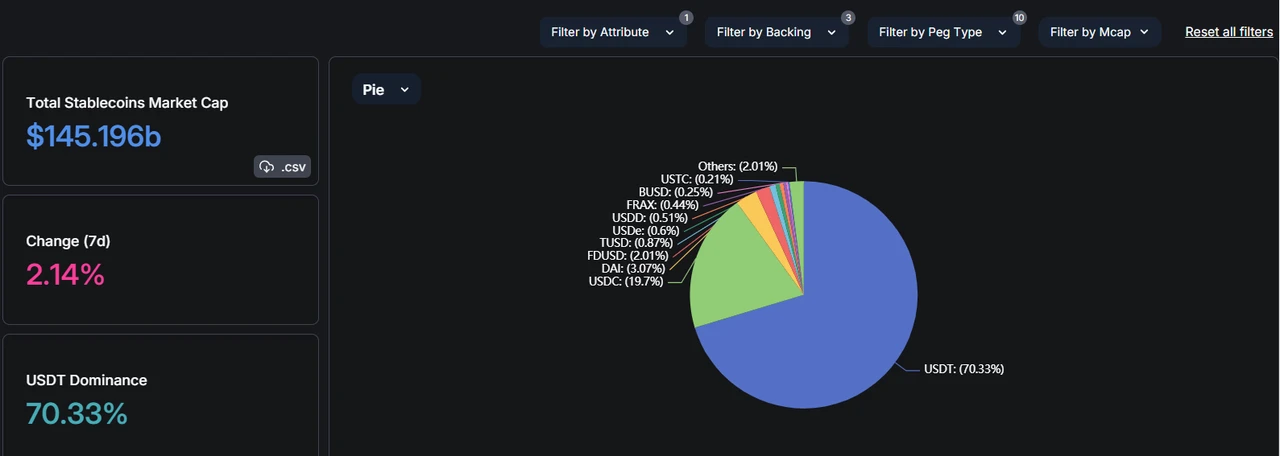

USDC itself has high stability and consensus, and the barrier to replication is high.

limitation

The degree of centralization is high, but Circle is a relatively reliable institution with such a scale.

Retail investors cannot participate, it is a 2b business

5. Stablecoin Market Share

Data source: https://defillama.com/stablecoins

appendix

https://foresightnews.pro/article/detail/52378

https://www.odaily.news/post/5192646

https://mp.weixin.qq.com/s/k7hsTHPgTJG2uhxh0ry_ZQ

https://www.chaincatcher.com/article/2111830

https://weird3d.com/new/6668.html

About E2M Research

From the Earth to the Moon

E2M Research focuses on research and learning in the field of investment and digital currency.

Article collection: https://mirror.xyz/0x80894DE3D9110De7fd55885C83DeB3622503D13B

Follow us on Twitter: https://twitter.com/E2mResearch ️

Audio podcast: https://e2m-research.castos.com/

Xiaoyuzhou link: https://www.xiaoyuzhoufm.com/podcast/6499969a932f350aae20ec6d

DC Link: https://discord.gg/WSQBFmP772