Original author: 0x Loki (X: @Loki_Zeng )

1. The eternal driving force: asset issuance

Recently I saw a very interesting concept - land salinization of public chains - a large amount of land (L2) has been reclaimed but no seedlings (Dapp) have been planted. If the public chain is compared to land, the ecosystem is equivalent to the industry on the land, and then a fiscal entity can be abstracted. From this perspective, analogous to the government, the system income (or distributable value) of ETH (or other public chains) can also be divided into three parts:

(1) Direct income/tax (gas fee);

(2) Fiscal deficit (block rewards);

(3) Non-tax revenue, mainly land finance (asset issuance);

According to Tokenterminal data, the current annualized cost of ETH (corresponding to taxes) is approximately US$6.9 billion, while the non-tax revenue is:

(1) In May 2020 (before DeFi Summer), the total market value of ERC 20 tokens was close to 100% of ETH’s market value, about $100 billion; the current total market value is $449 billion, which is 103% of ETH’s total market value;

(2) The total market value of DeFi tokens is US$115.3 billion, which is approximately 26% of the market value of ETH;

(3) The total FDV of the top 10 L2 is US$97.3 billion (of which the circulating market value is more than US$30 billion), which is about 22% of the market value of ETH;

The market capitalizations of ERC 20 tokens, DeFi tokens, and Top 10 L2s are 65x, 16x, and 14x the annualized fees, respectively. So far, the driving force behind the ETH ecosystem and even the entire Crypto is not large-scale applications, but asset creation/asset issuance.

The development of ETH is like this, from large-scale ICO, to DeFi Summer, NFT Summer, to L2, and now Restaking. The same is true for non-ETH ecosystems, RWA, Meme, Socialfi, Inscription, all of which are centered around asset issuance, the only difference is [what assets are issued? ] and [how to issue assets? ]

2. ETH Ecosystem Construction from the Perspective of Land Finance

Land finance originates from the financial gap of local governments caused by tax reform. It is undeniable that land finance has played a positive role in economic growth for a long time, completing the initial capital accumulation and urbanization process. In the most simplified model, land-related income becomes government revenue, which is then used for investment and transfer payments (including salaries for public medical and education institutions), and further leverages consumption and drives employment. The rise in the [virtual market value] of housing prices fixes the additional value, and everyone gains wealth (static) or income (dynamic).

The ecological development of public chains is somewhat similar. The initial ICO is more like irregular urbanization, while DeFi Summer, Gamefi, and NFT are more like planned urbanization. Competitive L1 and L2 are more like alleviating demand by building new districts one after another after the carrying capacity of the main urban area is saturated.

The benefit of this process is that new assets can be continuously created. Especially when building new areas, not only housing is needed, but also supporting commercial, transportation, medical, and school facilities are needed, which will bring about a large-scale investment boom. This is reflected in the public chain ecosystem by the continuous issuance of new protocols and new assets. These new assets will accelerate the prosperity of the ecosystem in a bull market.

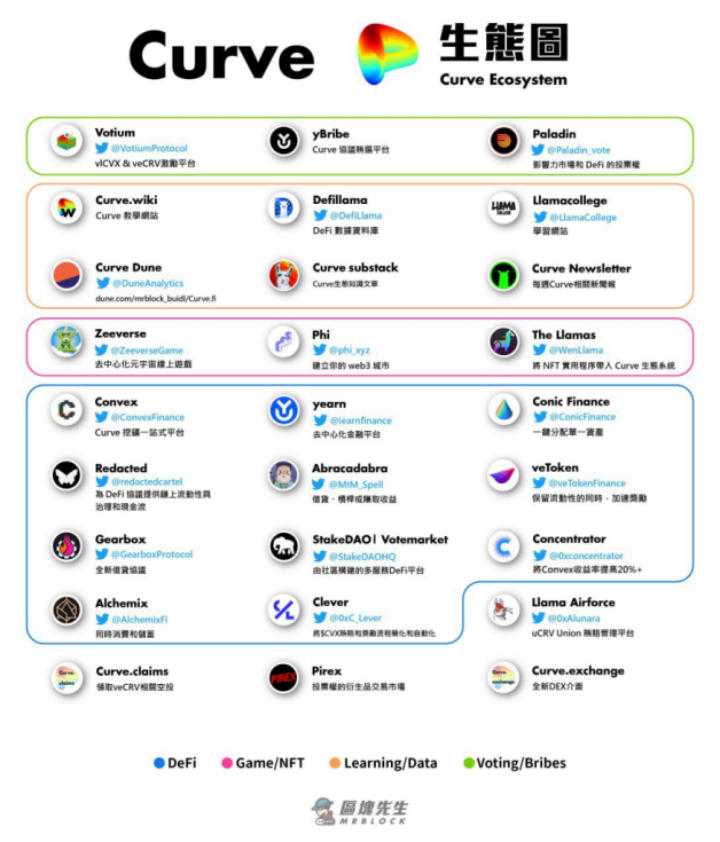

The most typical example is the Curve ecosystem. If we compare Curve to a community, we will find that not only can the houses be sold, but also the properties, parking spaces, basement stores, and even the convenience stores at the doorstep are all securitized (listed on the market) as assets. This practice is controversial. Supporters will think that [this is a reflection of a prosperous ecosystem and efficient division of labor], while opponents will think that [Echeng’s taxes have been collected 90 years later].

Source: @mrblocktw

3. Abuse of land finance leads to salinization problem

2022 is a turning point in the development of competitive L1 and L2. The background is that from January 2017 to November 2021, the total monthly gas usage of ETH increased by 62.3 times. Therefore, competitive L1 and L2 are essentially taking over the spillover demand of ETH. From the perspective of land finance, the main urban area cannot take over the spillover investment and residential demand, and the construction of satellite cities and new districts begins to appear. The land transfer fees captured by the new district can be used for infrastructure construction, and the economic cycle starts again.

Source: Glassnode

But this cycle is not endless. The first problem is that after the market turns bearish in 2022, the spillover of demand will no longer exist. The second problem is that we cannot repeat too many wheels. Schools in urban areas can open sub-districts in the suburbs, and the DeFi and Infra protocols on the ETH main chain can also be migrated to other L1 and L2. So we can see that many L2s have become salinized. The essence of this phenomenon is that most of the demand for ETH is for [asset issuance] , and L2 that does not have the ability to issue assets has natural defects.

The most intuitive example is that the only public chains that have truly successful Meme tokens (market value, duration, and community popularity) are ETH, BTC, and Solana. AIdoge, a relatively well-known blockchain on L2, currently has a market value of only $120 million.

In addition, some interesting models have also emerged in the process of ecological development around asset creation.

The first is the rise of Airdrop Hunter. Analogous to land finance, the practice of to C airdrop is somewhat like [monetization of shantytown renovation]. First, the land is transferred to obtain development funds to build infrastructure, and rewards are issued to early residents (users). The activities and residences of these residents attract more operators, and the prosperity of production and life will make the land more valuable. So we can see that the incentives of public chains are becoming more and more generous, and there are also spoilers such as zkfair, Blast, and Manta, but this is also a state of gradual involution. The sustainability of the effect of short-term incentives is becoming worse and worse, and more ruthless income farmers are beginning to appear.

The second is the emergence of developer incentives. Analogous to land finance, to B airdrops are more like industrial policies. The government will provide a series of preferential policies for entering new industrial parks, such as almost free land, low-interest loans, preferential treatment in administrative affairs, etc. The only requirement is that the company needs to contribute enough taxes starting at a certain point in time. In the Crypto industry, public chains can provide a series of services such as investment, incubation, market cooperation, and token incentives, but the protocol needs to contribute TVL, number of users, and number of transactions to the public chain. There are many typical cases, and some public chains will even set up a separate entity (such as Nears Proximity Labs) to promote the development of the ecosystem.

Whether it is To C or To B, the output brought by subsidies will not cover the cost for a long time, which will bring some problems: 1) Subsidy-oriented programming, such as the serious homogeneity of projects on Blast 2) After the incentives are issued, the number of users drops sharply, and it becomes a ghost chain. But this does not mean that this incentive is meaningless. Technological innovation and the establishment of new markets are accompanied by a certain degree of bubble.

4. Finding fertile soil

[Land salinization] means looking for higher efficiency. One of Munger’s investment principles is [fish where there are fish]. In the crypto world, fish means the ability to create (or issue) assets. Only with a large ecosystem or the ability to create new assets can there be big opportunities.

The Bitcoin ecosystem is the largest and only full-track opportunity at the moment. The emergence and development of inscriptions is the Bitcoin version of the Renaissance. Art does not directly increase productivity, and the same is true for inscriptions, but it can bring about changes in the way of issuance, allowing Bitcoin to return to the center of attention of Crypto and gather community consensus and participants. The current Bitcoin ecosystem is just like Western Europe hundreds of years ago. Bitcoin L2 represented by Merlin, Bitlayer, BSquare, and RGB++, and heavy asset DeFi represented by BitSmiley are about to launch an industrial revolution that will transform productivity.

ETHs growth rate may be slower in this cycle, but it does not change the fact that it is still on the right track. Although it does not make sense to repeatedly create DEX, animal avatars or P2E games, there are still some structural opportunities. These tracks are a bit like the new infrastructure in the traditional world. The first definite opportunity is Restaking. We have talked a lot about Restaking, but LRD is just the beginning. There are still a series of needs in its downstream and derivative service areas that have not been met.

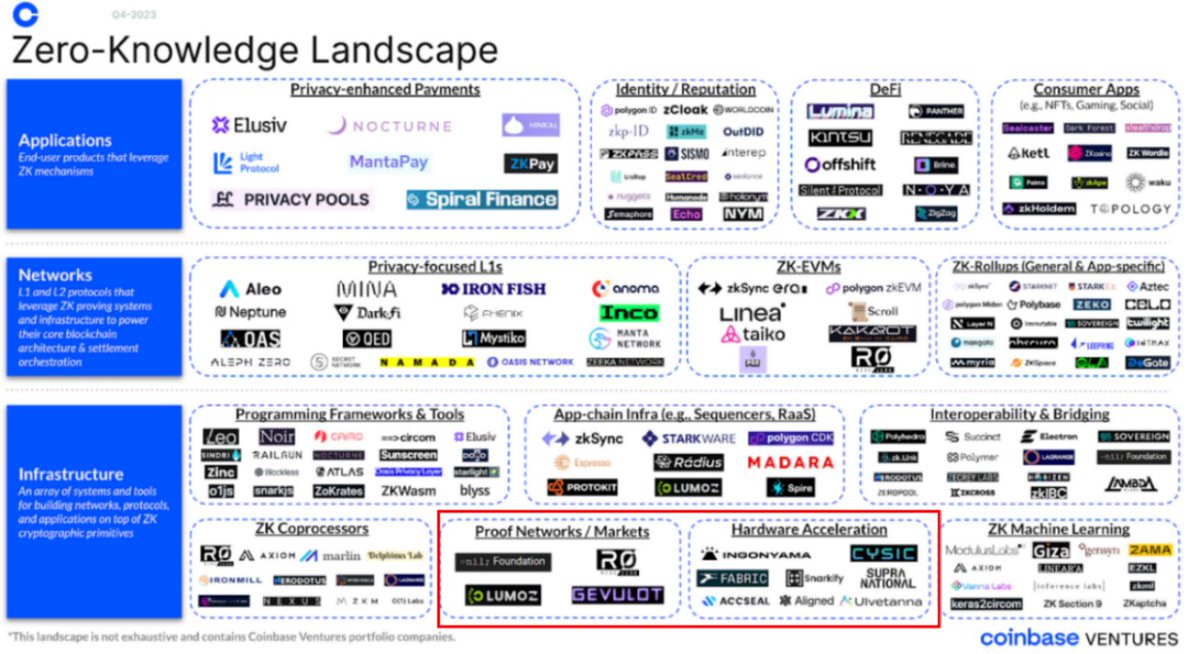

The second sub-track worth paying attention to is ZK hardware acceleration. The next 1-2 years are likely to be a period of large-scale outbreak of ZK, but in actual business, most projects need to limit the generation of ZK proofs to seconds and minutes. If the CPU is used entirely for calculation, it is almost impossible to achieve it under the current circumstances. The method of accelerating the generation of ZK proofs through high-performance hardware is currently the first choice.

The importance of hardware acceleration to ZK is equivalent to the importance of oracles to DeFi. It is the most urgent and necessary infrastructure in the ZK track. The probability of a billion-level project is very high. We have already seen many related projects moving forward steadily.

Source: @coinbase

Vitalik also pointed out at this years Hong Kong Web3 Festival that the efficiency of ZK-SNARK proof generation is low and that hardware-accelerated proof generation is needed.

A typical representative is Cysic, which will serve as the Proof Generation and Verification Layer, providing real-time proof solutions for ZKs large-scale applications from the two aspects of hardware and computing power network (which are also the two core requirements of ZK hardware acceleration).

Source: @cysic_xyz

In addition, we can see that some other ecosystems also show differentiated ecological structures, such as Solanas DePin and Meme ecosystem, Nears AI Memeization and DA narrative, and StarkNets game ecosystem activity. These public chains that have asset creation capabilities and have not yet completed urbanization deserve our higher expectations.

The last topic worth paying attention to is the improvement of asset efficiency and the construction of the liquidity layer (or asset reuse). When MakerDAO introduced a large number of RWAs and Blast came out in 2023, the seeds of the liquidity layer were planted.

Currently, there are only three major asset classes in the true sense: BTC, ETH, and Stablecoins. From a broad perspective, Restaking has built the prototype of ETHs liquidity layer, and Ethena has also drawn a blueprint for the stablecoin liquidity layer, but the largest asset, BTC, is at an earlier stage, and this trend has become more obvious recently, with projects such as Lorenzo, StakeStone, and Solv making some new progress. In particular, Babylon, which is about to be launched, will likely completely change BTCs low interest rate status quo, bringing on-chain demand-side benefits to BTC for the first time. On this basis, Lorenzo and other potential competitors will provide the possibility of releasing the potential for asset use. Compared with ETH and Stablecoin, BTC Restaking and liquidity layer construction have greater non-consensus opportunities.

Source: @babylon_chain